Market Overview:

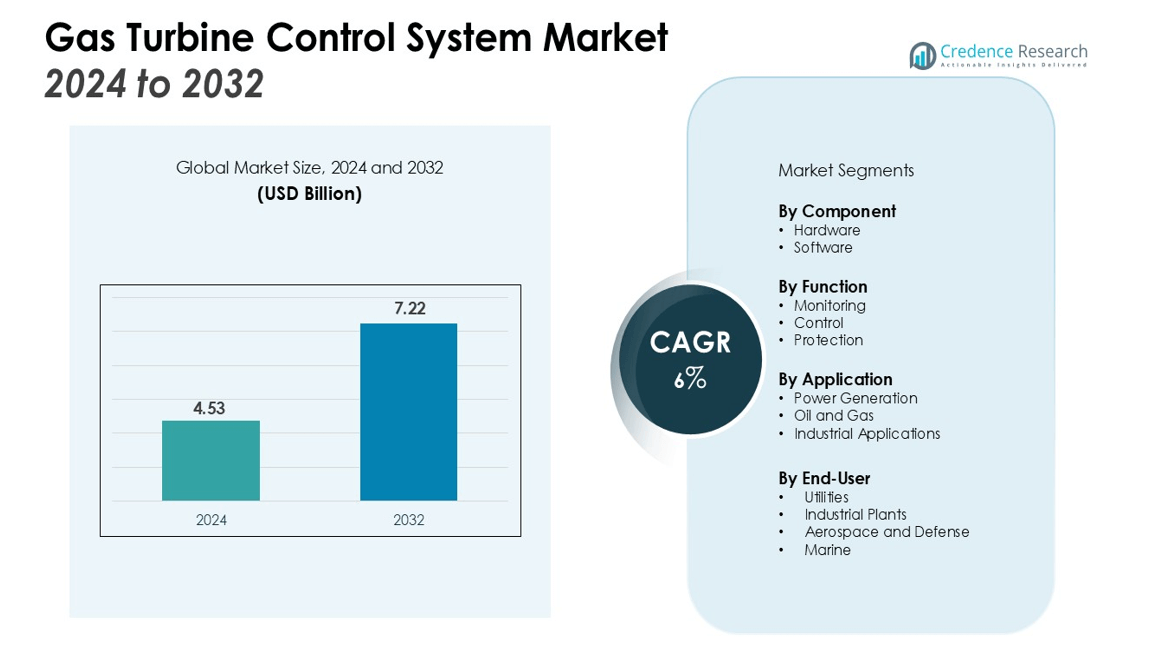

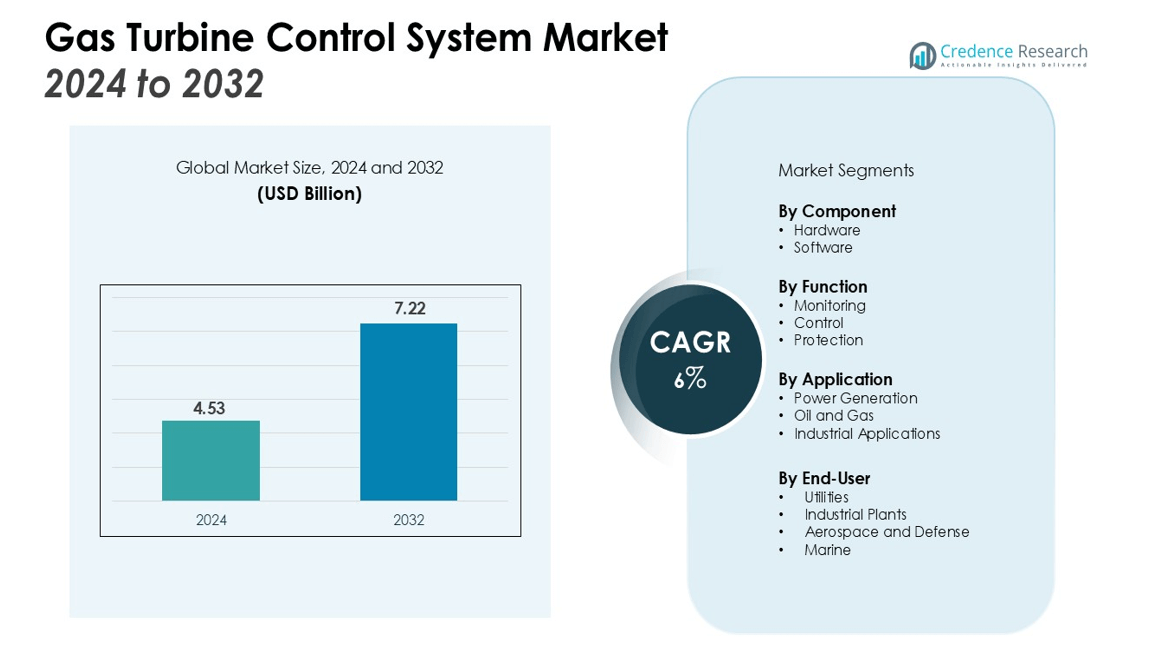

The Gas Turbine Control System Market size was valued at USD 4.53 billion in 2024 and is anticipated to reach USD 7.22 billion by 2032, at a CAGR of 6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Turbine Control System Market Size 2024 |

USD 4.53 billion |

| Gas Turbine Control System Market, CAGR |

6% |

| Gas Turbine Control System Market Size 2032 |

USD 7.22 billion |

Key drivers of market growth include the need for enhanced efficiency and reduced operational costs in power plants. Gas turbines are central to energy production due to their reliability and lower emissions compared to other fossil fuel-based power generation methods. Additionally, the increasing focus on renewable energy integration and the modernization of aging power infrastructure further propel the demand for advanced gas turbine control systems. The rising adoption of digital solutions for predictive maintenance and real-time monitoring also contributes to the market’s expansion. Furthermore, the growing emphasis on environmental regulations is prompting industries to adopt cleaner, more efficient turbine technologies.

Regionally, North America holds the largest market share due to the high demand for gas turbines in power generation and industrial applications. Europe follows with significant investments in upgrading power plants to meet sustainability goals. Asia Pacific is expected to witness the highest growth rate, driven by rapid industrialization, energy demand, and infrastructure development, particularly in countries like China and India. The Middle East & Africa also presents strong growth potential, driven by expanding energy infrastructure projects in the region.

Market Insights:

- The Gas Turbine Control System market is projected to grow from USD 4.53 billion in 2024 to USD 7.22 billion by 2032, with a CAGR of 6% during the forecast period.

- Rising demand for energy efficiency in power plants is driving the adoption of advanced gas turbine control systems, optimizing turbine performance and reducing operational costs.

- Tightening environmental regulations and the push for cleaner energy solutions accelerate the integration of gas turbine control systems, reducing emissions and improving fuel efficiency.

- Technological advancements, particularly in digital control systems, are enhancing turbine capabilities through real-time monitoring, predictive maintenance, and data analytics.

- The growing industrialization and infrastructure development in emerging markets, especially in Asia Pacific, are creating significant demand for reliable and efficient gas turbine control systems.

- High initial costs and the complexity of integrating advanced systems into existing infrastructures remain key challenges, particularly for smaller operators.

- North America, holding 35% of the market share, leads in demand for gas turbines in power generation and industrial applications, followed by Europe with 28% and Asia Pacific with 25%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy Efficiency in Power Plants

The increasing need for energy efficiency in power plants drives the adoption of advanced Gas Turbine Control Systems. These systems optimize the performance of gas turbines, helping plants reduce fuel consumption and lower operational costs. Gas turbines offer high efficiency and flexibility in power generation, making them ideal for balancing supply and demand in energy markets. As power plants seek to meet growing energy demand with minimal environmental impact, the integration of advanced control systems becomes a key factor in improving operational efficiency.

- For instance, Siemens Energy’s SGT6-9000HL turbine, at Duke Energy’s Lincoln Combustion Turbine Station, set a world record for the most powerful simple-cycle gas power plant with an output of 410.9 megawatts.

Focus on Reducing Emissions and Environmental Impact

Environmental regulations continue to tighten, encouraging industries to adopt cleaner energy solutions. Gas turbine control systems support this transition by enabling better fuel management, emission control, and overall turbine performance. Their ability to reduce carbon emissions and improve fuel efficiency aligns with global sustainability goals. Power plants are increasingly focusing on reducing their carbon footprints, making Gas Turbine Control Systems an essential component for achieving compliance with evolving environmental standards.

- For instance, GE’s advanced gas turbine technology enables its LM2500XPRESS units to achieve nitrogen oxide (NOx) emissions as low as 15 parts per million (ppm), aiding compliance with stringent environmental standards.

Technological Advancements and Integration with Digital Solutions

Recent technological advancements in digital control systems enhance the capabilities of gas turbines. Real-time monitoring, predictive maintenance, and data analytics enable operators to maximize turbine efficiency and extend their lifespan. The integration of digital solutions with Gas Turbine Control Systems allows for remote monitoring and troubleshooting, further reducing downtime and operational costs. This shift toward digitalization in power generation is a significant driver for the market.

Growing Industrialization and Infrastructure Development in Emerging Economies

The expansion of industrial sectors in emerging markets, particularly in Asia Pacific, is driving demand for Gas Turbine Control Systems. Rapid industrialization, combined with increasing energy demand, accelerates the need for reliable and efficient power generation solutions. Developing economies, such as China and India, are investing in new infrastructure projects, where gas turbines play a critical role in providing sustainable energy. This trend is expected to fuel the demand for advanced control systems in the coming years.

Market Trends:

Advancements in Digitalization and Automation in Gas Turbine Control Systems

The integration of digital technologies into Gas Turbine Control Systems is a significant trend shaping the market. Automation and real-time data analytics enhance turbine performance, providing operators with the ability to monitor systems remotely and make data-driven decisions. The shift toward predictive maintenance further optimizes turbine operations, reducing unplanned downtime and extending equipment lifespan. The adoption of Internet of Things (IoT) technologies within control systems enables seamless communication across devices, improving operational efficiency. Digital solutions enable gas turbines to respond dynamically to changing energy demands, increasing their adaptability in power generation. As the industry pushes for smarter, more flexible systems, the role of advanced software and cloud-based platforms continues to expand.

- For instance, Mitsubishi Power’s T-Point 2, a combined cycle power plant, is operated remotely from the Takasago TOMONI HUB, validating the capability of advanced software to manage a major power asset without onsite personnel.

Increased Focus on Hybrid Power Generation Systems

Gas turbines are increasingly integrated with renewable energy sources, reflecting the trend toward hybrid power generation systems. The blending of gas turbines with solar and wind energy systems offers a more reliable and sustainable energy solution, especially in regions with intermittent renewable power. This integration allows for more efficient use of gas turbines, which can compensate for fluctuations in renewable energy generation. The need for flexible and reliable power sources, especially in grid balancing, drives the demand for hybrid systems that combine the strengths of both conventional and renewable technologies. Gas Turbine Control Systems are key in ensuring seamless operation in these hybrid configurations, optimizing fuel usage while enhancing the grid’s overall stability and reliability.

- For instance, GE Vernova’s LM6000 Hybrid Electric Gas Turbine integrates a 10 MW/4.3 MWh battery energy storage system with a 50 MW gas turbine to support grid stability and allow for more effective use of renewables.

Market Challenges Analysis:

High Initial Costs and Complex Integration

One of the primary challenges in the Gas Turbine Control System market is the high initial investment required for advanced systems. The integration of these systems into existing infrastructure often involves significant upfront costs, including equipment and software. These expenses can deter smaller operators and facilities with limited budgets from adopting advanced control systems. Furthermore, retrofitting older turbines with modern control systems can be complex and time-consuming, requiring specialized expertise. Such high costs and operational disruptions are considerable barriers to the widespread adoption of advanced gas turbine control systems.

Technological Obsolescence and Maintenance Challenges

The rapid pace of technological advancements in the Gas Turbine Control System market presents another challenge. As new innovations emerge, older systems may become obsolete or less efficient, requiring frequent upgrades. Maintaining the compatibility of these systems with other power generation technologies also becomes increasingly difficult. Additionally, specialized maintenance is often needed to address issues with control system software, which can be costly and require specific expertise. The need for constant updates and maintenance can strain resources and increase operational costs, affecting long-term sustainability for many operators.

Market Opportunities:

Growing Demand for Hybrid Power Solutions

The rising shift toward hybrid power systems presents significant opportunities for the Gas Turbine Control System market. As renewable energy sources like wind and solar are increasingly integrated into power grids, the need for flexible and reliable gas turbine systems grows. Gas turbines provide the necessary backup during fluctuations in renewable energy generation, ensuring grid stability. Control systems that optimize this integration, allowing for seamless transitions between renewable and conventional power, are in high demand. This trend opens avenues for further innovations in control systems that enhance the performance and efficiency of hybrid power solutions, making it a promising area for market expansion.

Focus on Smart Grid and Digital Transformation

The ongoing digital transformation in the energy sector presents substantial opportunities for Gas Turbine Control Systems. The growing adoption of smart grid technologies requires advanced control systems that can seamlessly integrate with these grids, enhancing operational flexibility and efficiency. Gas turbines, powered by smart controls, can better adapt to real-time changes in demand and supply, improving overall energy management. This increased focus on automation, predictive maintenance, and remote monitoring positions the Gas Turbine Control System market to capitalize on the rising demand for digital solutions. The continued growth of IoT and AI technologies further supports the integration of these systems into next-generation power infrastructure.

Market Segmentation Analysis:

By Component

The Gas Turbine Control System market is segmented by component into hardware and software. Hardware includes control panels, sensors, and actuators that are essential for the operation and performance optimization of gas turbines. Software plays a crucial role in managing system performance, ensuring efficient operation, and enabling real-time monitoring. The demand for advanced software solutions, such as predictive maintenance and data analytics, is rising as operators seek to enhance turbine efficiency and reduce downtime.

- For instance, GE Vernova’s integrated control system enabled the Marafiq desalination facility in Saudi Arabia to achieve over 15 years of continuous operation with zero unscheduled downtime in the control systems.

By Function

The market is further segmented by function into monitoring, control, and protection. Monitoring systems are used to track turbine performance, ensuring that operational parameters remain within safe limits. Control systems adjust turbine functions to maximize efficiency and output. Protection systems are designed to prevent damage from operational failures, ensuring the safe and reliable performance of gas turbines. Each function is critical in maintaining optimal turbine performance and minimizing operational risks, contributing to the overall growth of the market.

- For instance, Mitsubishi Electric’s Turbine Protection System (TPS) enhances system reliability and maintainability by utilizing four independent controllers which operate in a redundant configuration to protect the turbine.

By Application

The Gas Turbine Control System market is also divided by application, including power generation, oil and gas, and industrial applications. In power generation, gas turbines are a primary source of electricity, and control systems are essential to optimize energy production. The oil and gas industry uses gas turbines for various applications, including pumping and compression, where reliability and efficiency are key. In industrial applications, gas turbines are used for mechanical drives, and advanced control systems improve operational efficiency while reducing maintenance costs. The diverse applications across these industries are driving the adoption of gas turbine control systems.

Segmentations:

By Component

By Function

- Monitoring

- Control

- Protection

By Application

- Power Generation

- Oil and Gas

- Industrial Applications

By End-User

- Utilities

- Industrial Plants

- Aerospace and Defense

- Marine

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Market Leadership Driven by Industrial Demand

North America holds 35% of the Gas Turbine Control System market share, contributing significantly to global demand. The region’s strong energy infrastructure, coupled with a high need for gas turbines in both power generation and industrial applications, supports this leadership. The U.S. and Canada are major contributors, focusing on modernizing power plants and integrating cleaner energy solutions. The increasing focus on sustainability and energy efficiency further accelerates the adoption of gas turbine control systems. Additionally, North America’s substantial investment in research and development (R&D) fosters continuous technological advancements, solidifying its position as a market leader.

Europe: Growing Adoption Fueled by Sustainability and Regulation

Europe holds 28% of the Gas Turbine Control System market share, driven by a strong focus on sustainability and regulatory compliance. Countries like Germany and the U.K. are leading the charge in reducing carbon emissions, encouraging the use of cleaner energy solutions, including gas turbines. The region’s commitment to enhancing energy efficiency and incorporating renewable sources into the grid further accelerates demand for advanced control systems. With stringent environmental policies and investments in smart grid technologies, Europe remains a key player in adopting and integrating gas turbines for cleaner, more efficient energy generation.

Asia Pacific: Rapid Growth from Industrialization and Energy Demand

Asia Pacific accounts for 25% of the Gas Turbine Control System market share, driven by rapid industrialization and rising energy demand in key countries like China, India, and Japan. The region’s expanding infrastructure and focus on reducing carbon emissions fuel the adoption of gas turbines for power generation. Emerging markets in Southeast Asia are investing heavily in energy projects, creating opportunities for advanced control systems. The need for grid stability and energy security further boosts the demand for gas turbines, positioning Asia Pacific as the fastest-growing region in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ansaldo Energia

- Baker Hughes

- General Electric (GE)

- Siemens AG

- MAN Energy Solutions

- Kawasaki Heavy Industries

- Mitsubishi Hitachi Power Systems

- Woodward Inc.

- ABB Ltd.

- Emerson Electric Co.

- Rolls-Royce Holdings plc

- Voith GmbH & Co. KGaA

- Honeywell International Inc.

- Rockwell Automation

- Schneider Electric

Competitive Analysis:

The Gas Turbine Control System market is highly competitive, with major players including General Electric (GE), Siemens Energy, ABB, Emerson Electric, Honeywell, Mitsubishi Heavy Industries (MHI), Ansaldo Energia, Centrax, and Oxsensis. These companies dominate through advanced technological offerings, strategic partnerships, and strong market presence. GE and Siemens Energy lead with comprehensive control solutions and a focus on energy efficiency, while ABB and Emerson Electric enhance their market share by integrating automation and process control systems. Honeywell capitalizes on digital solutions for turbine performance, and MHI maintains a robust portfolio in gas turbines for power plants. Ansaldo Energia and Centrax focus on high-performance turbines and industrial generating sets, respectively, while Oxsensis innovates with high-temperature sensors. The market’s growth is driven by the increasing demand for cleaner, more efficient power generation and the integration of renewable energy sources, with these key players well-positioned to leverage technological advancements to strengthen their market leadership.

Recent Developments:

- In September 2025, GE Aerospace entered into a partnership with BETA Technologies to advance hybrid electric flight technology.

- In July 2025, GE HealthCare launched a new advanced digital X-ray system aimed at improving efficiency in high-throughput medical environments.

- In May 2025, GE Vernova announced an investment of $16 million to expand its manufacturing and engineering footprint in India, with new facilities planned for Chennai and Noida.

Report Coverage:

The research report offers an in-depth analysis based on Component, Function, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for gas turbine control systems will continue to rise due to the increasing focus on energy efficiency and sustainability in power generation.

- Integration with renewable energy sources will drive innovation, with advanced control systems ensuring optimal performance and grid stability.

- The growing trend towards hybrid power systems will create new opportunities for gas turbine control systems to operate seamlessly with wind, solar, and other renewable technologies.

- Digitalization will play a critical role, with more advanced data analytics, predictive maintenance, and real-time monitoring improving turbine efficiency and reducing operational costs.

- Emerging markets, particularly in Asia Pacific and Africa, will see significant adoption of gas turbine control systems due to rapid industrialization and infrastructure development.

- Regulatory pressure for lower emissions will push industries to adopt more efficient gas turbine technologies, further increasing the demand for advanced control systems.

- The increasing complexity of power grids and the need for more flexible energy generation solutions will create new market opportunities for control systems in both centralized and decentralized applications.

- Continued investment in R&D by key players will foster advancements in control system technology, leading to more reliable, efficient, and cost-effective solutions.

- The shift towards smart grids and digital infrastructure will further enhance the integration and automation of gas turbine control systems.

- Strategic partnerships and collaborations between gas turbine manufacturers and control system providers will strengthen market growth and innovation.