Market Overview

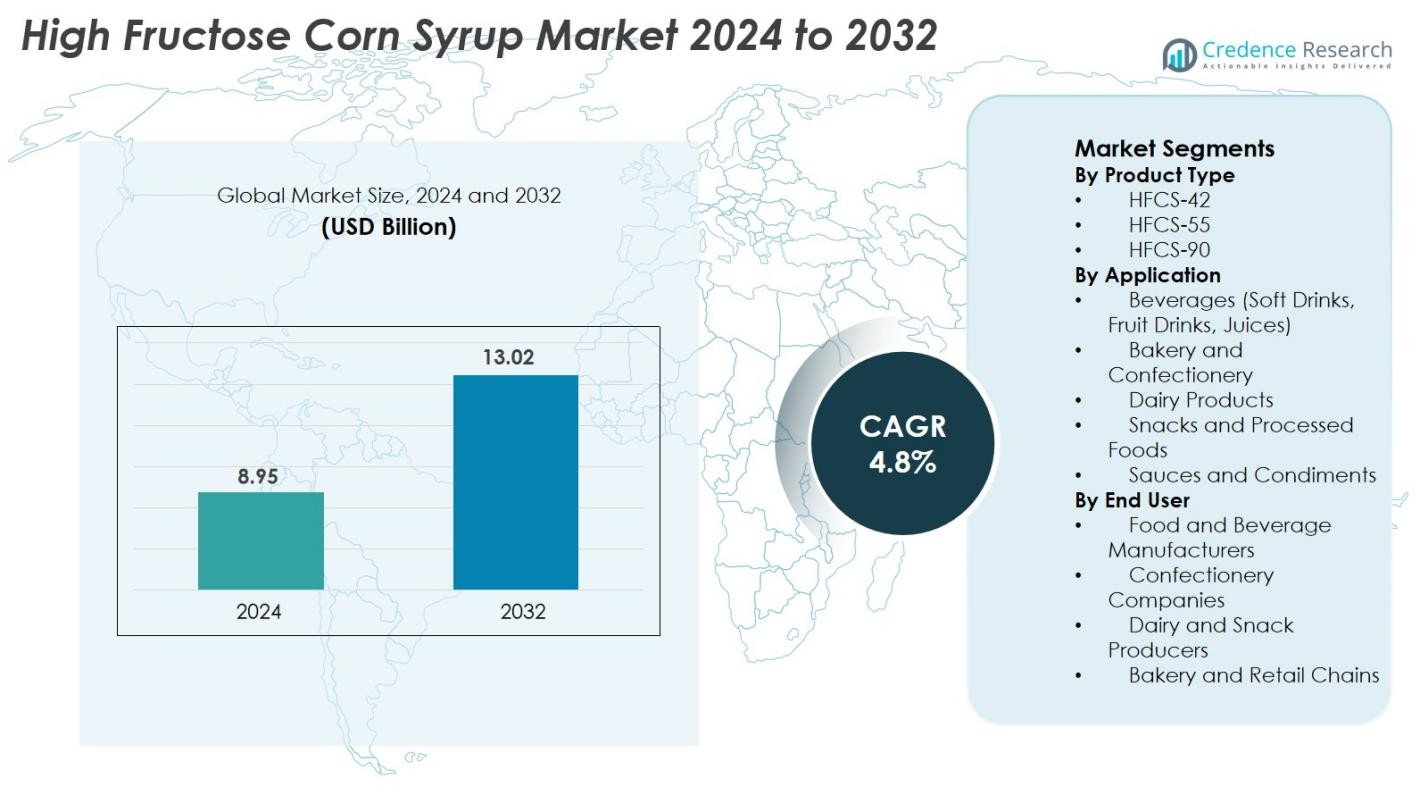

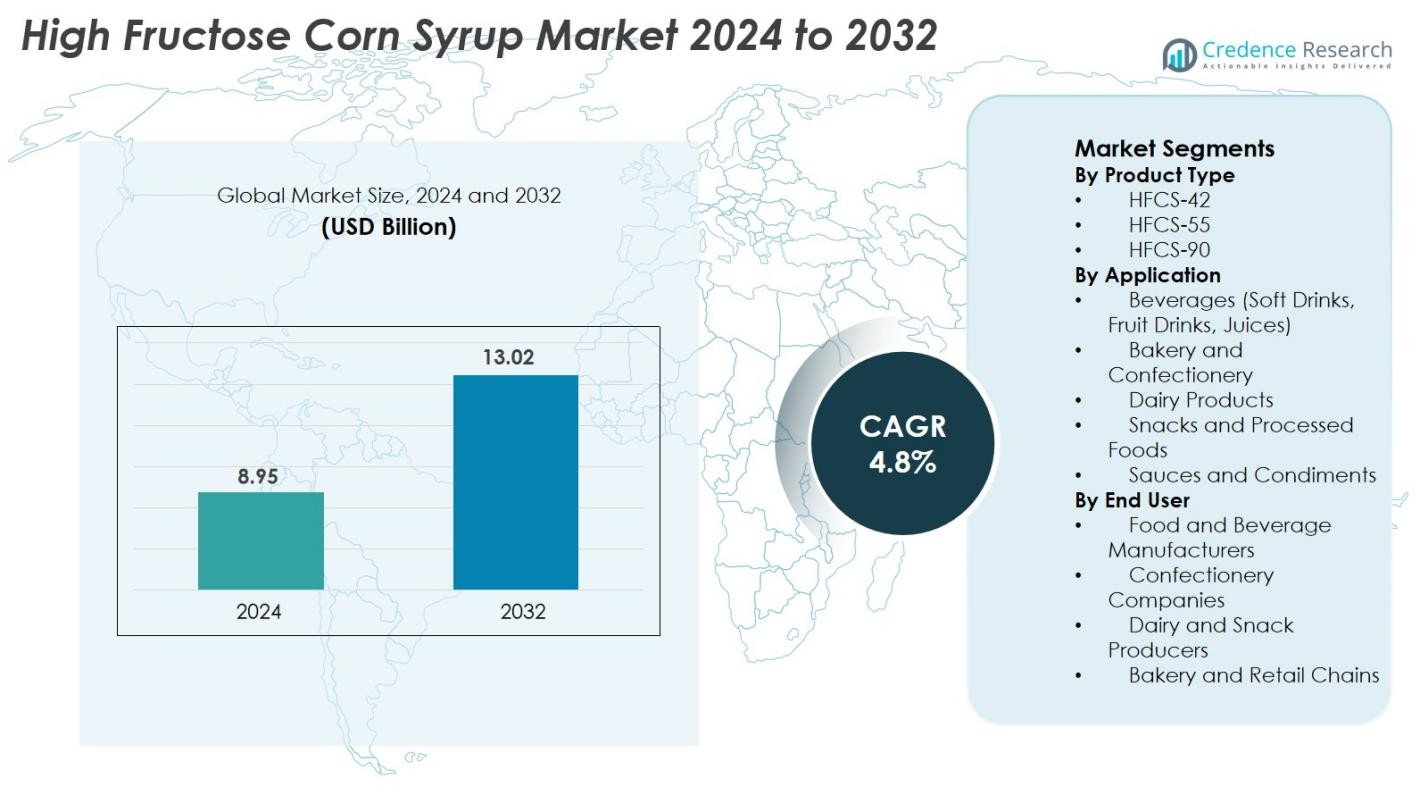

High Fructose Corn Syrup Market size was valued at USD 8.95 Billion in 2024 and is anticipated to reach USD 13.02 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Fructose Corn Syrup Market Size 2024 |

USD 8.95 Billion |

| High Fructose Corn Syrup Market, CAGR |

4.8% |

| High Fructose Corn Syrup Market Size 2032 |

USD 13.02 Billion |

The High Fructose Corn Syrup market is driven by major global producers such as Archer Daniels Midland Company, Cargill Inc., Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, Global Sweeteners Holdings Limited, Baolingbao Biology Co., Ltd., and COFCO Biochemical, all of which maintain strong manufacturing capacities and established distribution networks. These companies focus on expanding production efficiency, improving HFCS formulations, and strengthening partnerships with beverage, bakery, and processed food manufacturers. North America leads the global market with approximately 38% share, supported by extensive HFCS usage in soft drinks and packaged foods, followed by Asia-Pacific with around 28% share due to rising demand from its rapidly expanding food and beverage sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Fructose Corn Syrup market was valued at USD 8.95 Billion in 2024 and is projected to reach USD 13.02 Billion by 2032, registering a CAGR of 4.8% during the forecast period.

- Strong market drivers include rising demand for sweetened beverages, processed foods, and bakery products, with HFCS-55 holding the largest product share at about 62% due to its extensive use in soft drinks.

- Key trends include increasing HFCS adoption in emerging markets, growing usage in ready-to-eat foods, and technological improvements in corn refining that enhance product consistency and efficiency.

- The competitive landscape is shaped by major players such as ADM, Cargill, Ingredion, Tate & Lyle, Roquette, and COFCO Biochemical, who focus on capacity expansion, product optimization, and strategic partnerships with major food manufacturers.

- Regionally, North America leads with around 38% share, followed by Asia-Pacific at nearly 28%, while beverages dominate the application segment with approximately 48% share globally.

Market Segmentation Analysis

By Product Type

The High Fructose Corn Syrup market exhibits strong demand across HFCS-42, HFCS-55, and HFCS-90, with HFCS-55 dominating the segment with 62% share due to its intensive use in soft drinks and sweetened beverages. Its higher sweetness profile and cost efficiency drive widespread adoption among large beverage producers. HFCS-42 retains steady demand in processed foods, dairy desserts, and sauces, while HFCS-90 serves niche applications requiring higher sweetness blends. Growth across all product types is supported by rising consumption of ready-to-drink beverages and the expanding processed food sector in emerging economies.

- For instance, Tate & Lyle implemented advanced enzymatic conversion systems that allow production of HFCS-90 with a fructose purity of 90 g per 100 g, supporting its use in high-intensity sweetener blends.

By Application

In terms of application, beverages including soft drinks, juices, and fruit drinks lead the market with an 48% share, driven by consistent usage of HFCS-55 for flavor enhancement and stability. Bakery and confectionery products show growing uptake of HFCS-42 for moisture retention and improved texture, while dairy products and processed snacks increasingly rely on HFCS for taste uniformity and extended shelf life. Sauces and condiments also utilize HFCS-42 for viscosity control and cost-effective sweetness. The segment’s expansion is supported by rising consumer preference for packaged foods globally.

- For instance, Keurig Dr Pepper (formerly Dr Pepper Snapple Group) depends heavily on HFCS-55 in its carbonated soft drink portfolio to ensure product stability and sweetness uniformity.

By End User

Among end users, food and beverage manufacturers account for 54% share, making them the leading contributors to HFCS consumption. Their dominance stems from large-scale usage in beverages, bakery items, processed foods, and dairy formulations. Confectionery companies rely on HFCS-42 for texture modulation and sweetness stability, while dairy and snack producers integrate it to maintain taste consistency and product shelf life. Bakery and retail chains further boost demand due to the growing preference for low-cost sweetening agents across commercial production lines, particularly in emerging markets.

Key Growth Drivers

Rising Demand for Sweetened Beverages and Processed Foods

The High Fructose Corn Syrup market is significantly driven by the surging consumption of sweetened beverages, processed foods, and ready-to-eat products across global markets. Beverage manufacturers increasingly prefer HFCS-55 because it delivers a sugar-like sweetness, blends uniformly in liquids, and enhances flavor stability, especially in carbonated soft drinks and fruit-based beverages. The expanding fast-food and packaged snack industry further boosts adoption as HFCS provides moisture retention, extended shelf life, and cost-effective formulation benefits. Rapid urbanization and busy lifestyles also elevate the demand for affordable convenience foods where HFCS-42 is commonly used in bakery, confectionery, and dairy items. Growing penetration of Western dietary habits across Asia-Pacific and Latin America reinforces this driver, creating sustained demand for HFCS as a versatile sweetening ingredient. Together, these factors make sweetened beverages and processed food consumption a dominant catalyst for market expansion.

- For Instance, General Mills previously used high-fructose corn syrup (HFCS) in some processed foods like cereals and snacks for functional purposes such as moisture retention and shelf stability. However, the company has since removed HFCS from most of its popular U.S. cereal brands, often replacing it with conventional sugar (sucrose) in response to consumer demand.

Cost Efficiency Compared to Traditional Sugar

The cost-effectiveness of HFCS relative to cane and beet sugar remains a major growth driver, especially for large-scale food and beverage manufacturers seeking to optimize production expenses. HFCS benefits from lower production costs due to efficient corn conversion processes, stable feedstock availability, and reduced-price volatility compared to global sugar markets influenced by climate risks and trade restrictions. Its liquid form also reduces transportation, handling, and blending costs, making it a preferred option for beverage and food processing companies requiring high-volume sweeteners. HFCS-55 and HFCS-42 offer consistent sweetness levels that minimize reformulation challenges, further lowering operational complexities. In emerging regions where sugar tariffs and supply chain fluctuations are common, HFCS provides a financially advantageous alternative. As manufacturers continue prioritizing cost optimization without compromising product taste, texture, or stability, the economic benefits of HFCS continue to reinforce its widespread adoption across multiple application segments.

- For instance, Cargill reports that its wet-milling technology allows conversion efficiencies above 92% starch-to-glucose yield, significantly reducing sweetener production costs versus refined sugar, and enabling cost-stable HFCS supply for beverage manufacturers.

Functional Advantages in Food Formulations

High Fructose Corn Syrup is widely adopted due to its multifunctional benefits beyond sweetness, providing strong formulation advantages that drive market growth. HFCS enhances moisture retention in baked goods, improves freezing-point depression in dairy desserts, prevents crystallization in confectionery, and contributes to desirable browning and texture in processed foods. HFCS-42 is particularly valued for its ability to maintain softness in bread, cakes, and pastries during storage, while HFCS-55 delivers excellent flavor enhancement and consistency in beverages. Its stability under varying temperature and pH conditions enables manufacturers to produce uniform products with extended shelf life. These functional strengths are difficult to replicate with alternative sweeteners, making HFCS a critical ingredient across numerous product categories. As food producers increasingly seek ingredients that offer performance reliability, improved sensory attributes, and cost-effectiveness, HFCS’s multifunctional formulation capabilities remain a key driver supporting its long-term demand.

Key Trends & Opportunities

Expansion into Emerging Markets and Evolving Food Consumption Patterns

A major trend shaping the High Fructose Corn Syrup market is the rapid adoption of Western-style diets in emerging economies, driving increased incorporation of sweetened beverages, packaged snacks, and ready-made foods. Regions such as Asia-Pacific, the Middle East, and Latin America show rising consumption of HFCS-based beverages and bakery products due to urbanization, rising disposable income, and the proliferation of global food chains. This shift presents substantial opportunities for manufacturers to expand capacities and establish partnerships with local beverage and food producers. Furthermore, national dietary transitions favor the growth of large-scale food retail chains, accelerating demand for economical sweeteners like HFCS-42. As consumer lifestyles evolve toward convenience-driven choices, multinational beverage and snack brands are increasing HFCS utilization to maintain consistent taste profiles across global markets. The expansion into developing regions thus creates strong long-term market opportunities for HFCS suppliers.

- For instance, Ingredion expanded its starch and sweetener operations in China through its Shandong facility, building a new, state-of-the-art facility adjacent to the existing one, which more than doubles its starch production capacity and capabilities in the country, supporting growing demand from local beverage, dairy, and processed food manufacturers.

Innovation in Formulations and Expansion into Clean-Label Applications

Emerging trends indicate rising R&D activity aimed at developing modified HFCS formulations with improved functional and nutritional attributes. Manufacturers are focusing on creating HFCS variants that support clean-label positioning, lower calorie contributions, or enhanced stability in high-acid and high-heat applications. Opportunities also arise from combining HFCS with natural flavors, fruit concentrates, or reduced-sugar recipes to align with evolving consumer expectations for healthier formulations without compromising taste. Additionally, advancements in enzymatic processing and starch conversion technologies enable the creation of higher-purity HFCS grades suitable for premium beverage and dairy applications. As food producers aim to reformulate products for better shelf life, texture, and flavor retention, HFCS’s compatibility with modern processing techniques positions it strongly within new product development pipelines. This innovation-driven transition opens opportunities for expanded application across evolving food categories.

- For instance, Novozymes, a global leader in industrial enzymes, developed advanced glucoamylase solutions such as Spirizyme® Ultra that improve starch-to-glucose conversion yields by up to 5%, directly supporting the production of higher-purity HFCS variants used in beverages and dairy formulations.

Key Challenges

Health Concerns and Growing Preference for Natural Sweeteners

A significant challenge for the High Fructose Corn Syrup market is growing public scrutiny regarding the perceived health impacts of HFCS consumption, particularly its association with obesity, diabetes, and metabolic disorders. Although regulatory bodies consider HFCS comparable to sugar in terms of safety, consumer sentiment increasingly favors natural alternatives such as honey, stevia, cane sugar, agave syrup, and fruit-based sweeteners. This shift is amplified by trends in clean-label, organic, and minimally processed foods, prompting many brands to reformulate products to remove HFCS. Beverage producers, bakery brands, and snack manufacturers face mounting pressure to market products with natural sweetening solutions to appeal to health-conscious consumers. Such demand shifts can reduce HFCS usage in certain categories, requiring producers to adapt strategies to maintain relevance in an evolving nutritional landscape.

Regulatory Pressure and Volatility in Corn Supply Chains

The HFCS market also faces regulatory and supply-chain challenges driven by government policies, tariff structures, and corn price fluctuations. Corn availability, influenced by climate variability, crop diseases, and biofuel production demand, can cause price instability that affects HFCS manufacturing margins. Additionally, trade restrictions or subsidies altering the cost structure of corn-based products may impact the competitiveness of HFCS relative to sugar or other sweeteners. Regulatory pressure surrounding ingredient labeling, dietary guidelines, and sugar-reduction policies in many countries creates further obstacles, compelling companies to re-evaluate HFCS inclusion in product portfolios. These complexities, combined with sustainability-driven initiatives across global food industries, challenge manufacturers to stabilize supply chains and comply with evolving regulatory frameworks while sustaining market growth.

Regional Analysis

North America

North America leads the High Fructose Corn Syrup market with 38% share, supported by extensive consumption of sweetened beverages, processed foods, and packaged snacks. The U.S. remains the dominant market due to its large-scale beverage production and well-established corn-processing infrastructure. High availability of feedstock, stable supply chains, and strong presence of major HFCS producers reinforce regional dominance. Demand is further driven by fast-food expansion and consistent use of HFCS-55 in carbonated soft drinks. Despite rising preference for natural sweeteners, HFCS maintains strong demand across mainstream food and beverage applications.

Europe

Europe holds 22% share of the global HFCS market, driven by bakery, confectionery, and dairy applications rather than beverages, where sugar remains more common. Eastern European countries increasingly adopt HFCS due to lower cost and growing processed food manufacturing. The lifting of sugar production quotas has influenced comparative sweetener economics, creating selective opportunities for HFCS usage. Demand is also supported by expanding convenience food consumption and rising imports of HFCS-based ingredients. However, Western Europe’s strong shift toward natural sweeteners and clean-label products presents a moderating factor for HFCS expansion in the region.

Asia-Pacific

Asia-Pacific captures 28% market share, driven by rapid urbanization, rising disposable incomes, and growing adoption of Western-style diets. China, Japan, South Korea, and India exhibit strong demand for HFCS across beverages, processed snacks, confectionery, and dairy products. Local production capacities continue to expand, especially in China, supporting cost efficiencies and broader availability. The region’s thriving soft drink sector fuels HFCS-55 consumption, while HFCS-42 is widely used in bakery and packaged food categories. APAC’s young demographic, fast-growing retail sector, and increasing penetration of global food brands collectively create strong long-term growth potential.

Latin America

Latin America accounts for 8% share, with Mexico, Brazil, and Argentina emerging as key consumers of HFCS in beverages and packaged foods. Mexico’s long-standing integration of HFCS in soft drinks supports steady demand, while Brazil’s expanding confectionery and bakery industries further strengthen market growth. Cost advantages over sugar and increasing adoption of HFCS-42 in sauces, snacks, and dairy products contribute to market expansion. Although health-conscious consumer behavior is rising, the region’s strong preference for sweetened beverages and convenient food products continues to support HFCS usage across major food-processing industries.

Middle East & Africa (MEA)

The Middle East & Africa region holds about 4% share, supported by growing imports of HFCS and rising adoption in bakery, confectionery, and beverage segments. GCC countries, led by Saudi Arabia and the UAE, show increasing use of sweeteners in juices, flavored drinks, and processed foods, benefiting HFCS demand. Africa’s expanding urban population and rising penetration of multinational food brands create additional opportunities for HFCS-based products. However, limited local corn processing and dependence on imports keep costs higher than in other regions. Gradual shift toward packaged food consumption continues to support market potential.

Market Segmentations

By Product Type

By Application

- Beverages (Soft Drinks, Fruit Drinks, Juices)

- Bakery and Confectionery

- Dairy Products

- Snacks and Processed Foods

- Sauces and Condiments

By End User

- Food and Beverage Manufacturers

- Confectionery Companies

- Dairy and Snack Producers

- Bakery and Retail Chains

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The High Fructose Corn Syrup market features a diverse and well-established competitive landscape dominated by global food ingredient manufacturers with strong production capacities, extensive distribution networks, and consistent access to corn-based feedstock. Leading companies such as Archer Daniels Midland Company, Cargill Inc., Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, Global Sweeteners Holdings Limited, Baolingbao Biology Co., Ltd., COFCO Biochemical, Xiwang Group Co., Ltd., and Tereos Group play a central role in shaping market dynamics through continuous investments in processing technologies, formulation improvement, and regional expansion. Many players focus on enhancing the purity, consistency, and functional performance of HFCS grades to cater to beverage, bakery, and confectionery manufacturers. Strategic collaborations with large food and beverage companies, capacity expansions in high-demand regions, and cost optimization remain core competitive strategies. As demand for affordable sweeteners grows in emerging markets, leading producers intensify efforts to strengthen market penetration while adapting to evolving regulatory and consumer trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roquette Frères

- Ingredion Incorporated

- Global Sweeteners Holdings Limited

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Baolingbao Biology Co., Ltd.

- COFCO Biochemical

- Xiwang Group Co., Ltd.

- Tereos Group

Recent Developments

- In September 2025, Tyson Foods, Inc. disclosed that it will eliminate HFCS (among other additives) from all its branded U.S. products by the end of 2025.

- In July 2025, The Coca‑Cola Company announced the launch of a U.S. version of its flagship soda sweetened with cane sugar (rather than HFCS).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for sweetened beverages and processed foods continues to rise globally.

- HFCS-55 will remain the preferred sweetener for soft drink manufacturers due to its sweetness profile and formulation efficiency.

- Emerging markets in Asia-Pacific and Latin America will drive significant consumption growth over the next decade.

- Food manufacturers will increasingly adopt HFCS for cost optimization and stable supply advantages over traditional sugar.

- Advancements in corn refining technologies will enhance product purity and expand application possibilities.

- The bakery, confectionery, and dairy sectors will continue to integrate HFCS-42 for improved texture and shelf-life benefits.

- Market players will intensify capacity expansions to support rising regional demand and reduce import reliance.

- Health-awareness trends may encourage development of modified HFCS formulations with improved nutritional attributes.

- Regulatory changes in sugar and sweetener policies will influence production strategies and pricing dynamics.

- Global supply chain optimization will remain a priority to ensure consistent availability and competitive cost structures.