Market Overview

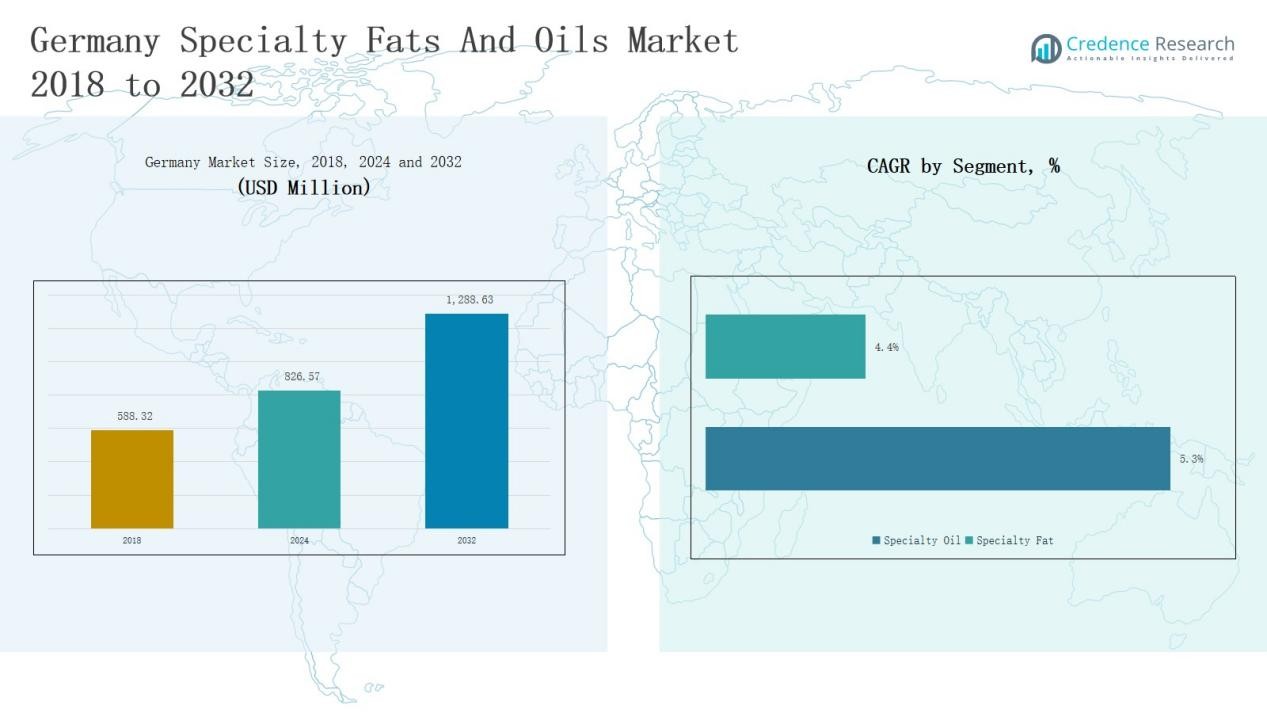

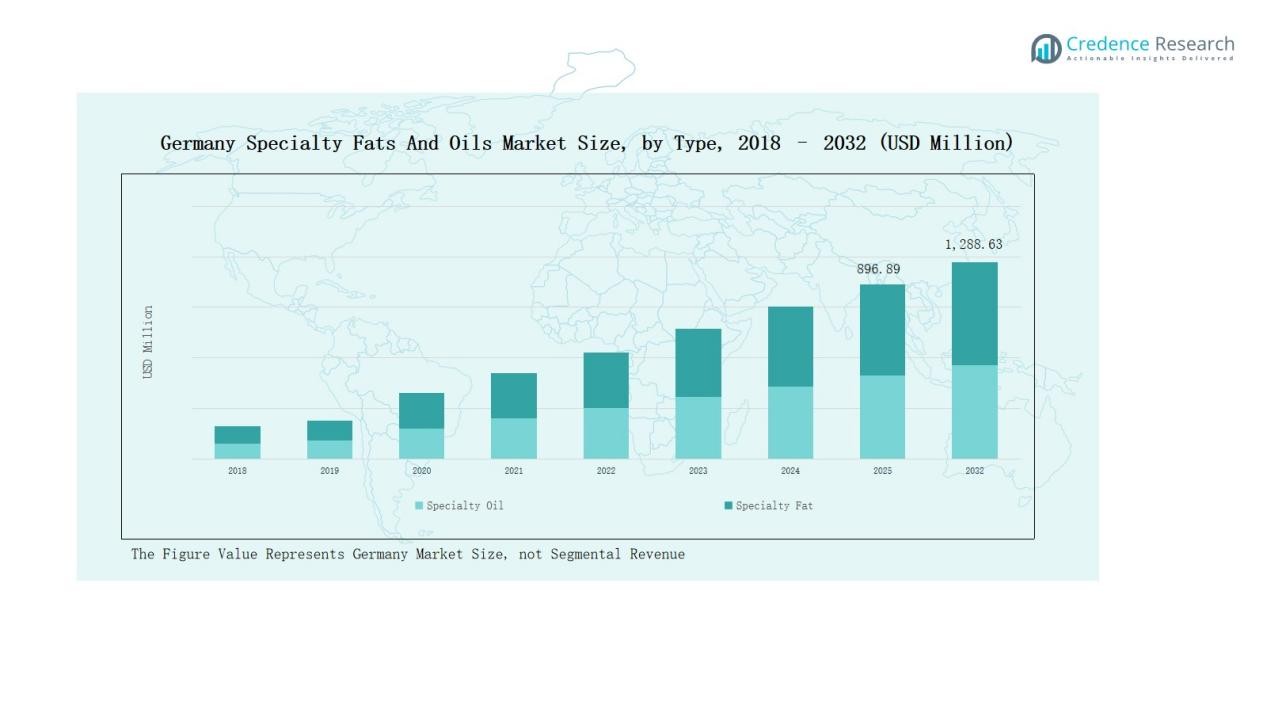

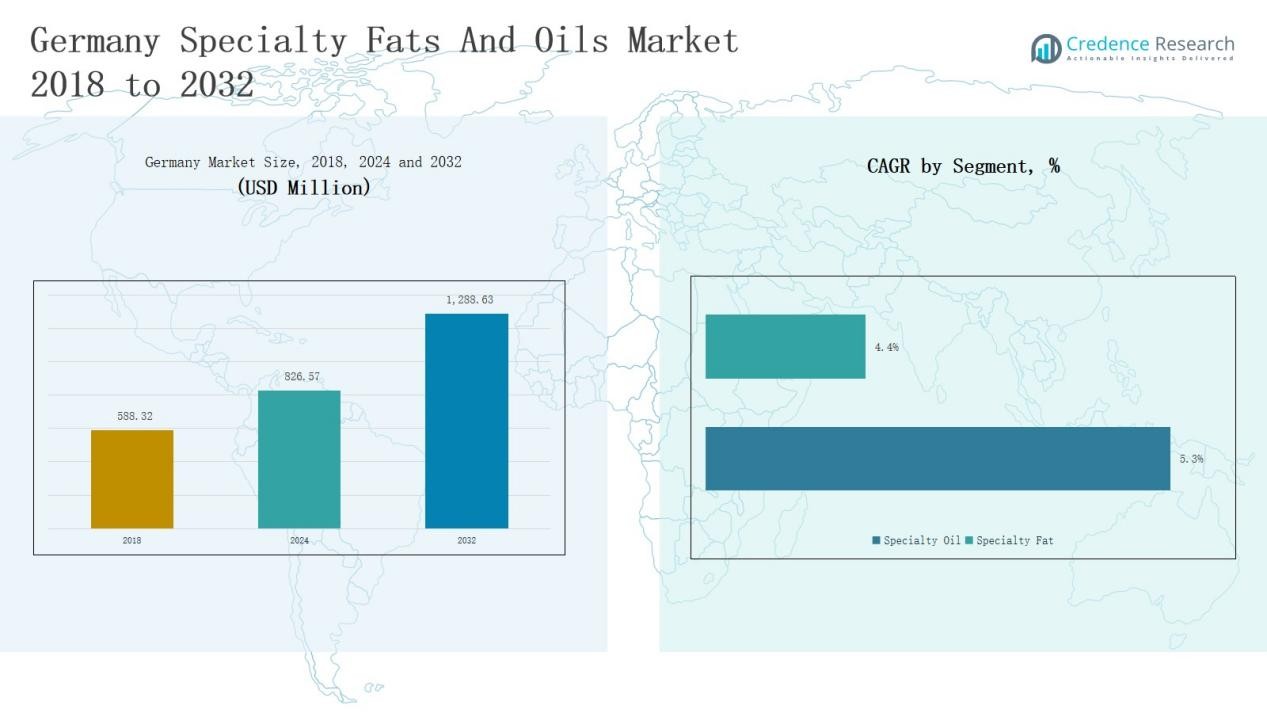

