Market Overview:

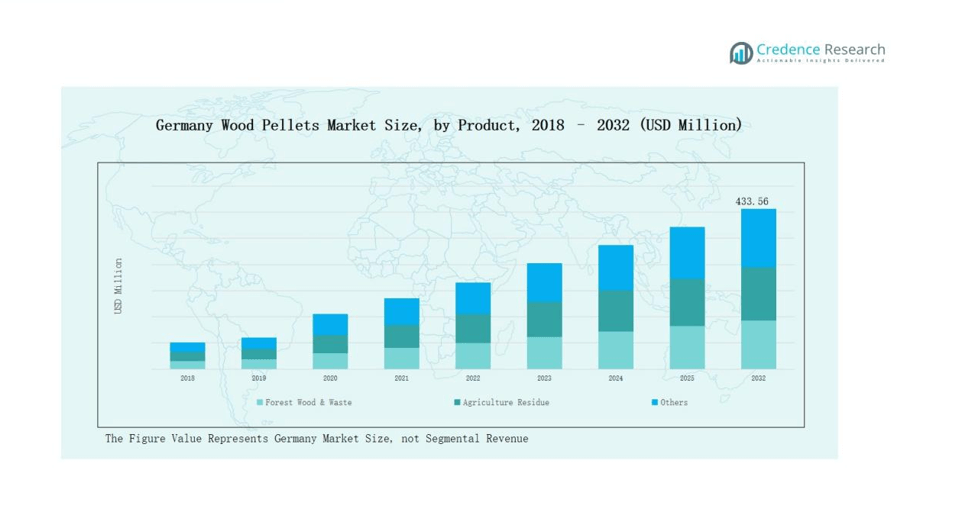

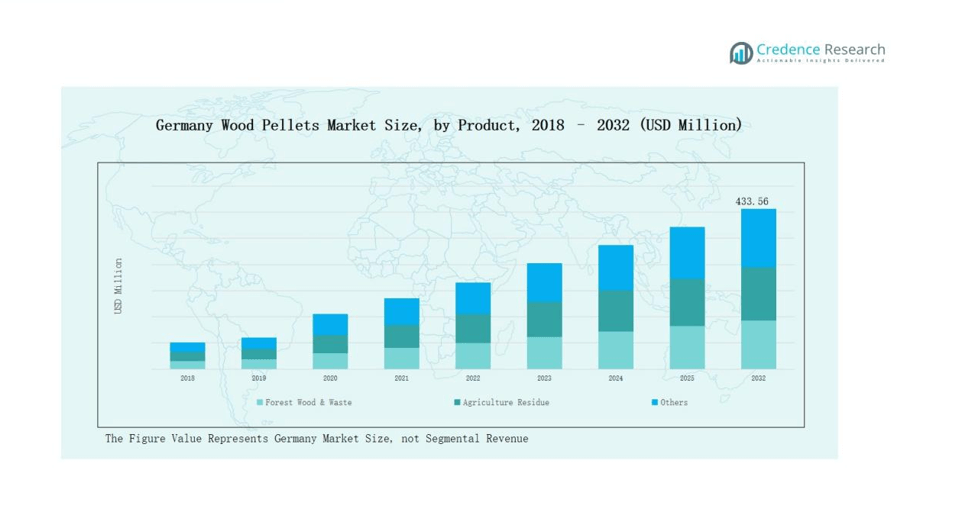

Germany Wood Pellets Market size was valued at USD 183.27 million in 2018 to USD 266.51 million in 2024 and is anticipated to reach USD 433.56 million by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Wood Pellets MarketSize 2024 |

USD 266.51 million |

| Germany Wood Pellets Market, CAGR |

5.84% |

| Germany Wood Pellets Market Size 2032 |

USD 433.56 million |

The Germany Wood Pellets Market is shaped by established players including German Pellets GmbH, Pfeifer Group, Holzindustrie Schweighofer, Durawood Pellet, Sägewerk-Schmitz, Bioenergie Stade GmbH & Co, Eusta Energie- und Umwelttechnik GmbH, and Energopellets GmbH. These companies compete through large-scale production, sustainable sourcing, and strong distribution networks, with larger firms focusing on industrial supply while regional producers serve residential and commercial demand. Northern Germany leads the market with 28% share in 2024, supported by advanced district heating systems, a high concentration of biomass power plants, and robust cross-border pellet trade.

Market Insights

- The Germany Wood Pellets Market grew from USD 183.27 million in 2018 to USD 266.51 million in 2024 and is projected to reach USD 433.56 million by 2032, expanding at 5.84% CAGR.

- Forest wood and waste held the largest product share with 69% in 2024, while agriculture residue accounted for 22% and other sources contributed 9%, supported by technological advances in pelletizing.

- By application, industrial pellets for CHP and district heating dominated with 56% share in 2024, followed by residential and commercial heating at 21%, co-firing at 18%, and other uses at 5%.

- Northern Germany led regionally with 28% share in 2024, supported by biomass power plants, district heating infrastructure, and cross-border pellet trade, while Western Germany followed with 26% share.

- Key companies such as German Pellets GmbH, Pfeifer Group, and Holzindustrie Schweighofer drive the market through large-scale production, sustainable sourcing, and strong supply chain networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Forest wood and waste dominate the Germany wood pellets market, holding nearly 69% share in 2024. Strong forest resources, well-developed forestry management, and supportive sustainability policies drive its leadership. Agriculture residue accounts for around 22% share, with rising utilization in smaller biomass plants and rural heating systems. The remaining 9% share comes from other sources, including recycled wood and mixed biomass, supported by ongoing innovation in pelletizing technologies.

- For instance, companies like Vecoplan AG have developed shredding and pelletizing systems that allow efficient conversion of waste wood and mixed materials into high-quality pellets for industrial applications.

By Application

Industrial pellets for CHP and district heating represent the largest segment, contributing about 56% share in 2024. This dominance stems from Germany’s strong district heating infrastructure, high demand for renewable energy, and government incentives for decarbonizing industrial heat. Industrial pellets for co-firing hold roughly 18% share, supported by their role in lowering coal emissions within power plants. Residential and commercial heating pellets account for around 21% share, driven by rising household adoption of pellet stoves and boilers. The remaining 5% share falls under other applications, such as export demand and specialized industrial usage, reflecting niche but growing opportunities.

- For instance, Drax Power Station in the UK completed its conversion from coal to biomass in 2021, and now consumes about 8 million tonnes of pellets annually to generate renewable electricity.

Market Overview

Key Growth Drivers

Rising Demand for Renewable Heating Solutions

Germany’s wood pellets market benefits from a growing shift toward renewable heating sources. The government’s strong climate goals and carbon reduction commitments have increased demand for sustainable alternatives to coal, oil, and gas. Wood pellets are favored for their lower emissions and stable energy supply, especially in district heating systems. Expanding adoption of pellet stoves and boilers in residential and commercial sectors further strengthens demand. Financial incentives and carbon pricing mechanisms provide additional momentum, encouraging investments in pellet-based energy solutions nationwide.

- For instance, Viessmann, a major German heating systems manufacturer, integrates pellet boilers into its renewable energy portfolio, supporting both residential and commercial users.

Strong District Heating and CHP Infrastructure

The well-established district heating and combined heat and power (CHP) networks in Germany serve as a major growth driver. These facilities require reliable, large-scale fuel sources, and wood pellets provide a cost-effective and sustainable solution. Policy support for biomass integration ensures long-term demand, particularly as utilities move to decarbonize operations. Growing industrial adoption of CHP further increases pellet consumption. With continuous upgrades in energy infrastructure and strong collaboration between pellet suppliers and utilities, this segment remains the backbone of the German wood pellets market.

- For instance, Stadtwerke Hannover (Enercity) operates CHP plants that integrate biomass, including wood pellets, to supply heat and electricity to thousands of households.

Sustainable Forest Resource Availability

Germany’s vast forest reserves underpin stable pellet supply and market growth. Well-regulated forestry practices ensure long-term resource availability, reinforcing the dominance of forest wood and waste as the primary raw material. Sustainable harvesting policies maintain ecological balance while enabling consistent production volumes. This abundance allows producers to meet both domestic consumption and export demand. Furthermore, increasing use of certified sustainable wood improves consumer confidence and aligns with the EU’s strict renewable energy directives. Secure raw material access continues to be a key enabler of steady market expansion.

Key Trends & Opportunities

Expansion of Residential Pellet Heating

An increasing number of households are adopting pellet-based heating systems due to high energy efficiency and cost savings. Government subsidies for replacing fossil fuel boilers with biomass systems drive this trend. Residential consumers view wood pellets as a reliable alternative amid rising gas prices and energy security concerns. Manufacturers are focusing on user-friendly technologies, such as automated pellet boilers and compact stoves, to attract wider adoption. This residential expansion provides a strong opportunity for market players to diversify customer bases beyond industrial demand.

- For instance, ÖkoFEN introduced the “Pellematic Condens_e,” a pellet boiler capable of simultaneously generating heat and small-scale electricity using a micro-combined heat and power (CHP) unit, well before 2022, making it an attractive option for energy-conscious households.

Innovation in Pellet Production and Export Potential

Technological advancements in pelletizing equipment and logistics are opening new growth avenues. Producers are investing in automation, drying technology, and quality control systems to improve efficiency and reduce costs. These innovations enable higher-quality pellets that meet stringent EU standards, strengthening Germany’s position in export markets. Rising demand from neighboring countries, particularly in Northern and Western Europe, creates lucrative trade opportunities. With Germany’s central location and robust infrastructure, producers are well-placed to serve cross-border demand, enhancing competitiveness on a regional scale.

- For instance, ANDRITZ introduced its Paladin 2000 pellet mill with automated lubrication and die-change systems, improving uptime and production consistency.

Key Challenges

Price Volatility of Raw Materials

The Germany wood pellets market faces challenges from fluctuating raw material prices, particularly forest residues and sawmill by-products. Competing industries such as construction and paper also rely on wood, creating supply pressure. Seasonal variations and weather conditions affect availability, leading to unpredictable costs. This volatility can reduce profitability for producers and create uncertainty for consumers. Maintaining stable pricing while ensuring sustainable sourcing remains a key concern, forcing companies to adopt risk management strategies and diversify raw material procurement channels.

Competition from Alternative Renewable Sources

The growing penetration of solar, wind, and heat pumps creates stiff competition for wood pellets. Germany’s renewable energy strategy emphasizes electrification, particularly in heating and power generation, which could limit pellet demand growth. Consumers and policymakers are increasingly drawn to zero-emission technologies with higher efficiency levels. While biomass has advantages in CHP and industrial heating, its long-term competitiveness may weaken if subsidies shift toward alternatives. Market participants must focus on highlighting the sustainability and reliability of pellets to defend their market position.

Stringent Environmental and Regulatory Requirements

Strict EU and national regulations pose challenges for pellet producers in Germany. Compliance with emission standards, sustainability certifications, and forest management rules adds to operational costs. Small and mid-sized producers often struggle to meet these requirements, reducing competitiveness. Moreover, public debates around land use, biodiversity, and carbon neutrality may increase regulatory scrutiny in the future. The high cost of certification and monitoring can limit expansion, particularly for export-oriented businesses. Navigating this complex regulatory environment remains one of the most pressing challenges for market players.

Regional Analysis

Northern Germany

Northern Germany leads the Germany Wood Pellets Market with 28% share in 2024. The region benefits from a high concentration of biomass power plants and advanced district heating infrastructure. Strong trade links with Scandinavia and the Baltic states also support cross-border pellet flows. Producers in this region focus on large-scale industrial supply, ensuring reliable volumes for combined heat and power facilities. Government support for renewable heating networks enhances demand further. With established port facilities, Northern Germany acts as both a domestic hub and an export gateway.

Southern Germany

Southern Germany holds 24% share in 2024, supported by abundant forest resources and well-organized forestry operations. The region contributes significantly to raw material supply, enabling a steady stream of forest wood and waste for pellet production. Demand is strong from residential and commercial heating sectors due to colder winters. Many small and medium producers operate here, meeting both local consumption and export commitments. Investments in sustainable forestry practices enhance the region’s long-term supply stability. It continues to play a vital role in balancing industrial and residential demand.

Western Germany

Western Germany accounts for 26% share in 2024, driven by strong industrial demand and energy-intensive manufacturing activities. The region’s developed logistics network enables efficient pellet transportation to large heating utilities and CHP plants. Demand is also rising in residential markets where pellet stoves and boilers replace fossil fuel systems. Regional producers collaborate closely with utilities to maintain reliable supply chains. Supportive policy frameworks encourage adoption of biomass solutions in both urban and rural areas. Western Germany’s industrial base ensures consistent growth in pellet usage.

Eastern Germany

Eastern Germany represents 22% share in 2024, with steady growth driven by its expanding renewable energy infrastructure. The region focuses on biomass integration in power plants and district heating systems. Its vast rural areas encourage adoption of agricultural residue-based pellets alongside forest wood. Producers are leveraging cost advantages through modern pelletizing facilities and improved logistics. Local governments encourage biomass adoption to diversify energy sources and reduce dependency on fossil fuels. Eastern Germany is emerging as an important contributor to overall market growth.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Germany

- Southern Germany

- Eastern Germany

- Western Germany

Competitive Landscape

The Germany Wood Pellets Market is highly competitive, shaped by a mix of large producers, mid-sized companies, and regional suppliers. Leading firms such as German Pellets GmbH, Pfeifer Group, and Holzindustrie Schweighofer dominate through large-scale production capacity, integrated supply chains, and long-term contracts with utilities. These players focus on securing forest resources, expanding pelletizing facilities, and maintaining compliance with strict EU sustainability standards. Mid-tier companies like Durawood Pellet, Sägewerk-Schmitz, and Bioenergie Stade GmbH & Co. strengthen their market presence by serving residential and commercial segments with tailored pellet solutions. Smaller producers, including Eusta Energie- und Umwelttechnik GmbH and Energopellets GmbH, compete on price, niche demand, and regional distribution. Intense competition is driving investment in advanced production technologies, sustainable sourcing, and certifications to enhance market credibility. With rising demand for renewable energy, the competitive landscape is expected to consolidate further, with partnerships and acquisitions playing a key role in future strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2023, LEAG Group acquired Wismar Pellets GmbH, strengthening its position in Germany’s pellet production market.

- In December 2024, LEAG Group completed the acquisition of Scandbio, Scandinavia’s largest wood pellet producer, expanding its international presence across Sweden, Latvia, and Denmark.

- In August 2025, Pfeifer Group launched a new waste wood recycling plant and advanced sawline in Uelzen to strengthen sustainable supply for its pellet and block production.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for pellets will expand with stronger adoption of renewable heating systems.

- Forest wood and waste will remain the primary feedstock for pellet production.

- Residential pellet boilers and stoves will see rising installation in urban and rural homes.

- Industrial demand will strengthen through combined heat and power and district heating projects.

- Co-firing applications in power plants will continue supporting gradual decarbonization of coal.

- Export opportunities will increase as neighboring European countries expand biomass imports.

- Innovation in pelletizing technologies will improve efficiency and product quality standards.

- Companies will focus on sustainability certifications to meet EU environmental regulations.

- Partnerships between producers and utilities will secure long-term supply agreements.

- Market consolidation will intensify with mergers and acquisitions among regional players.