Market Overview

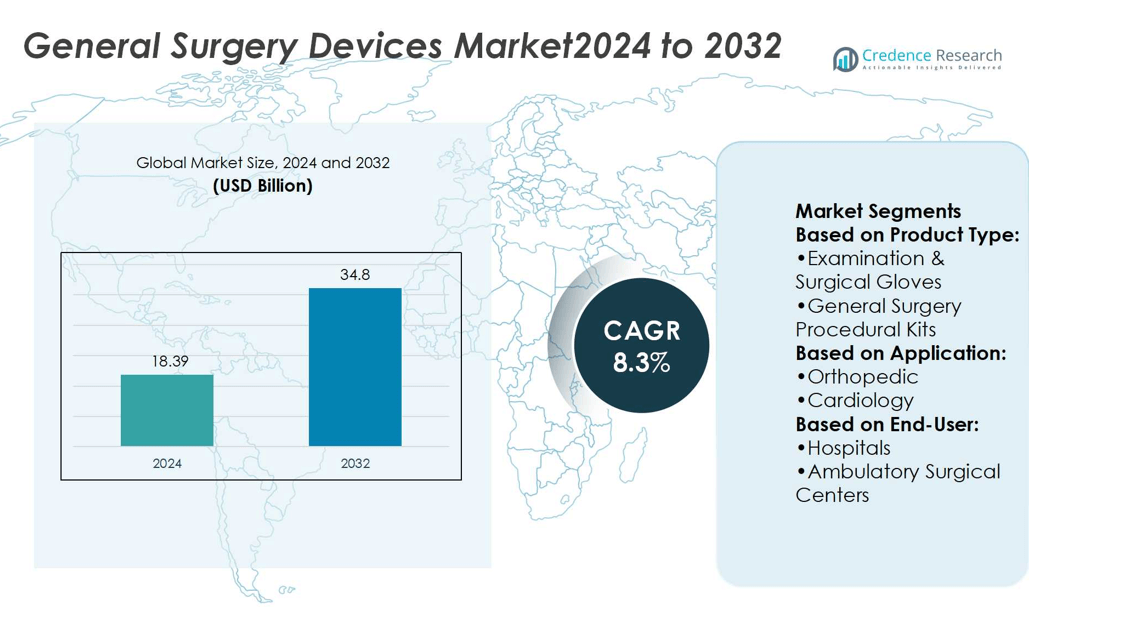

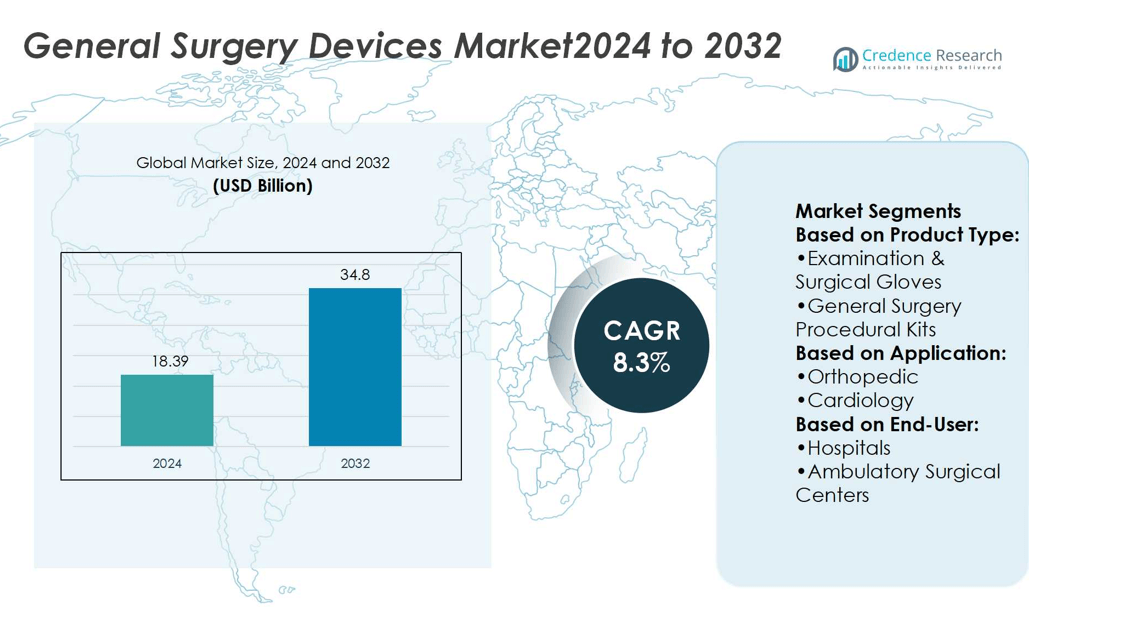

General Surgery Devices Market size was valued at USD 18.39 billion in 2024 and is anticipated to reach USD 34.8 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| General Surgery Devices Market Size 2024 |

USD 18.39 billion |

| General Surgery Devices Market, CAGR |

8.3% |

| General Surgery Devices Market Size 2032 |

USD 34.8 billion |

The General Surgery Devices Market is driven by rising surgical procedures, increasing demand for minimally invasive techniques, and continuous advancements in robotic-assisted systems. Growing prevalence of chronic diseases and aging populations further boost the need for effective surgical interventions. Healthcare providers actively adopt energy-based devices and precision instruments to improve patient outcomes and reduce recovery times. Trends highlight the integration of artificial intelligence, smart visualization tools, and data-driven platforms into surgical practices. Expanding healthcare infrastructure in emerging regions and strategic investments in research and development strengthen market growth, while sustainability and cost-effective solutions shape future purchasing decisions.

North America dominates the General Surgery Devices Market due to advanced healthcare infrastructure and high adoption of innovative technologies. Europe follows with strong regulatory support and established surgical practices, while Asia Pacific emerges as the fastest-growing region driven by expanding healthcare facilities and rising surgical demand. Latin America and the Middle East & Africa show gradual growth with improving access to care. Key players shaping the market include Medtronic, Johnson & Johnson, Stryker, B. Braun, Olympus, BD, Smith & Nephew, Boston Scientific, Conmed, and Intuitive Surgical.

Market Insights

- The General Surgery Devices Market was valued at USD 18.39 billion in 2024 and is expected to reach USD 34.8 billion by 2032, growing at a CAGR of 8.3%.

- Rising surgical procedures and increasing preference for minimally invasive techniques drive consistent demand.

- Continuous advancements in robotic-assisted systems and precision instruments enhance surgical efficiency and outcomes.

- High device costs and strict regulatory requirements act as restraints, limiting adoption in cost-sensitive regions.

- Competitive dynamics are shaped by innovation, acquisitions, and expanding product portfolios of leading companies.

- North America leads with advanced healthcare systems, Europe follows with regulatory support, and Asia Pacific records the fastest growth.

- Trends highlight growing use of AI, visualization tools, and sustainable solutions, alongside wider adoption of energy-based devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Chronic Diseases Driving Surgical Demand

The General Surgery Devices Market experiences growth from the increasing prevalence of chronic diseases requiring surgical interventions. Rising cases of cardiovascular conditions, cancer, and gastrointestinal disorders create sustained demand for surgical procedures. Hospitals rely on advanced surgical tools to improve patient outcomes and reduce recovery times. It supports the adoption of minimally invasive and robotic-assisted techniques. Growing global disease burdens push healthcare providers to expand surgical capabilities. This trend ensures consistent investments in device innovations to meet rising clinical needs.

- For instance, Cadence Inc. employs about 800 people across eight facilities in the U.S. and Costa Rica to serve markets like robotic-assisted surgery, minimally invasive procedures, diagnostics, and drug delivery.

Expansion of Minimally Invasive and Robotic-Assisted Procedures

The General Surgery Devices Market benefits from the strong adoption of minimally invasive and robotic-assisted procedures. Patients seek solutions that reduce trauma, shorten hospital stays, and improve recovery. Surgeons prefer devices that enhance accuracy and operational efficiency. It promotes continuous development of advanced surgical instruments and energy-based devices. Robotic platforms gain traction due to their precision in complex procedures. Healthcare systems allocate significant budgets to integrate these technologies. This accelerates the overall shift toward advanced surgical care.

- For instance, Boston Scientific’s FARAPULSE Pulsed Field Ablation (PFA) System has been used in over 200,000 patients globally to treat cardiac arrhythmias.

Technological Advancements Enhancing Surgical Outcomes

The General Surgery Devices Market advances with continuous improvements in surgical technologies. Energy-based devices, powered staplers, and electrosurgical instruments improve efficiency during procedures. Imaging-guided tools enhance visualization and precision. It enables surgeons to achieve better outcomes and minimize complications. Digital integration supports real-time data use in operating rooms. Device manufacturers emphasize ergonomic designs to improve usability. These advancements increase confidence among healthcare providers in adopting new solutions.

Rising Healthcare Expenditure and Infrastructure Development

The General Surgery Devices Market gains momentum from rising healthcare expenditure and expanding hospital infrastructure worldwide. Governments and private sectors invest in upgrading surgical facilities to meet growing demand. It ensures access to modern devices in both developed and emerging regions. Improved reimbursement policies encourage hospitals to adopt advanced equipment. Rapid urbanization increases the patient pool requiring surgical care. Expansion of healthcare networks supports large-scale procurement of surgical tools. These factors collectively drive long-term market growth.

Market Trends

Growing Adoption of Robotic and AI-Integrated Surgical Systems

The General Surgery Devices Market observes strong momentum from robotic and AI-integrated systems. Hospitals invest in platforms that improve accuracy and reduce human error. It supports greater adoption in complex surgeries such as oncology and cardiovascular care. AI-enabled devices enhance surgical planning and intraoperative decision-making. Robotics allow minimally invasive approaches with smaller incisions and faster recovery. Rising preference for advanced tools drives consistent innovation. This trend strengthens the shift toward technology-driven surgery worldwide.

- For instance, Integra’s MicroMatrix® UBM (Urinary Bladder Matrix) and Cytal® Wound Matrix sheets have been used in more than 360,000 procedures globally to support tissue regeneration.

Increasing Demand for Minimally Invasive Surgical Procedures

The General Surgery Devices Market benefits from the rising preference for minimally invasive surgery. Patients favor reduced pain, shorter stays, and faster return to normal activities. Healthcare providers adopt advanced laparoscopic instruments and energy-based devices. It supports the replacement of traditional open surgeries with less invasive techniques. Demand is particularly high in procedures related to gynecology, urology, and gastroenterology. Growing awareness of patient-centered care accelerates this shift. Hospitals adapt infrastructure to accommodate minimally invasive solutions.

- For instance, Conmed’s Zone Specific AIM™ Device delivers implants and sutures for meniscal tear repair; the handheld device deploys implants in two configurations with a 25-degree curved needle and a 15-degree reverse curve.

Integration of Smart and Connected Surgical Devices

The General Surgery Devices Market advances with the integration of smart and connected devices. Sensors and IoT-enabled platforms allow real-time monitoring of surgical outcomes. It provides better tracking of device performance and patient safety. Digital dashboards in operating rooms help surgeons analyze data instantly. Manufacturers focus on interoperability to align devices with hospital information systems. Smart surgical instruments reduce risk and improve workflow efficiency. These features position connected devices as essential components of future surgeries.

Rising Focus on Single-Use and Disposable Surgical Instruments

The General Surgery Devices Market expands with growing demand for single-use and disposable devices. Infection control and regulatory compliance fuel this shift. It reduces risks of cross-contamination and supports strict hygiene protocols. Hospitals adopt disposable staplers, trocars, and energy devices to ensure safety. Manufacturers highlight cost efficiency and time savings in sterilization. Demand increases across both developed and emerging regions. This trend supports sustainable growth in the surgical devices landscape.

Market Challenges Analysis

High Cost of Advanced Surgical Devices and Limited Accessibility

The General Surgery Devices Market faces challenges due to the high cost of advanced instruments and robotic platforms. Many hospitals in developing regions struggle to afford cutting-edge technologies, restricting widespread adoption. It creates inequality in surgical care between developed and emerging economies. Limited reimbursement for certain procedures further discourages investment in innovative devices. Smaller healthcare facilities often continue using traditional instruments to manage budgets. This restricts the growth potential of technologically advanced solutions. The gap between affordability and accessibility remains a significant barrier.

Stringent Regulatory Approvals and Shortage of Skilled Professionals

The General Surgery Devices Market encounters hurdles from stringent regulatory approval processes and shortage of trained professionals. Regulatory agencies require extensive clinical evidence, which delays product launches and increases costs. It slows the entry of new technologies into global markets. A lack of skilled surgeons trained in minimally invasive and robotic procedures limits utilization of advanced tools. Training requirements demand significant time and resources for healthcare providers. Emerging regions face the highest impact due to limited infrastructure and expertise. These constraints restrict the pace of adoption across key markets.

Market Opportunities

Expansion in Emerging Healthcare Markets and Rising Infrastructure Investments

The General Surgery Devices Market presents strong opportunities in emerging economies driven by healthcare infrastructure growth. Governments in Asia Pacific, Latin America, and the Middle East allocate significant budgets to upgrade surgical facilities. It creates demand for advanced devices across public and private hospitals. Rising medical tourism in these regions further accelerates adoption of innovative surgical solutions. Expanding hospital networks enable access to modern operating rooms equipped with advanced tools. Improved reimbursement structures support broader availability of surgical devices. These conditions open significant avenues for global manufacturers to expand presence.

Innovation in Minimally Invasive and Smart Surgical Technologies

The General Surgery Devices Market benefits from opportunities linked to innovation in minimally invasive and smart surgical technologies. Growing demand for laparoscopic and robotic-assisted procedures encourages continuous product development. It pushes manufacturers to design devices with integrated imaging, AI support, and enhanced ergonomics. Smart surgical tools improve precision, reduce complications, and enhance patient safety. Rising adoption of disposable and single-use devices creates new revenue streams. Expanding partnerships between device makers and healthcare providers foster tailored solutions. These innovations strengthen growth prospects across multiple surgical specialties.

Market Segmentation Analysis:

By Product Type

The General Surgery Devices Market demonstrates strong diversification across multiple product categories. Disposable surgical supplies, including non-wovens, gloves, procedural kits, needles, and syringes, account for a significant share due to consistent demand in routine procedures and infection control practices. Venous access catheters and open surgery instruments, such as retractors, dilators, and catheters, remain essential in complex interventions. Energy-based and powered instruments expand adoption due to their precision and efficiency in tissue management. Minimally invasive surgery instruments gain rapid growth, driven by rising patient preference for less invasive procedures. Medical robotics and computer-assisted devices stand out as high-value segments supported by technological advancements. Adhesion prevention products contribute to safer surgical outcomes, reinforcing overall demand.

- For instance, Erbe’s ICC series electrosurgical generators had more than 80,000 units installed globally, making it its most successful electrosurgical generator line.

By Application

The General Surgery Devices Market serves a wide range of medical specialties. Orthopedic and cardiology applications generate high demand, supported by growing prevalence of musculoskeletal and cardiovascular conditions requiring surgery. Ophthalmology and wound care utilize advanced surgical kits and energy-based devices for precision treatments. Neurosurgery, plastic surgery, and urology demonstrate rising adoption of minimally invasive and robotic-assisted systems. It also supports gynecology procedures, where laparoscopic instruments and adhesion prevention products improve outcomes. Other applications, including gastrointestinal and general surgical interventions, further broaden the market scope. Increasing demand across varied specialties ensures sustained device utilization.

- For instance, 3m advanced wound care and skin integrity portfolio includes over 20 different dressing types, including antimicrobial, silicone non-adherent, and hydrogel versions.

By End-User

The General Surgery Devices Market finds its primary customers in hospitals, which dominate due to large surgical volumes and comprehensive infrastructure. Hospitals invest heavily in advanced equipment, including robotics and energy-based systems, to meet patient needs. Ambulatory surgical centers show strong growth, supported by rising preference for outpatient surgeries that reduce costs and recovery times. Specialty clinics adopt targeted surgical instruments for niche procedures, enhancing care in focused medical areas. It creates opportunities for manufacturers to tailor devices for smaller-scale facilities. Other end-users, including academic and research centers, contribute by integrating devices into training and clinical studies. Expanding demand across all end-user segments supports balanced market growth.

Segments:

Based on Product Type:

- Examination & Surgical Gloves

- General Surgery Procedural Kits

Based on Application:

Based on End-User:

- Hospitals

- Ambulatory Surgical Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the General Surgery Devices Market in 2024, accounting for 38.6% of the global market. The region benefits from advanced healthcare infrastructure, strong regulatory frameworks, and high adoption of technologically advanced surgical instruments. Hospitals and ambulatory surgical centers in the United States and Canada invest heavily in robotic-assisted systems, powered surgical tools, and minimally invasive devices. It remains the leading region due to favorable reimbursement policies, rising surgical volumes, and a strong presence of global medical device manufacturers. The prevalence of chronic diseases such as cardiovascular disorders and cancer creates steady demand for surgical interventions. High levels of R&D expenditure and continuous product innovation further strengthen market leadership. Growing collaborations between hospitals and medical device companies ensure rapid adoption of new technologies, keeping North America ahead in market growth and innovation.

Europe

Europe represented 27.4% of the General Surgery Devices Market in 2024, making it the second-largest regional market. The region demonstrates strong demand driven by an aging population, high prevalence of chronic diseases, and significant healthcare expenditure. Countries such as Germany, the United Kingdom, and France serve as major hubs for advanced surgical procedures. It benefits from favorable government funding for research, stringent safety standards, and the availability of skilled surgeons. European hospitals focus on integrating minimally invasive and robotic-assisted technologies to improve efficiency and patient outcomes. Adoption of disposable surgical supplies remains high due to strict infection control regulations. Continuous growth in healthcare modernization and public–private partnerships enhances the accessibility of advanced surgical equipment across the region. The presence of leading medical device companies and supportive policies ensure Europe maintains a dominant share in global adoption.

Asia Pacific

Asia Pacific captured 21.8% of the General Surgery Devices Market in 2024 and is projected to be the fastest-growing region. Rising healthcare investments, growing surgical volumes, and expanding hospital infrastructure fuel market expansion across countries such as China, India, and Japan. It shows significant growth potential due to rapid urbanization, increasing disposable incomes, and the rising burden of chronic diseases. Medical tourism in countries such as India, Thailand, and Singapore strengthens demand for advanced surgical technologies. Government-led initiatives to expand healthcare access create new opportunities for global and regional manufacturers. Adoption of minimally invasive and robotic systems is accelerating, supported by rising awareness of advanced treatment options. With growing local manufacturing capabilities and rising R&D activity, Asia Pacific is emerging as a critical hub for future market growth.

Latin America

Latin America accounted for 6.2% of the General Surgery Devices Market in 2024. Brazil and Mexico lead the region due to growing healthcare investments, rising medical tourism, and expanding hospital networks. It faces challenges from limited reimbursement policies and economic constraints, yet surgical procedure volumes continue to rise. Demand for disposable surgical supplies, minimally invasive instruments, and adhesion prevention products remains strong. Increasing government focus on healthcare modernization supports adoption of advanced devices. Regional healthcare reforms and international partnerships expand accessibility of surgical technologies. Despite infrastructure limitations, steady growth is expected as healthcare facilities improve across the region.

Middle East and Africa

The Middle East and Africa contributed 6.0% to the General Surgery Devices Market in 2024. The region shows gradual growth driven by rising investments in healthcare infrastructure and expanding private hospital networks. Gulf countries, including Saudi Arabia and the United Arab Emirates, invest heavily in modern surgical facilities and robotic systems. It gains momentum from the growing demand for advanced procedures among a rising middle-class population. Africa lags behind due to limited infrastructure and shortage of trained professionals, yet improvements in healthcare access support gradual adoption. International collaborations and government funding initiatives aim to strengthen surgical capacities. Growing focus on infection control, disposable instruments, and energy-based systems drives incremental market growth across both subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cadence Inc

- Boston Scientific Corporation

- Integra LifeSciences

- Conmed Corporation

- Erbe Elektromedizin Gmbh

- 3M

- Becton

- Integer Holdings Corporation

- Braun Melsungen Ag

- Dickinson and Company

Competitive Analysis

The General Surgery Devices Market players such as Medtronic Plc, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, Olympus Corporation, Becton, Dickinson & Company, Smith & Nephew, Boston Scientific Corporation, Conmed Corporation, Intuitive Surgical Inc. The General Surgery Devices Market demonstrates intense competition, driven by continuous innovation and rapid adoption of advanced technologies. Market participants are investing heavily in research and development to enhance robotic-assisted surgery systems, energy-based surgical devices, and minimally invasive solutions. These innovations aim to improve surgical precision, reduce recovery times, and enhance patient outcomes, making them highly attractive to hospitals and healthcare providers worldwide. Companies are also expanding their product portfolios through acquisitions, collaborations, and partnerships, allowing them to strengthen market presence and address diverse clinical needs across specialties. Despite strong growth opportunities, the market faces challenges such as high device costs, strict regulatory frameworks, and growing demand for affordable solutions in cost-sensitive regions. These factors often slow product adoption in developing economies, placing pressure on pricing strategies and profit margins.

Recent Developments

- In October 2024, Smith & Nephew signed a co-marketing agreement with JointVue for its patented OrthoSonic 3D Surgery Planning Technology. JointVue’s technology enables surgeons utilizing Smith+Nephew’s CORI Surgical System to develop personalized surgical plans for robotic-assisted knee arthroplasty.

- In August 2024, Johnson & Johnson announced the launch of the MatrixSTERNUM Fixation System. This advanced plate and screw fixation system is designed to stabilize and secure the anterior chest wall following procedures such as open-heart surgery and chest surgery.

- In February 2024, Boston Scientific Corporation received U.S. FDA approval for its WaveWriter spinal cord stimulator systems used in the treatment of chronic lower back and leg pain.

- In January 2024, GE Healthcare entered into an agreement to acquire MIM Software, one of the leading providers of medical imaging analysis and AI solutions. The company specializes in areas such as radiation oncology, molecular radiotherapy, diagnostic imaging, and urology in various healthcare settings.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of minimally invasive surgical techniques.

- Robotic-assisted surgery will gain wider acceptance across hospitals and specialty clinics.

- Demand for energy-based surgical devices will rise due to higher efficiency and precision.

- Emerging economies will offer strong growth opportunities with expanding healthcare infrastructure.

- Increasing surgical volumes will drive continuous investment in advanced surgical technologies.

- Artificial intelligence and data integration will enhance surgical planning and execution.

- Strategic mergers and acquisitions will remain a key route to portfolio expansion.

- Regulatory compliance will become more stringent, requiring higher investment in clinical validation.

- Cost pressure will encourage development of affordable yet advanced surgical solutions.

- Sustainability and reusable devices will gain importance in procurement decisions of healthcare providers.