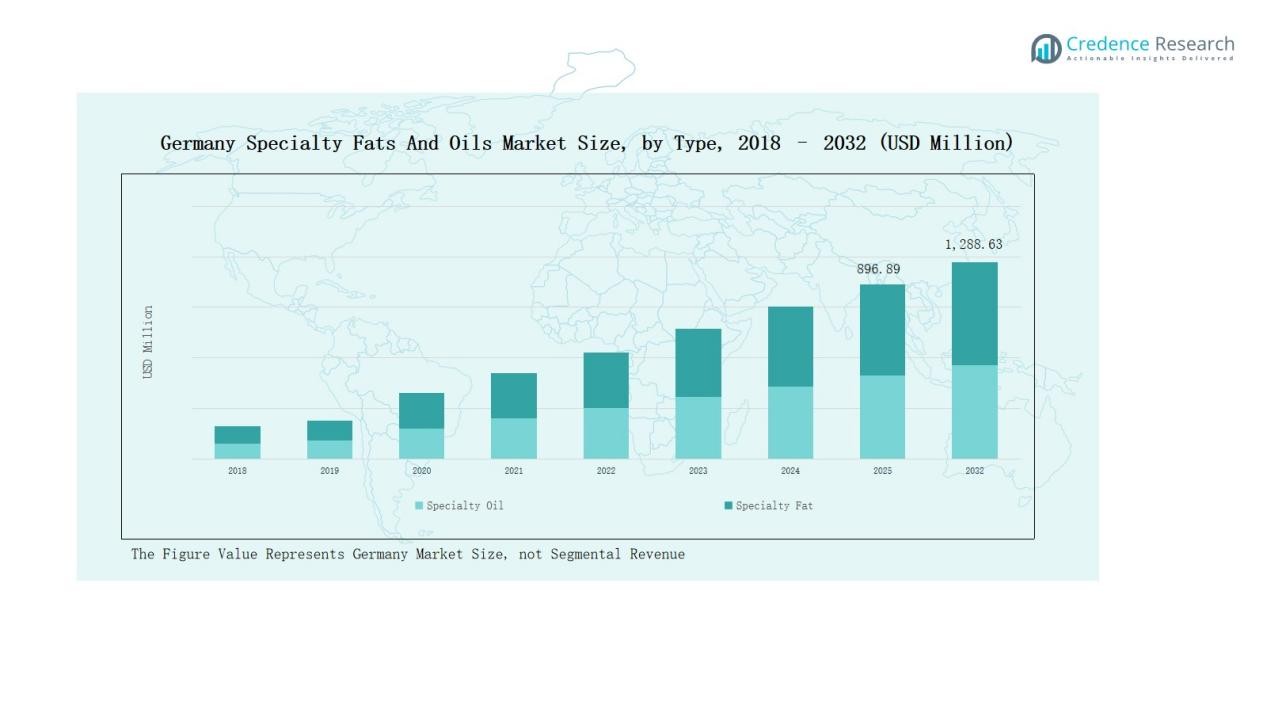

Germany Specialty Fats And Oils Market size was valued at USD 588.32 million in 2018 to USD 826.57 million in 2024 and is anticipated to reach USD 1,288.63 million by 2032, at a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Specialty Fats And Oils Market Size 2024 |

