Market Overview:

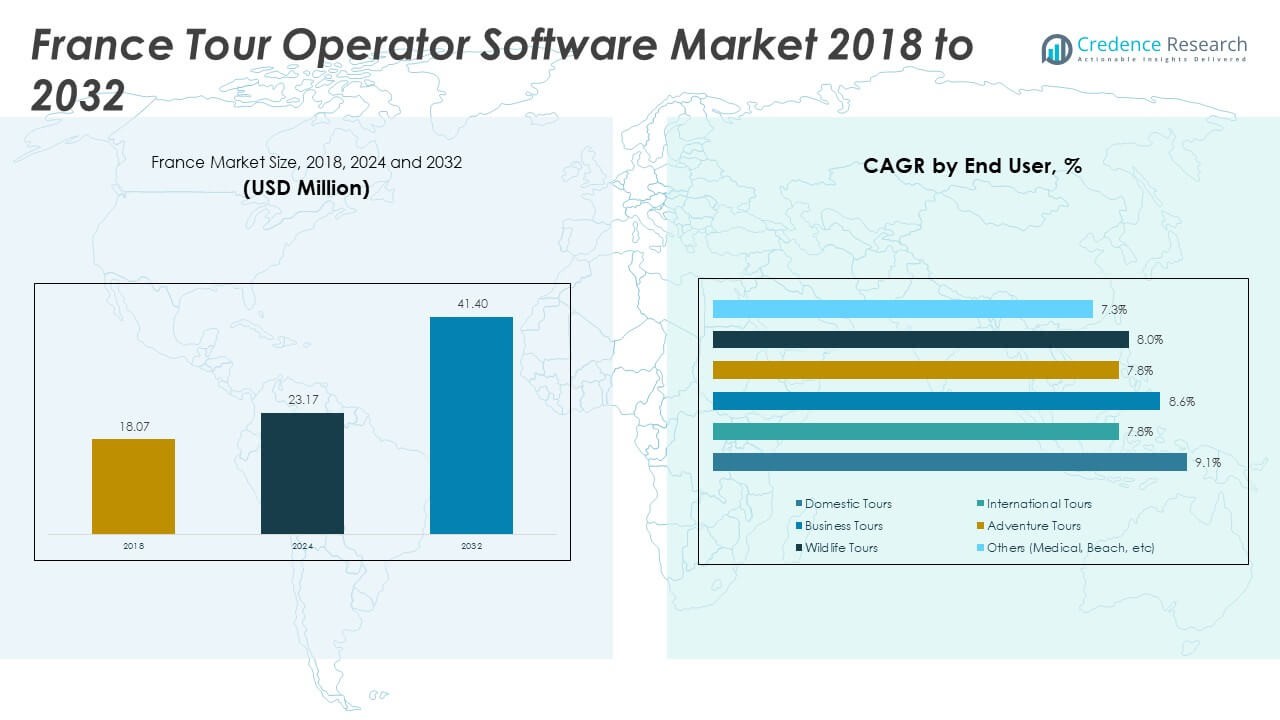

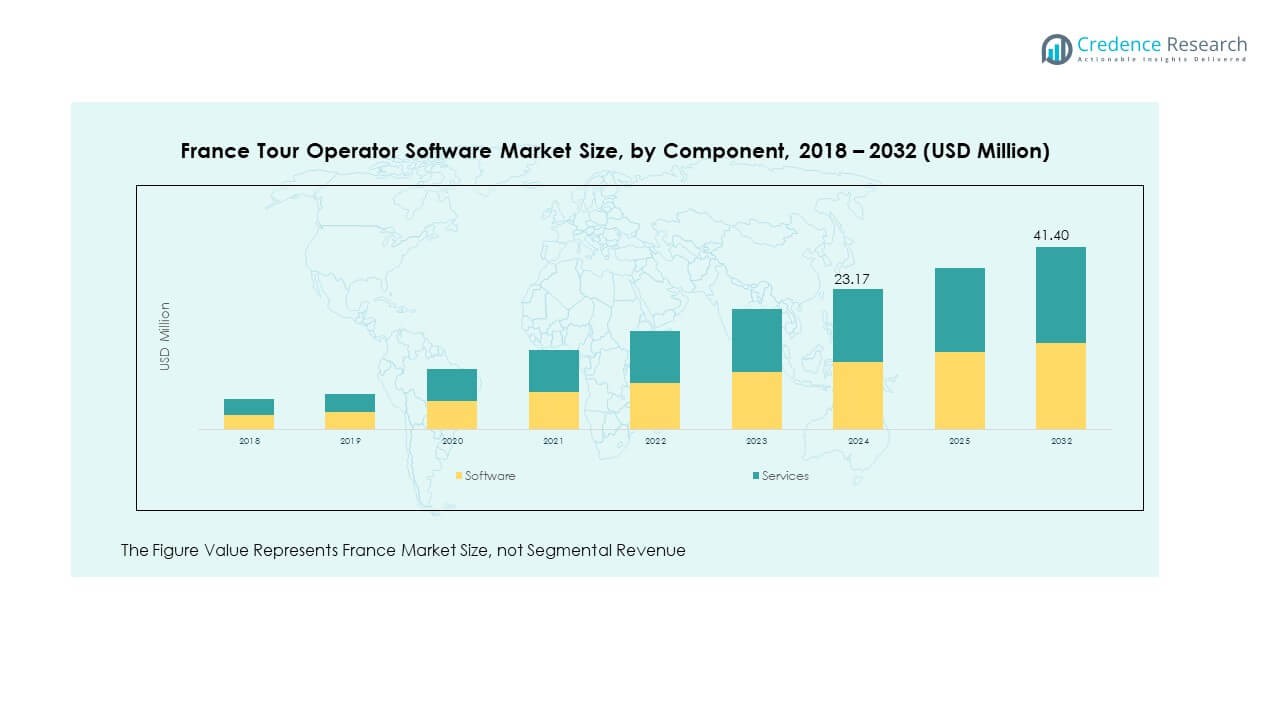

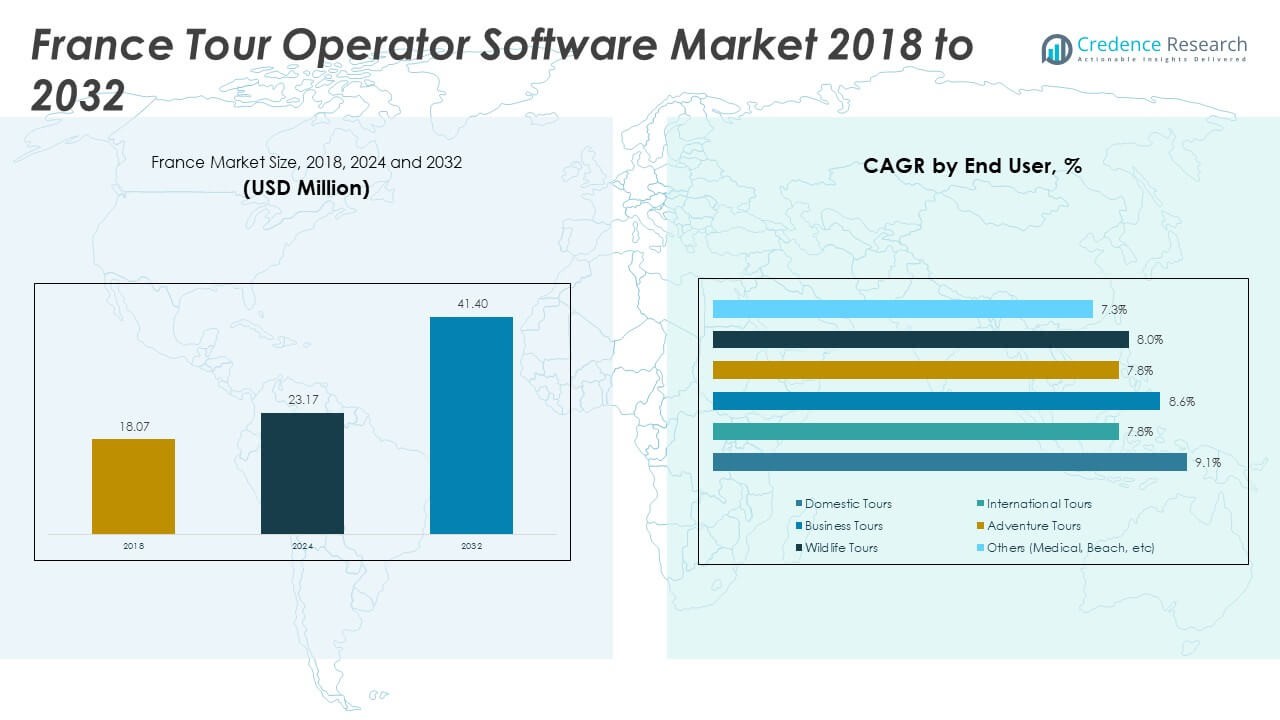

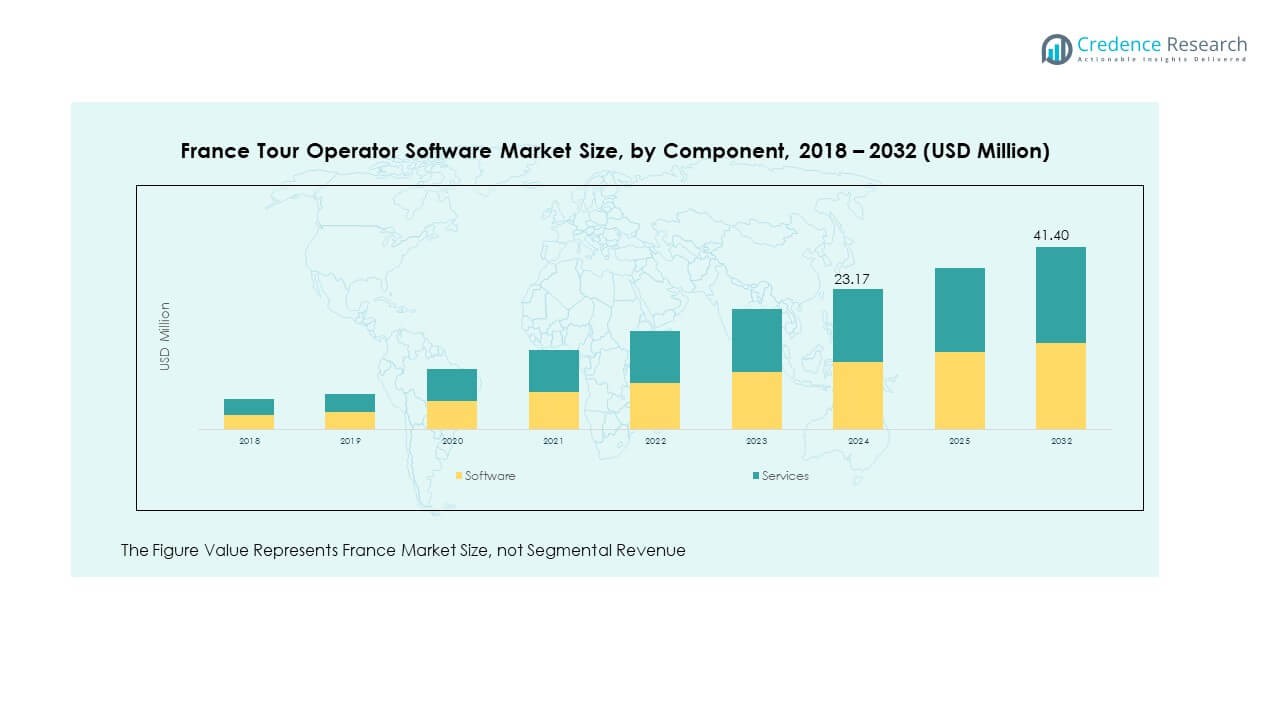

The France Tour Operator Software Market size was valued at USD 18.07 million in 2018 to USD 23.17 million in 2024 and is anticipated to reach USD 41.40 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Tour Operator Software Market Size 2024 |

USD 23.17 Million |

| France Tour Operator Software Market, CAGR |

7.52% |

| France Tour Operator Software Market Size 2032 |

USD 41.40 Million |

Growing digitization across travel services is driving market demand in France. Tour operators are adopting automated platforms to manage bookings, pricing, and customer engagement efficiently. Rising inbound and outbound tourism creates strong momentum for software providers. Integration of AI and cloud-based solutions is enabling personalized travel experiences. Operators increasingly focus on mobile accessibility to engage with travelers directly. Rising competition from online booking platforms is pushing adoption of advanced tools. Strong support from tourism bodies enhances innovation in the sector. These drivers collectively sustain steady software market growth.

Regional dynamics highlight Europe as the leading market due to its strong tourism base. France benefits from high international arrivals, supported by Paris and other cultural destinations. North America follows, driven by mature adoption of travel software and advanced digital ecosystems. Asia-Pacific is emerging quickly, fueled by expanding middle-class tourism and digital penetration in China and India. Latin America and the Middle East are evolving markets where software adoption is tied to growing travel infrastructure. Africa is still nascent but holds untapped opportunities. This geographic spread shows a mix of established dominance and emerging growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Tour Operator Software Market was valued at USD 18.07 million in 2018, reached USD 23.17 million in 2024, and is projected to attain USD 41.40 million by 2032, growing at a CAGR of 7.52%.

- Northern France led with 45% share in 2024, followed by Central France at 30% and Southern France at 25%, supported by Paris-driven inbound tourism, cultural heritage, and luxury destinations.

- Southern France is the fastest-growing region with 25% share, fueled by luxury, cultural, and seasonal tourism combined with strong mobile-first adoption among SMEs.

- By component, software dominated with nearly 60% share in 2024, reflecting demand for integrated booking and CRM solutions.

- Services accounted for around 40% share, driven by training, maintenance, and support requirements that enhance software efficiency and adoption.

Market Drivers:

Rising Demand for Digital Transformation in Tour Operations:

The France Tour Operator Software Market is witnessing strong demand for digital transformation across travel agencies and tour operators. Companies are replacing legacy systems with automated solutions that improve efficiency in booking, reservations, and itinerary planning. Customers increasingly expect seamless digital interactions, which drives operators to integrate mobile-friendly platforms. It is also pushing firms to adopt centralized dashboards for managing clients and suppliers. Cloud-based tools allow scalability and cost savings, making them attractive for small and medium tour operators. The adoption of automation helps reduce errors and enhance customer satisfaction. Operators also seek to streamline operations by integrating accounting, CRM, and back-office features into a single platform. These factors collectively make digital transformation a primary growth driver in this market.

- For example, Amadeus IT Group’s cloud booking systems have reduced booking processing times by 30% for many French agencies. Customers increasingly expect seamless digital interactions, which drives operators to integrate mobile-friendly platforms

Growing Tourism Industry and Rising Customer Expectations:

Tourism plays a vital role in shaping demand for advanced tour operator software in France. The country continues to attract millions of international visitors each year, strengthening the need for efficient digital systems. Operators must manage diverse travel packages, accommodations, and transport arrangements at scale. Customers expect personalized experiences, which increases reliance on data-driven insights offered by these platforms. The market also benefits from the growing preference for online bookings over traditional channels. It is encouraging tour operators to adopt integrated systems that link with GDS and OTAs. Real-time availability updates are now essential for both travelers and agencies. The growth of adventure, cultural, and business tourism further expands demand for versatile software solutions.

- For instance, Operators must manage diverse travel packages, accommodations, and transport arrangements at scale, often handling upwards of 10,000 bookings per month during peak seasons.

Integration of AI, Data Analytics, and Automation:

The rise of artificial intelligence and analytics is a significant driver of this market. Tour operator software is evolving into a smart ecosystem that provides predictive recommendations. AI-based chatbots support customer service by offering instant responses, enhancing user experience. Analytics-driven insights help operators identify consumer trends and adjust offerings accordingly. It is also enabling dynamic pricing models that boost profitability for agencies. Automation of repetitive tasks, such as confirmations and cancellations, saves time and reduces operational costs. Cloud-driven AI capabilities allow real-time language translation for global travelers. These innovations support the competitive positioning of tour operators in France. As adoption accelerates, AI integration will remain a strong growth driver.

Expansion of Mobile and Cloud-Based Solutions:

Mobile penetration and cloud adoption are transforming how travel services operate. Tour operator software now prioritizes mobile compatibility to connect with travelers on-the-go. Operators use mobile apps to offer instant itinerary changes, payment gateways, and travel alerts. Cloud solutions ensure accessibility, data security, and collaboration across teams. It is helping operators serve customers across different regions with real-time updates. SaaS-based models are also reducing upfront infrastructure costs, attracting startups and SMEs. Mobile-first strategies are improving engagement, particularly among younger demographics. These platforms also enhance loyalty programs by providing personalized deals directly to smartphones. This mobile and cloud expansion remains a fundamental driver for market growth.

Market Trends:

Adoption of Cloud-Native and SaaS Platforms:

The France Tour Operator Software Market is increasingly shifting toward cloud-native and SaaS-based platforms. Operators prefer these solutions due to lower upfront investment and easy scalability. SaaS systems allow smaller agencies to access advanced features without heavy infrastructure. It is also helping businesses manage peak travel seasons with flexible subscriptions. Integration with global distribution systems is more efficient through cloud-based architecture. Companies benefit from centralized updates and improved data security in SaaS models. The pay-as-you-go approach attracts startups and SMEs. This adoption trend ensures long-term cost savings and greater adaptability in the market.

- For instance, SaaS systems allow smaller travel agencies to access advanced features without heavy infrastructure. This enables businesses to handle peak travel seasons with subscription flexibility, scaling their access to features and users up or down as needed.

Growing Focus on Personalization and Customer Experience:

Personalization has become a defining trend in the tour operator industry. Software providers now integrate AI-driven engines to tailor itineraries and offers. The market is shaped by travelers demanding unique experiences, from cultural tours to adventure packages. It is driving operators to leverage customer data for targeted marketing campaigns. Platforms with CRM integration provide deeper insights into behavior and preferences. Loyalty programs are also enhanced with real-time offers linked to mobile apps. Tour operators rely on analytics to fine-tune pricing and product bundles. This focus on personalization is elevating customer satisfaction and strengthening retention rates.

- For instance, Platforms with CRM integration provide deeper insights into customer behavior and preferences, enabling a 20% improvement in customer retention rates. Loyalty programs are enhanced with real-time mobile app offers, with operators reporting a 30% increase in engagement when using AI-driven loyalty tools.

Integration of Payment Gateways and Digital Wallets:

Digital payment adoption is rapidly increasing in the travel sector. Tour operator software now supports multiple payment gateways and digital wallets. It is enabling secure, instant, and global transactions for both domestic and international travelers. Multi-currency support has become standard in software platforms targeting diverse customer bases. The growth of contactless and mobile payments in France aligns with this shift. Operators offering seamless checkout options gain a competitive edge. Advanced fraud detection features are integrated to protect sensitive data. This trend enhances trust and convenience, making payments a strong innovation driver.

Expansion of API Connectivity and Ecosystem Integration:

API-driven connectivity is transforming tour operator software into interconnected ecosystems. Platforms integrate with airlines, hotels, car rentals, and cruise services through real-time APIs. It is creating seamless booking experiences for customers across multiple travel categories. Operators benefit from broader supplier access and competitive pricing. API integration also supports dynamic packaging, where travelers customize itineraries in real-time. The trend allows agencies to expand their offerings without managing direct supplier contracts. It also improves accuracy by reducing manual updates. As demand for end-to-end solutions rises, API connectivity continues to strengthen market competitiveness.

Market Challenges:

Complexity in Integration and Legacy Systems:

The France Tour Operator Software Market faces integration challenges due to existing legacy systems. Many operators still use outdated platforms that lack compatibility with modern SaaS solutions. Transitioning data and processes into new systems often proves costly and time-consuming. It creates resistance among small and mid-sized operators with limited budgets. Training staff on advanced tools adds another barrier to adoption. Frequent software updates also demand technical expertise that some agencies lack. Integration with multiple suppliers through APIs requires strong IT support. These complexities slow down the pace of full-scale adoption despite market growth potential.

Rising Competition and Regulatory Barriers:

Competition in the French travel industry adds pressure on tour operators. Online travel agencies and direct booking platforms capture a growing share of customers. It forces traditional operators to invest heavily in advanced software to remain relevant. Compliance with European data protection regulations also creates added challenges. GDPR requirements push vendors to enhance security and ensure privacy standards. Cybersecurity threats raise concerns around storing sensitive traveller data. Price competition from global vendors further strains profitability for local providers. These regulatory and competitive barriers form a significant challenge for the market’s expansion.

Market Opportunities:

Growth of Inbound and Experiential Tourism:

The France Tour Operator Software Market presents strong opportunities through rising inbound tourism. France continues to attract global travelers drawn to cultural, culinary, and luxury experiences. Operators are using software to design personalized and themed travel packages. It is enabling new revenue streams through adventure, wellness, and heritage tours. Niche tourism creates demand for flexible platforms that manage diverse itineraries. Agencies offering real-time customization will benefit the most. This rising preference for experiential travel strengthens the role of tour operator software. The market is positioned to capitalize on evolving consumer expectations.

Expansion into Mobile-First and AI-Driven Solutions:

Mobile-first adoption provides another major opportunity for software providers. France’s high smartphone penetration supports strong app-based engagement. It is fueling innovation in mobile booking, itinerary updates, and location-based offers. AI integration also unlocks predictive tools for dynamic pricing and customer support. Start-ups entering with mobile-first solutions can quickly scale in this market. Established vendors expanding mobile capabilities gain customer loyalty. Operators using AI-driven personalization are likely to stand out. Together, mobile-first and AI innovations offer a powerful growth trajectory for this market.

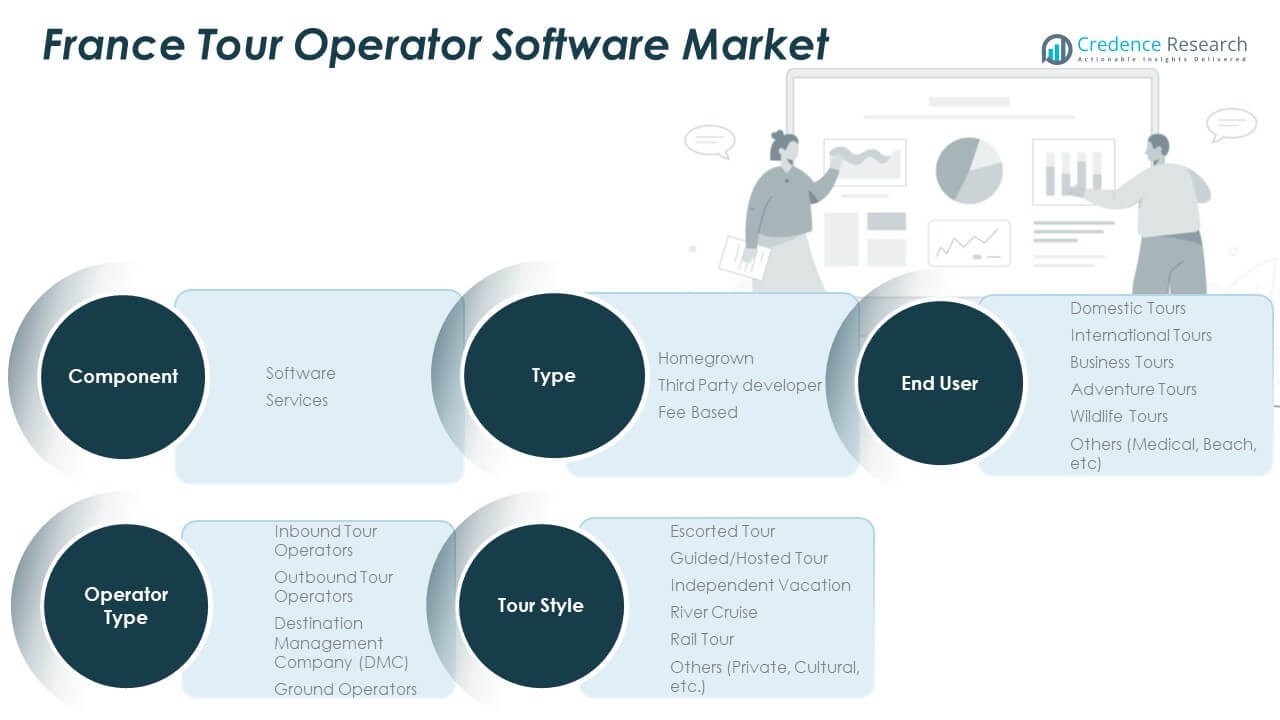

Market Segmentation Analysis:

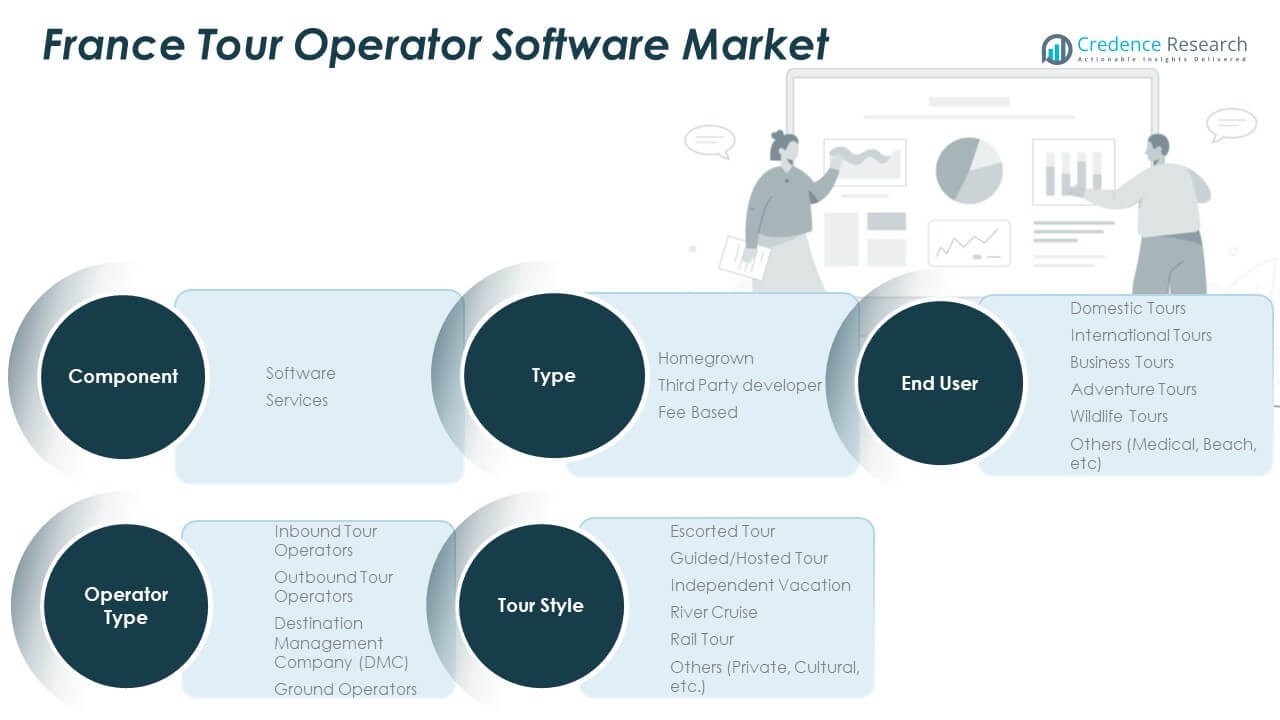

By Type

The France Tour Operator Software Market shows strong demand across type segments. Third-party developer solutions lead the market due to their scalability and seamless integration with global booking platforms. Homegrown systems remain relevant for local operators needing customized features. Fee-based platforms attract specialized businesses seeking advanced tools for niche operations. It is ensuring widespread adoption across operators of different sizes.

- For instance, Homegrown systems remain relevant for local operators needing customized features, with several regional providers serving over 1,000 operators each.

By Component

Software dominates the component segment, reflecting operators’ preference for advanced booking engines, CRM modules, and automation tools. Services, including maintenance, training, and support, complement software adoption. It is helping operators maximize efficiency while ensuring smooth platform performance. The combination strengthens operational reliability.

- For instance, services, including maintenance, training, and support, complement software adoption. By expanding the capacity of these services, a company can ensure operators maintain smooth platform performance during peak seasons.

By Operator Type

Inbound and outbound tour operators are the primary adopters, supported by France’s strong tourism inflows and outbound travel demand. Destination Management Companies (DMCs) leverage these platforms for handling large groups and complex itineraries. Ground operators use software to streamline transportation scheduling. It is creating a balanced adoption pattern across operator types.

By Tour Style

Escorted and guided tours represent leading categories, with demand for structured group travel. Independent vacations are growing due to flexibility and younger traveler preferences. River and rail tours attract niche customers seeking unique experiences. Other categories such as private and cultural tours also add significant value. It is broadening the diversity of tour styles managed through software.

By End User

International tours dominate the end-user segment, supported by high inbound travel. Business tours maintain consistent demand, while adventure and wildlife tours are rising in popularity. Domestic tourism continues to grow, benefiting local operators. Other categories expand opportunities for specialized offerings. It is ensuring the market addresses both mainstream and niche travelers effectively.

Segmentation:

By Type

- Homegrown

- Third-Party Developer

- Fee-Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Companies (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Northern France

Northern France leads the France Tour Operator Software Market with nearly 45% share in 2024. Paris acts as the central hub, attracting strong inbound tourism for leisure, cultural, and business travel. Operators in this region adopt advanced booking and reservation systems to handle large transaction volumes. It is supported by strong digital infrastructure, international connectivity, and partnerships with global vendors. Demand for multi-language and multi-currency features is high due to diverse traveller profiles. Northern France continues to set the pace for adoption, driven by its mix of business and leisure tourism.

Central France

Central France contributes around 30% share to the France Tour Operator Software Market, supported by a mix of domestic and international travelers. Historic cities, cultural festivals, and conference tourism create steady demand for modern platforms. Operators adopt CRM-integrated software to manage customer engagement effectively. It is shaped by government programs that encourage SMEs to digitize their operations. Independent vacations and guided tours are popular segments in this region. Central France remains a balanced and growing market for software providers.

Southern France

Southern France holds nearly 25% share of the France Tour Operator Software Market, led by destinations like the French Riviera, Provence, and Bordeaux. Tourism here is shaped by luxury, cultural, and adventure packages. Operators adopt mobile-first and SaaS-based platforms to manage seasonal peaks and dynamic pricing. It is supported by demand for flexible platforms that allow real-time itinerary updates. SMEs dominate the region, creating opportunities for affordable and scalable solutions. Seasonal festivals and international arrivals continue to drive recurring demand for advanced tour operator software.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tourpaq

- Travel Technology Interactive (TTI)

- Lemax

- ResLynx

- Softvoyage

- iTours

- group

- Trawex

Competitive Analysis:

The France Tour Operator Software Market is moderately competitive with a mix of global and regional players. Companies compete on technology innovation, integration capabilities, and service quality. It is characterized by vendors offering SaaS-based, mobile-first, and AI-driven solutions to meet rising digital demand. Global firms such as Lemax and Softvoyage expand their footprint with scalable platforms, while regional providers like Tourpaq and TTI strengthen niche customization. The market benefits from continuous investments in cloud, API integration, and customer experience enhancements. Competitive intensity remains high, pushing vendors to focus on partnerships and client-centric solutions.

Recent Developments:

- In 2024, Travel Technology Interactive (TTI) merged with CitizenPlane. Following this acquisition, TTI’s flagship Passenger Service System, Zenith, became a key component of the CitizenPlane Operating System. This new modular platform supports offer creation, revenue optimization, distribution, and delivery for mid-tier and fast-growing airlines globally. The merger has marked a new chapter for TTI in airline IT and SaaS solutions.

- Trawex continues to play a significant role in the travel technology industry by providing a powerful unified travel technology platform customized for travel agencies, tour operators, and OTAs. Their platform integrates multiple aspects of travel, including flights, hotels, transfers, and activities via real-time APIs, multi-currency processing, and advanced reporting capabilities, facilitating digital transformation in travel operations as of early 2025.

- Lemax, known for collectible village miniatures, marked its 25th anniversary recently and continues to expand its European presence with a dedicated office near Amsterdam to better serve European customers. The company remains committed to delivering high-quality collectible village pieces and leveraging new LED and mechanical technology to enhance collector experiences.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for SaaS-based tour operator platforms will rise with scalable adoption.

- Personalization will become central, powered by AI-driven customer insights.

- Mobile-first solutions will dominate engagement across traveler touchpoints.

- Integration with payment gateways will strengthen secure multi-currency transactions.

- API connectivity will expand supplier ecosystems and dynamic packaging.

- Business tours will sustain steady demand alongside international tourism growth.

- Independent vacation packages will expand with younger traveler preferences.

- Partnerships and acquisitions will drive consolidation and feature enhancement.

- Cybersecurity and GDPR compliance will remain critical for customer trust.

- Regional adoption will expand, with Asia-Pacific emerging as the fastest growth hub.