Market Overview:

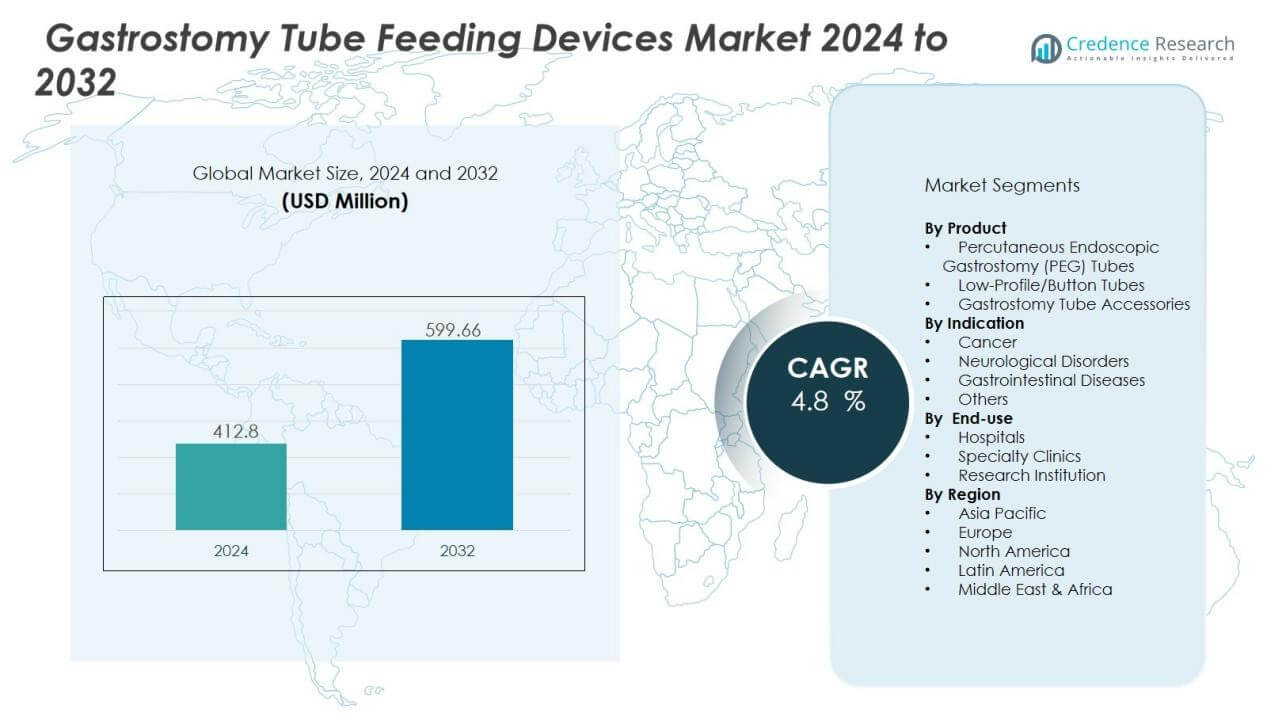

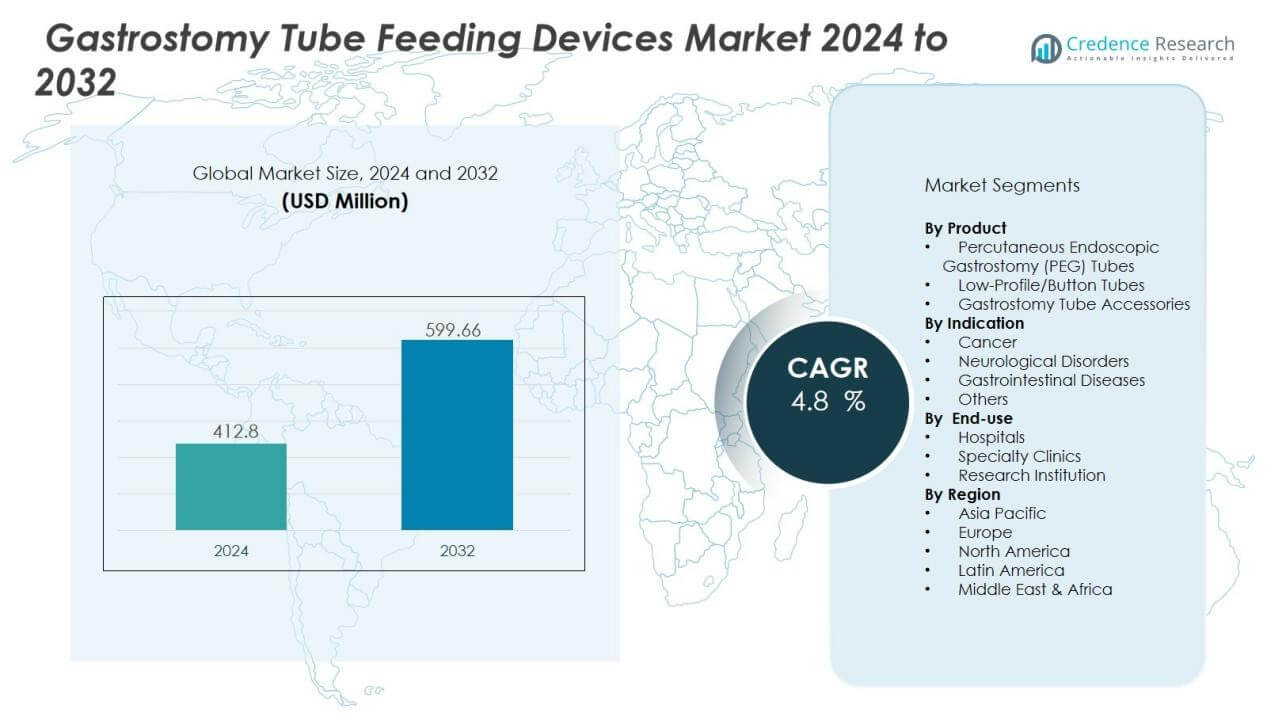

The gastrostomy tube feeding devices market size was valued at USD 412.8 million in 2024 and is anticipated to reach USD 599.66 million by 2032, at a CAGR of 4.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gastrostomy Tube Feeding Devices Market Size 2024 |

USD 412.8 Million |

| Gastrostomy Tube Feeding Devices Market, CAGR |

4.8% |

| Gastrostomy Tube Feeding Devices Market Size 2032 |

USD 599.66 Million |

Key drivers include the rising incidence of cancer, neurological disorders, and gastrointestinal diseases that limit oral intake. The growing geriatric population, coupled with higher hospitalization rates and demand for home-based care, further supports market expansion. Advancements in device design, with emphasis on patient comfort, infection prevention, and ease of use, are improving acceptance across both hospitals and homecare settings. Increased awareness of early nutritional intervention also contributes to sustained demand.

Regionally, North America leads the market due to advanced healthcare infrastructure, favorable reimbursement systems, and high adoption of innovative feeding devices. Europe follows, supported by robust clinical practices and government healthcare funding. Asia-Pacific is expected to record the fastest growth, fueled by expanding healthcare access, rising chronic disease burden, and growing medical device investments in countries such as China and India. Latin America and the Middle East & Africa also present emerging opportunities through ongoing improvements in healthcare delivery.

Market Insights:

- The gastrostomy tube feeding devices market was valued at USD 412.8 million in 2024 and is projected to reach USD 599.66 million by 2032, growing at a CAGR of 4.8%.

- Rising prevalence of cancer, neurological disorders, and gastrointestinal diseases continues to drive demand for gastrostomy feeding solutions.

- The expanding geriatric population with higher risks of swallowing disorders strengthens long-term care needs.

- Technological advancements in device design focus on patient comfort, safety, and infection prevention, improving adoption.

- Growing preference for home-based care creates demand for cost-effective, user-friendly, and portable feeding devices.

- Challenges such as infections, blockages, and high device costs limit adoption in certain regions.

- North America led with 41% share in 2024, followed by Europe at 28% and Asia-Pacific at 22%, with Asia-Pacific expected to grow fastest.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Chronic Diseases and Nutritional Disorders:

The gastrostomy tube feeding devices market is strongly driven by the increasing incidence of chronic illnesses such as cancer, neurological disorders, and gastrointestinal diseases. These conditions often impair the patient’s ability to swallow or consume food orally. Gastrostomy tubes provide a reliable method of ensuring continuous nutritional support for such patients. It enables healthcare providers to reduce malnutrition risks and improve patient survival outcomes.

- For instance, Avanos Medical’s MIC-KEY low-profile gastrostomy tube is used by clinicians to provide nutrition support for over 500,000 enteral feeding patients annually.

Growing Geriatric Population and Long-Term Care Needs:

The expanding elderly population is another major growth driver for the gastrostomy tube feeding devices market. Older patients often face higher risks of swallowing disorders and degenerative conditions, requiring consistent nutritional management. Demand is rising in hospitals, nursing homes, and homecare environments where these devices offer effective long-term feeding solutions. It improves overall quality of care by reducing complications linked to inadequate nutrient intake.

- For instance, at IRCCS INRCA hospital in Italy, between 2017 and 2023, percutaneous endoscopic gastrostomy (PEG) tubes were successfully positioned in 134 of 136 geriatric patients with a mean age of 81.34 years, demonstrating a 98.48% procedural success rate, with most patients managed safely for an extended duration of home enteral nutrition therapy.

Advancements in Device Design and Patient Comfort:

Technological innovations are enhancing the usability and safety of gastrostomy tube feeding devices. Manufacturers are focusing on infection control features, ergonomic designs, and materials that improve patient comfort. Improved device reliability reduces complications such as leakage or dislodgement, increasing confidence among healthcare professionals. It supports wider adoption in both acute care and home-based settings, strengthening market growth.

Expansion of Home Healthcare and Cost-Effective Care Models:

The rise of home healthcare services significantly supports the gastrostomy tube feeding devices market. Patients and caregivers increasingly prefer home-based nutrition management to avoid frequent hospital visits and reduce costs. These devices provide a practical solution for long-term feeding outside clinical facilities. It aligns with healthcare systems’ focus on cost efficiency, patient independence, and improved care outcomes.

Market Trends:

Increasing Focus on Minimally Invasive Procedures and Advanced Feeding Solutions:

The gastrostomy tube feeding devices market is witnessing a growing preference for minimally invasive placement techniques. Healthcare providers are adopting endoscopic and image-guided procedures that reduce hospital stays, lower complication risks, and improve patient recovery. Demand is also rising for devices that integrate advanced safety features such as anti-reflux valves and secure locking mechanisms. It supports greater acceptance among patients and caregivers who seek comfort, reliability, and reduced procedural risks. Manufacturers are also introducing devices with biocompatible materials and simplified insertion kits that streamline clinical workflows. This trend highlights the industry’s shift toward precision-driven, patient-centered solutions.

- For example, MiniONE® Balloon Button uses medical-grade silicone for enhanced patient comfort and reduced skin irritation in long-term use. This trend highlights the industry’s shift toward precision-driven, patient-centered solutions.

Adoption of Homecare Nutrition and Technological Integration:

The expansion of home-based healthcare is shaping new product trends in the gastrostomy tube feeding devices market. Growing reliance on homecare settings creates demand for user-friendly tubes and accessories designed for long-term use outside hospitals. It encourages innovations such as low-profile button devices and portable feeding systems that improve patient independence. The integration of digital monitoring tools, including sensors and mobile connectivity, is also gaining traction to track feeding schedules and detect complications early. Healthcare systems increasingly value these devices for their role in reducing readmissions and improving cost efficiency. The trend underscores a future where personalized care and technology-enabled feeding solutions play a central role in patient management.

- For Instance, Avanos Medical manufactures and sells the MIC-KEY® Low-Profile Gastrostomy Feeding Tube, including a version with an 18 Fr tube diameter and a 3.0 cm stoma length.

Market Challenges Analysis:

High Risk of Complications and Device-Related Limitations:

The gastrostomy tube feeding devices market faces challenges due to complications such as infections, tube blockages, and accidental dislodgement. These risks create concerns for both healthcare providers and patients, often requiring repeat procedures or hospital readmissions. It impacts patient confidence and can delay adoption in certain care settings. Limited awareness about proper device handling among caregivers also contributes to safety issues. Manufacturers must continuously improve design and material quality to address these risks effectively. Such complications remain a key barrier to widespread acceptance despite growing clinical need.

Cost Constraints and Limited Access in Developing Regions:

The high cost of advanced gastrostomy tube feeding devices restricts their availability in price-sensitive markets. Patients in low- and middle-income countries often lack reimbursement support, making access to these devices difficult. It challenges hospitals and caregivers to balance affordability with the need for reliable feeding solutions. Inadequate healthcare infrastructure further limits adoption, especially in rural and underserved areas. Variability in regulatory standards across regions also delays approvals and market entry for new products. These cost and access barriers continue to hinder the full growth potential of the market globally.

Market Opportunities:

Rising Demand for Home Healthcare and Patient-Centric Solutions:

The gastrostomy tube feeding devices market holds significant opportunity in the expanding home healthcare sector. Patients and caregivers increasingly seek user-friendly devices that support independent management of long-term nutrition. It creates demand for compact, low-profile, and portable solutions that improve quality of life outside hospitals. Manufacturers focusing on simplified insertion kits, comfort-driven designs, and reduced maintenance requirements can capture strong growth. Growing preference for cost-effective home-based care also aligns with healthcare systems aiming to reduce hospital stays. This shift positions homecare-driven innovation as a major opportunity for market players.

Integration of Digital Health and Expansion into Emerging Markets:

The adoption of digital health technologies presents another promising growth avenue for the gastrostomy tube feeding devices market. Devices integrated with smart sensors and mobile applications can provide real-time monitoring, early complication detection, and improved caregiver support. It enhances treatment outcomes and fosters trust among patients and providers. At the same time, emerging markets in Asia-Pacific, Latin America, and the Middle East offer untapped potential due to increasing healthcare investments and rising awareness of nutritional therapy. Companies that adapt products to local price sensitivities while meeting global quality standards can strengthen their presence. The combination of digital innovation and geographic expansion creates long-term growth prospects.

Market Segmentation Analysis:

By Product:

The gastrostomy tube feeding devices market is segmented into percutaneous endoscopic gastrostomy (PEG) tubes, low-profile/button tubes, and accessories. PEG tubes hold the largest share due to their widespread use in hospitals and long-term care facilities. Low-profile tubes are gaining popularity among pediatric and homecare patients for comfort and ease of handling. Accessories such as extension sets and connectors continue to support the adoption of core devices. It reflects the importance of reliable and safe device options across clinical and home environments.

- For Instance, Avanos Medical manufactures and sells the MIC-KEY® Low-Profile Gastrostomy Feeding Tube, including a version with an 18 Fr tube diameter and a 3.0 cm stoma length.

By Indication:

The market is segmented by indications such as cancer, neurological disorders, gastrointestinal diseases, and others. Cancer patients form a significant segment due to increased demand for long-term nutritional support during treatment. Neurological disorders, including stroke and dementia, also drive growth as feeding support becomes essential in advanced stages. Gastrointestinal diseases contribute steadily with the rising prevalence of swallowing difficulties and obstruction cases. It highlights the critical role of enteral nutrition in diverse medical conditions.

- For instance, a study at the Neurology ICU of Zunyi Medical University showed that supplementing enteral nutrition with whey protein powder and Bifidobacterium quadruplex significantly improved nutritional indicators such as albumin and total protein levels after 7 days in 100 neurological patients, reducing gastrointestinal complications and improving prognosis.

By End Use:

Hospitals dominate the gastrostomy tube feeding devices market due to advanced infrastructure and skilled professionals. Ambulatory surgical centers contribute with demand for minimally invasive procedures. Homecare settings are growing rapidly, supported by rising patient preference for comfort and cost-effective care. It reflects a shift toward decentralized healthcare models that prioritize patient independence and long-term management.

Segmentations:

By Product

- Percutaneous Endoscopic Gastrostomy (PEG) Tubes

- Low-Profile/Button Tubes

- Gastrostomy Tube Accessories

By Indication

- Cancer

- Neurological Disorders

- Gastrointestinal Diseases

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Homecare Settings

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 41% market share in the gastrostomy tube feeding devices market in 2024. The region benefits from advanced healthcare infrastructure, high healthcare spending, and strong reimbursement frameworks. The United States drives growth through widespread adoption in hospitals, long-term care facilities, and homecare environments. It also benefits from a strong presence of leading medical device manufacturers focusing on innovation and safety. Rising cases of chronic diseases such as cancer and neurological disorders fuel consistent demand. Government emphasis on patient safety and quality care further strengthens the market position.

Europe:

Europe accounted for 28% market share in the gastrostomy tube feeding devices market in 2024. The region is driven by robust clinical practices, strong government healthcare funding, and expanding geriatric populations. Countries such as Germany, France, and the United Kingdom lead adoption due to established medical guidelines and awareness of nutritional therapy. It benefits from a network of hospitals and specialized nutrition centers supporting advanced feeding solutions. Rising prevalence of chronic and post-surgical conditions continues to sustain demand. Strong regulatory oversight also ensures consistent product quality and safety standards.

Asia-Pacific:

Asia-Pacific held 22% market share in the gastrostomy tube feeding devices market in 2024. The region is expected to grow rapidly due to expanding healthcare access, rising chronic disease burden, and increasing investments in medical devices. China, Japan, and India remain key contributors with improving infrastructure and growing awareness of enteral nutrition. It is also supported by a rising elderly population and the shift toward cost-effective homecare models. Local manufacturers are entering the market with competitively priced devices, increasing adoption across different care settings. The region’s strong growth potential makes it a strategic focus for global and regional players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Conmed Corporation

- Gravitas Medical

- R.Bard

- Boston Scientific Corporation

- Moog Inc.

- Cook Medical

- Fresenius Kabi AG

- Danone Medical Nutrition

- Abbott Nutrition

- B Braun Melsungen AG

- Avanos Medical, Inc.

- Kimberly-Clark

- Cardinal Health

Competitive Analysis:

The gastrostomy tube feeding devices market is defined by strong competition among global and regional players. Key companies include Conmed Corporation, Gravitas Medical, C.R. Bard, Boston Scientific Corporation, Moog Inc., Cook Medical, and Fresenius Kabi. It is characterized by continuous product innovation, with firms focusing on patient comfort, safety features, and infection control solutions. Leading players invest in research and development to enhance device efficiency and reliability, while strategic partnerships and acquisitions strengthen their market presence. Distribution networks and aftersales support remain critical factors in maintaining competitive advantage. Companies are also expanding their reach into emerging markets by offering cost-effective solutions tailored to local healthcare needs. The market reflects a balance between established manufacturers leveraging brand trust and new entrants driving competition with innovative designs. It continues to evolve with a strong emphasis on technological integration, patient-centric solutions, and long-term care adoption.

Recent Developments:

- In February 2025, Conmed Corporation launched HydroSeal™, a flexible silicone shoulder cannula designed to enhance maneuverability and reduce fluid leakage during surgery.

- In January 2025, C.R. Bard agreed to a $17 million settlement related to kickback allegations.

Report Coverage:

The research report offers an in-depth analysis based on Product, Indication, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The gastrostomy tube feeding devices market will see rising demand from the growing elderly population worldwide.

- Advancements in minimally invasive placement techniques will strengthen adoption among hospitals and specialty clinics.

- Increased focus on patient comfort and device safety will drive innovation in product design.

- The shift toward home healthcare will expand opportunities for compact, low-profile, and user-friendly feeding devices.

- Digital integration with sensors and mobile applications will support real-time monitoring and complication prevention.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will attract strong investments.

- Regulatory approvals for improved devices will enhance trust among healthcare providers and caregivers.

- Collaborations between manufacturers and healthcare systems will strengthen distribution networks and market reach.

- Growing awareness of early nutritional intervention will increase the role of gastrostomy feeding in preventive care.

- Sustainability in device materials and packaging will become a priority for leading manufacturers.