USD 826.57 Million |

| Germany Specialty Fats And Oils Market, CAGR |

5.31% |

| Germany Specialty Fats And Oils Market Size 2032 |

USD 1,288.63 Million |

The Germany Specialty Fats and Oils Market features strong competition from global and domestic players, with leading companies including Oleon GmbH, Wilmar Europe AG, Bunge Deutschland GmbH, Cargill Deutschland GmbH, AAK Germany GmbH, Palsgaard GmbH, Kerry Group Germany, BASF SE, IOI Oils & Fats Germany, and the Fraunhofer Institute. These players strengthen their positions through innovation, sustainable sourcing, and partnerships with food processors. South Germany leads the market with 38% share in 2024, driven by its concentration of chocolate, bakery, and confectionery manufacturers supported by advanced industrial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Specialty Fats and Oils Market grew from USD 588.32 million in 2018 to USD 826.57 million in 2024 and is forecasted to reach USD 1,288.63 million by 2032, expanding steadily at 5.31%.

- Specialty oils dominated with 61.5% share in 2024, led by palm oil’s versatility in bakery and confectionery, while sunflower and olive oils gained popularity from rising health-conscious consumption.

- Industry led applications with 54.2% share in 2024, supported by large-scale chocolate, bakery, and confectionery manufacturing, while households contributed 25.3% share with growing adoption of olive and sunflower oils.

- Chocolate held the top end-user share of 33.8% in 2024, followed by confectioneries at 22.6% and bakeries at 20.4%, with infant food and functional fats showing rising growth opportunities.

- South Germany led regionally with 38% share in 2024, followed by North Germany at 27%, West Germany at 21%, and East Germany at 14%, highlighting varied industrial and household strengths.

Market Segment Insights

By Type

Specialty oils dominate the Germany market with 61.5% share in 2024, supported by extensive palm oil usage across bakery, confectionery, and processed foods. Palm oil remains the most cost-efficient and versatile option, ensuring wide adoption by manufacturers. Sunflower and olive oil are also gaining ground due to health-conscious consumer preferences. Specialty fats, holding 38.5% share, are driven by demand for bakery fats and confectionery fats that enhance product texture and quality.

- For instance, Cargill launched its Clear Valley® neutral-flavored oils in Europe, providing cleaner-label solutions for food processors aiming to reduce saturated fat without compromising functionality.

By Application

Industry accounts for the largest share at 54.2% in 2024, reflecting strong reliance on specialty oils and fats in large-scale chocolate, bakery, and confectionery manufacturing. Household usage holds 25.3% share, driven by consumer adoption of sunflower and olive oils for everyday cooking and health benefits. Restaurants contribute 15.6% share, supported by frying fats for quick-service menus. The remaining 4.9% comes from other niche applications, including institutional kitchens and specialty product development.

- For instance, Barry Callebaut expanded its European chocolate factory capacity in Lodz, Poland, increasing demand for specialty cocoa butter and fats to support bakery and confectionery manufacturers.

By End User

Chocolate leads with 33.8% share in 2024, reflecting Germany’s globally recognized chocolate industry and its reliance on cocoa butter substitutes and specialty fats for premium output. Confectioneries follow at 22.6% share, boosted by rising demand for sweet fillings and coatings. Bakery applications represent 20.4% share, supported by high demand for bakery fats. Infant food (9.3%) and functional fats (7.1%) show growth opportunities, while culinary (4.5%) and others (2.3%) contribute smaller proportions.

Key Growth Drivers

Rising Demand from Chocolate and Confectionery Industry

Germany’s strong chocolate and confectionery sector drives consistent demand for specialty fats and oils. Cocoa butter equivalents and replacers are widely used to maintain texture and reduce production costs, particularly in premium chocolate manufacturing. Growing consumer preference for innovative confectionery flavors and sustainable formulations further strengthens this demand. With Germany being a hub for global chocolate exports, the industry remains a central driver for specialty fats and oils consumption, ensuring steady market growth over the forecast period.

- For instance, Cargill introduced its Infuse by Cargill toolbox in Germany, integrating specialty oils and cocoa butter replacers to enable chocolatiers to develop plant-based and indulgent chocolate formulations.

Increasing Health-Conscious Consumer Preferences

The shift toward healthier eating habits is boosting demand for sunflower oil, olive oil, and low-trans-fat bakery fats in Germany. Consumers prefer oils with perceived health benefits, such as heart health support and reduced cholesterol. Manufacturers are responding by reformulating products to include healthier fat blends without compromising taste or performance. This trend strengthens specialty oil adoption in household and industrial applications, making health-focused product innovation a major driver shaping future market expansion across multiple consumer categories.

- For instance, Bunge announced the launch of its NuliGo structured lipid ingredient in Europe, designed to support muscle health and used in reformulated food and nutrition applications.

Expanding Food Processing and Industrial Applications

Germany’s advanced food processing industry creates strong opportunities for specialty fats and oils, particularly in bakery, dairy, and processed foods. Industrial users prefer specialty formulations that provide better shelf life, frying stability, and improved product consistency. With rising demand for ready-to-eat and convenience foods, industrial application segments continue to expand. Investments in high-capacity processing plants and partnerships with specialty oil suppliers reinforce growth, positioning industrial demand as a key long-term driver of the German market.

Key Trends & Opportunities

Growth of Sustainable and Plant-Based Alternatives

Sustainability is reshaping the Germany Specialty Fats and Oils Market, with rising demand for RSPO-certified palm oil and plant-based alternatives. Consumers and food manufacturers increasingly prefer eco-friendly sourcing practices, creating opportunities for players offering certified sustainable fats. Moreover, plant-based oils such as sunflower, rapeseed, and olive are gaining traction in vegan and vegetarian food formulations. This growing focus on sustainability and plant-based solutions creates opportunities for companies to align with green consumer preferences and regulatory requirements.

- For instance, Peter Greven Group operates all its locations with RSPO Mass Balance certification, offering certified sustainable fatty acids under product lines like LIGAMED® and PALMSTAR®, which are widely used in German specialty fats markets.

Innovation in Specialty Bakery and Functional Fats

Innovation in bakery fats and functional fats is creating new opportunities for German manufacturers. Bakery fats are being reformulated to deliver superior texture and mouthfeel while meeting trans-fat-free regulations. Functional fats enriched with health benefits, such as omega-3 and vitamin fortification, are becoming more popular in infant food and wellness-focused applications. These innovations not only expand product portfolios but also open growth avenues in premium and health-oriented food categories, allowing companies to differentiate in a competitive market.

- For instance, Bunge Loders Croklaan introduced its Delica Pro Gold range in Europe, a non-hydrogenated and trans-fat-free bakery fat designed to improve aeration and volume in cakes while meeting EU regulatory standards.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material prices, particularly for palm oil, rapeseed oil, and sunflower oil, pose significant challenges. Global supply disruptions, weather uncertainties, and geopolitical tensions often lead to unpredictable cost structures for German producers. These price swings reduce profit margins and increase financial pressure on manufacturers dependent on imported inputs. Companies must develop risk management strategies and diversify sourcing to mitigate volatility, but managing consistent profitability remains a persistent challenge across the specialty fats and oils market.

Stringent Regulatory Standards and Compliance

Germany’s strict food safety and labeling regulations add compliance challenges for specialty fats and oils producers. European Union restrictions on trans fats and requirements for sustainable sourcing certification increase operational costs. Companies must consistently adapt product formulations to align with evolving standards, often involving complex reformulation processes. Compliance with RSPO certification and other sustainability frameworks is crucial, but it requires significant investment. Regulatory pressures remain a key barrier for both domestic producers and international suppliers in Germany.

Rising Competition from Substitutes

The growing popularity of alternative fat sources and substitutes, such as shea butter and other plant-based oils, challenges traditional specialty fats and oils demand. Consumers seeking natural, minimally processed ingredients may favor substitutes over conventional fats. This trend puts pressure on established players to innovate and diversify their portfolios to retain market share. Failure to adapt may lead to a shift in consumer preference toward alternatives, creating competitive risks for specialty fats and oils suppliers in Germany.

Regional Analysis

South Germany

South Germany leads the Germany Specialty Fats and Oils Market with 38% share in 2024, supported by its strong concentration of confectionery, bakery, and chocolate manufacturers. The region benefits from established industrial clusters in Bavaria and Baden-Württemberg, which serve both domestic and export markets. Specialty oils such as palm and sunflower dominate here due to their extensive use in processed foods and premium chocolate. Strong infrastructure and advanced food processing facilities further support the region’s dominance. It continues to set the benchmark for innovation and industrial consumption.

