Market Overview

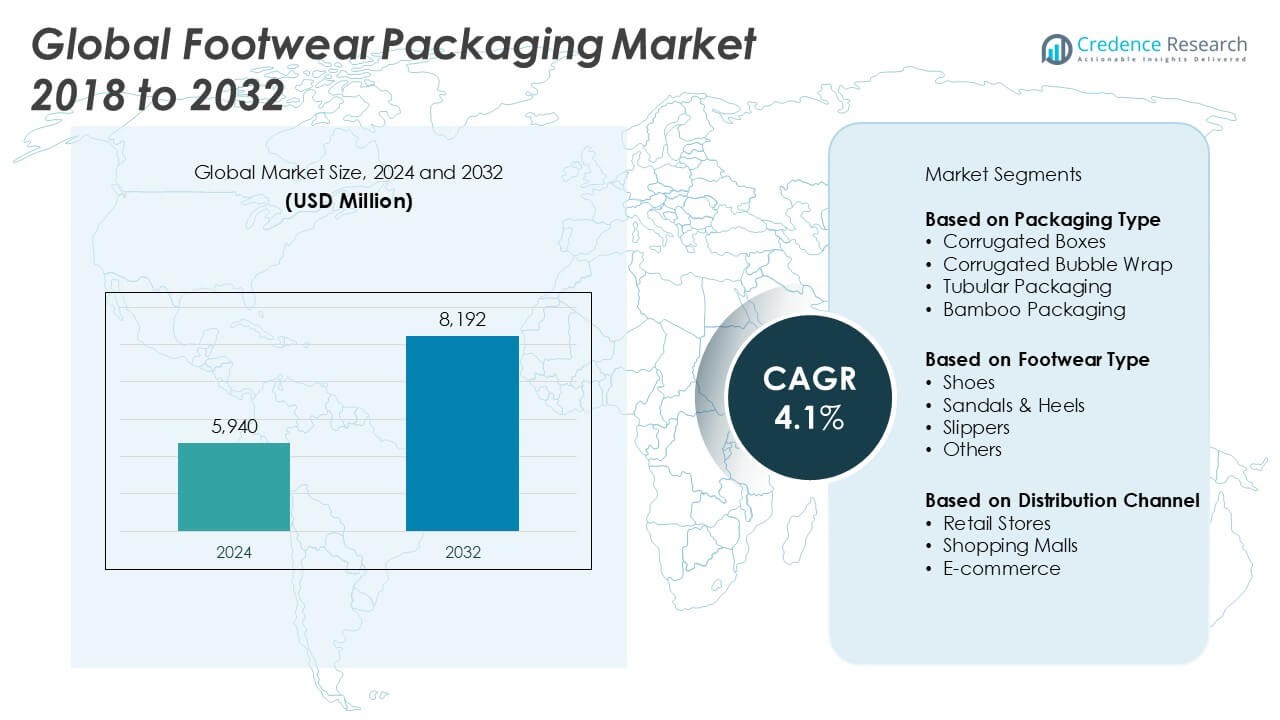

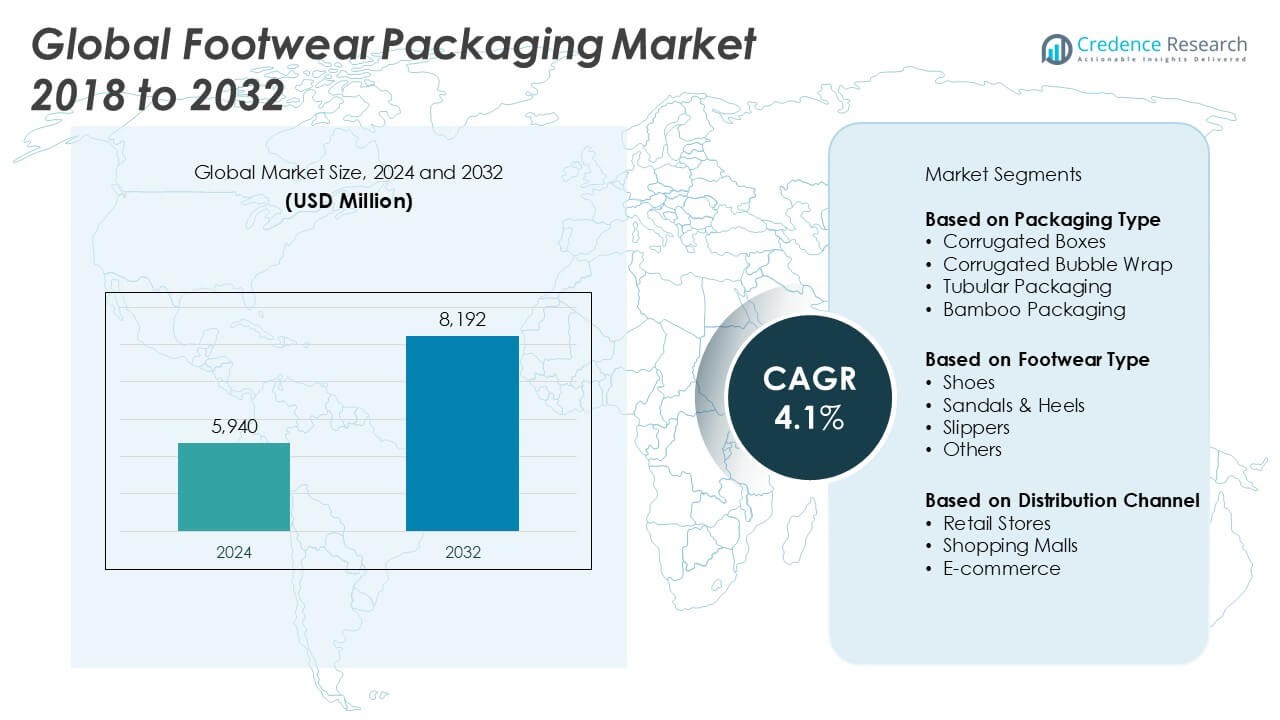

The Footwear Packaging market size was valued at USD 5,940 million in 2024 and is anticipated to reach USD 8,192 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Footwear Packaging Market Size 2024 |

USD 5,940 Million |

| Footwear Packaging Market, CAGR |

4.1% |

| Footwear Packaging Market Size 2032 |

USD 8,192 Million |

The footwear packaging market is led by prominent players such as Elevate Packaging, Packman, Great Little Box Company, Nike, Skechers, and Wolverine Worldwide. These companies compete through product innovation, sustainable materials, and customized packaging solutions aligned with brand positioning. Elevate Packaging and Great Little Box Company focus on eco-friendly and recyclable options, while Nike and Skechers integrate branded, premium packaging to enhance consumer engagement. Among regions, Asia Pacific dominates the global market with a 36% share, driven by high footwear production and consumption in countries like China and India. North America and Europe follow with 26% and 24% shares respectively, benefiting from advanced packaging technologies and growing sustainability initiatives. Leading companies continue to invest in design, functionality, and green packaging practices to strengthen their competitive positions across key regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global footwear packaging market was valued at USD 5,940 million in 2024 and is projected to reach USD 8,192 million by 2032, growing at a CAGR of 4.1% during the forecast period.

- Rising footwear sales through e-commerce platforms and increasing demand for sustainable, protective packaging materials are driving market growth across both developed and developing regions.

- Trends such as eco-friendly packaging, premiumization, and the use of smart packaging technologies are gaining traction, especially among global footwear brands aiming to enhance consumer experience.

- The market is moderately competitive, with key players like Elevate Packaging, Packman, Nike, Skechers, and Wolverine Worldwide focusing on customization, innovation, and environmental compliance to gain a competitive edge.

- Regionally, Asia Pacific holds the largest share at 36%, followed by North America (26%) and Europe (24%). Among packaging types, corrugated boxes dominate due to their durability and recyclability, supporting both retail and online distribution.

Market Segmentation Analysis:

By Packaging Type

The footwear packaging market is segmented into corrugated boxes, corrugated bubble wrap, tubular packaging, and bamboo packaging. Among these, corrugated boxes hold the dominant market share due to their durability, cost-effectiveness, and wide availability. Corrugated boxes offer excellent protection during transportation and are preferred by major footwear brands for both retail and e-commerce deliveries. Their recyclability aligns with sustainability goals, further driving adoption. Growing environmental awareness and rising consumer preference for eco-friendly packaging are also encouraging the use of bamboo packaging, which is gaining gradual traction in premium footwear segments.

- For instance, Nike transitioned to using corrugated cardboard made from 90% post-consumer recycled fiber across several product lines and reduced packaging waste per unit shipped by over 20 million kg between 2019 and 2023.

By Footwear Type

Based on footwear type, the market includes shoes, sandals & heels, slippers, and others. Shoes represent the largest sub-segment, accounting for the highest market share due to their widespread use across formal, athletic, and casual categories. The demand for athletic and casual shoes, in particular, has grown significantly, driving packaging needs for robust and well-designed boxes to support branding and logistics. The rise in fitness consciousness and increasing participation in sports and outdoor activities further fuel shoe sales, thus contributing to the expanding need for secure, brand-aligned footwear packaging solutions.

- For instance, Skechers reported selling 121 million pairs of shoes globally in 2022 and deployed reinforced corrugated packaging across its e-commerce logistics, enhancing durability while also eliminating 8.5 million plastic bags from its distribution process.

By Distribution Channel

The distribution segment comprises retail stores, shopping malls, and e-commerce, with e-commerce emerging as the dominant sub-segment. E-commerce commands a growing market share owing to the global shift toward online shopping and the convenience it offers consumers. This channel demands durable and protective packaging materials to ensure product integrity during shipping. Increased internet penetration, smartphone usage, and the rise of direct-to-consumer footwear brands are key drivers. Moreover, sustainable and innovative packaging solutions are being prioritized by online retailers to enhance unboxing experiences and reduce environmental impact, strengthening this segment’s market position.

Key Growth Drivers

Surge in Footwear Sales through E-commerce

The rapid growth of e-commerce platforms has significantly influenced the footwear packaging market. With increasing consumer preference for online shopping, brands require durable and aesthetically pleasing packaging to ensure product safety and enhance customer experience. E-commerce demands sturdy materials like corrugated boxes and bubble wraps to minimize damage during transit. Furthermore, unboxing experiences and sustainable packaging are becoming essential for online footwear retailers to stand out. This shift toward digital retail is expected to continue driving demand for customized and protective footwear packaging solutions globally.

- For instance, Wolverine Worldwide reported 31% of its total revenue came from direct-to-consumer channels in 2023, prompting the company to implement tamper-evident corrugated boxes across all online footwear orders shipped from its U.S. and European fulfillment centers.

Rising Environmental Awareness and Sustainable Packaging Demand

Growing awareness regarding environmental issues is pushing manufacturers toward adopting eco-friendly packaging materials. Consumers and regulatory bodies increasingly favor biodegradable, recyclable, and reusable materials, which is leading to innovation in packaging design and raw material sourcing. Alternatives like bamboo packaging are gaining traction, especially among premium and sustainability-focused brands. This environmental consciousness not only drives new product development but also enhances brand image, fostering loyalty among environmentally conscious consumers. As sustainability becomes a core value for businesses, demand for green footwear packaging is set to rise steadily.

- For instance, Allbirds, a sustainable footwear brand, uses 100% recycled cardboard packaging and claims to offset approximately 12.5 kg of CO₂ emissions per order through its carbon-neutral shipping and packaging program.

Branding and Differentiation through Innovative Packaging

Footwear companies are investing in visually appealing and brand-specific packaging to enhance consumer perception and brand recall. Innovative packaging plays a vital role in marketing strategies, especially for premium and fashion footwear. Customized packaging helps brands differentiate themselves in a crowded marketplace and create a memorable unboxing experience. Unique design elements, logos, and storytelling through packaging are now integral to customer engagement strategies. This trend encourages manufacturers to offer flexible and creative packaging solutions, thereby driving consistent innovation and growth in the market.

Key Trends & Opportunities

Adoption of Smart and Interactive Packaging

The integration of smart packaging technologies, such as QR codes and augmented reality (AR), is emerging as a significant trend. These features provide additional product information, authenticity verification, and interactive brand experiences. Footwear brands are leveraging such technology to engage tech-savvy consumers and add value to their packaging. This trend opens opportunities for tech-enabled packaging solutions that not only improve security and traceability but also elevate brand interaction, especially in online retail environments where physical interaction is limited.

- For instance, Nike integrated NFC (Near Field Communication) chips into packaging for its limited-edition HyperAdapt and Adapt BB lines, enabling real-time product authentication. This initiative resulted in over 350,000 authenticated scans during the first two quarters of deployment, enhancing trust and reducing counterfeit issues across key markets.

Increasing Demand for Customization and Premium Packaging

Consumers are increasingly valuing personalized and premium packaging, especially in high-end footwear segments. Customization helps brands cater to specific audiences and occasions, such as limited-edition launches or festive collections. Premium packaging materials and exclusive designs are being used to align with luxury branding. This shift presents opportunities for packaging manufacturers to offer bespoke solutions that reflect a brand’s identity while ensuring durability. The trend also aligns with gifting culture and influencer marketing, where presentation significantly impacts product perception and shareability.

- For instance, Adidas partnered with Parley for the Oceans to launch its premium Ultraboost DNA sneaker line in custom-molded packaging made from 100% recycled marine plastic waste, removing 11 tons of plastic debris from coastal areas to support the packaging run for its first 50,000 units of the limited collection.

Key Challenges

High Cost of Sustainable and Custom Packaging Solutions

While sustainable and customized packaging options are gaining popularity, they often come with higher production and material costs. Small and mid-sized footwear brands may find it challenging to absorb these costs without affecting profitability. Additionally, transitioning from traditional plastic-based packaging to eco-friendly alternatives requires investment in new materials and technologies. These financial constraints can hinder the widespread adoption of innovative packaging solutions, especially in price-sensitive markets, slowing the overall market growth potential.

Logistics and Supply Chain Constraints

Supply chain disruptions, fluctuating raw material prices, and logistical inefficiencies pose significant challenges to the footwear packaging industry. The reliance on global suppliers for materials such as paperboard and bio-based plastics can make manufacturers vulnerable to delays and price volatility. Inadequate storage and handling during transit can also lead to product damage, undermining packaging effectiveness. These operational hurdles affect timely delivery and customer satisfaction, forcing manufacturers to invest more in efficient logistics and inventory planning.

Regulatory Compliance and Waste Management Issues

Increasing regulations related to packaging waste, recyclability, and carbon emissions create compliance challenges for footwear packaging manufacturers. Adhering to evolving packaging laws across different regions requires continuous adjustments in materials and processes. Additionally, managing packaging waste responsibly demands collaboration with recycling infrastructure, which may be underdeveloped in certain regions. These regulatory pressures require proactive measures and may increase operational costs, particularly for global brands operating in multiple jurisdictions.

Regional Analysis

North America

North America holds a significant share of the global footwear packaging market, accounting for approximately 26% in 2024. The region benefits from a strong presence of established footwear brands and advanced packaging technologies. The growth of e-commerce, especially in the U.S. and Canada, continues to drive demand for durable and aesthetically designed packaging solutions. Additionally, increasing consumer awareness regarding sustainable practices is fostering the adoption of eco-friendly materials such as recycled paper and biodegradable plastics. The market also witnesses high investments in innovative and smart packaging to enhance brand experience and meet evolving consumer expectations.

Europe

Europe captures around 24% of the global footwear packaging market, driven by stringent environmental regulations and a mature fashion industry. Countries such as Germany, France, and Italy lead the demand for premium and sustainable packaging solutions. The region’s emphasis on circular economy practices is accelerating the shift toward recyclable and biodegradable packaging materials. Footwear manufacturers are also adopting minimalist and branded packaging designs to appeal to environmentally conscious consumers. Moreover, the strong retail infrastructure and rising online sales in Western Europe continue to support the market’s steady growth, making sustainability and innovation key differentiators in this region.

Asia Pacific

Asia Pacific dominates the footwear packaging market with an estimated 36% market share in 2024. The region’s leadership is attributed to high footwear production and consumption in countries like China, India, and Vietnam. The booming e-commerce sector and expanding middle-class population are fueling demand for cost-effective yet durable packaging. Additionally, rising urbanization and growing awareness of sustainable practices are pushing manufacturers toward eco-friendly alternatives. The market is highly competitive, with both global and local packaging providers offering customized solutions to meet diverse consumer preferences. Government initiatives promoting green manufacturing further enhance growth prospects in this region.

Latin America

Latin America holds a moderate share of approximately 8% in the global footwear packaging market. The region experiences steady demand, particularly from countries like Brazil, Mexico, and Argentina, where domestic footwear industries are well-established. Growth in retail and online footwear sales is driving the need for efficient and visually appealing packaging. However, cost sensitivity and limited adoption of advanced packaging technologies restrict market expansion. Nonetheless, increasing environmental awareness and gradual shifts toward sustainable materials present new opportunities for innovation. Local manufacturers are also investing in lightweight and recyclable packaging to meet regulatory and consumer expectations.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for around 6% of the global footwear packaging market. Although the market is relatively smaller, it shows potential for growth due to rising urbanization, expanding retail sectors, and increasing footwear consumption in countries like the UAE, South Africa, and Saudi Arabia. E-commerce growth and changing consumer lifestyles are creating new demand for protective and attractive packaging formats. However, infrastructural challenges and limited access to sustainable materials may hinder widespread adoption. Still, ongoing investments in manufacturing and packaging innovation signal gradual growth and expansion opportunities for market players in this region.

Market Segmentations:

By Packaging Type

- Corrugated Boxes

- Corrugated Bubble Wrap

- Tubular Packaging

- Bamboo Packaging

By Footwear Type

- Shoes

- Sandals & Heels

- Slippers

- Others

By Distribution Channel

- Retail Stores

- Shopping Malls

- E-commerce

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the footwear packaging market is characterized by a mix of global packaging manufacturers, regional suppliers, and in-house packaging operations by major footwear brands. Companies such as Elevate Packaging, Packman, and Great Little Box Company compete by offering innovative, sustainable, and customizable packaging solutions that cater to both mass and premium footwear segments. Footwear brands like Nike, Skechers, and Wolverine Worldwide are increasingly investing in eco-friendly and branded packaging to strengthen their sustainability goals and brand identity. Regional players such as Kanishka Printer and Royal Packers serve localized markets with cost-effective and tailored solutions, while companies like SNEAKERBOX and Merrypak focus on niche and premium packaging formats. Strategic collaborations between packaging suppliers and footwear companies are becoming common, especially to meet evolving consumer demands and regulatory compliance. As sustainability, e-commerce readiness, and aesthetic appeal become key differentiators, companies are leveraging technological advancements and design innovation to gain a competitive edge in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wolverine Worldwide

- Packman

- SNEAKERBOX

- Skechers

- Great Little Box Company

- Elevate Packaging

- Cross Country Box Company

- Kanishka Printer

- Royal Packers

- Marber

- Nike

- Merrypak

- Precious Packaging

Recent Developments

- In February 2025, Dow introduced bio-circular resins for footwear packs through a collaboration with Porto Indonesia Sejahtera.

- In February 2025, Mondi and CMC launched an on-demand e-commerce line that sizes every shoe box to order, slashing fiber and filler waste.

- In December 2024, SMX released chip-protective coatings that extend NFC life and fight counterfeits in premium shoe packaging.

- In April 2024, Fast Feet Grinded opened Europe’s first shoe-recycling plant, supporting closed-loop packaging reuse.

- In January 2024, WestRock Company announced plans to build a new corrugated box plant in Pleasant Prairie, Wisconsin, to meet the growing demand from customers in the Great Lakes region.

- In July 2023, Smurfit Kappa inaugurated its first plant in North Africa. The Group invested over EUR 35 million (USD 37.05 million) in the 25,000 sq. m. facility, which was completed from ground-break to operation.

Market Concentration & Characteristics

The Footwear Packaging Market exhibits moderate market concentration, with a blend of global leaders and regional players competing across diverse product segments. It includes both specialized packaging providers and in-house packaging divisions of major footwear brands. The market reflects a strong emphasis on sustainability, cost-efficiency, and customization. Companies prioritize recyclable materials, lightweight designs, and enhanced product protection to meet environmental regulations and consumer expectations. Innovation in design and material selection helps firms differentiate their offerings and align with branding strategies. The market remains highly responsive to changes in retail formats, especially the shift toward e-commerce, which requires durable and protective packaging solutions. Regional dynamics shape demand patterns, with Asia Pacific leading in volume due to its large-scale footwear production and growing consumer base. North America and Europe contribute significant value through premium and eco-conscious packaging. Competitive behavior centers on technology integration, sustainable practices, and client-centric solutions to retain brand loyalty and expand market presence.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Footwear Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily driven by rising global footwear consumption.

- E-commerce expansion will boost demand for durable and protective packaging formats.

- Sustainable packaging materials like recycled cardboard and bamboo will see increased adoption.

- Brands will invest more in customized and branded packaging to enhance consumer engagement.

- Smart packaging technologies such as QR codes and interactive features will gain traction.

- Asia Pacific will maintain its dominance due to strong manufacturing and growing domestic demand.

- Europe will see higher demand for eco-friendly packaging due to strict environmental regulations.

- Lightweight and cost-effective packaging solutions will remain a priority for mass-market segments.

- Local packaging companies will expand capabilities to meet rising demand from small and medium footwear brands.

- Strategic partnerships between footwear brands and packaging firms will shape innovation and efficiency.