Market Overview

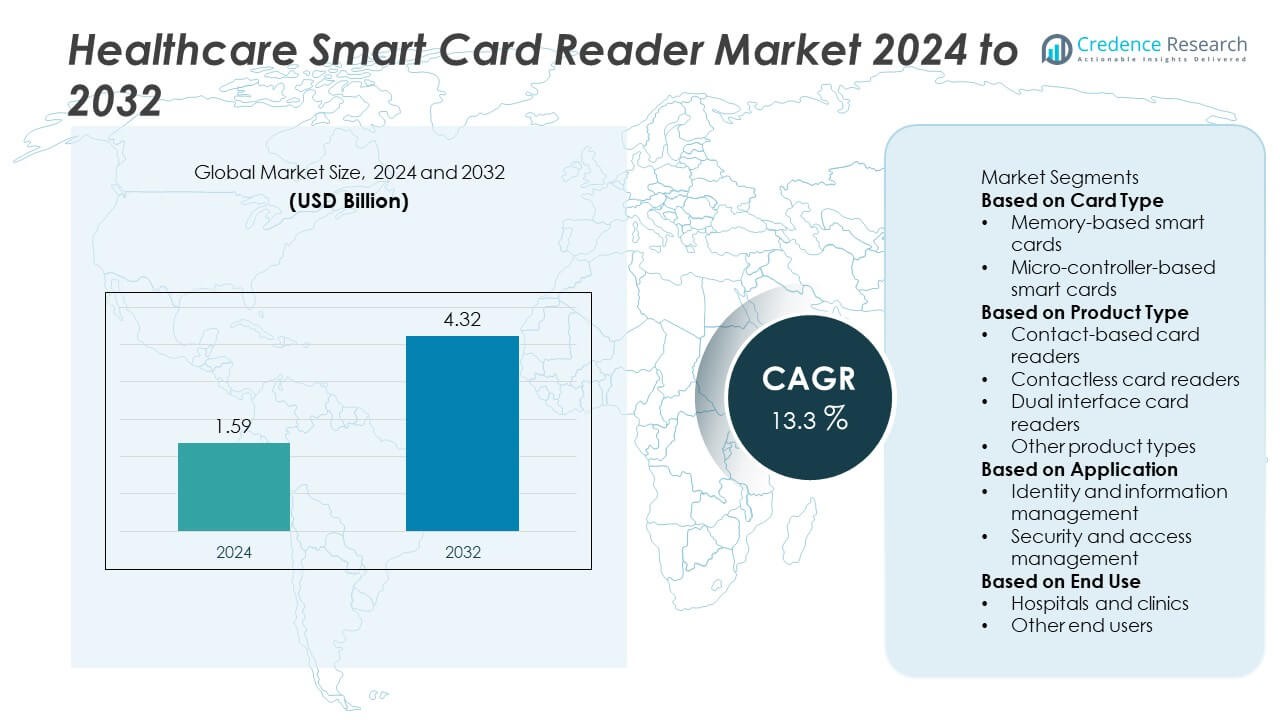

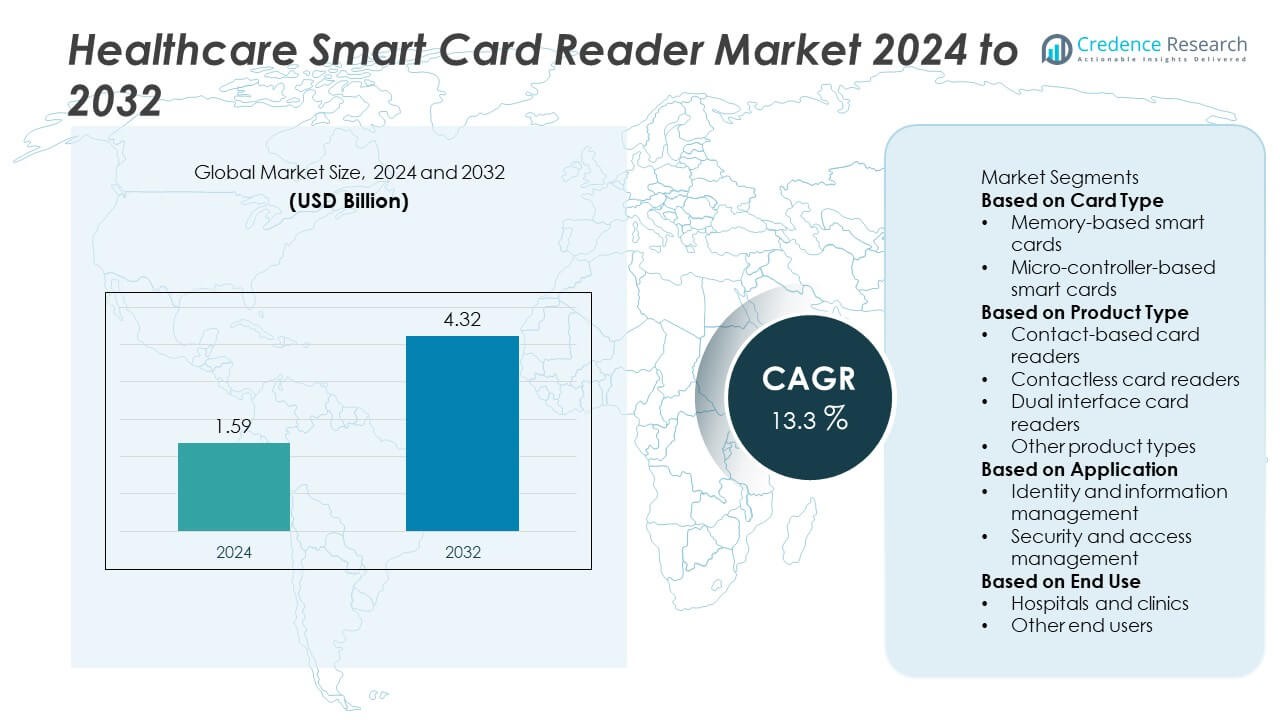

The Healthcare Smart Card Reader Market was valued at USD 1.59 billion in 2024 and is projected to reach USD 4.32 billion by 2032, growing at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Smart Card Reader Market Size 2024 |

USD 1.59 Billion |

| Healthcare Smart Card Reader Market, CAGR |

13.3% |

| Healthcare Smart Card Reader Market Size 2032 |

USD 4.32 Billion |

The Healthcare Smart Card Reader Market is led by major companies including IDENTOS, CHERRY, HID Global Corporation, CardLogix, Ingenico, FEITIAN Technologies, Advantech, Identiv, Advanced Card Systems, and IDEMIA. These players focus on developing secure, efficient, and interoperable card reader systems to support healthcare digitalization. North America dominated the market with a 39% share in 2024, driven by strong regulatory frameworks and widespread use of electronic health record systems. Europe followed with 31%, supported by GDPR-driven security compliance and national eHealth programs. Asia-Pacific held 23% share, emerging as the fastest-growing region due to expanding healthcare infrastructure and government-backed digital health initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare Smart Card Reader Market was valued at USD 1.59 billion in 2024 and is projected to reach USD 4.32 billion by 2032, growing at a CAGR of 13.3%.

- Growth is driven by the rising need for secure patient identification and digital healthcare transformation supported by government-backed eHealth initiatives.

- Contactless and dual-interface readers are gaining traction as hospitals prioritize hygiene and faster authentication, especially in post-pandemic environments.

- Key players such as HID Global Corporation, IDEMIA, Identiv, and Ingenico are focusing on cybersecurity, interoperability, and smart connectivity to enhance healthcare data management.

- North America led with 39% share in 2024, followed by Europe with 31% and Asia-Pacific with 23%, while micro-controller-based smart cards held the largest 61% segment share, supported by their superior data security and integration capabilities in healthcare systems.

Market Segmentation Analysis:

By Card Type

Micro-controller-based smart cards dominated the Healthcare Smart Card Reader Market with a 61% share in 2024. These cards are preferred for their advanced processing capabilities, higher data storage, and enhanced security features. They enable authentication, encryption, and secure access to patient information, making them ideal for hospitals and insurance verification systems. Memory-based smart cards hold a smaller share, mainly used for basic data storage. Growing concerns over data breaches and compliance with healthcare security standards such as HIPAA and GDPR are driving the shift toward micro-controller-based smart card adoption.

- For instance, IDEMIA developed its ID-One PIV 243 micro-controller smart card featuring an embedded chip with NIST FIPS 140-3 Level 2 validation. The card supports on-chip cryptographic key generation and 2048-bit RSA encryption, ensuring secure access control in government, enterprise, and other environments.

By Product Type

Contact-based card readers led the market with a 49% share in 2024, driven by their wide availability, cost-effectiveness, and compatibility with existing healthcare IT infrastructure. Hospitals and diagnostic centers favor these readers for secure data transfer and patient identification. However, contactless and dual-interface readers are gaining traction due to faster authentication and hygiene benefits, especially after the COVID-19 pandemic. Increasing deployment of RFID and NFC-enabled systems across modern healthcare networks is expected to boost the adoption of contactless technologies over the coming years.

- For instance, HID Global offers the OMNIKEY SE Reader Core module, which integrates RFID, BLE, and NFC capabilities for secure authentication in various systems, including healthcare environments. This module can read a range of high and low-frequency credentials, including those on mobile phones with Apple Wallet support.

By Application

The identity and information management segment accounted for a 57% share in 2024, making it the dominant application in the Healthcare Smart Card Reader Market. These systems streamline patient identification, reduce administrative errors, and ensure secure medical data exchange between facilities. Growing implementation of electronic health record (EHR) systems and digital insurance verification drives demand for smart card-based identity solutions. Security and access management applications are also expanding rapidly as healthcare institutions prioritize secure entry and patient data protection within connected digital ecosystems.

Key Growth Drivers

Rising Digitalization in Healthcare Systems

The growing adoption of digital health infrastructure and electronic health records (EHR) is a major driver of the Healthcare Smart Card Reader Market. Hospitals and clinics are increasingly integrating smart card systems to ensure secure and accurate patient identification. Governments worldwide are encouraging eHealth initiatives to improve data management and reduce fraud. The demand for efficient access to medical data and improved administrative efficiency continues to accelerate smart card reader deployment across healthcare facilities.

- For instance, Identiv SCR3310v2.0 smart card readers are widely used in healthcare, including for EHR authentication. The device supports a standard USB interface and is fully compliant with industry standards like ISO/IEC 7816 and FIPS 201, which are important for secure applications.

Growing Need for Data Security and Authentication

With increasing healthcare data breaches, security has become a top priority for medical organizations. Smart card readers enable encrypted data access, protecting sensitive patient information from unauthorized entry. Their integration supports regulatory compliance with data protection standards such as HIPAA and GDPR. As healthcare providers digitize more records, the need for strong authentication systems will continue to drive market demand for secure smart card technologies.

- For instance, FEITIAN Technologies introduced its R502 Dual Interface Reader equipped with ISO/IEC 14443 Type A/B compliance, which supports encrypted firmware upgrades and enables multi-factor authentication for applications like healthcare databases, thus helping to reduce access breach incidents in medical institutions.

Government Initiatives and eHealth Programs

Government-backed health ID programs and national eHealth policies are fueling market growth. Countries are implementing smart health cards for insurance verification, patient tracking, and digital health record management. These initiatives enhance interoperability between healthcare providers and streamline billing and data sharing. Financial incentives and infrastructure investments in digital healthcare systems further strengthen the adoption of smart card readers across both public and private healthcare institutions.

Key Trends & Opportunities

Adoption of Contactless and Dual-Interface Readers

Healthcare organizations are rapidly adopting contactless and dual-interface readers for faster and safer data exchange. These systems improve hygiene by eliminating physical contact while maintaining high-speed authentication. The trend gained momentum after the pandemic as healthcare facilities prioritized non-contact verification solutions. Continuous innovation in RFID and NFC technology is expected to open new opportunities for smart card reader manufacturers targeting large hospital networks and diagnostic chains.

- For instance, CHERRY introduced its KC 1000 SC keyboard-integrated contact smart card reader. The device supports ISO 7816 protocols and provides secure workstation access in hospitals and laboratories through secure PIN entry and authentication.

Integration with Cloud and IoT Platforms

The integration of smart card readers with IoT-enabled devices and cloud-based data systems is transforming healthcare management. These systems allow real-time patient monitoring, remote data access, and seamless information sharing between departments. Manufacturers are developing solutions compatible with modern hospital IT infrastructure, improving interoperability and efficiency. The shift toward connected and automated health management platforms offers long-term growth potential for the industry.

- For instance, Advantech developed its HIT-W183 Cloud IoT medical terminal integrated with a smart card reader and RFID connectivity. The unit features an Intel Celeron N4200 processor, a default of 4 GB RAM (with a maximum capacity of 8 GB), and dual isolated Ethernet for secure data traffic.

Key Challenges

High Implementation and Maintenance Costs

The initial setup and integration costs of smart card reader systems can be high, particularly for small healthcare centers. Maintenance, software upgrades, and system compatibility issues add to operational expenses. This cost barrier restricts adoption in developing regions with limited healthcare budgets. Manufacturers are working on cost-effective models and flexible deployment solutions to address this challenge.

Interoperability and Technical Integration Issues

Many healthcare facilities face challenges integrating smart card systems with existing IT infrastructure and EHR platforms. Lack of standardized communication protocols and differing data formats create compatibility problems. These technical barriers delay full-scale adoption and limit system efficiency. Continuous efforts toward global interoperability standards and unified data frameworks are essential to overcome these issues and enhance market growth.

Regional Analysis

North America

North America dominated the Healthcare Smart Card Reader Market with a 39% share in 2024. The region’s leadership is driven by the high adoption of digital health infrastructure and strong emphasis on patient data security. The United States leads due to extensive healthcare IT spending, electronic health record integration, and advanced hospital networks. Government regulations such as HIPAA promote secure patient identification systems, boosting demand for smart card readers. Increasing partnerships between healthcare providers and IT firms are further enhancing market penetration across hospitals, clinics, and insurance platforms.

Europe

Europe held a 31% share of the Healthcare Smart Card Reader Market in 2024, supported by widespread eHealth initiatives and stringent data protection laws. Countries such as Germany, the United Kingdom, and France are key adopters, driven by regulatory frameworks like GDPR ensuring secure health data management. Healthcare providers across Europe are rapidly implementing contactless and dual-interface smart card readers for identity verification and insurance processing. Public funding for healthcare digitalization and interoperability projects continues to strengthen market growth across both private and government healthcare institutions.

Asia-Pacific

Asia-Pacific accounted for 23% of the global market share in 2024 and is projected to grow fastest during the forecast period. Rapid healthcare infrastructure development, rising patient populations, and digital transformation initiatives are fueling adoption. China, India, Japan, and South Korea are major contributors due to expanding hospital networks and government-backed eHealth programs. Increasing focus on data security, insurance digitization, and electronic health card deployment drives regional demand. Growing investment by local IT and medical device firms in secure health data technologies further accelerates market expansion across the region.

Latin America

Latin America captured a 4% share of the Healthcare Smart Card Reader Market in 2024. Growth is driven by improving healthcare systems and increasing adoption of electronic health identification in countries such as Brazil, Mexico, and Chile. The need for accurate patient data handling and reduced medical fraud is encouraging hospitals to integrate smart card-based authentication. Gradual digital transformation in healthcare infrastructure, coupled with support from international health technology providers, is strengthening market penetration. However, limited funding and uneven digital maturity across the region continue to constrain faster growth.

Middle East & Africa

The Middle East & Africa held a 3% share of the Healthcare Smart Card Reader Market in 2024. Expansion in the region is supported by healthcare modernization initiatives and growing awareness of digital data management. GCC nations, including the UAE and Saudi Arabia, are leading adoption through national health identification programs and smart hospital investments. In Africa, digital health programs backed by government and global aid organizations are improving patient record systems. Despite slow adoption rates in rural areas, infrastructure investments and rising healthcare IT integration are enhancing long-term growth prospects.

Market Segmentations:

By Card Type

- Memory-based smart cards

- Micro-controller-based smart cards

By Product Type

- Contact-based card readers

- Contactless card readers

- Dual interface card readers

- Other product types

By Application

- Identity and information management

- Security and access management

By End Use

- Hospitals and clinics

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Healthcare Smart Card Reader Market features key players such as IDENTOS, CHERRY, HID Global Corporation, CardLogix, Ingenico, FEITIAN Technologies, Advantech, Identiv, Advanced Card Systems, and IDEMIA. These companies focus on enhancing data security, interoperability, and system integration across healthcare facilities. Leading players are developing advanced contactless and dual-interface readers to meet growing demand for fast and hygienic patient identification. Strategic collaborations with hospitals, IT service providers, and government agencies strengthen their market presence. Product innovations incorporating encryption, biometric verification, and cloud-based connectivity are key areas of investment. North American and European manufacturers emphasize regulatory compliance and technological precision, while Asia-Pacific companies are targeting cost-effective and scalable smart card reader solutions. Continuous R&D and integration with electronic health record systems are expected to shape competitive positioning in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, IDEMIA launched its SMART-E kiosks in Pennsylvania and Colorado, achieving a fingerprint rejection rate under 2% during civil applicant processing.

- In August 2025, HID Global unveiled its OMNIKEY SE Plug Reader, enabling secure authentication across FIDO2, smart card, and multi-factor credentials.

- In July 2025, IDEMIA’s ID-One PIV 243 smart cards earned NIST FIPS 140-3 Level 2 validation and entered the U.S. GSA Approved Products List.

- In April 2024, HID Global introduced the OMNIKEY SE Reader Core module supporting RFID, Apple Wallet, BLE, and future-ready embedded desktop integration.

Report Coverage

The research report offers an in-depth analysis based on Card Type, Product Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for contactless smart card readers will continue to grow in healthcare facilities.

- Integration with electronic health record systems will strengthen digital identity management.

- Governments will expand national eHealth programs promoting smart card-based authentication.

- Hospitals will adopt dual-interface readers for improved speed and hygiene in patient verification.

- AI and IoT integration will enhance real-time data access and interoperability.

- Manufacturers will focus on stronger encryption and biometric-enabled card reader solutions.

- Asia-Pacific will experience the fastest growth due to rapid healthcare digitalization.

- Partnerships between healthcare IT providers and smart card firms will increase.

- Cost-efficient and portable reader models will gain popularity among small clinics.

- Continuous innovation in secure, cloud-based healthcare identification systems will drive market expansion.