Market Overview

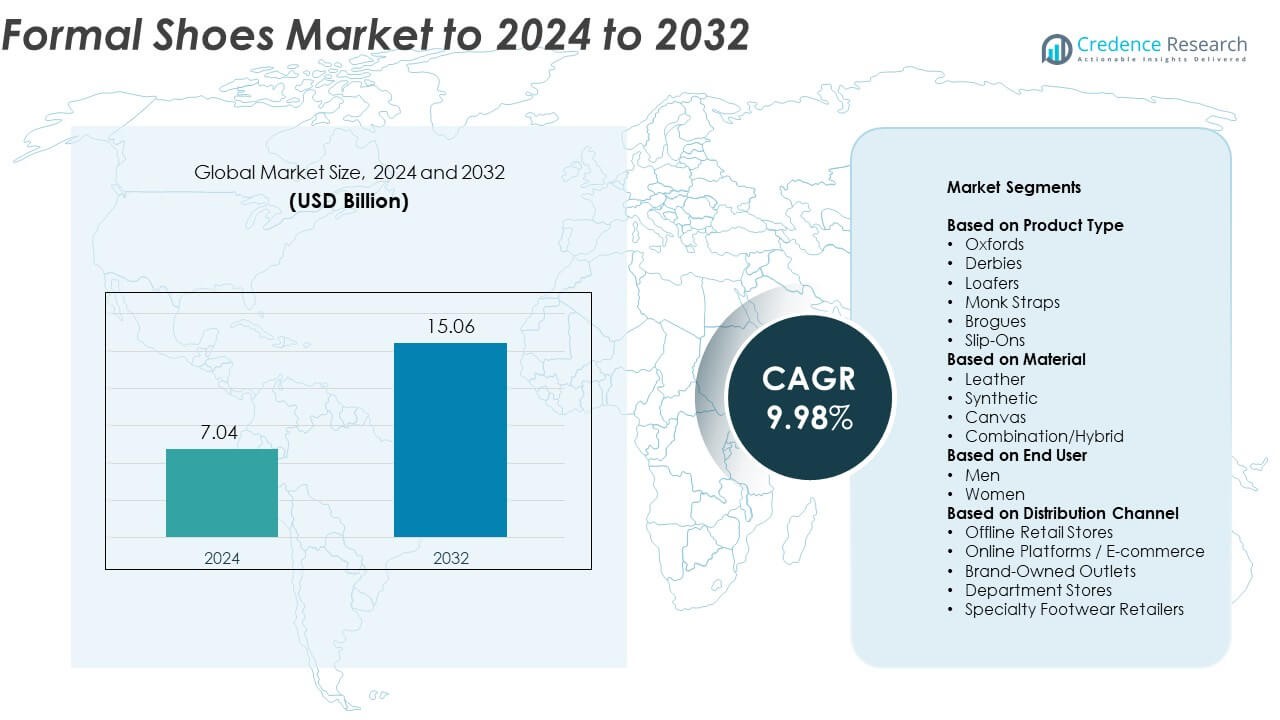

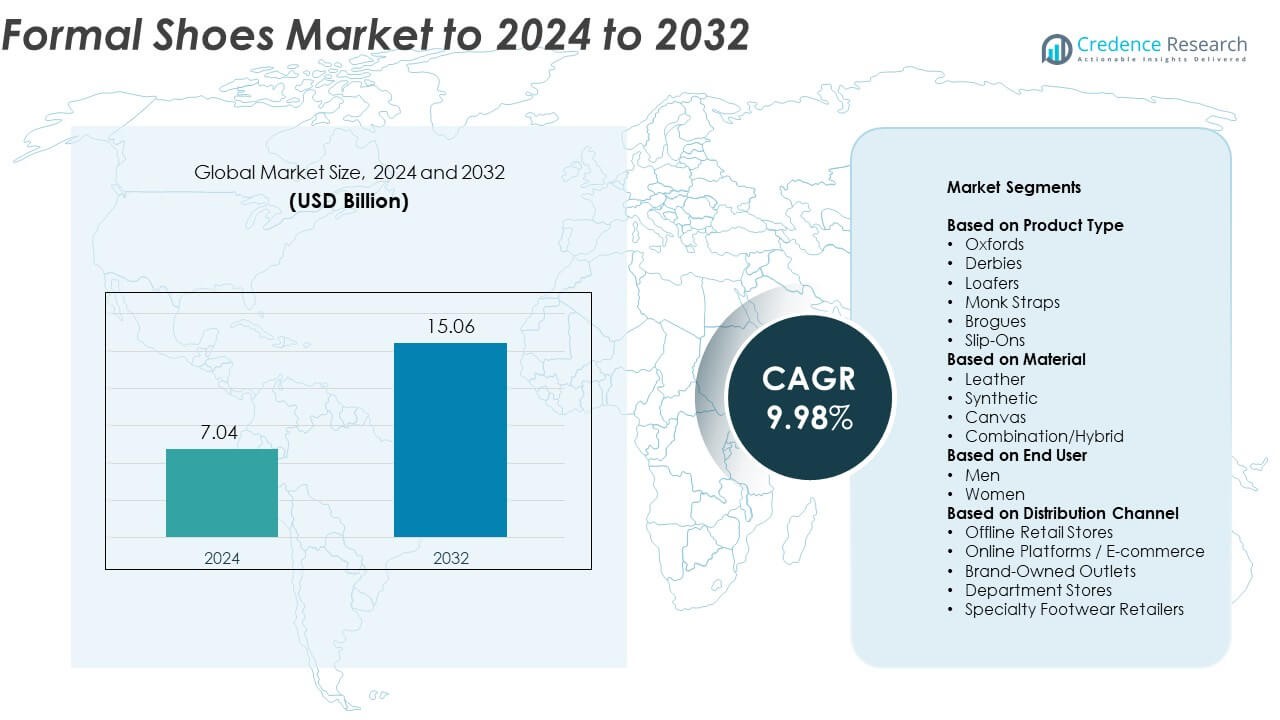

Formal Shoes Market size was valued at USD 7.04 Billion in 2024 and is anticipated to reach USD 15.06 Billion by 2032, at a CAGR of 9.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Formal Shoes Market Size 2024 |

USD 7.04 Billion |

| Formal Shoes Market, CAGR |

9.98% |

| Formal Shoes Market Size 2032 |

USD 15.06 Billion |

Leading companies such as Ecco, Johnston & Murphy, Clarks, Salvatore Ferragamo, Loake, Hugo Boss, Barker, John Lobb, Allen Edmonds, Geox, Meermin, Bruno Magli, Church’s, Florsheim, and Magnanni play a major role in shaping the global formal shoes market. North America dominates with a 32.7% share, supported by a mature retail network and high consumer spending on luxury footwear. Europe follows with 27.4%, driven by strong brand heritage and craftsmanship in Italy and the U.K. Asia Pacific holds 24.6% share and remains the fastest-growing region due to rising middle-class income and corporate workforce expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The formal shoes market was valued at USD 7.04 billion in 2024 and is projected to reach USD 15.06 billion by 2032, expanding at a CAGR of 9.98%.

- Growing corporate employment, increasing fashion consciousness, and rising preference for premium footwear drive strong market growth.

- Sustainable leather sourcing, eco-friendly tanning, and digitized customization are emerging as key trends influencing consumer choices.

- The competitive landscape is dominated by international brands focusing on craftsmanship, innovation, and global retail expansion through online and offline channels.

