Market Overview:

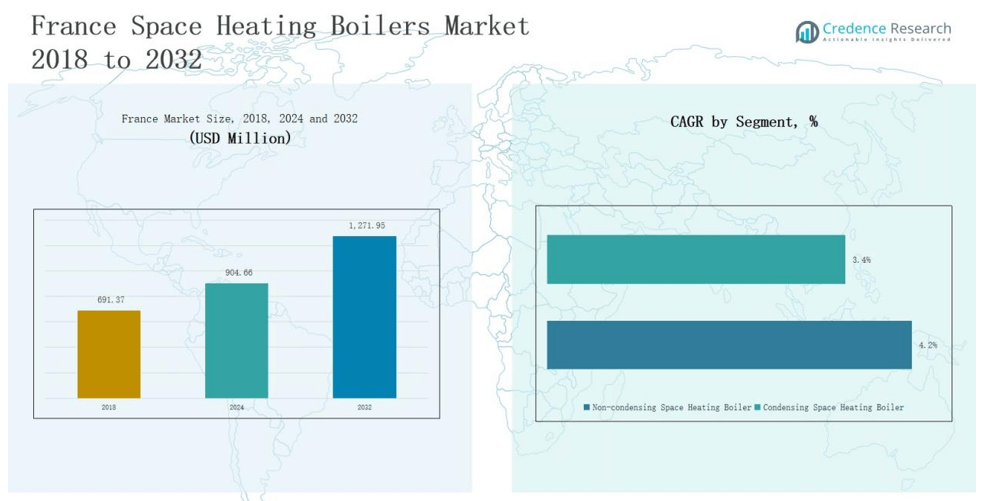

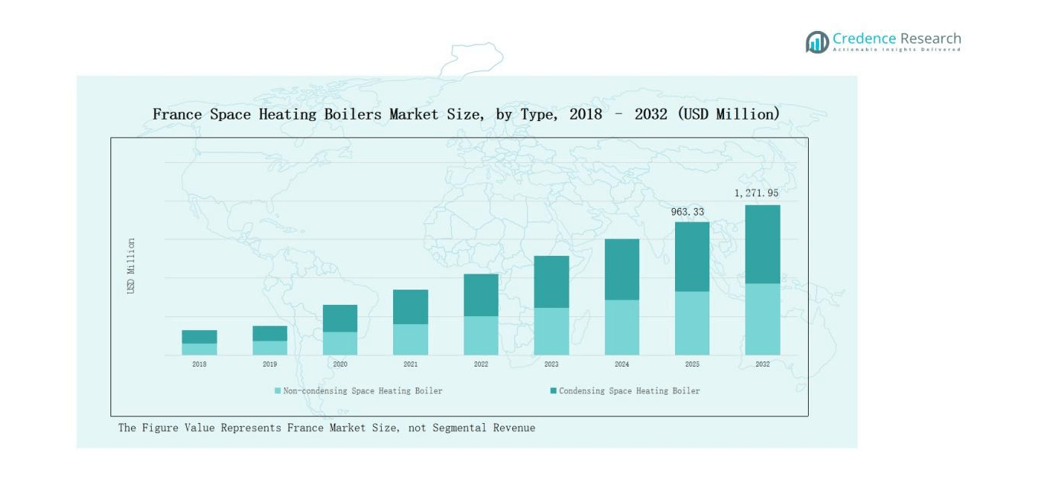

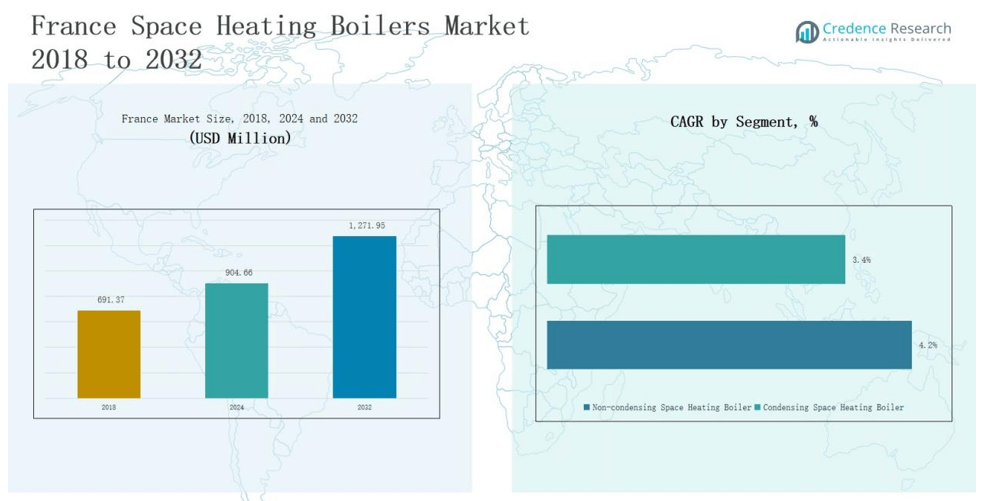

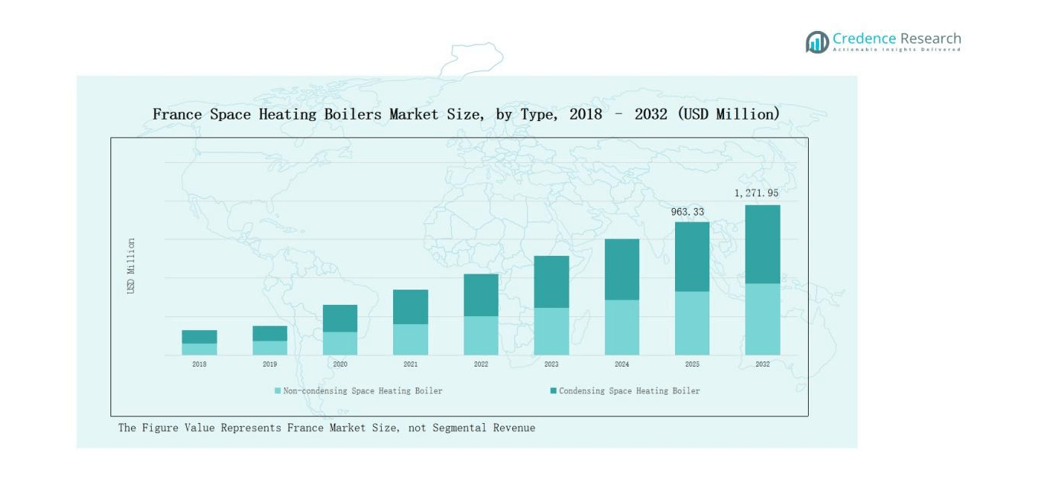

France Space Heating Boilers Market size was valued at USD 691.37 million in 2018 to USD 904.66 million in 2024 and is anticipated to reach USD 1,271.95 million by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Space Heating Boilers Market Size 2024 |

USD 904.66 million |

| France Space Heating Boilers Market, CAGR |

4.05% |

| France Space Heating Boilers Market Size 2032 |

USD 1,271.95 million |

The France Space Heating Boilers Market is shaped by strong competition among global and regional manufacturers, with leading players including Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, Baxi Heating, Ariston Thermo Group, Ferroli, Atlantic Group, and De Dietrich Thermique. These companies focus on condensing technology, hybrid solutions, and digital integration to align with France’s energy efficiency goals and consumer demand for sustainable heating. Among regional markets, Northern France leads with 34% share in 2024, supported by colder winters, dense urban populations, and established gas infrastructure, making it the central hub for boiler adoption and technological innovation.

Market Insights

- The France Space Heating Boilers Market grew from USD 691.37 million in 2018 to USD 904.66 million in 2024 and will reach USD 1,271.95 million by 2032.

- Leading companies include Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, Baxi Heating, Ariston Thermo Group, Ferroli, Atlantic Group, and De Dietrich Thermique.

- Condensing boilers held 68% share in 2024, driven by EU efficiency rules, while non-condensing units continued losing ground due to higher emissions.

