Market Overview:

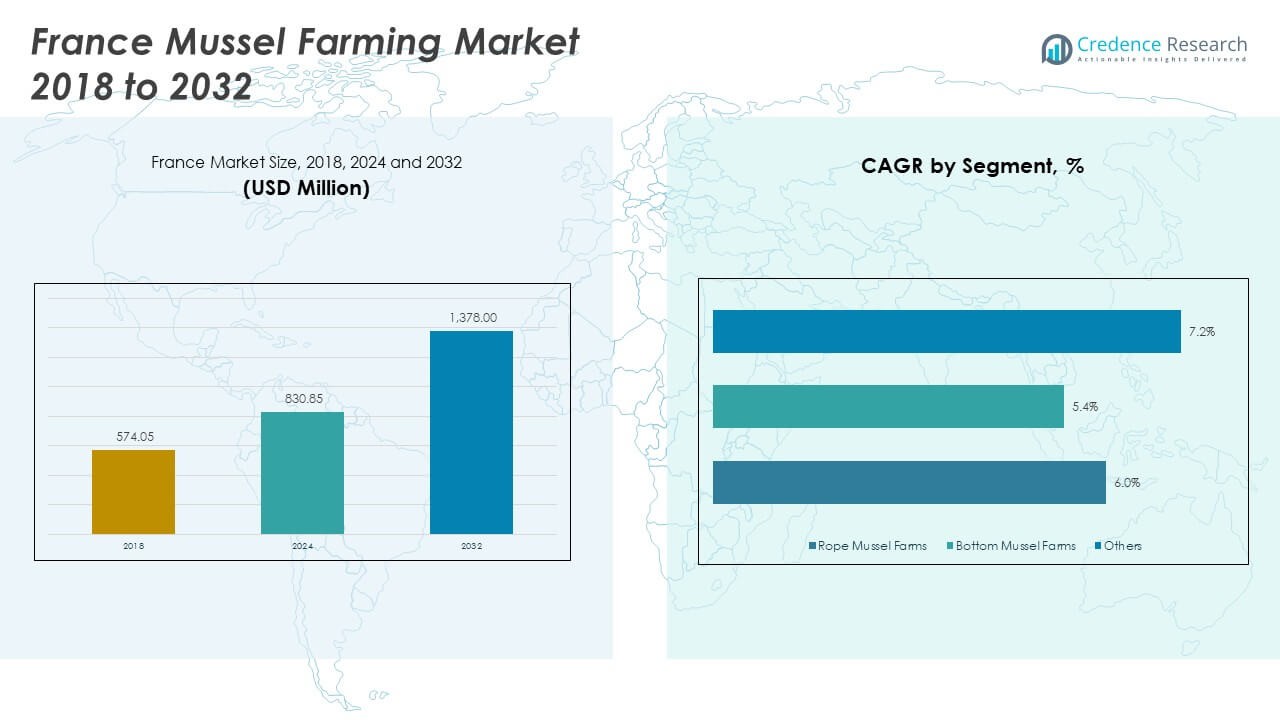

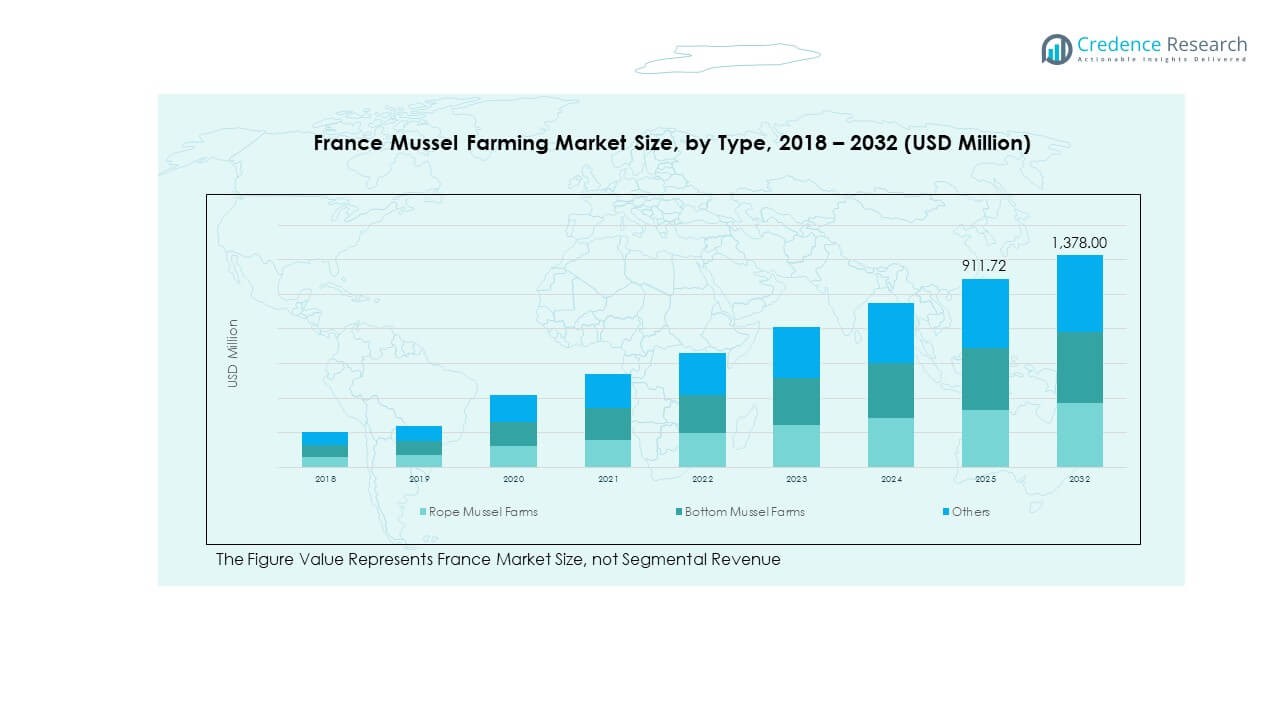

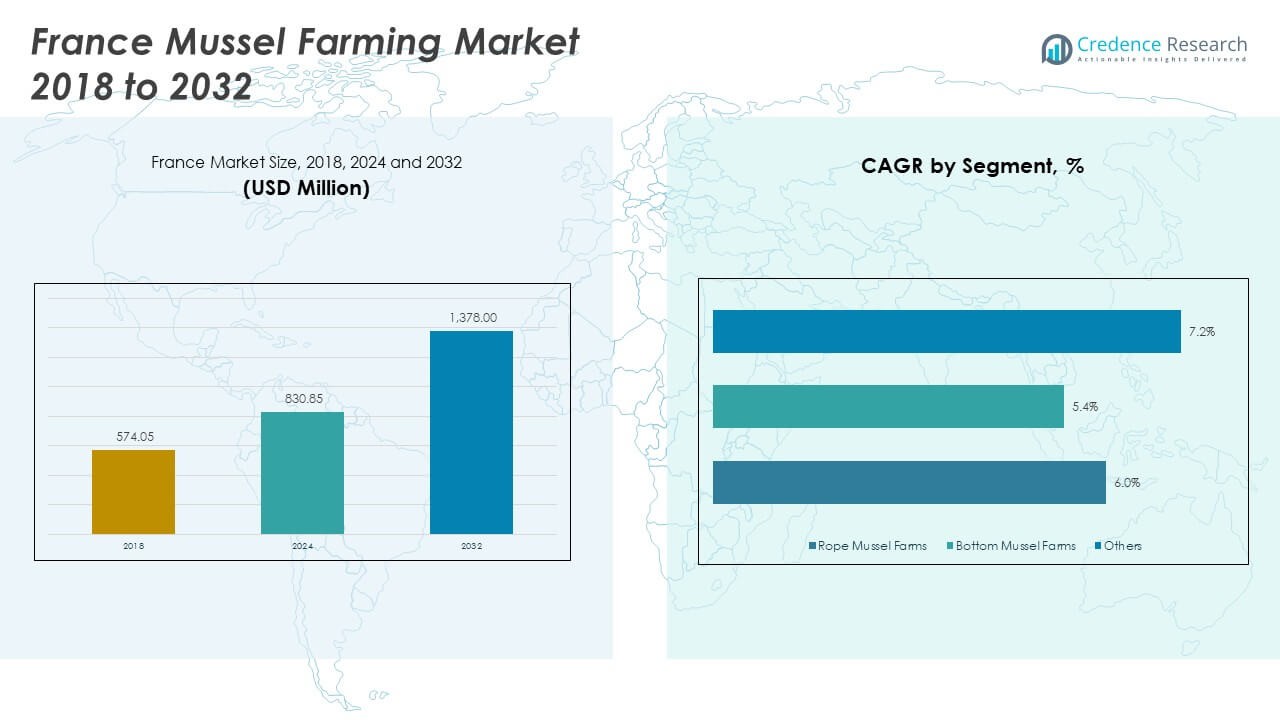

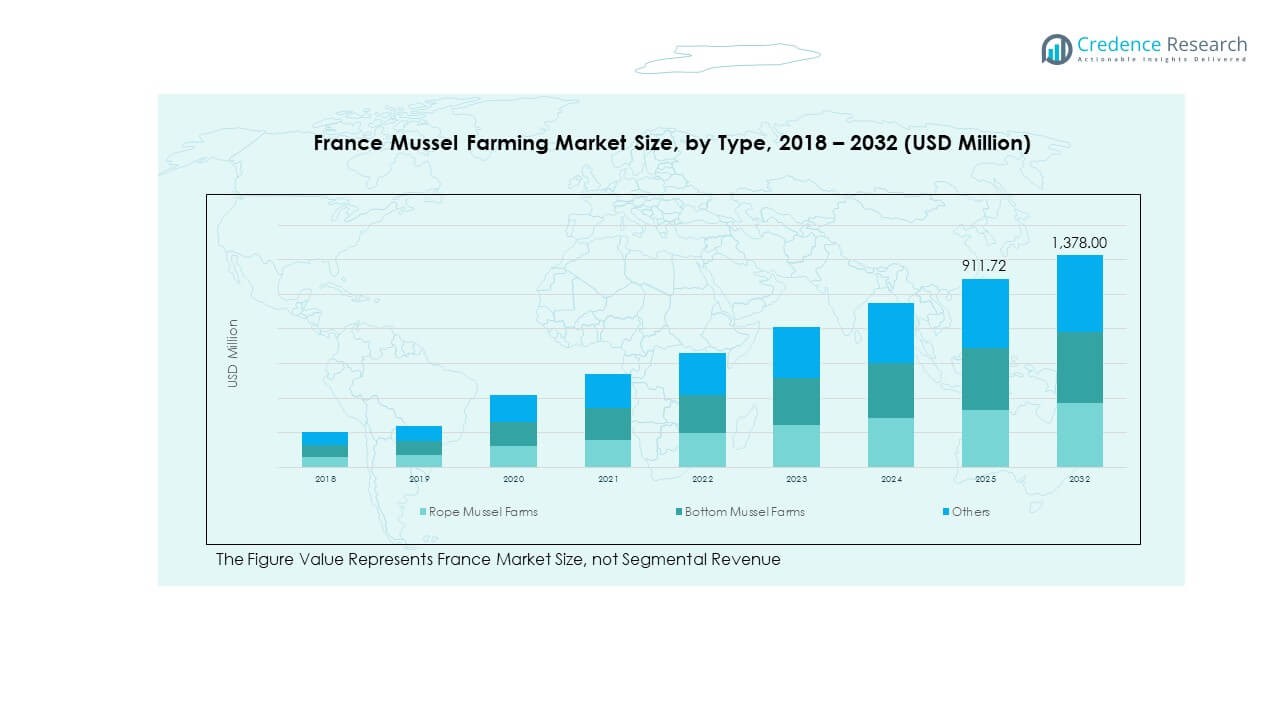

The France Mussel Farming Market size was valued at USD 574.05 million in 2018 to USD 830.85 million in 2024 and is anticipated to reach USD 1,378.00 million by 2032, at a CAGR of 6.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Mussel Farming Market Size 2024 |

USD 830.85 Million |

| France Mussel Farming Market, CAGR |

6.08% |

| France Mussel Farming Market Size 2032 |

USD 1,378.00 Million |

France mussel farming is driven by strong consumer demand for high-quality seafood, especially in coastal regions where shellfish is a dietary staple. Favorable environmental conditions, such as nutrient-rich coastal waters, support high yields and consistent production. Government support through aquaculture regulations and sustainability initiatives further promotes growth. Rising awareness of the nutritional value of mussels, coupled with demand for sustainable protein alternatives, has also boosted market development. Advancements in farming technologies and logistics continue to improve efficiency and market reach.

Regional growth in the France Mussel Farming Market is supported by diverse aquaculture zones across the Atlantic coast, Normandy, and Brittany. These regions lead production due to their favorable climatic conditions and established mussel farming traditions. Emerging areas in southern France are also expanding, supported by rising domestic consumption and local investments. European Union policies on aquaculture sustainability and cross-border seafood trade strengthen France’s role as a key supplier in Europe. The country’s geographic advantage, with access to both Atlantic and Mediterranean waters, positions it strategically in regional and export markets.

