Market Overview

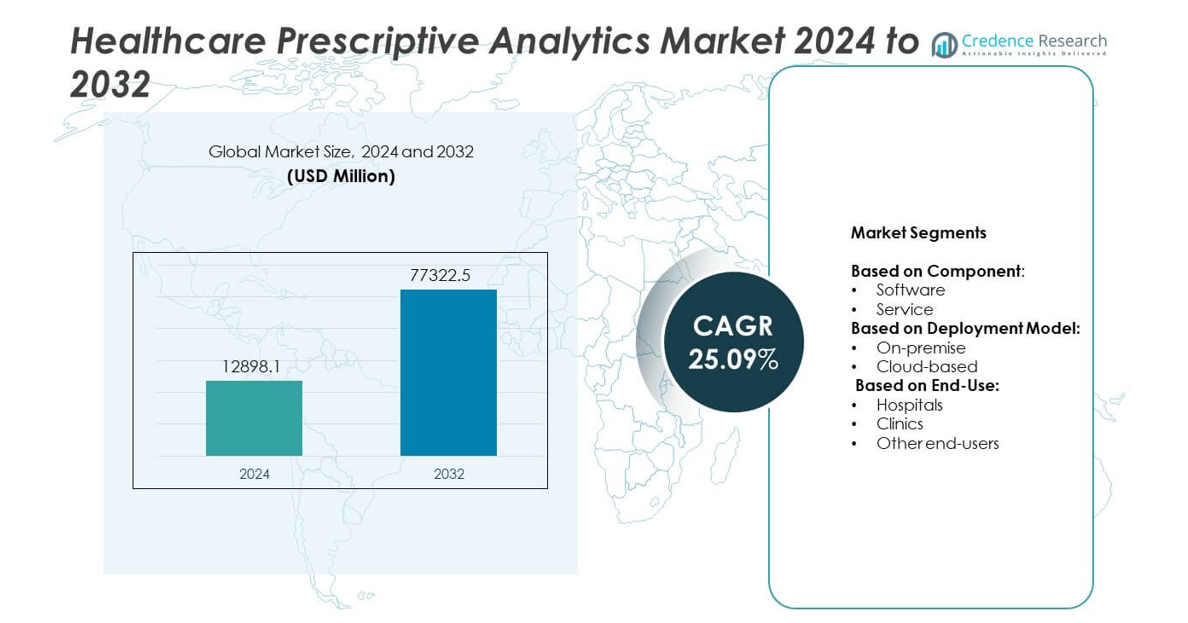

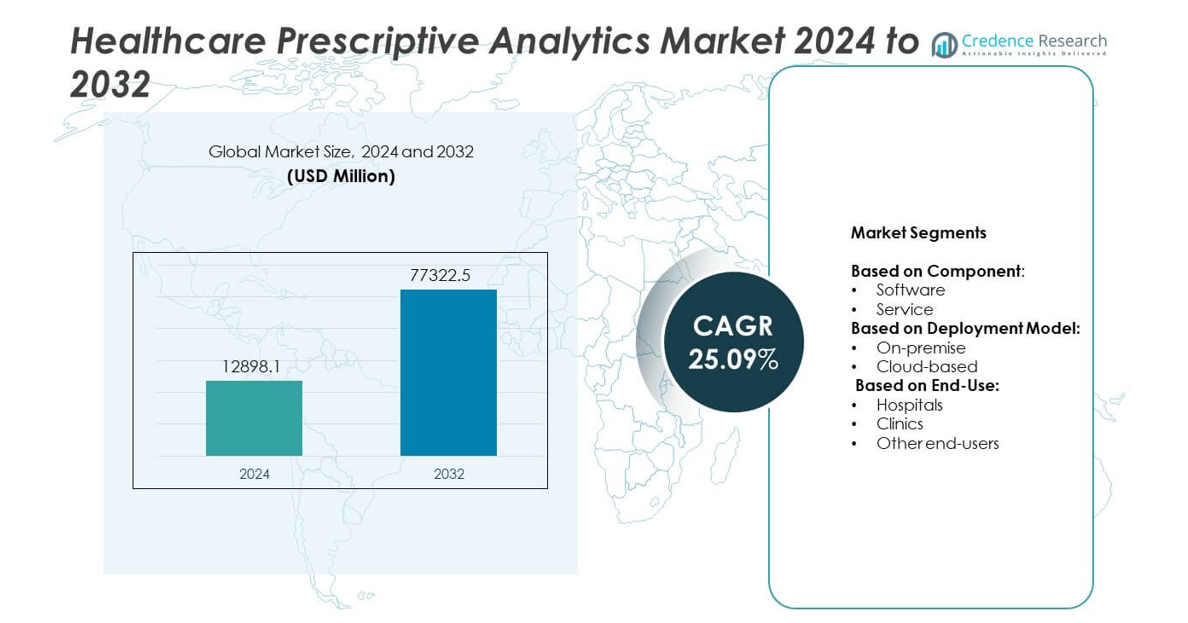

The Healthcare Prescriptive Analytics Market size was valued at USD 12,898.1 million in 2024 and is anticipated to reach USD 77,322.5 million by 2032, at a CAGR of 25.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Prescriptive Analytics Market Size 2024 |

USD 12,898.1 million |

| Healthcare Prescriptive Analytics Market, CAGR |

25.9% |

| Healthcare Prescriptive Analytics Market Size 2032 |

USD 77,322.5 million |

The Healthcare Prescriptive Analytics market is driven by the rising demand for data-driven decision-making, the growing need to reduce healthcare costs, and the shift toward value-based care models. Integration of artificial intelligence, machine learning, and big data enhances predictive and prescriptive capabilities, improving patient outcomes and operational efficiency. Cloud adoption further accelerates accessibility and scalability, while personalized medicine initiatives expand use cases. These drivers and trends position prescriptive analytics as a vital tool in transforming modern healthcare delivery.

North America leads adoption due to advanced healthcare infrastructure and strong investment in digital solutions, while Europe emphasizes regulatory compliance and interoperability. Asia Pacific shows rapid growth with rising healthcare modernization in China, India, and Japan. Latin America and the Middle East & Africa gradually adopt prescriptive tools, supported by government initiatives and private sector investments. Key players such as IBM Corporation, Optum, Oracle Corporation, and Health Catalyst focus on innovation, partnerships, and AI integration to strengthen market presence.

Market Insights

- The Healthcare Prescriptive Analytics market was valued at USD 12,898.1 million in 2024 and is projected to reach USD 77,322.5 million by 2032, growing at a CAGR of 25.09%.

- Rising demand for data-driven decision-making and the need to improve patient outcomes drive strong adoption across hospitals and clinics.

- Key trends include increasing use of cloud-based platforms, integration of genomic and personalized medicine data, and growing focus on real-time decision support systems.

