| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Footwear Market Size 2024 |

USD 4,379.5 million |

| Footwear Market, CAGR |

6.63% |

| Footwear Market Size 2032 |

USD 7,303.9 million |

Market Overview:

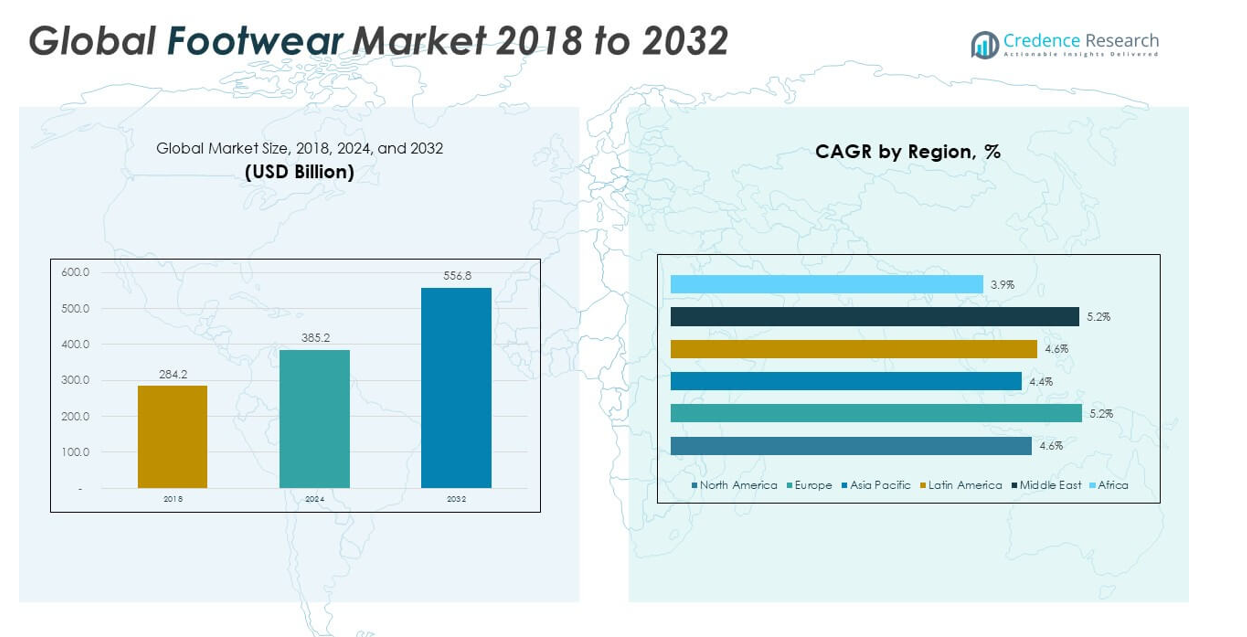

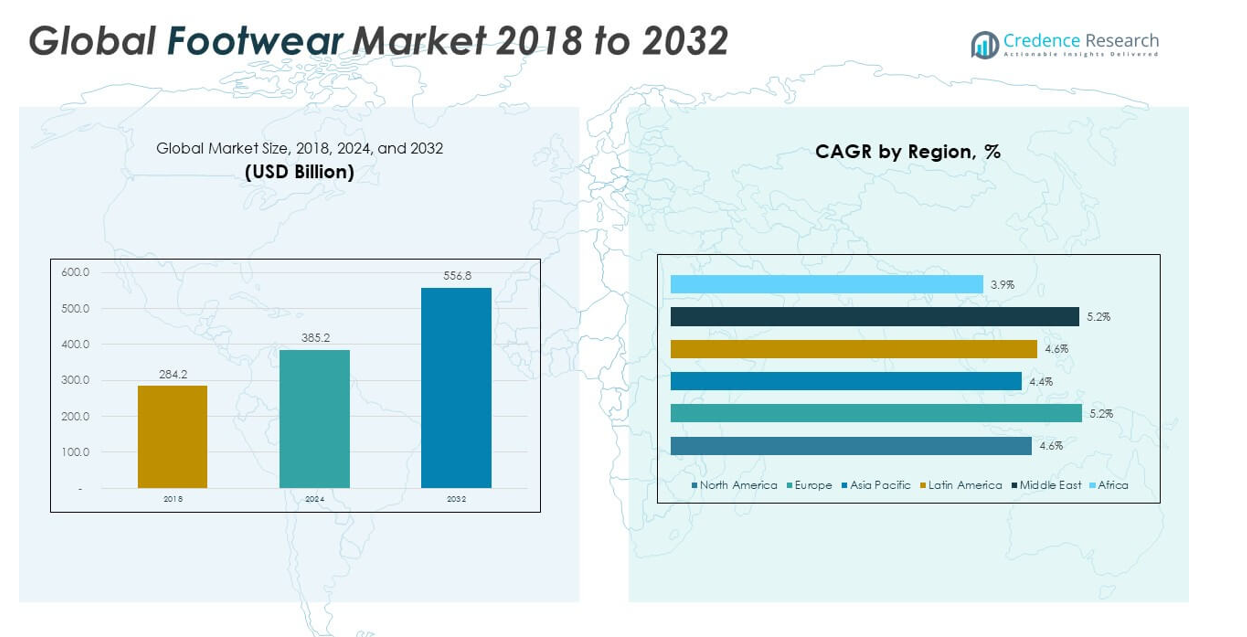

The Footwear Market size was valued at USD 3,000.3 million in 2018 to USD 4,379.5 million in 2024 and is anticipated to reach USD 7,303.9 million by 2032, at a CAGR of 6.63% during the forecast period.

The footwear market is experiencing significant growth driven by increasing disposable incomes, lifestyle changes, and heightened health awareness. As consumers, particularly in emerging economies, gain more purchasing power, their inclination toward branded and premium footwear has grown. This is reinforced by the rise of athleisure, where comfort and fashion intersect, making performance shoes a part of everyday wardrobes. The global fitness boom has further accelerated demand for sports footwear across demographics. In addition, sustainability has become a key purchase driver, with brands innovating around recycled materials, biodegradable components, and ethical manufacturing processes to meet evolving consumer expectations. Digital transformation has also played a pivotal role, with the growth of e-commerce, AI-driven personalization, virtual try-ons, and direct-to-consumer strategies enhancing accessibility and shopping experience.

Asia-Pacific dominates the global footwear market, led by China, which is both the largest producer and consumer of footwear. China’s scale, combined with rapid urbanization and online retail penetration, fuels continuous growth. India is emerging as a high-growth market with a rising middle class and increasing digital adoption, particularly in Tier 2 and Tier 3 cities. North America ranks second, with the U.S. contributing significantly due to strong demand for athleisure, sneaker culture, and innovative digital retail. Europe remains a fashion-forward market where sustainability and heritage craftsmanship influence purchasing decisions, particularly in countries like Germany, France, and Italy. Latin America shows promising growth, supported by an expanding retail sector, youthful demographics, and rising brand consciousness. Meanwhile, the Middle East and Africa are developing steadily, driven by urban growth, rising fashion awareness, and increased international brand presence.

Market Insights:

- The Footwear Market grew from USD 3,000.3 million in 2018 to USD 4,379.5 million in 2024 and is projected to reach USD 7,303.9 million by 2032, growing at a CAGR of 6.63%.

- Athletic footwear demand is rising due to increased fitness awareness, with running shoes, sports cleats, and training shoes seeing strong global adoption.

- Emerging economies are driving premium footwear growth as middle-class consumers shift to branded, fashion-forward, and lifestyle-oriented shoe purchases.

- Sustainability is shaping consumer preferences, with growing demand for biodegradable materials, recycled components, and ethically sourced footwear.

- E-commerce growth and direct-to-consumer models are reshaping retail, supported by AI-based personalization, virtual try-ons, and real-time digital engagement.

- Raw material price fluctuations and supply chain instability are putting pressure on manufacturers to balance cost control with consistent product quality.

- Asia-Pacific leads the global market, with China as the largest producer and consumer, while India emerges as a key growth driver due to rising urbanization and digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Health Awareness and Sports Participation Fuel Demand for Athletic Footwear

Consumers are increasingly prioritizing fitness, sports, and active lifestyles, which is driving the demand for athletic footwear. Gym memberships, running events, and participation in sports have surged globally, particularly among younger demographics. This has led to higher sales of specialized shoes designed for performance, comfort, and injury prevention. The Footwear Market is witnessing significant growth from categories such as running shoes, training shoes, and sports cleats. Major brands are capitalizing on this trend by launching footwear with enhanced cushioning, breathability, and stability. Collaborations with athletes and endorsements from sports personalities are further accelerating consumer interest in performance footwear.

- For example, Adidas’s Adizero Adios Pro Evo 1, weighing just 138 grams (4.87 ounces), is 40% lighter than previous models and features a novel forefoot rocker.

Rising Disposable Incomes and Fashion Consciousness Boost Premium Product Adoption

Economic growth in emerging regions is increasing the spending capacity of middle-class consumers, encouraging them to purchase branded and premium footwear. It supports a growing preference for stylish, high-quality shoes that reflect social status and personal identity. Consumers view footwear as a fashion statement, integrating it into lifestyle and casual wear choices beyond traditional utility. The Footwear Market is benefitting from seasonal fashion collections, limited-edition drops, and designer collaborations that drive consumer enthusiasm. Companies are also investing in product innovation to appeal to fashion-forward customers, introducing features such as bold colors, unique textures, and smart aesthetics. This evolution is reinforcing the trend toward footwear as a blend of function and fashion.

Sustainability and Ethical Manufacturing Practices Influence Consumer Preferences

Eco-conscious consumers are pressuring companies to adopt sustainable practices, leading to significant changes in product development and supply chains. Many brands are incorporating recycled materials, biodegradable soles, and ethically sourced components in their designs. It reflects a strong market shift toward transparency, environmental responsibility, and ethical labor practices. The Footwear Market is seeing increased demand for vegan shoes, carbon-neutral collections, and products with certifications that validate sustainable claims. Companies are leveraging these features to build brand loyalty and differentiate in a competitive landscape. Regulations and government guidelines are also reinforcing the transition toward environmentally sustainable footwear production.

Digital Transformation and Direct-to-Consumer Models Reshape Market Dynamics

E-commerce platforms and brand-owned online stores are enabling companies to bypass traditional retail barriers and engage directly with customers. It enhances pricing flexibility, personalization, and global accessibility for both legacy brands and digital-first entrants. The Footwear Market is evolving with technologies such as 3D scanning, virtual try-ons, and AI-based style recommendations that improve online shopping experiences. Social media and influencer marketing also play critical roles in shaping trends and driving instant consumer demand. Data analytics is helping brands refine inventory management and forecast buying patterns. These developments are enabling faster product launches and deeper consumer engagement across global markets.

- For instance, Adidas has invested over €1 billion in digital transformation, aiming for the majority of its sales to be generated from digitally created and sold products by 2025, supported by a growing internal tech team and advanced ERP systems.

Market Trends:

Customization and Personalization Create Competitive Advantage

Brands are offering greater product personalization to meet rising consumer expectations for uniqueness and exclusivity. It includes options such as custom colors, sole types, monograms, and design features tailored to individual preferences. Technological advancements in 3D printing and digital design tools are making this process faster and more scalable. The Footwear Market is responding by integrating customization modules into online platforms and retail stores. Consumers value the opportunity to co-create products that reflect their personal style, driving higher engagement and loyalty. Brands that offer easy-to-use personalization interfaces and quick delivery timelines are gaining a competitive edge.

Sustainable and Circular Designs Redefine Product Development

Companies are shifting toward eco-friendly materials and circular production models to align with growing environmental concerns. It involves using biodegradable fabrics, recycled components, and water-efficient manufacturing techniques. The Footwear Market is witnessing a rise in take-back programs and initiatives that extend product lifecycles through refurbishment or recycling. Brands are also developing footwear with modular components that can be replaced or reused, reducing waste. Sustainability is no longer a niche offering but a mainstream expectation influencing purchasing decisions. Transparent supply chains and third-party certifications are building consumer trust in eco-conscious brands.

- For instance, Vivobarefoot’s ReVivo program has refurbished over 170,000 pairs of shoes since 2020, achieving a record 62,300 pairs renewed in 2023/24 and expanding its take-back scheme to accept used sneakers from any brand in the US, UK, and Europe.

Digital Retail Expansion and Omnichannel Integration Drive Growth

Consumers expect seamless shopping experiences across digital and physical platforms, prompting companies to adopt omnichannel strategies. It enables them to unify online and offline inventory, offer click-and-collect services, and provide real-time order tracking. The Footwear Market is seeing strong growth from digital-native brands and traditional players enhancing their e-commerce capabilities. Visual search, virtual try-on tools, and augmented reality applications are becoming standard features in digital retail. These innovations improve buyer confidence and reduce return rates. Companies that invest in integrated logistics and personalized customer journeys are better positioned to capture market share.

- For example, Amazon Fashion’s AR-powered “Virtual Try-On for Shoes” lets customers in the US and Canada visualize thousands of styles from brands such as New Balance, Adidas, and Puma, reducing return rates and boosting buyer confidence

Lifestyle and Cultural Influences Shape Product Innovation

Fashion trends and cultural movements significantly influence footwear design and marketing strategies. Streetwear, music, and pop culture collaborations are helping brands create buzz and attract younger consumers. The Footwear Market is evolving to meet lifestyle needs, blending performance, comfort, and visual appeal in everyday footwear. Hybrid designs that transition from casual to formal wear are gaining traction in urban markets. Limited-edition drops and influencer-led campaigns generate urgency and drive rapid sales. Brands that remain culturally relevant and agile in responding to trends are strengthening their market position.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions Pressure Profit Margins

Fluctuating prices of raw materials such as rubber, leather, foam, and synthetic fabrics are posing a significant challenge for manufacturers. It affects production planning, pricing strategies, and overall profitability. Geopolitical tensions, shipping delays, and labor shortages further disrupt supply chains, increasing lead times and inventory costs. The Footwear Market must continuously adapt to material shortages and transportation issues, which hinder timely delivery and product availability. Smaller players face greater risks due to limited negotiating power with suppliers and logistics partners. Maintaining consistent quality while managing cost volatility remains a difficult balance for the industry.

Counterfeit Products and Intense Competition Erode Brand Value

The increasing prevalence of counterfeit footwear affects consumer trust and damages brand reputation. It undermines innovation efforts by diverting revenue from authentic manufacturers. The Footwear Market faces heightened competition from both established global brands and fast-emerging digital-first labels. It puts pressure on pricing, marketing spend, and product differentiation. Brands must invest heavily in anti-counterfeiting measures, intellectual property protection, and consumer education. Standing out in a saturated market demands continuous innovation, agile marketing strategies, and a strong brand narrative that resonates with evolving consumer expectations.

Market Opportunities:

Expansion into Emerging Markets Unlocks New Growth Potential

Rapid urbanization, rising disposable incomes, and growing brand awareness in emerging economies present lucrative opportunities for global footwear companies. Markets in Asia-Pacific, Latin America, and Africa are experiencing a surge in demand for both functional and fashion-oriented footwear. The Footwear Market can benefit by tailoring product lines to local preferences and price sensitivities. It enables brands to establish early loyalty and expand market presence through regional partnerships and localized marketing. Strengthening retail infrastructure and mobile commerce adoption also support wider reach and higher sales volumes. Companies that localize designs and invest in affordable innovation can capture long-term value.

Innovation in Smart and Sustainable Footwear Creates Differentiation

Consumer interest in smart technology and eco-friendly products continues to rise, opening new avenues for product innovation. Smart shoes with features such as fitness tracking, posture monitoring, and temperature control are gaining attention across urban segments. The Footwear Market can capitalize on this trend by combining performance features with sustainability, using recycled materials and energy-efficient manufacturing. It appeals to tech-savvy and environmentally conscious consumers seeking advanced and responsible product choices. Collaborations with tech firms and green startups can accelerate product development and market entry. Investing in R&D and sustainable innovation will strengthen competitive advantage.

Market Segmentation Analysis:

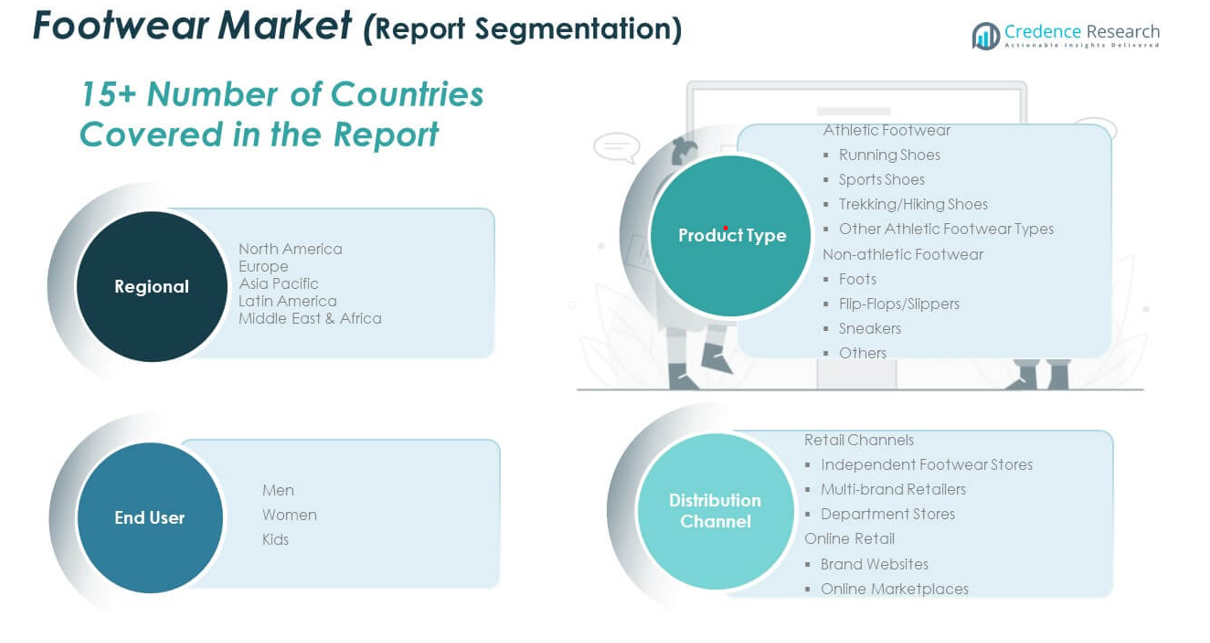

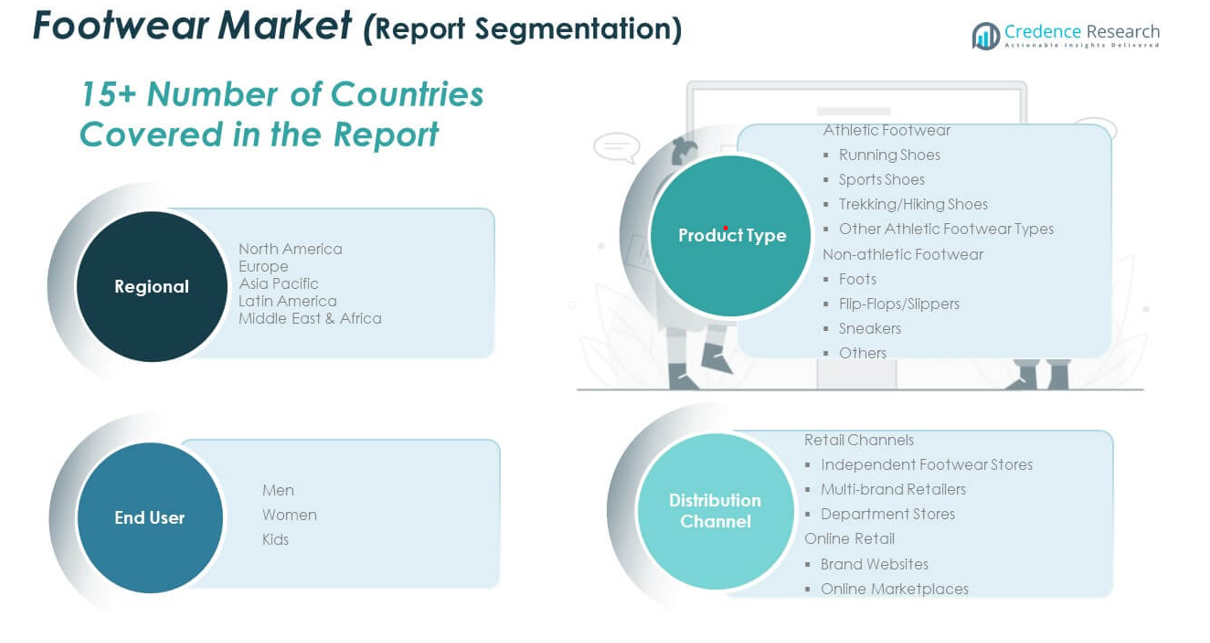

The Footwear Market is segmented by product type, end user, and distribution channel.

By product type, athletic footwear dominates with strong demand for running shoes, sports shoes, trekking/hiking shoes, and other performance-oriented styles. It reflects the rising health awareness and fitness trends across global markets. Non-athletic footwear also holds a substantial share, including boots, flip-flops/slippers, sneakers, and other casual and formal styles. It caters to everyday wear, fashion trends, and seasonal requirements across various demographics.

- For example, Nike’s Air Zoom Pegasus 40 is a leading running shoe, recognized for its responsive cushioning and global popularity among runners.

By end user, men lead in market share due to consistent demand for both formal and athletic footwear. Women’s footwear is expanding rapidly, supported by greater fashion consciousness and product variety. The kids segment is growing steadily with rising school and casual wear demand, especially in urban centers.

By distribution channel, retail remains the primary revenue generator through independent footwear stores, multi-brand outlets, and department stores. However, online retail is expanding quickly, with brand websites and online marketplaces offering convenience, customization, and wider reach. The Footwear Market continues to diversify across all segments to meet evolving consumer expectations.

- For instance, WEARFITS’ AR platform has been shown to boost sales conversions by up to 500% and allows real-time visualization of fit and style. Puma, among other leading brands, uses AR try-on solutions to enhance online shopping, though the 500% figure is documented by WEARFITS for its platform overall and not attributed to Puma specifically.

Segmentation:

By Product Type:

- Athletic Footwear:

- Running Shoes

- Sports Shoes

- Trekking/Hiking Shoes

- Other Athletic Footwear Types

- Non-Athletic Footwear:

- Boots

- Flip-Flops/Slippers

- Sneakers

- Others

By End User:

By Distribution Channel:

- Retail Channels:

- Independent Footwear Stores

- Multi-brand Retailers

- Department Stores

- Online Retail:

- Brand Websites

- Online Marketplaces

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Footwear Market size was valued at USD 621.66 million in 2018 to USD 889.80 million in 2024 and is anticipated to reach USD 1,444.72 million by 2032, at a CAGR of 6.3% during the forecast period. North America holds a significant 18% share of the global footwear market, driven by strong demand for athletic, lifestyle, and premium shoes. It is fueled by a growing culture of health, fitness, and fashion-conscious consumers. The U.S. leads regional sales, supported by a robust retail infrastructure and high digital adoption. Leading brands continue to launch exclusive collections and leverage celebrity endorsements to attract diverse consumer segments. Digital-first strategies, including virtual try-ons and AI-powered recommendations, are helping brands gain a competitive edge in the region.

Europe

The Europe Footwear Market size was valued at USD 686.76 million in 2018 to USD 987.65 million in 2024 and is anticipated to reach USD 1,614.17 million by 2032, at a CAGR of 6.4% during the forecast period. Europe accounts for 20% of the global market, characterized by high fashion awareness, sustainability priorities, and growing e-commerce penetration. Countries like Germany, France, and Italy lead in both production and consumption. It benefits from strong heritage brands, innovative designs, and increasing demand for ethically sourced and eco-friendly footwear. The region continues to adopt circular economy practices, influencing product offerings and consumer expectations. Luxury and designer footwear segments remain highly competitive and influential.

Asia Pacific

The Asia Pacific Footwear Market size was valued at USD 1,110.10 million in 2018 to USD 1,676.74 million in 2024 and is anticipated to reach USD 2,921.57 million by 2032, at a CAGR of 7.2% during the forecast period. Asia Pacific holds the largest share globally at 37%, driven by high consumption in China, India, Japan, and Southeast Asia. It benefits from growing urban populations, expanding middle-class income, and digital transformation. China is the world’s top producer and consumer, while India is emerging as the fastest-growing market in the region. Local and international brands compete by offering diverse price points and styles suited to regional preferences. E-commerce growth and mobile retail apps are reshaping consumer behavior and access.

Latin America

The Latin America Footwear Market size was valued at USD 180.02 million in 2018 to USD 244.00 million in 2024 and is anticipated to reach USD 365.20 million by 2032, at a CAGR of 5.2% during the forecast period. Latin America represents 5% of the global market and continues to expand through increasing retail networks and brand presence. Brazil, Mexico, and Colombia dominate the region’s footwear consumption. It is influenced by rising youth populations, casual wear trends, and growing exposure to international fashion. Local manufacturing hubs help maintain affordability and supply chain agility. Brands focusing on affordability and local style preferences see strong acceptance in this price-sensitive market.

Middle East

The Middle East Footwear Market size was valued at USD 256.82 million in 2018 to USD 376.39 million in 2024 and is anticipated to reach USD 631.06 million by 2032, at a CAGR of 6.7% during the forecast period. The Middle East holds nearly 6% of the global market, led by the UAE and Saudi Arabia. It is experiencing rising demand for luxury and sports footwear, supported by growing disposable income and urban retail development. Western brands are expanding their footprint through online and in-store channels. Cultural preferences shape product designs, particularly in segments like sandals and traditional styles. Fashion-forward consumers and increasing tourism are supporting premium category growth.

Africa

The Africa Footwear Market size was valued at USD 144.91 million in 2018 to USD 204.96 million in 2024 and is anticipated to reach USD 327.22 million by 2032, at a CAGR of 6.0% during the forecast period. Africa accounts for 4% of global footwear demand, with growth driven by urbanization, population expansion, and rising digital connectivity. Nigeria, South Africa, and Kenya are key consumption centers. It benefits from local manufacturing and growing accessibility to global brands via online platforms. Price-sensitive consumers prefer durable and affordable footwear. Government support for domestic industries and retail modernization is enhancing market development across urban and semi-urban regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nike Inc.

- Adidas AG

- Puma SE

- New Balance Athletics, Inc.

- Asics Corporation

- Under Armour

- VF Corporation

- Fila Holdings Corp.

- The Bata Corporation

- Geox S.p.A

- LVMH Moët Hennessy Louis Vuitton SE

- Kering SA

Competitive Analysis:

The Footwear Market is highly competitive, with leading global players such as Nike, Adidas, Puma, Skechers, and New Balance holding substantial market share. It reflects a strong emphasis on innovation, brand loyalty, and design differentiation. Companies compete on factors like comfort, performance, sustainability, and style, catering to a wide range of consumer segments. Fast-fashion brands and digital-first entrants are intensifying competition through affordable pricing and quick turnaround times. Local and regional manufacturers are also gaining traction by offering culturally tailored products at competitive rates. E-commerce expansion enables new entrants to reach global audiences without heavy retail investment. To maintain their edge, major players are investing in advanced manufacturing, eco-friendly materials, celebrity endorsements, and smart retail technologies.

Recent Developments:

- In January 2025, Adidas AG launched the Predator 25 football boot, a modern update to its legendary Predator franchise. The new model features upgraded STRIKESKIN and HYBRIDTOUCH 2.0 technologies, enhanced grip, and a bold red and grey colorway.

- In February 2025, Nike Inc. unveiled a major partnership with SKIMS, launching a new brand called NikeSKIMS. This collaboration aims to redefine the activewear and footwear space for women, blending Nike’s innovation in sport with SKIMS’ focus on inclusivity and body confidence. The NikeSKIMS line will feature extensive training apparel, footwear, and accessories, setting a new standard for women athletes worldwide.

- In May 2025, Skechers entered a merger agreement with 3G Capital, giving control of approximately 80% of the company to the investment firm. The $9.4 billion deal will take Skechers private, with closing expected in Q3 2025. 3G plans to apply its proven strategies to enhance margins and operational efficiency.

Market Concentration & Characteristics:

The Footwear Market exhibits moderate to high market concentration, with a few dominant global players accounting for a significant portion of total revenue. It features a balanced mix of multinational corporations, regional brands, and niche manufacturers. The market is characterized by frequent product launches, rapid trend cycles, and strong brand-driven consumer behavior. Innovation in design, materials, and technology plays a crucial role in maintaining competitiveness. Consumer preferences vary across geographies, with urban areas favoring premium and fashion-forward products, while rural and developing regions prioritize affordability and durability. The market operates across a wide price spectrum, allowing both luxury and value-focused brands to coexist.

Report Coverage:

The research report offers an in-depth analysis based on product type, end user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable footwear will increase, driven by consumer awareness and regulatory pressure.

- Smart footwear technology integration will create new niche segments, especially in sports and healthcare.

- Expansion in emerging economies will fuel sales through rising incomes and retail infrastructure development.

- E-commerce and direct-to-consumer models will dominate distribution, supported by digital innovation.

- Athleisure and multifunctional footwear will continue to outperform traditional categories.

- Customization and 3D-printed footwear will gain traction among younger demographics.

- Global brands will strengthen local collaborations to address regional style and price preferences.

- Investment in circular economy models will shape product lifecycle strategies.

- Competitive intensity will rise as digital-first brands enter the global stage.

- Consumer demand for comfort, functionality, and style convergence will drive product innovation.