- North America leads with 32.7% share, followed by Europe with 27.4%, while Asia Pacific, holding 24.6%, remains the fastest-growing region; by product type, Oxfords dominate with 34.8% share.

Market Segmentation Analysis:

By Product Type

Oxfords dominate the formal shoes market, accounting for nearly 34.8% share in 2024. Their leadership is supported by timeless appeal, sleek design, and suitability for corporate and ceremonial wear. Oxfords are favored for their versatility, often crafted with premium leather and minimalist aesthetics that match global fashion standards. Rising demand from professionals and increasing focus on premium footwear collections across luxury brands further boost growth. Derbies and loafers follow closely, gaining traction due to their comfort and semi-formal adaptability in both business and casual settings.

- For instance, Church’s shoes take about 8 weeks and over 250 manual operations to make, with a recent factory output reported at roughly 1,500 to 3,500 pairs per week in Northampton.

By Material

Leather leads the market with about 58.7% share in 2024, driven by its durability, comfort, and premium finish. Genuine leather remains the preferred choice among consumers seeking longevity and classic appeal in formal footwear. The growing availability of eco-friendly and sustainably sourced leather further strengthens demand. Luxury brands are expanding product lines using full-grain and patent leather, while hybrid models combining leather and synthetic materials are also gaining attention. Rising consumer preference for long-lasting, breathable materials continues to sustain leather’s dominance across both men’s and women’s categories.

- For instance, ECCO operates 4 tanneries—in Indonesia, the Netherlands, Thailand, and China—and states all are rated Gold by the Leather Working Group.

