Market Overview

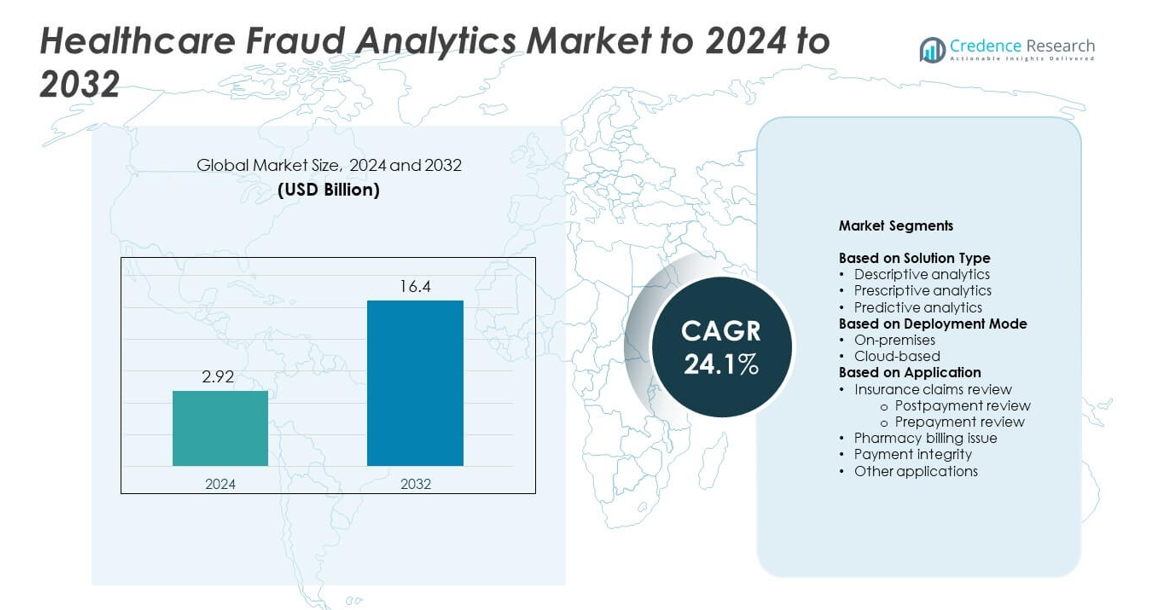

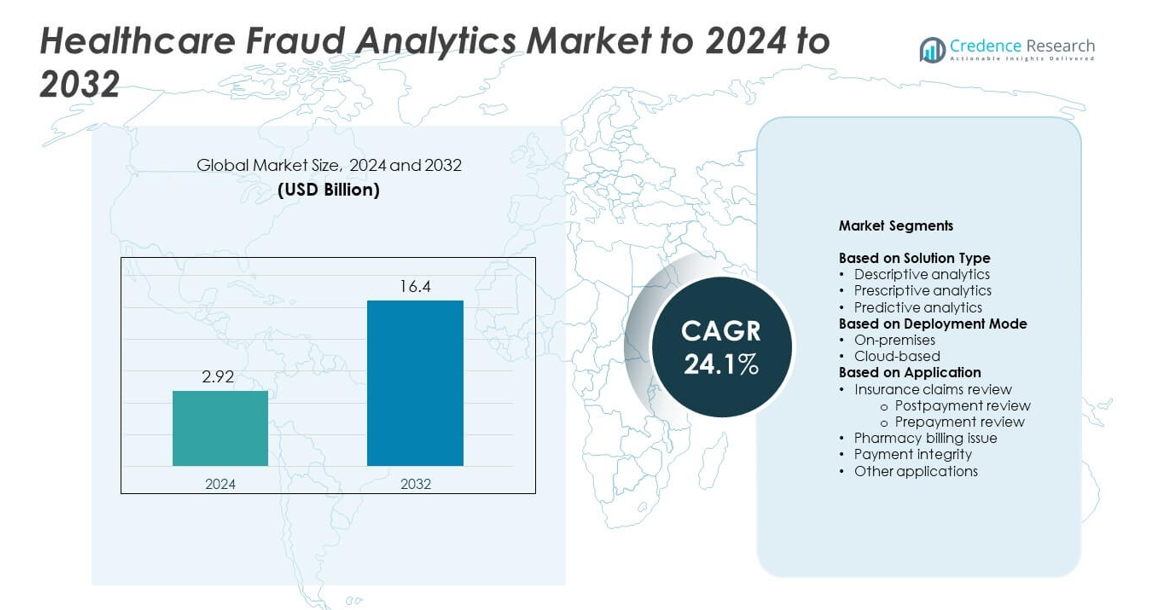

Healthcare Fraud Analytics Market size was valued at USD 2.92 billion in 2024 and is anticipated to reach USD 16.4 billion by 2032, at a CAGR of 24.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Fraud Analytics Market Size 2024 |

USD 2.92 billion |

| Healthcare Fraud Analytics Market, CAGR |

24.1% |

| Healthcare Fraud Analytics Market Size 2032 |

USD 16.4 billion |

The Healthcare Fraud Analytics Market includes key players such as Conduent, Inc, SAS Institute, Inc, Kyndryl, Optum, Inc, Wipro Limited, Cotiviti, Inc, EXL Service Holdings, Inc, HCL Technologies Limited, IBM, and DXC Technology. These companies strengthen their position through AI-based fraud detection tools, cloud analytics platforms, and integrated payment integrity solutions that support real-time claim monitoring. North America remained the leading region in 2024 with about 46% share due to strict regulatory oversight, strong digital adoption, and early deployment of advanced analytics across insurance networks. Europe held around 28% share, supported by national health systems adopting predictive fraud detection and compliance-focused technologies.

Market Insights

- The Healthcare Fraud Analytics Market was valued at USD 2.92 billion in 2024 and is projected to reach USD 16.4 billion by 2032, growing at a CAGR of 24.1%.

- Strong demand rises as insurers and hospitals adopt analytics to reduce rising fraudulent claims, with insurance claims review holding about 52% share in 2024.

- AI-driven detection, cloud migration, and real-time monitoring remain key trends as organizations strengthen compliance and reduce payment leakages.

- Competition grows as major vendors enhance predictive models and integrated fraud-prevention platforms, focusing on accuracy, automation, and scalable deployment.

- North America led the market with about 46% share in 2024, followed by Europe with 28%, while cloud-based deployment held nearly 58% share due to faster scaling and lower infrastructure costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution Type

Descriptive analytics led the solution type segment in 2024 with about 46% share of the Healthcare Fraud Analytics Market. Hospitals and insurers used descriptive models to detect suspicious billing trends and flag abnormal claim patterns in real time. Growth came from the rising volume of digital health records and the need for clear insights into fraud-prone activities. Predictive analytics also expanded as payers adopted machine-learning tools to forecast fraud risks, while prescriptive analytics gained attention for guiding corrective actions.

- For instance, SAS fraud analytics supports Odisha’s BSKY (Biju Swasthya Kalyan Yojana) scheme, which provides health coverage to over 3.56 crore (35.6 million) cardholders across a network of 9,509 hospitals

By Deployment Mode

Cloud-based deployment dominated this segment in 2024 with nearly 58% share of the Healthcare Fraud Analytics Market. Healthcare providers preferred cloud platforms because they offer faster scaling, stronger integration with claims systems, and lower upfront infrastructure costs. Adoption increased as insurers shifted to SaaS-based fraud detection tools that support real-time monitoring and secure data sharing across networks. On-premises deployment remained relevant for organizations with strict internal data-control policies but grew at a slower pace.

- For instance, Amazon Web Services supports healthcare workloads for 19 of the top 20 global pharmaceutical companies using its cloud platform.

By Application

Insurance claims review held the leading position in 2024 with about 52% share of the Healthcare Fraud Analytics Market. Both prepayment and postpayment review systems gained traction as insurers worked to reduce false claims and identify coding errors before reimbursement. Demand rose due to strict regulatory oversight and rising healthcare costs, which pushed payers to adopt automated review tools. Pharmacy billing issue detection and payment integrity solutions also grew as fraud involving drug claims and overbilling became more common across healthcare networks.

Key Growth Drivers

Rising healthcare fraud cases

Healthcare fraud cases surged across insurance and provider networks, pushing organizations to adopt advanced analytics tools. Payers sought faster ways to detect abnormal claim behavior and reduce financial losses linked to false billing and identity misuse. Adoption increased as regulatory agencies tightened audit rules and promoted stronger surveillance systems. These conditions positioned fraud analytics as a core requirement for both private and public healthcare programs.

- For instance, CVS Caremark processed about 2.3 billion pharmacy claims for roughly 108 million members in 2023, highlighting the scale of claims exposed to misuse risk.

Shift toward digital health records

Growing use of electronic health records created large datasets that supported stronger fraud detection. Healthcare providers leveraged analytics to spot mismatched patient information, improper coding, and duplicate claim submissions. The migration to digital platforms allowed real-time monitoring and reduced manual review delays. This shift improved transparency, strengthened compliance, and accelerated the demand for automated fraud analytics tools across hospitals and insurers.

- For instance, Epic manages electronic records for over 325 million patients and supports massive data exchange across hospitals and clinics through its interoperability network.

Expansion of AI and machine learning

AI and machine learning models improved the accuracy of fraud detection by identifying hidden billing patterns that traditional systems often missed. Health insurers adopted ML-based scoring systems to flag high-risk claims and reduce payment errors. Automated decision models helped shorten investigation time and support proactive fraud prevention. These capabilities made AI-driven analytics a major growth catalyst in the market.

Key Trends and Opportunities

Growth of cloud-based analytics

Cloud platforms gained strong traction as payers and providers shifted from legacy systems to scalable fraud detection tools. Cloud deployment reduced setup costs and enabled faster integration with claims platforms. Real-time dashboards supported better risk classification and data sharing among stakeholders. This trend opened major opportunities for vendors offering secure, flexible, and AI-integrated cloud analytics solutions.

- For instance, Salesforce Health Cloud is in active use by hundreds of healthcare and life-science organizations worldwide—over 630 customers in total—supporting cloud-based patient engagement, care coordination, and data analytics.

Increasing focus on payment integrity

Healthcare providers placed stronger focus on payment accuracy due to rising reimbursement pressures. Analytics tools that validated claim submissions, verified coding accuracy, and monitored provider behavior saw rapid adoption. Payers used integrated platforms to cut wasteful spending and ensure compliance with reimbursement guidelines. This trend created new opportunities for vendors offering unified payment integrity and fraud prevention technology.

- For instance, Cotiviti’s payment accuracy suite can cut claim review cycles from over 90 days to fewer than five days for health plans.

Growing adoption in pharmacy fraud detection

Rising misuse of drug claims and escalating prescription costs boosted demand for analytics in pharmacy billing oversight. Systems designed to detect unusual refill patterns, controlled-substance misuse, and false pharmacy submissions gained deeper use. Health plans viewed pharmacy fraud analytics as a high-value tool to reduce losses and manage formulary spending. This shift provided a growing opportunity for specialized analytics providers.

Key Challenges

Data privacy and security concerns

Healthcare data remains highly sensitive, and fraud analytics platforms require access to large datasets for effective performance. This creates concerns related to data sharing, cross-network access, and compliance with privacy laws. Providers and insurers must balance strong analytics adoption with strict protection of patient records. These constraints slow deployment and increase the need for secure, compliant infrastructure.

Complexity of integrating multiple data sources

Healthcare networks operate with diverse systems, coding standards, and claim formats, making data integration difficult. Fraud analytics tools need consistent and high-quality inputs to deliver accurate detection. Merging datasets from hospitals, insurers, pharmacies, and third-party administrators can create technical challenges. This complexity delays implementation and raises operational costs for healthcare organizations adopting analytics platforms.

Regional Analysis

North America

North America held the largest share of the Healthcare Fraud Analytics Market in 2024 with about 46%. Strong adoption came from strict regulatory oversight, advanced insurance systems, and high digital integration across hospitals and payers. The United States led growth due to rising fraudulent claim cases and rapid use of AI-based detection tools by major insurers. Canada also expanded its analytics adoption as health agencies strengthened audit processes. Demand increased as healthcare networks focused on reducing wasteful spending and improving payment integrity. Broad deployment of cloud analytics further supported the region’s strong position.

Europe

Europe accounted for nearly 28% share of the Healthcare Fraud Analytics Market in 2024. Growth accelerated as national health systems adopted predictive analytics to identify improper billing and coding errors. Countries such as Germany, the United Kingdom, and France strengthened fraud prevention frameworks and encouraged digital monitoring across insurance bodies. The region saw rising interest in cloud-based solutions as organizations sought flexible platforms with strong compliance features. Increased cross-border healthcare activities also pushed insurers to invest in better fraud detection tools. These factors supported consistent adoption across public and private healthcare networks.