North Germany

North Germany holds 27% share in 2024, driven by its robust port infrastructure in Hamburg and Bremen that facilitates raw material imports. The region benefits from easy access to palm oil and other imported oils, ensuring consistent supply for processing units. Industrial bakeries and large-scale food processors are concentrated in this area, supporting strong usage of bakery fats and frying fats. The growing presence of quick-service restaurants also enhances demand for specialty oils. It remains an important hub for distribution and logistics in the market.

West Germany

West Germany accounts for 21% share in 2024, supported by a mix of industrial and household demand. North Rhine-Westphalia, the most populous state, contributes significantly with its extensive urban consumer base. Specialty oils such as rapeseed and olive oil are highly consumed in households due to health awareness trends. Industrial bakeries and confectionery firms further boost specialty fat consumption. The region benefits from its dense retail networks and diverse food culture. It continues to expand its share through steady growth in both household and industrial applications.

East Germany

East Germany captures 14% share in 2024, making it the smallest but steadily growing region in the market. Food manufacturers in Saxony and Thuringia are investing in specialty fats to meet rising demand in bakery and confectionery. Household consumption of sunflower and rapeseed oils is increasing due to price advantages and local sourcing. Limited industrial infrastructure compared to other regions restricts growth, yet niche opportunities exist in functional fats and infant food applications. It is expected to strengthen its position gradually through targeted industrial investments.

Market Segmentations:

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed Oil

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fats

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectionaries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Others

By Region

- South Germany

- North Germany

- West Germany

- East Germany

Competitive Landscape

The Germany Specialty Fats and Oils Market is characterized by the presence of global leaders and strong domestic players competing across diverse product portfolios. Key companies such as Oleon GmbH, Wilmar Europe AG, Bunge Deutschland GmbH, Cargill Deutschland GmbH, AAK Germany GmbH, and Kerry Group Germany maintain dominance through innovation, sustainable sourcing, and strategic partnerships with food processors. BASF SE and Palsgaard GmbH strengthen their positions with functional fats and tailored formulations, while IOI Oils & Fats Germany focuses on high-quality specialty oils. Fraunhofer Institute contributes through research-driven advancements in fat alternatives and sustainability solutions. Competition is shaped by factors such as compliance with EU trans-fat regulations, rising demand for RSPO-certified palm oil, and the shift toward healthier and plant-based alternatives. Players invest in new product launches, R&D, and certification to meet evolving consumer preferences, ensuring a dynamic yet highly competitive environment in the German specialty fats and oils industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Oleon GmbH

- Wilmar Europe AG

- Bunge Deutschland GmbH

- Cargill Deutschland GmbH

- AAK Germany GmbH

- Palsgaard GmbH

- Kerry Group Germany

- BASF SE

- IOI Oils & Fats Germany

- Fraunhofer Institute

Recent Developments

- In September 2024, Evonik inaugurated a new production plant for sustainable cosmetic emollients at its Steinau site in Germany, using an enzymatic process to increase production capacity for eco-friendly beauty products.

- In October 2023, Bioriginal Food & Science Corp., a subsidiary of Cooke Inc., expanded into Germany by acquiring Pflanzenölmühle Kroppenstedt GmbH, a century-old mill specializing in plant-based oils from conventional and organic sources.

- In October 2024, Polish refiner Orlen began selling pure hydrotreated vegetable oil (HVO100) at service stations in Germany, planning to expand availability further in Germany and the Czech Republic.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Specialty oils will continue to dominate demand led by palm, sunflower, and rapeseed oils.

- Chocolate and confectionery industries will drive steady usage of cocoa butter replacers and equivalents.

- Bakery fats will gain traction with growing consumer demand for premium baked goods.

- Health-focused formulations using olive oil and low-trans-fat blends will expand household adoption.

- Industry applications will strengthen through processed food and convenience product manufacturing.

- Functional fats enriched with nutritional benefits will gain wider adoption in infant and wellness foods.

- Sustainable sourcing and RSPO-certified palm oil will remain critical for compliance and consumer trust.

- Plant-based and vegan product trends will boost demand for alternative specialty oil blends.

- Regional players will focus on customization and quick service to compete with global leaders.

- Ongoing R&D in fat alternatives and clean-label solutions will reshape product innovation strategies.