Market Overviews

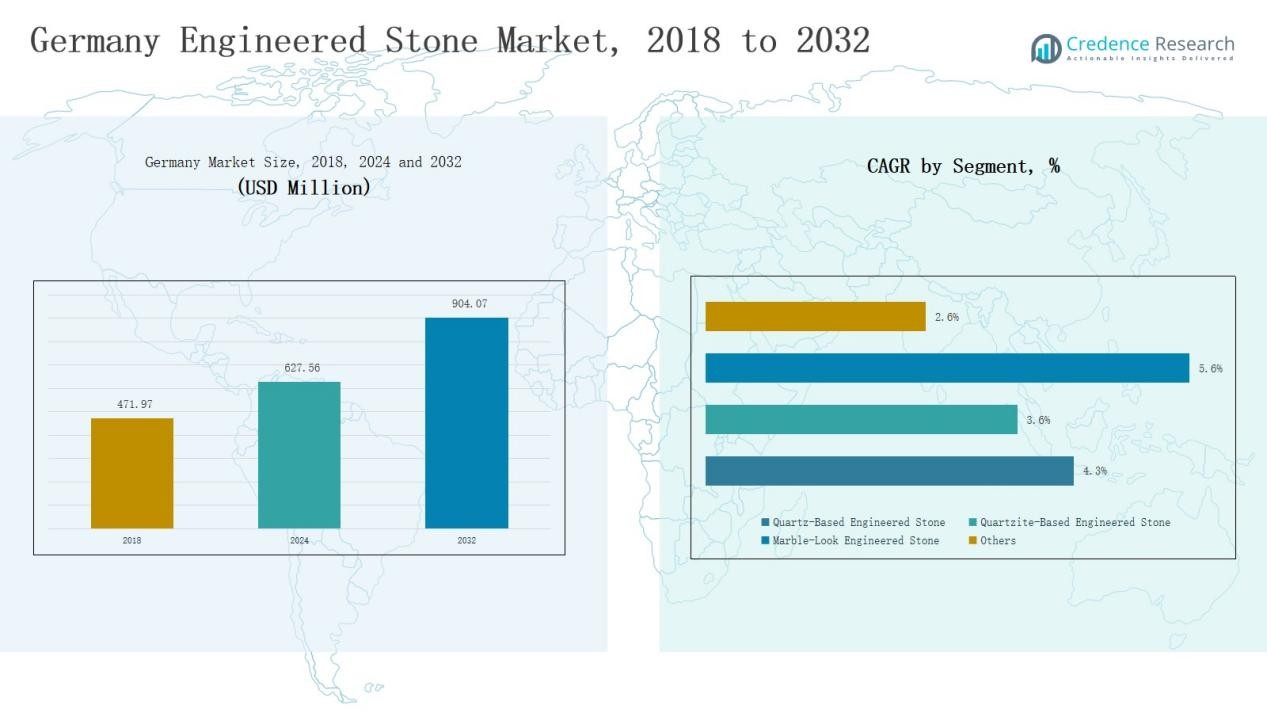

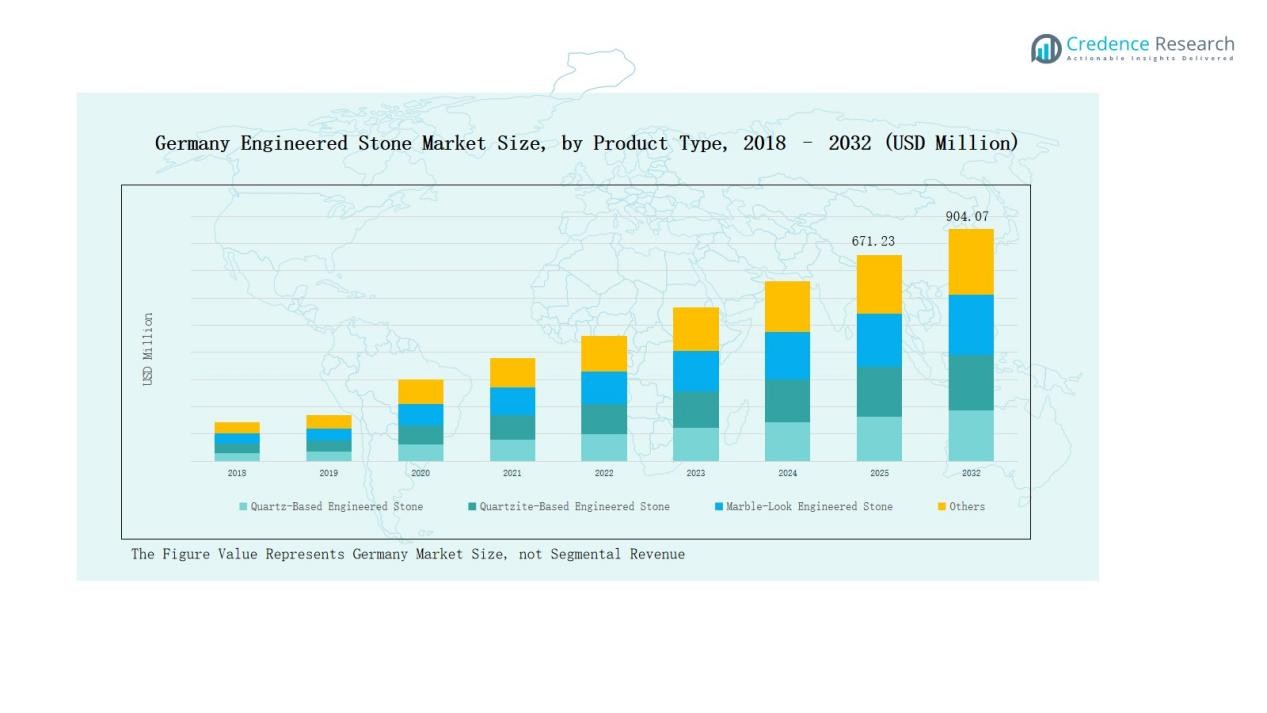

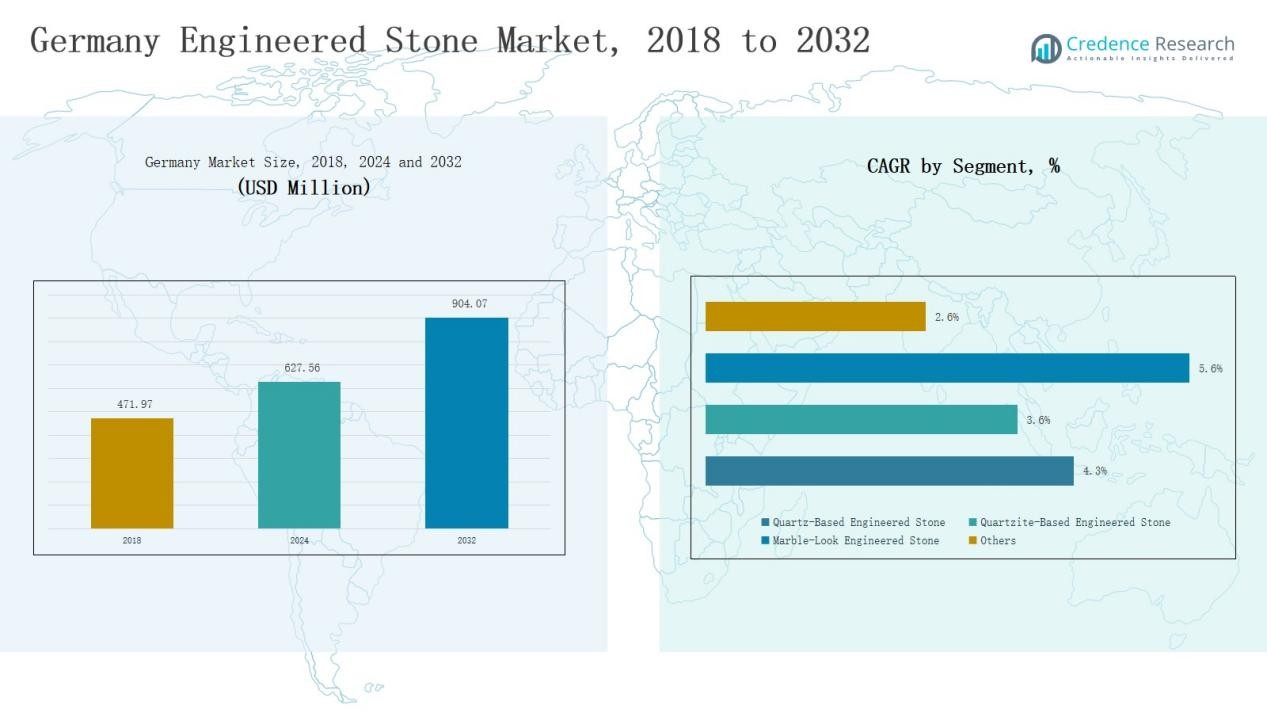

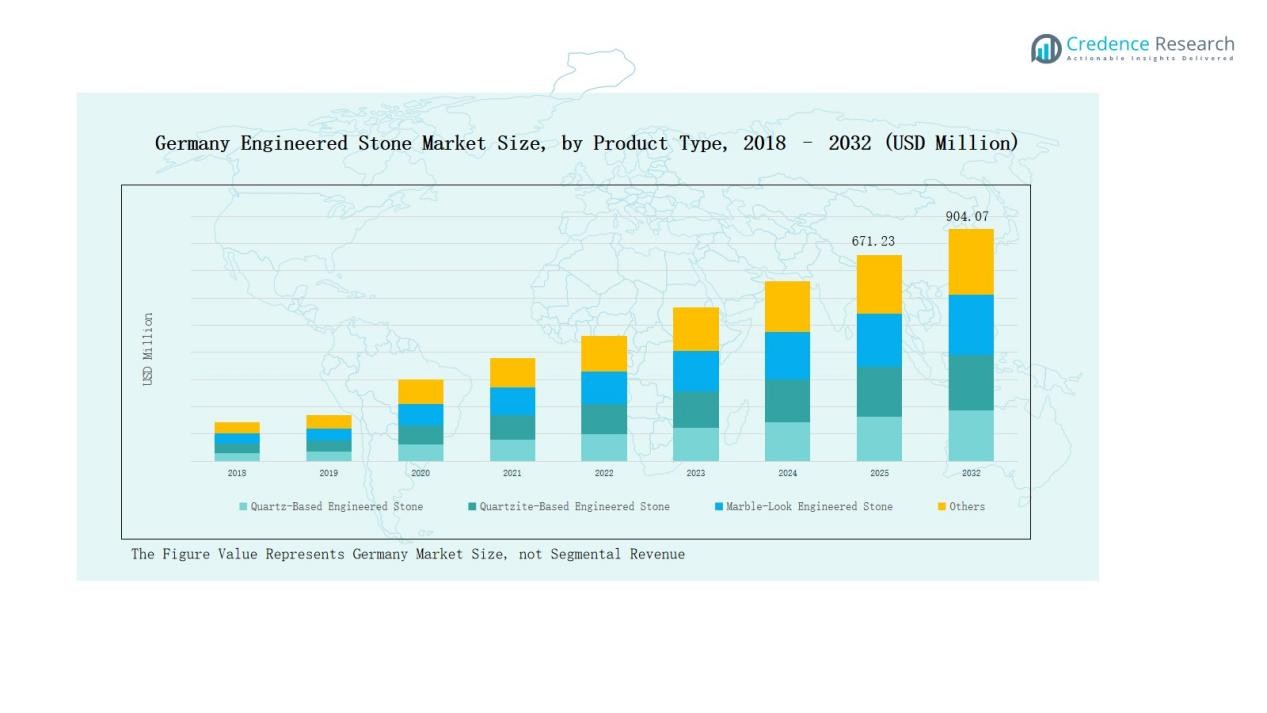

Germany Engineered Stone Market size was valued at USD 471.97 million in 2018, reached USD 627.56 million in 2024, and is anticipated to reach USD 904.07 million by 2032, at a CAGR of 4.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Engineered Stone Market Size 2024 |

USD 627.56 Million |

| Germany Engineered Stone Market, CAGR |

4.35% |

| Germany Engineered Stone Market Size 2032 |

USD 904.07 Million |

Major players such as Cosentino, Silestone Germany, Caesarstone Germany, Lapitec, Quarella, Compac, Technistone, Santa Margherita, Breton, and Franchi Umberto Marmi compete intensively on design, sustainability and distribution. They emphasize product innovation, localized supply chains, and strategic partnerships with architects and distributors. Southern Germany commands the lead in this market, holding 34% share in 2024, driven by high-income residential and luxury interior demand. It serves as a key battleground for these top firms to capture premium projects and design-conscious customers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Engineered Stone Market reached USD 627.56 million in 2024 and is projected to hit USD 904.07 million by 2032, expanding at 4.35% CAGR.

- Quartz-based engineered stone held 62% share in 2024, supported by durability, affordability, and growing demand for non-porous, low-maintenance surfaces in both residential and commercial projects.

- The residential sector led with 68% share in 2024, driven by rising renovations, kitchen upgrades, and luxury housing demand, while the commercial segment gained adoption in offices and hospitality.

- Construction and infrastructure accounted for 54% share in 2024, supported by flooring, cladding, and wall applications, while interior design and decoration followed with premium style-focused installations.

- Southern Germany led with 34% share in 2024, followed by Western at 28%, Northern at 21%, and Eastern at 17%, with demand fueled by luxury housing, commercial projects, and urban development.

Market Segment Insights

By Product Type

Quartz-based engineered stone dominated the Germany market in 2024, accounting for 62% share. Its popularity stems from durability, wide color variety, and cost-effectiveness compared to natural stone. Quartzite-based engineered stone followed, driven by luxury interior demand. Marble-look engineered stone is gaining traction as architects favor premium aesthetics for high-end projects. The “others” category, including recycled and hybrid materials, is emerging with sustainable building trends. Rising consumer preference for non-porous, low-maintenance surfaces further strengthens quartz-based engineered stone’s leadership.

- For instance, Caesarstone expanded its quartz surface portfolio with sustainable designs under the Pebbles Collection, targeting eco-conscious customers seeking non-porous and low-maintenance materials.

By Application

The residential sector led the Germany engineered stone market in 2024 with 68% share. Strong demand for modern kitchen countertops, bathroom vanities, and flooring solutions supported this dominance. Rising renovation activities, coupled with a growing trend toward luxury housing projects, have fueled residential uptake. The commercial segment, holding the remaining share, benefits from adoption in office complexes, retail stores, and hospitality interiors. Developers increasingly specify engineered stone for its design flexibility, durability, and compliance with safety standards, supporting steady commercial growth.

- For instance, Cosentino expanded its Silestone brand in Germany with the HybriQ+ technology surface collection, designed for sustainable residential countertops.

By End-Use Industry

Construction and infrastructure applications accounted for 54% share of the Germany market in 2024. Engineered stone is widely specified for flooring, cladding, and wall applications due to its strength and long life cycle. Interior design and decoration followed closely, driven by rising consumer demand for premium, stylish finishes in both residential and commercial projects. The “others” segment includes niche uses in furniture and specialty installations. Increasing sustainability focus and regulatory support for eco-friendly materials further propel demand across construction-driven projects.

Key Growth Drivers

Rising Demand for Residential Renovations

Germany’s engineered stone market benefits from increasing residential renovation projects, particularly in urban regions like Berlin and Munich. Homeowners prefer quartz-based products for kitchen countertops and bathroom surfaces due to durability, stain resistance, and low maintenance. Government-backed housing upgrades and energy-efficient building programs further accelerate adoption. Rising disposable incomes and consumer preference for luxury interiors enhance demand. The steady rise in apartment refurbishments and premium housing projects positions residential renovations as a primary growth engine for the market.

- For instance, Stone Italiana partnered with key German distributors to supply engineered quartz solutions for high-end housing projects, strengthening product availability for renovation-driven demand.

Expansion in Commercial and Hospitality Projects

The growing pipeline of commercial real estate and hospitality projects supports strong market growth. Hotels, office complexes, and retail spaces increasingly adopt engineered stone for flooring, reception areas, and high-traffic surfaces due to its durability and aesthetic appeal. Germany’s thriving tourism industry and corporate investment in modern office spaces add to demand. Compliance with fire safety and hygiene standards also drives preference. Developers prioritize engineered stone as a cost-effective, long-lasting, and visually appealing alternative to natural stone materials.

- For instance, Marriott International partnered with Cosentino Group for the installation of Silestone surfaces in high-traffic hotel lobbies and conference facilities, citing stain resistance and longevity as key benefits.

Sustainability and Eco-Friendly Materials Adoption

Sustainability remains a major growth driver, as Germany enforces stringent environmental regulations. Engineered stone manufacturers increasingly use recycled quartz, silica-free materials, and energy-efficient processes to meet eco-standards. Consumer awareness of sustainable construction and rising interest in DGNB- and LEED-certified buildings push adoption. Demand for eco-friendly interiors across both residential and commercial spaces enhances market growth. Industry players investing in low-carbon manufacturing technologies and circular economy initiatives strengthen their competitive edge, aligning with Germany’s sustainability-focused construction ecosystem.

Key Trends & Opportunities

Increasing Preference for Marble-Look and Custom Designs

A strong trend in Germany’s engineered stone market is the rising demand for marble-look surfaces. Architects and designers increasingly specify these premium styles for luxury housing and commercial projects. Consumers value the blend of marble aesthetics with quartz durability and affordability. Customization in textures, colors, and edge profiles is gaining traction, especially in bespoke interiors. This trend creates opportunities for manufacturers to differentiate with advanced digital design technologies and expand portfolios that meet evolving consumer style preferences.

- For instance, Cosentino’s marble-inspired collections provide eight distinct marble-look colours designed to pair with metals, wood or other materials.

Digitalization and Smart Manufacturing Integration

Germany’s market is witnessing opportunities from Industry 4.0 integration in engineered stone production. Smart manufacturing technologies such as robotics, automation, and digital finishing enhance precision, reduce waste, and improve customization. Digital platforms also expand retail reach, allowing buyers to visualize products online before purchase. Companies adopting advanced fabrication tools can deliver tailored, high-quality surfaces at scale. This transition supports cost optimization and environmental compliance, creating strong opportunities for manufacturers to strengthen competitiveness and meet rising demand efficiently.

- For instance, Bosch has implemented a comprehensive Industry 4.0 manufacturing platform across its 240 plants, combining intelligent software for production control, monitoring, and logistics planning, aiming to save nearly one billion euros over five years.

Key Challenges

Competition from Natural Stone and Ceramics

Despite growth, engineered stone faces competition from natural stone and ceramic alternatives. Many high-end customers still prefer natural granite and marble for authenticity and prestige. Ceramic tiles also challenge engineered stone in flooring and wall applications due to lower costs and extensive design availability. This competition pressures engineered stone manufacturers to continually innovate in design, durability, and sustainability. Effective marketing to highlight performance advantages over alternatives remains a critical challenge to secure long-term consumer preference.

High Production and Installation Costs

Engineered stone production involves energy-intensive processes and reliance on imported raw materials, raising costs. Installation also requires skilled labor, which increases total project expenditure. These higher costs can limit adoption among price-sensitive consumers and small-scale builders. Fluctuations in energy prices and transportation expenses further add to the challenge. Manufacturers are under pressure to balance product affordability with sustainability initiatives. Reducing production costs while maintaining quality remains a significant obstacle in achieving broader market penetration.

Regulatory and Environmental Compliance

Germany’s strict environmental and worker safety regulations present ongoing challenges for engineered stone producers. The ban on high-silica content surfaces and compliance with dust-control standards increase operational costs. Manufacturers must invest in silica-free alternatives and safer fabrication technologies, which require significant capital. Failure to meet evolving regulatory requirements risks penalties and reputational damage. Companies must consistently upgrade processes and materials to align with environmental goals, making compliance a demanding yet essential factor in sustaining market presence.

Regional Analysis

Southern Germany

Southern Germany accounted for 34% share of the Germany Engineered Stone Market in 2024. Strong demand stems from luxury housing projects in Bavaria and Baden-Württemberg, where high-income households drive premium surface adoption. The presence of major construction firms and design studios further supports growth. Quartz-based engineered stone remains the most preferred type in this region. It benefits from rising residential renovations and kitchen upgrades. Developers also specify engineered stone in large commercial complexes across Munich and Stuttgart, ensuring consistent demand.

Western Germany

Western Germany held 28% share in 2024, supported by a robust commercial real estate pipeline in cities like Frankfurt, Düsseldorf, and Cologne. Engineered stone is widely adopted in office towers, retail complexes, and hospitality spaces. It continues to gain popularity in residential renovations, with homeowners prioritizing durability and aesthetics. Government-backed urban development programs also drive adoption in this region. Strong collaborations between contractors, architects, and distributors further expand supply. The region’s focus on sustainable construction increases demand for eco-friendly engineered stone solutions.

Northern Germany

Northern Germany contributed 21% share to the market in 2024, led by infrastructure projects in Hamburg, Bremen, and Hannover. Rising investments in residential apartments and public buildings sustain growth. It benefits from adoption in commercial interiors such as airports, retail outlets, and educational institutions. Engineered stone is favored for its low maintenance and resistance to wear in high-traffic areas. Local distributors expand accessibility across both residential and institutional projects. The growing preference for marble-look engineered stone adds momentum in this region.

Eastern Germany

Eastern Germany represented 17% share in 2024, driven by construction and renovation activities in Berlin, Leipzig, and Dresden. The market grows steadily due to rising demand for modern apartments and commercial interiors. Interior design projects increasingly specify engineered stone for countertops, flooring, and decorative applications. It finds use in new infrastructure projects supported by regional development investments. Lower penetration compared to Western and Southern regions offers room for expansion. Focus on sustainable housing initiatives creates opportunities for eco-friendly engineered stone products.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Region

- South Germany

- West Germany

- Northern Germany

- Eastern Germany

Competitive Landscape

The Germany Engineered Stone Market features a competitive landscape shaped by global leaders and regional specialists focusing on design innovation, sustainability, and partnerships. Key players such as Cosentino, Silestone Germany, Caesarstone Germany, Lapitec, Quarella, Breton, Compac, Santa Margherita, Technistone, and Franchi Umberto Marmi maintain strong market presence through diversified product portfolios. Companies emphasize quartz-based and marble-look engineered stone, aligning with rising demand in residential renovations and commercial interiors. Sustainability drives competition, with manufacturers introducing silica-free surfaces, recycled content, and eco-friendly production processes to comply with Germany’s strict environmental regulations. Strategic collaborations with contractors, distributors, and architects strengthen supply chains and broaden access to high-demand regions such as Southern and Western Germany. Digitalization in design tools and fabrication also enhances competitiveness by enabling customization and efficient delivery. Intense competition encourages continuous product development, positioning established players to lead while creating space for innovative entrants focusing on niche applications and sustainability-driven offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cosentino

- Silestone Germany

- Caesarstone Germany

- Lapitec Germany

- Quarella Germany

- Breton Germany

- Compac Germany

- Santa Margherita Germany

- Technistone Germany

- Franchi Umberto Marmi Germany

Recent Developments

- On January 9, 2025, LATICRETE acquired a majority stake in the German profile-trim firm fuma-Bautec.

- On September 8, 2025, Saint-Gobain reorganized its German construction chemicals operations by transferring Weber GmbH’s dry mortars business into the joint venture Franken Maxit.

- In 2023, Diresco launched a new series of engineered surfaces using biopolymer resins, highlighting the shift toward eco-friendly engineered stone production.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will remain the leading choice in residential projects.

- Marble-look engineered stone will gain traction in luxury housing and premium commercial interiors.

- Sustainability initiatives will push wider adoption of recycled and silica-free engineered stone.

- Residential renovations will continue driving growth, supported by rising urban housing upgrades.

- Commercial real estate and hospitality projects will expand engineered stone applications in high-traffic areas.

- Digital fabrication and customization technologies will enhance design flexibility and consumer appeal.

- Regional demand will strengthen in Southern and Western Germany due to urban development.

- Collaboration between manufacturers, distributors, and contractors will improve market accessibility and reach.

- Environmental regulations will accelerate investments in eco-friendly manufacturing and safer materials.

- Increasing consumer preference for durable, stylish, and low-maintenance surfaces will secure long-term market growth.