Market Overview

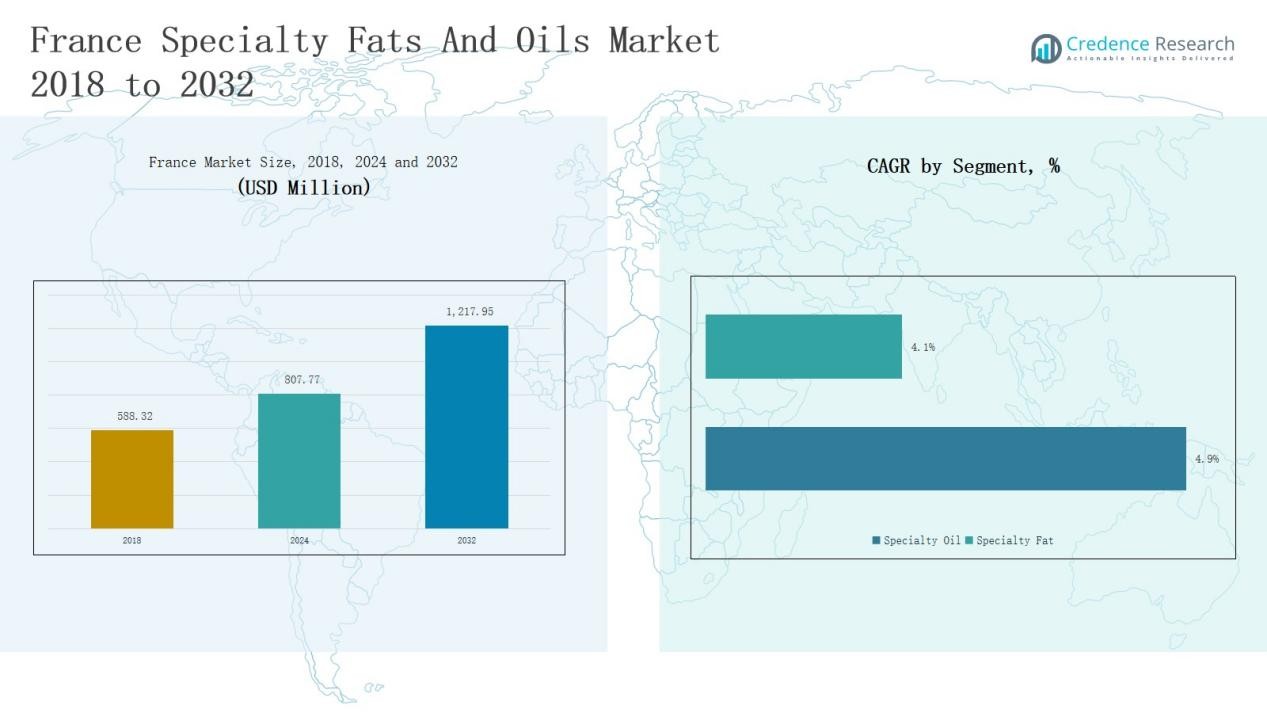

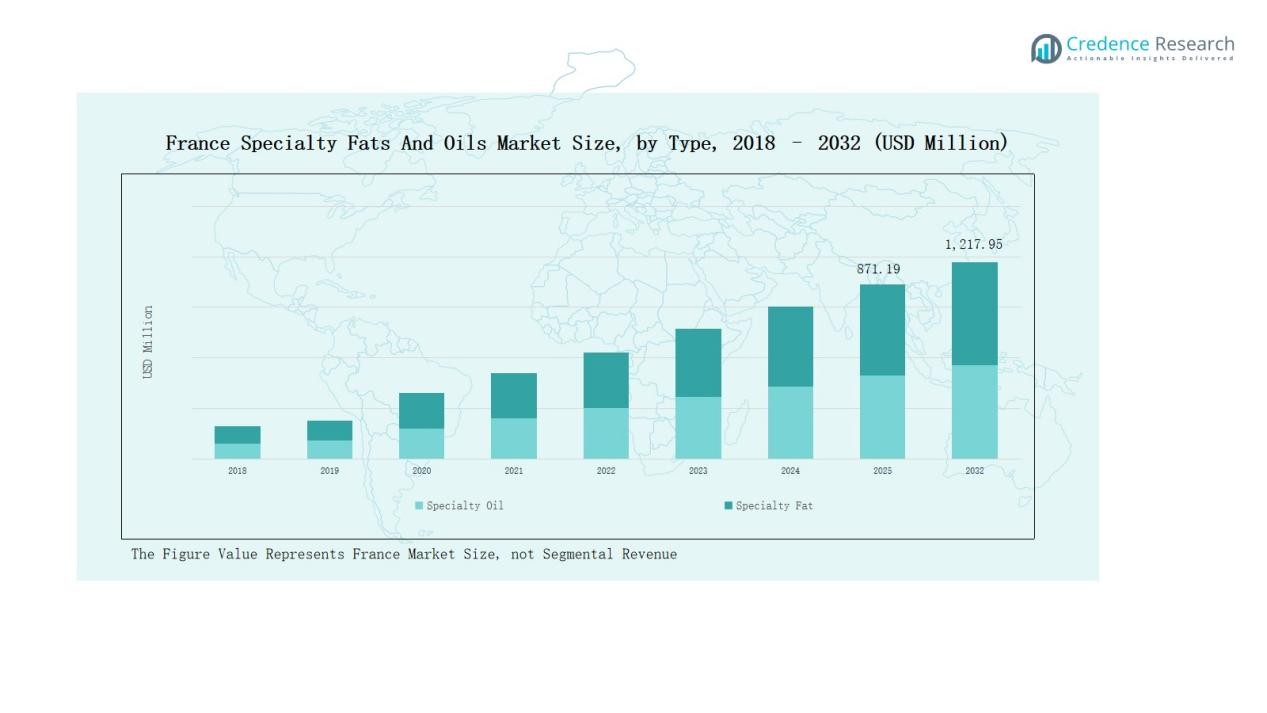

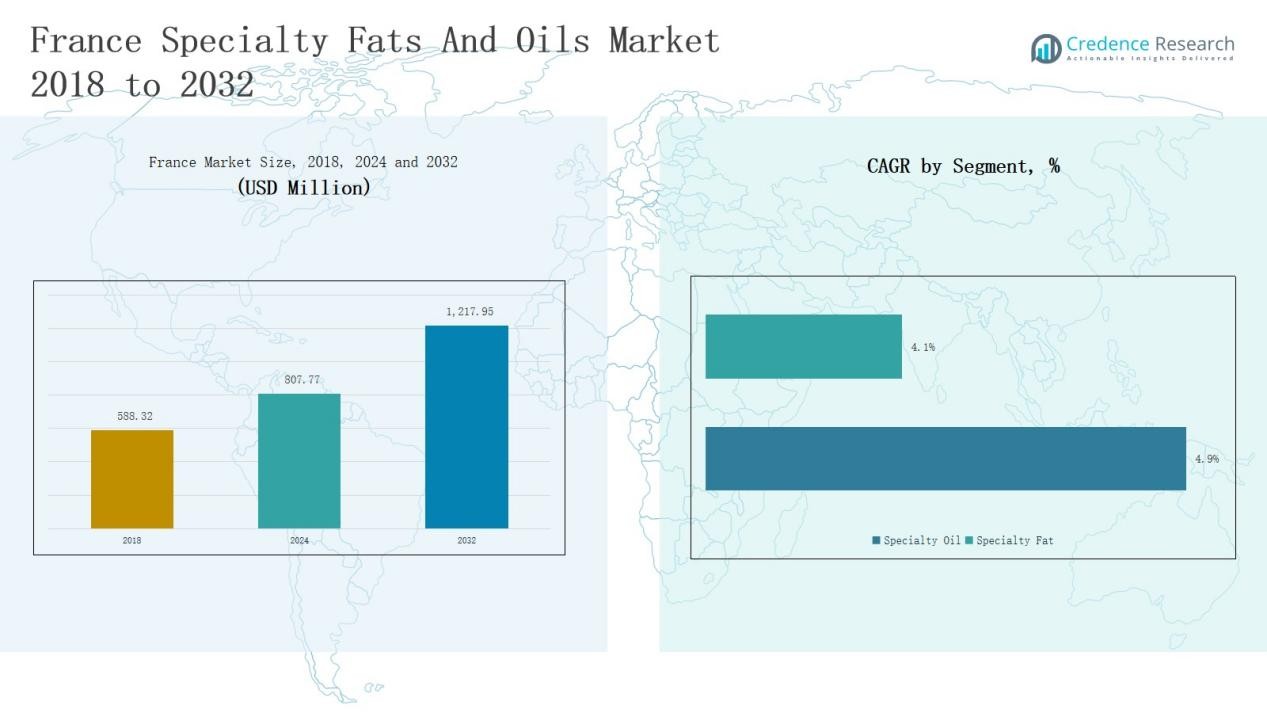

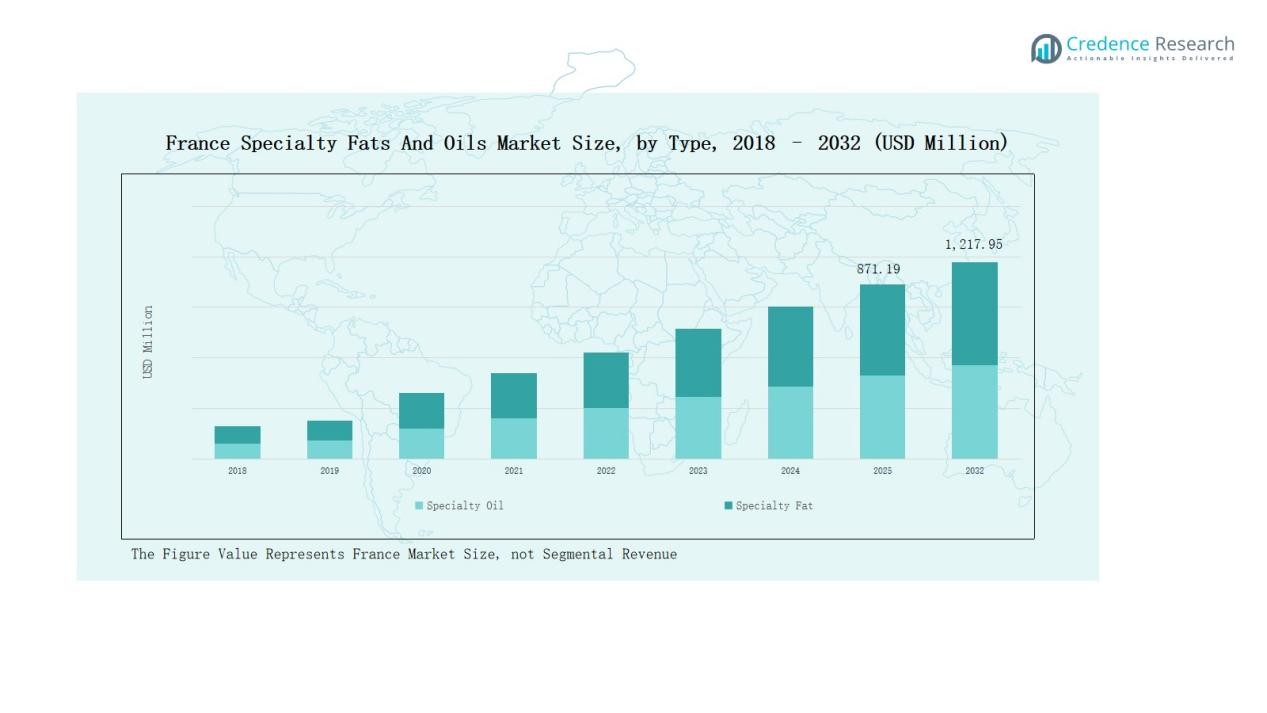

France Specialty Fats And Oils Market size was valued at USD 588.32 million in 2018 to USD 807.77 million in 2024 and is anticipated to reach USD 1,217.95 million by 2032, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Specialty Fats And Oils Market Size 2024 |

