| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Cyber Physical Systems Market Size 2024 |

USD 4624.6 million |

| France Cyber Physical Systems Market, CAGR |

9.89% |

| France Cyber Physical Systems Market Size 2032 |

USD 9832.22 million |

Market Overview:

The France Cyber Physical Systems is projected to grow from USD 4624.6 million in 2024 to an estimated USD 9832.22 million by 2032, with a compound annual growth rate (CAGR) of 9.89% from 2024 to 2032.

Several factors are driving the expansion of the CPS market in France. The nation’s robust industrial base, particularly in sectors like automotive, energy, and manufacturing, is increasingly adopting CPS solutions to enhance operational efficiency and innovation. These sectors are investing heavily in automation, predictive maintenance, and data-driven insights, all of which are powered by CPS technologies. Government initiatives aimed at promoting digital transformation and Industry 4.0 are further accelerating the integration of CPS technologies. The French government is actively supporting the development of smart cities, digital infrastructure, and advanced manufacturing techniques. Additionally, the proliferation of Internet of Things (IoT) devices and advancements in artificial intelligence (AI) are enhancing the capabilities of CPS, enabling real-time data processing and decision-making across various applications. These technological developments are revolutionizing traditional industries by offering solutions that improve reliability, reduce downtime, and optimize resource use.

Regionally, France stands out as a key player in the European CPS landscape. The country’s sophisticated infrastructure and commitment to technological advancement make it a favorable environment for CPS adoption. With France’s strong emphasis on sustainability, the government has prioritized smart grid technologies, renewable energy systems, and automation in transportation, all of which are areas where CPS can have a transformative impact. Significant investments in smart manufacturing, energy management, and autonomous systems are contributing to the market’s growth. French industries, especially in automotive and aerospace, are embracing CPS for innovations such as driverless vehicles and intelligent manufacturing systems. Collaboration between industry leaders and research institutions in France fosters innovation in CPS applications, further strengthening its position in the European market. These partnerships are accelerating the commercialization of CPS solutions, making France a leader in the development of cyber-physical systems within Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Cyber-Physical Systems market is projected to grow from USD 4.62 billion in 2024 to USD 9.83 billion by 2032, with a CAGR of 9.89% from 2024 to 2032.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- The increasing adoption of CPS in sectors such as automotive, energy, and manufacturing is driving market growth, enhancing efficiency, and optimizing operations.

- France’s government initiatives supporting Industry 4.0 and digital transformation play a crucial role in accelerating CPS adoption across various industries.

- Technological advancements in IoT and AI are enhancing CPS capabilities, enabling real-time data processing, predictive maintenance, and autonomous decision-making.

- The rise of smart city initiatives and renewable energy projects is creating significant opportunities for CPS in urban planning, energy management, and transportation.

- France’s strong industrial base and commitment to technological innovation make it a favorable environment for CPS solutions, contributing to its regional dominance in Europe.

- Despite market growth, challenges such as high implementation costs, data security concerns, and a shortage of skilled professionals could slow down the adoption of CPS technologies.

Report scope

This report segment the France Cyber Physical Systems Market as follow;

Market Drivers:

Technological Advancements and Innovation

Technological advancements are a significant driver of the growth in the Cyber-Physical Systems (CPS) market in France. The rapid development of Internet of Things (IoT) devices and artificial intelligence (AI) has greatly enhanced the capabilities of CPS solutions. These technologies enable seamless integration between the digital and physical worlds, fostering real-time data processing, autonomous decision-making, and predictive analytics. For instance, IoT sensors embedded in smart infrastructure allow real-time monitoring, fault prediction, and energy optimization, enhancing operational efficiency and reducing costs. As businesses in sectors such as manufacturing, automotive, and energy continue to adopt these advancements, CPS technologies are becoming integral to their operations. The innovation fueled by AI and IoT has made it possible for organizations to enhance operational efficiency, reduce costs, and improve the overall reliability of their systems.

Government Initiatives and Industry 4.0 Integration

The French government’s strong focus on digital transformation and Industry 4.0 initiatives further accelerates the adoption of CPS. France has introduced several policies and programs aimed at modernizing its industrial infrastructure, including the development of smart factories, digital manufacturing processes, and autonomous systems. These initiatives provide a favorable environment for the integration of CPS technologies across various industries. The French government also supports the growth of smart cities and the digitalization of the public sector, creating opportunities for CPS adoption in sectors such as transportation, healthcare, and urban planning. For instance, France’s CPS4EU project, co-financed by the EU, promotes CPS adoption across industries by integrating IoT and AI for real-time automation and predictive maintenance. By promoting digital innovation, the government helps drive investments in CPS technologies, facilitating their widespread implementation.

Demand for Enhanced Efficiency and Automation

The demand for increased efficiency and automation is another critical driver of the CPS market in France. Industries such as automotive, aerospace, and energy are increasingly relying on CPS solutions to streamline operations and improve productivity. By leveraging CPS technologies, these sectors can automate complex processes, monitor system performance in real-time, and ensure better resource utilization. In manufacturing, for example, CPS enables predictive maintenance, allowing companies to anticipate equipment failures before they occur, reducing downtime and maintenance costs. This growing demand for automation solutions is pushing companies to adopt CPS in order to stay competitive in an increasingly digital and automated global market.

Collaboration and Research in Industry

Collaboration between French industries and research institutions has played a pivotal role in advancing the development and application of CPS. France has a rich ecosystem of universities, research centers, and industry players focused on innovation in cyber-physical systems. These collaborations are driving breakthroughs in CPS technologies, particularly in areas such as autonomous systems, robotics, and smart grids. By fostering innovation through partnerships between the public and private sectors, France is positioning itself as a leader in the European CPS market. These collaborative efforts ensure that the country remains at the forefront of technological advancements, driving the continued adoption and growth of CPS across various industries.

Market Trends:

Integration of Artificial Intelligence and Machine Learning

A prominent market trend in France’s Cyber-Physical Systems (CPS) sector is the integration of artificial intelligence (AI) and machine learning (ML) to enhance system capabilities. These technologies are increasingly embedded into CPS solutions to drive autonomous decision-making, predictive analytics, and adaptive behaviors. AI algorithms enable CPS to learn from historical data, identify patterns, and optimize processes in real time. As AI and ML continue to evolve, they are opening new possibilities for CPS applications in industries such as manufacturing, healthcare, and automotive. The use of AI within CPS is improving efficiency and enabling organizations to proactively address challenges, such as system failures or production bottlenecks, thereby enhancing operational reliability.

Shift Toward Smart Manufacturing and Industry 4.0

Another significant trend in France’s CPS market is the ongoing shift towards smart manufacturing, driven by Industry 4.0 principles. CPS is at the heart of this transformation, providing the necessary infrastructure for highly automated and interconnected production environments. For example, Airbus utilizes digital twins and advanced robotics in Toulouse to streamline aerospace production processes. In particular, France’s manufacturing sector is adopting CPS solutions to create smart factories where machines, sensors, and production lines communicate seamlessly with each other. This transition is fostering greater flexibility in production processes, reducing operational costs, and enabling manufacturers to meet the growing demand for personalized and on-demand products. The rise of smart factories and automated production lines is accelerating the demand for CPS technologies in the French industrial landscape.

Expansion of Smart City Initiatives

The development of smart cities in France is another important trend influencing the CPS market. French cities are increasingly integrating CPS solutions into their urban planning to optimize transportation, energy consumption, waste management, and public services. The French government has been actively promoting smart city initiatives that leverage the capabilities of CPS to improve the quality of life for citizens. With real-time data collection and analysis, CPS technologies enable smarter decision-making in areas like traffic management, energy grid optimization, and public safety. As urbanization continues to rise, the demand for CPS in city management will grow, further fueling the adoption of these technologies across France.

Growth of Autonomous Systems and Robotics

The expansion of autonomous systems and robotics is shaping the future of CPS in France. Industries such as automotive, logistics, and agriculture are increasingly adopting autonomous robots and vehicles, which are powered by advanced CPS technologies. For example, collaborative robots (cobots) are increasingly used alongside human workers to improve safety and efficiency in manufacturing environments. French companies, particularly in the automotive and aerospace sectors, are leading the development of autonomous systems, including self-driving cars, drones, and robotic process automation (RPA). These systems are designed to operate with minimal human intervention, improving safety and efficiency. As technological advancements continue to enhance the capabilities of autonomous systems, the demand for CPS in these industries will rise, positioning France as a key player in the global robotics and automation market.

Market Challenges Analysis:

High Implementation Costs

One of the key restraints for the growth of the Cyber-Physical Systems (CPS) market in France is the high initial implementation costs associated with these technologies. Deploying CPS solutions involves significant investment in advanced hardware, software, and infrastructure, which can be a barrier for small to medium-sized enterprises (SMEs). The cost of integrating CPS into existing systems, coupled with the need for specialized skills to manage and operate these solutions, can strain financial resources. This financial burden often leads to slower adoption rates, particularly for businesses that lack the capital or technical expertise to implement these complex systems.

Data Security and Privacy Concerns

Another significant challenge facing the CPS market in France is the increasing concern over data security and privacy. As CPS solutions rely heavily on the collection, analysis, and transmission of vast amounts of data, particularly personal and operational information, there is a heightened risk of cyber-attacks, data breaches, and misuse. For example, a cyberattack on a hospital in Corbeil-Essonnes near Paris disrupted operations significantly, forcing staff to revert to manual data entry. France, being part of the European Union, is subject to stringent data protection regulations such as the General Data Protection Regulation (GDPR). Ensuring compliance with these regulations while securing sensitive data remains a complex challenge for organizations adopting CPS. The risks associated with data privacy and security can hinder the adoption of these systems, especially in sectors such as healthcare and finance, where confidentiality is paramount.

Complexity in Integration

The complexity involved in integrating CPS with legacy systems is another challenge for the French market. Many industries are still heavily reliant on outdated infrastructure that may not be compatible with advanced CPS technologies. The process of upgrading or replacing existing systems to enable seamless integration can be time-consuming and disruptive. Additionally, there is a lack of standardized protocols for CPS, making it difficult to ensure interoperability across different platforms and technologies. This integration challenge can slow down the adoption of CPS solutions and increase the time-to-market for businesses seeking to leverage these technologies effectively.

Skills Shortage

The shortage of skilled professionals in the fields of cybersecurity, data analytics, and system integration is also a significant challenge. As the demand for advanced CPS solutions increases, there is a growing need for experts who can design, implement, and maintain these systems. The lack of qualified talent in these areas creates a bottleneck for companies seeking to adopt and optimize CPS technologies, delaying the progress of market penetration in France.

Market Opportunities:

The increasing demand for smart infrastructure presents a significant opportunity for the Cyber-Physical Systems (CPS) market in France. As the French government continues to prioritize digital transformation and sustainability, cities and industries are increasingly adopting CPS to optimize urban living, energy consumption, and industrial productivity. With initiatives focused on the development of smart cities, CPS technologies can enhance transportation systems, energy grids, and waste management, improving overall efficiency and quality of life. The ongoing push for green energy and sustainability further accelerates the need for CPS solutions in energy management, creating new avenues for growth in this market. As France moves toward a more interconnected, sustainable, and automated future, CPS presents an opportunity to integrate digital and physical systems for smarter, more efficient operations.

Another promising market opportunity lies in the expansion of autonomous systems and Industry 4.0 initiatives. France’s automotive, aerospace, and manufacturing sectors are embracing automation and autonomous technologies powered by CPS. With the rise of self-driving vehicles, drones, and robotic automation, French companies have the opportunity to lead in the development and application of these technologies. The growing demand for automation in industries such as manufacturing and logistics offers substantial growth prospects for CPS adoption. Additionally, France’s emphasis on innovation and research in the CPS field further provides opportunities for collaboration between businesses and research institutions, fostering advancements in automation and robotic technologies. This trend presents a fertile ground for the adoption of CPS solutions, positioning France as a leader in Europe’s digital transformation efforts.

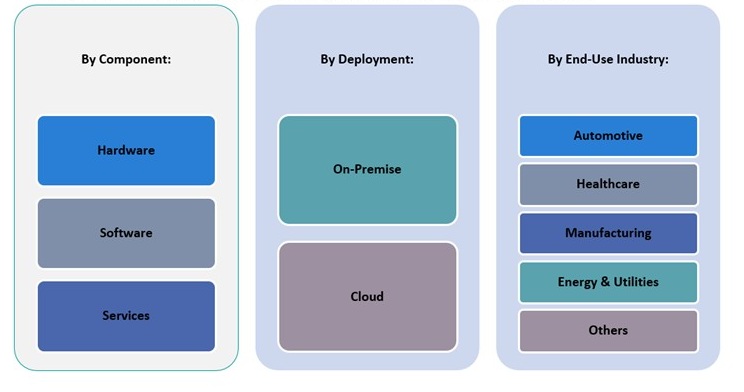

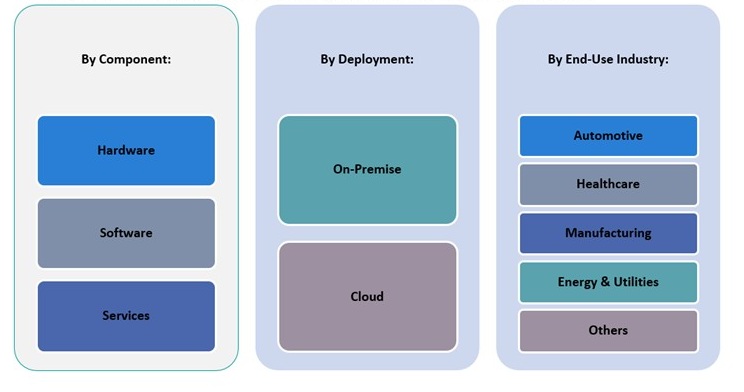

Market Segmentation Analysis:

By Component

The France Cyber-Physical Systems (CPS) market is segmented into three key components: hardware, software, and services. Hardware holds a significant share, driven by the increasing demand for sensors, actuators, and embedded systems that enable real-time monitoring and control. Software is also a major contributor, particularly with advancements in artificial intelligence (AI), machine learning (ML), and data analytics, which are integrated into CPS for enhanced functionality. Services, including consulting, integration, and maintenance, are gaining traction as companies seek expert assistance in implementing and optimizing their CPS solutions.

By Deployment

CPS solutions in France are deployed either on-premise or in the cloud. On-premise deployment is more common in industries such as manufacturing and energy, where sensitive data must be processed locally for greater control and security. However, the cloud segment is experiencing significant growth due to its scalability, flexibility, and cost-effectiveness. Cloud-based CPS solutions are increasingly adopted in sectors like automotive and healthcare, as they offer easier access to data, remote monitoring, and reduced infrastructure costs.

By End-Use Industry

The CPS market in France is widely used across several end-use industries. The automotive sector is a key driver, with CPS technologies enabling innovations in autonomous driving and smart manufacturing. In healthcare, CPS solutions are revolutionizing patient care through real-time monitoring and telemedicine. Manufacturing and energy & utilities are also major contributors, with CPS being utilized for predictive maintenance, process optimization, and smart grid management. Other industries, including agriculture and logistics, are also adopting CPS to streamline operations and enhance decision-making processes. The diverse applications across industries are further accelerating the growth of the CPS market in France.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

By End-Use Industry:

- Automotive

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

Regional Analysis:

The Cyber-Physical Systems (CPS) market in France is poised for significant growth, driven by technological advancements, government initiatives, and increasing demand for automation across various sectors. As one of the largest economies in Europe, France plays a crucial role in the adoption of CPS technologies. In particular, the market dynamics are shaped by the country’s regional strengths, investments in digital infrastructure, and growing emphasis on sustainable industrial practices.

Northern France and Île-de-France

Northern France, including the Île-de-France region, is home to Paris, the capital and a hub for technological and industrial advancements. This region leads the country in CPS adoption, with a strong concentration of tech companies, research institutions, and manufacturing industries. The Île-de-France region dominates the CPS market, accounting for approximately 35% of the total market share. The presence of major corporations and government agencies in this region has fueled innovations in sectors such as automotive, aerospace, and energy. Moreover, the region’s commitment to smart city initiatives and digital transformation in public services has further accelerated the demand for CPS solutions.

South-Eastern France (Provence-Alpes-Côte d’Azur and Auvergne-Rhône-Alpes)

The South-Eastern regions of France, particularly Provence-Alpes-Côte d’Azur and Auvergne-Rhône-Alpes, are key contributors to the CPS market. Known for their strong industrial presence, including sectors like aerospace, automotive, and healthcare, these regions collectively account for approximately 30% of the CPS market share. The adoption of CPS in these areas is driven by the need for automation in manufacturing processes, as well as advancements in smart grid technologies for energy management. Additionally, healthcare innovation in this region is pushing the adoption of CPS for patient monitoring and medical robotics.

Western France and Brittany

Western France, including regions like Brittany and Pays de la Loire, also represents a growing segment of the CPS market. While these areas contribute approximately 20% of the market share, they are quickly gaining momentum, especially in manufacturing, maritime, and renewable energy sectors. The shift towards more sustainable and efficient operations in industries such as energy and logistics has led to increased adoption of CPS solutions. In particular, advancements in offshore wind energy and automation in the manufacturing sector are strong drivers for CPS growth in this region.

Southern France and Occitanie

Southern France, including the Occitanie region, is emerging as a key player in the CPS market, contributing approximately 15% of the total market share. This region’s growth is largely attributed to its involvement in renewable energy, agriculture, and transportation sectors. CPS technologies are being implemented to optimize agricultural processes, enhance transportation systems, and improve energy management. With increasing government and private sector investments in these industries, Southern France is well-positioned for continued growth in the CPS market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- Schneider Electric SE

- Bosch Rexroth AG

- Thales Group

- Dassault Systèmes

- SAP SE

- Rolls-Royce Holdings plc

- Airbus SE

- Philips N.V

Competitive Analysis:

The competitive landscape of the Cyber-Physical Systems (CPS) market in France is marked by the presence of both established multinational corporations and innovative local players. Leading global companies such as Siemens, Schneider Electric, and Bosch are actively driving CPS adoption in France, leveraging their extensive experience in automation, energy management, and industrial solutions. These companies offer a wide range of CPS products and services, catering to sectors like manufacturing, automotive, and energy. In addition to these global giants, several French companies and startups are contributing to market growth, particularly in specialized areas such as smart city infrastructure, healthcare technologies, and autonomous systems. French firms like Valeo, Dassault Systèmes, and Thales are key players, fostering innovation in the automotive, aerospace, and defense sectors. The collaboration between industry leaders, research institutions, and government initiatives further enhances the competitive dynamics, ensuring continuous advancements in CPS technology across France.

Recent Developments:

- On January 1, 2025, Honeywell introduced “Cyber Insights,” an OT-focused solution designed to provide real-time visibility into operational technology systems. This initiative addresses emerging cybersecurity challenges in critical infrastructure environments while leveraging AI for improved monitoring and incident response.

- On April 4, 2025, Bosch Rexroth partnered with Trackunit to integrate BODAS Connect OTA technology into Trackunit’s ecosystem. This collaboration enables remote diagnostics and software updates for construction machinery while ensuring compliance with cybersecurity regulations like the Cyber Resilience Act.

- On March 6, 2025, Armis, a prominent cyber exposure management company, acquired OTORIO, a leading provider of operational technology (OT) and cyber-physical system (CPS) security. OTORIO’s Titan platform will now be integrated into Armis’ Centrix™ cloud-based platform, expanding its capabilities to include on-premises CPS solutions for air-gapped environments.

Market Concentration & Characteristics:

The Cyber-Physical Systems (CPS) market in France is characterized by moderate concentration, with a mix of global technology giants and local innovators leading the sector. Major multinational companies such as Siemens, Schneider Electric, and Bosch hold a substantial market share, benefiting from their vast resources, global reach, and extensive expertise in automation, energy, and manufacturing solutions. These players dominate the market in terms of technological advancements, research capabilities, and large-scale deployments. At the same time, the French CPS market also features a vibrant ecosystem of smaller companies and startups, focusing on niche applications in sectors such as smart cities, healthcare, and robotics. This blend of large-scale corporations and agile, specialized firms fosters a dynamic and competitive market environment. The increasing number of strategic partnerships and collaborations between industry leaders, research institutions, and the public sector further fuels innovation, enhancing the market’s overall competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for smart manufacturing solutions will continue to drive CPS adoption in industrial sectors across France.

- Increasing government support for Industry 4.0 initiatives will facilitate broader CPS integration in public and private infrastructure.

- Growth in the automotive sector, driven by advancements in autonomous vehicles, will further expand CPS applications.

- The expansion of smart cities will boost CPS adoption in urban planning, energy management, and transportation.

- Technological advancements in AI and IoT will enhance the capabilities and efficiency of CPS systems in real-time data processing.

- The rise of renewable energy initiatives will create opportunities for CPS in smart grid and energy optimization.

- Healthcare’s growing focus on telemedicine and patient monitoring will increase CPS demand in medical technologies.

- The demand for secure and scalable cloud-based solutions will drive the adoption of cloud-based CPS deployments.

- Enhanced collaborations between French industries and research institutions will foster innovation in CPS technologies.

- The ongoing shortage of skilled professionals may slow down market growth but also presents an opportunity for workforce development initiatives.