- The market is highly competitive with players such as IBM Corporation, Optum, Oracle Corporation, Health Catalyst, SAS Institute Inc., and AIMMS focusing on innovation, AI integration, and partnerships.

- High implementation costs, data privacy concerns, and regulatory compliance requirements act as restraints for smaller providers and emerging markets.

- North America leads adoption due to advanced infrastructure and strong payer-provider collaboration, while Europe grows with strict compliance frameworks, and Asia Pacific shows fastest expansion through healthcare modernization.

- Latin America and the Middle East & Africa show steady growth supported by digital health initiatives, local investments, and partnerships with global vendors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Data-Driven Decision Making in Healthcare

Healthcare providers face increasing pressure to improve patient outcomes and operational efficiency. The Healthcare Prescriptive Analytics market addresses this demand by enabling real-time insights for clinical and administrative decisions. It helps clinicians reduce errors, optimize treatments, and manage costs effectively. Hospitals use prescriptive models to predict patient risks and recommend actionable steps. Governments and payers support analytics adoption to improve healthcare quality. This driver accelerates the deployment of advanced platforms across hospitals and clinics.

- For instance, OpenAI and Penda Health deployed “AI Consult,” an AI-powered clinical copilot, in 15 of Penda’s Nairobi clinics. A July 2025 study, conducted across nearly 40,000 patient visits, found that clinicians using the tool saw a 16% relative reduction in diagnostic errors and a 13% relative reduction in treatment errors.

Growing Need for Cost Reduction and Resource Optimization

Healthcare systems struggle with rising costs and limited resources. The Healthcare Prescriptive Analytics market helps organizations allocate resources more efficiently while cutting unnecessary spending. It identifies patterns in resource utilization and recommends adjustments for better capacity management. Hospitals adopt prescriptive tools to reduce readmissions, manage staff levels, and optimize supply chains. It improves revenue cycle management through predictive payment and claims analysis. Providers use these insights to strengthen long-term financial sustainability.

- For instance, a large U.S. hospital network deployed ML models predicting next-day discharges and ICU transfers. Their tool helped discharge 10 to 28.7 more patients and cut average hospital stay by 0.67 days per patient

Advancements in Big Data and Artificial Intelligence Integration

The integration of artificial intelligence and big data transforms healthcare operations. The Healthcare Prescriptive Analytics market benefits from innovations in predictive modeling, natural language processing, and cloud-based analytics. It enables the analysis of diverse datasets, including patient histories, diagnostics, and genomics. These capabilities improve precision in treatment recommendations and operational forecasting. Pharmaceutical companies use prescriptive tools to guide drug discovery and clinical trials. Growing AI maturity expands adoption across healthcare organizations worldwide.

Shift Toward Value-Based Healthcare and Patient-Centric Models

Healthcare systems move toward value-based models focused on patient outcomes. The Healthcare Prescriptive Analytics market supports this transition by aligning care strategies with measurable results. It helps providers personalize treatments while improving efficiency in care delivery. Payers adopt prescriptive solutions to design reimbursement models that reward better outcomes. Patients benefit from proactive health management supported by predictive and prescriptive insights. It strengthens trust between providers and patients through data-driven transparency.

Market Trends

Increased Adoption of Cloud-Based Analytics Platforms

Healthcare organizations shift toward cloud platforms for scalability and flexibility. The Healthcare Prescriptive Analytics market grows as providers migrate from traditional systems to secure cloud-based tools. It supports remote access to data and enables collaboration across multiple facilities. Cloud deployment reduces infrastructure costs while enhancing storage and computing capabilities. Vendors focus on developing HIPAA-compliant platforms to build trust among healthcare providers. This trend accelerates digital transformation across hospitals and clinics.

- For instance, OceanMD’s Ocean Platform provides digital administrative tools for healthcare providers, including patient engagement solutions and eReferrals. According to their social media in 2024, the platform had onboarded 1,500 clinics and processed 1.35 million eReferrals annually.

Integration of Genomic and Personalized Medicine Data

The move toward personalized care drives analytics innovation. The Healthcare Prescriptive Analytics market expands through integration of genomic, clinical, and behavioral data. It enables clinicians to predict treatment responses and recommend targeted therapies. Precision medicine initiatives strengthen demand for advanced prescriptive solutions. Pharmaceutical companies use integrated platforms to design more effective clinical trials. This trend fosters collaboration between technology providers and healthcare researchers.

- For instance, PharmGKB is a pharmacogenomics knowledge resource that actively collects, curates, and disseminates information on the impact of genetic variation on drug response. The knowledge base includes data from thousands of publications, hundreds of genes and drugs, and dozens of clinical guidelines. The figure of 160 drug-biomarker pairs refers to an older, static analysis of FDA labels, not the full scope of PharmGKB’s current and continuously expanding catalog of pharmacogenomic information.

Emergence of Real-Time Decision Support Systems

Healthcare providers require immediate insights for critical decision-making. The Healthcare Prescriptive Analytics market responds by delivering real-time dashboards and predictive alerts. It improves early detection of risks such as sepsis or cardiac failure. Emergency departments use prescriptive analytics to allocate staff and beds during peak hours. Decision support tools reduce delays and improve patient safety across care settings. The trend highlights a shift from retrospective reporting to proactive interventions.

Growing Focus on Interoperability and Data Integration

Healthcare organizations face challenges with fragmented data sources. The Healthcare Prescriptive Analytics market emphasizes solutions that unify data from electronic health records, wearables, and imaging systems. It ensures smoother information flow across providers, payers, and researchers. Interoperability standards such as HL7 FHIR support seamless integration efforts. Improved data connectivity strengthens collaboration and care coordination. This trend positions analytics as a core enabler of connected healthcare ecosystems.

Market Challenges Analysis

High Implementation Costs and Complex Integration Issues

Healthcare organizations face significant financial and technical barriers when deploying advanced analytics systems. The Healthcare Prescriptive Analytics market encounters challenges due to high upfront costs, including software licensing, hardware upgrades, and staff training. It often requires integration with legacy electronic health record systems, which creates compatibility issues. Many providers lack the expertise to manage complex data pipelines and advanced algorithms. Smaller clinics struggle more with affordability and skilled workforce shortages. These hurdles slow adoption across diverse healthcare settings.

Concerns Over Data Privacy, Security, and Regulatory Compliance

Patient data privacy remains a critical concern in analytics adoption. The Healthcare Prescriptive Analytics market must comply with strict regulations such as HIPAA and GDPR. It faces risks of cyberattacks, unauthorized access, and data breaches that can damage trust. Healthcare providers hesitate to fully leverage prescriptive tools due to fear of non-compliance. Vendors must invest heavily in encryption, monitoring, and secure cloud solutions. Ensuring compliance while maintaining usability presents an ongoing challenge for the industry.

