Market Overview:

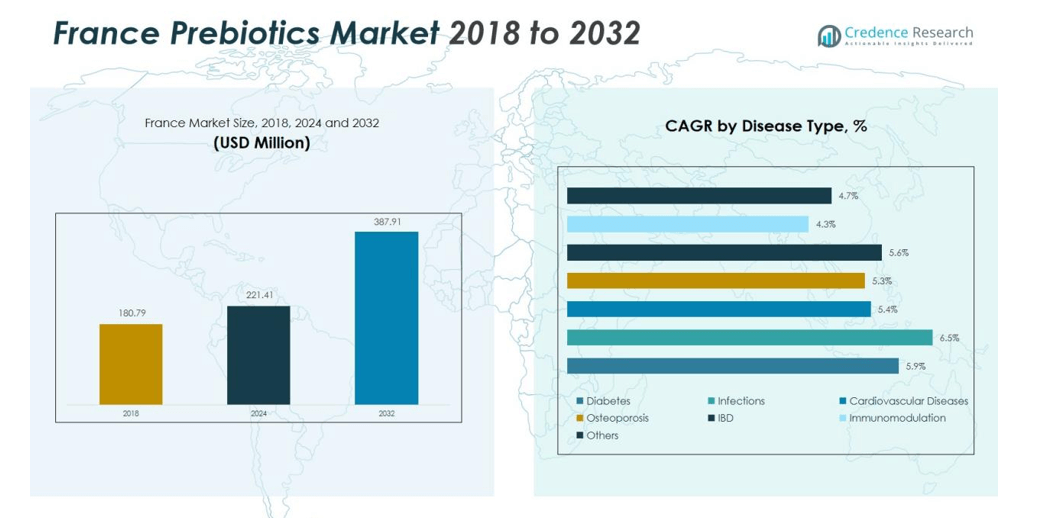

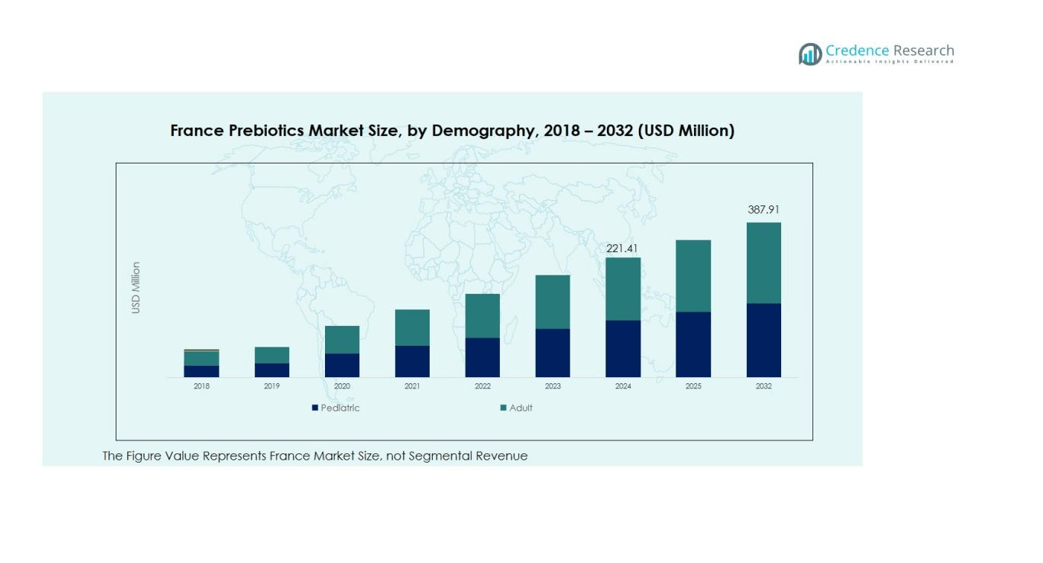

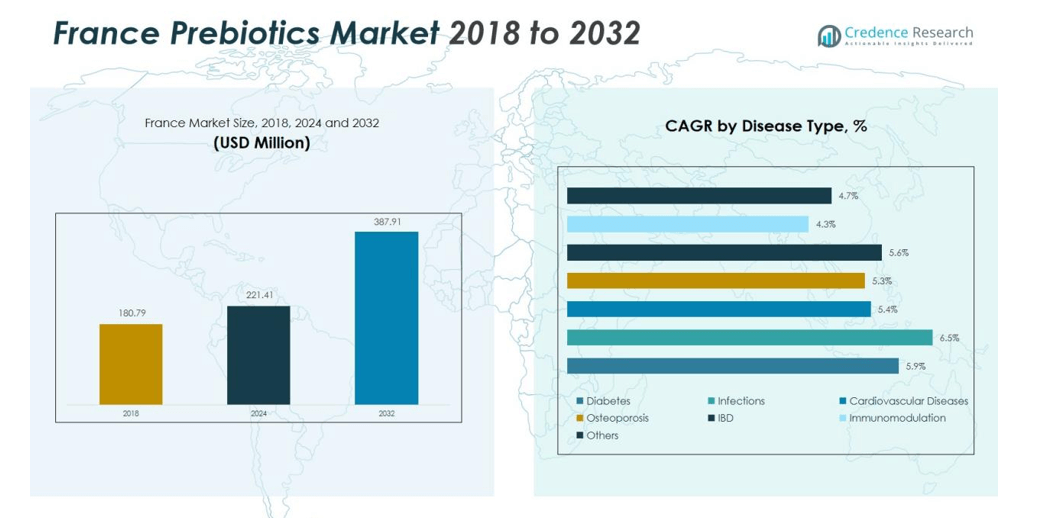

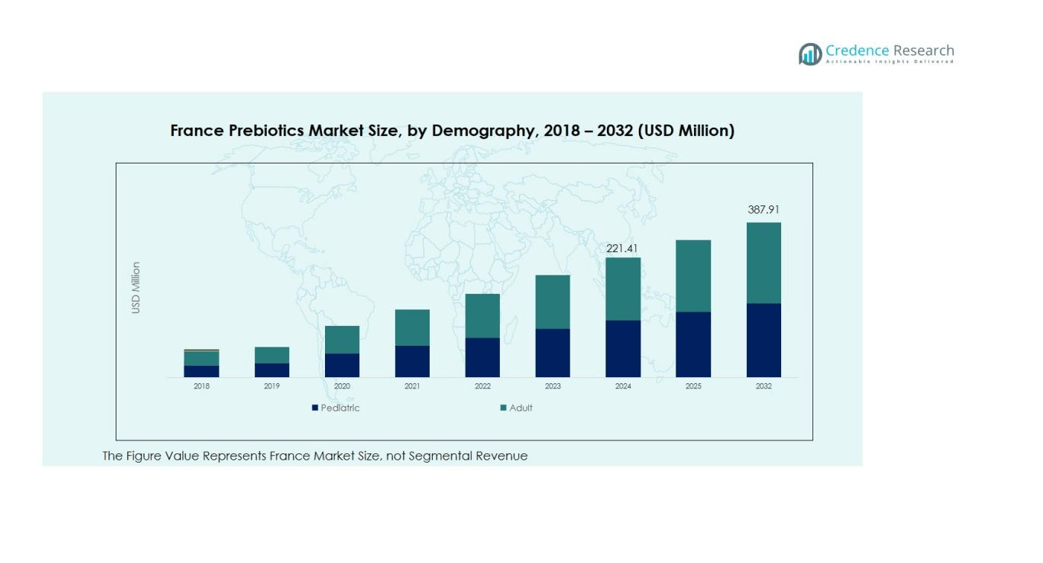

The France Prebiotics Market size was valued at USD 180.79 million in 2018 to USD 221.41 million in 2024 and is anticipated to reach USD 387.91 million by 2032, at a CAGR of 7.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Prebiotics Market Size 2024 |

USD 221.41 million |

| France Prebiotics Market, CAGR |

7.26% |

| France Prebiotics Market Size 2032 |

USD 387.91 million |

Market growth is primarily driven by rising awareness about digestive health, immunity, and gut microbiota balance. French consumers are shifting toward clean-label and wellness-oriented food products, encouraging manufacturers to incorporate inulin, FOS, and GOS into diverse formulations. Ongoing research investments and favorable European regulations supporting health claims strengthen innovation and competitive differentiation among domestic and international brands.

Regionally, Northern and Western France lead the market, supported by advanced food manufacturing facilities and a high concentration of health-conscious consumers. Paris and neighboring regions show strong consumption patterns due to higher disposable incomes and access to functional products. Southern and Eastern France are emerging as growth areas, driven by the expansion of nutraceutical distribution networks and increasing adoption in fortified dairy and bakery segments.

Market Insights:

- The France Prebiotics Market was valued at USD 180.79 million in 2018, reached USD 221.41 million in 2024, and is projected to attain USD 387.91 million by 2032, registering a CAGR of 7.26% during the forecast period.

- Northern France holds the largest share of 38%, supported by strong consumer awareness, advanced food processing facilities, and the presence of major functional food manufacturers.

- Western France accounts for 27% of the market, driven by established dairy industries and increasing adoption of fortified food and beverage products.

- Southern France, with a 19% share, is the fastest-growing region, supported by expanding nutraceutical production, higher disposable incomes, and growing demand for healthy beverages and snacks.

- By product, inulin leads with a 32% share, followed by fructo-oligosaccharides (FOS) at 24%, reflecting strong demand in functional dairy and dietary supplements across France.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Digestive Health and Preventive Nutrition

The France Prebiotics Market is driven by increasing consumer awareness about the role of gut health in overall wellness. People are adopting dietary habits that support digestive balance, immunity, and metabolic health. This shift encourages manufacturers to develop products enriched with prebiotic ingredients like inulin, FOS, and GOS. It benefits from growing demand for functional foods that promote natural and preventive nutrition across all age groups.

- For Instance, FrieslandCampina Ingredients partnered with Brenntag Specialties to exclusively distribute its Biotis prebiotic range for nutritional health products in France.

Expansion of Clean-Label and Plant-Based Food Products

Consumers in France are increasingly prioritizing transparency and sustainability in food choices. The demand for clean-label and plant-based food and beverage products supports the inclusion of prebiotic fibers sourced from chicory, agave, and other natural origins. It encourages food producers to reformulate offerings and comply with evolving consumer expectations for traceable ingredients. This transition strengthens the position of prebiotics within the broader health and wellness market.

- For Instance, BENEO expanded its overall chicory root fiber production capacity by more than 40% through a multi-million euro investment announced in November 2021. The expansion project involves its production sites in both Oreye, Belgium, and Pemuco, Chile, and was initiated in 2022 to meet growing demand for prebiotic fiber.

Government Support and Regulatory Framework for Functional Foods

Strong government backing and European Food Safety Authority (EFSA) regulations encourage innovation in the functional food sector. The France Prebiotics Market benefits from these favorable policies, which help brands secure approvals for scientifically validated health claims. It enables product differentiation and boosts consumer trust in prebiotic-based products. This environment supports R&D investments and fosters long-term market competitiveness.

Expanding Applications Across Nutraceutical and Dairy Industries

Prebiotics are gaining importance across sectors such as nutraceuticals, dairy, and infant nutrition. Leading French food and supplement manufacturers are integrating prebiotics to improve gut health benefits and product functionality. It allows producers to target diverse consumer groups, from infants to older adults. The growing availability of fortified yogurts, drinks, and supplements highlights the expanding use of prebiotics across multiple industries.

Market Trends:

Integration of Prebiotics in Functional Foods and Nutraceutical Formulations

The France Prebiotics Market is witnessing strong integration of prebiotics into functional foods, beverages, and nutraceutical products. Manufacturers are leveraging scientific research to develop formulations that improve gut microbiota and immunity. Growing consumer awareness of digestive wellness has led to widespread adoption of prebiotic-enriched dairy, bakery, and plant-based alternatives. It supports higher innovation in natural sweeteners and fiber-rich ingredients sourced from chicory and Jerusalem artichoke. Companies are introducing new formats such as gummies, powders, and drink mixes to appeal to younger demographics. The rising preference for convenient and personalized nutrition solutions is reinforcing the market’s diversification across both retail and online platforms.

- For instance, Danone launched Activia Proactive in August 2025, a thick and creamy low-fat yogurt containing billions of live probiotics and 3 grams of prebiotic fiber per serving, specifically designed to support digestive health and cater to the growing consumer demand for functional wellness foods.

Rising Influence of Clean-Label, Sustainable, and Personalized Nutrition Trends

Sustainability and transparency have become key purchasing factors among French consumers. The France Prebiotics Market reflects this shift through rising use of locally sourced, traceable, and eco-friendly ingredients. It aligns with the country’s broader movement toward responsible consumption and reduced environmental impact. Manufacturers are increasingly focusing on clean-label product innovation, highlighting natural origin and absence of synthetic additives. Digital health tools and personalized nutrition apps are helping consumers choose products that match specific digestive and metabolic needs. Collaborations between research institutions and food producers are expanding the scientific validation of prebiotic benefits, driving long-term market credibility and brand differentiation.