Market Insights:

Market Insights:

- The France Mussel Farming Market was valued at USD 574.05 million in 2018, reached USD 830.85 million in 2024, and is projected to reach USD 1,378.00 million by 2032, growing at a CAGR of 6.08%.

- Normandy leads with 38% share, driven by nutrient-rich waters and advanced aquaculture infrastructure, followed by Brittany at 34% with strong maritime traditions, and Southern France at 18%, benefiting from coastal expansion and niche production.

- The fastest-growing region is Southern France, holding 18% share, supported by warmer waters, niche varieties, and rising domestic demand.

- Rope mussel farms dominate with nearly 65% share, reflecting efficiency and large-scale adoption in key coastal hubs.

- Bottom mussel farms hold about 25% share, while the others segment accounts for the remaining 10%, showing limited but emerging growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Demand for Sustainable Seafood and Nutritious Protein Sources:

The France Mussel Farming Market benefits from strong consumer demand for sustainable seafood options. Mussels provide protein, omega-3 fatty acids, vitamins, and minerals, making them highly valued in modern diets. Awareness of eco-friendly farming practices positions mussels as a responsible protein alternative. Coastal populations in France continue to prioritize mussels as a staple food choice. Export demand in Europe adds momentum, with French mussels recognized for high quality and authenticity. National branding initiatives also improve global visibility and acceptance. It continues to gain traction through rising consumer interest in healthy and sustainable diets.

- For instance, Barbé Group’s contribution to sustainable mussel farming includes adopting traceability and sorting technologies that ensure product quality and sustainability. While exact throughput numbers for processing mussels at their facilities are not publicly detailed, industry-standard traceability systems are widely deployed in French aquaculture to guarantee product authenticity and sustainable sourcing compliance.

Favorable Environmental Conditions and Advanced Aquaculture Infrastructure:

France’s coastal geography provides nutrient-rich waters that enable consistent mussel cultivation. Normandy, Brittany, and Atlantic regions dominate production due to favorable conditions. Strong aquaculture infrastructure ensures reliable yields and steady supply. Investments in modern farming equipment reduce costs and improve operational efficiency. Hatchery and seed supply facilities strengthen production stability across regions. Well-integrated logistics networks ensure distribution efficiency across domestic and export markets. The France Mussel Farming Market leverages these environmental and structural advantages to secure competitiveness.

- For instance, French shellfish farming cooperatives often employ remote monitoring systems to gather real-time water quality data over large farming areas, consistent with contemporary aquaculture technology, though specific technology implementations by individual cooperatives like Isigny may vary.

Government Support and Strategic Aquaculture Policies in France:

The French government implements policies that balance sustainability with aquaculture expansion. Incentives encourage mussel farmers to adopt modern and eco-friendly practices. Regulations ensure marine ecosystem preservation while maintaining production quality. National programs actively promote aquaculture as part of food security planning. Training programs enhance farmer skills and technological adoption. Regional authorities collaborate to monitor water resources and biodiversity health. It benefits from these coordinated policies that support long-term sector growth and environmental responsibility.

Rising Export Potential and Strengthening European Trade Relations:

France plays a central role in supplying mussels to European countries. Strong trade partnerships with Spain, Italy, and Germany strengthen demand. Compliance with EU aquaculture standards enhances credibility and consumer confidence. Exporters benefit from efficient logistics channels connecting coastal hubs with foreign markets. Certification schemes further improve acceptance among environmentally conscious buyers. Market visibility improves with participation in international seafood trade fairs and branding campaigns. The France Mussel Farming Market continues to grow its export footprint through these expanding trade relations.

Market Trends:

Increasing Adoption of Smart Aquaculture and Precision Farming Technologies:

The France Mussel Farming Market is experiencing technological transformation through smart aquaculture tools. Automated feeding and water monitoring systems improve yield accuracy. Data-driven solutions allow better resource management and sustainability compliance. Farmers adopt precision tools to monitor growth rates and predict harvest cycles. AI-based solutions help optimize feed use and minimize environmental impact. Remote monitoring enhances control over farming operations in diverse coastal regions. It is witnessing consistent technology integration that reshapes operational efficiency.

- For instance, SudMaris or similar companies have recognized the value of AI and sensor-based systems in aquaculture. Research and development in AI-powered imaging systems to assess mussel quality and growth parameters have demonstrated accuracy close to in quality prediction, primarily from work done in New Zealand and elsewhere, which influences global aquaculture practice adoption.