Asia Pacific

Asia Pacific captured about 17% share of the Healthcare Fraud Analytics Market in 2024 and showed high growth potential. Expanding health insurance coverage and rapid digitalization in countries like China, India, and Japan boosted adoption. Governments invested in advanced analytics to manage rising claim volumes and reduce fraud-related losses. Hospitals and insurers used AI-enabled platforms to detect unusual billing behaviors and strengthen compliance. Increasing cloud usage improved access to scalable fraud detection systems. Growing private healthcare spending and rising fraud awareness further supported the region’s upward trajectory.

Latin America

Latin America held around 6% share of the Healthcare Fraud Analytics Market in 2024. Growth was supported by rising fraudulent claim activity and the need for stronger oversight in public insurance programs. Countries such as Brazil and Mexico adopted digital fraud monitoring platforms to improve audit performance and reduce monetary losses. The region saw increasing deployment of cloud-based analytics as organizations sought cost-effective detection tools. Limited digital infrastructure in some nations slowed progress, yet expanding insurance markets created steady demand for analytics-driven fraud prevention.

Middle East and Africa

The Middle East and Africa accounted for nearly 3% share of the Healthcare Fraud Analytics Market in 2024. Adoption grew as healthcare systems modernized and insurers introduced digital claim processing platforms. Governments in the Gulf region invested in analytics to strengthen regulatory compliance and detect improper billing. Africa showed gradual progress with expanding health insurance programs and rising digital health initiatives. Market growth remained moderate due to uneven technology infrastructure, yet increasing awareness of fraud and waste encouraged more organizations to adopt analytical tools for stronger payment integrity.

Market Segmentations:

By Solution Type

- Descriptive analytics

- Prescriptive analytics

- Predictive analytics

By Deployment Mode

By Application

- Insurance claims review

- Postpayment review

- Prepayment review

- Pharmacy billing issue

- Payment integrity

- Other applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Healthcare Fraud Analytics Market features major players such as Conduent, Inc, SAS Institute, Inc, Kyndryl, Optum, Inc, Wipro Limited, Cotiviti, Inc, EXL Service Holdings, Inc, HCL Technologies Limited, IBM, and DXC Technology. The competitive landscape reflects strong investment in AI, machine learning, and cloud-based analytics platforms designed to improve real-time fraud detection and reduce claim-related leakages. Vendors focus on developing integrated solutions that support payment integrity, automated claim review, and risk scoring. Partnerships with insurers, government health agencies, and large hospital networks help expand market reach and strengthen product adoption. Many companies enhance their offerings through advanced data integration capabilities, predictive modeling, and secure cloud infrastructure to meet regulatory requirements. The rising demand for scalable and automated fraud detection platforms continues to intensify competition, encouraging players to differentiate through faster processing, higher detection accuracy, and improved interoperability with existing health IT systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Cotiviti, Inc. showcased their advanced solution, 360 Pattern Review™, at the National Health Care Anti-Fraud Association (NHCAA) Annual Training Conference.

- In 2025, DXC Technology announced it had been named to the prestigious Forbes America’s Best Management Consulting Firms 2025 list for the third consecutive year.

- In 2023, Kyndryl has announced the deployment of a next generation of insurance fraud analytics with comprehensive technology solution for ClaimSearch Israel Ltd.

Report Coverage

The research report offers an in-depth analysis based on Solution Type, Deployment Mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven fraud detection models will grow across insurers and hospitals.

- Cloud-based analytics platforms will expand as organizations shift from legacy systems.

- Real-time claim monitoring will become standard to reduce payment delays and fraud losses.

- Predictive analytics will gain deeper use to identify high-risk patterns earlier in the claims cycle.

- Pharmacy fraud detection tools will rise due to increasing misuse of drug billing.

- Integration of analytics with electronic health records will improve data accuracy and insight quality.

- Payment integrity platforms will merge with fraud detection systems for unified oversight.

- Regulatory pressure will intensify, pushing providers to invest in advanced fraud prevention tools.

- Machine-learning-based automation will reduce manual review workloads for payers.

- Expansion of digital health ecosystems will create larger datasets that enhance fraud detection accuracy.