USD 807.77 Million |

| France Specialty Fats And Oils Market, CAGR |

4.90% |

| France Specialty Fats And Oils Market Size 2032 |

USD 1,217.95 Million |

France Specialty Fats And Oils Market size was valued at USD 588.32 million in 2018 to USD 807.77 million in 2024 and is anticipated to reach USD 1,217.95 million by 2032, at a CAGR of 4.90% during the forecast period.

The France Specialty Fats and Oils Market is shaped by global leaders and strong domestic producers, including Lesieur, Avril Group, Cargill France, Bunge SAS France, Wilmar Europe France, Oleon, DRT Group, Kerry Group France, Société des Produits Nestlé, and Estron Chemicals. These companies compete through diversified product portfolios, sustainable sourcing, and innovation in specialty oils and fats tailored for bakery, confectionery, and chocolate applications. Among regions, Île-de-France leads with a 34% share in 2024, driven by its concentration of premium chocolate manufacturers, large-scale bakeries, and advanced food processing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Specialty Fats and Oils Market grew from USD 588.32 million in 2018 to USD 807.77 million in 2024 and is expected to reach USD 1,217.95 million by 2032, expanding at 4.90%.

- Specialty oils led with 61.5% share in 2024, driven by palm oil demand across processed foods, confectionery, and bakery, while bakery fats dominated within specialty fats.

- By application, the industry segment accounted for 52.8% share in 2024, followed by restaurants at 26.7% and household consumption at 16.5%, reflecting diversified demand.

- By end user, chocolate dominated with 34.9% share in 2024, followed by confectioneries at 22.4% and bakery at 20.8%, supported by France’s strong confectionery and bakery culture.

- Île-de-France led regionally with 34% share in 2024, followed by Auvergne-Rhône-Alpes at 21%, Provence-Alpes-Côte d’Azur at 18%, Hauts-de-France at 15%, and other regions contributing 12%.

Market Segment Insights

By Type

In the France Specialty Fats and Oils Market, specialty oils dominate with a 61.5% share in 2024, led by palm oil, which accounts for the largest contribution due to its wide use in processed foods, confectionery, and bakery applications. Sunflower oil and rapeseed oil follow, supported by domestic cultivation and consumer preference for healthier oils. Within specialty fats, bakery fats hold the strongest share, driven by the country’s strong patisserie and baked goods culture. Growing demand for premium bakery and confectionery products continues to reinforce the leadership of oils and bakery fats in this segment.

- For instance, in 2023, Bunge introduced Beleaf PlantBetter in Europe, a plant-based alternative to dairy butter initially designed for premium bakery applications to match the sensory qualities and functionality of traditional butter.

By Application

The industry segment leads with a 52.8% share in 2024, supported by extensive use of specialty fats and oils in large-scale food processing, chocolate production, and confectionery manufacturing. Restaurants represent the second-largest application area, accounting for 26.7%, fueled by demand for frying oils, culinary fats, and premium cooking oils. Household consumption contributes 16.5%, reflecting rising adoption of olive oil and sunflower oil in daily cooking. Growth across applications is driven by France’s advanced food manufacturing ecosystem and evolving consumer trends toward clean-label and sustainable fat alternatives.

- For instance, Cargill launched its Infuse by Cargill platform in Europe to provide customized specialty fats solutions for bakery and confectionery manufacturers.

By End User

Among end users, the chocolate segment dominates with 34.9% share in 2024, as France remains a major hub for premium chocolate production and exports. Confectioneries follow closely, holding 22.4%, supported by demand for cocoa butter equivalents and specialty oils in candies and sweets. The bakery segment contributes 20.8%, benefiting from strong artisanal and industrial bread and pastry sectors. Infant food and culinary uses together account for nearly 15%, with functional fats showing steady growth due to rising health-focused formulations. Demand is primarily driven by France’s strong confectionery and bakery heritage, coupled with innovation in functional and healthier fat blends.

