Market Overview:

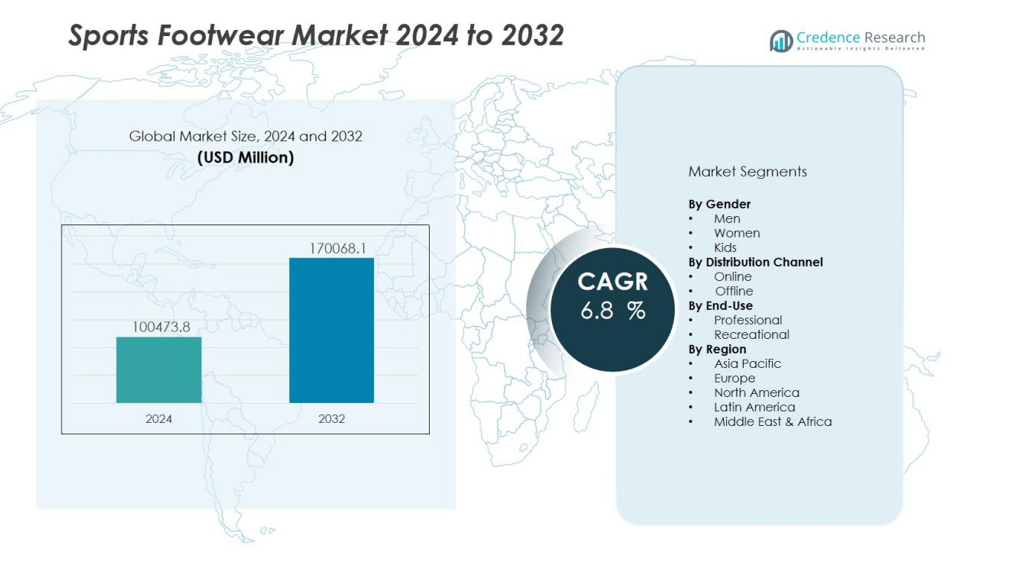

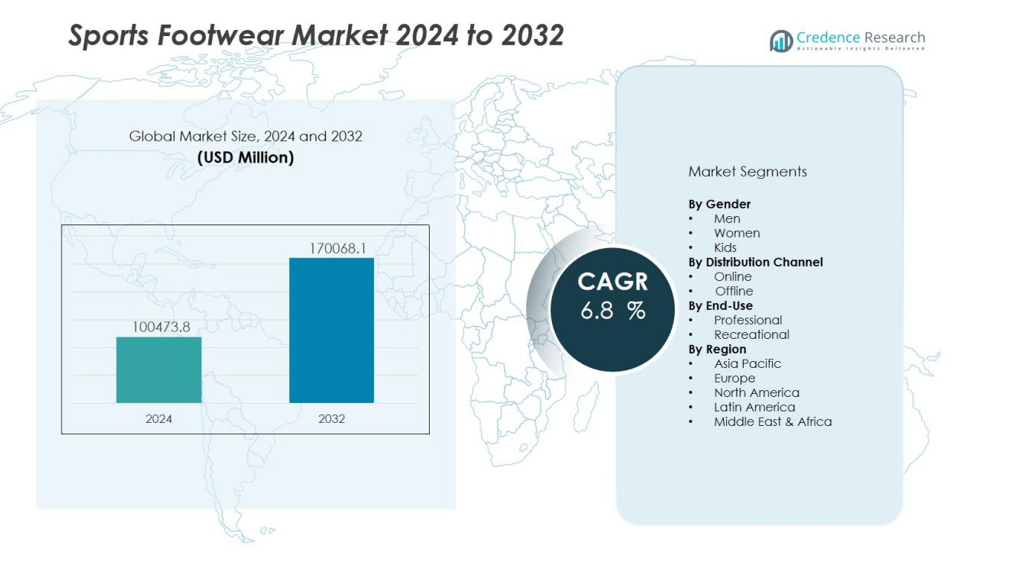

The sports footwear market size was valued at USD 100473.8 million in 2024 and is anticipated to reach USD 170068.1 million by 2032, at a CAGR of 6.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sports Footwear Market Size 2024 |

USD 100473.8 million |

| Sports Footwear Market, CAGR |

6.8% |

| Sports Footwear Market Size 2032 |

USD 170068.1 million |

Key market drivers include the rising influence of athleisure trends, which blend performance and fashion, and the growing adoption of sports footwear for daily wear. Technological advancements, such as 3D printing, smart insoles, and energy-return midsoles, are enhancing performance and comfort, encouraging brand loyalty. Additionally, endorsements by professional athletes, sports sponsorships, and strategic marketing campaigns are boosting product visibility and consumer engagement, particularly among younger demographics.

