Market Overview

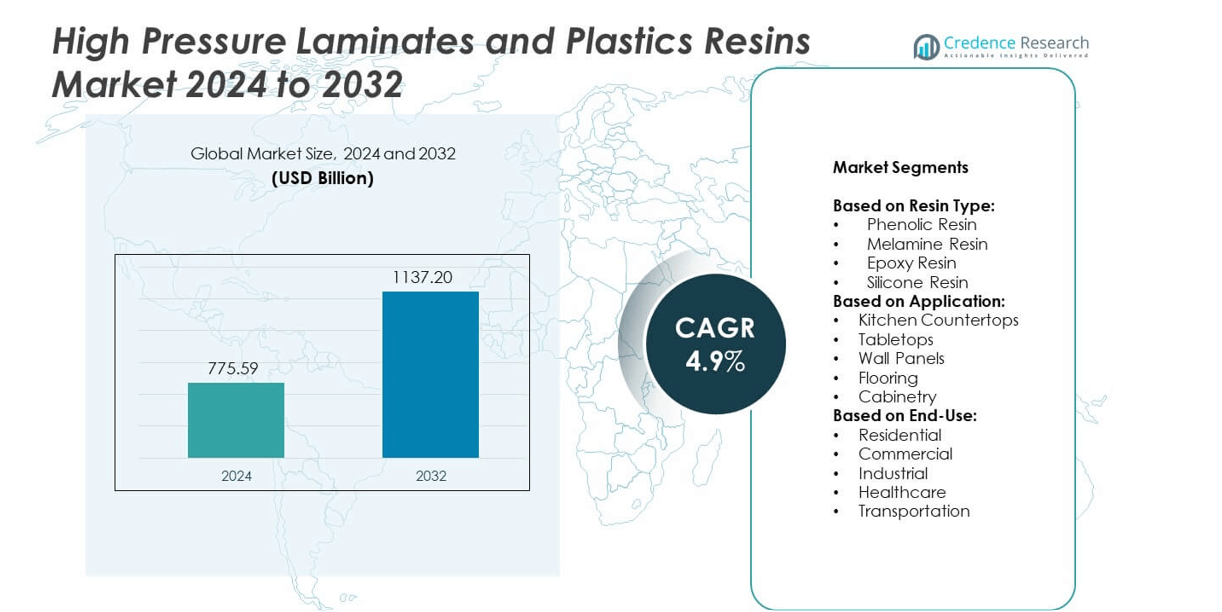

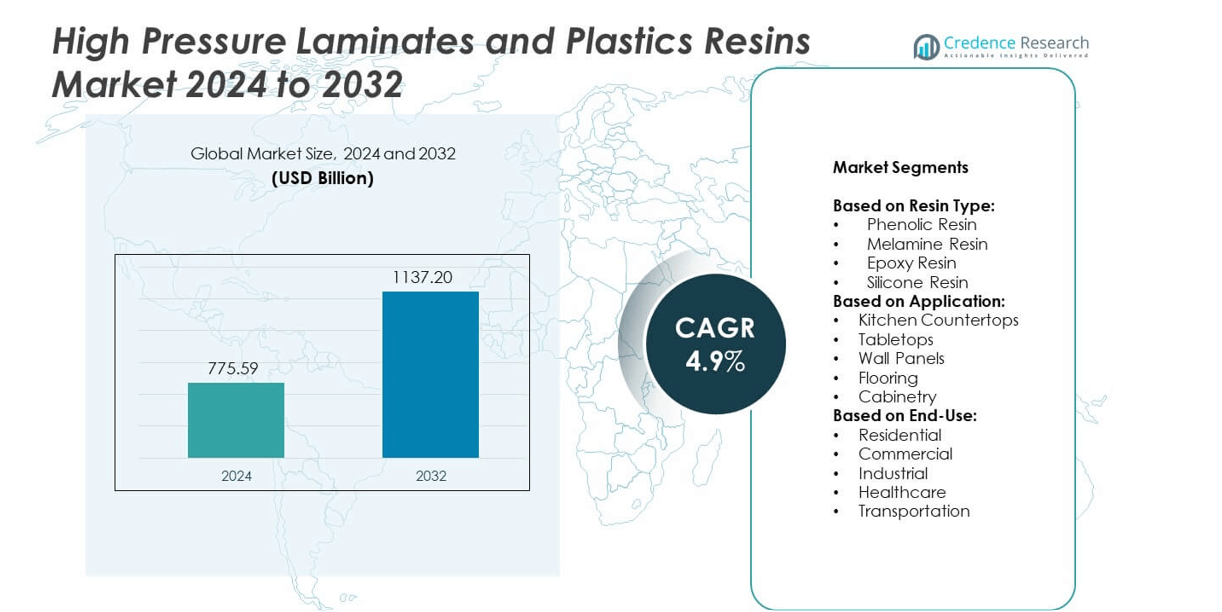

The High Pressure Laminates and Plastics Resins Market size was valued at USD 775.59 billion in 2024 and is anticipated to reach USD 1137.20 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Pressure Laminates and Plastics Resins Market Size 2024 |

USD 775.59 billion |

| High Pressure Laminates and Plastics Resins Market, CAGR |

4.9% |

| High Pressure Laminates and Plastics Resins Market Size 2032 |

USD 1137.20 billion |

The High Pressure Laminates and Plastics Resins market grows with rising demand in construction, furniture, and automotive industries. Increasing preference for durable, lightweight, and aesthetic materials supports widespread adoption across residential and commercial applications. Eco-friendly resins and recyclable laminates gain traction under stricter environmental regulations and consumer awareness of sustainability. Advances in digital printing and surface technologies enhance product customization, boosting market appeal. It continues to expand with urbanization, infrastructure investments, and innovation in high-performance materials meeting diverse industrial needs

North America and Europe lead the High Pressure Laminates and Plastics Resins market with strong adoption in construction, interiors, and commercial spaces, supported by technological innovation and sustainability regulations. Asia Pacific shows rapid expansion due to urbanization, rising incomes, and large-scale infrastructure projects across China and India. Latin America and the Middle East & Africa demonstrate steady growth from construction and hospitality investments. Key players driving the market include Kronospan, Trespa International, Egger, and Wilsonart, each focusing on innovation and regional expansion.

Market Insights

- The High Pressure Laminates and Plastics Resins market was valued at USD 775.59 billion in 2024 and is projected to reach USD 1137.20 billion by 2032, growing at a CAGR of 4.9%.

