Market Overview:

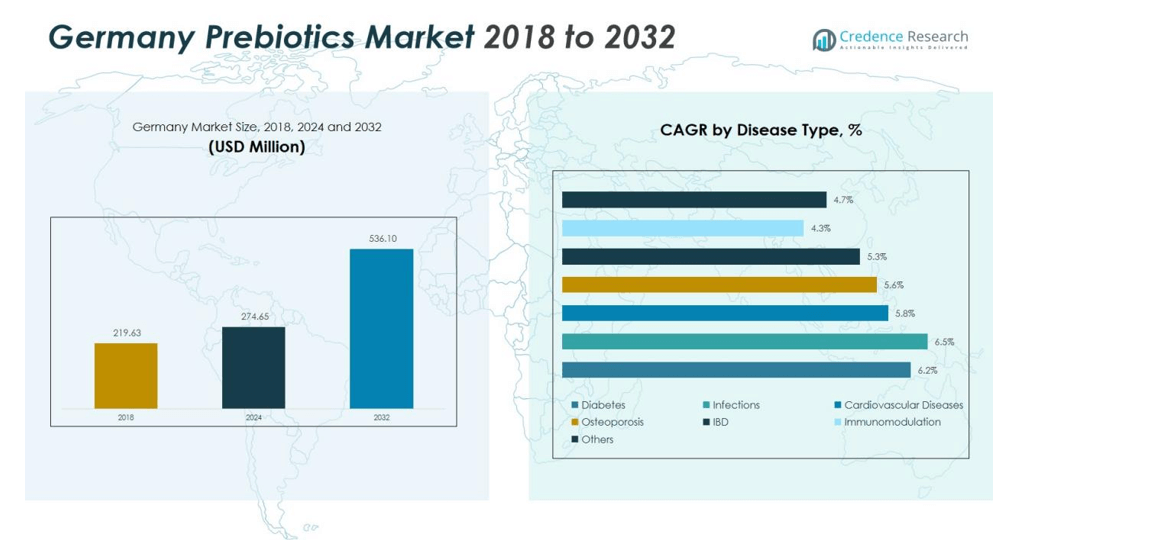

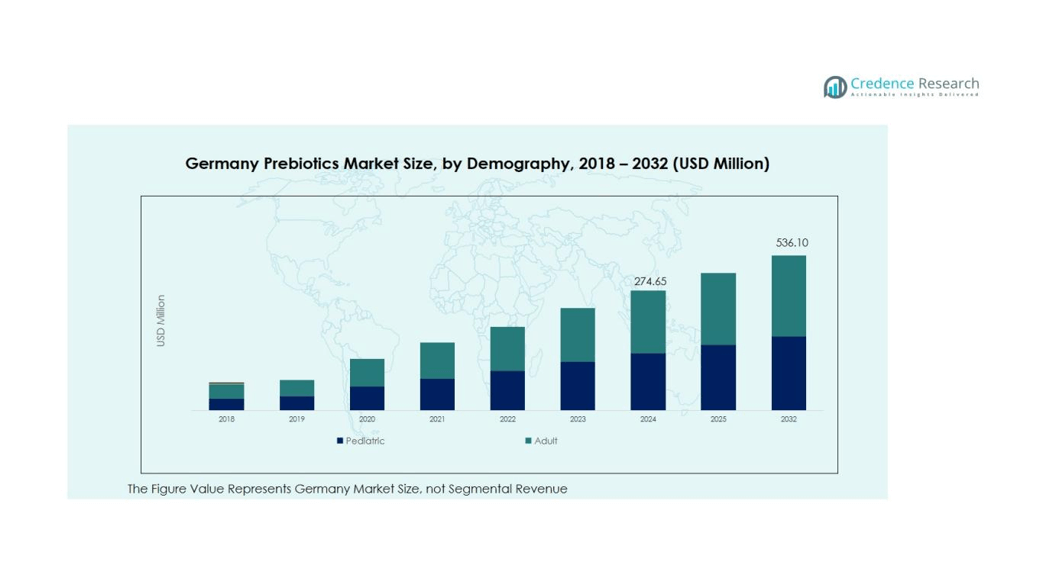

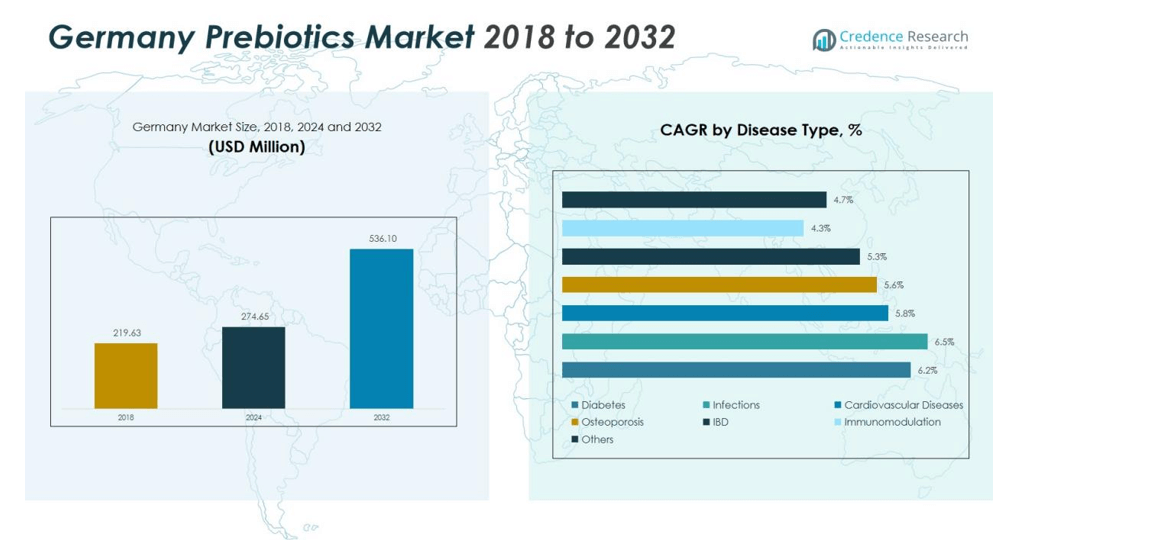

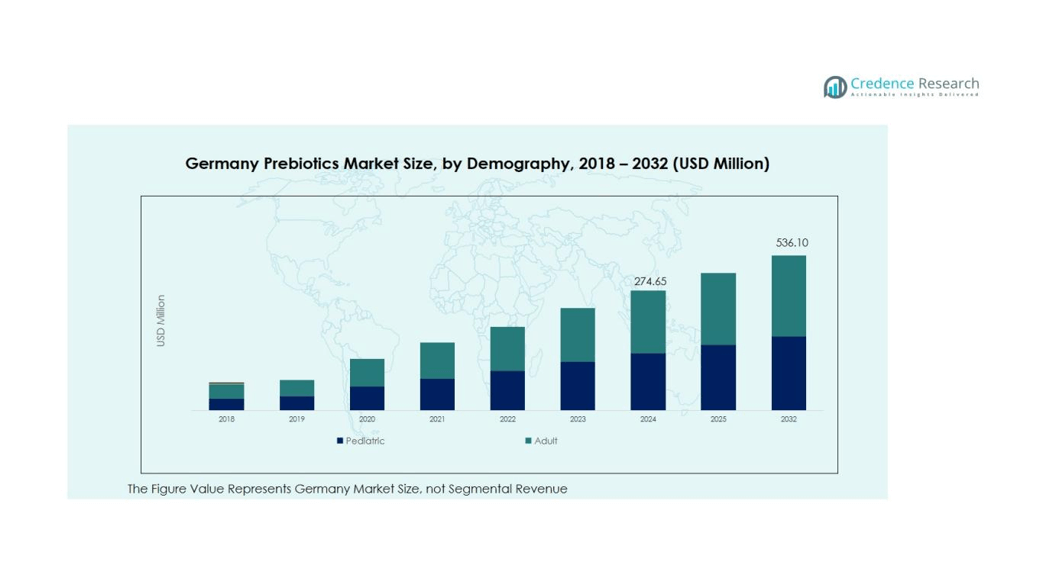

The Germany Prebiotics Market size was valued at USD 219.63 million in 2018 to USD 274.65 million in 2024 and is anticipated to reach USD 536.10 million by 2032, at a CAGR of 8.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Prebiotics Market Size 2024 |

USD 274.65 million |

| Germany Prebiotics Market, CAGR |

8.72% |

| Germany Prebiotics Market Size 2032 |

USD 536.10 million |

Rising consumer focus on digestive wellness and preventive healthcare continues to drive product demand in Germany. Manufacturers are increasingly integrating inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) into dairy, bakery, and beverage products. Strong investments in R&D and supportive regulations for health claims under EU frameworks further enhance product innovation, leading to greater product differentiation and competitiveness among domestic and international brands.

Regionally, Southern and Western Germany dominate the market due to strong consumer awareness, robust food processing infrastructure, and high retail penetration of functional products. Northern Germany shows growing adoption driven by the expansion of nutraceutical and pharmaceutical applications. Meanwhile, Eastern Germany is emerging as a fast-growing region, supported by urbanization, dietary diversification, and increasing demand for fortified foods and supplements.

Market Insights:

- The Germany Prebiotics Market was valued at USD 219.63 million in 2018, reaching USD 274.65 million in 2024 and projected to hit USD 536.10 million by 2032, growing at a CAGR of 8.72%.

- Southern Germany accounts for 38% of the market share, supported by advanced food processing industries and strong consumer awareness of functional nutrition.

- Western Germany holds 33% of the market, driven by dense urban populations, high disposable incomes, and strong retail networks promoting prebiotic-rich food products.

- Northern Germany captures 18% share, led by expanding nutraceutical and pharmaceutical applications supported by regional wellness campaigns and growing manufacturing capabilities.

- Eastern Germany represents the fastest-growing region with a 12% share, benefiting from rising urbanization, increased retail presence, and growing consumer demand for fortified foods.

- By product, inulin dominates with 41% share due to its wide application in dairy, bakery, and beverage sectors.

- Fructo-oligosaccharides hold 26% share, supported by increasing use in infant nutrition and clean-label formulations across leading food brands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Awareness of Gut Health and Preventive Nutrition

The Germany Prebiotics Market is driven by growing consumer focus on digestive wellness and disease prevention. Consumers increasingly seek food and beverage products that support gut microbiota balance and immunity. Rising health consciousness has encouraged food manufacturers to add inulin, FOS, and GOS to daily consumables. It benefits from national nutrition programs promoting dietary fibers and healthy eating habits.

- For instance, the German government’s IN FORM initiative, active since 2008, has supported more than 250 projects aimed at improving dietary habits and promoting nutritional education across all age groups, with fiber intake identified as a key priority

Expanding Use of Prebiotics in Functional and Fortified Foods

Strong demand for functional foods continues to boost prebiotic integration in Germany. Leading producers use prebiotic ingredients in dairy, bakery, and beverages to enhance nutritional value and flavor. It benefits from an expanding consumer base interested in clean-label and plant-based options. The ongoing innovation in formulation supports product diversification and improves market competitiveness.

- For Instance, Nestlé launched its N3 milk line in China in November 2023, containing prebiotic fibers and over 15% fewer calories, fortified to support bone health and immunity. This product exemplifies innovation in the global functional foods market, which includes Germany, where the market generated USD 23,801.1 million in 2023.

Supportive Regulatory Environment and Active Research Investments

Germany’s favorable EU-backed regulations on functional food claims promote confidence among manufacturers and consumers. Clear labeling guidelines and strong enforcement have supported responsible marketing and transparency. Research funding from government and private institutions encourages product development using advanced biotechnological methods. It helps accelerate innovation and strengthens collaborations between industry and academia.

Growing Applications in Pharmaceuticals and Nutritional Supplements

The pharmaceutical and nutraceutical sectors increasingly use prebiotics to enhance therapeutic formulations and supplement efficacy. Rising demand for immunity-boosting and digestive health supplements drives steady adoption. It benefits from higher consumer spending on health maintenance and preventive care. Expanding product portfolios across pharmacies and online platforms strengthen industry growth and visibility.

Market Trends:

Rising Integration of Prebiotics into Clean-Label and Plant-Based Food Products

The Germany Prebiotics Market is witnessing strong momentum toward clean-label and plant-based product formulations. Food manufacturers are increasingly using inulin, FOS, and GOS in dairy alternatives, cereals, and bakery items to align with consumer preference for natural ingredients. Growing awareness of gut health and immunity among vegan and vegetarian consumers supports this trend. It encourages product innovation across fortified snacks and beverages that emphasize transparency and nutritional balance. Partnerships between ingredient suppliers and food brands focus on developing multifunctional products that meet both health and sustainability goals. Expanding retail availability of prebiotic-rich foods under major brands strengthens consumer access and loyalty.

- For Instance, In April 2025, BENEO GmbH, a part of the Südzucker Group, inaugurated a new €50 million pulse-processing plant in Obrigheim, Rhineland-Palatinate, Germany

Expansion of Prebiotics in Personalized Nutrition and Nutraceuticals

Personalized nutrition solutions are becoming a defining trend within Germany’s evolving health and wellness landscape. It reflects a growing consumer demand for customized dietary products that target digestive health, metabolism, and immunity. The increasing adoption of digital health tools and microbiome testing enables brands to design prebiotic-based solutions tailored to individual needs. Pharmaceutical and nutraceutical companies are integrating prebiotics into supplement formats like capsules, powders, and gummies for higher absorption and ease of use. The focus on preventive health and lifestyle management drives R&D investments in bioactive ingredients and formulation technologies. Continuous clinical validation of prebiotic benefits is expected to further strengthen consumer confidence and long-term market growth.

- For instance, myBioma, a German microbiome testing company certified with double ISO 13485 certification (the first globally in microbiome analysis), identifies approximately 5,000 distinct bacterial species using next-generation sequencing technology with proprietary bioinformatic algorithms, providing evidence-based personalized nutrition recommendations validated through peer-reviewed research integration.

Market Challenges Analysis:

High Production Costs and Complex Supply Chain Structure

The Germany Prebiotics Market faces cost challenges linked to extraction, purification, and formulation processes. Producing high-quality inulin, FOS, and GOS requires advanced technology and reliable raw material sourcing, which raise operational expenses. It also depends on global supply chains for plant-based inputs such as chicory roots, creating vulnerability to price fluctuations. Small and medium enterprises find it difficult to compete with large-scale producers due to high investment requirements. Limited local manufacturing capacity further restricts pricing flexibility in a competitive landscape.

Regulatory Constraints and Low Consumer Awareness in Rural Regions

Strict EU labeling and health claim regulations demand strong clinical evidence, slowing product approvals and innovation. Many companies face delays in launching new products due to lengthy testing and compliance processes. It also struggles with uneven consumer awareness between urban and rural regions, where understanding of prebiotic benefits remains limited. Limited access to functional foods in smaller markets reduces potential sales volumes. High education and marketing costs are required to expand consumer trust and acceptance, which impacts profit margins for emerging brands.

Market Opportunities:

Rising Demand for Functional Foods and Health-Oriented Nutrition Products

The Germany Prebiotics Market is poised to benefit from growing demand for functional and fortified food products. Consumers increasingly seek foods that support digestion, immunity, and overall well-being. It creates a strong opportunity for manufacturers to expand product portfolios in dairy, bakery, and beverage categories. Growing alignment with sustainability and clean-label trends also supports innovation using plant-based prebiotic sources. Collaborations between ingredient suppliers and food brands can help develop new applications that combine taste and health benefits. The shift toward preventive healthcare continues to open new growth channels for fortified everyday foods.

Growing Role of Prebiotics in Personalized Healthcare and Nutraceuticals

Personalized health solutions and microbiome-focused products present significant opportunities for market expansion. It enables brands to introduce customized formulations targeting gut health, metabolism, and immune support. Advances in microbiome research and digital health tools strengthen consumer trust in prebiotic-based supplements. The rising popularity of nutraceuticals, powders, and gummies enhances accessibility across different age groups. Expanding online retail networks and pharmacy channels further boost product reach and convenience. Companies investing in clinical validation and consumer education can secure a strong position in the evolving wellness ecosystem.

Market Segmentation Analysis:

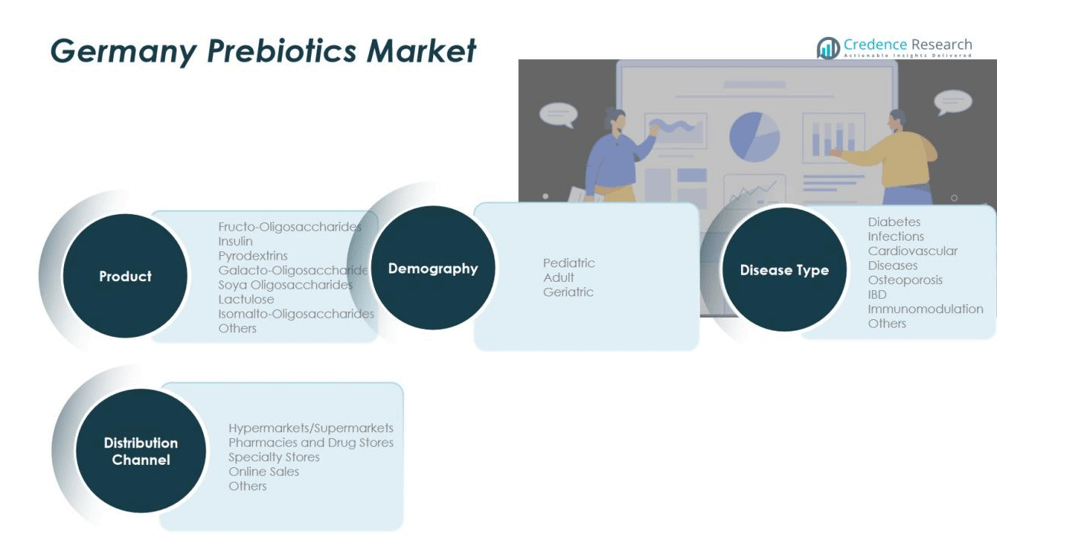

By Product

The Germany Prebiotics Market is segmented into fructo-oligosaccharides, inulin, pyrodextrins, galacto-oligosaccharides, soya oligosaccharides, lactulose, isomalto-oligosaccharides, and others. Inulin holds the largest share due to its wide use in functional foods, beverages, and dietary supplements. It benefits from strong demand for natural fiber sources and digestive health ingredients. Galacto-oligosaccharides and fructo-oligosaccharides follow, supported by expanding use in infant nutrition and dairy formulations. The growing preference for plant-based ingredients continues to shape product diversification and innovation in prebiotic applications.

- For instance, FrieslandCampina Ingredients unveiled Biotis GOS-OP High Purity, featuring a galacto-oligosaccharide content of over 94% with proven efficacy at doses as low as 2 grams, thereby enabling brands to formulate smaller, more convenient prebiotic supplements in formats such as gummies, tablets, and capsules—a significant breakthrough in the gut health supplement market.

By Disease Type

Prebiotics are widely applied across conditions such as diabetes, infections, cardiovascular diseases, osteoporosis, inflammatory bowel disease (IBD), immunomodulation, and others. The diabetes segment leads due to increasing awareness of gut health’s role in glucose regulation. It benefits from the rising adoption of prebiotic-enriched diets to improve metabolism and immunity. Cardiovascular and IBD segments show strong potential driven by preventive health awareness and evolving clinical research.

- For Instance, ZOE BIOME trial involved 399 healthy UK adults, and participants with type 1 or 2 diabetes were explicitly excluded. Therefore, no results concerning type 2 diabetes can be derived from this study.

By Demography

Based on demography, the market covers pediatric, adult, and geriatric groups. The adult category dominates due to high health consciousness and consistent consumption of functional food products. It also reflects the growing number of working individuals focusing on preventive healthcare. The geriatric segment is expanding rapidly due to aging population trends and demand for digestive and immunity-boosting supplements. Pediatric applications continue to grow through fortified milk formulas and nutritional products.

Segmentations:

By Product Segment

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type Segment

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography Segment

- Pediatric

- Adult

- Geriatric

By Distribution Channel Segment

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

Regional Analysis:

Dominance of Southern and Western Germany in Prebiotic Consumption

The Germany Prebiotics Market is led by Southern and Western regions, supported by advanced food processing infrastructure and high consumer awareness of functional nutrition. These regions host several leading food and beverage manufacturers focused on integrating inulin, FOS, and GOS into everyday food products. It benefits from dense urban populations with strong purchasing power and preference for clean-label formulations. The presence of major retail and distribution networks further accelerates access to fortified and prebiotic-rich products. Strong innovation ecosystems and proximity to research institutions also drive faster product development and commercialization.

Emerging Growth Potential in Northern Germany

Northern Germany represents a growing region within the national market landscape, driven by increasing interest in preventive healthcare and wellness foods. Rising consumer preference for natural and plant-based ingredients strengthens the adoption of prebiotic supplements and fortified snacks. It gains support from regional health campaigns promoting dietary fiber intake and digestive health. Expanding manufacturing capacity in key industrial cities improves production efficiency and distribution reach. The growing influence of online health platforms and retail channels supports greater market penetration.

Rapid Expansion Across Eastern Germany through Urbanization and Awareness

Eastern Germany is emerging as a high-potential growth area due to rising urbanization and increasing disposable incomes. The expansion of supermarkets and health-focused retail outlets improves consumer access to functional products. It experiences growing adoption of nutraceuticals, fortified dairy, and bakery products in both urban and semi-urban areas. Public health initiatives promoting balanced diets enhance long-term demand for prebiotic ingredients. The region’s improving economic landscape and growing investment in food technology support sustained market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Nestlé S.A.

- OptiBac Probiotics Ltd.

- Archer Daniels Midland Company

- BioGaia AB

- Lallemand Inc.

- Kerry Group plc

- Hansen Holding A/S

- DuPont Nutrition & Biosciences

- General Mills Inc.

- Arla Foods amba

Competitive Analysis:

The Germany Prebiotics Market features strong competition among multinational and regional players focusing on innovation, product expansion, and strategic partnerships. Key companies include Danone S.A., Yakult Honsha Co., Ltd., Nestlé S.A., OptiBac Probiotics Ltd., Archer Daniels Midland Company, BioGaia AB, and Lallemand Inc. It is characterized by high investment in research and development to create clinically supported, science-based formulations that enhance digestive and immune health. Companies emphasize sustainable sourcing, clean-label positioning, and advanced formulation techniques to meet evolving consumer expectations. Strong distribution networks across supermarkets, pharmacies, and online platforms help maintain brand visibility and consumer trust. Market players also invest in awareness campaigns and educational initiatives to strengthen demand across both urban and rural areas.

Recent Developments:

- In October 2025, Yakult Honsha completed a merger between Yakult Europe B.V. and Yakult Oesterreich GmbH, effective October 1, 2025, to enhance operational efficiency and strengthen sales activities across Austria.

- In August 2025, Nestlé entered a partnership with IBM Research to develop sustainable food packaging using generative AI, aiming to reduce plastic use through advanced, data‑driven material science.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Disease Type Segment, Demography Segment and Distribution Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Prebiotics Market is expected to experience steady growth driven by rising demand for functional and fortified foods.

- Consumer preference for natural, plant-based, and clean-label ingredients will continue to shape product innovation.

- Manufacturers will focus on developing diversified formulations that target digestive, metabolic, and immune health.

- Pharmaceutical and nutraceutical sectors will expand prebiotic integration in supplements, gummies, and powders.

- It will witness growing adoption of microbiome research to design personalized nutrition products.

- Collaborations between food producers, health institutions, and biotech firms will strengthen product validation and awareness.

- Online retail platforms will play a major role in improving accessibility and consumer engagement.

- Sustainability and ethical sourcing practices will influence brand differentiation and long-term loyalty.

- Regional demand will expand across Northern and Eastern Germany due to increasing health awareness and urbanization.

- Continuous R&D investments and favorable regulations will position Germany as a leading European hub for prebiotic innovation.