Market Opportunities

Expansion Through Value-Based Care and Preventive Healthcare Models

Healthcare systems worldwide shift from volume-based to value-based care. The Healthcare Prescriptive Analytics market creates opportunities by enabling providers to link clinical decisions with measurable patient outcomes. It helps design preventive healthcare strategies that reduce hospitalizations and improve population health. Payers explore prescriptive tools to structure reimbursement models based on efficiency and quality. Hospitals adopt analytics to personalize treatments, improving patient satisfaction and long-term results. This opportunity strengthens the role of prescriptive analytics in healthcare transformation.

Rising Demand in Emerging Markets and Technological Innovation

Emerging economies invest heavily in healthcare modernization and digital adoption. The Healthcare Prescriptive Analytics market benefits from growing infrastructure, government support, and rising patient volumes in these regions. It leverages artificial intelligence, machine learning, and natural language processing to enhance insights. Wearables and remote monitoring devices generate real-time patient data, opening new possibilities for prescriptive solutions. Pharmaceutical companies and startups invest in advanced platforms to expand access and efficiency. This creates strong opportunities for global expansion and innovation.

Market Segmentation Analysis:

By Component:

The Healthcare Prescriptive Analytics market divides into software and services. Software holds a significant share, driven by advanced platforms that support predictive modeling and clinical decision-making. It allows providers to analyze large volumes of patient and operational data efficiently. Service offerings, including consulting and managed services, are growing with demand for customization and integration support. It helps healthcare organizations overcome challenges in adoption and ensure smoother workflows. Both segments continue to expand with rising digital transformation initiatives.

- For instance, in early 2023, Veradigm has divested parts of its business and shifted its focus since then. In March 2022, before the rebranding, the company sold its hospital and large physician practices business segment to Constellation Software. This would have impacted the number of hospitals and providers using its systems, although the figures of over 180,000 physicians and 2,700 hospitals are still cited in recent overviews of the company.

By Deployment Model:

The market categorizes into on-premise and cloud-based solutions. On-premise systems remain preferred by large hospitals with strict control needs over sensitive data. However, the cloud-based segment shows faster growth due to scalability, lower costs, and ease of access. It enables seamless data sharing across facilities and supports remote decision-making. Vendors focus on enhancing cloud security and compliance to build trust among healthcare providers. Cloud deployment gains popularity in both developed and emerging economies.

By End-Use:

The market includes hospitals, clinics, and other end-users. Hospitals dominate due to their extensive patient bases and requirement for complex data analysis. The Healthcare Prescriptive Analytics market benefits from hospital investments in advanced decision-support systems to improve outcomes. Clinics adopt prescriptive analytics at a smaller scale, focusing on operational efficiency and patient engagement. Other end-users, such as research institutes and insurance providers, use analytics to enhance research accuracy and policy design. It creates diverse adoption opportunities across healthcare settings.

Segments:

Based on Component:

Based on Deployment Model:

Based on End-Use:

- Hospitals

- Clinics

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the dominant share of the Healthcare Prescriptive Analytics market, accounting for 42% in 2024. The region benefits from advanced healthcare infrastructure, strong investment in digital technologies, and a high focus on value-based care. Large-scale adoption by hospitals, payers, and research institutes fuels the demand for prescriptive analytics solutions. It supports personalized treatments, predictive care management, and resource optimization, enhancing clinical and operational efficiency. The United States leads with significant adoption across hospitals and insurance providers. Canada contributes with growing government-led digital healthcare initiatives and supportive reimbursement frameworks. North America maintains leadership through continuous innovation and strong partnerships between technology firms and healthcare providers.

Europe

Europe represents a significant share of the Healthcare Prescriptive Analytics market, capturing 27% in 2024. The region emphasizes data-driven healthcare supported by government policies and funding for digital transformation. It benefits from strong regulatory frameworks that encourage interoperability and patient data protection. Key adoption comes from hospitals focusing on predictive diagnostics, clinical decision support, and operational efficiency. Countries such as Germany, the United Kingdom, and France drive growth with investments in AI-driven analytics platforms. It also gains traction from pharmaceutical firms leveraging prescriptive analytics in clinical trials. The region shows a balanced mix of established healthcare systems and ongoing modernization efforts.

Asia Pacific

Asia Pacific is emerging as the fastest-growing region, holding 20% share in 2024. Rising healthcare expenditure, growing patient populations, and rapid digital adoption drive this expansion. The Healthcare Prescriptive Analytics market gains momentum from governments investing in AI, cloud solutions, and smart hospitals. China and India witness accelerated adoption through large-scale healthcare modernization programs. Japan and South Korea lead with advanced healthcare systems that integrate prescriptive analytics for personalized care. It also benefits from regional startups and multinational collaborations driving innovation. Asia Pacific shows strong potential for future growth due to rising demand for efficiency and patient-centric healthcare.

Latin America

Latin America accounts for 6% of the Healthcare Prescriptive Analytics market in 2024. The region experiences gradual adoption as healthcare providers modernize their infrastructure. Brazil and Mexico are the leading markets, supported by government-led health programs and private sector investment. It focuses on improving resource allocation, reducing costs, and strengthening patient engagement. Adoption is slower compared to developed regions due to financial and technical barriers. Vendors expand their presence through partnerships and localized solutions tailored for cost-sensitive environments. Latin America shows promising growth as awareness of digital healthcare benefits increases.

Middle East and Africa

The Middle East and Africa collectively hold 5% share in 2024. The Healthcare Prescriptive Analytics market develops steadily with growing investments in digital health solutions. Gulf countries such as the UAE and Saudi Arabia lead adoption through smart healthcare initiatives and government funding. South Africa and other African nations gradually integrate analytics into healthcare systems to improve efficiency. It faces challenges from infrastructure gaps and limited skilled workforce but benefits from rising collaborations with global vendors. Hospitals in wealthier economies adopt advanced platforms to align with national digital health goals. The region demonstrates early-stage adoption yet shows significant long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- River Logic, Inc.

- Optum, Inc.

- IBM Corporation

- GUROBI OPTIMIZATION, LLC.

- Oracle Corporation

- Health Catalyst

- Frontline Systems, Inc.

- Deerwalk Inc.

- FICO

- Alteryx

- SAS Institute Inc.

- AIMMS

Competitive Analysis

The Healthcare Prescriptive Analytics market is highly competitive with key players including AIMMS, Alteryx, Deerwalk Inc., FICO, Frontline Systems, Inc., GUROBI OPTIMIZATION, LLC., Health Catalyst, IBM Corporation, Optum, Inc., Oracle Corporation, River Logic, Inc., and SAS Institute Inc. These companies focus on developing advanced analytics platforms that combine predictive and prescriptive capabilities to improve decision-making across healthcare systems. They invest in artificial intelligence, machine learning, and cloud-based technologies to enhance accuracy, scalability, and real-time insights. Vendors strengthen their market presence through mergers, acquisitions, and strategic collaborations with hospitals, payers, and research organizations. Product innovation remains a priority, with emphasis on data integration, security, and compliance with healthcare regulations. Companies also expand geographically by targeting emerging markets with cost-effective and customizable solutions. Strong competition encourages continuous development of user-friendly platforms designed to support clinical, financial, and operational decision-making. The industry’s competitive landscape reflects a balance between established technology leaders and specialized firms, each aiming to capture growth opportunities in digital healthcare transformation.

Recent Developments

- In 2025, AIMMS contributed to Metcash’s supply chain digital transformation by providing SC Navigator

- In 2025, Health Catalyst entered a partnership with Databricks to advance healthcare data sharing and analytics.

- In 2022, Carle Health and Health Catalyst entered in a five-year partnership, enhancing their existing relationship. This collaboration granted Carle Health all-access to technology, including analytics along with prescriptive analytics for population management, data management, reporting, and project management services. The partnership aimed to focus on advancing analytics capabilities and enhancing patient care.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with growing adoption of AI-driven healthcare tools.

- Cloud-based solutions will dominate due to scalability, cost efficiency, and easier access.

- Integration of genomics and personalized medicine will create stronger demand for prescriptive analytics.

- Hospitals will continue to lead adoption, focusing on predictive care and efficiency.

- Clinics will increasingly use prescriptive tools to improve patient engagement and outcomes.

- Data security and compliance will remain a critical focus for vendors and providers.

- Emerging economies will accelerate growth with rising investments in digital health infrastructure.

- Real-time decision support systems will become standard in emergency and critical care units.

- Partnerships between healthcare providers and technology firms will drive innovation.

- Interoperability and seamless data integration will shape the future of connected healthcare systems.