- Strong demand from construction, furniture, and interior design industries fuels market expansion, supported by consumer preference for durable and aesthetic materials.

- Growing trend toward decorative laminates with advanced textures, finishes, and digital printing technologies enhances product appeal across residential and commercial sectors.

- Competition intensifies among global players focusing on innovation, eco-friendly materials, and regional expansions to strengthen market presence.

- Volatility in raw material prices, dependence on petroleum-based inputs, and strict environmental regulations act as restraints for manufacturers.

- North America and Europe dominate through advanced technologies and sustainable adoption, while Asia Pacific shows rapid growth due to infrastructure projects and urbanization.

- Latin America and the Middle East & Africa demonstrate steady demand, with rising investments in residential, commercial, and hospitality construction supporting future growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Dmand from Construction and Interior Applications

The High Pressure Laminates and Plastics Resins market benefits strongly from expanding construction and interior projects. Increasing urbanization drives demand for durable, cost-effective, and aesthetic building materials. These laminates provide resistance to scratches, stains, and moisture, making them suitable for countertops, flooring, and wall panels. Plastic resins support a wide variety of architectural applications due to their strength and flexibility. It supports large-scale adoption in both residential and commercial projects. Growth in modular construction techniques further strengthens demand for lightweight yet durable materials.

- For instance, Greenlam Industries commenced commercial production of a greenfield laminates manufacturing facility at Naidupeta, Andhra Pradesh, on September 29, 2023. This facility, which is a project of the company’s subsidiary, Greenlam South, has an annual installed capacity of 3.5 million sheets and boards. This expansion, along with other projects, increased the company’s total consolidated capacity to 24.52 million sheets annually.

Expanding Role of Consumer Goods and Automotive Industries

The High Pressure Laminates and Plastics Resins market gains traction from growing consumer goods and automotive industries. Demand rises for materials that combine durability, lightweight properties, and visual appeal. Automakers increasingly use laminates for interior trims, dashboards, and panels due to their design flexibility. Plastic resins enable vehicle manufacturers to reduce weight, improve efficiency, and meet safety standards. It provides manufacturers with cost-effective options while ensuring compliance with performance requirements. Consumer product companies also integrate laminates into furniture and appliances to enhance product longevity.

- For instance, The Hyundai IONIQ 6, launched globally in 2022, is built on the Electric-Global Modular Platform (E-GMP) and features a streamlined design with a low drag coefficient of 0.21, contributing to its energy efficiency.

Sustainability and Adoption of Eco-Friendly Alternatives

The High Pressure Laminates and Plastics Resins market evolves with greater emphasis on sustainability. Companies invest in bio-based resins and low-emission laminates to meet regulatory standards. Demand grows for recyclable and environmentally responsible materials in furniture, flooring, and packaging applications. It drives innovation in greener production methods while reducing reliance on petroleum-based inputs. Governments introduce stricter environmental guidelines, encouraging industries to shift towards eco-friendly solutions. Rising consumer preference for sustainable products supports steady adoption across diverse sectors.

Technological Advancements and Product Customization

The High Pressure Laminates and Plastics Resins market expands through innovations in design, texture, and manufacturing technologies. Advanced digital printing enables laminates with realistic patterns and enhanced aesthetic appeal. Plastic resins benefit from improved processing methods that deliver greater strength and durability. It allows producers to create materials tailored to end-user specifications. Customization in colors, finishes, and performance features improves competitiveness among manufacturers. Continuous R&D investments create opportunities for high-value applications across architecture, automotive, and industrial sectors.

Market Trends

Growing Use of Decorative and Aesthetic Solutions Across Industries

The High Pressure Laminates and Plastics Resins market observes a shift toward decorative and aesthetic solutions. Rising consumer preference for visually appealing surfaces drives demand for innovative designs. Manufacturers introduce laminates with varied textures, finishes, and color patterns to meet this need. Plastic resins are increasingly applied in stylish consumer goods and durable furniture. It enables manufacturers to balance aesthetics with functionality. Growth in interior design and lifestyle-driven purchases further accelerates the use of decorative laminates.

- For instance, Fundermax introduced its updated “Exterior 2.3” collection for Max Compact Exterior panels at the BAU 2023 trade show, which featured new decors and surface finishes. Fundermax’s Max Compact panels have consistently been manufactured with a core of approximately 65% natural fibers, derived mainly from wood by-products, ensuring a high renewable content.

Integration of Advanced Digital Printing and Surface Technologies

The High Pressure Laminates and Plastics Resins market benefits from advances in digital printing and surface technologies. Manufacturers adopt printing methods that replicate natural materials such as wood, stone, or marble with precision. High-resolution printing enhances realism and creates stronger market acceptance in premium interiors. Surface technology improvements increase durability against scratches, wear, and chemicals. It enhances product lifespan while maintaining aesthetic quality. This trend supports a wider adoption in commercial and residential applications requiring long-lasting finishes.

- For instance, Wilsonart Traceless Laminate, which was launched before 2023, features anti-fingerprint technology. The product exhibits heat resistance, but manufacturer documentation specifies that it should not be subjected to temperatures higher than 275°F (135°C) for substantial periods. An extension of the Traceless line, including Solicor and Compact versions, was introduced in 2023

Increasing Preference for Lightweight and Functional Materials

The High Pressure Laminates and Plastics Resins market grows with rising demand for lightweight yet functional materials. Automotive, aerospace, and packaging sectors drive adoption to reduce weight without compromising performance. Plastic resins enable significant fuel efficiency improvements in transportation industries. Laminates find use in modular furniture and mobile structures due to ease of handling. It offers durability while maintaining cost-effectiveness. This preference for lightweight materials reflects a broader trend toward efficiency and sustainability across industries.

