Market Overview:

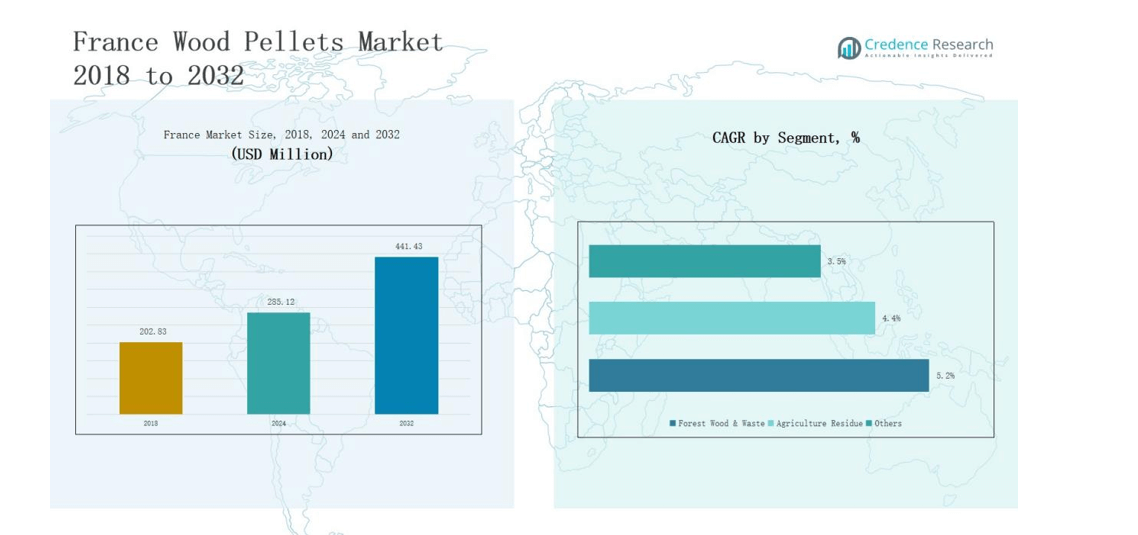

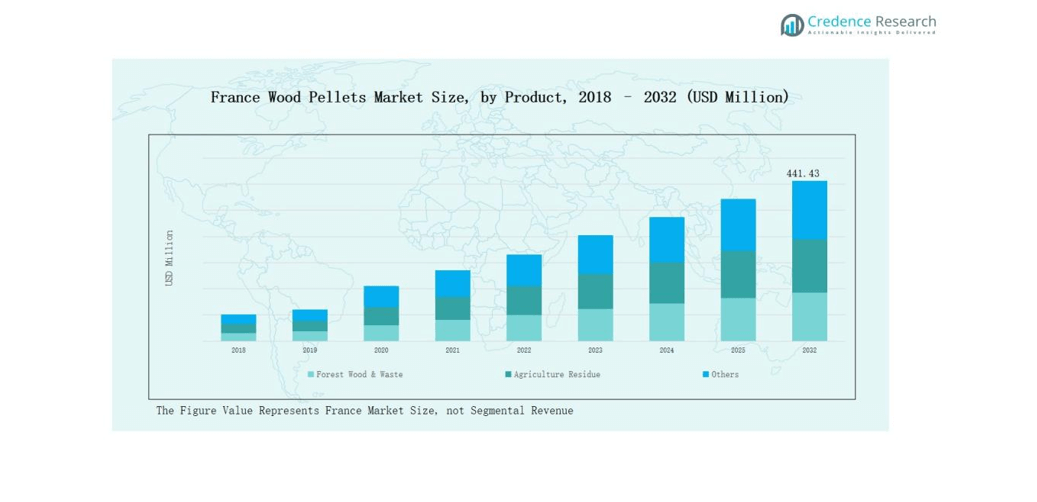

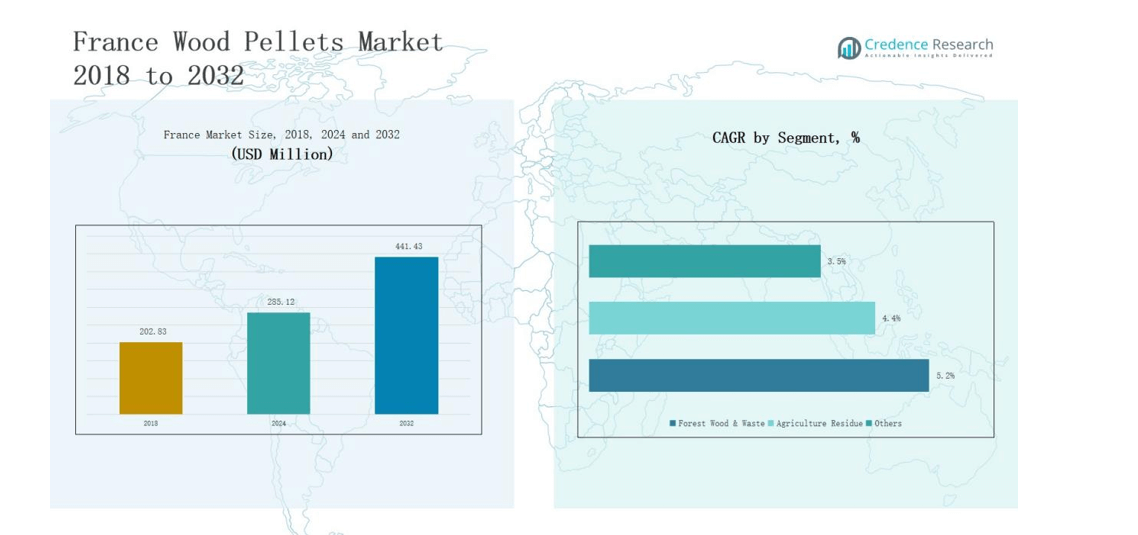

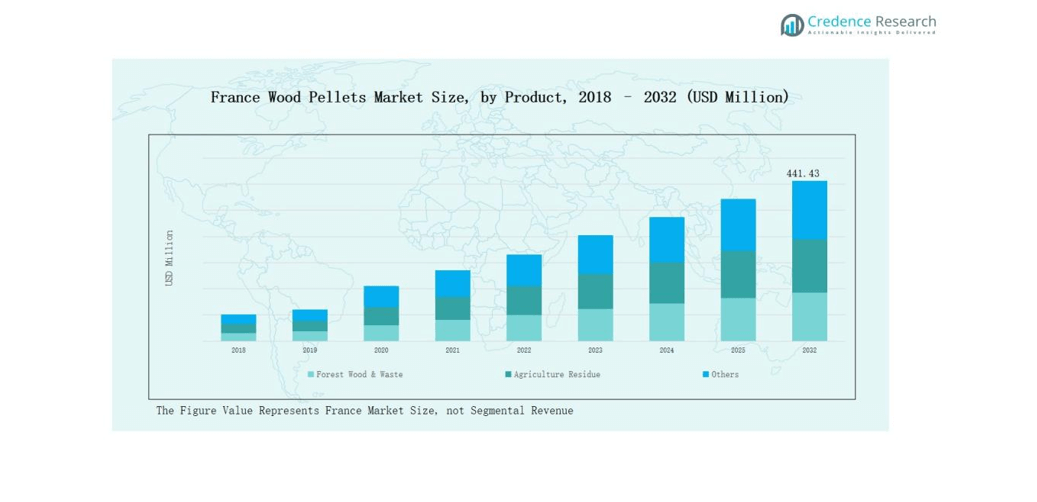

France Wood Pellets Market size was valued at USD 202.83 million in 2018 to USD 285.12 million in 2024 and is anticipated to reach USD 441.43 million by 2032, at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Wood Pellets Market Size 2024 |

USD 285.12 million |

| France Wood Pellets Market, CAGR |

5.23% |

| France Wood Pellets Market Size 2032 |

USD 441.43 million |

The France Wood Pellets Market is shaped by leading companies such as Dalkia, Bioéléments, Groupe SNI, Atlan Pellets, Les Grands Bois, Champ bois énergie, Sofanor, and Cendres+Métaux, which collectively drive competition through strong production capacities, long-term supply agreements, and sustainable sourcing practices. Larger firms focus on industrial demand for combined heat and power, while regional producers cater to residential and commercial heating segments. Among regions, Northern France leads with a 28% market share in 2024, supported by a high concentration of biomass power plants, advanced district heating infrastructure, and robust cross-border pellet trade, making it the core hub of the country’s pellet industry.

Market Insights

- The France Wood Pellets Market grew from USD 202.83 million in 2018 to USD 285.12 million in 2024 and will reach USD 441.43 million by 2032.

- Forest wood and waste dominate with 68% share in 2024, followed by agriculture residue at 22% and other blends and recovered wood at 10%.

- Industrial pellets for CHP and district heating lead with 54% share, while co-firing contributes 21%, residential and commercial heating 19%, and others 6%.

- Northern France leads with 28% share, supported by biomass power plants and district heating networks, followed by Western France at 25% and Southern France at 22%.

- Key players include Dalkia, Bioéléments, Groupe SNI, Atlan Pellets, Les Grands Bois, Champ bois énergie, Sofanor, and Cendres+Métaux, competing through production capacity and sustainable sourcing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Forest wood & waste dominates the France wood pellets market, accounting for nearly 68% share in 2024. Its leadership stems from consistent supply availability, sustainability certifications, and suitability for industrial-scale energy generation. Agriculture residue contributes around 22%, supported by government incentives promoting biomass utilization in rural areas. The others category, with a 10% share, includes blends and recovered wood used in small-scale commercial and niche heating applications. The strong presence of forest-based feedstock ensures reliable growth, reinforcing France’s renewable energy transition.

- For instance, in 2023, the French Agency for Ecological Transition (ADEME) backed projects using cereal straw for pellet production to diversify rural income sources.

By Application

Industrial pellets for CHP/district heating lead the France market with a 54% share in 2024. The dominance is driven by rising investments in district heating networks, urban energy efficiency goals, and supportive renewable energy policies. Industrial pellets for co-firing hold about 21%, fueled by the country’s shift toward low-carbon power generation in coal and mixed-fuel plants. Residential and commercial heating pellets represent nearly 19%, gaining traction due to eco-friendly heating adoption and consumer preference for cost-efficient energy. The others segment contributes 6%, covering export-oriented and specialty uses. This strong industrial demand underlines France’s reliance on biomass for large-scale clean energy supply.

- For instance, EDF’s Cordemais power station conducted large-scale trials in 2022 under the “Ecocombust” project, demonstrating the viability of biomass pellets as a substitute for coal.

Market Overview

Expansion of District Heating Networks

The expansion of district heating systems is a major driver of the France wood pellets market. Rising investments in urban heating infrastructure are boosting the demand for biomass-based energy. Pellets derived from forest wood and waste provide cost efficiency and compliance with EU renewable energy directives. Municipalities increasingly rely on wood pellets to reduce emissions and achieve sustainability goals. This trend strengthens long-term demand while ensuring stable consumption across industrial and urban heating networks in France.

- For instance, Dalkia, a subsidiary of EDF, has commissioned multiple district heating projects in France powered by wood biomass, including a facility in Rouen that saves over 35,000 tons of CO₂ annually.

Government Incentives and Renewable Energy Policies

Government support plays a pivotal role in advancing the French pellet industry. Incentives, subsidies, and tax benefits encourage pellet adoption for both industrial and residential heating. France’s renewable energy policies emphasize biomass as a reliable alternative to fossil fuels. Stringent emission reduction targets further accelerate the use of pellets in power generation and heating. Regulatory alignment with EU climate goals secures consistent market growth, fostering confidence among producers, utilities, and end-users.

Abundant Forest Resources and Sustainable Supply

France benefits from vast forest resources that ensure a reliable and sustainable pellet supply. The availability of certified raw materials allows large-scale production and meets sustainability standards. This consistent feedstock base strengthens the competitiveness of domestic producers while reducing reliance on imports. With forest wood and waste holding the largest market share, supply chain stability becomes a crucial growth enabler. Sustainable forestry practices and certifications also boost acceptance among environmentally conscious consumers and industries.

- For instance, Piveteaubois is France’s leading wood pellet producer, with over 200,000 tons annually from two sites. It was the first sawmill in France to earn the DIN PLUS certification, producing high-energy, low-ash pellets from 100% softwood sawdust without additives.

Key Trends & Opportunities

Rising Demand for Residential and Commercial Heating

The shift toward cleaner energy solutions is creating strong demand for residential and commercial pellet heating in France. Consumers prefer wood pellets for their cost-effectiveness, low emissions, and easy storage. Increasing adoption of pellet stoves and boilers in urban and rural households provides a major growth opportunity. Small-scale commercial facilities, such as hotels and offices, are also turning to pellets to lower carbon footprints. This trend positions pellets as a preferred eco-friendly heating option across varied end-user segments.

- For instacne, German company Hargassner serves over 140,000 customers worldwide with pellet boilers ranging from 6 to 550 kW, achieving some of the lowest emissions and highest efficiencies in biomass heating systems.

Export Growth and International Trade Opportunities

France’s wood pellet industry is expanding beyond domestic consumption, with exports becoming a growing opportunity. Neighboring countries facing supply constraints are increasingly sourcing pellets from French producers. Strong forest resources and production capacities enable France to compete in European trade markets. Export expansion supports revenue diversification while reducing risks linked to domestic demand fluctuations. As energy security becomes a priority in Europe, France is well-positioned to strengthen its role as a regional pellet supplier.

- For instance, Piveteau Bois, one of France’s leading pellet manufacturers, boosted its production capacity to over 200,000 tonnes annually, allowing it to serve both French heating networks and customers in neighboring Spain.

Key Challenges

High Production and Logistics Costs

Despite strong demand, the France wood pellets market faces challenges linked to production and logistics expenses. Pellet manufacturing requires advanced processing equipment, storage facilities, and efficient transportation systems. Rising fuel and energy costs further strain profitability for producers. Distribution to rural and urban heating networks adds logistical complexity. These high operational costs create pricing pressure, making pellets less competitive against other renewable alternatives and fossil fuels in certain market segments.

Competition from Alternative Renewable Sources

The growing presence of alternative renewable energy sources presents a major challenge. Solar, wind, and geothermal energy projects in France receive significant policy backing and consumer attention. These sources often provide lower long-term costs and broader scalability compared to biomass. As the energy mix diversifies, wood pellets must maintain competitiveness through innovation, efficiency, and sustainability credentials. Without continuous improvement, market share could gradually shift toward faster-growing renewable alternatives.

Regulatory Pressure and Sustainability Standards

The industry faces increasing regulatory requirements linked to emissions, certifications, and sustainability practices. Strict compliance with EU directives demands significant investment in technology and monitoring. Small-scale producers often struggle to meet certification and quality standards, limiting their competitiveness. Additionally, concerns about deforestation and ecological balance put pressure on the sector to demonstrate sustainable sourcing. These regulatory and environmental obligations add complexity, potentially slowing down growth for smaller players in the France wood pellets market.

Regional Analysis

Northern France

Northern France holds a 28% share of the France Wood Pellets Market, driven by its concentration of biomass power plants and strong district heating infrastructure. The region benefits from well-developed transport networks that support efficient pellet distribution. Large urban centers have adopted combined heat and power systems that rely heavily on pellet fuel. It demonstrates steady growth due to favorable government policies supporting renewable energy adoption. The presence of industrial users ensures consistent demand throughout the year. It also serves as a hub for cross-border pellet trade with neighboring countries.

Western France

Western France accounts for 25% share, supported by its abundant forest resources and pellet manufacturing facilities. The region has strong production capacity, making it a critical supplier to both domestic and export markets. Residential heating demand contributes significantly, with rural households increasingly using pellet stoves and boilers. It benefits from sustainability certifications that improve consumer confidence in locally produced pellets. Industrial users in this region rely on forest wood and waste for reliable fuel supply. Western France continues to strengthen its position as a leader in production and consumption.

Southern France

Southern France represents 22% share, driven by rising adoption of residential and commercial heating applications. Warmer climates limit overall heating demand, but growth in eco-friendly energy solutions is improving pellet use. Local production facilities cater to regional demand, while imports complement seasonal requirements. It benefits from government incentives that encourage cleaner energy usage in both urban and rural areas. Agricultural residue also plays a stronger role here compared to other regions. Southern France reflects balanced growth across both industrial and consumer markets.

Eastern France

Eastern France holds a 15% share, influenced by its industrial base and expanding district heating projects. The region’s proximity to Central European countries supports export opportunities and cross-border energy trade. Pellet adoption is increasing in residential sectors, though industrial demand remains dominant. It benefits from integration with regional supply chains that enhance production efficiency. Eastern France also leverages forest waste resources to meet sustainability standards. The region continues to grow steadily with policy support and industrial adoption.

Central France

Central France contributes 10% share, making it the smallest regional market segment. Limited industrial activity reduces large-scale pellet demand, but residential and small commercial heating are growing steadily. Local producers focus on supplying nearby towns and rural communities. It relies heavily on forest resources to ensure a stable pellet supply chain. Government subsidies play an important role in encouraging adoption in households. Central France is gradually increasing its relevance within the broader France Wood Pellets Market through steady demand growth.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern France

- Western France

- Souther France

- Eastern France

Competitive Landscape

The France Wood Pellets Market features a mix of established energy companies, specialized pellet producers, and regional suppliers competing for market share. Leading players such as Dalkia, Bioéléments, Groupe SNI, and Atlan Pellets dominate through strong production capacities, long-term supply contracts, and partnerships with district heating operators. Les Grands Bois, Champ bois énergie, Sofanor, and Cendres+Métaux strengthen competition by focusing on sustainable sourcing, localized distribution, and certified product quality. Larger firms cater mainly to industrial demand for CHP and co-firing, while mid-sized producers target residential and commercial heating segments. Market competition is shaped by regulatory compliance, cost efficiency, and sustainable forestry practices, as certifications are critical to maintaining consumer trust and meeting EU energy standards. Increasing exports to neighboring countries also influence competitive positioning, encouraging companies to expand capacity. The market remains moderately consolidated, with leading players holding a strong share while smaller producers compete through niche strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Dalkia

- Bioéléments

- Groupe SNI

- Atlan Pellets

- Les Grands Bois

- Champ bois énergie

- Sofanor

- Cendres+Métaux

- Others

Recent Developments

- In April 2025, French consumer group UFC Que‑Choisir’s commercial arm launched a group‑purchase offer for wood pellets. Participants could order in bulk (minimum two tonnes), receiving competitive pricing and home delivery deals they could accept or reject.

- In August 2024, Zollikofer Group, part of the Koehler Group, completed the acquisition of SAS REKO Energie Bois, a French supplier of biomass and fuelwood. This move strengthened its presence in France’s renewable energy supply chain.

- On June 5, 2025, ENplus announced that it certified more than 13.3 million tonnes of wood pellets in 2024. The program includes French producers, reinforcing confidence in pellet quality standards across the market.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for district heating applications will continue to strengthen pellet consumption.

- Government policies will keep supporting pellet adoption as part of renewable energy goals.

- Forest wood and waste will remain the dominant feedstock for pellet production.

- Residential and commercial heating demand will expand with wider use of pellet stoves and boilers.

- Export opportunities will grow as European countries seek reliable pellet suppliers.

- Investments in sustainable forestry will secure long-term raw material availability.

- Technological upgrades in pellet manufacturing will improve efficiency and reduce costs.

- Competition will intensify as new producers enter regional and niche markets.

- Certification and sustainability standards will become more critical to maintain market trust.

- Rising energy security concerns will increase reliance on biomass as a stable energy source.