Market Overview

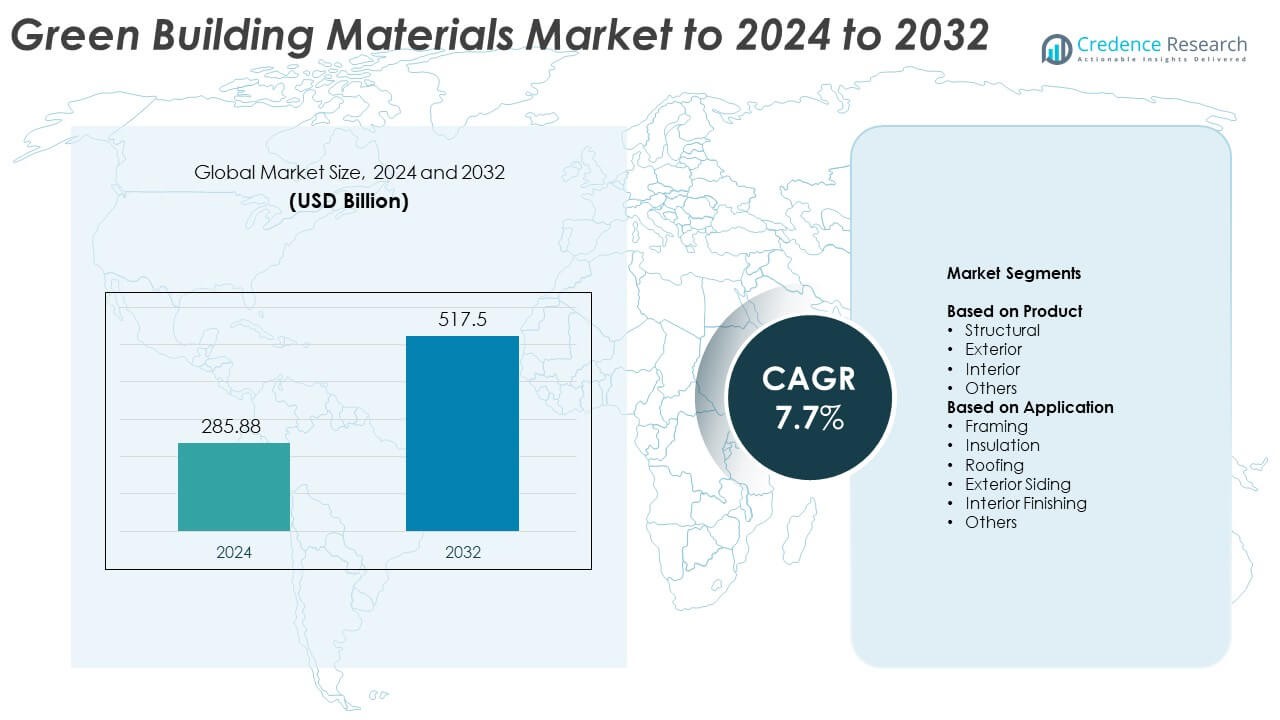

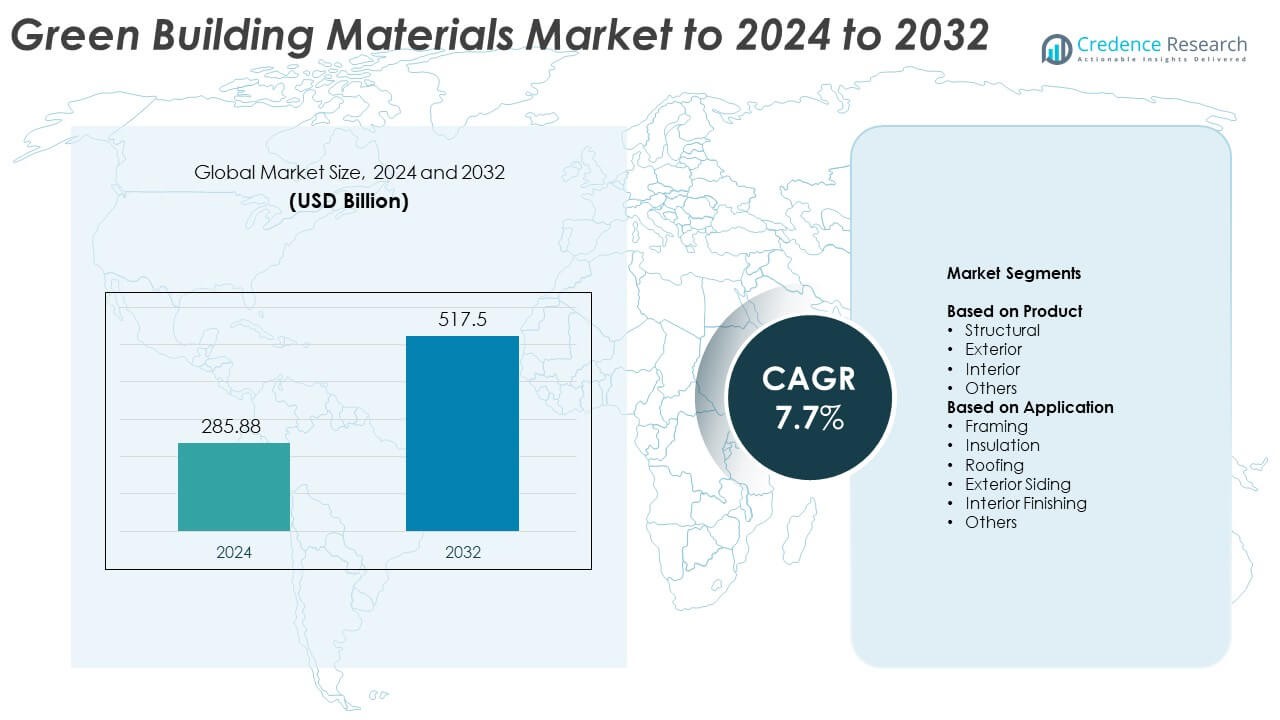

Green Building Materials Market size was valued USD 285.88 Billion in 2024 and is anticipated to reach USD 517.5 Billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Building Materials Market Size 2024 |

USD 285.88 Billion |

| Green Building Materials Market, CAGR |

7.7% |

| Green Building Materials Market Size 2032 |

USD 517.5 Billion |

The Green Building Materials Market is led by major players including BASF SE, Owens Corning, Kingspan Group plc, Saint-Gobain, Interface Inc., PPG Industries, Forbo Group, DuPont, RedBuilt LLC, BSW Group, Alumasc Group Plc, Bauder Ltd, CertainTeed Corporation, and Holcim. These companies are investing heavily in sustainable product innovation, focusing on recyclable, energy-efficient, and low-emission materials. They are expanding through mergers, green certifications, and smart material technologies to strengthen global market presence. Regionally, North America dominated the market in 2024 with a 35% share, supported by strict environmental regulations, strong consumer awareness, and extensive adoption of eco-friendly construction practices across both residential and commercial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Green Building Materials Market was valued at USD 285.88 billion in 2024 and is projected to reach USD 517.5 billion by 2032, growing at a CAGR of 7.7%.

- Growth is driven by rising demand for energy-efficient structures, strict environmental policies, and expanding sustainable construction practices worldwide.

- Key trends include adoption of recycled and bio-based materials, digital design integration, and smart self-healing technologies in building systems.

- The market is competitive, with global players focusing on low-carbon materials, R&D investment, and green certification programs to enhance their presence.

- North America led with a 35% share in 2024, followed by Europe at 29% and Asia Pacific at 24%, while the structural product segment held the largest share at 41%.

Market Segmentation Analysis:

By Product

The structural segment dominated the Green Building Materials Market in 2024, holding around 41% share. Structural materials such as engineered wood, recycled steel, and insulated concrete form the foundation of sustainable construction. These materials reduce embodied carbon, enhance thermal performance, and support long-term building durability. Rising adoption of prefabricated and modular construction methods further boosts structural segment growth, driven by cost savings and waste reduction initiatives in both residential and commercial projects.

- For instance, West Fraser reported 75% renewable energy use across operations in 2024.