Key Growth Drivers

Rising Demand in Bakery and Confectionery Industry

The bakery and confectionery sector in France is a major driver for specialty fats and oils. Growing consumer preference for premium pastries, artisanal bread, and chocolates boosts demand for bakery fats, cocoa butter equivalents, and specialty oils. French patisserie culture and expanding exports of high-quality confectionery strengthen this trend. Industrial-scale chocolate and bakery producers increasingly adopt specialty fats for consistency, taste enhancement, and cost efficiency, securing this sector’s role as the largest growth driver in the market.

- For instance, in 2024, Cargill became the first global edible oils supplier to meet WHO standards for trans-fatty acid content below 2 grams per 100 grams, catering to industrial-scale bakery and confectionery producers focusing on healthier fat solutions.

Shift Toward Healthier Oil Alternatives

French consumers are becoming more health-conscious, which is increasing demand for oils such as sunflower, rapeseed, and olive. These oils are perceived as healthier substitutes to traditional palm oil due to their lower saturated fat content. Regulations around trans-fat reduction also encourage manufacturers to innovate with healthier formulations. Growing retail adoption of organic and non-GMO oils further accelerates the market. This shift supports expansion opportunities for producers targeting clean-label and functional oils with proven health benefits.

- For instance, Avril Group expanded its Lesieur brand with a new organic rapeseed and sunflower oil blend in France, marketed for its natural omega-3 benefits and non-GMO sourcing.

Expansion of Food Processing Industry

France’s strong food processing industry remains a crucial driver of specialty fats and oils demand. Industrial-scale production of confectionery, bakery items, infant foods, and processed meals requires consistent fat and oil inputs. Rising exports of packaged foods also amplify the need for specialized fat blends to meet international standards. Manufacturers are investing in plant-based and trans-fat-free formulations to address consumer preferences. This industry’s size, combined with innovation in processing, secures its role as a long-term driver of market growth.

Key Trends & Opportunities

Growth of Plant-Based and Sustainable Solutions

Sustainability has emerged as a defining trend, with companies shifting toward RSPO-certified palm oil and plant-based alternatives. Consumer demand for eco-friendly and ethical sourcing practices is growing, pushing firms to integrate sustainable supply chains. Plant-based oils and fats, including functional blends for vegan bakery and dairy-free confectionery, are gaining popularity. This trend creates opportunities for companies to align with evolving consumer values and strengthen their competitive positioning in both domestic and export markets.

- For instance, Hershey confirmed sourcing 100% RSPO Mass Balance and Segregated certified palm oil globally, supplementing with RSPO Credits where supply gaps occur, and actively engaging in supply chain traceability and no deforestation initiatives through partnerships like Earthworm Foundation.

Innovation in Functional and Specialty Applications

Opportunities are expanding in functional fats and oils tailored for infant nutrition, dietary supplements, and health-focused products. The development of omega-enriched oils, low-trans-fat bakery fats, and customized blends supports evolving nutritional needs. Food manufacturers are innovating with ingredients that offer both functionality and health benefits, such as enhanced digestibility or improved shelf life. Growing interest in functional food products allows companies to differentiate through innovation and capture new consumer segments.

- For instance, Croda launched a low-trans-fat bakery fat blend that improves shelf life and texture without compromising health benefits.

Key Challenges

Volatility in Raw Material Prices

The France specialty fats and oils market faces challenges due to fluctuating prices of palm oil, soya, and sunflower oil. Global supply chain disruptions, climate conditions, and geopolitical factors significantly affect raw material availability and pricing. These fluctuations increase production costs for manufacturers and impact profitability. Companies must rely on strategic sourcing and long-term supplier partnerships to manage risks. The volatility limits smaller producers’ competitiveness, creating pressure across the supply chain.

