Market Overview

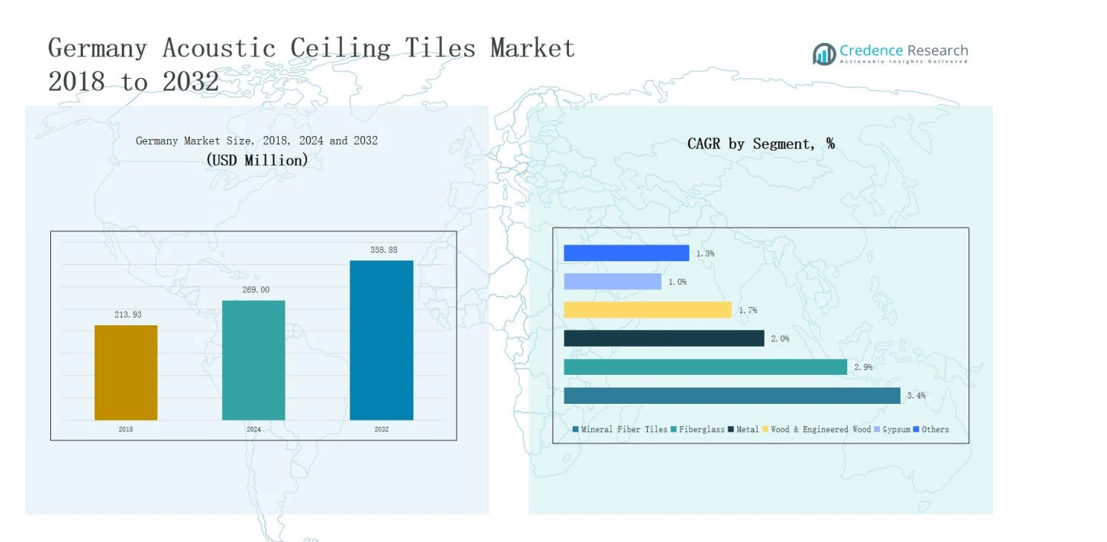

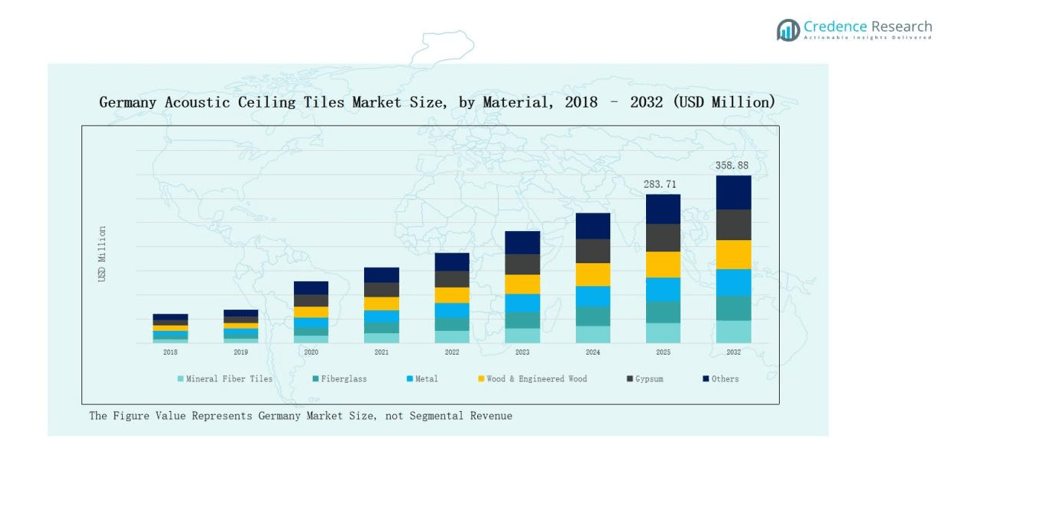

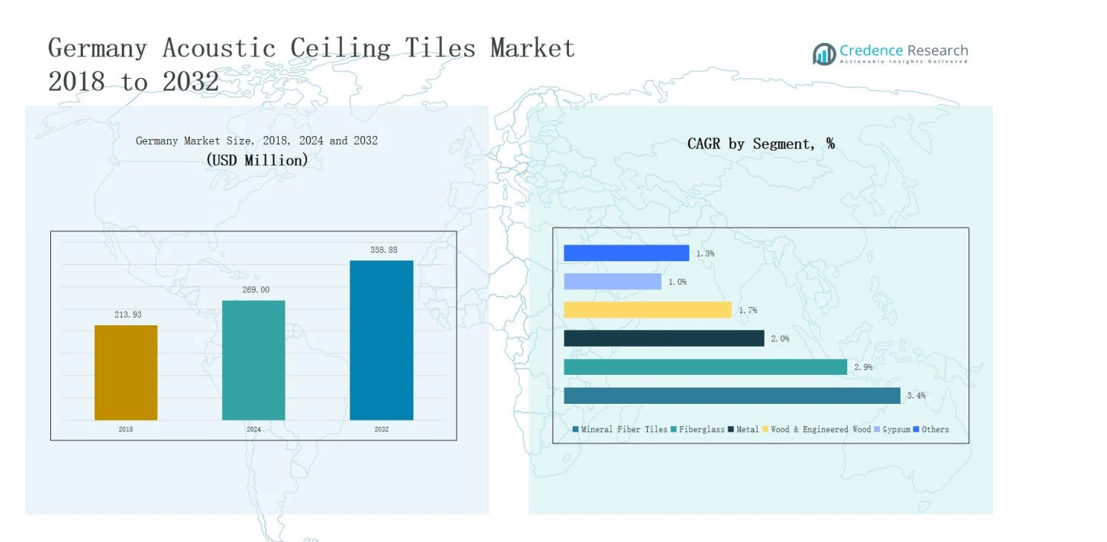

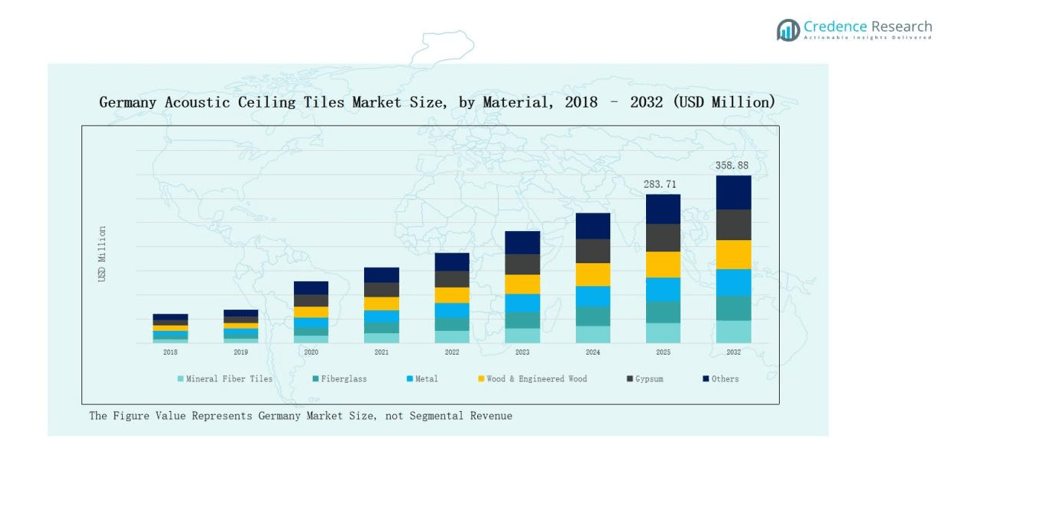

Germany Acoustic Ceiling Tiles Market size was valued at USD 213.93 million in 2018, reached USD 269.00 million in 2024, and is anticipated to reach USD 358.88 million by 2032, at a CAGR of 3.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Acoustic Ceiling Tiles Market Size 2024 |

USD 269.00 million |

| Germany Acoustic Ceiling Tiles Market, CAGR |

3.41% |

| Germany Acoustic Ceiling Tiles Market Size 2032 |

USD 358.88 million |

The Germany Acoustic Ceiling Tiles Market is shaped by global leaders and regional specialists that focus on product innovation, sustainability, and broad distribution networks. Key players include Knauf Insulation, Saint-Gobain, Armstrong World Industries, Rockfon Germany, OWA GmbH, USG Boral Germany, Hunter Douglas Germany, SAS International Germany, Texaa, and Decoustics, each strengthening their presence through advanced acoustic solutions and strategic partnerships with architects and contractors. Competitive strategies emphasize eco-friendly materials, integration of functional features, and design versatility to meet Germany’s evolving construction standards. Regionally, South Germany led the market with a 31% share in 2024, driven by its concentration of industrial hubs, commercial real estate development, and high-end residential projects. This dominance reflects the region’s strong role in adopting premium ceiling systems and shaping long-term growth opportunities.

Market Insights

- The Germany Acoustic Ceiling Tiles Market is driven by global and regional players emphasizing product innovation, eco-friendly materials, and design versatility to meet construction standards.

- Mineral fiber tiles led the market with a 42% share in 2024, supported by strong acoustic insulation, fire resistance, and recyclability, making them the most adopted material segment.

- Suspended ceiling tiles dominated installation types with a 63% share in 2024, favored for design flexibility, concealed wiring, and compatibility with modern lighting and HVAC systems.

- Building contractors accounted for a 46% share in 2024, driving demand through large-scale procurement and influencing material adoption in both residential and commercial projects.

- South Germany held the largest regional share at 31% in 2024, benefiting from industrial hubs, commercial expansion, and high-end residential projects that demand premium and sustainable ceiling solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

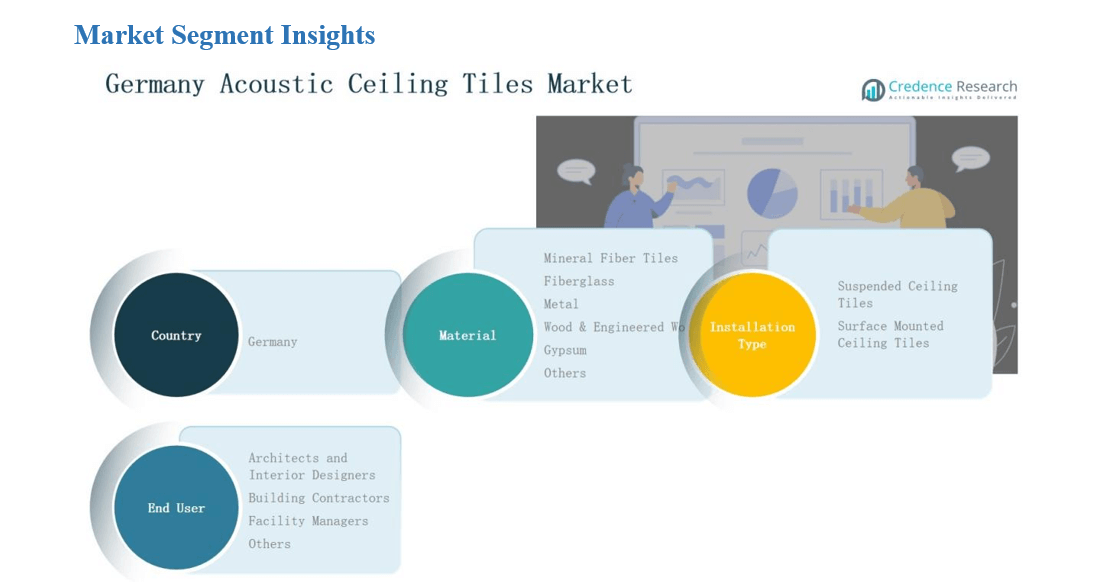

Market Segment Insights

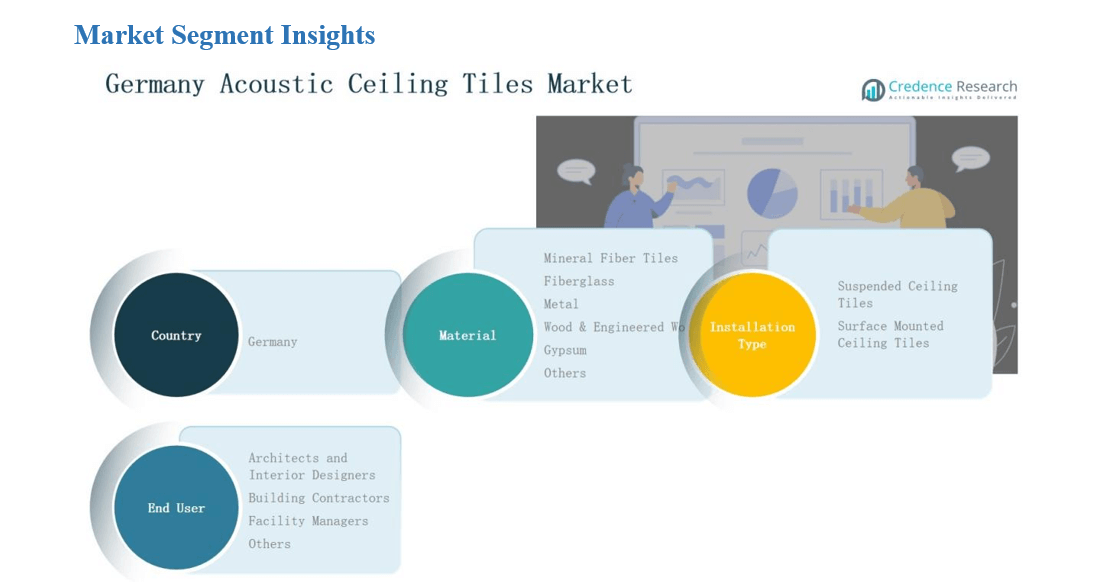

By Material

Mineral fiber tiles dominate the Germany acoustic ceiling tiles market, holding a 42% share in 2024. Their popularity stems from superior acoustic insulation, cost-effectiveness, and widespread use in commercial buildings. Demand is further driven by Germany’s energy-efficiency standards, which encourage adoption of lightweight and thermally efficient ceiling materials. In addition, strong fire resistance, moisture control, and recyclability make mineral fiber tiles a preferred choice across office spaces, healthcare facilities, and institutional projects, strengthening their long-term adoption in the market.

- For instance, Knauf Ceiling Solutions introduced HERADESIGN acoustic panels, made of magnesite-bonded wood wool, which are recognized for their fire resistance and sustainable composition.

By Installation Type

Suspended ceiling tiles account for the largest share, representing 63% of the market in 2024. They are favored for their design flexibility, ease of installation, and ability to conceal wiring and ductwork. The segment benefits from Germany’s active commercial construction and renovation projects, particularly in office complexes and educational facilities. Their rising demand is also linked to improved indoor aesthetics, better maintenance access, and compatibility with advanced lighting systems, making them the standard solution across Germany’s modern residential and commercial buildings.

- For instance, Saint-Gobain’s Ecophon ceiling tiles were incorporated into educational facilities in Hamburg to enhance indoor air quality and support sustainable building standards.

By End User

Building contractors lead the end-user segment with a 46% share in 2024. Their dominance is supported by large-scale procurement for residential and commercial projects, where cost control and material efficiency are prioritized. Growth is further reinforced by Germany’s expanding infrastructure investments and rising demand for sustainable construction solutions. Contractors also influence material choices through partnerships with architects and suppliers, driving bulk adoption of mineral fiber and suspended ceiling tiles, thereby consolidating their position as the most influential stakeholders in the market.

Market Overview

Rising Demand for Energy-Efficient Buildings

Germany’s strong focus on energy-efficient and sustainable construction is a major driver for the acoustic ceiling tiles market. Green building certifications such as DGNB and LEED encourage the use of materials that enhance thermal performance and reduce energy costs. Mineral fiber and fiberglass tiles, known for their insulation properties, are widely adopted in commercial and institutional projects. Strict building regulations and incentives for eco-friendly construction push developers to integrate acoustic solutions that combine energy efficiency, sustainability, and compliance with Germany’s evolving environmental standards.

- For instance, OWA’s OWActive mineral climate ceiling reportedly lets room temperature be 2-3 °C lower without losing comfort, combining radiant heat control and acoustic performance.

Expansion of Commercial and Institutional Infrastructure

Ongoing expansion in office complexes, healthcare facilities, and educational institutions fuels the demand for acoustic ceiling tiles. These sectors prioritize noise reduction, aesthetics, and compliance with safety standards, creating consistent market growth. Renovation of aging infrastructure in urban regions also drives installation of modern suspended ceiling systems, particularly in Berlin, Munich, and Frankfurt. Rising government investments in public sector projects, combined with private investments in commercial real estate, position acoustic ceiling tiles as essential building materials to ensure comfort, design flexibility, and regulatory compliance.

Technological Advancements in Acoustic Solutions

Innovation in materials and manufacturing technologies significantly boosts adoption across Germany. Modern acoustic ceiling tiles now offer improved durability, fire resistance, and moisture control, alongside enhanced design options for aesthetic integration. Smart ceiling solutions with embedded lighting and air circulation systems are also gaining traction in premium projects. Manufacturers like Knauf Insulation and Saint-Gobain focus on R&D to deliver lightweight, customizable, and eco-friendly tiles. These advancements not only meet growing architectural demands but also support Germany’s transition toward advanced building technologies in residential and commercial construction.

- For instance, Rockfon, a ROCKWOOL subsidiary, expanded its Color-all® range in Germany with tiles offering enhanced humidity resistance and a wide spectrum of finishes tailored for architectural projects.

Key Trends & Opportunities

Growing Adoption of Sustainable Materials

The shift toward environmentally friendly construction materials creates significant opportunities for acoustic ceiling tile manufacturers. Recyclable mineral fiber and engineered wood tiles are increasingly preferred due to Germany’s circular economy goals. Companies focus on reducing carbon footprints through low-emission production and recyclable raw materials. This aligns with consumer and regulatory demand for sustainable building products. As green construction becomes mainstream, manufacturers offering eco-certified acoustic tiles gain a competitive advantage, enabling long-term market growth and differentiation across both public and private construction projects.

- For instance, Autex Acoustics has gained traction by producing panels made from recycled materials, reducing environmental impact while maintaining sound absorption performance.

Integration of Aesthetic and Functional Features

Architects and interior designers increasingly demand ceiling tiles that merge acoustics with design appeal. Decorative finishes, customizable patterns, and integration with lighting and HVAC systems are becoming popular in high-end commercial and hospitality spaces. This trend elevates ceiling tiles from functional building components to central design elements. Opportunities arise for manufacturers to target premium segments with innovative designs that balance style, functionality, and performance. By offering solutions that support both acoustic comfort and modern aesthetics, the market expands beyond traditional applications into luxury and specialty projects.

- For instance, Armstrong World Industries introduced its DesignFlex™ Ceiling System that combines unique geometric patterns with integrated lighting compatibility, allowing architects to achieve both acoustic comfort and visual appeal in upscale interiors.

Key Challenges

High Installation and Maintenance Costs

Despite their benefits, acoustic ceiling tiles often involve high installation and maintenance costs compared to conventional ceiling options. Skilled labor requirements and complex suspended ceiling systems increase project expenses, limiting adoption in budget-sensitive projects. Regular maintenance for durability and performance also adds recurring costs, discouraging smaller developers. Price-sensitive end users, particularly in the residential sector, may opt for cheaper alternatives. This cost barrier restricts penetration of advanced acoustic solutions and forces manufacturers to focus on cost innovation while maintaining product quality.

Intense Market Competition

The Germany acoustic ceiling tiles market faces strong competition among global and regional players. Companies like Knauf, Armstrong, and Rockfon compete through product innovation, pricing strategies, and distribution networks. Local manufacturers often offer lower-cost alternatives, intensifying pricing pressure. This competitive environment challenges premium product adoption, as contractors and facility managers prioritize cost-efficiency. Additionally, frequent product launches and technological upgrades create shorter product lifecycles, pushing companies to sustain continuous R&D investments. High competition limits margins and makes differentiation crucial for long-term success in Germany’s construction sector.

Slow Residential Adoption

While commercial and institutional demand is strong, residential adoption of acoustic ceiling tiles remains limited. Homeowners often perceive them as non-essential or costly, especially in smaller housing projects. Traditional plasterboard or drywall ceilings dominate residential construction due to lower costs and easier installation. Lack of awareness about benefits such as improved acoustics and energy efficiency also slows penetration in the housing segment. For manufacturers, overcoming this perception gap and offering cost-effective residential solutions is a key challenge to expand the market beyond institutional and commercial applications.

Regional Analysis

North Germany

North Germany accounted for 22% share in 2024, supported by strong demand from Hamburg and Bremen. The region benefits from expanding commercial construction and port-related infrastructure projects. Office and hospitality sectors prefer suspended ceiling tiles for flexibility and acoustic performance. Mineral fiber tiles hold a notable presence due to energy efficiency standards promoted by local authorities. Renovation of aging institutional buildings further supports adoption of modern acoustic solutions. Companies expand distribution networks here to meet the rising demand for durable and sustainable ceiling products.

South Germany

South Germany dominated the market with a 31% share in 2024, driven by Munich and Stuttgart’s industrial and commercial hubs. Large-scale corporate offices and high-end residential projects adopt suspended ceiling systems for both acoustic control and design appeal. Building contractors drive demand through bulk procurement in urban infrastructure projects. Mineral fiber and fiberglass tiles gain strong traction due to their thermal and fire-resistant properties. The growing preference for premium aesthetics supports adoption of metal and wood ceiling tiles in luxury spaces. This region remains central for leading manufacturers targeting long-term growth.

West Germany

West Germany held a 25% share in 2024, supported by strong construction activity in Frankfurt and Cologne. The region benefits from a high concentration of banking, finance, and corporate offices, driving consistent demand for advanced acoustic ceiling tiles. Facility managers and architects prioritize solutions that combine cost-effectiveness with acoustic performance. Gypsum and mineral fiber tiles dominate due to their affordability and compliance with green building standards. Renovation of old office spaces further boosts market expansion. Strong contractor presence ensures rapid deployment of suspended ceiling solutions in large-scale projects.

East Germany

East Germany captured a 22% share in 2024, led by development in Berlin and Dresden. Government investments in healthcare, education, and public infrastructure projects strengthen adoption of acoustic ceiling tiles. Architects and designers focus on integrating modern suspended ceilings in institutional and commercial spaces. Mineral fiber tiles remain dominant due to their acoustic insulation and recyclability. Surface-mounted systems gain traction in smaller projects requiring cost efficiency. The region’s emphasis on sustainable urban development ensures continued market opportunities for eco-certified ceiling products.

Market Segmentations:

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Wood

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- North Germany

- South Germany

- West Germany

- East Germany

Competitive Landscape

The Germany Acoustic Ceiling Tiles Market is characterized by the presence of global leaders and strong regional players competing across product innovation, pricing strategies, and distribution strength. Companies such as Knauf Insulation, Saint-Gobain, Armstrong World Industries, Rockfon Germany, and OWA GmbH dominate through extensive product portfolios and established supply chains. Their strategies emphasize the development of eco-friendly, recyclable, and high-performance ceiling tiles that align with Germany’s sustainability standards. Regional firms like USG Boral Germany, Hunter Douglas Germany, SAS International Germany, Texaa, and Decoustics strengthen competition by offering customized solutions and design-focused products. Innovation in suspended ceiling systems, integration of acoustic performance with aesthetics, and adoption of digital tools for design optimization are shaping market dynamics. Intense competition has led to continuous investment in R&D, partnerships with contractors and architects, and expansion of distribution networks, ensuring companies remain competitive while meeting the growing demand across commercial and institutional construction projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Knauf Insulation

- Saint-Gobain

- Armstrong World Industries

- Rockfon Germany

- OWA GmbH

- USG Boral Germany

- Hunter Douglas Germany

- SAS International Germany

- Texaa

- Decoustics

Recent Developments

- In December 2023, Troldtekt introduced its T24 acoustic ceiling tiles in Germany, designed as demountable ceilings with tool-free installation and lower-carbon cement.

- In 2024, Knauf Group invested €100 million in a new factory in France, near the German border, to produce TOPIQ® Alpha acoustic ceiling tiles, strengthening supply for the German market.

- In January 2024, Nanoleaf launched the Skylight Modular Ceiling Light Panels, a first-of-its-kind smart ceiling fixture that combines functional lighting with customization, blending technology and design innovation.

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mineral fiber tiles will continue to grow due to energy efficiency standards.

- Suspended ceiling systems will remain the preferred choice across commercial and institutional projects.

- Adoption of eco-friendly and recyclable materials will strengthen under stricter sustainability regulations.

- Architects and interior designers will drive demand for tiles that combine acoustic performance with aesthetics.

- Renovation of aging public and private infrastructure will create steady opportunities for manufacturers.

- Residential adoption will gradually increase as awareness of acoustic comfort improves.

- Digital design tools and modular construction practices will boost demand for customizable ceiling solutions.

- Partnerships between manufacturers and contractors will expand distribution and enhance market penetration.

- Premium tiles with integrated lighting and ventilation features will gain popularity in luxury projects.

- Competition among global and regional players will intensify, driving innovation and pricing strategies.