- For instance, Exden, a French manufacturer specializing in probiotic, prebiotic, and postbiotic supplements, guarantees 100% French manufacturing with ISO 22000 certification for quality and traceability, supporting clean-label innovation in the sector with small or large batch production capabilities.

Market Challenges Analysis:

High Production Costs and Complex Ingredient Sourcing Processes

The France Prebiotics Market faces challenges from high production costs and complex sourcing of raw materials. Extracting inulin, FOS, and GOS from natural sources like chicory and agave involves energy-intensive processes and advanced purification systems. It limits cost competitiveness and makes prebiotics more expensive than synthetic alternatives. Supply chain disruptions and seasonal fluctuations in raw material availability increase price volatility. Smaller manufacturers often struggle to maintain profit margins while ensuring quality and consistency. These factors create barriers for new entrants and affect large-scale commercialization efforts.

Regulatory Complexity and Limited Consumer Understanding of Prebiotic Benefits

Regulatory complexity remains a major restraint for the France Prebiotics Market. The approval process for health claims under EFSA regulations requires strong clinical evidence and detailed product validation. It slows product launches and increases compliance costs for companies. Limited consumer understanding of the difference between probiotics and prebiotics also affects market penetration. Many consumers associate gut health benefits only with probiotics, reducing awareness of prebiotic functionality. Continuous education and marketing investments are essential to overcome misconceptions and support long-term market growth.

Market Opportunities:

Growing Potential in Personalized Nutrition and Functional Food Innovation

The France Prebiotics Market holds strong potential in personalized nutrition and functional product innovation. Rising demand for tailored health solutions encourages the development of prebiotic formulations designed for specific digestive, metabolic, and immune needs. It allows brands to target niche segments such as sports nutrition, weight management, and healthy aging. The adoption of digital health platforms supports customized dietary recommendations based on gut microbiome data. Food and beverage companies are using this trend to launch fortified products with measurable health outcomes. This focus on personalization is expected to redefine consumer engagement and expand market penetration.

Expansion Across Pharmaceutical, Animal Feed, and Infant Nutrition Segments

Emerging applications across pharmaceuticals, animal feed, and infant nutrition create new avenues for growth. The France Prebiotics Market benefits from ongoing clinical research linking prebiotics to immune modulation and metabolic health. It enables wider product diversification beyond traditional food categories. Infant formula producers are incorporating prebiotic blends to replicate the benefits of human milk oligosaccharides. Animal feed manufacturers are also adopting prebiotics to enhance gut health and productivity in livestock. Expanding across these high-value sectors strengthens industry resilience and opens sustainable long-term growth prospects.

Market Segmentation Analysis:

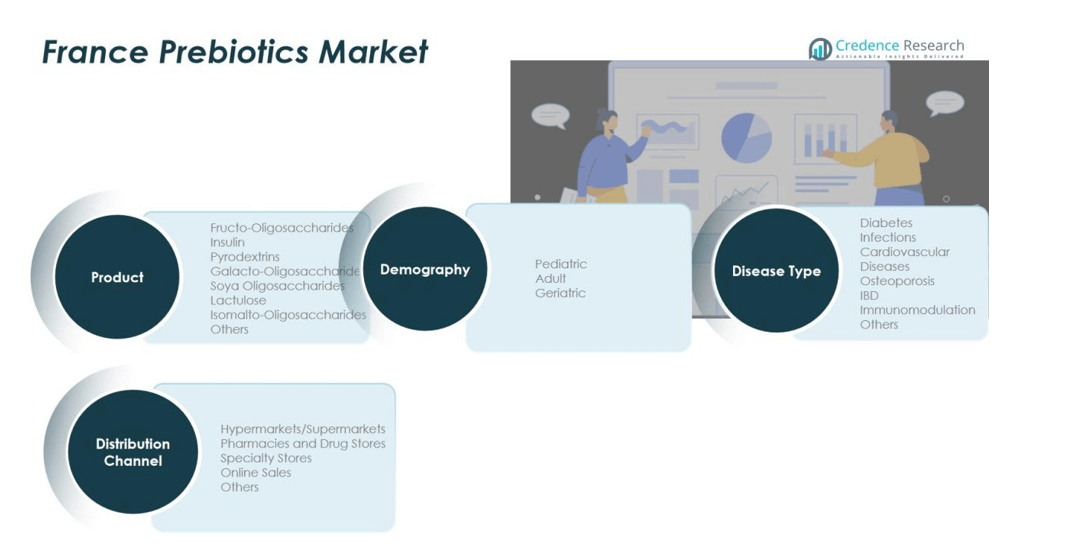

By Product Segment

The France Prebiotics Market features a diverse product range led by inulin and fructo-oligosaccharides (FOS). These ingredients dominate due to their proven digestive and immune health benefits. Galacto-oligosaccharides (GOS) and lactulose are gaining demand in infant nutrition and dairy applications. Pyrodextrins and soya oligosaccharides contribute to functional bakery and beverage formulations. It continues to evolve through innovation in plant-based and fiber-enriched food solutions that align with clean-label trends.

- For instance, Roquette, a global leader in plant-based ingredients, launched its NUTRIOSE® FB06 soluble fiber formulation in bakery applications showcasing Mediterranean-style savory cakes with Nutri-Score A rating and featuring combined solutions with NUTRALYS® B85F pea protein delivering 8 grams of prebiotic fiber and 15 grams of plant-based protein per 3-ounce serving for functional beverage applications targeting GLP-1 health management.

By Disease Type Segment

The market shows strong adoption across diabetes management, cardiovascular health, and infection prevention segments. Prebiotics play a vital role in reducing inflammation, balancing glucose levels, and improving metabolic function. Demand for immunity and gut-related disease management further supports market expansion. It benefits from scientific validation and rising public awareness of preventive nutrition. Osteoporosis and inflammatory bowel disease (IBD) segments are witnessing increased interest among older consumers.

- For instance, a 2024 randomised controlled trial by Cambridge University reported that a 24-week intake of 20 g/day of a diverse prebiotic fiber by participants with pre-diabetes led to a 0.17% reduction in HbA1c and a 1.62-point improvement in insulin sensitivity, highlighting clinical efficacy in glucose control.

By Demography Segment

Prebiotic consumption in France spans across pediatric, adult, and geriatric populations. Adults remain the largest consumer base due to their focus on digestive wellness and balanced nutrition. Pediatric applications grow through fortified infant formulas and functional dairy products. The geriatric population drives demand for products supporting bone density and immune health. It highlights the broad demographic acceptance and long-term growth potential of prebiotics across all age groups.

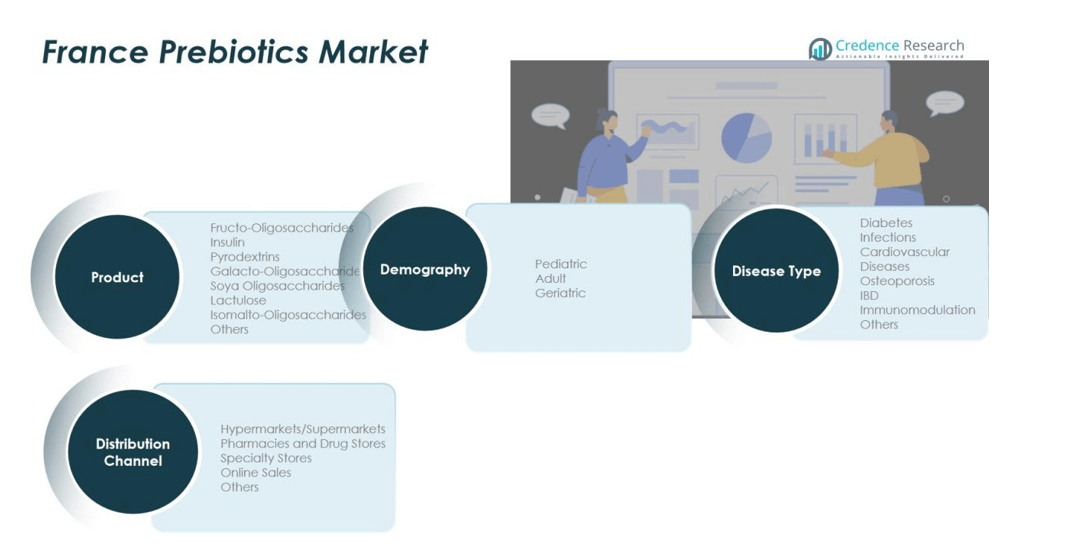

Segmentations:

By Product Segment:

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type Segment:

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography Segment:

- Pediatric

- Adult

- Geriatric

By Distribution Channel Segment:

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

Regional Analysis:

Strong Market Presence in Northern and Western France

The France Prebiotics Market records strong dominance in Northern and Western regions, driven by advanced food processing infrastructure and higher consumer awareness. Paris, Normandy, and Brittany lead in consumption and production due to the concentration of functional food manufacturers and research institutions. It benefits from established retail distribution networks and a large base of health-conscious consumers. Demand for clean-label and plant-based products is particularly high in these areas. The presence of multinational brands and local startups supports continuous product innovation and regional revenue growth.

Emerging Growth Opportunities in Southern France

Southern France is rapidly developing into a promising growth region supported by expanding nutraceutical and dairy industries. Rising disposable incomes and increasing interest in fortified foods contribute to steady market expansion. The France Prebiotics Market in this region gains strength from tourism-driven demand for healthy beverages and snacks. It attracts new investments from food producers aiming to diversify product portfolios. Regional trade clusters and agricultural resources enhance the supply of natural raw materials for prebiotic production.

Expanding Distribution and Awareness Across Eastern and Central France

Eastern and Central France show growing adoption of prebiotic-enriched products, driven by urbanization and improved retail penetration. Consumers are becoming more aware of gut health benefits, supported by local promotional campaigns and educational initiatives. It benefits from government programs encouraging functional food innovation and sustainable agriculture. Expanding e-commerce platforms and pharmacy networks are widening product accessibility. The gradual rise in consumer engagement with natural supplements positions these regions for consistent future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Nestlé S.A.

- OptiBac Probiotics Ltd.

- Archer Daniels Midland Company

- BioGaia AB

- Lallemand Inc.

- Kerry Group plc

- Hansen Holding A/S

- DuPont Nutrition & Biosciences

- General Mills Inc.

- Arla Foods amba

- Biotiful Gut Health Ltd.

Competitive Analysis:

The France Prebiotics Market features a competitive landscape led by multinational and regional players such as Danone S.A., Yakult Honsha Co., Ltd., Nestlé S.A., OptiBac Probiotics Ltd., Archer Daniels Midland Company, BioGaia AB, Lallemand Inc., and Kerry Group plc. These companies focus on product innovation, scientific validation, and expanding their prebiotic ingredient portfolios. It demonstrates steady competition in functional food, nutraceutical, and dairy-based applications. Strong emphasis on R&D supports the development of clean-label and plant-derived formulations aligned with consumer health trends. Companies are also strengthening distribution networks and forming collaborations to improve regional reach. The competitive environment continues to evolve with strategic mergers and product diversification aimed at sustaining market leadership and expanding consumer engagement.

Recent Developments:

- In October 2025, Yakult Honsha completed a merger between Yakult Europe B.V. and Yakult Oesterreich GmbH, effective October 1, 2025, to enhance operational efficiency and strengthen sales activities across Austria.

- In August 2025, Nestlé entered a partnership with IBM Research to develop sustainable food packaging using generative AI, aiming to reduce plastic use through advanced, data‑driven material science.

Report Coverage:

The research report offers an in-depth analysis based on Product, Disease Type, Demography and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Prebiotics Market is expected to witness strong expansion driven by rising health awareness and clean-label trends.

- Growing consumer preference for natural digestive health products will support steady product adoption.

- Food and beverage companies will expand their prebiotic-enriched offerings across dairy, bakery, and plant-based categories.

- The integration of prebiotics into functional snacks and drinks will attract younger consumers.

- R&D investments will focus on enhancing stability, taste, and compatibility of prebiotics in various formulations.

- Personalized nutrition solutions and digital health tools will increase targeted product recommendations.

- The pharmaceutical and nutraceutical sectors will adopt prebiotics for immunity and metabolic health support.

- Online retail and direct-to-consumer models will enhance product accessibility and brand visibility.

- Sustainability-focused sourcing and transparent labeling will strengthen consumer trust and market credibility.

- Strategic collaborations among manufacturers, research bodies, and food producers will drive innovation and long-term competitiveness.