Market Overview:

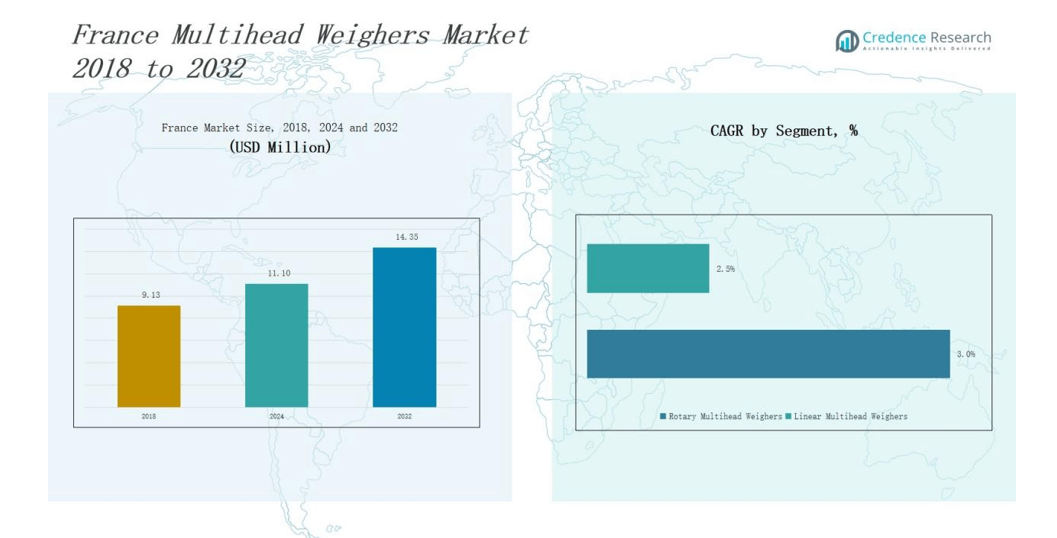

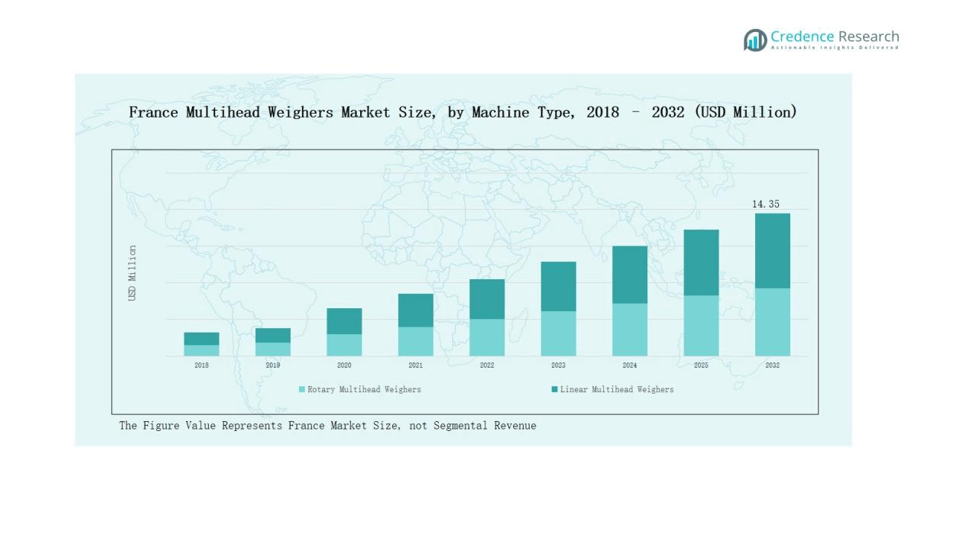

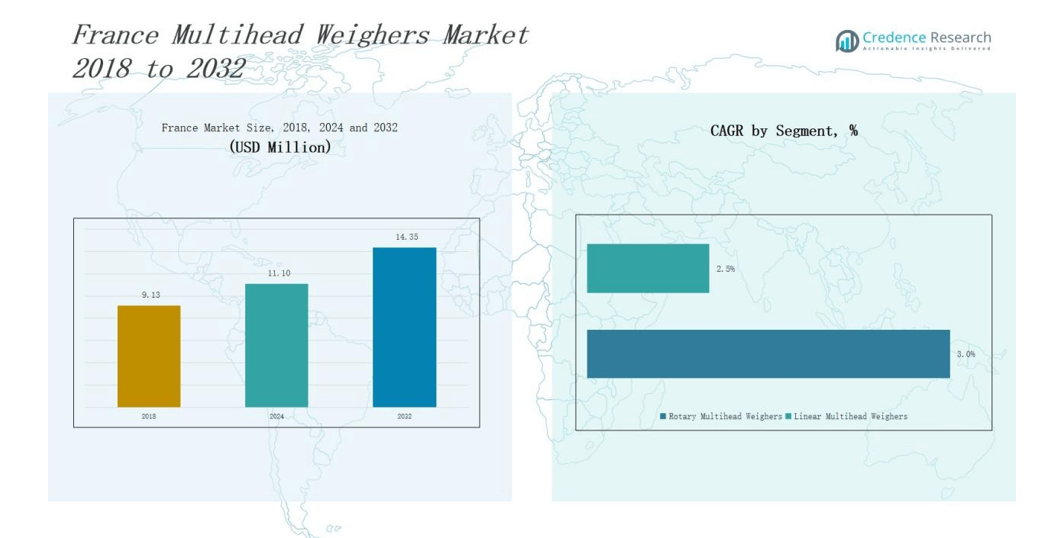

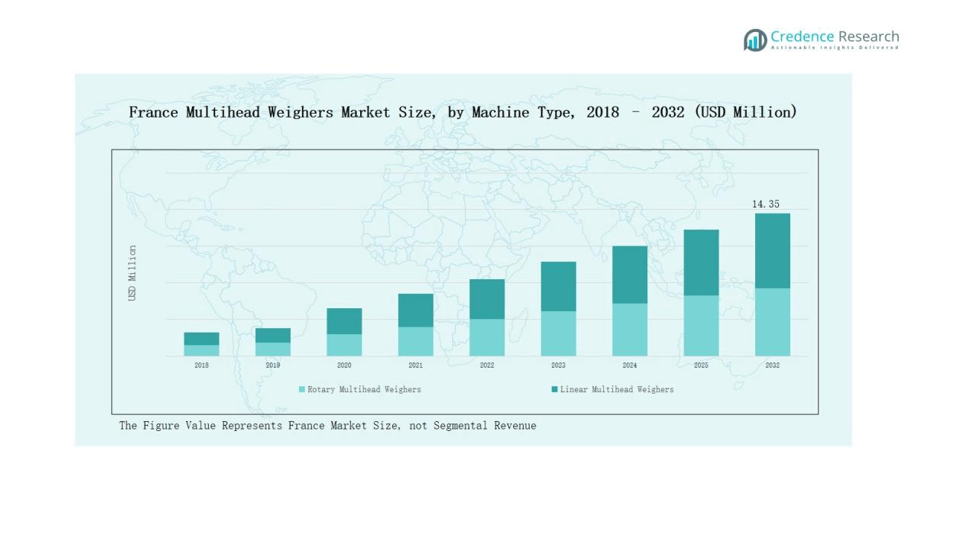

France Multihead Weighers Market size was valued at USD 9.13 million in 2018 to USD 11.10 million in 2024 and is anticipated to reach USD 14.35 million by 2032, at a CAGR of 3.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Multihead Weighers Market Size 2024 |

USD 11.10 million |

| France Multihead Weighers Market, CAGR |

3.04% |

| France Multihead Weighers Market Size 2032 |

USD 14.35 million |

The France Multihead Weighers Market features strong competition among leading players such as Ishida Europe, Multipond, MBP S.r.l, Paxiom Group, Multivac, Ilapak, Pfm Group, Comek S.r.l, ExaktaPack, and KPM Verpackungsmaschinen. These companies strengthen their presence through advanced product portfolios, automation-driven innovations, and tailored solutions for food, pharmaceutical, cosmetics, and chemical industries. Ishida Europe and Multipond lead with high-speed rotary weighers, while MBP S.r.l and Paxiom Group focus on modular, cost-efficient systems suited for SMEs. Among regions, Northern France commanded the largest share of 29% in 2024, driven by its strong food processing clusters, advanced logistics networks, and rising demand for packaged snacks and bakery products. This concentration of demand solidifies Northern France as the core hub for multihead weighers in the country.

Market Insights

- The France Multihead Weighers Market grew from USD 9.13 million in 2018 to USD 11.10 million in 2024 and is expected to reach USD 14.35 million by 2032, expanding at a CAGR of 3.04%.

- Rotary multihead weighers held 63% share in 2024, dominating with high-speed performance in snacks, confectionery, and bakery packaging, while linear weighers captured 37% share in precision-based industries.

- By application, the food and beverage sector led with 57% share in 2024, followed by pharmaceuticals at 18%, cosmetics at 14%, and chemicals at 11%.

- Northern France commanded the largest share at 29% in 2024, supported by strong food processing clusters, advanced logistics infrastructure, and consistent demand for high-volume packaging solutions.

- Leading players include Ishida Europe, Multipond, MBP S.r.l, Paxiom Group, Multivac, Ilapak, Pfm Group, Comek S.r.l, ExaktaPack, and KPM Verpackungsmaschinen, competing through automation, customization, and cost-efficient systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Machine Type

Rotary multihead weighers dominate the France market with nearly 63% share in 2024, supported by high-speed performance and efficiency in large-scale packaging operations. Their widespread use in snacks, confectionery, and bakery segments highlights their ability to manage high volumes while maintaining accuracy. Linear multihead weighers, holding the remaining 37% share, serve specialized industries such as pharmaceuticals and cosmetics, where precision, gentle handling, and adaptability to irregular or fragile products are critical. The strong demand from France’s packaged food sector sustains rotary weighers as the leading segment.

- For instance, Ishida Europe’s CCW-RV series can achieve up to 210 weighments per minute, with some integrated systems reaching up to 300 bags per minute for specific snack products.

By Application

The food and beverage industry leads with approximately 57% share in 2024, driven by rising demand for packaged snacks, ready-to-eat meals, and confectionery across France. Compliance with strict hygiene and traceability standards also drives installations of advanced weighers in this segment. Pharmaceuticals account for around 18% share, with accurate dosing and adherence to regulatory requirements fueling adoption. Cosmetics hold close to 14% share, supported by premium beauty packaging needs that rely on precision-based systems. Chemicals represent about 11% share, where consistent dosing for powders and granules sustains demand.

- For instance, in 2024, companies like Nestlé have integrated AI-powered quality control systems that improved production efficiency by 10% while ensuring traceability compliance across their packaging lines, significantly boosting automation in this sector.

Market Overview

Rising Packaged Food Consumption

The France Multihead Weighers Market benefits from the country’s expanding packaged food and beverage industry. Increasing demand for snacks, bakery products, and ready-to-eat meals drives investments in high-speed weighing systems. Rotary multihead weighers lead due to their ability to handle bulk production efficiently. Compliance with strict European Union hygiene and safety regulations further accelerates adoption. Food producers prefer advanced weighers to achieve consistency, reduce waste, and meet rising consumer expectations for portion-controlled and premium packaging, sustaining strong growth in this segment.

- For instance, Marel’s multihead weighers allow poultry processors to scale operations with high precision, achieving a throughput of up to 80 batches per minute for fresh products and 60 batches per minute for frozen IQF products.

Pharmaceutical Sector Precision Needs

The pharmaceutical industry in France fuels growth through its reliance on precise weighing and dosing systems. Multihead weighers ensure strict adherence to regulatory standards while minimizing errors in packaging capsules, tablets, and powders. Their ability to provide traceability and accuracy supports quality assurance, which is critical in a highly regulated sector. With rising demand for generic medicines and increased production of healthcare products, pharmaceutical manufacturers continue to adopt advanced weighing equipment. This segment significantly strengthens the need for linear multihead weighers that focus on precision over speed.

- For instance, METTLER TOLEDO has developed precision weighing systems with accuracy up to ±0.1 mg, validated for compliance with EU Good Manufacturing Practices (GMP).

Automation and Industry 4.0 Integration

The integration of Industry 4.0 and smart automation is a major driver in France’s market. Multihead weighers equipped with IoT sensors and AI-based controls enable predictive maintenance, real-time monitoring, and higher operational efficiency. Manufacturers invest in automation to reduce labor dependency and improve productivity, especially in high-volume industries like food and beverages. Enhanced connectivity also ensures data-driven decision-making and quality control. These advancements make multihead weighers more attractive to producers aiming to modernize operations and align with global technological standards.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging

Growing emphasis on sustainability in France creates opportunities for eco-friendly weighing systems. Multihead weighers compatible with recyclable films, biodegradable packaging materials, and energy-efficient operations align with regulatory pressures and consumer preferences. Manufacturers prioritize equipment that reduces waste and lowers power consumption to meet environmental goals. This trend drives innovation and positions suppliers with sustainable product portfolios at a competitive advantage. The push toward greener packaging practices ensures long-term demand for advanced, environmentally conscious weighing systems.

- For instance, in 2022, Marel integrated energy-monitoring features into its weighing equipment, enabling processors to track and minimize electricity use during operations as part of their sustainability strategies.

Demand for Customized and Flexible Solutions

French producers increasingly seek customized and modular weighing systems that adapt to diverse product lines. Multihead weighers with flexible configurations serve small-batch production runs and specialty products such as premium cosmetics and organic foods. This demand creates opportunities for equipment suppliers offering tailored solutions with quick-changeover capabilities. The ability to handle fragile or irregular products without compromising accuracy makes customized systems vital for SMEs and niche players. This trend reinforces the market’s movement toward versatility and client-specific innovation.

- For instance, Ishida’s CCW line hits up to 210 weighments per minute with 0.5–1.0 g accuracy, and models offer rapid recipe changeovers with up to 100 presets.

Key Challenges

High Initial Investment Costs

The high capital cost of multihead weighers remains a significant barrier in France. Small and medium-sized enterprises often hesitate to adopt these systems due to budget limitations. Although the technology reduces waste and labor costs over time, the upfront expense slows adoption. Companies must weigh long-term benefits against short-term affordability, which limits penetration in price-sensitive industries. Manufacturers focusing on cost-efficient or modular systems may overcome this challenge and tap into a wider customer base.

Maintenance and Technical Expertise

Multihead weighers require regular maintenance and technical expertise for optimal performance. In France, many SMEs lack in-house skilled operators or technicians trained to manage advanced automation. This reliance on external support increases downtime and operational costs. Complex systems with IoT and AI integration also demand higher technical know-how, making adoption more challenging for smaller firms. Addressing this gap through training programs and simplified user interfaces could improve accessibility and reduce the operational burden for businesses.

Competitive Pressure and Market Fragmentation

The France Multihead Weighers Market faces intense competition with both global and local players offering diverse solutions. Price pressure from low-cost equipment suppliers challenges established brands focusing on high-quality, advanced systems. Fragmentation leads to slow differentiation, forcing companies to compete on service, customization, or after-sales support. This environment creates challenges for manufacturers in maintaining profitability while meeting customer expectations for innovation and cost efficiency. Effective positioning and continuous product development remain critical in overcoming this challenge.

Regional Analysis

Northern France

Northern France holds 29% share of the France Multihead Weighers Market, driven by its strong concentration of food processing industries. The packaged food sector demands high-speed rotary weighers to maintain efficiency in bakery, confectionery, and snacks. It benefits from well-established logistics networks and advanced manufacturing hubs. Leading international players frequently target this region due to its industrial scale and export potential. Demand for precision and automation continues to shape investments, ensuring the segment maintains its dominant role.

Western France

Western France accounts for 22% share, supported by its pharmaceutical and cosmetics clusters. The region emphasizes accuracy and compliance, which favors linear multihead weighers for fragile and high-value products. Local manufacturers invest in automated systems to meet rising regulatory standards. Growth is further fueled by cosmetics production, where premium packaging requires precision weighing. It positions the region as a critical hub for specialized applications. Strong export orientation in pharma enhances adoption of advanced weighing technology.

Southern France

Southern France captures 25% share, led by the expanding food and beverage sector, particularly fresh produce and packaged meals. Demand for multihead weighers increases with the rise in ready-to-eat consumption and retail packaging. Rotary weighers dominate due to their high-speed performance in handling bulk volumes. The tourism-driven hospitality industry boosts packaged food consumption, reinforcing the market presence. Local adoption is also shaped by sustainability initiatives, where energy-efficient machines gain traction. The regional market continues to display strong upward momentum.

Eastern France

Eastern France secures 24% share, shaped by its strong chemical and industrial base. Multihead weighers play a vital role in dosing powders and granules with consistency. Producers in this region value systems that reduce material waste while maintaining efficiency. Investment in smart automation supports manufacturers in scaling production capabilities. Linear weighers find steady demand due to their adaptability to specialized applications. With strong industrial activity, it remains an essential growth contributor to the overall market performance.

Market Segmentations:

By Machine Type

- Rotary Multihead Weighers

- Linear Multihead Weighers

By Application

- Food and Beverage Industry

- Pharmaceuticals

- Cosmetics

- Chemicals

By Region

- Northern France

- Western France

- Southern France

- Eastern France

Competitive Landscape

The France Multihead Weighers Market is characterized by strong competition among global leaders and regional players, each striving to strengthen market presence through innovation and tailored solutions. Companies such as Ishida Europe, Multipond, and MBP S.r.l. dominate with advanced rotary weighers designed for high-speed applications in food and beverages, while firms like Paxiom Group, Comek S.r.l., and ExaktaPack focus on modular and cost-efficient systems that appeal to small and medium enterprises. Competitive differentiation increasingly depends on automation, integration with Industry 4.0, and compatibility with sustainable packaging materials. Local manufacturers play a crucial role by offering customized machines suited for regional applications in pharmaceuticals and cosmetics. Strategic partnerships, after-sales service, and long-term maintenance contracts enhance customer retention in a fragmented market. With rising demand for precision and sustainability, players continue to invest in R&D, ensuring a dynamic landscape that balances technological leadership with cost competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Paxiom Group

- MBP S.r.l

- Multivac

- KPM Verpackungsmaschinen

- Multipond

- Ishida Europe

- Ilapak

- Pfm Group

- Comek S.r.l

- ExaktaPack

Recent Developments

- In March 2024, Ishida Europe expanded its footprint by acquiring National Packaging Systems (NPS), a South African packaging equipment manufacturer. Ishida is a significant player in Europe’s multihead weighers market.

- In June 2024, Marel inaugurated a state-of-the-art Global Distribution Center in Eindhoven, which enhances its global customer service capabilities in food processing equipment, including multihead weighers.

- In March 2025, Dibal is in the process of acquiring Precia Molen’s retail weighing activities in France.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rotary weighers will expand due to France’s rising packaged food demand and bulk production needs.

- Linear weighers will strengthen adoption in pharmaceuticals and cosmetics where precision and gentle handling matter.

- Industry 4.0 integration will accelerate with predictive maintenance, real-time monitoring, and data-driven decision-making systems.

- Sustainability targets will push adoption of eco-friendly, energy-efficient machines compatible with recyclable packaging materials.

- SMEs will adopt modular, cost-efficient systems to balance affordability, flexibility, and long-term operational efficiency.

- Food and beverage applications will remain dominant, supporting high-speed weighing for bakery, confectionery, and snacks.

- Cosmetics sector will demand flexible multihead weighers supporting premium, small-batch production and premium beauty packaging.

- After-sales support and long-term service contracts will differentiate suppliers and enhance competitive market positioning.

- Local players will benefit by delivering tailored machines suited for niche and regional-specific applications.

- Strict regulatory frameworks will drive investment in hygienic, traceable, and compliance-focused weighing technologies across industries.