Market Overview

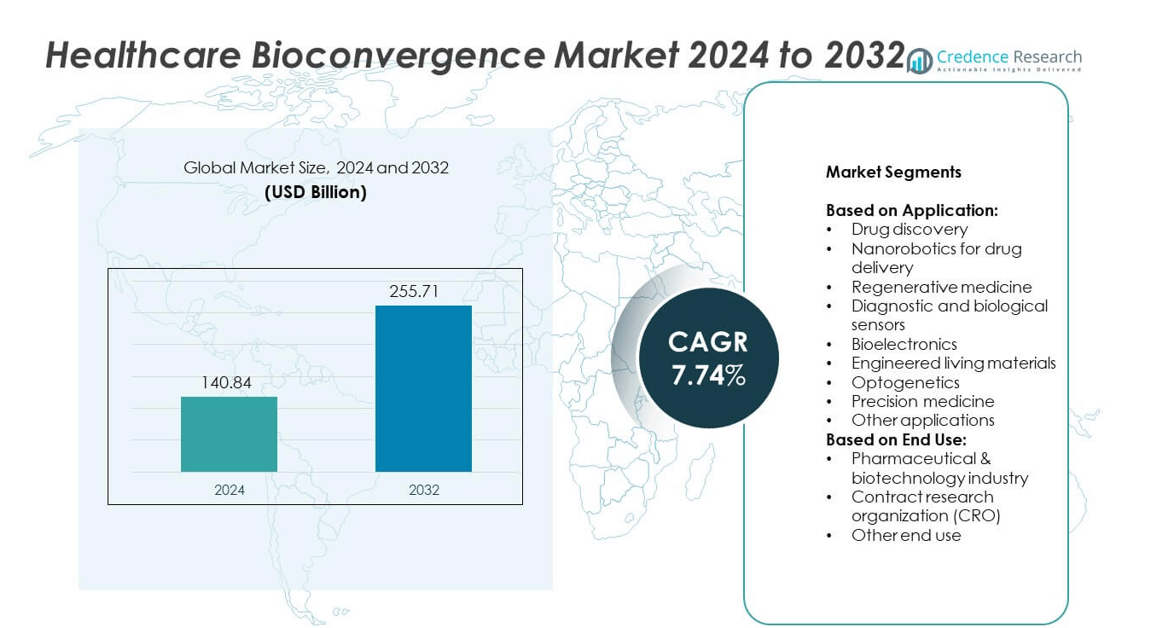

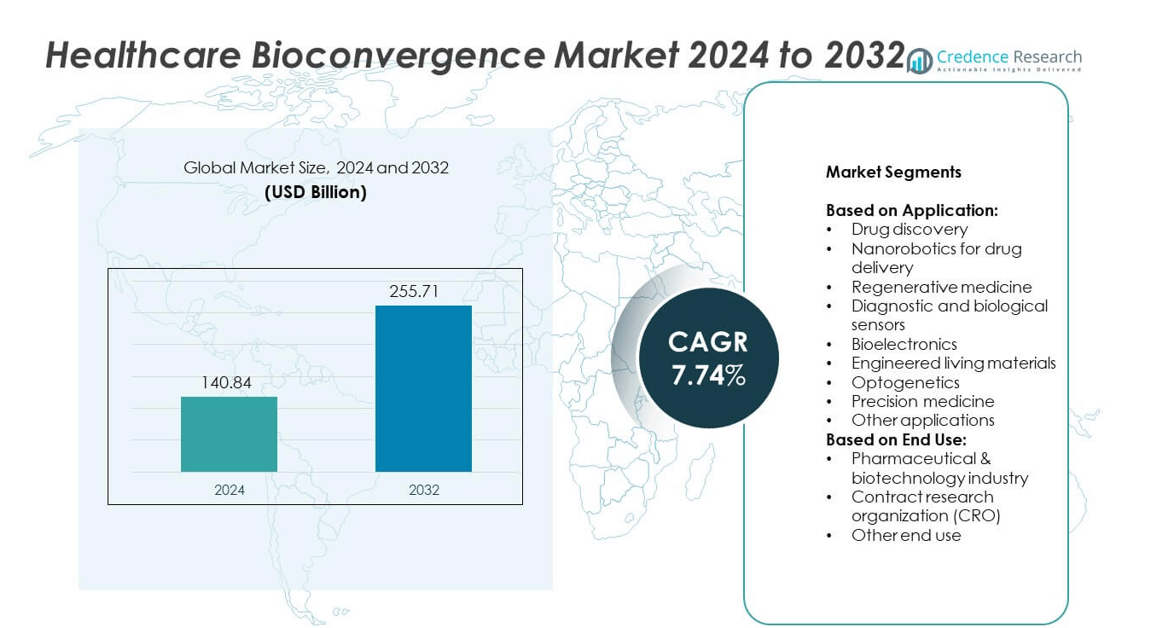

The Healthcare Bioconvergence Market size was valued at USD 140.84 billion in 2024 and is expected to reach USD 255.71 billion by 2032, growing at a CAGR of 7.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Bioconvergence Market Size 2024 |

USD 140.84 billion |

| Healthcare Bioconvergence Market, CAGR |

7.74% |

| Healthcare Bioconvergence Market Size 2032 |

USD 255.71 billion |

The Healthcare Bioconvergence market grows through integration of biotechnology, nanotechnology, and digital health solutions. Advances in precision medicine, regenerative therapies, and bioinformatics strengthen its role in improving patient outcomes. Artificial intelligence and big data analytics accelerate drug discovery, diagnostics, and treatment personalization. Rising demand for targeted therapeutics, coupled with government funding and supportive regulations, drives rapid adoption. Cross-industry collaborations between technology firms, pharmaceutical companies, and research institutions expand innovation ecosystems, ensuring strong momentum for future healthcare transformation.

North America leads the Healthcare Bioconvergence market due to advanced infrastructure, strong research funding, and rapid adoption of digital health solutions. Europe follows with a focus on precision medicine, collaborative research programs, and regulatory support for innovative therapies. Asia Pacific shows fastest growth, driven by government initiatives, expanding biotechnology clusters, and large patient populations. Key players such as GE Healthcare, Merck, Thermo Fisher Scientific, and BICO strengthen their presence through investments, partnerships, and advanced product portfolios across these regions.

Market Insights

- The Healthcare Bioconvergence market was valued at USD 140.84 billion in 2024 and is projected to reach USD 255.71 billion by 2032, at a CAGR of 7.74%.

- Strong drivers include integration of biotechnology, nanotechnology, and artificial intelligence to improve precision medicine, regenerative therapies, and drug discovery efficiency.

- Key trends highlight rapid adoption of bioinformatics, biosensors, and nanorobotics, along with growing focus on personalized healthcare and targeted therapeutics.

- Competitive analysis shows global leaders expanding through acquisitions, partnerships, and investments in cross-disciplinary technologies while smaller firms specialize in advanced niches such as bioelectronics and engineered living materials.

- Market restraints include high development costs, complex regulatory frameworks, and data security challenges that slow commercialization and adoption across healthcare systems.

- Regional analysis identifies North America as the leader supported by innovation ecosystems, Europe advancing through collaborative research and supportive policies, and Asia Pacific emerging as the fastest-growing region with strong government initiatives and rising healthcare demand.

- Latin America and Middle East & Africa demonstrate gradual adoption with modernization of healthcare infrastructure and growing partnerships, positioning themselves as important markets in long-term global expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Integration of Biotechnology and Digital Technologies Enhancing Healthcare Innovation

The Healthcare Bioconvergence market benefits from the integration of biotechnology, engineering, and digital technologies. It drives advancements in precision medicine, drug development, and diagnostic tools. Companies deploy AI and big data analytics to improve clinical outcomes and accelerate research. Wearable devices and biosensors enable continuous health monitoring and data-driven treatment plans. This convergence supports faster innovation cycles across pharmaceutical and medical device sectors. It strengthens patient-centric approaches and fosters personalized healthcare delivery.

- For instance, the FDA has authorized 72 AI-enabled medical devices from GE HealthCare as of May 2024. GE also reports that over 50 million patients have been scanned with its deep-learning solutions.

Rising Demand for Advanced Therapeutics and Regenerative Medicine

The Healthcare Bioconvergence market experiences strong growth from regenerative medicine and cell-based therapies. It helps address chronic conditions and rare diseases with high unmet medical needs. Stem cell research and gene-editing technologies support breakthroughs in treatment solutions. Companies invest in advanced biomaterials to create new therapeutic platforms. It enables healthcare systems to expand targeted treatment options for patients. Clinical adoption of these solutions reinforces the role of convergence in long-term healthcare strategies.

- For instance, According to a Century Therapeutics presentation, they have developed a multi-stage manufacturing process using scalable suspension bioreactors to produce over 60 billion (\(>6\times 10^{10}\)) fully differentiated NK cells per batch. This process has achieved more than an 8-fold increase in cell yield while maintaining product quality, including over 90% viability and over 98-99% purity.

Supportive Regulatory Frameworks and Strategic Collaborations

The Healthcare Bioconvergence market gains momentum from regulatory support and collaborative ecosystems. Governments encourage cross-disciplinary research and provide funding for innovation. It encourages partnerships between biotech firms, research institutions, and technology providers. Regulatory bodies streamline approval pathways for novel therapies and diagnostic platforms. This environment accelerates commercialization timelines and adoption across healthcare systems. It also strengthens international cooperation in addressing global health challenges.

Growing Investment in Healthcare Infrastructure and Digital Health

The Healthcare Bioconvergence market expands with strong investments in healthcare infrastructure and digital platforms. Hospitals and clinics adopt connected devices and AI-driven diagnostic solutions. It improves efficiency in patient care, clinical trials, and drug discovery. Venture capital funding continues to flow toward startups focused on bioconvergence solutions. Health systems worldwide prioritize digital integration to improve accessibility and cost-efficiency. It supports the transition toward preventive and personalized care models on a large scale.

Market Trends

Expansion of Personalized and Precision Medicine Through Bioconvergence

The Healthcare Bioconvergence market is witnessing strong momentum from personalized medicine adoption. It leverages genetic profiling, advanced imaging, and AI analytics to deliver tailored therapies. Pharmaceutical companies focus on biomarker-driven drug development to reduce trial failures. Patients benefit from customized treatment plans that improve outcomes and reduce side effects. This trend supports integration of genomics and computational tools into clinical practice. It also fosters collaboration between technology firms and healthcare providers for more precise care.

- For instance, Galvani Bioelectronics was formed as a joint venture between GSK and Verily in 2016, with an initial investment of up to £540 million over seven years. The company develops bioelectronic medicines that use miniaturized, implantable devices to modulate electrical signals in the body to treat chronic diseases

Increased Use of Artificial Intelligence and Big Data in Healthcare Solutions

The Healthcare Bioconvergence market is shaped by rising deployment of AI and big data platforms. It supports predictive diagnostics, drug discovery, and disease management. Companies utilize machine learning to analyze massive biological datasets for actionable insights. Hospitals implement AI-powered decision support systems for faster clinical responses. This trend enhances efficiency, reduces healthcare costs, and enables proactive patient management. It also strengthens global healthcare networks with real-time data sharing and collaboration.

- For instance, in 2024, VC funding in Nature Tech (which overlaps with bioconvergence) reached $2.1 billion, increasing by 16% compared to 2023, and early-stage investments nearly tripled since 2020. This indicates ongoing investment in innovative solutions within the bioconvergence sector.

Growing Role of Advanced Materials and Nanotechnology in Therapeutics

The Healthcare Bioconvergence market advances with the growing role of nanotechnology and biomaterials. It enables targeted drug delivery, regenerative implants, and smart prosthetics. Researchers develop nanocarriers for precision delivery of oncology and neurological therapies. Advanced biomaterials provide durability, compatibility, and improved performance in medical devices. This trend accelerates innovation in orthopedics, cardiovascular care, and wound healing solutions. It expands opportunities for next-generation therapies and devices with higher clinical acceptance.