Emphasis on Sustainable and Circular Economy Practices

The High Pressure Laminates and Plastics Resins market evolves under pressure for sustainable practices. Manufacturers focus on recyclable laminates and bio-based resin formulations to reduce environmental impact. Stricter government regulations reinforce this shift toward eco-conscious production. Consumer awareness of environmental impact increases demand for green-certified products. It encourages industries to expand recycling capabilities and use renewable raw materials. Companies embracing sustainability gain stronger positioning in global markets emphasizing circular economy principles.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Constraints

The High Pressure Laminates and Plastics Resins market faces challenges from fluctuating raw material costs and supply disruptions. Dependence on petroleum-based inputs exposes manufacturers to oil price volatility, which directly impacts production expenses. Geopolitical tensions and trade restrictions further limit the stable availability of essential raw materials. It pressures companies to balance cost efficiency with consistent product supply. Delays in logistics and transportation add complexity for manufacturers operating across global markets. These issues restrict long-term planning and increase operational risks for industry participants.

Environmental Regulations and Sustainability Pressures

The High Pressure Laminates and Plastics Resins market must address strict environmental standards and sustainability expectations. Rising concerns about emissions, plastic waste, and recyclability create compliance burdens for manufacturers. Companies face higher costs to adopt eco-friendly production methods and invest in recycling infrastructure. It challenges smaller players with limited resources to meet regulatory demands. Growing consumer demand for sustainable products forces a shift toward bio-based alternatives, which remain expensive and less scalable. Regulatory and market pressures together create barriers for consistent profitability in the sector.

Market Opportunities

Expansion Across Emerging Economies and Infrastructure Growth

The High Pressure Laminates and Plastics Resins market has strong opportunities in emerging economies experiencing rapid urbanization and infrastructure growth. Rising investments in residential, commercial, and industrial construction create demand for durable, versatile, and cost-effective materials. Expanding middle-class populations increase consumption of furniture, consumer goods, and interior décor, supporting higher laminate adoption. Plastic resins play a vital role in packaging and automotive industries, both of which are growing in developing regions. It positions manufacturers to expand market presence through local production facilities. Strategic partnerships with regional players further enhance access to fast-developing markets.

Innovation in Eco-Friendly Materials and Advanced Applications

The High Pressure Laminates and Plastics Resins market can capitalize on innovation in sustainable and high-performance materials. Demand grows for recyclable laminates and bio-based resins aligned with green building certifications and regulatory compliance. Manufacturers developing low-emission, lightweight, and durable products strengthen their competitive edge. It also creates opportunities for advanced applications in automotive, healthcare, and aerospace sectors requiring performance-driven solutions. Growth in digital printing technologies enables customized designs for premium interior and architectural markets. Companies investing in sustainable innovation and value-added solutions stand to capture long-term opportunities.

Market Segmentation Analysis:

By Resin Type:

The High Pressure Laminates and Plastics Resins market demonstrates diverse demand across multiple categories. Phenolic resin dominates due to its high resistance to heat, chemicals, and impact, making it suitable for heavy-duty surfaces in laboratories and industrial spaces. Melamine resin secures strong adoption in decorative laminates because of its hardness and ability to deliver scratch-resistant finishes. Epoxy resin finds rising use in applications requiring superior bonding strength and chemical resistance, particularly in industrial and healthcare environments. Silicone resin, valued for its thermal stability and weather resistance, gains traction in specialized applications across transportation and high-performance construction projects. It creates opportunities for manufacturers to target both mass-market and niche demand.

- For instance, Sumitomo Bakelite is a major manufacturer of phenolic resins and high-performance plastics for various applications, including automotive, electronic, and industrial components. The company also produces materials for laminates used in circuit boards. The company’s European High-Performance Plastics subsidiary (SBHPP Europe) operates multiple facilities, including one in Genk with an 80,000-tonnes capacity. According to Belgian company filings, Sumitomo Bakelite Europe had a total turnover of €88.7 million in 2024.

By Application:

The High Pressure Laminates and Plastics Resins market sees consistent growth across kitchen countertops, tabletops, wall panels, flooring, and cabinetry. Kitchen countertops hold the largest share due to their high durability and resistance to stains, which makes them popular in both residential and commercial kitchens. Tabletop applications gain traction in hospitality and educational sectors, where long-lasting surfaces are critical. Wall panels and flooring applications expand due to increasing demand for decorative and functional interior solutions in modern buildings. Cabinetry applications also grow steadily with rising demand for stylish, functional storage solutions in homes and offices. It supports the broader adoption of laminates across multiple building segments.

- For instance, Egger operates 22 production facilities across 11 countries and sells its products to customers in over 120 countries. The company’s focus has diversified from solely laminate flooring to include a wide range of wood-based materials and timber

By End-Use:

The High Pressure Laminates and Plastics Resins market spans residential, commercial, industrial, healthcare, and transportation sectors. Residential applications dominate through widespread demand for furniture, flooring, and interior décor. Commercial spaces such as offices, retail stores, and hospitality centers integrate laminates and resins for durability and design flexibility. Industrial applications require high-performance laminates with chemical and impact resistance, driving demand for phenolic and epoxy resins. Healthcare facilities adopt these materials for hygienic and easy-to-maintain surfaces in laboratories and patient areas. Transportation end-use grows with laminates used in vehicle interiors to reduce weight and improve durability. It reflects the versatility of these materials across industries seeking both performance and aesthetics.

Segments:

Based on Resin Type:

- Phenolic Resin

- Melamine Resin

- Epoxy Resin

- Silicone Resin

Based on Application:

- Kitchen Countertops

- Tabletops

- Wall Panels

- Flooring

- Cabinetry

Based on End-Use:

- Residential

- Commercial

- Industrial

- Healthcare

- Transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the High Pressure Laminates and Plastics Resins market with a market share of 32%. Strong demand arises from the construction, residential, and commercial interior sectors. Kitchen countertops, wall panels, and flooring represent core applications, supported by high renovation spending in the United States and Canada. The region benefits from advanced technological infrastructure, which supports the production of durable and innovative laminates with superior finishes. Growth in sustainable construction practices drives adoption of eco-friendly resin-based laminates that meet stringent green building standards. Healthcare facilities across the region also invest in hygienic laminates with anti-bacterial properties to meet safety requirements. It maintains steady expansion through well-established supply chains, major global players, and consistent innovation in digital printing technologies tailored to consumer preferences.

Europe

Europe secures a market share of 27%, driven by strong focus on sustainability and compliance with environmental regulations. The construction sector emphasizes eco-friendly and recyclable materials, creating high demand for bio-based resins and low-emission laminates. Countries such as Germany, France, Italy, and the United Kingdom showcase consistent adoption of laminates in residential interiors, commercial offices, and retail projects. The hospitality and transportation sectors also contribute significantly, with laminates widely used in furniture and vehicle interiors. European consumers prioritize both design and sustainability, creating opportunities for manufacturers offering premium and environmentally responsible solutions. It strengthens further due to regulatory frameworks such as REACH and the EU Green Deal that mandate reduced emissions and waste. Continuous investment in R&D supports advanced surface technologies and customized design solutions, positioning Europe as a mature but innovative market.

Asia Pacific

Asia Pacific dominates growth momentum in the High Pressure Laminates and Plastics Resins market with a market share of 29%. Rapid urbanization, rising disposable income, and large-scale infrastructure projects across China, India, Japan, and Southeast Asia fuel expansion. Residential demand is especially strong, with laminates widely used in cabinetry, flooring, and countertops for urban housing developments. Commercial spaces, including offices, malls, and educational institutions, create additional opportunities through high-volume furniture requirements. Manufacturing strength in the region ensures cost-efficient production and widespread supply. It also benefits from government-backed smart city initiatives and rising adoption of eco-friendly construction practices. The strong base of regional producers coupled with global players expanding manufacturing facilities positions Asia Pacific as the fastest-growing contributor to overall market share.

Latin America

Latin America contributes a market share of 7%, supported by growing construction activities and rising demand for affordable residential solutions. Brazil and Mexico lead regional consumption, with significant adoption in kitchen countertops, flooring, and wall panels. Increasing investments in commercial infrastructure, including hotels and retail complexes, enhance opportunities for laminates and resins. The region’s growing middle-class population fuels demand for stylish and durable home interiors at competitive prices. Industrial and healthcare sectors also show gradual uptake as modern facilities adopt functional, cost-effective materials. It remains a developing market where affordability and durability drive consumer choices more than advanced customization. Regional manufacturers often collaborate with international players to expand product offerings and access new technologies.

Middle East & Africa

The Middle East & Africa region holds a market share of 5%, reflecting emerging but steady adoption trends. High demand originates from the booming construction sector in Gulf countries such as Saudi Arabia, the UAE, and Qatar. Large infrastructure investments, including commercial complexes, hotels, and airports, drive laminates and resin-based applications. Africa, though smaller in demand, shows rising interest in residential projects as urbanization increases. Healthcare investments also support growth, with laminates used for hygienic and durable wall panels and cabinetry. It continues to expand through strong construction pipelines and growing awareness of high-quality interior solutions. Partnerships between global suppliers and local distributors are strengthening regional market access and supply availability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kronospan

- Trespa International

- Resopal

- Uniboard

- Egger

- DLH Industries

- Wilsonart

- Arpa Industriale S.p.A

- Alvic

- Wilamex

- Maica Internationa

- Polyrey

- Abet Laminatin

- The Formica Corpora

- Formic a

Competitive Analysis

Competitive landscape of the High Pressure Laminates and Plastics Resins market features key players such as Kronospan, Trespa International, Resopal, Uniboard, Egger, DLH Industries, Wilsonart, Arpa Industriale S.p.A, Alvic, Wilamex, Maica Internationa, Polyrey, Abet Laminatin, The Formica Corpora, and Formic a. These companies compete by offering a wide portfolio of laminates and resins designed to meet diverse industry requirements across construction, residential, commercial, healthcare, and transportation sectors. They emphasize product durability, aesthetic value, and eco-friendly materials to strengthen customer loyalty and comply with strict regulatory standards. Market leaders continue to expand production capabilities and integrate advanced digital printing and surface technologies, enabling highly customized finishes. Innovation in bio-based and recyclable resins supports long-term sustainability goals and positions manufacturers strongly in environmentally conscious markets. Partnerships, acquisitions, and regional expansions remain core strategies to enhance global reach and build stronger distribution networks. Competitive intensity increases with growing demand for decorative laminates and lightweight resin solutions across Asia Pacific and North America. Continuous R&D investments allow these players to differentiate their products with improved performance, durability, and design flexibility. The market remains dynamic, with established players leveraging innovation, scale, and sustainability to maintain leadership and expand into emerging economies.

Recent Developments

- In 2025, Trespa International plans to participate in Future Facade 2025 held on 7 & 8 May 2025, where it will showcase sustainable, high-performance facade panels designed to store CO₂

- In 2023, Kronospan opened a new Design Centre in Bucharest, showcasing its Harmony collection and enhanced customer engagement

- In 2023, Wilsonart launched new residential HPL designs under the theme “affordable luxury”.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising construction and interior design activities worldwide.

- Demand will grow for decorative laminates with advanced textures and finishes.

- Eco-friendly resins and recyclable laminates will gain strong adoption under sustainability goals.

- Manufacturers will invest in bio-based raw materials to meet environmental regulations.

- Asia Pacific will remain the fastest-growing region due to urbanization and infrastructure growth.

- North America and Europe will continue leading innovation with premium and green-certified products.

- Digital printing technology will support greater customization in furniture and interiors.

- Automotive and transportation sectors will increase use of lightweight laminates and resins.

- Healthcare and industrial facilities will adopt laminates for durability and hygiene benefits.

- Strategic partnerships and regional expansions will shape long-term competitiveness in the market.