Market Overview:

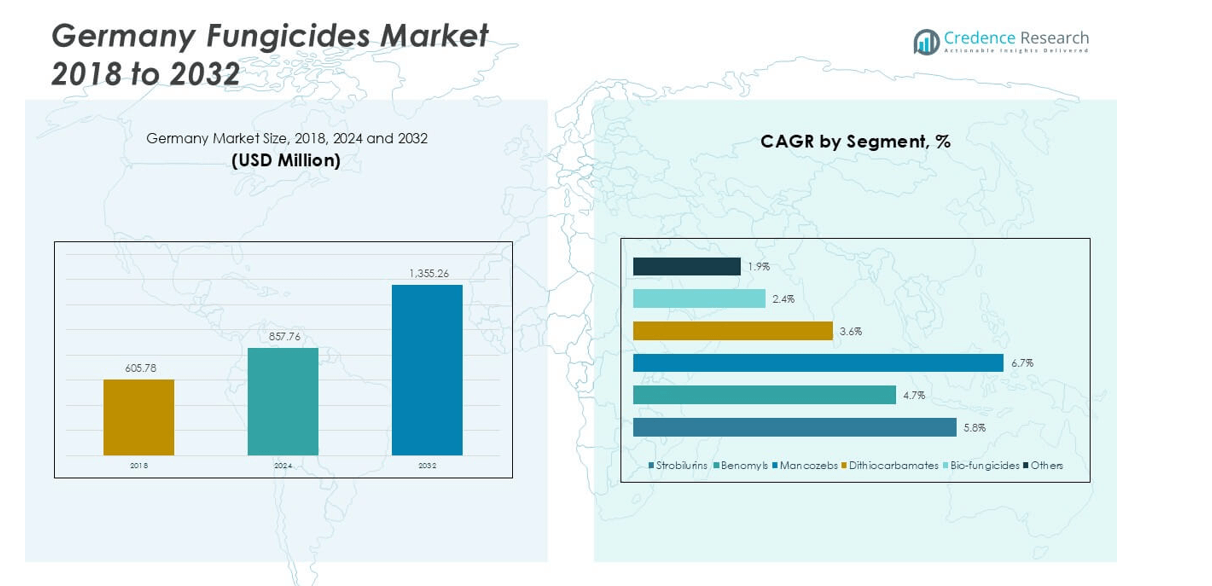

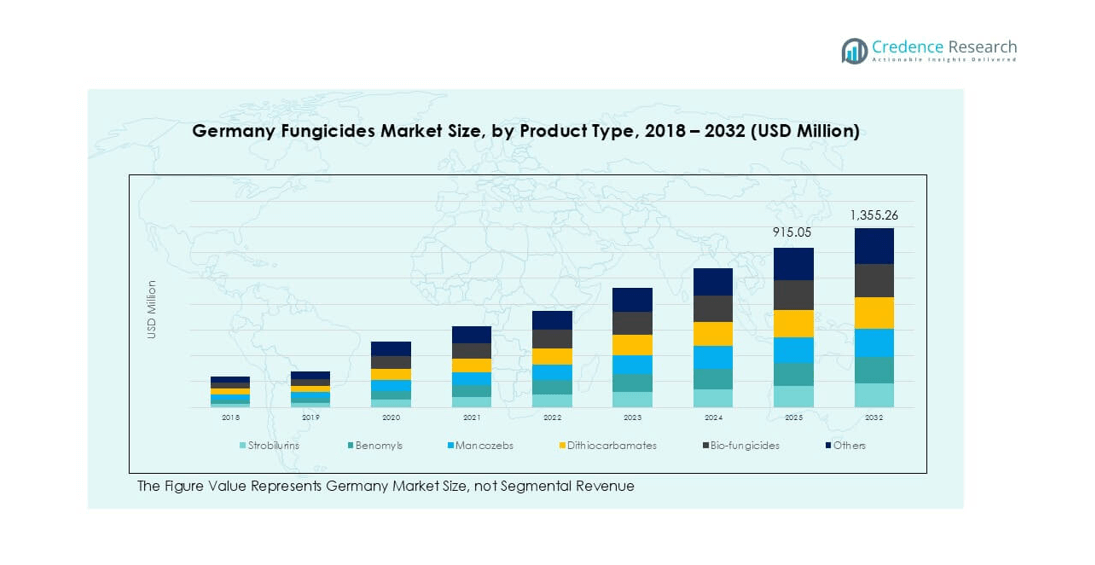

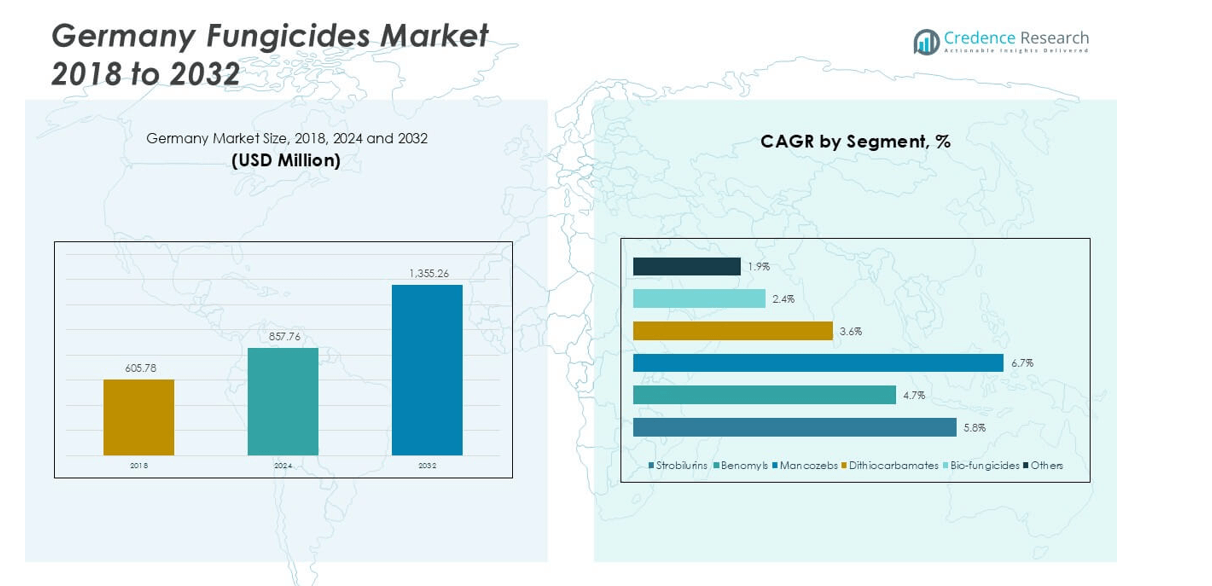

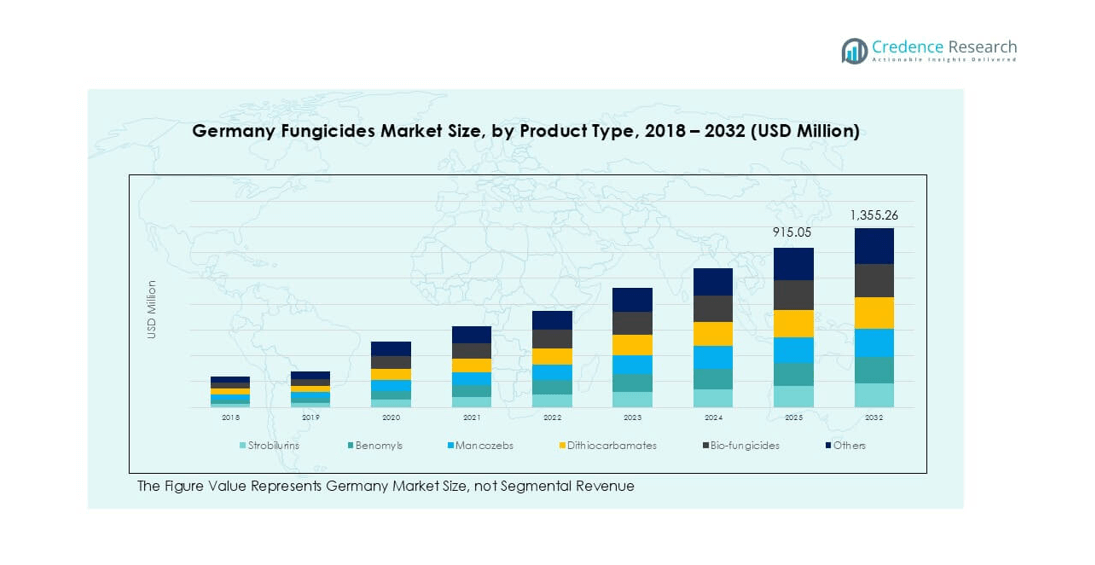

Germany Fungicides market size was valued at USD 605.78 million in 2018, grew to USD 857.76 million in 2024, and is anticipated to reach USD 1,355.26 million by 2032, at a CAGR of 5.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Fungicides Market Size 2024 |

USD 857.76 million |

| Germany Fungicides Market, CAGR |

5.77% |

| Germany Fungicides Market Size 2032 |

USD 1,355.26 million |

The Germany fungicides market is shaped by leading players including BASF SE, Bayer AG, Syngenta Agro GmbH, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions, Lanxess Deutschland GmbH, Helm AG, Cheminova Agro GmbH, and Nufarm. These companies drive competitiveness through broad portfolios, innovation in bio-fungicides, and strong distribution networks. BASF and Bayer dominate with advanced R&D, while Syngenta and Corteva emphasize sustainable solutions aligned with EU regulations. Regionally, Southern Germany leads with 32% market share, supported by intensive fruit and vegetable cultivation, followed by Northern Germany at 28%, where cereals and grains drive demand. Western and Eastern Germany hold 22% and 18% shares, respectively, reflecting diverse farming practices and large-scale crop production.

Market Insights

- The Germany fungicides market was valued at USD 857.76 million in 2024 and is projected to reach USD 1,355.26 million by 2032, growing at a CAGR of 5.77%.

- Rising demand for high-value crops such as fruits, vegetables, and cereals drives fungicide adoption, with strobilurins leading the product segment at over 30% share.

- Bio-fungicides show strong growth potential, supported by EU sustainability goals and rising consumer demand for organic produce, creating opportunities for eco-friendly solutions.

- The market is highly competitive with players like BASF SE, Bayer AG, Syngenta Agro GmbH, Corteva, FMC, and ADAMA focusing on innovation, digital tools, and integrated crop protection strategies.

- Southern Germany leads with 32% market share, followed by Northern Germany at 28%, Western Germany at 22%, and Eastern Germany at 18%, reflecting diverse crop profiles and regional drivers of fungicide usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Strobilurins dominate the Germany fungicides market, holding over 30% market share in 2024. Their broad-spectrum activity, systemic properties, and ability to control resistant fungal strains make them the preferred choice for growers. Farmers rely on strobilurins for high-value crops such as fruits, vegetables, and cereals, ensuring enhanced yield and crop protection. Demand is further supported by their compatibility with integrated pest management practices and favorable regulatory approvals. Bio-fungicides are also gaining traction due to rising consumer preference for organic produce and strict EU regulations promoting sustainable farming solutions.

- For instance, in 2022, Corteva Agriscience continued the deployment of its Inatreq active in Germany as part of a strategy for fungicide resistance management in cereal crops like wheat and barley.

By Application

Fruits & Vegetables represent the leading application segment, accounting for more than 35% market share in 2024. Germany’s strong horticultural base, particularly in apples, grapes, and tomatoes, drives fungicide adoption to prevent losses from powdery mildew, downy mildew, and leaf spot diseases. Farmers prioritize fungicides to safeguard quality and maintain export competitiveness. Increasing demand for fresh produce, coupled with strict quality standards from retail chains, supports consistent fungicide use. Cereals & Grains follow as a significant segment, driven by wheat and barley cultivation, where fungicides ensure higher yield and disease resistance.

- For instance, Vineyards use a diverse range of products to manage diseases like Botrytis cinerea and prevent the development of fungicide resistance.

Market Overview

Rising Demand for High-Value Crops

Germany’s expanding fruit and vegetable sector drives strong fungicide adoption. Farmers invest in advanced formulations to protect apples, grapes, and tomatoes from common fungal threats like mildew and rust. The need for higher yields, premium quality, and compliance with strict EU food standards fuels sustained demand. Consumers’ growing preference for fresh and export-grade produce also supports the application of fungicides. This trend makes crop protection products a critical component of sustainable farming practices and ensures long-term market growth for leading agrochemical suppliers.

- For instance, in 2021, Bayer supplied Luna Experience fungicide to farms in Germany for use on crops such as grapes, apples, and cherries to ensure compliance with residue limits for export markets.

Regulatory Push for Sustainable Solutions

Stringent EU and national regulations push the adoption of safer and eco-friendly fungicides. Germany’s commitment to reducing chemical residues in food encourages bio-fungicides and low-toxicity formulations. Manufacturers develop next-generation solutions that align with integrated pest management (IPM) practices. The government also provides incentives for organic farming, accelerating the uptake of bio-based products. This regulatory shift ensures strong demand for innovative solutions that reduce environmental impact. Companies that adapt quickly to these standards strengthen their competitive position in the German market.

- For instance, in 2022, approximately 18,000 hectares of German fruit-growing land, representing nearly a quarter of the country’s fruit-cultivation area, was farmed organically.

Technological Advancements in Formulations

Innovation in fungicide formulations supports market growth by enhancing efficacy and application efficiency. Companies are investing in systemic and combination products that provide longer-lasting protection against resistant fungal strains. Improved delivery systems, such as microencapsulation and water-dispersible granules, increase farmer adoption by simplifying use and reducing dosage frequency. Digital tools, including precision agriculture and real-time monitoring, further optimize fungicide use in fields. These advancements help farmers manage costs, improve productivity, and comply with sustainability standards, making technology a key driver of fungicide market expansion in Germany.

Key Trends & Opportunities

Shift Toward Bio-Fungicides

The bio-fungicide segment is expanding rapidly as farmers adopt eco-friendly alternatives. Germany’s strong organic farming sector, supported by EU policies, accelerates demand for biological solutions. Producers are investing in microbial-based products that offer targeted action with minimal environmental risks. Retailers and consumers prefer sustainably grown produce, increasing pressure on growers to adopt bio-based inputs. This creates growth opportunities for companies that innovate in bio-fungicides, particularly those offering effective solutions for high-value horticulture crops where chemical usage is tightly regulated.

- For instance, Bayer produces Serenade ASO, a bio-fungicide based on the bacterium Bacillus amyloliquefaciens, which can be used by German farmers seeking organic certification standards.

Expansion of Precision Agriculture

Precision agriculture is reshaping fungicide usage by improving efficiency and reducing waste. German farmers increasingly adopt digital tools such as drones, sensors, and satellite imaging to monitor crop health. These technologies enable timely fungicide applications, ensuring higher yields while lowering costs and environmental impact. The integration of data-driven platforms creates opportunities for agrochemical companies to offer bundled solutions combining fungicides with digital services. This trend enhances product value and supports compliance with sustainability targets, strengthening the role of precision farming in the country’s crop protection landscape.

Key Challenges

Stringent Regulatory Framework

Germany operates under one of the most rigorous regulatory environments in Europe, challenging fungicide manufacturers. The EU’s strict approval process delays the introduction of new chemical products. Many active ingredients face restrictions or phase-outs due to environmental and health concerns. Companies must invest heavily in research to meet evolving standards, raising development costs. This creates barriers for smaller players and increases reliance on alternative solutions. Compliance with these regulations is necessary but limits product availability, slowing growth for conventional fungicides in the German market.

Rising Resistance Among Fungal Pathogens

Growing resistance to commonly used fungicides poses a major challenge for German farmers. Overreliance on strobilurins and triazoles has led to reduced effectiveness against pathogens such as powdery mildew and Septoria leaf blotch. This resistance forces farmers to adopt complex crop protection strategies, often involving costlier combination products. It also accelerates the need for continuous innovation from manufacturers, increasing R&D investments. Without effective resistance management, yield losses and production costs could rise significantly, threatening the profitability and sustainability of farming operations in Germany.

Regional Analysis

Northern Germany

Northern Germany holds around 28% market share in the fungicides market, supported by large-scale cereal and grain farming. The region’s wheat and barley cultivation requires consistent protection against leaf spot and rust diseases. Coastal climatic conditions, with high humidity and rainfall, increase fungal pressure, further boosting fungicide usage. Farmers in this region prioritize strobilurins and mancozeb-based solutions due to their effectiveness against multiple pathogens. Growing adoption of bio-fungicides is also noticeable, driven by sustainability goals and export requirements. Northern Germany’s agricultural cooperatives actively promote integrated pest management, enhancing fungicide demand across both conventional and organic farming practices.

Southern Germany

Southern Germany accounts for nearly 32% market share, making it the leading region in fungicide consumption. The dominance stems from intensive fruit and vegetable farming, particularly vineyards, apple orchards, and vegetable greenhouses. Powdery mildew and downy mildew remain major threats in vineyards, ensuring consistent demand for strobilurins and bio-fungicides. Favorable climatic conditions and the region’s reputation for premium wine production drive higher input usage. Farmers adopt advanced formulations and precision spraying technologies to meet strict EU residue limits. Southern Germany’s reliance on fungicides highlights its role as a core contributor to Germany’s overall fungicide market growth.

Eastern Germany

Eastern Germany captures about 18% market share in the fungicides market, driven by large-scale farming operations. The region has extensive cereal and oilseed cultivation, particularly wheat, barley, and rapeseed. These crops require regular fungicide applications to counter Septoria, Fusarium, and mildew infections. Larger farm sizes in the east support higher adoption of advanced formulations, including systemic fungicides and combination products. While conventional fungicides dominate, bio-fungicides are gradually penetrating due to government-backed sustainability programs. Eastern Germany’s strong agricultural exports also encourage farmers to maintain high-quality standards, making fungicide use a critical element in regional farming practices.

Western Germany

Western Germany holds around 22% market share, supported by diverse agricultural practices. The region combines fruit and vegetable production with significant cereal and ornamental crop cultivation. Apples, pears, and horticultural products drive fungicide demand, especially against scab, mildew, and blight. Farmers in this region increasingly adopt bio-fungicides, responding to retail and consumer preferences for eco-friendly solutions. Wetter climatic conditions in parts of western Germany intensify fungal disease risks, encouraging preventive fungicide usage. The strong presence of cooperatives and agri-businesses ensures efficient distribution and training for farmers, solidifying fungicide adoption across multiple crop categories in the region.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Northern Germany

- Southern Germany

- Eastern Germany

- Western Germany

Competitive Landscape

The Germany fungicides market is highly competitive, led by multinational agrochemical giants and strong domestic players. Key companies such as BASF SE, Bayer AG, Syngenta Agro GmbH, Corteva Agriscience, FMC Corporation, and ADAMA Agricultural Solutions maintain dominance through extensive product portfolios and continuous innovation. BASF and Bayer leverage their German headquarters to strengthen R&D pipelines and expand sustainable crop protection solutions. Syngenta and Corteva focus on advanced formulations and bio-fungicides to align with EU sustainability policies. FMC and ADAMA emphasize cost-effective and broad-spectrum solutions for cereals and horticultural crops. Domestic companies like Lanxess Deutschland GmbH, Helm AG, and Cheminova Agro GmbH contribute with specialized offerings and localized distribution networks. Competitive intensity is further driven by partnerships, digital integration in precision agriculture, and regulatory compliance. With increasing demand for bio-fungicides and sustainable practices, companies invest heavily in next-generation products to capture market share, positioning themselves strongly for long-term growth in Germany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany fungicides market will expand steadily with rising demand for crop protection.

- Bio-fungicides adoption will grow rapidly due to EU sustainability targets and organic farming.

- Strobilurins will remain the dominant product segment with strong demand in cereals and fruits.

- Digital farming and precision agriculture will optimize fungicide application and reduce wastage.

- Major players will invest more in advanced formulations to address resistance challenges.

- Regulatory pressure will drive innovation in safer and low-toxicity crop protection solutions.

- High-value crops like grapes, apples, and tomatoes will continue to fuel fungicide demand.

- Farmers will increasingly shift toward integrated pest management to meet quality standards.

- Southern Germany will maintain leadership, supported by intensive horticulture and vineyards.

- Strategic partnerships and R&D collaborations will shape the competitive landscape in the market.