Rising Collaboration Across Industries to Drive Innovation Ecosystems

The Healthcare Bioconvergence market evolves through cross-industry collaborations and innovation ecosystems. It combines expertise from pharmaceuticals, biotechnology, engineering, and digital technologies. Companies form alliances with research institutes to accelerate discovery pipelines. Tech firms enter healthcare partnerships to provide advanced platforms and analytics. This trend supports scaling of bioconvergence solutions to global markets. It creates a dynamic environment where multidisciplinary approaches redefine future healthcare delivery.

Market Challenges Analysis

High Complexity of Integration and Standardization Across Multiple Disciplines

The Healthcare Bioconvergence market faces challenges due to the complexity of integrating biology, technology, and engineering. It requires seamless collaboration between diverse industries with different standards and processes. Lack of harmonized frameworks makes interoperability between platforms and devices difficult. Companies struggle to align research outcomes with regulatory expectations and clinical adoption. This slows down commercialization timelines and raises development costs. It also limits the scalability of new solutions across global healthcare systems.

Regulatory Barriers, Data Security, and Cost Pressures Impacting Growth

The Healthcare Bioconvergence market encounters barriers related to strict regulatory pathways and data privacy concerns. It must comply with varying international standards that often delay product approvals. Concerns about cybersecurity and patient data protection hinder digital adoption in healthcare ecosystems. High development costs and uncertain reimbursement models create financial strain for companies. Smaller firms face difficulty in sustaining research due to limited resources. It constrains broader adoption of innovative bioconvergence solutions despite strong demand potential.

Market Opportunities

Advancement of Next-Generation Therapeutics and Precision Healthcare Models

The Healthcare Bioconvergence market presents strong opportunities in next-generation therapeutics and precision healthcare. It enables development of targeted drugs, gene therapies, and regenerative medicine solutions. Integration of AI and genomics supports earlier disease detection and individualized treatment plans. Pharmaceutical and biotech companies can expand pipelines by leveraging computational biology and advanced biomaterials. Healthcare providers gain the ability to deliver efficient, patient-specific care that improves outcomes. It creates pathways for breakthrough therapies addressing chronic and rare diseases.

Expansion of Digital Health Platforms and Cross-Industry Collaborations

The Healthcare Bioconvergence market benefits from the expansion of digital platforms and collaborative ecosystems. It supports adoption of telemedicine, connected devices, and AI-driven diagnostics across healthcare networks. Cross-industry partnerships between technology firms, research institutions, and life sciences companies create innovation hubs. Venture capital funding and government support strengthen opportunities for scaling solutions globally. Hospitals and clinics gain access to integrated systems that improve efficiency and reduce costs. It accelerates digital transformation while expanding access to advanced healthcare worldwide.

Market Segmentation Analysis:

By Application:

The Healthcare Bioconvergence market by application demonstrates diverse opportunities across advanced therapeutic and diagnostic fields. Drug discovery benefits from AI-driven models and computational biology, reducing timelines and improving accuracy. Nanorobotics for drug delivery creates highly targeted treatment pathways, particularly in oncology and neurological disorders. Regenerative medicine leverages stem cells and biomaterials to restore organ and tissue functions. Diagnostic and biological sensors provide real-time monitoring and early disease detection, strengthening preventive healthcare. Bioelectronics, engineered living materials, and optogenetics open new dimensions in neural repair, biosensing, and advanced therapeutics. Precision medicine integrates genomics and digital platforms to offer patient-specific care. It reflects a growing convergence of technology and biology across critical medical applications.

- For instance, Setpoint Medical’s implantable neuroimmune modulation device, the SetPoint System, received U.S. FDA approval in July 2025 for treating moderate to severe rheumatoid arthritis. Supported by data from the 242-patient randomized, sham-controlled RESET-RA study, the device is designed to be surgically placed on the vagus nerve in an outpatient procedure.

By End-Use:

The Healthcare Bioconvergence market by end use highlights strong adoption within the pharmaceutical and biotechnology industry. It supports drug development pipelines, accelerates clinical trials, and enhances product innovation. Contract research organizations play a pivotal role by offering specialized services, advanced platforms, and flexible research capacity to global companies. Other end users, including academic institutions and healthcare providers, contribute to translational research and deployment of emerging solutions. Hospitals also benefit from advanced diagnostic platforms and personalized healthcare applications. It ensures broad adoption across commercial, clinical, and research ecosystems that accelerate innovation.

- For instance, Anima Biotech utilizes its mRNA Lightning platform, which combines high-throughput phenotypic screening with AI, to discover RNA-modulating therapies. The platform’s image neural network was trained on over 2 billion proprietary images of mRNA regulatory pathways.

Segments:

Based on Application:

- Drug discovery

- Nanorobotics for drug delivery

- Regenerative medicine

- Diagnostic and biological sensors

- Bioelectronics

- Engineered living materials

- Optogenetics

- Precision medicine

- Other applications

Based on End Use:

- Pharmaceutical & biotechnology industry

- Contract research organization (CRO)

- Other end use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Healthcare Bioconvergence market, accounting for 39.2% in 2024. The region benefits from robust research and development investments, advanced healthcare infrastructure, and strong adoption of digital health technologies. It supports innovation through integration of AI, biotechnology, and bioinformatics into clinical practices and drug discovery. The presence of leading pharmaceutical and biotechnology companies enhances commercialization of bioconvergence solutions. Academic institutions and research hospitals in the United States and Canada play a central role in translational research that bridges laboratory findings with clinical applications. Supportive regulatory frameworks, such as FDA fast-track approvals and funding initiatives, encourage cross-disciplinary collaboration and faster product adoption. It continues to maintain leadership by driving advancements in personalized medicine, regenerative therapies, and nanotechnology-based healthcare.

Europe

Europe represents a significant share of the Healthcare Bioconvergence market, contributing 28.6% in 2024. The region leverages collaborative research networks supported by Horizon Europe programs and country-specific funding initiatives. Pharmaceutical and biotechnology firms across Germany, the United Kingdom, France, and Switzerland actively invest in precision medicine and regenerative medicine platforms. It is reinforced by a strong academic ecosystem with institutions pioneering tissue engineering, bioelectronics, and optogenetics. The European Medicines Agency provides clear regulatory guidance that accelerates approval of innovative therapies while ensuring patient safety. The growing demand for advanced diagnostic and biological sensors also drives adoption across healthcare systems. Europe emphasizes sustainability and value-based healthcare delivery, making bioconvergence a key driver of its evolving medical landscape.

Asia Pacific

Asia Pacific accounts for 21.4% of the Healthcare Bioconvergence market in 2024, showing the fastest growth trajectory. The region benefits from rising healthcare investments, government-led digital health initiatives, and an expanding biotechnology industry. Countries such as China, Japan, South Korea, and India demonstrate strong focus on regenerative medicine, nanorobotics, and bioinformatics. It creates opportunities through public-private partnerships that accelerate adoption of precision healthcare solutions. A large patient population provides a significant base for clinical trials and adoption of personalized medicine approaches. Regional startups supported by venture funding contribute to innovation ecosystems across therapeutics, diagnostics, and advanced medical devices. Asia Pacific continues to gain importance as a hub for cost-efficient research, clinical testing, and scaling of bioconvergence technologies.

Latin America

Latin America contributes 6.3% to the Healthcare Bioconvergence market in 2024. The region demonstrates growing interest in bioconvergence solutions through healthcare modernization programs and digital transformation strategies. Brazil and Mexico lead regional adoption with expanding biotechnology clusters and investments in diagnostic platforms. It benefits from rising collaborations with North American and European companies to strengthen local research capacity. Healthcare providers in the region increasingly adopt biosensors and AI-driven tools to improve patient outcomes. Regulatory agencies are working toward more streamlined frameworks to support commercialization of innovative therapies. Latin America shows steady potential by aligning public healthcare reforms with technology-driven solutions to address chronic diseases and wider health challenges.

Middle East & Africa

The Middle East & Africa region holds 4.5% of the Healthcare Bioconvergence market in 2024. Growth is supported by strategic investments in healthcare infrastructure, digital health platforms, and biotechnology hubs, particularly in the United Arab Emirates, Saudi Arabia, and South Africa. It strengthens adoption through government-backed initiatives focused on precision medicine, telehealth, and advanced diagnostic tools. Cross-border collaborations with global pharmaceutical and technology companies enhance regional capabilities. Hospitals in the Gulf Cooperation Council countries integrate advanced biosensors, regenerative medicine solutions, and bioelectronics to deliver high-quality care. Challenges related to infrastructure gaps and regulatory alignment persist, but partnerships help overcome these barriers. Middle East & Africa continues to expand its role by prioritizing innovation and positioning itself as an emerging player in global healthcare transformation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Biomx

- Singota Solution

- Pangea Biomed

- Thermo Fisher Scientific

- Anima Biotech

- Setpoint Medical Corporation

- GE Healthcare

- Zymergen

- Galvani Bioelectronics

- Merck

- Cytena

- Century Therapeutics

- Ginkgo Bioworks

- BioConvergent Health

- BICO – The Bio Convergence Company

Competitive Analysis

The leading players in the Healthcare Bioconvergence market include GE Healthcare, Merck, Thermo Fisher Scientific, BICO, Ginkgo Bioworks, Anima Biotech, Century Therapeutics, Zymergen, Galvani Bioelectronics, Biomx, Pangea Biomed, Setpoint Medical Corporation, Singota Solution, BioConvergent Health, and Cytena. These companies focus on cross-disciplinary innovation that integrates biotechnology, digital health, nanotechnology, and advanced materials. They invest heavily in research and development to expand therapeutic platforms and accelerate drug discovery pipelines. Strong emphasis is placed on artificial intelligence, bioinformatics, and regenerative medicine to enhance clinical outcomes and support personalized healthcare models. Competitive strategies include mergers, acquisitions, and partnerships that strengthen product portfolios and expand global presence. Large multinational corporations leverage advanced infrastructure, regulatory expertise, and global distribution networks to maintain market leadership. Emerging players focus on niche areas such as nanorobotics, bioelectronics, and engineered living materials, offering highly specialized solutions to address unmet medical needs. Collaborations with academic institutions and research organizations help bridge laboratory innovation with real-world healthcare applications. The competitive environment is defined by rapid technological adoption, continuous innovation, and strong funding support, which together shape the growth trajectory of the Healthcare Bioconvergence market.

Recent Developments

- In 2024, Anima Biotech advanced its research significantly by unveiling positive preclinical data for a candidate targeting Idiopathic Pulmonary Fibrosis (IPF).

- In December 2023, BICO announced that Biosero, a subsidiary, signed its largest project to date involving lab automation solutions for a global pharma customer.

- In 2023, GE Healthcare launched “Operation Pink” for breast cancer, a public welfare activity that includes new product technologies and digital innovations for breast cancer screening and diagnosis.

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Healthcare Bioconvergence market will expand with stronger adoption of precision medicine.

- Integration of AI, nanotechnology, and biotechnology will drive new treatment models.

- Hospitals will adopt advanced biosensors and diagnostic platforms for real-time monitoring.

- Pharmaceutical firms will accelerate drug discovery through computational biology and data analytics.

- Regenerative medicine will gain wider clinical acceptance across chronic and rare disease treatments.

- Cross-industry collaborations will enhance innovation ecosystems and speed commercialization.

- Governments will increase funding for bioconvergence research and translational projects.

- Personalized healthcare solutions will become standard practice in many healthcare systems.

- Emerging regions will witness faster adoption supported by digital health infrastructure.

- Global companies will prioritize scalable bioconvergence solutions to address unmet healthcare needs.