Rising Popularity of Organic and Eco-Certified Mussel Products in France:

Consumer demand for eco-certified seafood is expanding in France. Organic mussel products meet rising expectations of sustainability and food safety. Certifications attract environmentally conscious consumers in domestic and export markets. Premium pricing for organic seafood improves profitability for mussel farmers. Retailers highlight certified mussels as part of their sustainable product ranges. Restaurants and catering services increasingly use organic mussels to strengthen brand image. The France Mussel Farming Market is moving toward greater adoption of organic certification practices.

- For instance, Palourde France and other producers comply with EU organic aquaculture certification standards (EU Reg. 848/2018), which regulate organic seafood production. Organic certification in France is overseen by recognized bodies such as Ecocert.

Growing Emphasis on Diversified Product Formats and Value-Added Mussel Offerings:

Mussel producers are innovating with value-added products such as frozen, pre-cooked, and ready-to-eat items. Changing consumer lifestyles increase demand for convenience seafood solutions. Retailers expand product lines to meet demand for diverse consumption formats. Exports of processed mussels improve competitiveness against other global suppliers. Innovative packaging enhances shelf life and maintains freshness in retail distribution. Culinary adaptations also boost mussel use in international cuisine. It shows strong potential for growth through diversification into new product formats.

Expansion of Domestic Distribution Channels and Online Retail Platforms:

France is witnessing growth in online seafood retail platforms. Direct-to-consumer sales allow farmers to expand their market presence. Supermarkets increase their fresh and packaged mussel product ranges. Specialty seafood stores highlight regional mussel varieties for niche customers. Online channels support traceability and consumer trust in product quality. Restaurants also strengthen partnerships with local mussel suppliers. The France Mussel Farming Market adapts to new retail dynamics by embracing both traditional and digital channels.

Market Challenges Analysis:

Environmental Vulnerability and Climate-Related Risks to Mussel Farming:

The France Mussel Farming Market faces challenges linked to environmental vulnerability. Rising sea temperatures affect mussel growth cycles and survival rates. Algal blooms and water pollution increase risks to coastal farming zones. Ocean acidification reduces shell quality and overall yield potential. Storms and extreme weather disrupt harvesting and damage infrastructure. Farmers must adapt with resilient farming systems and climate monitoring. It remains under pressure to mitigate environmental risks while maintaining production efficiency.

Operational Constraints and Rising Competition in Domestic and Export Markets:

Operational costs present significant challenges for mussel farmers across France. Feed, labor, and energy costs increase financial pressure on small producers. Access to financing and modern equipment remains uneven among operators. Export competition intensifies with suppliers from other European countries. Compliance with EU and national regulations also raises operational complexity. Rising consumer expectations on sustainability further increase compliance costs. The France Mussel Farming Market must navigate these operational and competitive constraints to sustain growth.

Market Opportunities:

Expansion of Sustainable Aquaculture Investments and Technological Partnerships:

The France Mussel Farming Market holds strong opportunities through sustainable aquaculture investments. Partnerships with technology providers enable farmers to adopt advanced monitoring tools. International funding supports projects that improve eco-friendly aquaculture practices. Coastal development initiatives also provide infrastructure support to farming communities. Collaboration between research institutes and farmers fosters innovation. It is positioned to expand sustainability through targeted investment and partnerships.

Growing Export Potential and Branding of French Mussels in Global Markets:

France has opportunities to strengthen its global presence through branding initiatives. Premium positioning of French mussels can attract higher-value international buyers. Targeting Asian and North American markets provides new revenue streams. Certification and traceability systems enhance global credibility. Export promotion campaigns highlight the quality and heritage of French mussels. The France Mussel Farming Market is set to capitalize on international demand through strategic branding and export development.

Market Segmentation Analysis:

By Type

Rope mussel farms dominate the France Mussel Farming Market due to their efficiency and ability to produce high yields in nutrient-rich coastal waters. This method is widely used in Brittany and Normandy, where favorable conditions support sustainable practices and consistent supply. Bottom mussel farms continue to play an important role, particularly in areas with suitable seabed conditions, sustaining traditional farming methods that cater to regional demand. The others segment includes small-scale and experimental systems, which remain limited but contribute to niche growth and product diversity.

