Market Overview

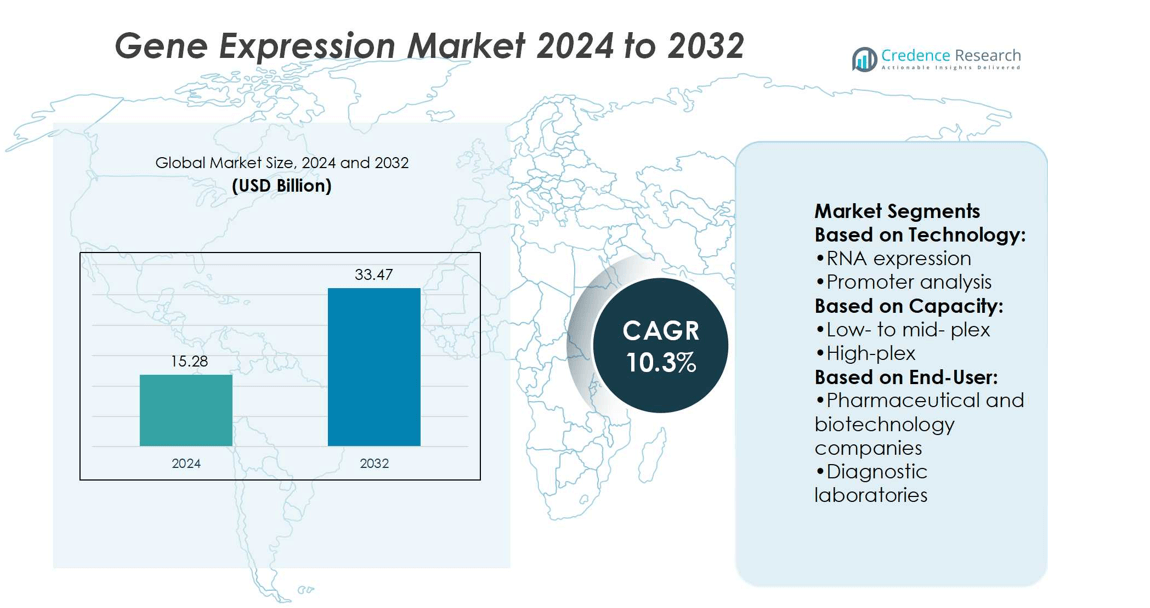

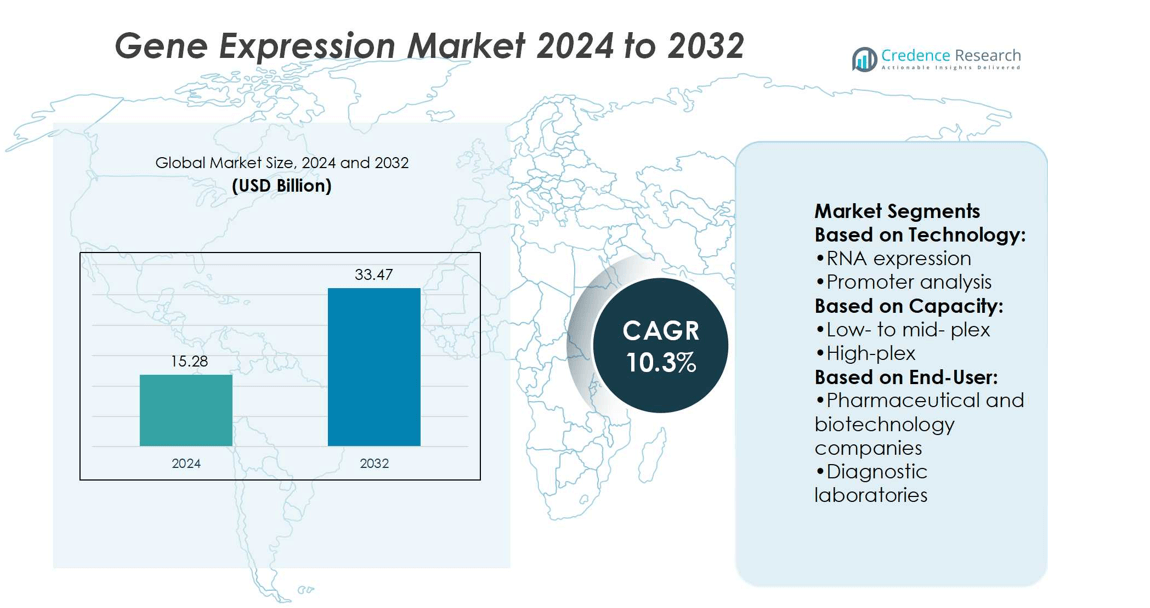

Gene Expression Market size was valued at USD 15.28 billion in 2024 and is anticipated to reach USD 33.47 billion by 2032, at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gene Expression Market Size 2024 |

USD 15.28 billion |

| Gene Expression Market, CAGR |

10.3% |

| Gene Expression Market Size 2032 |

USD 33.47 billion |

The Gene Expression Market grows due to increasing demand for precision medicine, drug discovery, and diagnostic applications. Advances in high-throughput sequencing, RNA analysis, and protein expression technologies enhance research accuracy and efficiency. Rising investment in biotechnology and pharmaceutical research drives adoption of automated and scalable platforms. Integration of AI and bioinformatics enables faster data analysis and predictive modeling. Trends include development of multi-omics approaches, portable sequencing systems, and cloud-based data management solutions. Growing focus on personalized healthcare, regulatory support, and expansion in emerging regions further propels market growth, while continuous innovation and workflow optimization remain central to industry advancement.

North America leads the Gene Expression Market, driven by advanced research infrastructure, high pharmaceutical investment, and early adoption of innovative technologies. Europe follows, supported by strong clinical research activities and regulatory initiatives promoting genomic studies. The Asia Pacific region shows rapid growth due to expanding biotechnology research, increasing government funding, and rising demand for personalized medicine. Key players focus on strengthening regional presence through partnerships, collaborations, and distribution networks. Latin America and the Middle East register steady adoption, supported by growing healthcare awareness and infrastructure development.

Market Insights

- The Gene Expression Market size was valued at USD 15.28 billion in 2024 and is anticipated to reach USD 33.47 billion by 2032, growing at a CAGR of 10.3%.

- Increasing demand for precision medicine, drug discovery, and diagnostic applications drives market growth.

- Advances in high-throughput sequencing, RNA analysis, and protein expression technologies enhance research efficiency and accuracy.

- Rising investment in biotechnology and pharmaceutical research encourages adoption of automated and scalable platforms.

- Integration of AI and bioinformatics enables faster data interpretation, predictive modeling, and workflow optimization.

- North America leads due to advanced research infrastructure, high pharmaceutical investment, and early adoption of innovative technologies, followed by Europe and Asia Pacific with strong clinical research and government support.

- Market competition intensifies as companies focus on partnerships, collaborations, regional expansion, and continuous innovation to strengthen presence and capture emerging opportunities globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Advancements in Genomic Research and Personalized Medicine

The Gene Expression Market grows strongly due to rapid advancements in genomic research. Large-scale projects focused on sequencing and functional genomics increase demand for precise expression analysis tools. Personalized medicine depends on accurate profiling to tailor treatments based on genetic variations. This market benefits from the rising integration of transcriptomics into drug discovery pipelines. Researchers prioritize technologies that deliver deeper insights into disease mechanisms. The focus on targeted therapies strengthens the use of advanced gene expression platforms.

- For instance, Illumina’s Alliance for Genomic Discovery has sequenced 250,000 whole genomes to support drug target discovery and clinical development pipelines. Personalized medicine depends on accurate profiling to tailor treatments based on genetic variations.

Rising Demand for Biomarker Discovery and Disease Diagnostics

The growing emphasis on biomarker discovery supports expansion across the Gene Expression Market. Biomarkers enable early disease detection and inform treatment strategies across oncology, neurology, and infectious diseases. Diagnostic laboratories adopt advanced microarray and sequencing methods for faster and more reliable results. Healthcare systems focus on improving patient outcomes with predictive diagnostics. Pharmaceutical companies invest in biomarker-driven drug development, creating wider adoption of gene expression profiling. This trend drives continuous innovation and accelerates market adoption.

- For instance, a study analyzed 93 human cervical squamous cell carcinoma tissue samples paired with adjacent normal tissues, which confirmed that the expression levels of GABRA2, ZNF257, and SLC5A8 were significantly lower in cancer cells compared to normal cells.

Increasing Investments in Biotechnology and Pharmaceutical R&D

Strong investments in biotechnology and pharmaceutical research drive consistent growth in this market. Governments, private firms, and research institutes allocate significant funding to strengthen molecular biology infrastructure. Pharmaceutical companies apply expression profiling to identify novel drug targets and optimize clinical trials. It supports advancements in precision drugs by linking gene activity to therapeutic responses. The rise of collaborative research initiatives fuels the adoption of advanced platforms. Continuous R&D spending ensures steady progress in this field.

Technological Innovations in Sequencing and Data Analysis Tools

Continuous innovation in sequencing technologies plays a critical role in driving the Gene Expression Market. Next-generation sequencing delivers faster, more cost-effective, and higher-throughput analysis compared to older methods. Advances in bioinformatics support the management of large and complex data sets. Integration of AI and machine learning enhances accuracy in identifying gene patterns. Researchers and clinicians rely on these improvements for both discovery and clinical applications. These technological achievements ensure the market maintains strong growth momentum.

Market Trends

Growing Adoption of Next-Generation Sequencing for Expression Profiling

The Gene Expression Market shows strong movement toward next-generation sequencing platforms for expression analysis. These systems provide deeper transcript coverage, higher throughput, and lower error rates. Research institutes favor them for large-scale population studies and disease-specific projects. Pharmaceutical companies use them to validate drug targets and monitor therapeutic effects. The shift from microarrays to sequencing highlights demand for precision and scalability. It supports rapid advancements in both research and clinical applications.

- For instance, Agilent’s SureSelect Human All Exon V8 panel targets a 35.1 Mb region of the human genome, using an end-to-end design size of 41.6 Mb, covering RefSeq, CCDS, GENCODE, plus the TERT promoter and hard-to-capture exons.

Expanding Role of Single-Cell Expression Analysis in Research

Single-cell expression analysis has emerged as a key trend in this market. It allows researchers to study cell heterogeneity and identify rare cell populations linked to disease progression. Academic centers and biotech firms integrate these tools into cancer biology, neurology, and immunology studies. The demand for single-cell RNA sequencing platforms continues to accelerate globally. Insights gained from this approach influence the design of targeted therapies. It provides unmatched resolution for mapping complex biological systems.

- For instance, PacBio introduced the Kinnex single-cell RNA kit, which yields 80-100 million reads per Revio SMRT Cell using full-length transcript sequencing and is compatible with both 10x Chromium 3’ and 5’ library kits.

Integration of Artificial Intelligence and Advanced Bioinformatics

Artificial intelligence and bioinformatics platforms are transforming how expression data is interpreted. AI models process large datasets to identify patterns that traditional tools often overlook. Bioinformatics software integrates diverse data types, including sequencing, proteomics, and clinical records. Pharmaceutical developers rely on these systems to predict patient responses and optimize trial design. Research groups apply machine learning to reduce analysis time and improve accuracy. It ensures that complex gene expression results translate into actionable insights.

Rising Emphasis on Clinical Applications and Personalized Healthcare

The Gene Expression Market records a clear trend toward clinical adoption. Diagnostic labs use expression assays for early detection of cancer and rare diseases. Hospitals expand use of expression profiling to support personalized treatment strategies. Regulatory bodies approve more expression-based tests, strengthening confidence in their clinical relevance. Pharmaceutical firms develop companion diagnostics alongside targeted therapies. It highlights the growing alignment of expression research with patient-centered healthcare.

Market Challenges Analysis

High Costs and Complexity of Advanced Technologies

The Gene Expression Market faces challenges linked to the high costs of advanced sequencing and analysis platforms. Laboratories require significant capital investment to install next-generation sequencing systems and maintain them. Smaller research institutes and clinics often lack resources to adopt these tools. Skilled personnel are also necessary to operate equipment and manage workflows effectively. Data processing requires robust computational infrastructure, which further increases financial burden. It restricts widespread adoption, especially in resource-limited regions, limiting the pace of market penetration.

Data Management, Standardization, and Regulatory Barriers

Handling vast amounts of gene expression data presents another major challenge for this market. Research groups face difficulties in integrating data across different platforms and ensuring reproducibility. Lack of universal standards for analysis methods slows collaboration between organizations. Regulatory hurdles for approval of gene expression-based diagnostics also delay clinical adoption. Compliance with data privacy and patient safety requirements increases operational complexity. It underscores the need for standardized protocols, stronger regulatory clarity, and advanced bioinformatics tools to manage large datasets effectively.

Market Opportunities

Expanding Clinical Applications and Growth in Personalized Medicine

The Gene Expression Market offers significant opportunities through expanding use in clinical diagnostics and personalized medicine. Hospitals and diagnostic centers adopt expression assays to detect cancers, infectious diseases, and genetic disorders at earlier stages. Pharmaceutical companies align expression profiling with companion diagnostics to optimize therapeutic outcomes. Growing emphasis on personalized healthcare drives wider integration into patient care workflows. Regulatory approvals for expression-based tests continue to increase, opening new avenues for commercialization. It strengthens the role of gene expression tools in shaping precision healthcare delivery.

Technological Advancements and Emerging Market Expansion

Technological progress in next-generation sequencing, single-cell analysis, and bioinformatics creates strong growth opportunities for this market. Improved affordability of sequencing platforms supports adoption across mid-sized research laboratories. Integration of artificial intelligence accelerates the discovery of biomarkers and therapeutic targets. Emerging markets in Asia-Pacific and Latin America expand adoption through investments in healthcare infrastructure. Collaborative projects between research institutes and biotech companies encourage wider deployment of advanced platforms. It ensures the Gene Expression Market maintains momentum by meeting growing global demand for innovative solutions.

Market Segmentation Analysis:

By Technique

The Gene Expression Market records strong adoption across diverse analytical techniques. RNA expression dominates as it provides detailed insights into gene activity and disease pathways. Promoter analysis supports identification of regulatory elements that influence gene function and drug response. Protein expression and posttranslational modification analysis play a critical role in connecting gene activity with functional biological outcomes. Pharmaceutical companies and research institutes rely on these techniques to accelerate biomarker discovery and therapeutic development. It ensures that different stages of molecular biology are linked for comprehensive research outcomes.

- For instance, Bio-Rad’s SeqSense Cloud v2.2 supports analysis of single-cell RNA-Seq data from the ddSEQ Single-Cell 3′ RNA-Seq Library Prep Kit and bulk RNA-Seq data using SEQuoia Complete and SEQuoia Express kits.

By Capacity

Segmentation by capacity highlights distinct adoption patterns in low- to mid-plex and high-plex platforms. Low- to mid-plex systems are widely used in diagnostic labs and academic centers for routine studies and targeted panels. High-plex systems gain preference in advanced research and pharmaceutical applications where scalability and throughput are priorities. These platforms enable simultaneous measurement of thousands of genes, enhancing precision in large-scale studies. Growing emphasis on multi-omics integration supports demand for high-plex solutions. It creates opportunities for laboratories to expand testing capabilities while improving research efficiency.

- For instance, Oxford Nanopore’s adaptive sampling was used to enrich a pharmacogenetic (PGx) gene panel comprising over 278 unique targets sourced from the FDA, PharmGKB, and CPIC.

By End-user

End-user segmentation underscores varied adoption across pharmaceutical and biotechnology companies, diagnostic laboratories, and academic research centers. Pharmaceutical and biotechnology companies represent a leading group, using expression profiling for drug target identification, clinical trial optimization, and precision therapy development. Diagnostic laboratories adopt expression assays to strengthen early disease detection and personalized treatment strategies. Academic research centers remain vital for advancing fundamental knowledge and validating new technologies. It highlights a balanced ecosystem where each end-user group contributes to innovation and clinical translation. This diversity ensures sustained growth across applications and research domains.

Segments:

Based on Technology:

- RNA expression

- Promoter analysis

Based on Capacity:

- Low- to mid- plex

- High-plex

Based on End-User:

- Pharmaceutical and biotechnology companies

- Diagnostic laboratories

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share at 47% due to strong research infrastructure and advanced healthcare systems. The United States drives adoption with extensive use of RNA expression, promoter analysis, and protein expression technologies. High-plex platforms support complex research projects in pharmaceutical and biotechnology companies. Academic and diagnostic laboratories integrate gene expression tools for drug development and clinical studies. Government funding and private investments ensure continuous innovation. Canada also contributes through adoption in research centers and hospitals. It remains the most mature and competitive market globally.

Europe

Europe accounts for 23.4% of the market, with Germany, the UK, and France leading adoption. Pharmaceutical and biotechnology companies widely use RNA and protein expression platforms. Promoter analysis gains attention in academic research. Regulatory frameworks ensure high-quality standards for clinical and research applications. Cross-border collaborations and EU-funded initiatives strengthen market growth. Hospitals and diagnostic laboratories increasingly integrate gene expression tools. It remains a key region for innovation in precision medicine.

Asia-Pacific

Asia-Pacific holds 23.8% of the market and is the fastest-growing region. China, India, and Japan drive adoption through government-backed genomics initiatives. High-plex protein and RNA expression platforms are used in pharmaceutical R&D and clinical studies. Academic research centers integrate promoter analysis for gene regulation studies. Local manufacturing of instruments reduces costs and increases accessibility. CROs and collaborative networks boost market growth. Focus on personalized medicine and infectious disease research strengthens opportunities.

Latin America

Latin America accounts for 6.46% of the market. Adoption is growing in academic institutions, hospitals, and diagnostic laboratories. RNA expression and protein analysis technologies support pharmaceutical research and disease monitoring. Government programs encourage genomics studies for public health. Partnerships with international companies enhance technology access. Limited infrastructure slows adoption, but investments are rising. It presents a growing market for future expansion.

Middle East & Africa

Middle East & Africa hold 3.67% of the market. Adoption occurs mainly in research centers and hospitals. RNA and protein expression technologies are integrated into clinical diagnostics and academic research. Government initiatives promote genomics for healthcare improvements. Pharmaceutical collaborations increase access to advanced tools. Market growth remains moderate due to infrastructure and funding challenges. Opportunities exist for expansion with rising investments in biotechnology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Illumina, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Pacific Biosciences of California, Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Oxford Nanopore Technologies Ltd.

- Promega Corporation

- Qiagen N.V.

- GE HealthCare Technologies, Inc.

Competitive Analysis

The Gene Expression Market players include Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., GE HealthCare Technologies, Inc., Illumina, Inc., Oxford Nanopore Technologies Ltd., Pacific Biosciences of California, Inc., PerkinElmer, Inc., Promega Corporation, and Qiagen N.V. The Gene Expression Market is highly competitive, driven by rapid technological advancements and increasing demand for precise and high-throughput solutions. Companies focus on developing innovative platforms for RNA and protein analysis, improving assay accuracy, and streamlining workflow efficiency. The market benefits from rising adoption in pharmaceutical, biotechnology, and diagnostic research, where accurate gene profiling is critical for drug discovery and personalized medicine. Investments in automation, data integration, and scalable systems further enhance research capabilities. Strategic initiatives such as collaborations, partnerships, and regional expansion support market growth. Regulatory compliance and continuous innovation act as key differentiators, enabling firms to maintain competitiveness and capture emerging opportunities in the evolving landscape of gene expression analysis.

Recent Developments

- In June 2025, CRISPR Therapeutics announced positive top-line Phase 1 data for their in vivo gene editing therapy CTX 310, which show dose-dependent reduction in triglycerides (up to 82%) and LDL cholesterol (up to 81%) with a well-tolerated safety profile.

- In January 2024, Danaher Corporation collaborated with the Innovative Genomics Institute (IGI). This partnership aims to develop CRISPR-based therapies for rare genetic disorders, leveraging Danaher’s diverse technological resources and IGI’s academic expertise.

- In January 2023, Voyager Therapeutics and Neurocrine Biosciences entered into a strategic collaboration for the commercialization & development of Voyager’s GBA1 program and other next-generation gene therapies for neurological diseases.

- In January 2023, QIAGEN Digital Insights (QDI) unveiled the QIAGEN CLC Genomics Workbench Premium, designed to tackle the bottleneck in next-generation sequencing data analysis. This advanced tool combines rapid analysis capabilities with comprehensive processing and interpretation of data from whole exome sequencing (WES), whole genome sequencing (WGS), and large panel sequencing, effectively addressing the NGS data analysis bottleneck.

Report Coverage

The research report offers an in-depth analysis based on Technology, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to rising demand for personalized medicine and targeted therapies.

- Advances in high-throughput sequencing will drive faster and more accurate gene analysis.

- Integration of AI and machine learning will enhance data interpretation and predictive capabilities.

- Growth in pharmaceutical and biotechnology research will increase adoption of gene expression technologies.

- Automation of laboratory workflows will improve efficiency and reduce operational costs.

- Emerging applications in diagnostics will create new market opportunities across healthcare sectors.

- Expansion in emerging regions will support broader access to gene expression platforms.

- Continuous development of multi-omics approaches will strengthen research capabilities.

- Regulatory support for genomic research will encourage innovation and product launches.

- Strategic partnerships and collaborations will accelerate technology integration and market penetration.