- Residential applications dominated with 61% share in 2024, followed by commercial demand, while industrial use remained limited due to alternative heating technologies.

- Northern France led regionally with 34% share in 2024, supported by cold winters, dense urban populations, and strong gas infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Condensing boilers dominate the France Space Heating Boilers Market, holding nearly 68% share in 2024. Their leadership stems from strict EU energy efficiency regulations and rising consumer preference for low-emission heating systems. Non-condensing boilers, while cost-effective, are steadily losing ground due to higher carbon emissions and government incentives promoting energy-efficient technologies.

- For instance, Viessmann’s Vitodens 100-W condensing boiler is equipped with a durable, corrosion-resistant Inox-Radial heat exchanger that significantly reduces fuel consumption by maximizing energy efficiency.

By Application

The residential sector accounts for around 61% share in 2024, making it the largest application segment in France. Strong demand arises from urban households, aging housing stock requiring replacement, and policies promoting efficient heating upgrades. Commercial usage follows, driven by office buildings, retail, and hospitality, while industrial adoption remains niche due to alternative heating technologies.

- For instance, Icade is committed to decarbonizing its portfolio by replacing fossil-fuel heating with low-carbon solutions, aligning with its overall goal of achieving net-zero carbon by 2050

By Operation

Gas-fired boilers lead the France Space Heating Boilers Market with nearly 59% share in 2024. France’s established natural gas infrastructure and consumer familiarity with gas systems support this dominance. Electric boilers are gaining ground due to decarbonization goals and integration with renewable energy, while oil-fired and coal boilers continue to decline under environmental restrictions. The “others” category, including biomass and hybrid systems, is expanding as a sustainable alternative.

Market Overview

Rising Demand for Energy Efficiency

Energy efficiency regulations in France drive strong adoption of condensing boilers, which reduce energy use and emissions. Government-backed incentives, such as tax credits and subsidies, encourage households to replace outdated systems with efficient alternatives. Rising energy costs further push consumers toward technologies that lower heating bills. This creates consistent demand across residential and commercial markets, supported by sustainability targets, stricter EU policies, and increasing consumer awareness of long-term environmental benefits and operational cost savings.

- For instance, Saunier Duval (Vaillant Group) introduced hybrid heat pump-condensing boiler systems in France. While they comply with EU regulations, the actual CO2 reduction (up to 50% cited) varies significantly based on installation, operating conditions, and local electricity grid.

Supportive Government Policies

The French government actively supports carbon reduction goals through heating system modernization programs. Incentives under energy transition initiatives accelerate replacement of oil-fired and coal boilers. Local municipalities also back clean heating technologies to meet EU decarbonization targets. These policy frameworks strengthen the position of efficient gas-fired and electric boilers in France, while driving innovation, attracting private investments, creating new business opportunities, and ensuring that heating infrastructure aligns with future sustainability, climate resilience, and energy security objectives.

- For instance, energy-services firm Dalkia has deployed over 330 district heating and cooling networks covering 2,900 km and heating more than 2 million homes in France, supporting local clean heating transitions.

Urbanization and Housing Renovation

France’s dense urban centers and aging housing stock fuel replacement demand for modern boilers. Renovation programs focus on upgrading outdated heating systems to comply with building efficiency standards. Homeowners prioritize reliable, compact, and efficient boilers to reduce maintenance costs. Rapid urbanization and population growth in cities further boost long-term adoption of modern heating technologies, supported by government incentives, rising environmental awareness, and the integration of smart controls that enhance energy efficiency and household comfort.

Key Trends & Opportunities

Shift Toward Electrification

Electrification is a growing trend as France invests heavily in renewable energy integration. Electric space heating boilers are gaining adoption in households looking for carbon-neutral solutions. This aligns with EU goals of phasing out fossil-fuel dependence. Manufacturers that expand their electric boiler portfolios can tap into this accelerating market shift, supported by smart grid technologies and rising consumer demand for sustainable, efficient, and cost-effective heating solutions across urban and rural residential sectors.

- For instance, the French government supports heat pump replacements through its MaPrimeRénov’ program, but subsidies aren’t universally €10,000. The amount is tiered based on income, and lower-income households receive the highest aid, while higher-income families get less.

Growth of Hybrid and Smart Systems

Smart and hybrid boiler systems are emerging as attractive opportunities in France. Consumers prefer integrated heating solutions that combine gas boilers with heat pumps or smart controls. These technologies optimize energy use, improve comfort, and reduce emissions. Adoption of smart connectivity further enables remote monitoring, making hybrid systems appealing for eco-conscious users, while government incentives and evolving EU standards continue to accelerate demand for efficient, flexible, and environmentally friendly home heating technologies nationwide.

- For instance, The Viessmann Vitocaldens 222-F hybrid unit can deliver significant efficiency gains by combining a heat pump with a gas condensing boiler. It uses an intelligent Hybrid Pro Control system to automatically switch between the most cost-effective and efficient heating source, potentially saving up to 40% on heating costs.

Key Challenges

High Initial Installation Costs

The upfront cost of condensing and hybrid boiler systems remains a barrier, particularly for low-income households. Even with subsidies, many consumers hesitate to replace functional but inefficient systems. This slows the pace of market penetration, especially outside urban centers, where financial incentives are less effective, credit access is limited, and residents often prioritize short-term affordability over long-term efficiency, making adoption slower and less consistent across regions.

Dependency on Gas Infrastructure

While gas-fired boilers dominate, reliance on France’s gas network poses risks amid fluctuating global gas prices. Policy shifts toward electrification also challenge long-term demand for gas systems. Manufacturers must adapt to mitigate dependency risks and align with sustainability targets, focusing on diversification, dual-fuel systems, and stronger investment in electric alternatives, while balancing consumer affordability and ensuring resilience against external energy market disruptions and geopolitical supply chain uncertainties.

Competition from Alternative Heating Technologies

Heat pumps, district heating, and renewable-based solutions present strong competition to traditional boilers. These alternatives receive growing support from EU decarbonization initiatives. As consumer awareness rises, space heating boilers face pressure to innovate and maintain relevance in France’s sustainable heating landscape, especially as government-backed renewable technologies gain subsidies, private investments surge, and energy efficiency standards tighten, requiring manufacturers to enhance product performance, integrate smart features, and emphasize sustainability benefits.

Regional Analysis

Northern France

Northern France holds the leading position in the France Space Heating Boilers Market with 34% share in 2024. Cold winters and high population density drive strong demand for residential heating systems. It benefits from an established gas infrastructure that supports the dominance of gas-fired condensing boilers. Government-backed renovation programs in older housing areas further boost adoption. The region also shows rising interest in electric boilers due to energy transition initiatives. It remains the core market for manufacturers expanding product portfolios.

Southern France

Southern France accounts for 26% share in 2024, supported by a mix of residential and commercial demand. Warmer climates reduce reliance on heavy-duty heating, yet seasonal peaks sustain consistent boiler adoption. Growing urbanization in cities such as Marseille and Nice encourages installation of compact and efficient systems. Hybrid boilers combining heat pumps with condensing units gain momentum in this region. Tourism-driven commercial infrastructure also contributes to steady demand. It is emerging as a growth hub for sustainable and smart boiler systems.

Eastern France

Eastern France represents 21% share in 2024, driven by industrial activities and colder climate conditions near the borders. Industrial facilities and large commercial buildings generate consistent demand for robust and efficient heating solutions. Cross-border trade with Germany and Switzerland influences the adoption of advanced boiler technologies. Policy incentives encourage businesses to replace outdated oil-fired systems with low-emission alternatives. The presence of strong manufacturing clusters adds to regional consumption. It remains vital for industrial and commercial boiler suppliers.

Western France

Western France holds 19% share in 2024, supported by residential and agricultural applications. The region has a balanced mix of rural households and medium-sized towns, generating steady replacement demand. Gas-fired boilers dominate due to widespread access to the national gas grid. Rising awareness of energy efficiency encourages gradual adoption of condensing boilers. Renewable integration, particularly biomass and hybrid systems, is gaining traction in rural communities. It presents opportunities for sustainable heating technologies tailored to smaller-scale applications.

