Market Overview

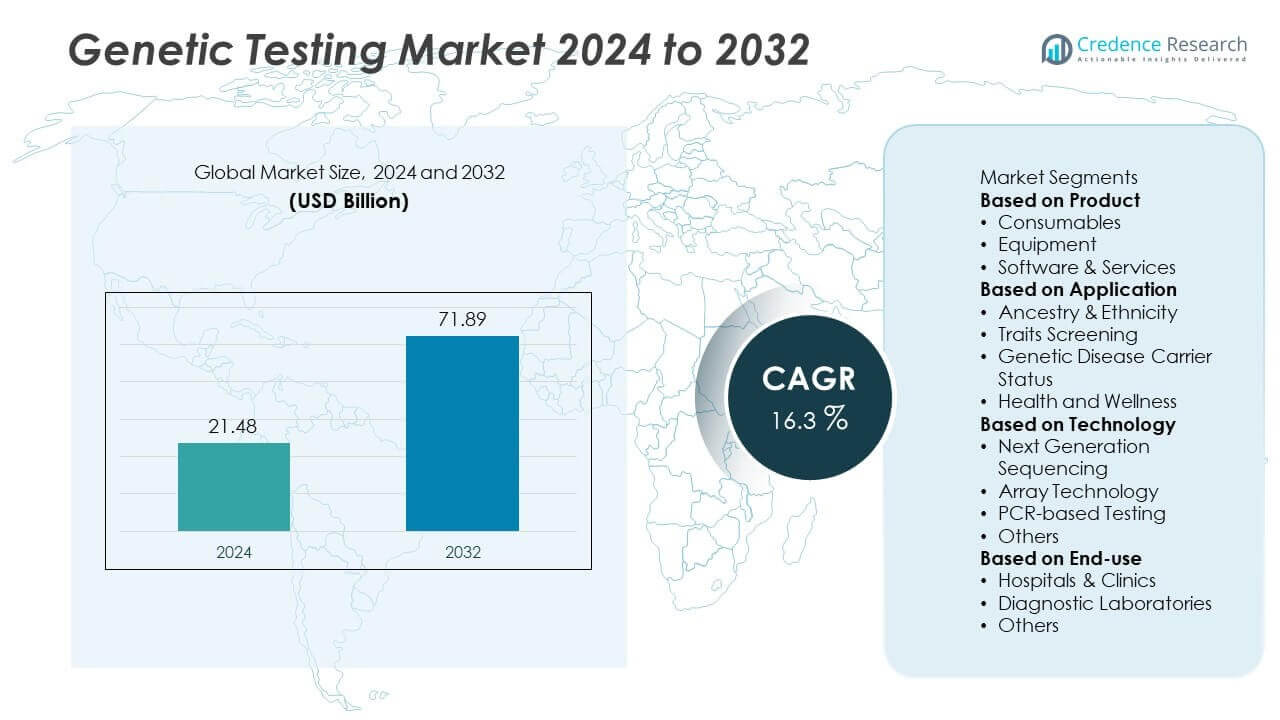

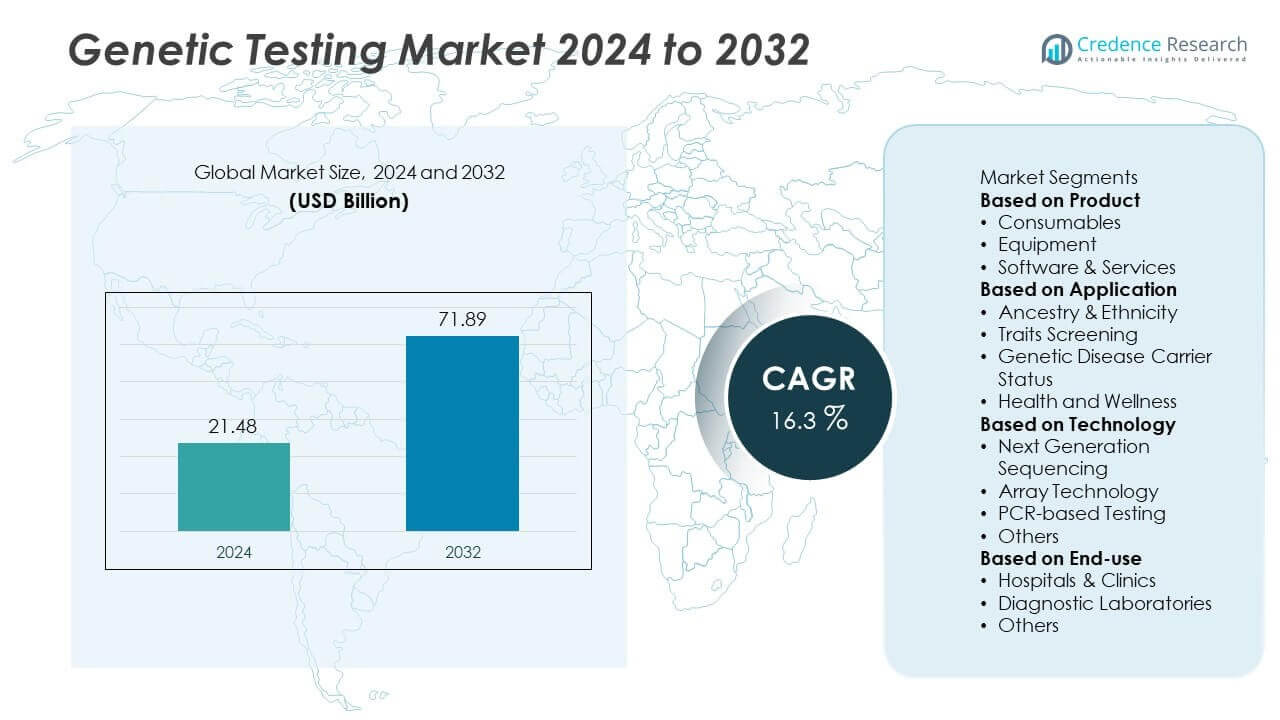

The Genetic Testing Market was valued at USD 21.48 billion in 2024 and is projected to reach USD 71.89 billion by 2032, expanding at a CAGR of 16.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Genetic Testing Market Size 2024 |

USD 21.48 Million |

| Genetic Testing Market, CAGR |

16.3% |

| Genetic Testing Market Size 2032 |

USD 71.89 Million |

The Genetic Testing Market is driven by rising demand for early disease detection, personalized medicine, and preventive healthcare. Growing adoption in oncology, rare diseases, and pharmacogenomics strengthens its role in improving treatment outcomes.

The Genetic Testing Market shows dynamic growth across major regions, each shaped by distinct healthcare priorities and infrastructure levels. North America leads in adoption, supported by advanced diagnostic facilities, strong research funding, and widespread use of genetic testing in oncology and pharmacogenomics. Europe emphasizes regulatory compliance, prenatal and newborn screening programs, and integration of genetic testing into national healthcare systems. Asia-Pacific is expanding rapidly with government-backed genomics initiatives, rising healthcare investments, and a growing middle-class population seeking preventive healthcare solutions. Latin America and the Middle East & Africa are gradually increasing adoption, driven by modernization of healthcare infrastructure and rising awareness of genetic disorders. Key players such as Illumina, Inc., Myriad Genetics, Inc., Igenomix, and AncestryDNA focus on expanding genetic testing platforms, enhancing sequencing technologies, and developing personalized medicine solutions. Their investments in innovation, accessibility, and partnerships continue to shape global growth and strengthen the market landscape.

Market Insights

- The Genetic Testing Market was valued at USD 21.48 billion in 2024 and is projected to reach USD 71.89 billion by 2032, growing at a CAGR of 16.3%.

- Rising demand for early disease detection, personalized medicine, and predictive healthcare is a major driver of adoption across global healthcare systems.

- Key market trends include increasing use of next-generation sequencing, multi-gene panel testing, bioinformatics integration, and growth of direct-to-consumer genetic testing platforms.

- Competitive landscape features players such as Illumina, Inc., Myriad Genetics, Inc., Igenomix, and AncestryDNA, who focus on sequencing innovations, personalized medicine tools, and global expansion strategies.

- Market restraints include high testing costs, limited accessibility in low-income regions, and ethical concerns around data privacy and regulatory inconsistencies.

- North America demonstrates strong demand supported by advanced infrastructure and early adoption of pharmacogenomics, while Europe emphasizes compliance, newborn screening, and population genomics.

- Asia-Pacific is the fastest-growing region, driven by large-scale genomics initiatives, expanding healthcare investments, and rising consumer awareness, while Latin America and the Middle East & Africa show steady adoption supported by improving healthcare modernization and growing awareness of genetic disorders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Early Disease Detection and Preventive Care

The Genetic Testing Market is driven by increasing demand for early diagnosis of inherited and chronic diseases. Genetic testing allows identification of disease risks before symptoms develop, supporting preventive healthcare. It enables physicians to recommend timely interventions and lifestyle changes, improving patient outcomes. Growing awareness among patients about proactive health management strengthens adoption. Governments and healthcare providers promote screening programs to reduce the burden of chronic diseases. Rising consumer interest in predictive and carrier testing continues to accelerate market demand.

- For instance, Myriad Genetics launched FirstGene™, a prenatal screening test that uses a single maternal blood sample to assess risk for fetal aneuploidies, a targeted number of serious fetal recessive conditions, and maternal carrier status, reducing the need for invasive testing.

Expansion of Personalized Medicine and Tailored Therapies

The Genetic Testing Market benefits from the growing shift toward personalized medicine. Genetic insights guide physicians in designing treatments based on an individual’s genetic profile. It improves drug efficacy, reduces adverse reactions, and optimizes therapeutic strategies. Pharmaceutical companies use genetic testing to identify patient subgroups for targeted drug development. Integration of pharmacogenomics into clinical practice expands adoption across oncology, neurology, and cardiology. Increasing acceptance of customized healthcare solutions reinforces the role of genetic testing in modern medicine.

- For instance, Helix expanded its pharmacogenomic portfolio with a DPYD test, which can detect gene variants that affect fluoropyrimidine metabolism, enabling doctors to personalize treatment and reduce the risk of life-threatening toxicity in the estimated 2–8% of U.S. cancer patients who carry these variants.

Technological Advancements in Sequencing and Bioinformatics

The Genetic Testing Market gains momentum from rapid advancements in next-generation sequencing (NGS), microarrays, and bioinformatics tools. These technologies reduce the cost and time required for comprehensive genetic analysis. It increases accuracy, sensitivity, and the ability to detect rare mutations. Enhanced computational tools allow researchers to analyze large datasets and generate clinically actionable results. The combination of improved technology and declining sequencing costs expands testing availability to broader populations. Continuous R&D investments support innovation and scalability in genetic testing platforms.

Supportive Regulatory Frameworks and Growing Healthcare Investments

The Genetic Testing Market is supported by favorable government policies and healthcare funding. Regulatory agencies provide guidelines to ensure quality, safety, and reliability of genetic tests. It builds trust among patients and providers, encouraging adoption across healthcare systems. National healthcare programs integrate genetic screening for conditions such as cancer, newborn disorders, and rare diseases. Rising healthcare investments in developed and emerging economies support widespread implementation of genetic services. Insurance coverage for certain tests further improves accessibility, reinforcing long-term market growth.

Market Trends

Growing Popularity of Direct-to-Consumer Genetic Testing Services

The Genetic Testing Market is witnessing increasing adoption of direct-to-consumer platforms. These services provide individuals with easy access to genetic insights without clinical involvement. It empowers consumers to explore ancestry, wellness traits, and potential health risks. Companies expand their offerings with affordable kits and user-friendly reports. Rising interest in personalized health management drives strong demand in this segment. Greater consumer awareness and digital engagement reinforce this trend globally.

- For instance, in February 2025, MyHeritage updated its DNA Ethnicity Estimate to cover 79 population groups, nearly doubling its previous coverage of 42 groups. This allowed millions of users to receive more detailed ancestry results.

Integration of Artificial Intelligence and Big Data Analytics

The Genetic Testing Market benefits from the integration of AI and big data in analysis workflows. Advanced algorithms process large genetic datasets quickly and deliver precise results. It supports faster identification of disease markers and actionable clinical insights. AI enhances predictive accuracy in oncology, rare diseases, and pharmacogenomics. Cloud-based bioinformatics platforms further improve scalability and accessibility. Growing reliance on digital technologies strengthens the efficiency and value of genetic testing.

- For instance, Illumina announced that its AI-enabled DRAGEN v4.3 secondary analysis software reduced whole-genome analysis time to under 25 minutes per genome, processing datasets of more than 3 billion base pairs with high accuracy.

Expansion of Prenatal and Newborn Genetic Screening Programs

The Genetic Testing Market shows strong growth in prenatal and newborn screening applications. Rising demand for early detection of congenital disorders boosts adoption across hospitals and clinics. It enables healthcare providers to identify conditions such as Down syndrome and cystic fibrosis at an early stage. Expanding government-backed screening initiatives improve accessibility in developed and emerging economies. Parents increasingly opt for these services to ensure timely interventions. This trend establishes genetic testing as a key element in maternal and child healthcare.

Advancements in Multi-Gene and Panel Testing Solutions

The Genetic Testing Market is shaped by growing demand for multi-gene panels and comprehensive test solutions. These panels detect multiple conditions in a single analysis, offering efficiency and cost-effectiveness. It provides clinicians with broader insights into genetic predispositions across several diseases. Oncology and rare disease management benefit strongly from this approach. Laboratories invest in expanding test panels to address rising clinical needs. Adoption of panel testing reflects a shift toward broader and more integrated diagnostic strategies.

Market Challenges Analysis

High Costs and Limited Accessibility in Developing Regions

The Genetic Testing Market faces challenges from the high cost of advanced sequencing technologies and limited accessibility in low-income regions. Many tests require specialized equipment, trained professionals, and advanced laboratory infrastructure, increasing overall expenses. It restricts adoption in developing countries where healthcare budgets remain constrained. Lack of insurance coverage for comprehensive testing further limits access for large populations. Price sensitivity also discourages widespread use in preventive healthcare. Overcoming these barriers requires affordable solutions and scalable testing models.

Ethical Concerns, Regulatory Variations, and Data Privacy Issues

The Genetic Testing Market is affected by ethical concerns, inconsistent regulations, and rising data privacy issues. Variations in national policies complicate test approvals and create uncertainty for global companies. It increases compliance costs and slows international market expansion. Patients and providers express concerns about genetic data misuse, discrimination, and lack of transparency in results. Ethical debates around predictive testing and direct-to-consumer services further challenge adoption. Maintaining patient trust and ensuring consistent regulatory frameworks remain critical hurdles for sustainable growth.

Market Opportunities

Expansion of Personalized Medicine and Pharmacogenomics Applications

The Genetic Testing Market holds strong opportunities through the global shift toward personalized medicine. Genetic insights enable physicians to design treatment plans tailored to an individual’s DNA profile, improving therapeutic outcomes. It supports pharmacogenomics by identifying how patients respond to specific drugs, reducing adverse reactions and optimizing prescriptions. Oncology, neurology, and cardiology are key fields where personalized testing shows strong potential. Pharmaceutical companies increasingly integrate genetic testing into clinical trials to identify responsive patient groups. Rising demand for targeted therapies ensures steady growth in this segment.

Adoption in Emerging Economies and Preventive Healthcare Programs

The Genetic Testing Market benefits from rising opportunities in emerging economies where healthcare modernization is accelerating. Governments and private providers invest in preventive screening programs to manage rising cases of chronic and genetic disorders. It opens avenues for wider adoption of carrier testing, prenatal diagnostics, and newborn screening. Growing middle-class populations and improving healthcare infrastructure support demand for advanced diagnostics. Declining sequencing costs make tests more affordable and accessible across developing regions. Expanding adoption in these markets offers significant growth opportunities for global players.

Market Segmentation Analysis:

By Product

The Genetic Testing Market is segmented by product into consumables, instruments, and software and services. Consumables, including reagents and test kits, dominate demand due to their recurring use in laboratories and clinical settings. It ensures consistent revenue streams for manufacturers as each test requires fresh supplies. Instruments such as sequencers and microarrays hold strong adoption in advanced diagnostic centers and research institutes. Software and services gain importance through bioinformatics platforms that enable accurate interpretation of complex genetic data. Growing reliance on digital analysis tools reinforces the role of software in supporting precise testing outcomes.

- For instance, in September 2022 Illumina launched its NovaSeq X Plus system, which enables laboratories to process over 20,000 whole genomes per year. In January 2025, Illumina announced software upgrades and new kits for the NovaSeq X Series to further enhance multiomic capabilities.

By Application

The Genetic Testing Market, by application, includes oncology, rare and inherited disorders, prenatal and newborn testing, and pharmacogenomics. Oncology remains the largest segment, driven by rising cancer cases and demand for early detection through genetic biomarkers. Rare and inherited disorders also represent a significant share, with genetic testing providing crucial insights for diagnosis and treatment planning. Prenatal and newborn screening is expanding rapidly, supported by government-backed health programs and parental demand for early detection of congenital conditions. It also gains traction in pharmacogenomics, where testing supports drug safety and personalized prescriptions. Growing use across diverse applications highlights the versatility of genetic testing.

- For instance, in 2020, Igenomix launched Embrace, a non-invasive embryo test that analyzes chromosomal status from a drop of spent culture media, offering results without the need for an embryo biopsy. In 2020, Igenomix announced new validation data for the test, supported by a study published in the American Journal of Obstetrics & Gynecology.

By Technology

The Genetic Testing Market is categorized by technology into polymerase chain reaction (PCR), next-generation sequencing (NGS), microarrays, and others. PCR dominates as a widely adopted method due to its cost-effectiveness, speed, and broad utility in clinical diagnostics. NGS is the fastest-growing segment, offering high throughput, precision, and comprehensive genomic coverage. It supports advanced applications in oncology, rare diseases, and large-scale population studies. Microarrays retain relevance in specific diagnostic applications, offering efficiency in multi-gene analysis. Continuous improvements in sequencing platforms and declining costs expand accessibility of advanced technologies. The balance of established and emerging methods strengthens the technological foundation of genetic testing worldwide.

Segments:

Based on Product

- Consumables

- Equipment

- Software & Services

Based on Application

- Ancestry & Ethnicity

- Traits Screening

- Genetic Disease Carrier Status

- Health and Wellness

Based on Technology

- Next Generation Sequencing

- Array Technology

- PCR-based Testing

- Others

Based on End-use

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 40% of the Genetic Testing Market share in 2024, making it the largest regional contributor. The region benefits from advanced healthcare infrastructure, widespread use of genetic diagnostics, and high awareness of preventive testing. The United States leads adoption with strong demand in oncology, pharmacogenomics, and direct-to-consumer testing. Canada contributes through supportive government policies, growing biotechnology investments, and expanding newborn screening programs. It also benefits from favorable reimbursement frameworks that improve access to advanced tests. Rising collaborations between research institutes and technology companies further strengthen innovation in this market.

Europe

Europe holds about 27% of the Genetic Testing Market share in 2024. Countries such as Germany, France, and the United Kingdom dominate regional growth, supported by strict regulatory frameworks, national screening initiatives, and a strong pharmaceutical base. Widespread adoption of prenatal and newborn screening across EU nations fuels demand. It also benefits from increasing integration of genetic testing into precision medicine and cancer care. Eastern European countries are gradually adopting testing solutions as healthcare investments expand. Strong emphasis on data privacy, regulatory compliance, and sustainable healthcare practices reinforces Europe’s market position.

Asia-Pacific

Asia-Pacific represents nearly 23% of the Genetic Testing Market share in 2024 and is the fastest-growing region. China leads adoption with heavy government investment in genomics, advanced research facilities, and rising cancer incidence rates. Japan and South Korea contribute with advanced technology platforms and integration of genetic testing into precision medicine initiatives. India is emerging as a key growth hub due to rising awareness, rapid urbanization, and increasing affordability of testing services. It also benefits from a growing middle-class population seeking preventive healthcare solutions. Expanding research collaborations and large-scale genomic projects further position Asia-Pacific as a vital growth engine.

Latin America

Latin America holds close to 6% of the Genetic Testing Market share in 2024. Brazil leads with growing adoption in oncology and prenatal testing, supported by private healthcare providers and research centers. Mexico shows steady growth through rising partnerships with international diagnostics companies. Argentina, Chile, and Colombia expand adoption of genetic services in niche areas such as rare diseases and carrier screening. It faces challenges from high testing costs and limited insurance coverage, but rising healthcare modernization and government-backed programs are improving accessibility. Growing medical tourism in parts of the region further supports steady market expansion.

Middle East and Africa

The Middle East and Africa together account for about 4% of the Genetic Testing Market share in 2024. The Middle East, led by Saudi Arabia, the United Arab Emirates, and Israel, demonstrates strong adoption of genetic testing in oncology, reproductive health, and rare disease management. Africa shows gradual progress, with South Africa, Nigeria, and Egypt being the primary markets where awareness and infrastructure are improving. It faces barriers such as affordability, limited skilled professionals, and insufficient laboratory capacity. However, government-backed healthcare modernization, expanding private sector investments, and international collaborations are opening new opportunities. The gradual push for preventive healthcare and population screening programs is expected to strengthen growth in this region over the forecast period.

Key Player Analysis

- Mapmygenome

- Helix OpCo LLC

- MyDNA

- MyHeritage Ltd.

- Everly Well

- Illumina, Inc.

- Igenomix

- VitaGen

- Myriad Genetics, Inc.

- AncestryDNA

Competitive Analysis

Competitive landscape in the Genetic Testing Market is defined by key players including Illumina, Inc., Myriad Genetics, Inc., Igenomix, AncestryDNA, MyDNA, Everly Well, Helix OpCo LLC, MyHeritage Ltd., Mapmygenome, and VitaGen. These companies drive market growth through continuous innovation in sequencing technologies, expansion of multi-gene panels, and development of direct-to-consumer platforms. Focus areas include oncology, pharmacogenomics, prenatal testing, and ancestry services, which collectively broaden the scope of adoption across clinical and consumer segments. It is also influenced by investments in bioinformatics, AI integration, and digital platforms that enhance test accuracy and streamline data interpretation. Strategic partnerships with healthcare providers, laboratories, and research organizations strengthen global reach and ensure compliance with regional regulations. Expansion into emerging economies with cost-effective solutions supports wider accessibility and long-term growth. The competitive intensity pushes companies to diversify offerings, improve affordability, and prioritize personalized medicine applications. This dynamic environment positions leading players to sustain market leadership and capture growing global demand for genetic testing solutions.

Recent Developments

- In May 2025, Helix expanded its pharmacogenomic (PGx) test offerings by adding the PGx Fluoropyrimidines DPYD Test. This helps predict how patients metabolize certain cancer therapies, reducing risk of severe toxicity.

- In May 2025, Myriad Genetics, Inc. A real-world study showed that their RiskScore tool (part of the MyRisk Hereditary Cancer Test) influenced breast cancer screening decisions in alignment with individual risk.

- In February 2025, MyHeritage released Ethnicity Estimate v2.5, an improved DNA ethnicity model. It nearly doubled the number of ethnicities identifiable (from 42 to 79).

- In 2025, MapmyGenome acquired Canadian CRO Microbiome Insights, enhancing its capabilities in microbiome sequencing/analysis and expanding its international reach.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Technology, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized medicine will drive adoption of advanced genetic testing solutions.

- Expansion of direct-to-consumer testing services will increase accessibility for broader populations.

- Next-generation sequencing will continue to dominate with declining costs and improved accuracy.

- Multi-gene panel testing will gain traction for oncology, rare diseases, and preventive healthcare.

- Integration of AI and bioinformatics will enhance speed, precision, and data interpretation.

- Prenatal and newborn screening programs will expand across developed and emerging economies.

- Regulatory frameworks will evolve to strengthen quality, data privacy, and ethical standards.

- Emerging economies will see accelerated adoption through government-backed healthcare initiatives.

- Partnerships between biotech firms and healthcare providers will improve scalability and reach.

- Rising awareness of preventive healthcare will reinforce long-term market growth and innovation.