By Application

The insulation segment led the Green Building Materials Market in 2024 with a 32% share. Insulation materials, including cellulose, mineral wool, and spray foam, significantly improve building energy efficiency. Governments are enforcing stricter building codes to reduce energy consumption and emissions. The growing use of bio-based insulation and recycled content products supports sustainable design goals, while the rising demand for net-zero and passive buildings further accelerates adoption across both new constructions and retrofit projects.

- For instance, ISOVER documents mineral wool thermal conductivity of 0.030–0.040 W/(m·K).

Key Growth Drivers

Rising Demand for Energy-Efficient Buildings

The growing global focus on energy conservation is a primary driver for green building materials. Construction firms are increasingly adopting materials that reduce heat loss and improve insulation. Products like reflective roofing and high-performance windows help lower building energy consumption. Supportive government policies promoting energy-efficient designs and certifications, such as LEED and BREEAM, are further accelerating adoption across both residential and commercial projects.

- For instance, 3M reports varying energy savings for its window films depending on location, building, and film type. While some installers have cited savings of up to 19 kWh per square foot of glass, 3M’s own documentation emphasizes that savings are context-dependent.

Government Regulations and Incentives for Sustainable Construction

Strict environmental regulations and incentives are pushing developers toward sustainable building practices. Many countries are introducing tax benefits and subsidies to promote eco-friendly materials in public infrastructure. These measures encourage investment in recycled, non-toxic, and renewable building resources. As urban areas expand, regulatory frameworks supporting low-carbon and circular construction are driving demand for certified sustainable materials.

- For instance, Kingspan completed a 51% stake acquisition of Steico in January 2024 to expand wood-fiber insulation.

Advancements in Green Material Technologies

Technological innovation is enabling the development of advanced materials that enhance durability and reduce emissions. Innovations in bioconcrete, recycled composites, and low-carbon cement are reshaping construction efficiency. Smart materials integrated with energy-monitoring systems offer improved environmental performance and cost savings. Continuous R&D by leading manufacturers is helping scale green material availability and performance reliability across large construction projects.

Key Trends and Opportunities

Integration of Smart and Self-Healing Materials

Smart and self-healing materials are emerging as major trends in sustainable construction. These materials repair minor cracks autonomously and extend the building’s lifespan, minimizing maintenance needs. Integration of sensors that monitor humidity, temperature, and air quality is improving indoor comfort and sustainability. The growing interest in intelligent material systems is creating opportunities for high-tech construction innovations.

- For instance, Penetron’s crystalline admixture can seal cracks up to 500 µm.

Growing Adoption of Circular Economy Principles

The transition toward a circular economy is influencing material selection and design strategies. Builders are focusing on materials that can be reused, recycled, or repurposed with minimal waste. Green certifications now emphasize lifecycle assessments and cradle-to-cradle models. This shift is fostering innovation in biodegradable and modular materials, promoting waste reduction and sustainable value chains.

- For instance, Holcim recycled 10.2 million tons of construction-demolition materials in 2024.

Key Challenges

High Initial Costs of Green Materials

Despite long-term energy savings, green materials often carry higher upfront costs than conventional alternatives. Limited economies of scale and complex manufacturing processes contribute to the price gap. Small and mid-sized builders face budget constraints, which slow adoption in emerging regions. Wider government support and material standardization could help bridge this cost divide over time.

Lack of Skilled Workforce and Awareness

A shortage of skilled labor and awareness limits effective use of green materials. Many construction professionals lack training in sustainable design techniques and eco-material applications. Insufficient education and limited availability of certified products create barriers to market expansion. Broader training programs and knowledge-sharing platforms are essential to accelerate widespread adoption.

Regional Analysis

North America

North America held the largest share of 35% in the Green Building Materials Market in 2024. The region’s dominance stems from strong regulatory support and advanced construction technologies. The U.S. and Canada are leading in LEED-certified projects and renewable material adoption. Increasing investments in sustainable residential and commercial developments are driving demand. Growing awareness of energy-efficient buildings and government incentives for low-emission construction further strengthen regional growth.

Europe

Europe accounted for 29% of the global market share in 2024, supported by stringent environmental regulations and green building standards. The European Green Deal and energy performance directives are promoting eco-friendly construction materials. Countries like Germany, the UK, and France are investing heavily in retrofitting and sustainable urban infrastructure. Rising use of recycled aggregates and low-carbon cement reinforces the market’s sustainability focus. Continuous innovation in insulation and façade systems contributes to regional expansion.

Asia Pacific

Asia Pacific captured a 24% share of the Green Building Materials Market in 2024, driven by rapid urbanization and government-led green initiatives. China, India, and Japan are prioritizing eco-conscious infrastructure to address energy consumption challenges. Growing investments in commercial complexes, smart cities, and green housing projects are fueling demand. Increasing adoption of bamboo-based materials and solar-integrated building products enhances regional sustainability efforts. Public-private partnerships and rising environmental awareness further support growth.

Latin America

Latin America represented an 8% share of the market in 2024, with steady progress in sustainable construction practices. Brazil and Mexico are leading regional adoption through eco-friendly residential and commercial projects. The rising availability of recycled and locally sourced materials is driving market growth. Supportive policies promoting green certifications are encouraging developers to adopt efficient construction solutions. Growing collaboration with international green building councils strengthens the region’s market presence.

Middle East and Africa

The Middle East and Africa accounted for 4% of the global share in 2024, driven by expanding sustainable construction in urban centers. The UAE and Saudi Arabia are focusing on green infrastructure within large-scale projects such as NEOM and Masdar City. Growing adoption of energy-efficient insulation and solar-integrated façades supports demand. Efforts to reduce carbon footprints and rising public investment in eco-friendly buildings are driving market expansion in this region.

Market Segmentations:

By Product

- Structural

- Exterior

- Interior

- Others

By Application

- Framing

- Insulation

- Roofing

- Exterior Siding

- Interior Finishing

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Green Building Materials Market is highly competitive, featuring major players such as BASF SE, Owens Corning, Kingspan Group plc, Saint-Gobain, Interface, Inc., PPG Industries, Forbo Group, DuPont, RedBuilt, LLC, BSW Group, Alumasc Group Plc, Bauder Ltd, CertainTeed Corporation, and Holcim. Companies are focusing on sustainable innovation, developing products that enhance energy efficiency and reduce carbon footprints. Strategic mergers, collaborations, and R&D investments are expanding their presence across residential, commercial, and industrial construction segments. Manufacturers are emphasizing recyclable, bio-based, and low-emission materials to align with global green certification standards. Advancements in composite insulation, solar-integrated roofing, and eco-friendly coatings are driving competitive differentiation. Regional expansion and digital solutions for supply chain transparency are further strengthening market positions. With rising environmental awareness and stricter regulations, leading players are prioritizing life-cycle performance, smart design integration, and circular economy models to gain a long-term competitive edge in the evolving green construction landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Owens Corning

- Kingspan Group plc

- Saint-Gobain

- Interface, Inc.

- PPG Industries

- Forbo Group

- DuPont

- RedBuilt, LLC

- BSW Group

- Alumasc Group Plc

- Bauder Ltd

- CertainTeed Corporation

- Holcim

Recent Developments

- In 2024, Saint-Gobain Launched the FutuRE range in Indonesia, featuring low-carbon and recycled-material products.

- In 2024, BASF partnered with Takazuri to develop sustainable construction solutions in East Africa.

- In 2023, Kingspan Launched RMG600+ LEC raised access floor panels and the Tate Grid LEC structural ceiling solution.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-carbon materials will continue to rise globally.

- Governments will strengthen green certification standards for construction projects.

- Technological innovation will enhance material durability and recyclability.

- Adoption of bio-based and recycled products will expand across major industries.

- Smart and self-healing materials will gain wider acceptance in sustainable buildings.

- Growing urbanization will drive investments in eco-friendly residential construction.

- Circular economy practices will shape future material design and waste management.

- Emerging economies will see increased green infrastructure development initiatives.

- Collaboration between manufacturers and developers will boost product standardization.

- Rising corporate sustainability goals will further accelerate market growth worldwide.