Market Segmentations:

By Type

- Condensing Boilers

- Non-condensing Boilers

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Boilers

- Electric Boilers

- Oil-fired Boilers

- Coal Boilers

- Others

By Country

- Northern France

- Southern France

- Western France

- Eastern France

Competitive Landscape

Northern France

Northern France holds the leading position in the France Space Heating Boilers Market with 34% share in 2024. Cold winters and high population density drive strong demand for residential heating systems. It benefits from an established gas infrastructure that supports the dominance of gas-fired condensing boilers. Government-backed renovation programs in older housing areas further boost adoption. The region also shows rising interest in electric boilers due to energy transition initiatives. It remains the core market for manufacturers expanding product portfolios.

Southern France

Southern France accounts for 26% share in 2024, supported by a mix of residential and commercial demand. Warmer climates reduce reliance on heavy-duty heating, yet seasonal peaks sustain consistent boiler adoption. Growing urbanization in cities such as Marseille and Nice encourages installation of compact and efficient systems. Hybrid boilers combining heat pumps with condensing units gain momentum in this region. Tourism-driven commercial infrastructure also contributes to steady demand. It is emerging as a growth hub for sustainable and smart boiler systems.

Eastern France

Eastern France represents 21% share in 2024, driven by industrial activities and colder climate conditions near the borders. Industrial facilities and large commercial buildings generate consistent demand for robust and efficient heating solutions. Cross-border trade with Germany and Switzerland influences the adoption of advanced boiler technologies. Policy incentives encourage businesses to replace outdated oil-fired systems with low-emission alternatives. The presence of strong manufacturing clusters adds to regional consumption. It remains vital for industrial and commercial boiler suppliers.

Western France

Western France holds 19% share in 2024, supported by residential and agricultural applications. The region has a balanced mix of rural households and medium-sized towns, generating steady replacement demand. Gas-fired boilers dominate due to widespread access to the national gas grid. Rising awareness of energy efficiency encourages gradual adoption of condensing boilers. Renewable integration, particularly biomass and hybrid systems, is gaining traction in rural communities. It presents opportunities for sustainable heating technologies tailored to smaller-scale applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Viessmann Group

- Bosch Thermotechnology

- Vaillant Group

- Worcester Bosch

- Ideal Boilers

- Baxi Heating

- Ariston Thermo Group

- Ferroli

- Atlantic Group

- De Dietrich Thermique

- Others

Recent Developments

- In June 2025, DS Smith activated a €90 million biomass boiler at its Rouen mill in Normandy. The project replaces coal operations and is set to lower CO₂ emissions by nearly 99,000 tonnes per year.

- In April 2024, Mitsubishi Electric Corporation, through its wholly owned subsidiaries Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A. and Mitsubishi Electric Europe B.V., wholly acquired AIRCALO, a French air-conditioning company.

- In September 2024, Boccard acquired Leroux & Lotz Technologies, a French industrial boiler manufacturer. This merger created a European leader in renewable thermal energy, combining expertise in biomass, waste-fired boilers, combustion systems, and carbon capture.

- In 2024, French boiler‑rental firm Tibbloc acquired Linkair, a temporary air‑solutions provider. That December, investment firm Gimv acquired a majority stake in Tibbloc, strengthening its position in mobile heating and cooling services.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condensing boilers will continue to expand under strict energy efficiency rules.

- Electric boilers will gain stronger adoption as France pushes toward electrification of heating.

- Hybrid systems combining boilers with heat pumps will see rising interest in urban households.

- Government incentives will drive faster replacement of outdated oil and coal-fired boilers.

- Smart connectivity and remote monitoring will become standard features in modern boiler systems.

- Residential demand will dominate, supported by ongoing housing renovation and replacement cycles.

- Commercial buildings will adopt advanced boiler solutions to meet sustainability certification needs.

- Industrial users will invest in efficient heating systems to cut energy costs and emissions.

- Local manufacturers will expand regional partnerships to strengthen distribution and service networks.

- Alternative renewable solutions will intensify competition, pushing boiler makers toward continuous innovation.