Market Overview:

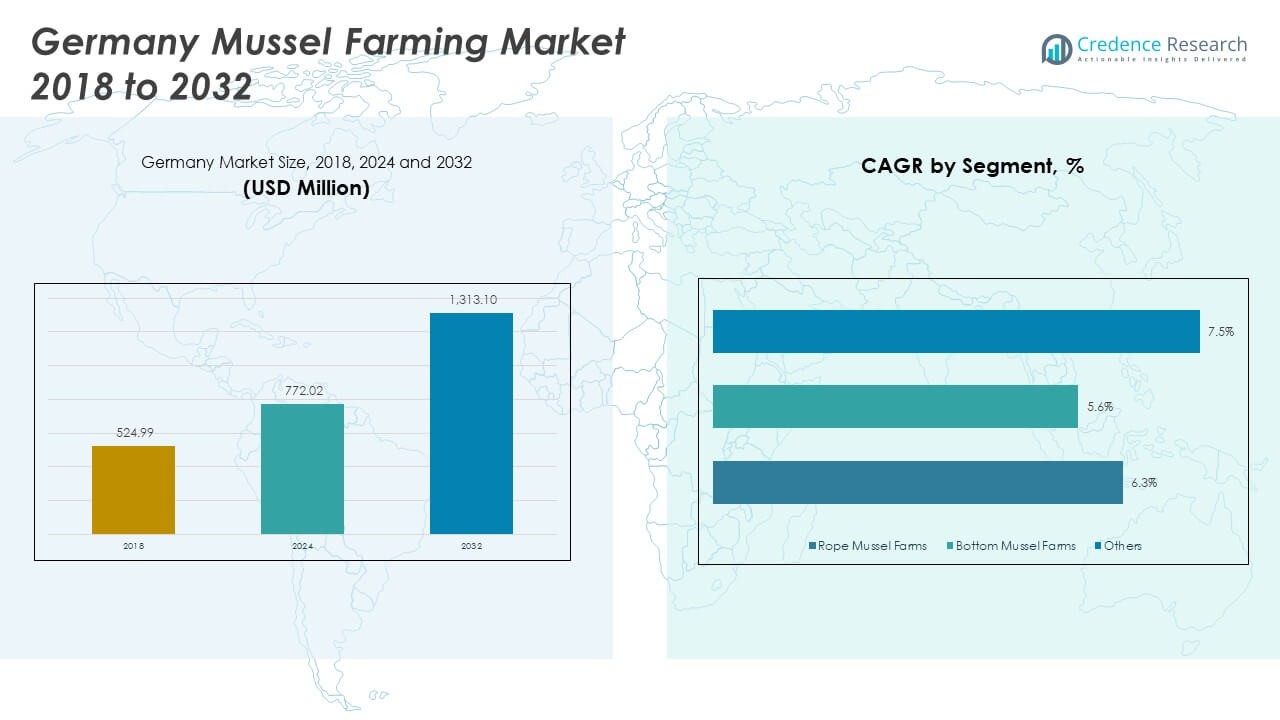

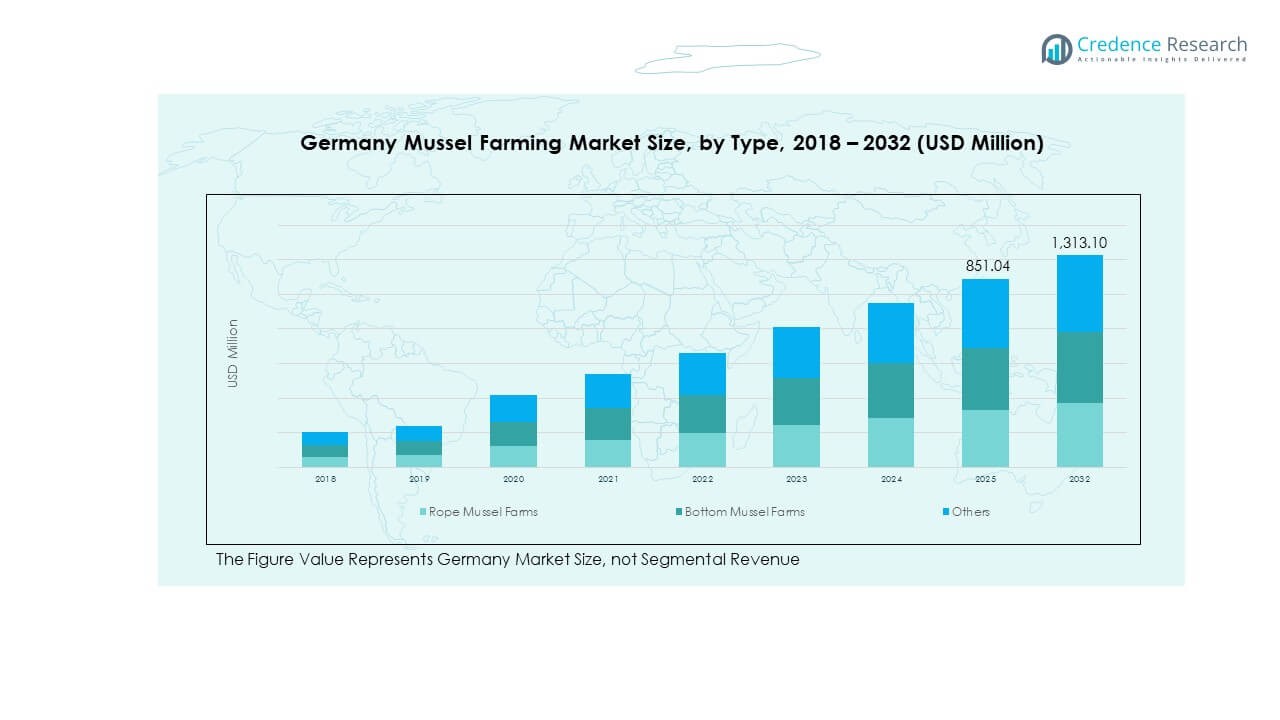

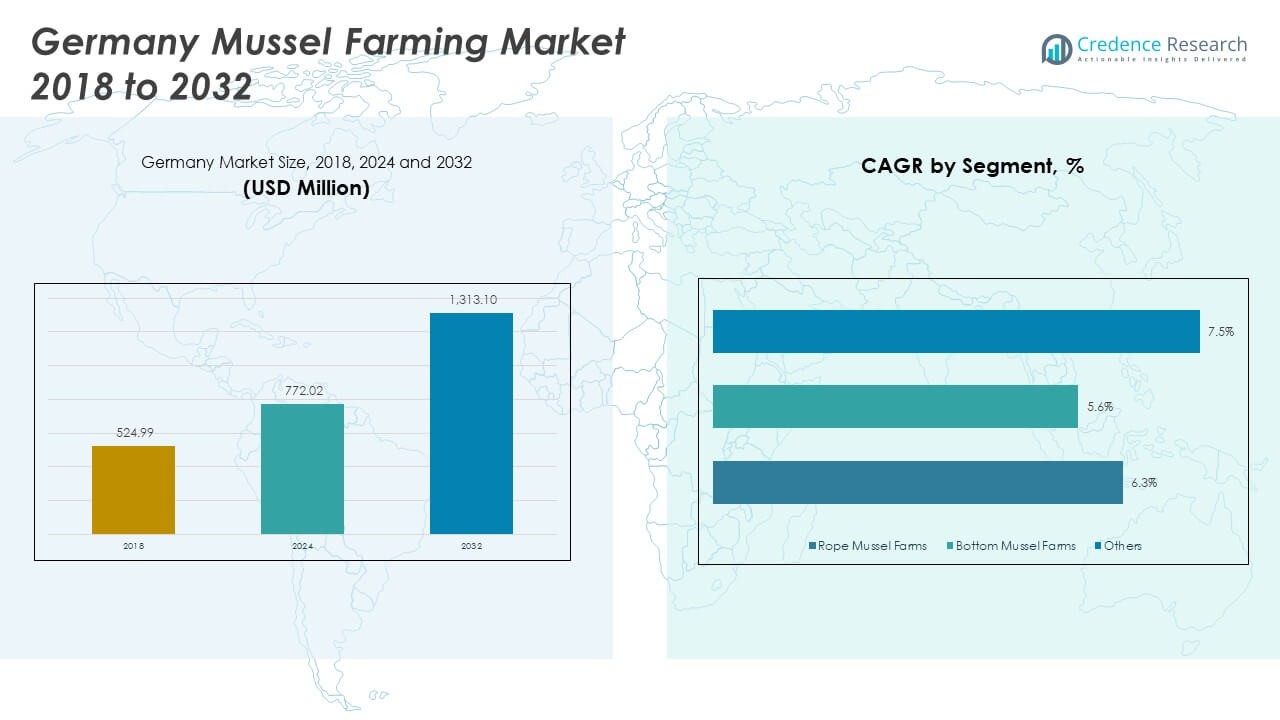

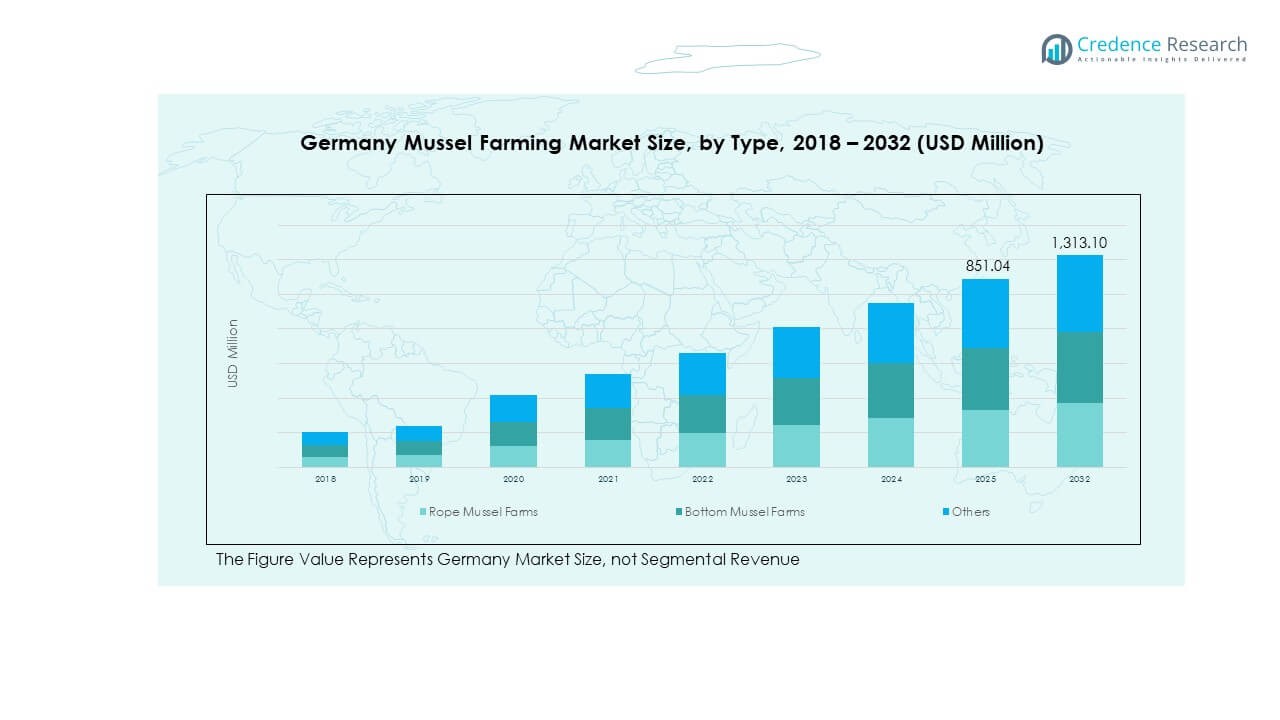

The Germany Mussel Farming Market size was valued at USD 524.99 million in 2018 to USD 772.02 million in 2024 and is anticipated to reach USD 1,313.10 million by 2032, at a CAGR of 6.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Mussel Farming Market Size 2024 |

USD 772.02 Million |

| Germany Mussel Farming Market, CAGR |

6.39% |

| Germany Mussel Farming Market Size 2032 |

USD 1,313.10 Million |

Growth is driven by rising consumer preference for sustainable seafood, government support for aquaculture, and expanding demand from foodservice chains. Consumers are increasingly adopting mussels as a source of protein with low environmental impact. Strong emphasis on organic certification and traceable supply chains enhances market trust and encourages higher adoption among retail and export channels.

Regionally, northern Germany dominates due to favorable coastal ecosystems and established aquaculture infrastructure. Neighboring EU countries present opportunities for cross-border trade, while emerging interest in sustainable seafood across Eastern Europe fosters expansion. The domestic market is strengthening through investments in advanced farming techniques, while international markets increase demand for premium-quality German mussels.

Market Insights:

- The Germany Mussel Farming Market was valued at USD 524.99 million in 2018, increased to USD 772.02 million in 2024, and is expected to reach USD 1,313.10 million by 2032, growing at a CAGR of 6.39%.

- Europe holds 54% share, dominating due to strong cultural seafood demand and advanced aquaculture infrastructure, while North America holds 18% and Asia-Pacific 15%, both supported by rising imports of sustainable mussels.

- Asia-Pacific is the fastest-growing region, with 15% share, driven by urbanization, premium seafood consumption, and expanding online distribution platforms.

- Rope Mussel Farms represent the largest segment with around 58% share, supported by higher yields and lower seabed impact.

- Bottom Mussel Farms hold nearly 30% share, reflecting traditional cultivation practices in coastal areas, while “Others” account for the remaining share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Protein Sources:

The Germany Mussel Farming Market benefits from consumer interest in sustainable protein options. Mussels require minimal feed inputs, making them more efficient compared to livestock. Growing awareness of overfishing encourages adoption of aquaculture-based seafood. Retailers highlight mussels for their low carbon footprint. Foodservice operators increasingly position mussels as a sustainable alternative to traditional seafood. Export demand strengthens due to eco-label certifications. Public campaigns stress the environmental benefits of mussel farming. It creates a strong foundation for continued growth.

- For instance, the MytiFit project in the German North Sea demonstrated blue mussels (Mytilus edulis) reaching market size within a season and a half under offshore conditions, highlighting rapid growth and environmental sustainability.

Government Initiatives Supporting Aquaculture Expansion:

Supportive policies strengthen growth across the Germany Mussel Farming Market. Regulations encourage environmentally responsible farming practices. Subsidies for aquaculture infrastructure boost production capacity. Certification schemes improve consumer trust in domestic produce. Research programs advance water quality monitoring and disease management. Regional authorities back coastal aquaculture zones to balance fishing and farming. Food security policies reinforce seafood self-sufficiency. This alignment between policy and market demand supports long-term stability.

- For instance, the German Federal States operate water quality monitoring stations that support aquaculture environmental compliance, leveraging advanced sensor technologies for real-time water quality surveillance.

Health Awareness Driving Mussel Consumption:

Rising health awareness boosts mussel demand in the Germany Mussel Farming Market. Mussels are recognized as rich in omega-3 fatty acids, protein, and minerals. Consumers increasingly seek functional foods for wellness. The aging population adopts mussels as part of heart-healthy diets. Retail promotions highlight nutritional advantages to differentiate products. Fitness trends integrate seafood into protein-based meal plans. Public dietary guidelines endorse seafood for balanced nutrition. This demand trend sustains steady growth.

Technological Advancements in Aquaculture Practices:

Innovation enhances efficiency in the Germany Mussel Farming Market. Rope farming and bottom culture methods improve yields. Automation reduces labor costs and enhances monitoring. Advanced filtration systems maintain water quality standards. Breeding techniques improve resilience against environmental stress. IoT-based tracking improves traceability from farm to market. Cold-chain logistics ensure consistent freshness in retail and exports. Technology adoption enables producers to scale sustainably. This transformation supports stronger competitiveness.

Market Trends:

Expansion of Organic and Eco-Certified Mussels:

Consumers increasingly demand organic-certified seafood, boosting eco-labeled mussel adoption. German mussel farms adopt certification to strengthen export competitiveness. Certification enhances transparency and consumer trust. Retail chains market eco-certified mussels as premium products. Certification fosters differentiation from conventional seafood. Traceability platforms integrate digital monitoring for compliance. This trend creates growth across domestic and international segments.

- For instance, while Germany’s Naturland organization certifies organic mussels, the 41,936 tonnes of certified organic mussels produced in 2020 was a figure for the entire EU, with major contributions also coming from countries like the Netherlands, Italy, and Ireland.

Integration of Mussels into Ready-to-Eat Meals:

Convenience-driven consumption is reshaping the Germany Mussel Farming Market. Food manufacturers launch pre-cooked mussel-based meals. Ready-to-eat and frozen products target busy urban consumers. Partnerships with retail stores increase accessibility. Online grocery channels expand seafood delivery services. Value-added products appeal to younger demographics. Innovative packaging extends shelf life. This trend widens product penetration across new households.

- For instance, major retailers in Germany partner with aquaculture and frozen food manufacturers to offer advanced convenience meals, such as seafood products, using innovative packaging that significantly extends shelf life.

Rising Export Demand Across European Markets:

Exports strengthen growth in the Germany Mussel Farming Market. Neighboring EU countries demand sustainably sourced mussels. Harmonized EU food regulations ease cross-border trade. Northern European countries favor mussels in traditional cuisines. Export-driven producers adopt advanced preservation systems. Premium-grade mussels find niche demand in gourmet restaurants. Trade partnerships open new routes to Central and Eastern Europe. Export growth diversifies revenue streams for German producers.

Collaboration Between Farmers and Research Institutes:

Research collaborations improve mussel farming practices. Institutes study breeding for resilience under climate change. Joint projects develop eco-friendly farming techniques. Farmers adopt research-backed innovations to maintain competitiveness. Training programs share best practices across small and medium farms. Monitoring programs address pollution and disease management. Industry-academia partnerships foster sustainability in production. This collaboration accelerates innovation adoption across the market.

Market Challenges Analysis:

Environmental and Regulatory Pressures:

The Germany Mussel Farming Market faces environmental and regulatory constraints. Water quality fluctuations disrupt farming yields. Climate change impacts spawning and growth cycles. Regulatory approvals for aquaculture zones often delay expansion. Strict environmental impact assessments raise operational costs. Pollution from nearby industries threatens farm sustainability. Farmers must invest heavily in monitoring systems. Compliance with EU food safety adds complexity. Balancing growth with regulation remains challenging.

Supply Chain and Labor Constraints:

Supply chain and labor shortages impact the Germany Mussel Farming Market. Seasonal demand spikes stress logistics systems. Limited skilled labor raises production costs. Transportation challenges hinder timely deliveries to retailers. Export operations depend on robust cold-chain facilities. Rising fuel costs increase distribution expenses. Pandemic disruptions highlighted vulnerabilities in supply networks. Labor shortages slow adoption of intensive farming techniques. These bottlenecks affect growth potential.

Market Opportunities:

Rising Popularity of Sustainable Seafood Exports:

Export growth offers strong opportunities for the Germany Mussel Farming Market. Global demand for eco-friendly protein continues to expand. Certification-backed mussels secure premium pricing in international markets. Producers can penetrate niche segments like gourmet restaurants. Growing seafood trade agreements enhance market access. Sustainability branding strengthens competitive positioning abroad. It creates a promising path for revenue diversification.

Growth of Value-Added Mussel Products:

Value-added processing provides new revenue streams. Pre-cooked, marinated, and packaged mussels appeal to convenience buyers. Innovative packaging extends product reach across supermarkets. Online delivery platforms open new sales channels. Foodservice partnerships expand product placement in fast-casual dining. Investment in processing facilities improves scalability. The trend toward ready meals supports sustained demand. It encourages greater profitability for domestic producers.

Market Segmentation Analysis:

By Type

The Germany Mussel Farming Market is segmented into rope mussel farms, bottom mussel farms, and others. Rope mussel farms lead the segment due to efficiency, better yields, and reduced seabed impact. Bottom mussel farms remain relevant in traditional coastal areas, sustaining local communities. The “others” category reflects experimental techniques, showing potential for future adoption. This diversity strengthens the industry’s resilience and supports adaptability to environmental conditions.

- For instance, rope culture systems in Baltic Sea farms have demonstrated production yields of 3-4 kg of mussels per running meter of cultivation rope, approximately four times higher than previous yields, significantly improving productivity and sustainability.

By Product

The market is further divided into marine water and freshwater mussels. Marine water mussels dominate because of the North Sea and Baltic Sea’s favorable environment. They form the backbone of commercial production and export trade. Freshwater mussels contribute at a smaller scale, mainly for regional consumption and niche markets. This balance enables producers to cater to varied consumer demands across different regions.

- For instance, 53% of German aquaculture production in 2022 occurred in marine and brackish waters, mostly on-bottom mussel farming, while freshwater mussels supply localized markets, supporting diversified production strategies.

Segmentation:

By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

By Product

By Geography

- Northern Germany (Production Hub)

- Western Germany (High Consumption Zone)

- Southern Germany (Expanding Consumption Market)

- Germany’s Export Regions (EU Trade Partners)

Regional Analysis:

Northern Germany – Core Production Hub

Northern Germany dominates mussel farming, supported by the North Sea and Baltic Sea coasts. Schleswig-Holstein and Lower Saxony account for the majority of production, where rope farming methods deliver consistent yields. Favorable water conditions and nutrient levels strengthen the sustainability of operations. Producers in this region also benefit from government-backed aquaculture zones. Cold-chain infrastructure ensures reliable transport to inland markets. This area represents the backbone of German mussel supply.

Western and Southern Germany – High Consumption Regions

Mussel consumption is strongest in Western and Southern Germany, particularly in North Rhine-Westphalia and Bavaria. These regions show high seasonal demand, with mussels integrated into cultural dishes during winter months. Retail chains and foodservice operators ensure steady distribution. Urban consumers increasingly prefer mussels due to their nutritional benefits. Demand is reinforced by supermarkets highlighting eco-certified and traceable products. These regions form the largest domestic consumption base for German mussels.

Germany’s Role in EU Trade

The Germany Mussel Farming Market extends beyond national borders through exports to nearby European countries. France, Belgium, and the Netherlands represent key buyers of German mussels. Export competitiveness is strengthened by eco-certification, traceability systems, and premium quality. Trade within the EU is supported by harmonized food regulations, simplifying cross-border distribution. Exports contribute to diversifying producer revenues and reducing reliance on domestic markets. Germany positions itself as a reliable supplier within European seafood trade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Thai Union Group

- Mareike Lüthje Aquaculture

- Nordsee Fischer

- Biokraft & Co GmbH

- Hanse-Aquakultur AG

- Fischerei und Aquakultur GmbH

- Aqua Aktiv GmbH

- Reederei Krämer

- Seenfischerei GmbH

- Others

Competitive Analysis:

The Germany Mussel Farming Market is moderately concentrated, with leading firms balancing domestic and export demand. Key players such as Thai Union Group, Mareike Lüthje Aquaculture, and Nordsee Fischer maintain strong footprints in coastal farming regions. Companies invest in eco-certification and advanced aquaculture technologies to secure competitiveness. Export-oriented firms expand partnerships across Europe and Asia-Pacific. Local players emphasize traditional farming methods while adopting modern traceability systems. Competition remains shaped by sustainability branding and product quality. It encourages innovation in processing and distribution channels.

Recent Developments:

- In August 2025, Thai Union Group entered a significant business alliance agreement with Japanese conglomerate Mitsubishi Corp., which plans to increase its stake from 6.19% to 20% by acquiring an additional 13.81% of shares. This alliance aims to maximize value across the seafood supply chain leveraging their strengths in procurement, processing, and sales, reinforcing Thai Union’s global seafood presence and sustainable sourcing efforts.

Report Coverage:

The research report offers an in-depth analysis based on type, product, and geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainable aquaculture practices will dominate growth strategies.

- Export demand across Europe and Asia-Pacific will strengthen.

- Technology integration in farming will enhance yields.

- Value-added products will drive new revenue streams.

- Government support will reinforce domestic expansion.

- Eco-certification will become a market entry prerequisite.

- Supply chain resilience will remain a strategic focus.

- Rising health awareness will increase mussel consumption.

- Online distribution will expand market accessibility.

- Climate adaptation measures will define long-term strategies.