Regionally, North America leads the market due to a well-established sports culture, high disposable income, and strong presence of leading brands. Asia-Pacific is the fastest-growing region, driven by urbanization, rising fitness awareness, and expanding middle-class populations in China, India, and Southeast Asia. Europe maintains steady growth, supported by active lifestyles, sports tourism, and a mature retail network.

Market Insights:

- The sports footwear market was valued at USD 100,473.8 million in 2024 and is projected to reach USD 170,068.1 million by 2032, growing at a CAGR of 6.8%.

- Rising health awareness and increased participation in sports and fitness activities are boosting demand for high-performance and comfort-oriented footwear.

- The athleisure trend is expanding the market’s appeal, with consumers adopting sports footwear for both athletic and daily lifestyle use.

- Technological innovations such as 3D printing, smart insoles, and energy-return midsoles are enhancing performance, comfort, and product differentiation.

- Endorsements, sponsorships, and collaborations with athletes, designers, and influencers are strengthening brand visibility and consumer engagement.

- North America leads with 36% market share, Asia-Pacific follows with 29% and the fastest growth, while Europe holds 24% supported by a strong sports heritage.

- Supply chain disruptions, raw material price volatility, and intense competition from global and regional players present ongoing challenges for market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Health Awareness and Fitness Participation:

The sports footwear market benefits from increasing consumer focus on health and fitness. Growing participation in gym workouts, running, and sports activities has created strong demand for high-performance shoes. Consumers are seeking footwear that supports comfort, injury prevention, and improved athletic performance. Rising obesity rates and lifestyle-related health concerns are prompting individuals to adopt more active routines, further boosting demand. It is driving consistent sales across both professional and recreational segments.

Expansion of Athleisure and Lifestyle Integration:

The blending of athletic performance and casual fashion continues to strengthen market growth. Sports footwear is no longer limited to athletic use, with consumers embracing it for daily wear due to its comfort and style. Global fashion trends are favoring sporty aesthetics, influencing both premium and mass-market segments. Brands are launching versatile designs that transition seamlessly from sports to social settings. It is expanding the consumer base beyond traditional sports enthusiasts.

Technological Advancements in Product Innovation:

Innovation in materials, cushioning systems, and sole technology is redefining the sports footwear market. Lightweight fabrics, breathable mesh, and responsive midsoles enhance performance while reducing fatigue. Advanced manufacturing techniques such as 3D printing allow for customization and precision in design. Integration of smart features, such as fitness tracking, is creating new value propositions. It is increasing brand differentiation and customer loyalty.

Growing Influence of Endorsements and Sponsorships:

Endorsements from athletes and partnerships with major sporting events are fueling brand visibility and consumer trust. Sports footwear brands leverage sponsorship deals to associate their products with performance excellence. Limited-edition collaborations with athletes and designers are generating high demand among collectors and trend-driven buyers. Social media and influencer marketing are further amplifying this effect, especially among younger consumers. It is reinforcing brand positioning in a competitive market.

Market Trends:

Sustainability and Eco-Friendly Material Adoption:

The sports footwear market is experiencing a significant shift toward sustainable production practices and eco-friendly materials. Brands are increasingly using recycled plastics, organic cotton, and plant-based alternatives to reduce environmental impact. Consumers are showing higher willingness to pay for products that align with their values on sustainability. Companies are introducing take-back programs and circular design models to extend product life cycles. Regulatory pressures in key markets are also pushing manufacturers to adopt greener processes. It is enabling brands to appeal to environmentally conscious buyers while meeting compliance requirements. The trend is expected to influence product development strategies for the foreseeable future.

Personalization and Smart Technology Integration:

Customization and technology integration are emerging as strong differentiators in the sports footwear market. Brands are offering personalized fit, design, and performance features through digital tools and in-store customization services. The adoption of smart footwear equipped with sensors for activity tracking and gait analysis is growing. These innovations cater to both professional athletes seeking performance optimization and casual users looking for advanced comfort. Integration of AI and data analytics is enabling brands to refine product recommendations and user experience. It is expanding market appeal across diverse customer segments and fostering long-term brand engagement. The convergence of technology and personalization is redefining consumer expectations in this sector.

Market Challenges Analysis:

Intense Competition and Price Pressure:

The sports footwear market faces high competition from global brands, regional players, and low-cost manufacturers. Price-sensitive consumers often opt for affordable alternatives, putting pressure on premium brands to balance quality and cost. Frequent discounting and promotional activities erode profit margins. New entrants and private labels in retail chains are increasing competitive intensity. It forces established brands to invest heavily in marketing, innovation, and customer engagement to maintain market share. Managing this competitive environment requires constant adaptation and differentiation strategies.

Supply Chain Disruptions and Raw Material Volatility:

Volatile raw material prices and supply chain disruptions pose significant challenges for manufacturers. Delays in material sourcing and transportation can impact production schedules and product availability. Rising costs for synthetic fabrics, rubber, and eco-friendly alternatives increase operational expenses. It often compels brands to reconsider sourcing strategies and explore local production options. Global events, trade restrictions, and environmental regulations add further complexity to logistics planning. Ensuring consistent supply while maintaining quality standards remains a critical challenge for industry players.

Market Opportunities:

Expansion in Emerging Economies and Untapped Markets:

The sports footwear market holds strong potential in emerging economies where urbanization and rising disposable incomes are driving lifestyle changes. Increasing participation in sports, fitness, and outdoor activities is expanding the consumer base. E-commerce growth in regions like Asia-Pacific, Latin America, and Africa is enabling wider product reach. It creates opportunities for both global and regional brands to establish stronger market presence. Targeted marketing strategies and affordable product lines can attract first-time buyers. Leveraging local sports events and cultural trends can further boost adoption.

Innovation in Product Design and Digital Retail Experiences:

Advancements in design, material science, and digital retail create substantial growth opportunities for the industry. Brands can integrate smart features, advanced cushioning systems, and sustainable materials to appeal to performance-focused and eco-conscious buyers. Customization tools and virtual try-on technologies enhance online shopping engagement. It allows companies to differentiate offerings and strengthen brand loyalty. Expansion of direct-to-consumer channels provides better control over pricing and customer relationships. Collaborations with fashion designers and influencers can also tap into lifestyle-driven demand.

Market Segmentation Analysis:

Segment Analysis – Sports Footwear Market

By Gender:

The sports footwear market is segmented into men, women, and kids. Men’s sports footwear accounts for the largest share due to higher participation in sports and fitness activities, along with a strong preference for performance-oriented designs. Women’s footwear is growing rapidly, driven by rising health awareness, increasing participation in organized sports, and expanding athleisure adoption. Kids’ footwear demand is supported by sports programs in schools and a rising focus on comfort and foot health in early age groups. It reflects growing diversity in product lines tailored to each demographic segment.

By Distribution Channel:

Distribution channels include online and offline retail. Offline channels, comprising specialty stores, supermarkets, and brand outlets, hold a significant share due to the preference for in-store trials and personalized service. Online channels are expanding quickly, fueled by e-commerce penetration, digital marketing, and virtual try-on technologies. It offers wider product accessibility, attractive discounts, and convenience, attracting both urban and rural consumers.

By End-Use:

End-use segments cover professional and recreational categories. Professional use is driven by athletes and sports professionals seeking advanced performance features, durability, and sport-specific designs. Recreational use dominates the market share, supported by casual wear trends, lifestyle integration, and comfort-oriented designs. It benefits from versatile styles that cater to both active use and daily wear needs.

Segmentations:

By Gender:

By Distribution Channel:

- Online

- Offline (Specialty Stores, Brand Outlets, Supermarkets/Hypermarkets, Others)

By End-Use:

- Professional

- Recreational

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America :

North America holds 36% market share in the sports footwear market, driven by a mature retail infrastructure and high consumer spending on premium products. The region benefits from a strong sports culture and widespread participation in athletic and fitness activities. Leading brands such as Nike, Adidas, and Under Armour maintain extensive retail networks and advanced e-commerce platforms. It is further supported by product innovation, athlete endorsements, and high adoption of athleisure trends. The United States dominates the regional market due to strong brand loyalty and rapid uptake of performance-enhancing technologies. Canada contributes steadily with growing interest in outdoor sports and sustainable footwear options.

Asia-Pacific :

Asia-Pacific accounts for 29% market share, supported by rising disposable incomes and urban lifestyle shifts. Rapid adoption of fitness-oriented routines and increasing interest in global sports are driving footwear demand. China, India, and Japan are leading markets, with local and international brands competing aggressively. It benefits from expanding e-commerce penetration and growing retail investment in tier-2 and tier-3 cities. Government initiatives promoting sports participation are further stimulating demand. Rising awareness of sustainable and fashionable sports footwear is shaping consumer preferences across the region.

Europe :

Europe holds 24% market share in the sports footwear market, sustained by a well-established sports culture and active lifestyles. The region is home to major sporting events and clubs, which significantly influence footwear trends. It benefits from a strong retail presence, both in-store and online, across countries such as Germany, the UK, and France. Sustainability-focused manufacturing and eco-friendly product lines are gaining traction among European consumers. Seasonal sporting activities and outdoor tourism contribute to consistent demand. Strategic collaborations between brands and sporting organizations continue to enhance market visibility and product innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nike Inc.

- MIZUNO Corporation

- Adidas Group

- ASICS Corp.

- Puma SE

- Skechers, USA Inc.

- Under Armour, Inc.

- Converse

- Fila Holdings Corp

- Diadora S.p.A.

Competitive Analysis:

The sports footwear market is highly competitive, with leading players such as Nike Inc., MIZUNO Corporation, Adidas Group, ASICS Corp., Puma SE, Skechers USA Inc., Under Armour Inc., and Converse shaping industry dynamics. It is driven by continuous innovation in design, material technology, and performance features to meet evolving consumer preferences. Brands compete on product quality, comfort, style, and sustainability, while also leveraging endorsements, sponsorships, and influencer collaborations to strengthen visibility. E-commerce expansion and direct-to-consumer strategies are enabling stronger brand-consumer relationships and higher margins. Regional players maintain a competitive edge through cost efficiency and local market adaptability. It requires established companies to invest in research, marketing, and brand differentiation to retain market share in a rapidly evolving global landscape.

Recent Developments:

- In March 2025 Nike Inc. launched the Air Max Dn8 on Air Max Day, introducing dual-pressure Air units and new colorways.

- In July 2025, Puma SE extended its partnership with Manchester City Football Club, continuing product innovation and global fan engagement.

- In May 2025, Skechers USA Inc. introduced the AERO Burst and AERO Spark technical running shoes in stores and online.

Market Concentration & Characteristics:

The sports footwear market is moderately concentrated, with a few global players such as Nike, Adidas, Puma, and Under Armour holding significant influence through brand strength, innovation, and extensive distribution networks. It is characterized by high product differentiation, with companies focusing on performance, comfort, style, and sustainability to capture diverse consumer segments. Competitive strategies include athlete endorsements, collaborations, and continuous technological advancements in materials and design. Regional players contribute to price competitiveness and cater to local preferences, while e-commerce growth intensifies market reach. It operates in a dynamic environment shaped by evolving fashion trends, sports participation rates, and consumer lifestyle shifts, requiring brands to adapt quickly to maintain relevance and market share.

Report Coverage:

The research report offers an in-depth analysis based on Gender, Distribution Channel, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for performance-driven sports footwear will rise as consumers prioritize comfort, injury prevention, and athletic efficiency.

- Sustainability will remain a core focus, with brands expanding the use of recycled materials, biodegradable components, and eco-friendly production processes.

- Athleisure trends will continue to blur the lines between sportswear and casual fashion, expanding the market’s appeal beyond athletes.

- E-commerce and direct-to-consumer channels will grow rapidly, supported by virtual try-on tools and AI-powered personalization.

- Smart footwear integrating sensors for activity tracking, gait analysis, and performance insights will gain wider adoption.

- Emerging markets in Asia-Pacific, Latin America, and Africa will drive significant growth due to rising disposable incomes and urbanization.

- Collaborations between sportswear brands, fashion designers, and influencers will strengthen lifestyle positioning.

- Customization options, including 3D printing and design personalization, will enhance consumer engagement and loyalty.

- Global sporting events and endorsements will continue to boost brand visibility and sales momentum.

- Innovation in lightweight, breathable, and durable materials will shape future product development and strengthen competitive advantage.