Market Overview

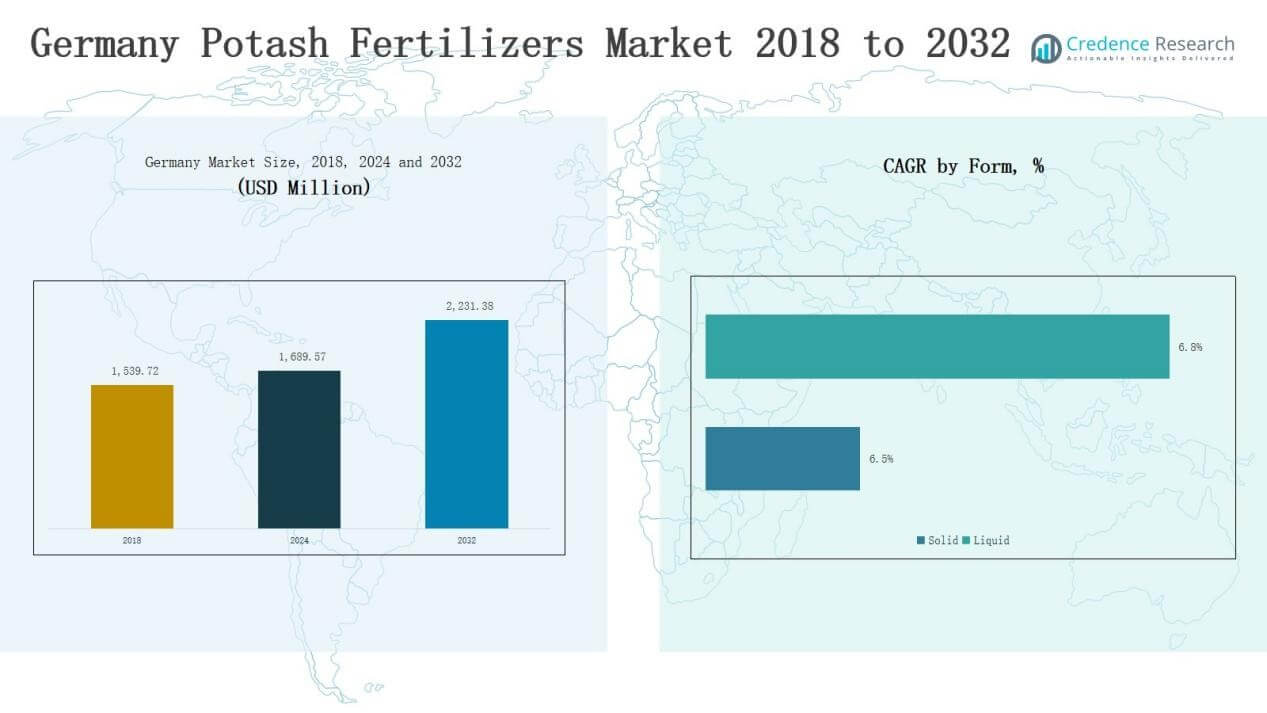

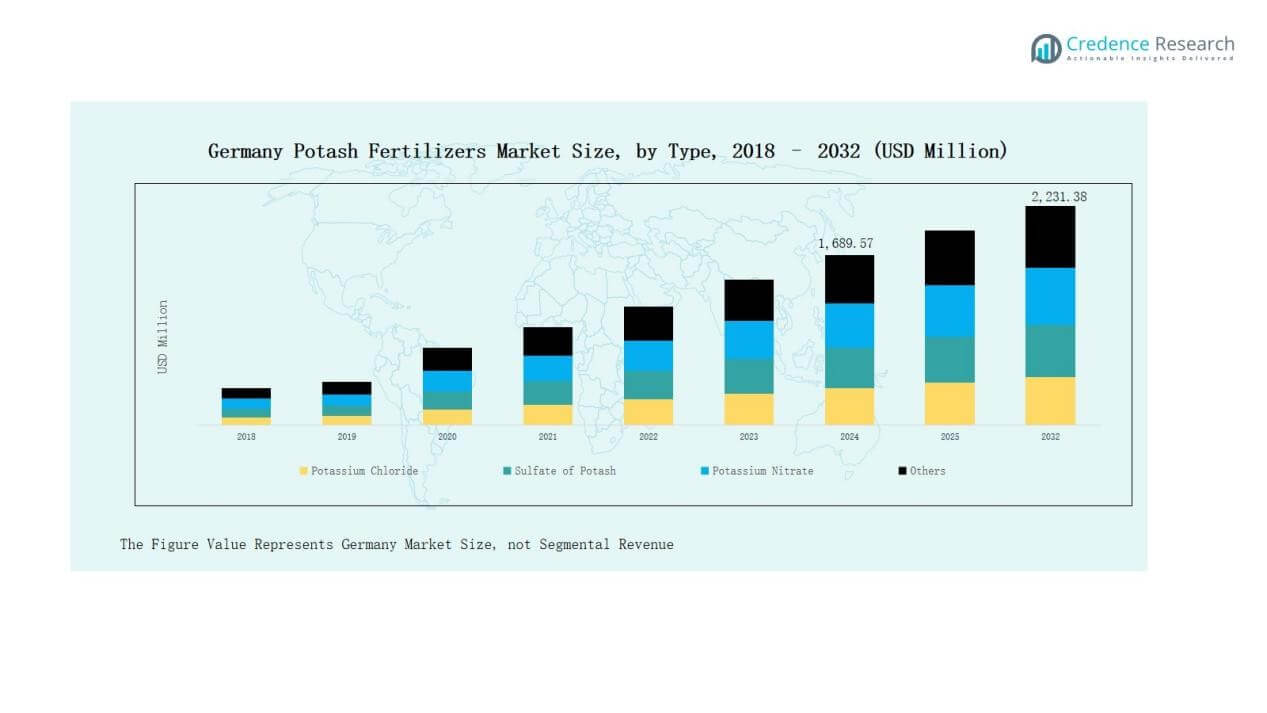

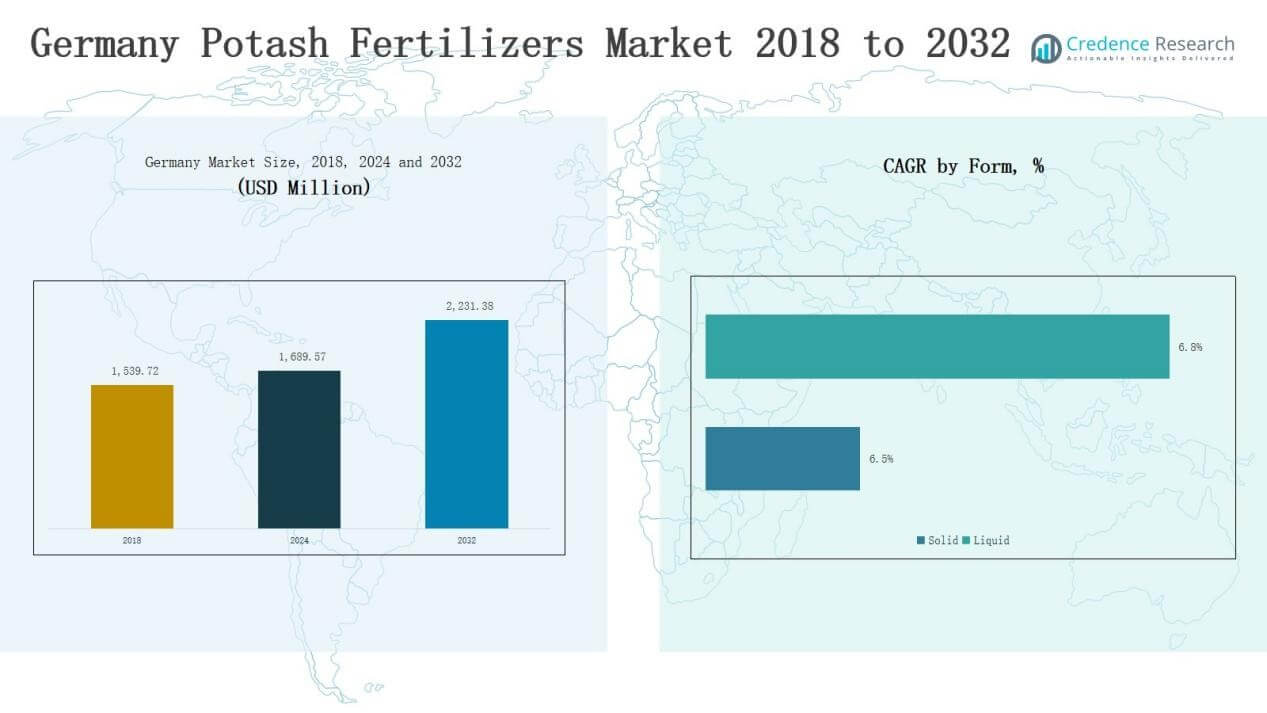

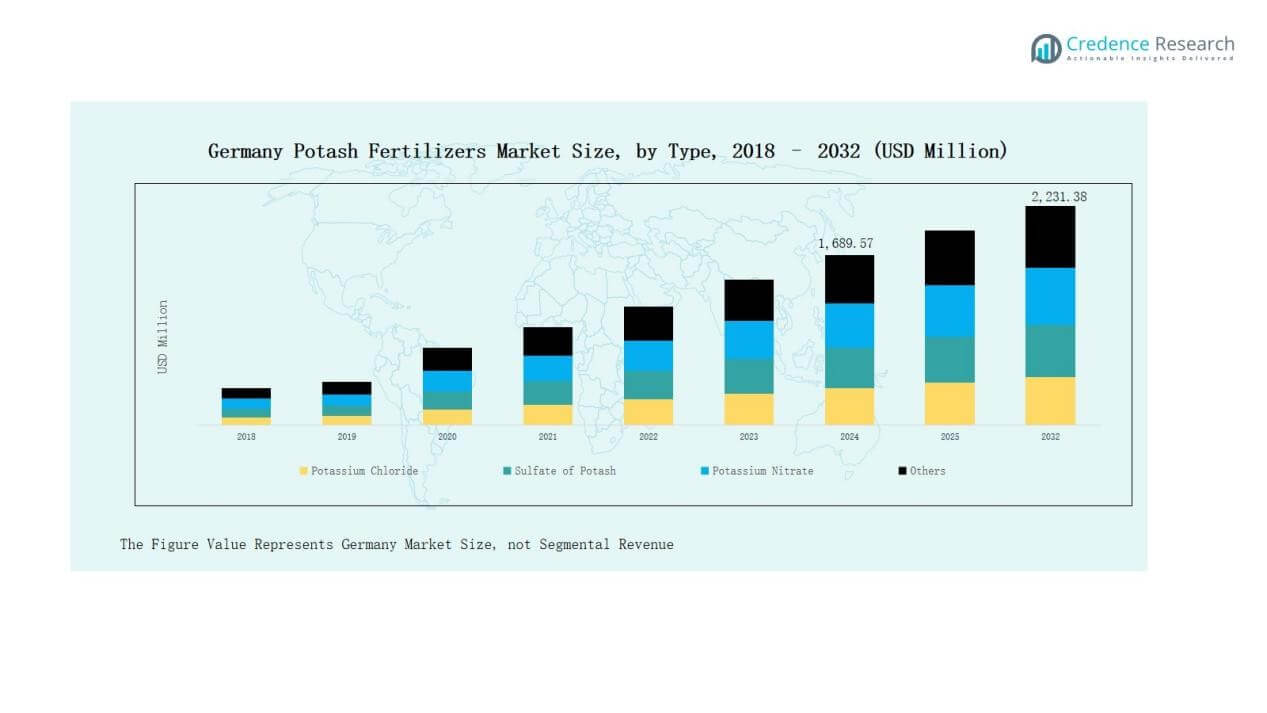

Germany Potash Fertilizers Market size was valued at USD 1,539.72 million in 2018 to USD 1,689.57 million in 2024 and is anticipated to reach USD 2,231.38 million by 2032, at a CAGR of 3.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Potash Fertilizers Market Size 2024 |

USD 1,689.57 Million |

| Germany Potash Fertilizers Market, CAGR |

3.54% |

| Germany Potash Fertilizers Market Size 2032 |

USD 2,231.38 Million |

The Germany Potash Fertilizers Market is shaped by global leaders and domestic players, including EuroChem Group AG, K+S Aktiengesellschaft, HELM AG, The Mosaic Company, Yara International ASA, Grupa Azoty S.A., SQM S.A., ICL Group, and Nutrien Ltd. These companies focus on strengthening supply chains, expanding chloride-free formulations, and investing in precision farming solutions to meet rising demand from cereals and specialty crops. Northern Germany led the market with a 35% share in 2024, driven by extensive cereal and grain cultivation supported by mechanized large-scale farming.

Market Insights

- The Germany Potash Fertilizers Market grew from USD 1,539.72 million in 2018 to USD 1,689.57 million in 2024 and is projected to reach USD 2,231.38 million by 2032, growing steadily at 3.54%.

- Potassium Chloride dominated with a 54% share in 2024, supported by affordability and extensive use in cereals and grains, while chloride-free alternatives gained traction in fruits and vegetables.

- Broadcasting led application methods with a 48% share in 2024 due to cost-effectiveness and suitability for large farms, while fertigation expanded rapidly with modern irrigation in high-value crops.

- Solid fertilizers held a 67% share in 2024, driven by affordability and wide adoption in traditional farming, while liquid fertilizers gained momentum in greenhouse and horticultural applications.

- Northern Germany led with 35% share in 2024, supported by extensive cereal and grain farming, while Southern Germany followed with 27% driven by vineyards, orchards, and specialty crops.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride led the Germany Potash Fertilizers Market with a 54% share in 2024, driven by cost efficiency and extensive use in cereal and grain production. Farmers favor it for its high solubility and wide availability, making it a preferred bulk fertilizer. Sulphate of Potash and Potassium Nitrate show growth in fruit and vegetable farming due to chloride-free properties. Other specialty products gain attention in niche, customized nutrition applications.

By Application Method

Broadcasting dominated with a 48% share in 2024, supported by its cost-effectiveness and suitability for large-scale field application. This method remains popular for cereals and grains, where quick and uniform nutrient spread is essential. Fertigation is expanding rapidly with modern irrigation practices, providing efficiency for fruits and vegetables. Foliar application holds a smaller but steady role, addressing nutrient deficiencies quickly. Other application methods serve specialized, controlled environment farming needs.

For instance, Netafim introduced the AlphaDisc™ automated fertigation filter system, designed to optimize nutrient delivery efficiency in fruit and vegetable cultivation.

By Form

Solid fertilizers accounted for a 67% share in 2024, underpinned by their affordability, ease of storage, and broad adoption in open-field farming. Solid potash is heavily used in cereals and grains, reflecting traditional practices. Liquid fertilizers, though smaller in volume, are advancing with fertigation and precision farming. Their effectiveness in greenhouse, horticultural, and high-value crops positions them as a growing alternative. This segment reflects Germany’s gradual shift toward modernized application techniques.

For instance, COMPO EXPERT expanded its NovaTec range of controlled-release fertilizers in Germany, targeting precision farming and sustainable nutrient delivery for vegetable and horticultural production.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Value Crops

The demand for fruits, vegetables, and specialty crops in Germany continues to increase, boosting the need for high-quality potash fertilizers. Chloride-free options like sulphate of potash and potassium nitrate gain traction for sensitive crops. Farmers adopt these fertilizers to enhance yield, improve quality, and meet export standards. This demand directly supports market expansion by shifting focus from bulk fertilizers toward premium nutrient formulations tailored to horticultural and specialty crop production.

For instance, Haifa Chemicals introduced a localized water-soluble potassium nitrate program in Europe to support greenhouse tomato and pepper cultivation, aimed at boosting yields for export markets.

Precision Farming Adoption

Germany is witnessing rapid growth in precision agriculture, supported by advanced irrigation and digital monitoring systems. Potash fertilizers are integral in fertigation and controlled application methods, ensuring optimal nutrient delivery. Farmers increasingly invest in technologies that allow accurate dosing and efficient input use. This trend improves soil health, reduces waste, and enhances profitability, making precision farming a strong driver for sustained fertilizer demand in both large-scale and high-value crop production.

For instance, John Deere launched its ExactShot technology at Agritechnica in Hanover, designed to deliver targeted fertilizer shots during planting, reducing nutrient waste by up to 60%.

Government Support and Sustainability Policies

Regulatory initiatives and sustainability programs in Germany encourage the efficient use of fertilizers to maintain soil fertility and reduce environmental impact. Policies promote balanced nutrient management, ensuring compliance with EU environmental standards. Subsidies and advisory services guide farmers toward adopting eco-friendly practices, often involving potash fertilizers with improved efficiency. Such supportive frameworks strengthen farmer confidence, create stable demand, and ensure long-term alignment with the country’s agricultural sustainability objectives.

Key Trends & Opportunities

Key Trends & Opportunities

Growth of Chloride-Free Fertilizers

A major trend in Germany is the increasing adoption of chloride-free fertilizers, particularly in fruits, vegetables, and vineyards. Sulphate of potash and potassium nitrate are gaining preference as they improve crop quality without causing chloride sensitivity issues. This shift creates opportunities for companies offering specialized formulations tailored to sensitive crops. Rising consumer demand for premium produce and sustainable agricultural practices further accelerates growth in this segment, positioning it as a key market opportunity.

For instance, ICL Group launched its “ICL PotashpluS” and potassium nitrate lines across European markets, including Germany, targeting chloride-sensitive crops like apples and grapevines.

Expansion of Liquid Fertilizers and Fertigation

Liquid potash fertilizers are witnessing growing adoption due to compatibility with fertigation systems and precision farming practices. Greenhouse cultivation and horticulture, which are expanding in Germany, favor liquid formulations for targeted nutrient delivery. This trend opens opportunities for fertilizer companies to innovate in liquid blends designed for efficiency and sustainability. The combination of modern irrigation, digital tools, and sustainable farming creates a favorable environment for expanding liquid fertilizer usage across the country.

For instance, K+S AG introduced a new granular fertilizer, ESTA Kieserit GRAN., to its ESTA Kieserit range, which supports precision application in horticulture and specialty crops.

Key Challenges

Environmental Regulations and Restrictions

Germany enforces strict EU directives on fertilizer usage, particularly concerning nutrient runoff and groundwater contamination. These regulations limit excessive application and demand greater compliance from farmers. While such policies aim to safeguard the environment, they increase operational costs and reduce flexibility in fertilizer use. Market players must innovate with efficient, eco-friendly formulations to remain competitive, creating a challenge for both manufacturers and farmers adapting to evolving compliance standards.

Price Volatility of Raw Materials

Fluctuating global prices of potash and related raw materials create uncertainty in the German market. Dependence on imports for certain fertilizer components exposes the industry to supply chain disruptions and cost instability. Rising energy costs further amplify pricing pressure. This volatility affects farmers’ purchasing decisions, often leading to reduced application or substitution. Stabilizing supply chains and managing costs remain crucial challenges for companies seeking to maintain market competitiveness and farmer trust.

Competition from Alternative Solutions

The rising popularity of organic fertilizers and bio-based soil enhancers poses a challenge to conventional potash fertilizer demand. Farmers increasingly explore alternatives driven by sustainability concerns and consumer preference for organic produce. These substitutes reduce reliance on mineral fertilizers, particularly in horticulture and specialty crops. For potash producers, the challenge lies in differentiating products, highlighting efficiency, and integrating sustainable practices to retain market share in an environment shifting toward eco-friendly agricultural inputs.

Regional Analysis

Northern Germany

Northern Germany held the largest share of the Germany Potash Fertilizers Market with 35% in 2024. The region benefits from extensive cereal and grain cultivation, supported by large-scale mechanized farming. Farmers here rely heavily on potash fertilizers to sustain soil fertility and improve crop yields. Coastal areas with fertile plains and access to efficient logistics channels strengthen supply and distribution. The dominance of cereals drives steady demand for potassium chloride. It remains a critical agricultural hub shaping overall market performance.

Southern Germany

Southern Germany accounted for 27% of the market share in 2024, supported by diverse crop patterns and strong demand from fruits and vegetables. Orchards, vineyards, and specialty crop farms drive the need for chloride-free fertilizers such as sulphate of potash and potassium nitrate. Farmers in the region emphasize quality improvement and export-oriented production. The adoption of fertigation and greenhouse farming practices boosts liquid potash fertilizer use. It continues to emerge as a growth engine for specialty applications.

Western Germany

Western Germany contributed 22% share in 2024, shaped by mixed farming practices and growing investment in precision agriculture. The region benefits from advanced infrastructure and high adoption of technology-driven methods. Broadcasting dominates in cereals and grains, while fertigation gains traction for horticulture. Rising urbanization increases pressure on farmland, leading to more efficient fertilizer use. Strong industrial presence supports distribution networks, ensuring timely supply. It remains a balanced market with both traditional and modern farming approaches.

Eastern Germany

Eastern Germany held 16% share in 2024, characterized by large-scale farming cooperatives and consolidated land holdings. The region relies on solid potash fertilizers for cereals and oilseeds, which dominate its agricultural output. Adoption of modern techniques is growing but slower compared to western regions. Limited horticultural activity restrains demand for chloride-free formulations. Despite this, investment in precision agriculture is gradually improving uptake. It offers potential for expansion through sustainability programs and modernization initiatives.

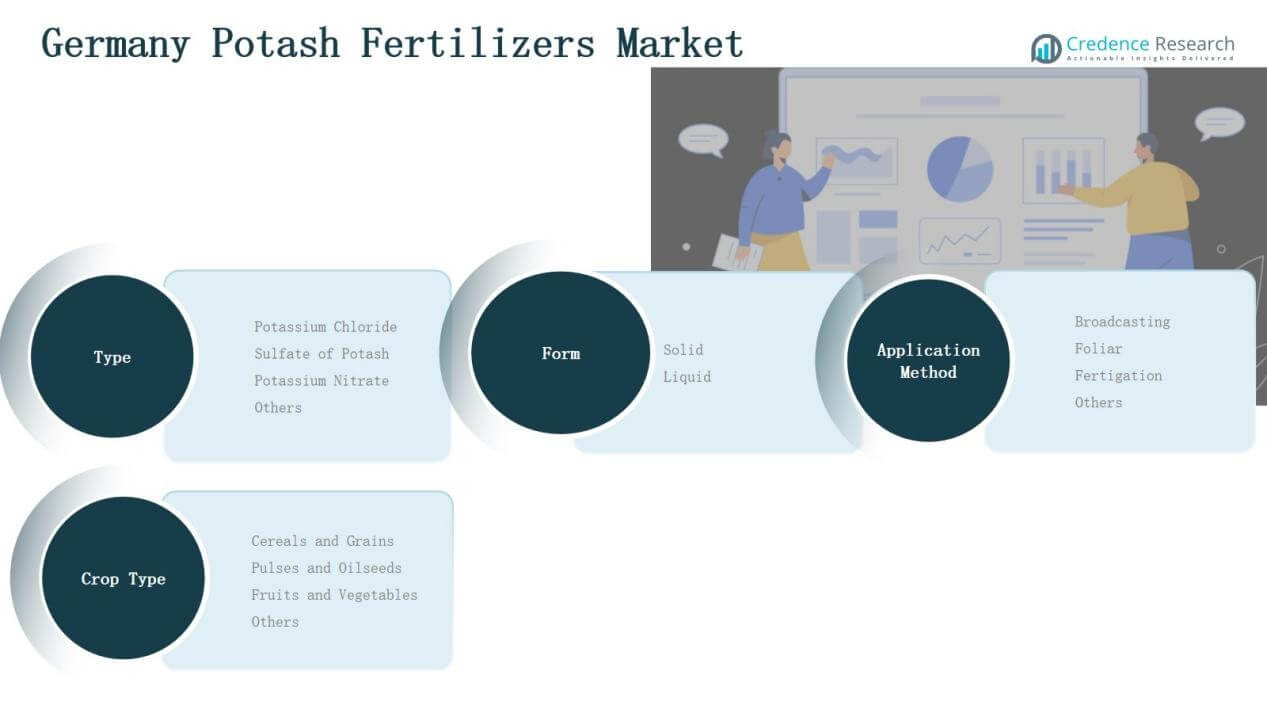

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- Northern Germany

- Southern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

The Germany Potash Fertilizers Market is moderately consolidated, with global leaders and domestic suppliers competing to strengthen their presence. Key players such as EuroChem Group AG, K+S Aktiengesellschaft, HELM AG, The Mosaic Company, Yara International ASA, Grupa Azoty S.A., SQM S.A., ICL Group, and Nutrien Ltd drive market growth through integrated supply chains, product diversification, and sustainable practices. K+S maintains a strong foothold with established production facilities in Germany, while global companies leverage imports and strategic partnerships to expand reach. Companies focus on expanding chloride-free formulations like sulphate of potash and potassium nitrate to meet demand in high-value crops, including fruits, vegetables, and vineyards. Sustainability, digital farming integration, and innovation in liquid formulations remain central strategies to gain a competitive edge. It reflects a market where established global corporations compete alongside local producers to meet evolving farmer preferences and strict environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In January 2025, K+S launched the C:LIGHT product line in Germany, offering CO₂-reduced potassium and magnesium fertilizers with a carbon footprint reduced by up to 90%, supporting more climate-friendly agriculture.

- In August 2025, ICL Group partnered with Landhandel Peters to open a new fertilizer blending plant in northern Germany, enabling on-site custom mixes using controlled-release technology.

- In January 2025, Grupa Azoty announced plans to consider selling its German fertilizer subsidiary, Compo Expert GmbH, as part of efforts to improve liquidity.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chloride-free fertilizers will grow with rising fruit and vegetable cultivation.

- Precision farming adoption will boost the use of liquid and specialty potash formulations.

- Sustainability policies will push farmers toward efficient and eco-friendly fertilizer use.

- Broadcasting will retain dominance but fertigation will expand with modern irrigation systems.

- Solid fertilizers will remain widely used while liquid formulations gain faster adoption.

- Northern Germany will maintain leadership due to strong cereal and grain farming.

- Southern Germany will expand demand with focus on vineyards, orchards, and specialty crops.

- Digital agriculture platforms will support optimized potash application and farm profitability.

- Competition from organic and bio-based alternatives will influence product differentiation strategies.

- Strategic partnerships and innovation will shape long-term growth opportunities for market players.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: