Market Overview:

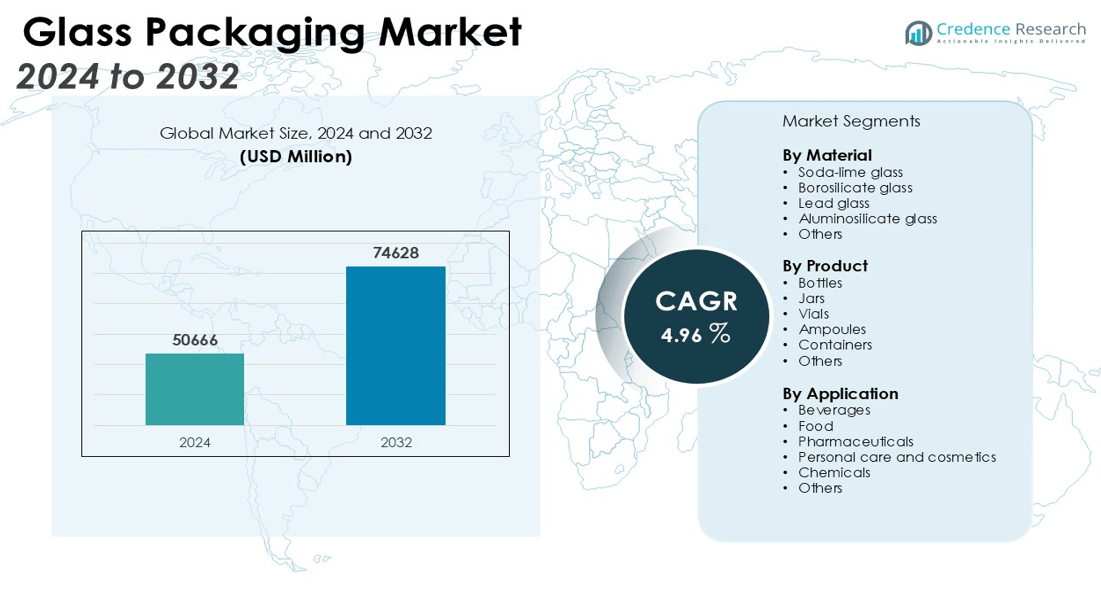

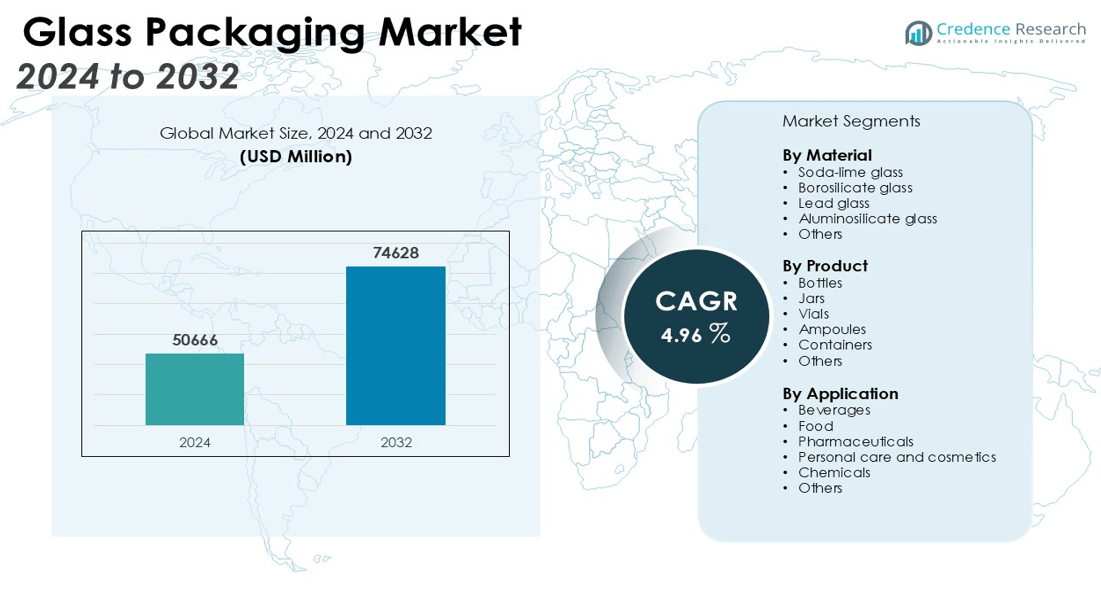

The glass packaging market size was valued at USD 50666 million in 2024 and is anticipated to reach USD 74628 million by 2032, at a CAGR of 4.96 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Packaging Market Size 2024 |

USD 50666 million |

| Glass Packaging Market, CAGR |

4.96% |

| Glass Packaging Market Size 2032 |

USD 74628 million |

Strong market drivers support ongoing growth in the glass packaging sector. Consumer preferences for non-toxic, recyclable, and inert packaging solutions lead brands to invest in glass as a preferred material. Glass offers excellent barrier properties, ensuring product freshness and extending shelf life, making it a material of choice for food safety and brand positioning. Heightened regulatory scrutiny on single-use plastics encourages a shift toward glass alternatives. Product innovation in lightweight glass containers and returnable systems supports cost efficiency and brand differentiation for manufacturers. Advances in glass manufacturing technologies improve energy efficiency and recycling rates, further strengthening the case for glass packaging.

Regionally, Europe dominates the global glass packaging market, supported by established recycling infrastructure, strict environmental standards, and robust demand in the beverage sector, particularly in Germany, France, and Italy. Key companies operating in this landscape include Piramal Glass Pvt. Ltd., Owens-Illinois Inc, WestPack LLC, Gerresheimer AG, Hindustan National Glass & Industries Ltd., and Ardagh Group. North America follows, driven by the expanding craft beverage market, premiumization trends, and regulatory shifts favoring sustainable packaging formats. The Asia Pacific region is poised for the fastest growth, underpinned by rapid urbanization, a rising middle class, and the growing adoption of glass packaging in China, India, and Southeast Asia.

Market Insights:

- The glass packaging market reached USD 50,666 million in 2024 and is forecast to hit USD 74,628 million by 2032.

- Consumer demand for non-toxic, recyclable, and sustainable packaging continues to drive glass adoption in multiple sectors.

- Glass packaging provides superior barrier properties, preserving product freshness and supporting food and brand safety.

- Stringent regulations on single-use plastics and strong corporate sustainability goals accelerate a shift toward glass.

- Innovations in lightweight glass, returnable systems, and advanced manufacturing improve cost efficiency and energy performance.

- Europe leads with 36% market share, benefiting from mature recycling infrastructure and high demand in beverages.

- Asia Pacific posts the fastest growth, supported by urbanization, a rising middle class, and investments in production and recycling.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Consumer Demand for Sustainable and Non-Toxic Packaging Solutions:

Growing environmental and health awareness has made sustainability a key factor in purchasing decisions, benefiting the glass packaging market. Glass is favored for its recyclability and chemical inertness, aligning with the increasing demand for eco-friendly, non-toxic materials. Regulatory bans on single-use plastics and corporate sustainability initiatives have further accelerated the shift toward glass. Consumers value glass for its ability to preserve product quality without leaching chemicals, reinforcing its reputation for purity and safety. This demand for green packaging drives investment in innovative glass solutions.

- For instance, Encirc produced glass bottles made from 100% recycled glass using biofuels at its Northern Ireland plant, setting a new sustainability benchmark in 2021.

Premiumization and Brand Differentiation Across Consumer Goods:

The premiumization trend is a significant driver for glass packaging, especially in the food, beverage, and personal care sectors. Consumers associate glass with luxury and quality, prompting brands to invest in distinctive designs and premium features like embossing and unique closures. Glass containers convey authenticity and help brands differentiate themselves in competitive markets. Customization options, such as tailored shapes and colors, further enhance brand appeal. This trend is sparking innovation in lightweight and colored glass packaging to meet evolving market demands.

- For instance, Ardagh Group launched a next-generation hybrid electric glass furnace at its Obernkirchen facility in Germany, capable of producing 350 tons of glass bottles per day, focusing on premium amber and colored glass for brand differentiation.

Stringent Regulations and Focus on Food and Product Safety:

Stringent regulatory frameworks in food and pharmaceuticals drive the adoption of glass packaging for sensitive products. Glass is selected for its inert properties, ensuring protection against contamination and maintaining product integrity. Manufacturers opt for glass as it meets evolving regulatory standards, guaranteeing safety throughout the supply chain. Glass packaging provides a reliable solution, ensuring compliance and reassuring consumers about product quality. Investments in sterilization and sealing technologies further enhance glass packaging’s ability to safeguard products.

Technological Advancements in Glass Manufacturing and Recycling:

Advancements in glass manufacturing technologies are improving efficiency, sustainability, and cost-effectiveness. Innovations like lightweight glass reduce raw material usage and transportation costs while maintaining strength. Enhanced recycling processes and returnable packaging systems further boost glass’s environmental appeal. Energy-efficient furnaces and automated quality control systems optimize production while maintaining consistent quality. These technological developments strengthen glass packaging’s position as a sustainable and versatile solution.

Market Trends:

Growth in Demand for Sustainable and Circular Packaging Solutions:

Sustainability remains a defining trend across the packaging industry, and the glass packaging market leads with its emphasis on recyclability and closed-loop systems. Major brands introduce collection and refill programs that prioritize waste reduction, supporting a shift away from single-use packaging formats. Consumers respond favorably to glass containers due to their perceived purity and environmental advantages. The industry invests in lightweighting technologies that decrease material usage while maintaining strength and durability. Innovations in color and coating processes further extend the lifespan and functionality of glass packaging, enabling multiple reuse cycles. Partnerships between manufacturers and retailers facilitate efficient collection, cleaning, and redistribution of glass containers. These strategies reinforce glass’s status as an essential material in the global move toward a circular economy.

- For instance, a 2021 review of European reuse systems found that reusable glass bottles now achieve on average 25–30 cycles per bottle, greatly improving resource efficiency.

Adoption of Advanced Design and Digital Technologies for Brand Differentiation:

Brand owners seek to enhance product appeal and consumer engagement through innovative design and smart packaging solutions. The glass packaging market incorporates digital printing, custom embossing, and surface treatments to create visually striking containers that capture consumer attention on shelves and online platforms. Brands deploy smart packaging features such as QR codes, NFC tags, and augmented reality elements to deliver interactive experiences and supply chain transparency. Demand for personalization and limited-edition releases fuels rapid adoption of flexible design technologies, allowing quick adaptation to changing market trends. Luxury and specialty brands benefit from the versatility of glass, which supports both high-impact graphics and tactile finishes. Manufacturers continue to expand capabilities for short production runs and complex design requests, making glass packaging a preferred choice for premium product positioning. These trends drive the evolution of glass containers from functional vessels into powerful marketing tools.

- For instance, Ardagh Group North America glass division provides brand customers with interactive 3D glass packaging design and can deliver nearly 300 distinct bottle and jar designs, offering short-run, rapid prototyping with their development machine for fast market testing of new products.

Market Challenges Analysis:

High Production Costs and Energy Consumption:

The glass packaging market faces significant pressure from high production costs and energy-intensive manufacturing processes. Producing glass requires large amounts of raw materials and sustained high-temperature furnaces, leading to elevated operational expenses and a larger carbon footprint compared to alternative packaging materials. Volatility in energy prices and raw material costs further intensifies margin pressure for manufacturers. These challenges drive companies to seek advanced technologies that improve energy efficiency and reduce emissions. Investments in recycling infrastructure and lightweight glass formats help offset some cost disadvantages. However, the industry must continue to address the economic and environmental impacts of traditional production methods.

Susceptibility to Breakage and Logistical Constraints:

Glass packaging remains vulnerable to breakage during handling, shipping, and retail display, which complicates logistics and increases risk of product loss. The weight and fragility of glass add to transportation costs and create challenges for global supply chains. Brands must invest in protective secondary packaging and specialized transport solutions, raising overall costs and limiting scalability in some markets. Consumers may opt for lighter, shatter-resistant alternatives when portability is a priority. The glass packaging market works to mitigate these issues through design innovation and improved handling protocols, but these structural limitations persist across end-use sectors.

Market Opportunities:

Expansion into Premium and Health-Focused Product Segments:

The glass packaging market holds strong opportunities in premium and health-oriented consumer goods, where quality and safety drive purchasing decisions. Brands targeting premium beverages, organic foods, and luxury cosmetics increasingly select glass to convey authenticity and purity. The inert nature of glass aligns with demand for non-reactive, non-toxic packaging, supporting brand positioning for health-conscious consumers. Customized designs, decorative finishes, and innovative shapes further attract brands aiming for shelf differentiation. The growth of wellness-focused products and artisanal brands creates new avenues for glass container manufacturers. Rising consumer willingness to pay for premium packaging supports value-added features and higher margins in these segments.

Adoption of Circular Economy and Refillable Systems:

The glass packaging market has opportunities to scale closed-loop and refillable packaging systems as sustainability gains priority for brands and regulators. Companies collaborate with retailers and logistics partners to develop deposit-return and reuse schemes that extend product life cycles and reduce waste. Investments in collection infrastructure and reverse logistics strengthen the appeal of reusable glass containers. Advances in cleaning and sterilization technologies enable repeated use without compromising product integrity. Governments and industry groups introduce incentives and regulations that accelerate adoption of circular models. This momentum positions glass as a leading material for environmentally responsible and future-ready packaging solutions.

Market Segmentation Analysis:

By Material:

The glass packaging market segments by material into soda-lime glass, borosilicate glass, and others. Soda-lime glass holds the dominant share due to its versatility, cost efficiency, and broad applicability in food and beverage packaging. Borosilicate glass finds use in premium and specialty applications, including pharmaceuticals and high-end cosmetics, due to its superior thermal and chemical resistance. Specialty glass types, though smaller in volume, address niche markets where durability and product stability are critical.

By Product:

Key product segments include bottles, jars, vials, and ampoules. Bottles account for the largest share, supporting demand across beverages, pharmaceuticals, and personal care. Jars serve the food, condiment, and cosmetic segments, valued for their ability to preserve freshness and offer brand visibility. Vials and ampoules remain essential in pharmaceutical and laboratory applications, where product integrity and precise dosing are vital. It maintains a diverse product portfolio to address the specific requirements of each end use.

- For instance, Amcor’s new onsite bottle manufacturing operation at PepsiCo’s Gatorade facility produces about 650 million PET bottles annually, demonstrating large-scale technological achievement in bottle production.

By Application:

Major application areas include beverages, food, pharmaceuticals, and personal care. The beverage industry drives the largest share, with alcoholic and non-alcoholic drinks utilizing glass for product protection and shelf appeal. Food applications leverage glass for jams, sauces, and condiments, emphasizing safety and preservation. Pharmaceutical companies select glass for its inertness and regulatory compliance, ensuring product safety. The personal care sector adopts glass for high-value fragrances and skincare, supporting premium positioning and consumer trust.

- For instance, Gerresheimer’s facilities in China and India are certified under ISO 15378, the global standard for good manufacturing practices in pharmaceutical packaging, supporting stringent quality and regulatory adherence for glass vials and ampoules.

Segmentations:

By Material:

- Soda-lime glass

- Borosilicate glass

- Lead glass

- Aluminosilicate glass

- Others

By Product:

- Bottles

- Jars

- Vials

- Ampoules

- Containers

- Others

By Application:

- Beverages

- Food

- Pharmaceuticals

- Personal care and cosmetics

- Chemicals

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe holds the largest share of the glass packaging market at 36%, supported by robust recycling systems, stringent environmental regulations, and mature consumer preferences for sustainable solutions. The region’s beverage sector, especially wine and beer, drives significant demand for glass containers. Countries such as Germany, France, and Italy maintain strong manufacturing bases and established supply chains, allowing efficient collection and reuse programs. Regulatory support and public awareness campaigns further reinforce the use of glass in packaging applications. Leading brands in the region capitalize on consumer trust in glass for purity and product safety. The European Union’s focus on circular economy principles sustains ongoing investments in new recycling and lightweighting technologies.

Asia Pacific:

Asia Pacific commands a 31% share of the glass packaging market, demonstrating rapid growth due to increasing urbanization, a rising middle class, and expanding food and beverage industries. China and India drive regional demand, with both countries witnessing a shift toward sustainable and premium packaging formats. Investment in new production capacity and improvements in recycling infrastructure bolster the supply of glass containers. Growing awareness of food safety and quality contributes to rising glass usage across diverse sectors. Local and multinational brands invest in differentiated glass packaging to address evolving consumer preferences. The region’s strong export orientation encourages adoption of high-quality packaging to meet international standards.

North America:

North America accounts for 21% of the glass packaging market, with steady demand supported by premiumization trends in beverages, cosmetics, and gourmet foods. The region’s craft beer, spirits, and specialty food sectors rely on glass for shelf appeal and product integrity. Brand owners leverage decorative technologies and custom shapes to enhance consumer engagement. Regulatory pressures on single-use plastics promote the adoption of recyclable and reusable glass containers. Investment in advanced manufacturing and logistics networks improves supply chain efficiency and reduces costs. Ongoing innovation in lightweight and durable glass formats supports North America’s competitive position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Piramal Glass Pvt. Ltd.

- Owens-Illinois Inc

- WestPack LLC

- Gerresheimer AG

- Hindustan National Glass & Industries Ltd.

- Ardagh Group

- HEINZ-GLAS GmbH & Co. KGaA

- Agrado SA

- SGD SA (SGD Pharma)

- AAPL Solutions Pvt. Ltd.

- Crestani Srl

Competitive Analysis:

The glass packaging market features strong competition among global leaders and specialized regional players. Key companies include Piramal Glass Pvt. Ltd., Owens-Illinois Inc., WestPack LLC, Gerresheimer AG, Hindustan National Glass & Industries Ltd., Ardagh Group, HEINZ-GLAS GmbH & Co. KGaA, Agrado SA, and SGD SA (SGD Pharma). Leading firms invest in advanced manufacturing, lightweighting, and sustainable practices to meet evolving regulatory standards and customer preferences. It emphasizes quality, innovation, and product safety to maintain brand loyalty across food, beverage, pharmaceutical, and personal care segments. Strategic acquisitions, expansion projects, and collaborative product development strengthen competitive positioning. Companies leverage automation, digital design, and efficient recycling to optimize costs and enhance operational flexibility. The focus on customized solutions and decorative features supports differentiation in premium and niche markets.

Recent Developments:

- In December 2024, Gerresheimer AG completed its acquisition of Blitz LuxCo, the holding company of Bormioli Pharma Group, significantly strengthening its European footprint and product portfolio.

- In July 2024, Ardagh Group launched a new series of American-made craft beverage glass bottles for the U.S. market, available in emerald green, flint, and amber, with a focus on sustainability and full recyclability.

Market Concentration & Characteristics:

The glass packaging market features moderate concentration, with a mix of global leaders and regional players shaping its competitive landscape. It is characterized by the presence of a few large multinational companies alongside a diverse range of smaller, specialized manufacturers. Leading firms invest heavily in advanced manufacturing technologies, lightweighting, and sustainability initiatives to maintain market share and meet evolving customer needs. The market responds quickly to regulatory changes and consumer preferences, driving ongoing innovation in design, decoration, and recycling. Strong emphasis on quality, product safety, and brand differentiation defines its core characteristics. Strategic partnerships, mergers, and capacity expansions remain common as companies pursue growth and operational efficiency.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing demand for refillable and returnable glass systems drives investment in closed‑loop infrastructure and reverse logistics.

- Innovation in lightweight, high-strength glass designs improves transport efficiency and reduces carbon emissions.

- Integration of smart technologies—such as NFC tags and QR codes—enhances traceability and consumer interaction on glass containers.

- Broader adoption of digital printing and customized surface finishes supports brand differentiation and premiumization.

- Expansion into emerging markets fuels demand, particularly within Asia Pacific and Latin America where urbanization accelerates consumption.

- Regulatory pressure on single‑use plastics spurs substitution and regulatory incentives favor glass packaging adoption.

- Partnerships between glass producers and beverage or pharmaceutical brands accelerate product-specific packaging solutions.

- Enhanced recycling capacity and material recovery systems increase circularity and reduce dependency on virgin raw materials.

- Focus on energy‑efficient furnace technologies and renewable energy integration lowers production emission levels.

- Cross‑sector collaboration in packaging innovation—between food, cosmetics, and pharma sectors—extends glass container applications.