Market Overview:

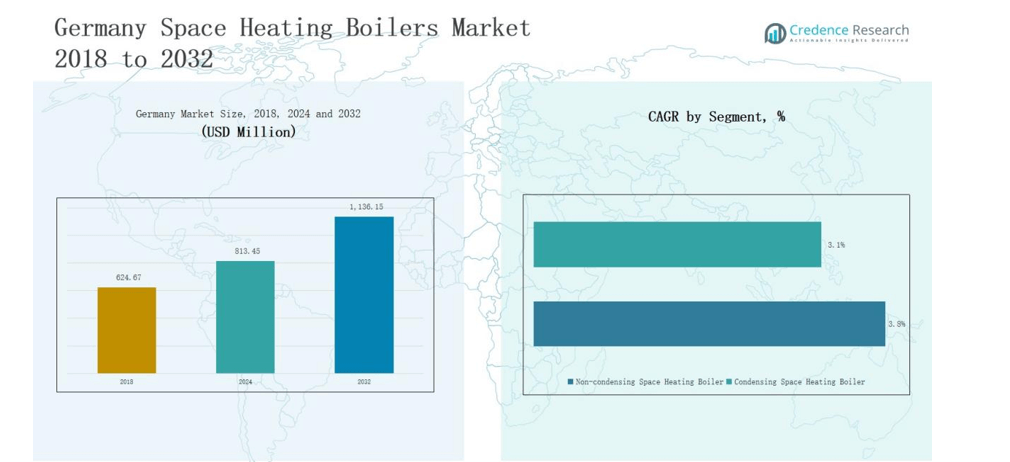

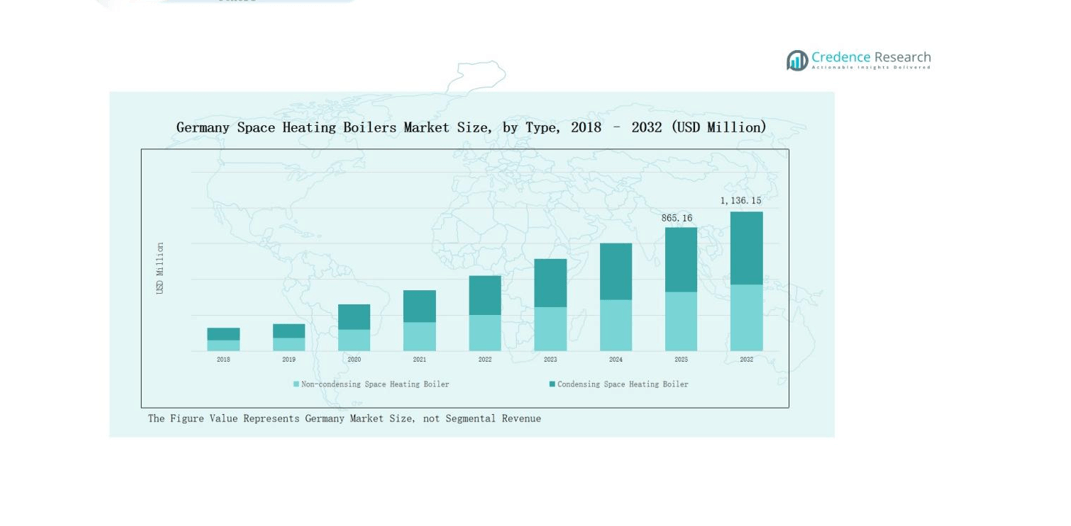

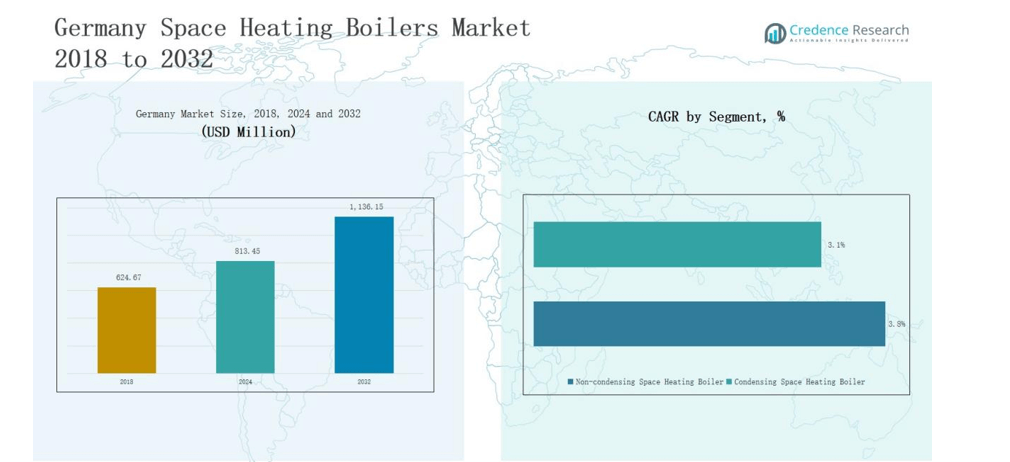

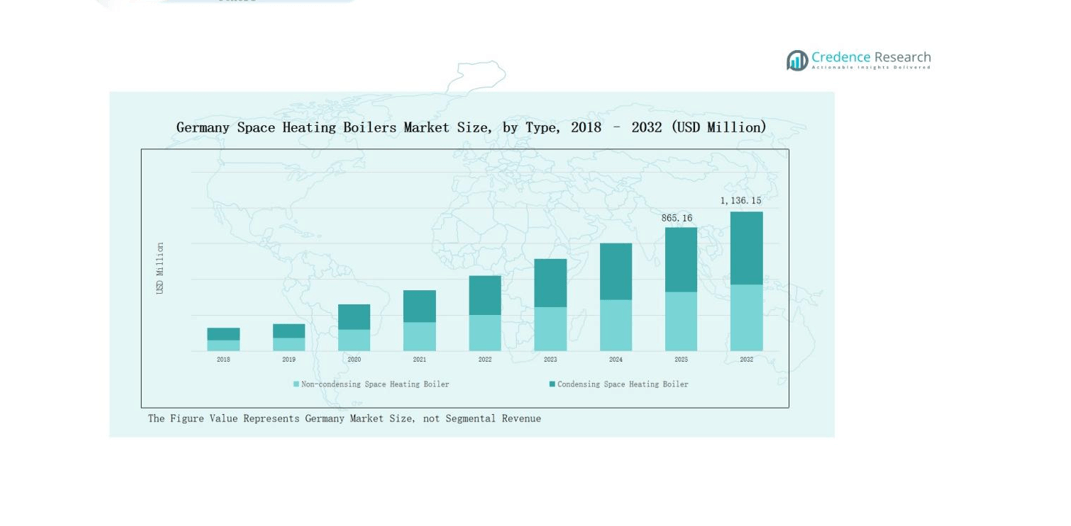

Germany Space Heating Boilers Market size was valued at USD 624.67 million in 2018 to USD 813.45 million in 2024 and is anticipated to reach USD 1,136.15 million by 2032, at a CAGR of 3.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Space Heating Boilers Market Size 2024 |

USD 813.45 million |

| Germany Space Heating Boilers Market, CAGR |

3.97% |

| Germany Space Heating Boilers Market Size 2032 |

USD 1,136.15 million |

The Germany Space Heating Boilers Market is shaped by strong competition among leading companies such as Viessmann Group, Bosch Thermotechnology, Vaillant Group, Buderus, Wolf GmbH, Baxi Heating, Ideal Boilers, Atlantic Group, De Dietrich Thermique, and ZILMET GmbH. These players maintain dominance through advanced product portfolios, extensive distribution networks, and a focus on condensing and hybrid boiler technologies aligned with Germany’s energy efficiency goals. Continuous investment in smart controls, digital integration, and eco-friendly systems strengthens their positions. Regionally, Northern Germany leads the market with 34% share in 2024, driven by colder winters, dense urban populations, and well-established natural gas infrastructure supporting higher adoption of efficient heating solutions.

Market Insights

- The Germany Space Heating Boilers Market grew from USD 624.67 million in 2018 to USD 813.45 million in 2024 and will reach USD 1,136.15 million by 2032.

- Condensing boilers held 68% share in 2024, supported by strict EU regulations, government incentives, and strong replacement demand for older systems.

- The residential sector dominated with 61% share in 2024, driven by urban housing, renovation programs, and strict building energy performance standards.

- Gas-fired boilers led with 72% share in 2024, supported by extensive natural gas infrastructure, while electric boilers grew under decarbonization policies.

- Northern Germany commanded 34% share in 2024, supported by cold winters, dense populations, and advanced gas networks boosting adoption of efficient condensing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Condensing space heating boilers dominate the Germany market with nearly 68% share in 2024. Their leadership is driven by strict EU energy efficiency regulations, government incentives, and strong replacement demand for older units. Non-condensing boilers continue to decline in adoption due to lower efficiency and regulatory restrictions, but they retain limited use in regions with older infrastructure.

- For instance, Viessmann’s Vitodens 300-W gas-condensing boiler has been widely adopted in Germany due to its seasonal efficiency of up to 98%, meeting both EU Ecodesign and Energy Labelling regulations.

By Application

The residential segment leads with around 61% market share in 2024, supported by high household demand for efficient heating solutions and ongoing renovation programs. Germany’s dense urban housing and strict energy performance standards in buildings further boost this segment. Commercial applications account for a moderate share, fueled by office and retail heating needs, while industrial usage remains smaller but steady, driven by specific process heating requirements.

- For instance, Bosch Thermotechnology announced in 2022 that it supplied large-scale hybrid heating systems for multiple office complexes in Frankfurt, aimed at reducing energy consumption.

By Operation

Gas-fired boilers hold the dominant position with 72% share in 2024, supported by Germany’s extensive natural gas infrastructure and consumer preference for reliable heating. Electric boilers are gaining gradual traction due to decarbonization targets and integration with renewable energy, while oil-fired boilers continue to lose share under EU emission reduction rules. Coal and other fuel-based options represent marginal shares, constrained by strict environmental policies and sustainability goals.

Market Overview

Strict Energy Efficiency Regulations

Germany enforces stringent energy efficiency and emission reduction laws, driving adoption of condensing boilers. The EU Energy Performance of Buildings Directive and national climate action programs push households and businesses to replace outdated heating systems. Subsidies and incentives from the government encourage homeowners to shift toward high-efficiency solutions. These regulatory frameworks significantly boost replacement demand and create a favorable environment for manufacturers offering sustainable and advanced boiler technologies.

High Residential Heating Demand

The residential sector accounts for the largest share in Germany’s heating market, fueled by cold winters and dense urban housing. Ongoing building renovations and retrofitting projects support consistent demand for efficient space heating systems. Consumers are increasingly aware of energy savings, prompting adoption of modern condensing and hybrid boilers. Strong housing stock replacement cycles also sustain market growth, ensuring steady revenue streams for leading manufacturers.

- For instance, Viessmann introduced the next generation of its Vitodens 200-W series in 2019, which, like its predecessors, delivers over 98% efficiency. These models, though having compact design options, are often marketed as a premium boiler for larger homes with multiple bathrooms, not exclusively for compact urban housing.

Government Decarbonization Initiatives

Germany’s climate goals aim to achieve carbon neutrality by 2045, directly impacting the heating sector. Policies under the Renewable Energy Heat Act and subsidy programs promote low-emission boilers and hybrid systems. This transition supports wider adoption of gas-condensing, electric, and renewable-integrated heating solutions. Government funding for clean energy technologies accelerates modernization in residential and commercial heating systems, creating long-term growth opportunities for companies offering eco-friendly space heating boilers.

- For instance, Viessmann introduced its Vitocal 250-A heat pump in 2022, designed for modernization projects in German homes, integrating with existing gas or oil boilers to cut emissions.

Key Trends & Opportunities

Shift Toward Hybrid and Renewable Integration

Hybrid boilers that combine gas with renewable sources, such as solar thermal, are gaining momentum. Consumers seek systems that lower energy costs while reducing carbon emissions. Manufacturers are introducing smart hybrid systems aligned with EU climate policies. This shift creates opportunities for companies to position themselves as providers of integrated energy solutions, while meeting rising demand for low-carbon heating. Growing collaboration between energy providers and boiler manufacturers further accelerates adoption, driving innovation in sustainable hybrid technologies and strengthening market competitiveness across Germany.

- For instance, Vaillant offers hybrid boiler and solar thermal systems. However, the “up to 30%” heating cost reduction applies to replacing an old, non-condensing boiler with a new, high-efficiency Vaillant condensing model alone.

Digitalization and Smart Controls

Smart heating technologies with IoT-enabled controls are emerging as a major trend in Germany. Consumers favor systems that optimize energy usage through automation and connectivity. Demand for mobile app-based monitoring and integration with home energy management systems is growing. This trend allows manufacturers to differentiate their offerings and create added value for both residential and commercial customers, strengthening user experience. Integration of voice assistants, predictive maintenance alerts, and advanced analytics enables smarter heating ecosystems, reducing costs while enhancing energy efficiency for environmentally conscious German households.

- For instance, in the commercial segment, Siemens’ Desigo CC building management platform provides predictive maintenance and centralized HVAC integration, helping businesses reduce operating costs while enhancing sustainability.

Key Challenges

High Installation and Upgrade Costs

The transition to modern condensing and hybrid boilers requires significant upfront investment. Many households face budget constraints, slowing large-scale adoption despite long-term savings. Installation complexities further add to cost burdens. This challenge limits penetration in lower-income segments and delays replacement cycles, creating financial barriers. Without targeted subsidies, awareness campaigns, and financing options, the shift to efficient heating technologies risks exclusion of vulnerable groups and uneven market adoption across Germany.

Dependence on Natural Gas Infrastructure

Gas-fired boilers dominate the German market, but reliance on natural gas poses risks. Geopolitical tensions and supply disruptions affect gas availability and pricing. The government’s push for reduced gas dependence creates uncertainty for boiler manufacturers heavily focused on gas technologies. Transitioning away from gas requires rapid innovation and diversification, including hybrid systems and electrification. Companies investing in renewable integration, hydrogen-ready solutions, and smart energy infrastructure will be better positioned to adapt, ensuring resilience against market volatility and policy-driven transitions.

Regulatory Pressure on Oil and Coal Boilers

Oil- and coal-fired boilers face steep declines due to strict environmental regulations. The government’s commitment to phase out fossil-based systems reduces market scope for these categories. Manufacturers serving this segment face revenue pressures and must pivot toward eco-friendly technologies. Adapting product portfolios quickly is critical to maintaining competitiveness in Germany’s evolving heating landscape, where sustainable innovation is prioritized. Strategic partnerships, investment in R&D, and early adoption of alternative fuels help manufacturers address regulatory risks, safeguarding long-term growth opportunities in heating markets.

Regional Analysis

Northern Germany

Northern Germany holds 34% share of the Germany Space Heating Boilers Market in 2024. Cold winters and a dense urban population drive high residential demand for efficient heating solutions. The region benefits from well-established natural gas infrastructure, supporting the widespread adoption of gas-fired condensing boilers. Strong renovation programs and incentives for energy-efficient upgrades further strengthen market penetration. Manufacturers often launch innovative products in this region due to its early adoption trends. It continues to serve as a leading hub for both residential and commercial heating demand.

Western Germany

Western Germany accounts for 27% share of the Germany Space Heating Boilers Market. High population density, strong industrial presence, and modernized housing stock create consistent demand for space heating systems. The region shows strong uptake of condensing boilers, supported by energy-efficiency awareness among consumers. Commercial and industrial facilities add to market expansion, with steady replacement cycles. It also benefits from supportive regional policies that encourage heating system modernization. The presence of manufacturing bases helps ensure reliable supply and service networks.

Southern Germany

Southern Germany contributes 22% share of the Germany Space Heating Boilers Market. Cold alpine winters drive strong residential heating needs, supported by affluent households investing in advanced systems. Condensing boilers dominate installations due to regulatory compliance and efficiency standards. The region shows growing interest in hybrid and renewable-integrated boilers, aligning with sustainability goals. Strong housing renovation activity and commercial adoption support stable market growth. It is an important region for testing new eco-friendly boiler technologies.

Eastern Germany

Eastern Germany holds 17% share of the Germany Space Heating Boilers Market. The region’s demand is shaped by older housing infrastructure requiring frequent replacement of outdated boilers. Government incentives and subsidy programs play a critical role in encouraging adoption of energy-efficient condensing models. Rising urbanization and new housing projects are creating opportunities for modern heating systems. While industrial demand is moderate, residential and small commercial projects drive steady growth. It shows increasing adoption of electric boilers as part of decarbonization initiatives.

Market Segmentations:

By Type

- Non-condensing Space Heating Boiler

- Condensing Space Heating Boiler

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Region

- Northern Germany

- Western Germany

- Southern Germany

- Eastern Germany

Competitive Landscape

The Germany Space Heating Boilers Market is highly competitive, with both domestic and international players driving innovation and growth. Leading companies such as Viessmann Group, Bosch Thermotechnology, Vaillant Group, Buderus, Wolf GmbH, and Baxi Heating dominate the landscape through extensive product portfolios and strong distribution networks. These firms focus on condensing technology, hybrid systems, and digital integration to meet strict energy efficiency standards and sustainability goals. Intense competition has led to continuous product innovation, particularly in smart-connected boilers and renewable-integrated solutions. Smaller players and niche manufacturers also contribute by offering region-specific products and competitive pricing, enhancing overall market diversity. Strategic partnerships, investments in R&D, and aftersales service differentiation remain key strategies for maintaining leadership. With high replacement demand in residential and commercial segments, companies that align with Germany’s decarbonization policies and consumer preference for efficient heating solutions are positioned to strengthen their market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Viessmann Group

- Bosch Thermotechnology

- Vaillant Group

- Wolf GmbH

- Ideal Boilers

- Baxi Heating

- Buderus

- ZILMET GmbH

- Atlantic Group

- De Dietrich Thermique

- Others

Recent Developments

- In 2024, Bosch Thermotechnik (Bosch Home Comfort Group) completed the acquisition of Johnson Controls’ global HVAC business for residential and light commercial buildings. The acquisition was integrated into the Bosch Home Comfort Group, strengthening its role in the German space heating boilers market and consolidating its heating portfolio.

- In July 2025, heat pump sales in Germany reached 139,000 units, surpassing gas boiler sales at 132,500 units for the first time. This shift highlights changing consumer preferences and reflects strong policy-driven momentum toward sustainable heating solutions.

- In January 2024, Viessmann finalized the sale of its heat pump division to Carrier Global for about €12 billion, with Max Viessmann joining Carrier’s board.

- In 2024, Bosch Thermotechnik (Bosch Home Comfort Group) strengthened its heating portfolio in Germany by acquiring Johnson Controls’ global HVAC business for residential and light commercial buildings.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condensing boilers will continue to rise under strict energy efficiency policies.

- Hybrid systems combining gas and renewable energy will gain wider adoption.

- Digital integration and smart controls will become standard features in new boilers.

- Replacement demand in residential housing will remain a primary growth driver.

- Electric boilers will expand steadily as part of Germany’s decarbonization efforts.

- Oil- and coal-fired boilers will decline sharply due to regulatory restrictions.

- Government incentives will support faster adoption of eco-friendly heating solutions.

- Manufacturers will invest more in R&D to develop low-emission and connected systems.

- Commercial and industrial users will modernize systems to cut energy costs and emissions.

- Regional markets in Northern and Western Germany will lead in innovation and adoption.