By Product

Marine water mussel farming leads production, supported by France’s extensive coastline and strong aquaculture traditions. This segment provides a steady output that supplies both domestic consumers and European export markets. Marine environments offer natural advantages that enhance quality and efficiency, reinforcing France’s position as a leading shellfish producer. Fresh water mussel farming, though smaller in scale, supports local markets through controlled inland systems. It offers growth potential in specialty segments, particularly as demand for diverse mussel varieties expands. The France Mussel Farming Market demonstrates a balanced structure where rope farms and marine water production form the backbone, while bottom farming and freshwater cultivation add resilience and niche opportunities.

- For instance, French mussel farms employ traditional and modern techniques, such as the Bouchot method, which involves growing mussels on ropes wound around wooden poles in the intertidal zone.

Segmentation:

Segmentation:

By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

By Product

By Country (Revenue Analysis Context)

Regional Analysis:

Normandy

Normandy leads the France Mussel Farming Market with nearly 38% share, supported by nutrient-rich waters and advanced aquaculture infrastructure. The region specializes in rope mussel farming, which ensures high yields and consistent quality. Logistics networks are well-established, enabling smooth distribution to both domestic and European markets. Branding strategies further enhance Normandy’s reputation as a source of premium mussels. Regional authorities emphasize sustainable practices and ecosystem monitoring, safeguarding long-term productivity. It continues to serve as the largest hub, balancing traditional knowledge with modern techniques.

Brittany

Brittany holds about 34% share, reflecting its long maritime tradition and extensive coastline. Rope mussel farms dominate production, while bottom mussel farming still contributes in selected areas. Producers have expanded cold storage and distribution facilities, improving access to nearby export markets. Spain and Italy remain strong destinations for Brittany’s mussel exports. Local authorities support innovation, encouraging smaller producers to adopt new aquaculture methods. The France Mussel Farming Market benefits from Brittany’s steady output and established export orientation.

Southern France and Other Regions

Southern France and Mediterranean areas account for around 18% share, while inland and smaller regions contribute about 10%. Warmer waters in the south favor specialty varieties and niche production, appealing to domestic consumers. Inland freshwater farms provide added diversity, though production remains modest compared to coastal zones. Investments in aquaculture infrastructure are increasing, supported by rising local demand. Export penetration is improving as producers build new supply capacity and develop logistics. It shows strong growth potential, complementing the dominance of Normandy and Brittany in the overall market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Barbé Group

- SUDMARIS

- Les Viviers de la Baie

- Civgeo (Coopérative d’Isigny)

- Shellfish Farming Alliance (SFA)

- Palourde France

- Vivier Kermadec

- Aquacole Lorraine

- Ferme Marine de Saint-Malo

- Others

Competitive Analysis:

The France Mussel Farming Market is characterized by established regional producers, cooperatives, and specialized aquaculture companies. Competition is shaped by factors such as production capacity, sustainability practices, distribution networks, and brand reputation. Rope mussel farms dominate due to efficiency, while bottom farms and emerging freshwater systems diversify the landscape. Leading players include Barbé Group, SUDMARIS, Les Viviers de la Baie, and Civgeo, all of which hold strong market presence in coastal hubs. It remains moderately fragmented, with regional leaders competing to expand exports across Europe. Investments in modern equipment, certifications, and partnerships strengthen competitive positioning and ensure long-term industry resilience.

Recent Developments:

- In February 2025, Vivier Kermadec launched a groundbreaking skincare product called Crème 47 Luxe Concentrate, celebrating the brand’s 25th anniversary with a formulation addressing seven essential skin functions including hydration, collagen support, and inflammation reduction.

- In January 2025, the Barbé Group implemented a comprehensive global Information Security Policy across all its locations and subsidiaries to ensure the confidentiality, integrity, and availability of sensitive data.

Report Coverage:

The research report offers an in-depth analysis based on type and product segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for eco-certified mussels will create premium opportunities.

- Expansion of rope farming technologies will sustain production leadership.

- Freshwater farming will gain traction in niche domestic markets.

- Export partnerships with Spain, Italy, and Germany will strengthen demand.

- Investments in cold storage and logistics will expand distribution efficiency.

- Climate resilience strategies will become critical to long-term farming success.

- Regional clusters in Normandy and Brittany will maintain dominant roles.

- New product formats such as ready-to-eat mussels will attract urban buyers.

- Digital traceability tools will enhance transparency and consumer trust.

- Sustainable aquaculture investments will shape competitiveness and growth.

Market Insights:

Market Insights:

Segmentation:

Segmentation: