Market Overview

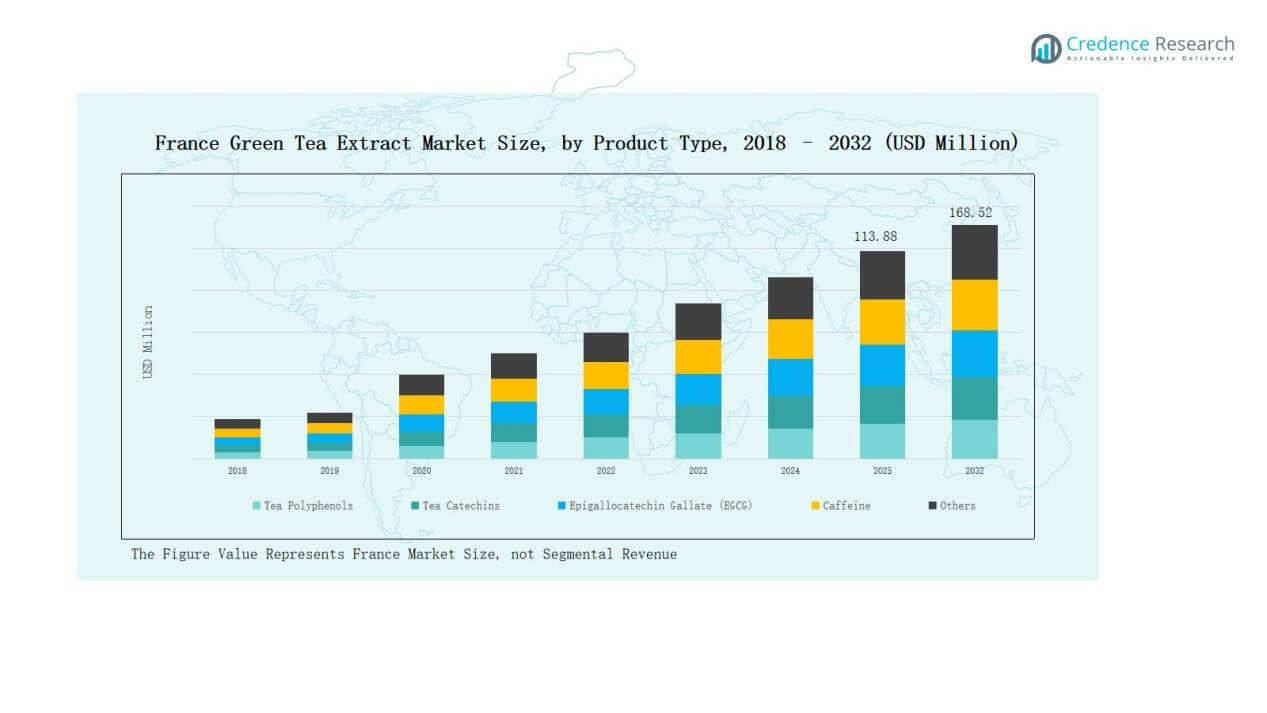

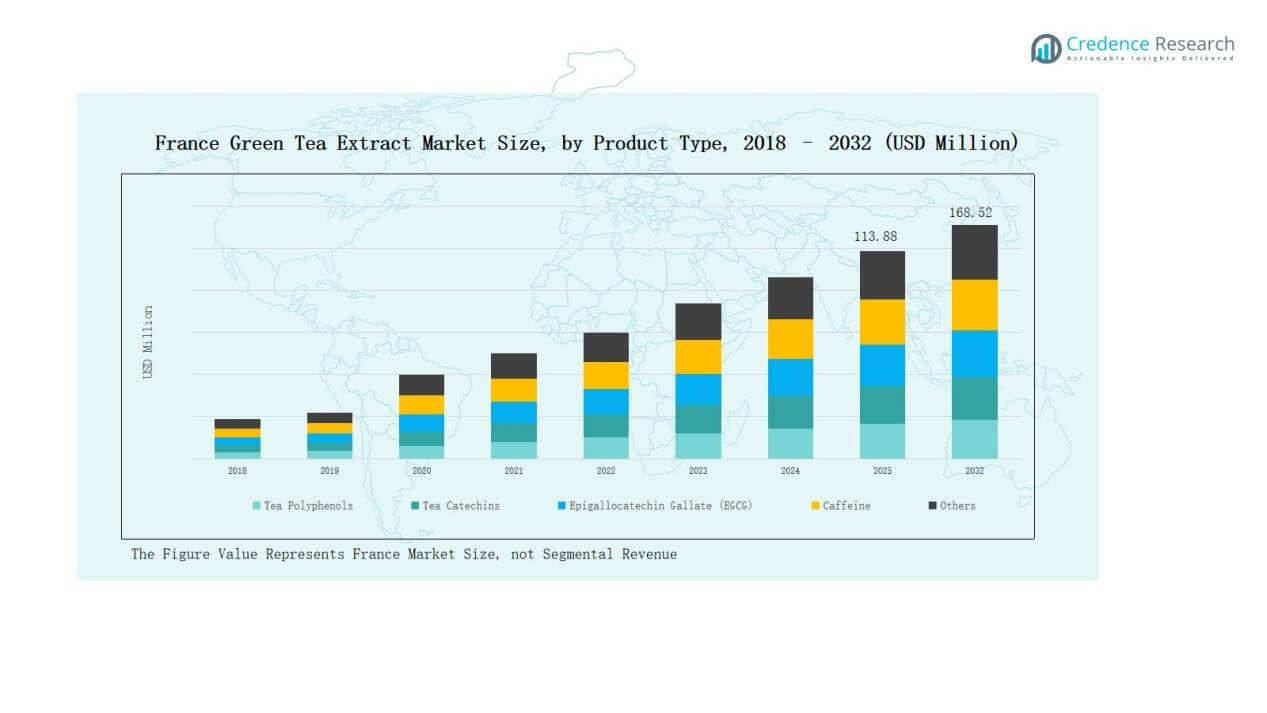

France Green Tea Extract Market size was valued at USD 72.43 million in 2018, reaching USD 104.27 million in 2024, and is anticipated to attain USD 168.52 million by 2032, at a CAGR of 5.76% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Green Tea Extract Market Size 2024 |

USD 104.27 Million |

| France Green Tea Extract Market, CAGR |

5.76% |

| France Green Tea Extract Market Size 2032 |

USD 168.52 Million |

The France Green Tea Extract Market is shaped by strong competition from multinational leaders and domestic specialists. Key players such as Nexira, Givaudan, Naturex SA, Pierre Fabre Group, Arkopharma, FRAMEN – France Extracts, Sensient Technologies, Robertet Group, DRT, and Sicobel Laboratory dominate through diversified portfolios, sustainable sourcing, and innovations across pharmaceuticals, nutraceuticals, food, beverages, and cosmetics. These companies focus on clean-label, organic, and functional formulations to align with evolving consumer preferences. Regionally, Northern France leads the market with a 34% share in 2024, supported by robust retail infrastructure, strong nutraceutical adoption, and advanced R&D capabilities that reinforce its position as the country’s primary growth hub.

Market Insights

- The France Green Tea Extract Market grew from USD 72.43 million in 2018 to USD 104.27 million in 2024 and will reach USD 168.52 million by 2032.

- Tea Catechins held the largest share of 37% in 2024, driven by strong demand in nutraceuticals and pharmaceuticals for their antioxidant and cardiovascular health benefits.

- Powder form dominated with 46% share in 2024, supported by its versatility, solubility, and long shelf life in dietary supplements and functional foods.

- Food & Beverages led applications with 41% share in 2024, fueled by rising adoption of fortified teas, beverages, and functional food products across urban markets.

- Northern France commanded 34% share in 2024, benefiting from robust retail infrastructure, strong nutraceutical adoption, and advanced R&D collaborations across pharmaceuticals and food sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the France Green Tea Extract Market with a 37% share in 2024, supported by strong demand in nutraceuticals and pharmaceuticals. Catechins are widely used for their antioxidant, anti-inflammatory, and cardiovascular health benefits, making them highly attractive to both health-conscious consumers and formulators. Epigallocatechin Gallate (EGCG) also shows steady growth due to its rising use in functional supplements and weight management products.

By Form

Powder holds the largest share at 46% in 2024, driven by its versatile use in dietary supplements, functional foods, and beverage formulations. French manufacturers favor powder extracts for their easy solubility, long shelf life, and compatibility with clean-label formulations. Liquid extracts follow, supported by applications in RTD teas and cosmetic formulations targeting anti-aging benefits.

For instance, Nexira introduced Thixogum Powder, a natural acacia-based stabilizer targeted at clean-label powdered beverages, aligning with growing demand in the French functional food sector.

By Application

Food & Beverages lead the application segment with a 41% share in 2024, reflecting strong consumer preference for fortified teas, beverages, and functional food products. Rising adoption of natural extracts in mainstream food formulations supports this dominance. Pharmaceuticals remain a key growth driver, with high investments in EGCG-based supplements for metabolic and cardiovascular health, while functional foods continue to gain traction among urban consumers.

For instance, Unilever expanded its Lipton Green Tea line in Europe with catechin-rich variants, highlighting consumer demand for antioxidant-enriched beverages.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Nutraceuticals and Functional Foods

The France Green Tea Extract Market benefits from increasing consumer preference for nutraceuticals and functional foods. Growing awareness of lifestyle-related diseases such as obesity and cardiovascular disorders has encouraged the use of natural antioxidants. Green tea extracts, especially catechins and EGCG, are being integrated into dietary supplements and fortified foods. This demand is further reinforced by a shift toward preventive healthcare, supported by urban consumers seeking natural, clean-label, and health-promoting products. The segment continues to drive strong growth across both pharmaceuticals and food industries.

For instance, Naturex (a French unit of Givaudan) expanded its botanical ingredients portfolio by highlighting plant-based antioxidants like green tea extracts in nutraceutical applications.

Expanding Applications in Pharmaceuticals

Pharmaceutical demand significantly drives the market, as green tea extracts are increasingly used for metabolic, cardiovascular, and immune health products. EGCG has become a key ingredient in supplements and prescription-based formulations targeting chronic health conditions. France’s strong pharmaceutical sector, combined with investment in R&D, supports innovation and wider product adoption. The government’s emphasis on promoting natural and safe formulations further accelerates pharmaceutical applications. This growth path highlights the strategic importance of extracts in addressing long-term healthcare needs.

For instance, DSM launched a high-purity EGCG supplement targeting cardiovascular health, backed by clinical data showing enhanced antioxidant benefits.

Growing Popularity of Clean-Label and Organic Products

French consumers show strong interest in organic and clean-label ingredients, boosting demand for high-quality green tea extracts. Manufacturers are expanding portfolios with certified organic catechins and EGCG to align with sustainability goals and consumer expectations. Growing transparency in ingredient sourcing and labeling practices further enhances market acceptance. Retailers also promote organic and plant-based solutions through premium product positioning. This shift toward natural, chemical-free formulations directly contributes to the expanding footprint of green tea extract in health and wellness sectors.

Key Trends & Opportunities

Key Trends & Opportunities

Innovation in Ready-to-Drink (RTD) Beverages

The RTD tea segment presents a strong growth opportunity, driven by urban lifestyles and on-the-go consumption patterns. French consumers are adopting fortified teas and beverages enriched with green tea extracts due to convenience and health appeal. Manufacturers are innovating with functional RTDs targeting immunity, energy, and weight management. Collaborations between beverage companies and nutraceutical firms further support product diversification. This trend strengthens the role of green tea extract in beverages as a functional, accessible, and mainstream health solution.

For instance, Twinings launched a new line of ready-to-drink sparkling teas infused with green tea extract, catering to consumer demand for healthier, functional, and sparkling beverages in Europe.

Rising Use in Cosmetics and Personal Care

The growing cosmetics industry in France creates opportunities for green tea extract adoption in skincare and haircare products. Extracts rich in polyphenols and catechins are valued for their anti-aging, anti-inflammatory, and UV-protective properties. Cosmetic brands are incorporating green tea extracts into creams, serums, and shampoos to meet rising consumer demand for natural ingredients. This cross-industry application broadens the scope of extract utilization beyond food and pharma, providing new growth pathways in personal care and wellness segments.

For instance, Activ’Inside launched Hair’inside™, a hair revitalizer containing 250mg green tea extract clinically proven to enhance hair growth, strength, and shine through antioxidant effects on scalp health.

Key Challenges

Intense Market Competition

The France Green Tea Extract Market faces high competition from multinational and local players offering diverse formulations. Established firms with global supply chains compete with domestic specialists focusing on organic and niche segments. Price competition and continuous product innovation pressure smaller firms to differentiate effectively. The competitive intensity makes it challenging to secure long-term customer loyalty, particularly in a market where brand reputation and ingredient quality strongly influence purchasing decisions.

Raw Material Supply and Pricing Volatility

Supply chain instability and fluctuations in green tea leaf availability impact raw material costs. Climatic variations in producing countries and growing global demand for premium tea strains contribute to pricing volatility. This directly affects profit margins for French manufacturers and may increase product costs for end-users. Companies relying on imported raw materials face higher risks, making it crucial to secure stable supply agreements and diversify sourcing strategies.

Regulatory Compliance and Standards

Strict regulations around food, pharmaceuticals, and cosmetics pose challenges for green tea extract manufacturers in France. Compliance with European Union standards for health claims, safety, and labeling requires significant investment in testing and certification. Failure to meet these regulations can restrict product launches and limit international trade opportunities. Smaller firms, in particular, struggle with the financial and operational burden of compliance, which can slow down innovation and expansion in a competitive landscape.

Regional Analysis

Northern France

Northern France leads the France Green Tea Extract Market with a 34% share in 2024. Strong consumer adoption of nutraceuticals and functional foods supports regional dominance. The area benefits from a robust retail infrastructure, enabling wide product availability across supermarkets and specialty stores. Pharmaceutical and nutraceutical companies maintain strong distribution networks, boosting extract applications. Health-conscious urban consumers drive demand for catechins and EGCG-based supplements. Northern France remains the center of innovation, supported by established R&D facilities and strategic partnerships with global and domestic players.

Southern France

Southern France holds a 26% share in 2024, driven by growing demand for organic and clean-label products. The region benefits from its rich culture of herbal remedies, encouraging wider use of natural extracts. Local manufacturers and specialty brands focus on sustainable sourcing, appealing to environmentally conscious consumers. Rising integration of green tea extracts into personal care and beauty products strengthens its market presence. Distribution through health food stores and online platforms continues to expand access. Southern France is emerging as a key hub for premium formulations across food and wellness categories.

Central France

Central France accounts for a 21% share in 2024, supported by increasing awareness of preventive healthcare. Consumers in the region show strong preference for dietary supplements enriched with green tea extracts. Functional foods and fortified beverages are gaining popularity, fueled by urbanization and changing lifestyles. Pharmaceutical companies in Central France are investing in EGCG-based product development targeting chronic conditions. Retail chains and pharmacies ensure steady product penetration across urban and semi-urban markets. The segment’s growth reflects balanced demand across both health and wellness applications.

Western France

Western France represents a 19% share in 2024, reflecting steady adoption of green tea extracts across food and beverages. The region benefits from strong agricultural traditions, which support consumer trust in plant-based solutions. Food manufacturers integrate extracts into ready-to-drink teas and fortified snacks to capture lifestyle-driven demand. Interest in natural and functional beverages strengthens the region’s growth trajectory. Online retail channels contribute to expanding consumer access beyond traditional markets. Western France continues to evolve as a supportive landscape for extract integration across mainstream and niche applications.

Market Segmentations:

Market Segmentations:

By Product Type

- Tea Polyphenols

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Caffeine

- Others

By Form

By Application

- Pharmaceuticals

- Food & Beverages

- Ready-to-Drink (RTD) Teas

- Functional Foods

- Others

By Region

- Northern France

- Southern France

- Central France

- Western France

Competitive Landscape

The France Green Tea Extract Market is highly competitive, with a mix of multinational corporations and domestic players driving growth through product innovation and strategic partnerships. Key companies such as Nexira, Givaudan, Naturex SA, Pierre Fabre Group, Arkopharma, FRAMEN – France Extracts, Sensient Technologies, Robertet Group, DRT, and Sicobel Laboratory hold strong positions across pharmaceuticals, nutraceuticals, food, beverages, and cosmetics. These firms leverage diverse product portfolios, advanced R&D capabilities, and sustainable sourcing practices to strengthen market presence. The focus on organic and clean-label formulations is intensifying competition, as players aim to meet rising consumer demand for natural health solutions. Smaller domestic companies emphasize niche offerings and local sourcing to differentiate from global leaders. Continuous investment in product quality, certifications, and distribution networks shapes the market’s competitive dynamics, while strategic collaborations with food, pharmaceutical, and cosmetic manufacturers ensure long-term growth opportunities across multiple application areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nexira

- Givaudan

- Naturex SA

- Pierre Fabre Group

- Arkopharma

- FRAMEN – France Extracts

- Sensient Technologies

- Robertet Group

- DRT

- Sicobel Laboratory

Recent Developments

- On May 13, 2025, Finlays Solutions launched its “Evolved Extracts Business” aimed at helping beverage companies develop new products.

- In 2022, Firmenich signed an agreement to market Finlays’ tea & coffee extracts portfolio across Europe.

- In 2025, the France Green Tea Essential Oil Extract Market features strong competition among the top 10 companies, who are driving market expansion through innovation, regulatory compliance, and strategic partnerships.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for nutraceuticals will continue to drive adoption across healthcare and wellness.

- Food and beverage manufacturers will expand fortified and functional product offerings.

- Pharmaceutical applications will grow with wider use of EGCG in chronic disease management.

- Organic and clean-label green tea extracts will gain preference among health-conscious consumers.

- Ready-to-drink teas will strengthen market presence with convenience-focused innovations.

- Cosmetic and personal care industries will expand usage of extracts for anti-aging and skin health.

- E-commerce platforms will become a critical distribution channel for wider market penetration.

- Local companies will emphasize sustainable sourcing to enhance competitiveness against global players.

- Collaborations between extract producers and food or pharma firms will accelerate product diversification.

- Investments in R&D will focus on bioactive efficiency, purity, and broader application development.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: