Market Overview

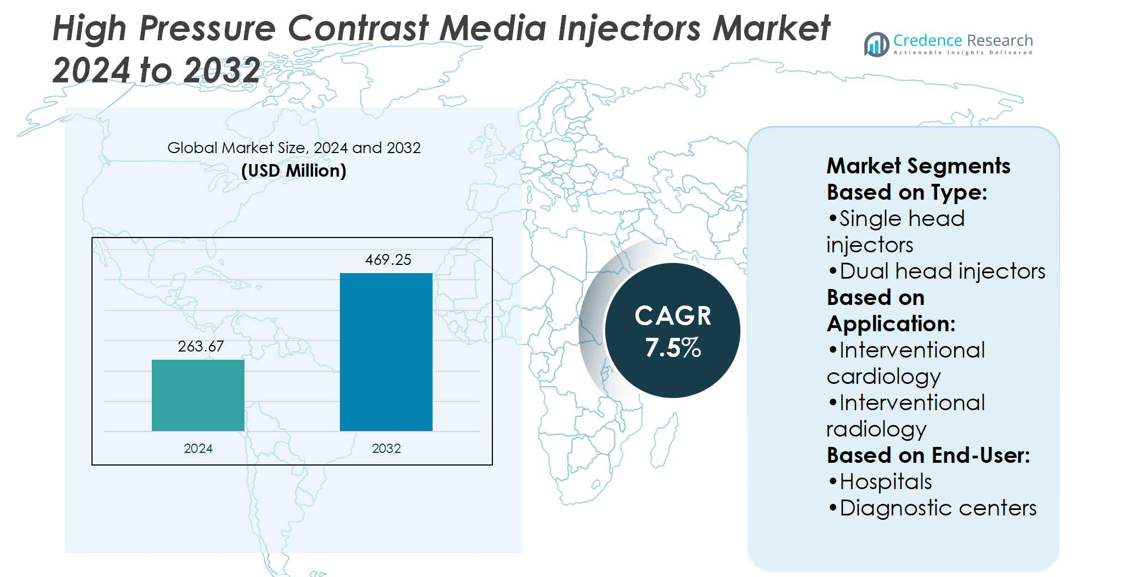

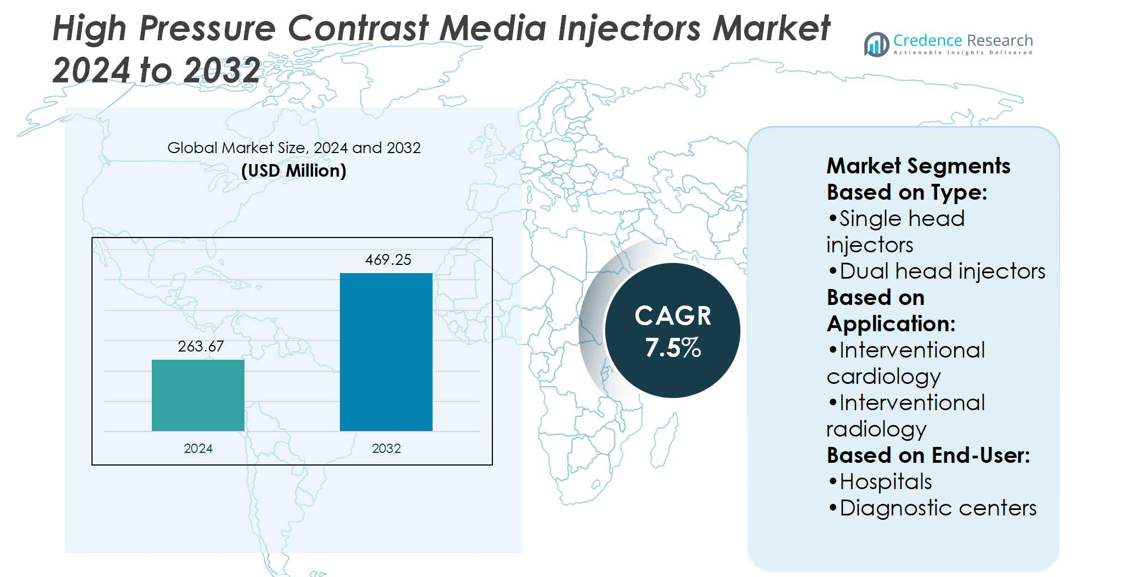

High Pressure Contrast Media Injectors Market size was valued at USD 263.67 million in 2024 and is anticipated to reach USD 469.25 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Pressure Contrast Media Injectors Market Size 2024 |

USD 263.67 million |

| High Pressure Contrast Media Injectors Market, CAGR |

7.5% |

| High Pressure Contrast Media Injectors Market Size 2032 |

USD 469.25 million |

The High Pressure Contrast Media Injectors Market grows through rising demand for advanced diagnostic imaging, driven by increasing cases of cardiovascular, oncological, and neurological diseases. Hospitals and diagnostic centers adopt dual-head and syringeless systems to enhance efficiency, reduce preparation time, and improve patient safety. The market benefits from technological innovations such as AI-enabled injectors, digital connectivity, and real-time monitoring that support accuracy and workflow integration. Growing healthcare investments in emerging economies and rising preference for minimally invasive diagnostics further accelerate adoption. Trends highlight the expansion of hybrid imaging applications, strengthening the role of advanced injector systems in modern healthcare.

The High Pressure Contrast Media Injectors Market shows strong geographical presence, with North America leading due to advanced healthcare infrastructure, followed by Europe with robust imaging adoption and Asia Pacific as the fastest-growing region supported by expanding healthcare investments. Latin America and the Middle East & Africa record steady but smaller shares, driven by rising private healthcare demand. Key players include Bracco Group, Medtron AG, Guerbet Group, Bayer HealthCare LLC, GE Healthcare, ulrich GmbH & Co. KG, and NemotoKyorindo Co., Ltd.

Market Insights

- The High Pressure Contrast Media Injectors Market was valued at USD 263.67 million in 2024 and is expected to reach USD 469.25 million by 2032, growing at a CAGR of 7.5%.

- Rising prevalence of cardiovascular, neurological, and oncological diseases drives strong demand for advanced diagnostic imaging.

- Dual-head and syringeless injectors gain traction for improving efficiency, reducing preparation time, and enhancing patient safety.

- AI-enabled injectors, digital connectivity, and real-time monitoring emerge as key trends shaping technological advancement.

- High equipment costs and strict regulatory requirements remain major restraints limiting adoption in cost-sensitive regions.

- North America leads the market, followed by Europe, while Asia Pacific is the fastest-growing region with expanding healthcare investments.

- Competition remains strong with leading players focusing on innovation, product integration, and global expansion to sustain market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Imaging Procedures Driving Market Expansion

The High Pressure Contrast Media Injectors Market grows with rising adoption of diagnostic imaging across hospitals and specialty centers. Increasing cases of cardiovascular, neurological, and oncological conditions fuel the use of CT and MRI scans. Growing awareness about early diagnosis and preventive healthcare supports stronger demand. Healthcare facilities adopt these injectors to ensure precise dosing and consistent imaging outcomes. It benefits from technological progress in multi-patient injectors that enhance efficiency and patient throughput. Rising patient pool and need for advanced imaging services provide a strong foundation for market expansion.

- For instance, Shenzhen Seacrown Electromechanical, which offers contrast injectors under the Zenith brand, has dual-head models available. The specifications for Zenith dual-head injectors, including the Zenith-C22 and Zenith-C60, show a programmable flow rate of 0.1 to 10.0 mL/sec, with increments of 0.1 mL/sec.

Technological Advancements in Injector Systems Supporting Greater Accuracy

Ongoing innovations in injector systems support accuracy and safety, strengthening adoption in clinical settings. Automated injectors with advanced sensors minimize the risk of extravasation and improve patient safety. It leverages smart protocols that allow personalized injection settings for specific diagnostic needs. Integration with imaging modalities enhances workflow and provides consistent results for radiologists. Dual-head and multi-head injectors offer flexibility for diverse procedures, improving utilization rates. The focus on delivering real-time monitoring and digital connectivity positions these systems as essential tools.

- For instance, ulrich GmbH & Co. KG’s CT motion injector features a syringeless roll-pump system that draws contrast media and saline from bulk containers. The system is capable of administering up to 400 mL of contrast media to a single patient in one session, as confirmed by product information.

Expanding Healthcare Infrastructure Across Emerging Economies Fueling Adoption

The High Pressure Contrast Media Injectors Market benefits from significant investments in healthcare infrastructure in emerging regions. Governments and private players invest in diagnostic imaging facilities to improve care delivery. Rising medical tourism in countries such as India, Thailand, and Mexico boosts demand for advanced imaging. It supports increased installation of modern injector systems in hospitals and diagnostic centers. Growing insurance coverage and higher healthcare expenditure enable access to these technologies. The push toward advanced diagnostic services in developing economies strengthens global adoption.

Regulatory Support and Rising Preference for Minimally Invasive Diagnostics Accelerating Growth

Favorable regulatory frameworks for diagnostic imaging devices promote faster adoption across healthcare systems. Growing preference for minimally invasive diagnostics drives higher use of contrast-enhanced imaging procedures. It benefits from clear approval pathways for advanced injector technologies. Rising patient safety standards encourage the use of precise injection systems over manual alternatives. Strategic collaborations between manufacturers and healthcare providers expand market reach. Growing demand for accurate imaging in complex procedures ensures strong long-term market growth.

Market Trends

Integration of Artificial Intelligence and Digital Connectivity Shaping Injector Innovation

The High Pressure Contrast Media Injectors Market advances with integration of AI and digital technologies. Smart injectors offer real-time monitoring, predictive maintenance, and automated error detection. It enables clinicians to customize injection protocols for patient-specific requirements. Digital connectivity allows seamless data sharing between imaging systems and hospital networks. Growing adoption of cloud-based solutions supports remote monitoring and operational efficiency. This trend enhances clinical outcomes while improving productivity in high-volume imaging centers.

- For instance, The software’s digital interface records injection data, such as volumes and flow rates, from connected injectors like the OptiVantage DH, which can track injection volumes up to 200 mL per syringe and flow rates up to 10 mL per second.

Rising Adoption of Multi-Head and Dual-Head Injector Systems Enhancing Efficiency

Hospitals and diagnostic centers increasingly prefer multi-head and dual-head injectors for improved workflow. These systems allow contrast media and saline injection without manual intervention. It reduces preparation time and supports higher patient throughput. Flexible operation ensures suitability across a range of imaging modalities. The trend strengthens utilization rates and improves patient safety. Growing need for time-efficient procedures drives further demand for advanced injector configurations.

- For instance, Apollo RT Co. Ltd. developed the APO 200 dual-head injector system with independent syringe control. It uses syringes with a capacity of up to 200 mL each and offers variable injection flow rates with a pressure limit of 350 PSI.

Growing Demand for Patient-Centric and Safety-Focused Features Driving Development

Manufacturers prioritize patient safety with innovations that reduce risk of extravasation and dosing errors. Advanced systems feature sensors, automated shut-offs, and pressure control mechanisms. It supports improved patient experience by minimizing discomfort during procedures. The trend reflects a broader shift toward personalized healthcare solutions. Hospitals and imaging centers adopt injectors with user-friendly interfaces to streamline operator training. Demand for safety-focused solutions continues to shape new product launches.

Expanding Role of Contrast Injectors in Hybrid Imaging and Complex Diagnostics

The High Pressure Contrast Media Injectors Market adapts to the rising use of hybrid imaging technologies. PET/CT and PET/MRI applications require precise injection control for accurate results. It supports complex diagnostics in oncology, cardiology, and neurology. Growing clinical trials and advanced research further expand the scope of injectors. The trend underscores the role of injectors in improving diagnostic accuracy in high-value procedures. Increasing adoption of hybrid imaging strengthens long-term market relevance.

Market Challenges Analysis

High Equipment Costs and Limited Accessibility Restricting Wider Adoption

The High Pressure Contrast Media Injectors Market faces challenges due to high equipment and maintenance costs. Advanced injector systems require significant investment, which limits adoption in small and mid-sized healthcare facilities. It creates barriers for diagnostic centers in cost-sensitive regions. Service contracts, consumables, and regular upgrades increase operational expenses. Budget constraints among hospitals and clinics in emerging economies slow down replacement cycles. Limited accessibility in rural areas restricts patient reach and creates disparities in diagnostic imaging availability.

Regulatory Barriers and Risk of Adverse Patient Outcomes Creating Constraints

Strict regulatory frameworks create delays in product approvals and limit faster market penetration. The need for compliance with multiple international standards increases development costs for manufacturers. It also raises challenges in navigating complex approval processes across different regions. Safety concerns, such as risks of extravasation and contrast-induced side effects, demand continuous innovation. Hospitals and diagnostic centers remain cautious in adoption due to liability risks. Operational errors from untrained staff further highlight the importance of skilled usage and training programs.

Market Opportunities

Expanding Use of Advanced Imaging Modalities Creating Growth Prospects

The High Pressure Contrast Media Injectors Market records strong opportunities with the rising use of CT, MRI, and hybrid imaging technologies. Growing demand for early and accurate diagnosis of chronic diseases drives adoption. It supports expansion across oncology, cardiology, and neurology, where precise imaging is critical. Hospitals and diagnostic centers invest in advanced injectors to handle higher patient volumes. The trend toward preventive healthcare and screening programs further accelerates demand. Increasing government and private investments in diagnostic infrastructure create new market potential.

Technological Innovation and Emerging Markets Offering Strategic Opportunities

Continuous innovation in injector design provides opportunities to meet evolving clinical requirements. Automated injectors with AI-enabled features, smart sensors, and digital integration gain rapid acceptance. It enhances workflow efficiency and patient safety, positioning these systems as preferred options. Emerging markets in Asia Pacific, Latin America, and the Middle East present untapped potential. Rising healthcare expenditure and growing insurance coverage expand access to advanced diagnostic solutions. Collaborations between manufacturers and healthcare providers strengthen opportunities for long-term growth.

Market Segmentation Analysis:

By Type

The High Pressure Contrast Media Injectors Market divides into single head injectors, dual head injectors, and syringeless injectors. Single head injectors remain widely used in smaller facilities due to cost efficiency and ease of use. Dual head injectors gain strong adoption for their ability to deliver contrast media and saline in quick succession, ensuring precision in complex imaging. It supports time efficiency and reduces patient discomfort, making these systems popular in advanced hospitals. Syringeless injectors emerge as a key growth area due to their focus on minimizing preparation time and improving safety. Their disposable design reduces contamination risk, driving acceptance in high-volume imaging centers.

- For instance, Medtron AG’s Accutron® CT-D is a dual-syringe injector that delivers contrast and saline at flow rates up to 10 mL per second with syringe volumes of 200 mL each.

By Application

Applications span interventional cardiology, interventional radiology, endovascular surgery, and interventional neuroradiology. Interventional cardiology leads due to increasing prevalence of cardiovascular diseases and higher demand for precise contrast delivery in angiographic procedures. Interventional radiology also holds significant share, supported by rising use of minimally invasive imaging techniques across cancer and trauma cases. It benefits from growing use of injectors in endovascular surgery, where accuracy in vascular imaging is critical. Interventional neuroradiology expands with increasing focus on stroke diagnosis and complex neurological interventions. Across applications, the role of high-pressure injectors in improving diagnostic accuracy drives adoption.

- For instance, Bayer HealthCare LLC’s MEDRAD® Avanta fluid management injector delivers contrast at fixed flow rates up to 45 mL per second or variable flow rates up to 10 mL per second, with a pressure limit of 1200 psi, supporting precision in complex interventional cardiology and radiology procedures while ensuring patient safety and consistency.

By End-User

End-users include hospitals and diagnostic centers. Hospitals dominate due to large patient volumes, advanced imaging infrastructure, and demand for integrated injector systems. It supports rapid adoption of dual and syringeless injectors, especially in tertiary care and teaching hospitals. Diagnostic centers gain traction with rising demand for outpatient imaging services and preventive healthcare screenings. Independent centers prefer cost-efficient solutions but gradually shift toward advanced injectors to remain competitive. Growth in diagnostic chains across emerging economies further expands opportunities. Together, both end-user groups play a vital role in sustaining demand and advancing technological adoption.

Segments:

Based on Type:

- Single head injectors

- Dual head injectors

Based on Application:

- Interventional cardiology

- Interventional radiology

Based on End-User:

- Hospitals

- Diagnostic centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the High Pressure Contrast Media Injectors Market with nearly 38% share. The region benefits from advanced healthcare infrastructure, high insurance coverage, and frequent use of diagnostic imaging. Strong demand comes from cardiovascular, cancer, and neurological cases that require contrast-enhanced scans. The United States dominates adoption, while Canada shows steady growth with investments in hospital facilities. It remains a hub for early adoption of dual and syringeless injectors. Ongoing product launches and regulatory support strengthen North America’s leading position.

Europe

Europe accounts for about 26% share of the market, ranking second globally. The region benefits from robust healthcare systems and high focus on non-invasive imaging. Strong demand is supported by aging populations and chronic disease prevalence. Countries such as Germany, France, and the UK dominate adoption, with Eastern Europe growing steadily. It also benefits from strict safety regulations that encourage hospitals to upgrade injector systems. The focus on advanced radiology and hybrid imaging supports Europe’s significant role in global demand.

Asia Pacific

Asia Pacific holds nearly 25% share and represents the fastest-growing region. Rising healthcare spending, growing diagnostic centers, and medical tourism drive adoption. Countries like China, India, Japan, and South Korea lead in modernization of imaging services. It shows strong demand for dual-head and syringeless injectors to meet patient volumes. Expanding insurance coverage and government programs for healthcare expansion also boost adoption. Asia Pacific is expected to capture a larger share in the coming years.

Latin America

Latin America captures around 6% share, driven by Brazil, Mexico, and Argentina. Growth is moderate due to uneven access to advanced imaging technologies. Private hospitals lead adoption, while public systems face cost challenges. It shows demand for injectors in cardiology and radiology but at slower pace compared to larger regions. Investment in private healthcare networks helps the region gain traction. Latin America remains a developing but important opportunity area.

Middle East & Africa

Middle East & Africa contribute about 5% share of the market. Wealthier Gulf nations such as Saudi Arabia and UAE lead adoption with strong investments in diagnostic imaging. Africa lags due to infrastructure gaps but shows growth in urban centers. It relies heavily on imported equipment and training programs. Growing prevalence of chronic diseases fuels gradual adoption of advanced injector systems. It is expected to post steady growth as healthcare access improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- VIVID IMAGING

- GE Healthcare

- ulrich GmbH & Co. KG

- Guerbet Group

- Apollo RT Co. Ltd.

- Medtron AG

- Bayer HealthCare LLC

- Bracco Group

- Sino Medical-Device Technology Co.

- NemotoKyorindo Co., Ltd.

Competitive Analysis

The High Pressure Contrast Media Injectors Market players include Bracco Group, Medtron AG, Guerbet Group, Bayer HealthCare LLC, NemotoKyorindo Co., Ltd., ulrich GmbH & Co. KG, GE Healthcare, Apollo RT Co. Ltd., Sino Medical-Device Technology Co., and VIVID IMAGING. The High Pressure Contrast Media Injectors Market is highly competitive, driven by continuous technological advancement and strong demand from healthcare providers. Companies focus on developing dual-head and syringeless injector systems that enhance workflow efficiency, reduce preparation time, and improve patient safety. Competition is also shaped by investments in digital connectivity, enabling real-time monitoring and integration with imaging platforms. Strategic partnerships with hospitals, diagnostic centers, and distributors expand global reach and support long-term market presence. Firms emphasize cost-effective solutions to gain traction in emerging economies while maintaining strong compliance with regulatory standards. Continuous innovation, safety-focused designs, and localized service remain critical to sustaining competitive advantage in this dynamic market.

Recent Developments

- In April 2025, Bayer and Siemens Healthineers introduced MEDRAD Centargo, an automated contrast injection system designed to reduce turnaround times between scans and minimize manual tasks for technologists. This innovation allows medical staff to focus more on patient care, enhancing efficiency and improving overall workflow in diagnostic imaging procedures.

- In March 2025, Mazda is developing a new Skyactiv-Z combustion engine with both internal combustion and hybrid versions – to be introduced by 2027 and will be seen first in the next-generation CX-5. The engine is under development for the future but will comply with the coming Euro 7 emissions regulations and be more efficient while offering improved driving dynamics but with fewer variations in models and control software.

- In December 2024, Bracco Diagnostics Inc., the U.S. arm of Bracco Imaging S.p.A., partnered with German medical device maker ulrich GmbH & Co. KG to announce FDA clearance of the Bracco Max 3. This rapid exchange, syringeless injector is designed for magnetic resonance imaging (MRI) procedures, enhancing efficiency and ease of contrast delivery in diagnostic imaging.

- In January 2024, Standard Motor Products, Inc. (SMP) announced a significant expansion of its gasoline fuel injectors program, introducing over 2,100 new part numbers. The update encompasses a broad spectrum of fuel injectors types, including Throttle Body Injectors (TBI), Multiport Fuel Injectors (MFI), and Gasoline Direct Injectors (GDI) systems demonstrating SMP’s strategic commitment to supporting both legacy and modern vehicle platforms.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for advanced diagnostic imaging procedures.

- Dual-head and syringeless injectors will see stronger adoption for efficiency and safety.

- Digital integration with imaging systems will become a standard feature in new injectors.

- AI-enabled injectors will support personalized protocols and improve workflow accuracy.

- Emerging economies will drive growth through expanding healthcare infrastructure and insurance coverage.

- Preventive healthcare programs will increase demand for contrast-enhanced imaging solutions.

- Hybrid imaging technologies such as PET/CT and PET/MRI will boost injector utilization.

- Safety-focused features like automated shut-offs and pressure monitoring will shape innovation.

- Collaborations between manufacturers and healthcare providers will strengthen market penetration.

- Continuous regulatory support will encourage faster approvals and global adoption of advanced systems.