By End User

Men hold the dominant 68.5% share in the formal shoes market in 2024, attributed to high demand from business professionals and corporate employees. The men’s segment benefits from expanding formalwear collections, increasing fashion consciousness, and a broader range of designs from classic Oxfords to contemporary loafers. Growing participation of men in formal and semi-formal occasions further supports demand. Meanwhile, the women’s segment is growing steadily due to increasing workforce participation and the introduction of gender-inclusive and stylish formal shoe lines across retail and online platforms.

Key Growth Drivers

Rising Professional and Corporate Workforce

The expanding global corporate sector significantly drives demand for formal shoes. Growing employment in business services, finance, and hospitality increases the need for professional footwear. Consumers are prioritizing premium quality and style for office and formal occasions, enhancing brand differentiation. Companies are introducing comfort-oriented designs with cushioned soles and lightweight materials to cater to long working hours. This sustained corporate growth supports consistent market expansion worldwide.

- For instance, Johnston & Murphy operates about 153 company-owned stores (as of April 2024, including airport locations) and supplies products to more than 2,000 global retail and wholesale locations.

Premiumization and Brand Positioning

Increasing consumer spending on luxury and branded footwear is fueling market growth. Brands are emphasizing craftsmanship, superior leather, and innovative design to attract affluent customers. The rising trend of aspirational buying and exposure to global fashion influences purchasing behavior. Leading players are launching exclusive collections and collaborations with designers to strengthen brand value. This shift toward premiumization boosts revenue and enhances customer loyalty in competitive markets.

- For instance, Salvatore Ferragamo operated 389 directly operated stores (DOS) worldwide as of December 31, 2022.

Technological Innovation in Manufacturing

Adoption of advanced manufacturing processes such as automated cutting, 3D modeling, and sustainable tanning is improving product quality. These innovations reduce production waste and enhance precision, leading to better fit and comfort. Use of digital platforms for customization and virtual try-ons increases consumer engagement. The integration of technology also supports scalability and quicker product launches, driving higher efficiency across the value chain.

Key Trends & Opportunities

Sustainable and Ethical Footwear Production

Growing environmental awareness is pushing manufacturers to adopt eco-friendly materials and ethical practices. The shift toward biodegradable leather alternatives and water-efficient tanning methods aligns with global sustainability goals. Consumers increasingly prefer brands transparent about sourcing and manufacturing. Companies focusing on recyclable packaging and carbon-neutral operations are gaining market advantage, creating long-term opportunities for sustainable growth.

- For instance, Dr. Martens reported diverting 23 tonnes of leather waste from landfill, reselling over 10,000 pre-loved pairs via ReWair, and completing 5,780 authorised repairs in FY2024.

Expansion of Online Retail and Direct-to-Consumer Models

The surge in e-commerce is transforming formal shoe distribution. Digital platforms allow brands to reach diverse consumer bases with personalized offerings and virtual fit tools. Direct-to-consumer strategies improve profit margins and enhance brand control. Growing digital marketing investments and mobile-based shopping convenience continue to expand this channel, particularly among younger, tech-savvy buyers in emerging economies.

- For instance, Cole Haan operated over 500 stores worldwideas of late 2023, expanding direct access to consumers.

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of leather, synthetic materials, and adhesives affect production expenses and pricing stability. The industry faces rising input costs due to supply chain disruptions and limited availability of premium hides. Small and medium-sized manufacturers struggle to maintain margins while meeting quality standards. Managing raw material sourcing efficiently is essential to ensure consistent profitability.

High Competition and Brand Imitation

The market experiences intense competition from global and regional players offering similar designs at varied price points. Counterfeit and imitation products also undermine brand reputation and erode market share. Maintaining exclusivity through innovation and quality assurance becomes crucial for established brands. Continuous investment in design differentiation and consumer engagement is necessary to sustain leadership in the evolving formal footwear market.

Regional Analysis

North America

North America holds the dominant 32.7% share of the formal shoes market in 2024. The region benefits from strong demand among working professionals and high adoption of premium leather footwear. The United States drives growth through an expanding corporate sector, rising disposable income, and preference for branded products. Retailers focus on offering both luxury and affordable formal collections to appeal to diverse consumers. The growing influence of sustainable manufacturing practices and online retail penetration continues to support market expansion across the U.S. and Canada.

Europe

Europe accounts for nearly 27.4% share of the global market in 2024. The region’s leadership stems from established fashion houses and long-standing craftsmanship traditions in Italy, Spain, and the United Kingdom. Consumers show high brand loyalty toward heritage labels offering leather Oxfords and brogues. Rising awareness of eco-friendly footwear production further boosts growth. Demand for formal shoes remains stable across business and ceremonial segments, while the rise of hybrid workwear trends encourages more casual yet sophisticated designs that merge comfort with premium aesthetics.

Asia Pacific

Asia Pacific represents about 24.6% share of the formal shoes market in 2024 and is the fastest-growing region. Rapid urbanization, growing middle-class income, and a strong corporate workforce in countries such as China, India, and Japan fuel demand. Local manufacturers are expanding production capacity to meet increasing domestic consumption. International brands are also strengthening their presence through online channels and exclusive retail stores. The shift toward western-style corporate dressing and rising fashion awareness among young professionals further support regional growth.

Latin America

Latin America captures around 8.9% share of the global market in 2024. Countries like Brazil and Mexico lead due to increasing urban employment and demand for stylish, affordable footwear. Local producers are focusing on cost-effective leather and synthetic options to attract price-sensitive buyers. Growth in retail modernization and rising brand visibility through digital channels are enhancing market presence. Although purchasing power varies across the region, the rising influence of online shopping and exposure to international fashion trends drive gradual adoption of formal shoes.

Middle East & Africa

The Middle East & Africa region accounts for nearly 6.4% share of the market in 2024. Demand is supported by a growing urban population, expanding corporate infrastructure, and increasing preference for premium lifestyle products. The Gulf countries witness high consumption of luxury formal footwear, especially from European and Italian brands. In Africa, affordability and availability remain key factors influencing purchase decisions. The gradual development of organized retail and e-commerce platforms is expected to improve accessibility and drive steady market growth across major urban centers.

Market Segmentations:

By Product Type

- Oxfords

- Derbies

- Loafers

- Monk Straps

- Brogues

- Slip-Ons

By Material

- Leather

- Synthetic

- Canvas

- Combination/Hybrid

By End User

By Distribution Channel

- Offline Retail Stores

- Online Platforms / E-commerce

- Brand-Owned Outlets

- Department Stores

- Specialty Footwear Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the formal shoes market features leading brands such as Ecco, Johnston & Murphy, Clarks, Salvatore Ferragamo, Loake, Hugo Boss, Barker, John Lobb, Allen Edmonds, Geox, Meermin, Bruno Magli, Church’s, Florsheim, and Magnanni. The market is defined by a blend of luxury heritage manufacturers and modern brands focusing on comfort and performance-driven design. Companies are investing heavily in sustainable materials, smart production technologies, and digital retail strategies to strengthen market presence. Innovation in lightweight soles, breathable materials, and ergonomic structures is reshaping product development across price tiers. Leading players are also expanding through exclusive retail stores and online platforms to reach global consumers. The rising influence of younger professionals and growing demand for premium aesthetics continue to push brands toward versatile and stylish offerings that balance elegance with everyday comfort. Strategic collaborations, craftsmanship excellence, and sustainable practices remain central to long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecco

- Johnston & Murphy

- Clarks

- Salvatore Ferragamo

- Loake

- Hugo Boss

- Barker

- John Lobb

- Allen Edmonds

- Geox

- Meermin

- Bruno Magli

- Church’s

- Florsheim

- Magnanni

Recent Developments

- In 2025, Hugo Boss released a new collection of men’s business shoes focusing on modern designs with soft leather for enhanced comfort.

- In 2025, Johnston & Murphy Launched new arrivals emphasizing classic style, advanced comfort tech (Nov 2024–2025); premium leather and Goodyear welt construction

- In 2023, Clarks launched the Origin 2.0 line, a collection of sustainable sneakers designed for disassembly, featuring recycled leather, eco-friendly soles, and no glue across Europe and North America.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing urban professional populations will increase demand for formal footwear in emerging economies.

- Rising consumer preference for premium and designer formal shoes will drive brand-led growth.

- Integration of sustainable materials and ethical manufacturing will become a major differentiator for footwear brands.

- Customisation options — such as tailored fits, unique colours and designs via online platforms — will expand market appeal.

- E-commerce and omnichannel distribution will broaden reach and boost sales in both developed and developing markets.

- Technological innovations in comfort features and materials, such as lightweight soles and breathable leather, will enhance product value.

- Expansion in women’s formal footwear and gender-inclusive styles will open new growth segments.

- Regional growth in Asia Pacific and Latin America will outpace mature markets due to rising incomes and formalwear adoption.

- Strategic collaborations between footwear brands and fashion houses or tech firms will generate fresh product lines and market buzz.

- Pressure on raw material costs and rising competition from casual footwear may challenge growth unless brands adapt with innovation and efficiency.