Regulatory Pressures on Trans Fats and Palm Oil

Strict EU regulations regarding trans-fat content and sustainability requirements for palm oil present significant challenges. France enforces tight food safety and labeling standards, forcing producers to invest heavily in reformulation and compliance. Meeting RSPO certification and ensuring traceable sourcing adds operational costs. Negative consumer perception of palm oil further limits its application, even where it remains cost-effective. These regulatory pressures restrict flexibility for manufacturers and increase the cost burden on industry players.

Rising Competition from Substitutes

The growing popularity of alternative ingredients, such as butter substitutes, nut-based oils, and other plant-derived fats, poses competitive pressure. Artisanal and organic product segments in France increasingly rely on locally sourced oils and fats, reducing reliance on conventional specialty fats. These substitutes are often marketed as healthier and more natural, appealing to premium consumers. This trend challenges traditional market players to differentiate their offerings and defend market share in a competitive and evolving landscape.

Regional Analysis

Île-de-France

Île-de-France holds the largest share of the France Specialty Fats and Oils Market, accounting for 34% in 2024. The region benefits from its concentration of food processing industries, premium chocolate manufacturers, and large-scale bakeries. It also supports strong demand from restaurants and households driven by diverse consumer preferences. International brands and domestic producers alike use the region as a hub for distribution. High purchasing power and urban lifestyles further boost consumption of premium and functional oils. It continues to set market trends with innovation in specialty fats for confectionery and bakery products.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes represents 21% of the market share in 2024, supported by its strong dairy, bakery, and confectionery industries. The region’s food manufacturers emphasize high-quality raw materials and innovative fat blends to cater to both domestic and export markets. Local consumer preferences for healthier oils, such as rapeseed and sunflower, support ongoing product adoption. Industrial food producers contribute to strong demand for bakery fats and frying oils. It has emerged as a growth center with rising investments in sustainable and plant-based alternatives. The presence of small and medium enterprises further strengthens competitive activity.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur accounts for 18% of the market share in 2024, supported by strong household and restaurant demand. The region’s Mediterranean dietary culture encourages significant use of olive oil and sunflower oil. Culinary applications dominate consumption, with restaurants and households preferring locally produced specialty oils. It also benefits from tourism-driven demand, particularly in premium culinary and bakery segments. Food manufacturers in the region are adopting specialty fats for confectionery and ice cream to support seasonal consumption. Strong alignment with Mediterranean health trends sustains long-term growth potential.

Hauts-de-France

Hauts-de-France captures 15% of the market share in 2024, driven by its established food processing base and bakery industries. The region serves as an important production and distribution hub for industrial users of specialty fats. Chocolate and confectionery manufacturers rely heavily on palm oil and cocoa butter equivalents sourced here. Household demand is lower compared to urban centers, but industrial applications maintain growth momentum. It has also seen rising adoption of sunflower oil and frying fats in restaurant use. Competitive presence of global and regional players ensures a steady market outlook.

Other Regions

Other French regions collectively contribute 12% of the market share in 2024. These include regions with smaller but growing demand for specialty fats and oils in bakery and culinary applications. Household adoption of olive oil and sunflower oil supports stable consumption patterns. Food producers in these areas are integrating functional oils for infant food and health-focused products. It demonstrates potential for gradual expansion, particularly with rising awareness of sustainable and plant-based options. Growing participation from local producers enhances competitiveness across these markets.

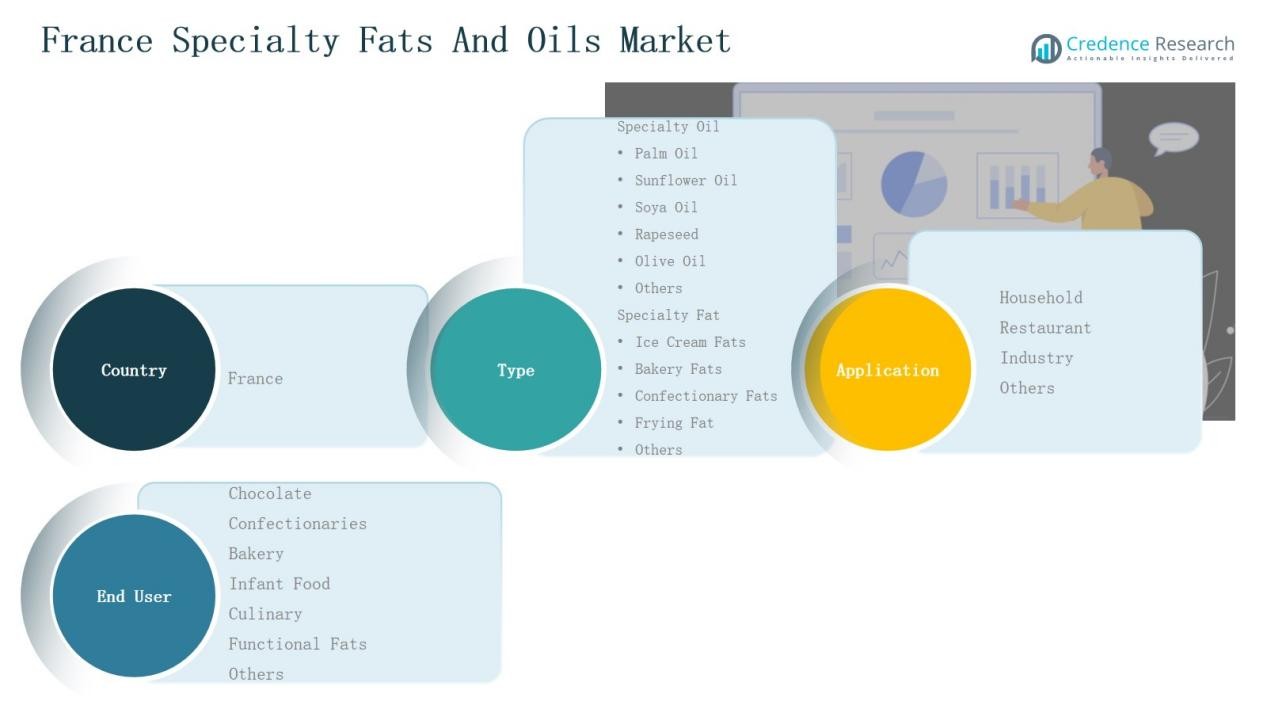

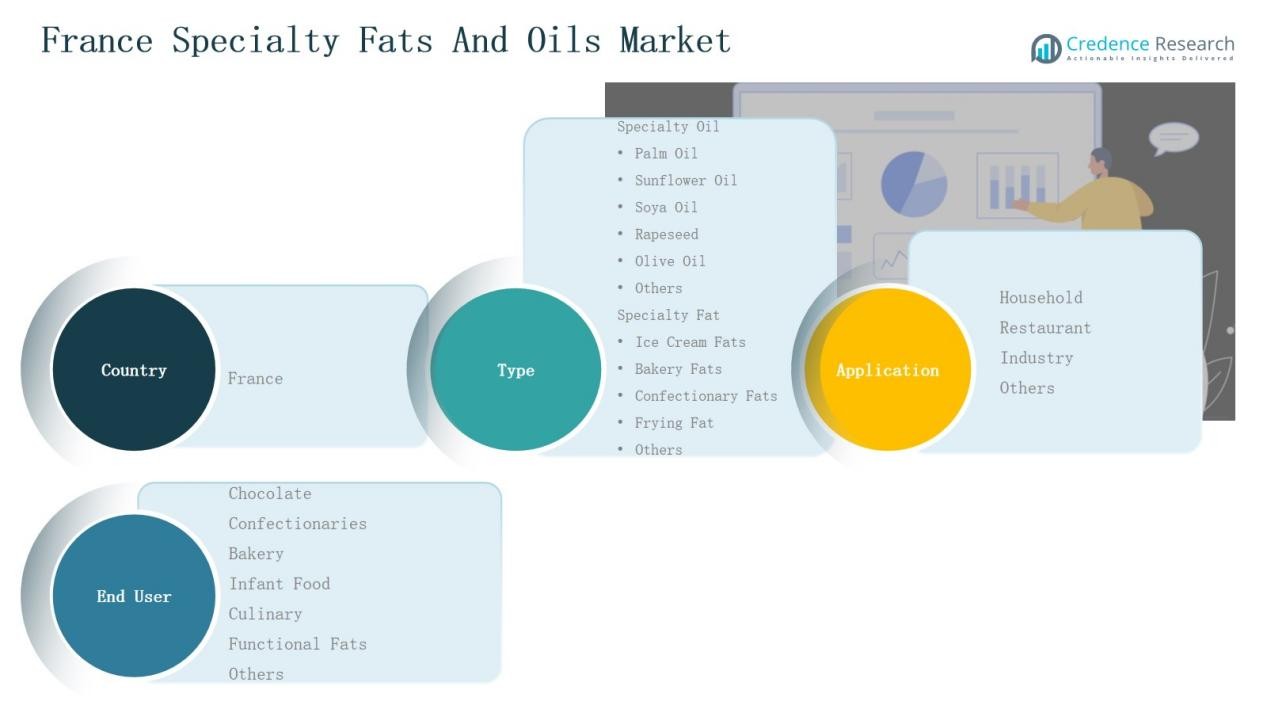

Market Segmentations:

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fats

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectionaries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Others

By Region

- Île-de-France

- Auvergne-Rhône-Alpes

- Provence-Alpes-Côte d’Azur

- Hauts-de-France

- Other Regions

Competitive Landscape

The France Specialty Fats and Oils Market features a competitive landscape shaped by global corporations and strong domestic producers. Key players include Lesieur, Avril Group, Cargill France, Bunge SAS France, Wilmar Europe France, Oleon, DRT Group, Kerry Group France, Société des Produits Nestlé, and Estron Chemicals. These companies compete through diversified product portfolios, advanced processing technologies, and strategic partnerships with food manufacturers. It is marked by rising investment in sustainable sourcing, particularly RSPO-certified palm oil, and innovation in plant-based and functional oils. French players focus on strengthening their presence in bakery, chocolate, and confectionery applications, while global leaders emphasize scale and efficiency in industrial supply chains. Continuous research in healthier oil alternatives, coupled with targeted acquisitions, allows firms to capture emerging consumer preferences. The competitive environment is defined by strong brand positioning, regulatory compliance, and ongoing adaptation to evolving health and sustainability trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Lesieur

- Avril Group

- Cargill France

- Bunge SAS France

- Wilmar Europe France

- Oleon

- DRT Group

- Kerry Group France

- Société des Produits Nestlé

- Estron Chemicals

Recent Developments

- In July 2024, Avril partnered with InVivo/Soufflet, securing regenerative farming-based rapeseed and sunflower supplies to enhance sustainability in oils and biofuel production.

- In July 2024, Blommer Chocolate launched a new product line called Elevate, a cocoa butter equivalent product developed to deliver superior texture and flavor in confectionery applications.

- In August 2025, Saipol launched Empreinte, a new line of rapeseed and sunflower oils produced from French-grown seeds under sustainable farming practices.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bakery fats will continue to rise with growth in artisanal and industrial baking.

- Chocolate and confectionery producers will expand usage of cocoa butter equivalents and specialty oils.

- Olive oil and rapeseed oil will gain wider adoption due to health-focused consumer preferences.

- Sustainable and RSPO-certified palm oil will remain a priority for manufacturers.

- Restaurants will drive demand for frying oils and culinary fats in premium segments.

- Functional fats and oils will see higher demand in infant food and dietary applications.

- Plant-based and vegan product innovation will support new specialty fat formulations.

- Local producers will strengthen competitiveness through customized blends and niche offerings.

- Regulatory compliance on trans-fat reduction will continue shaping product development.

- Export opportunities will expand as French specialty fats and oils reach international markets.