Market Overview

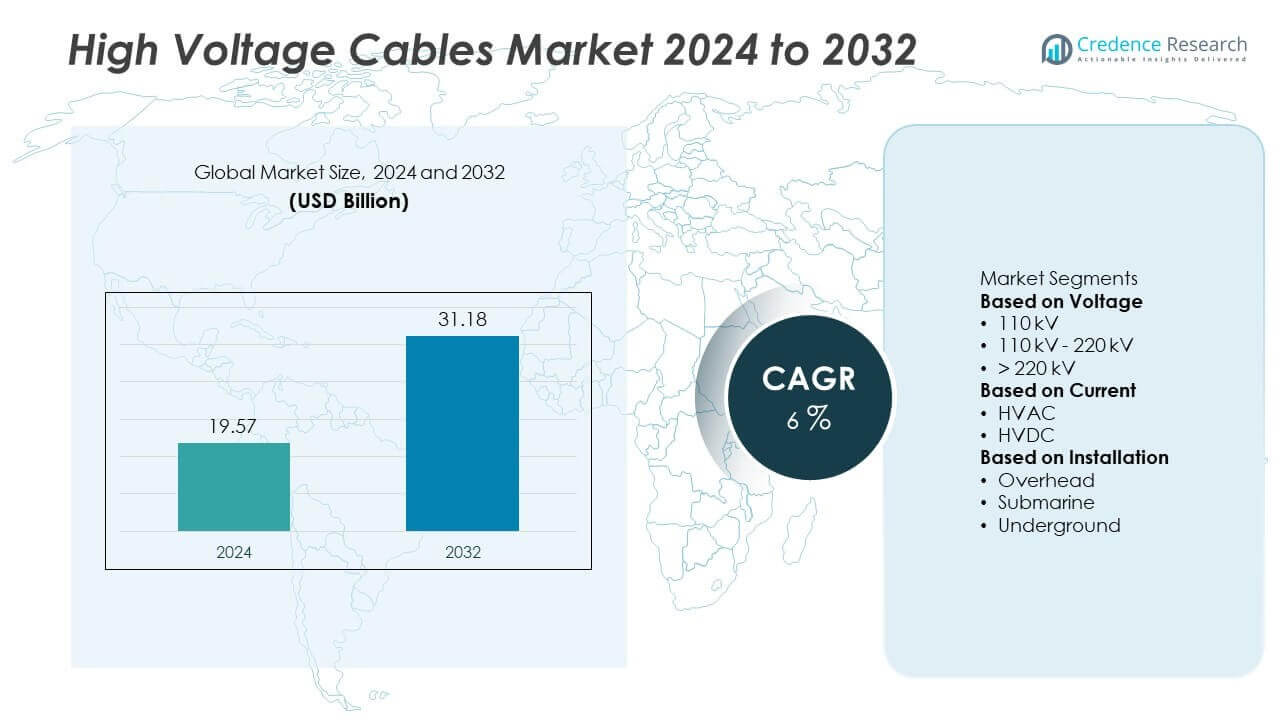

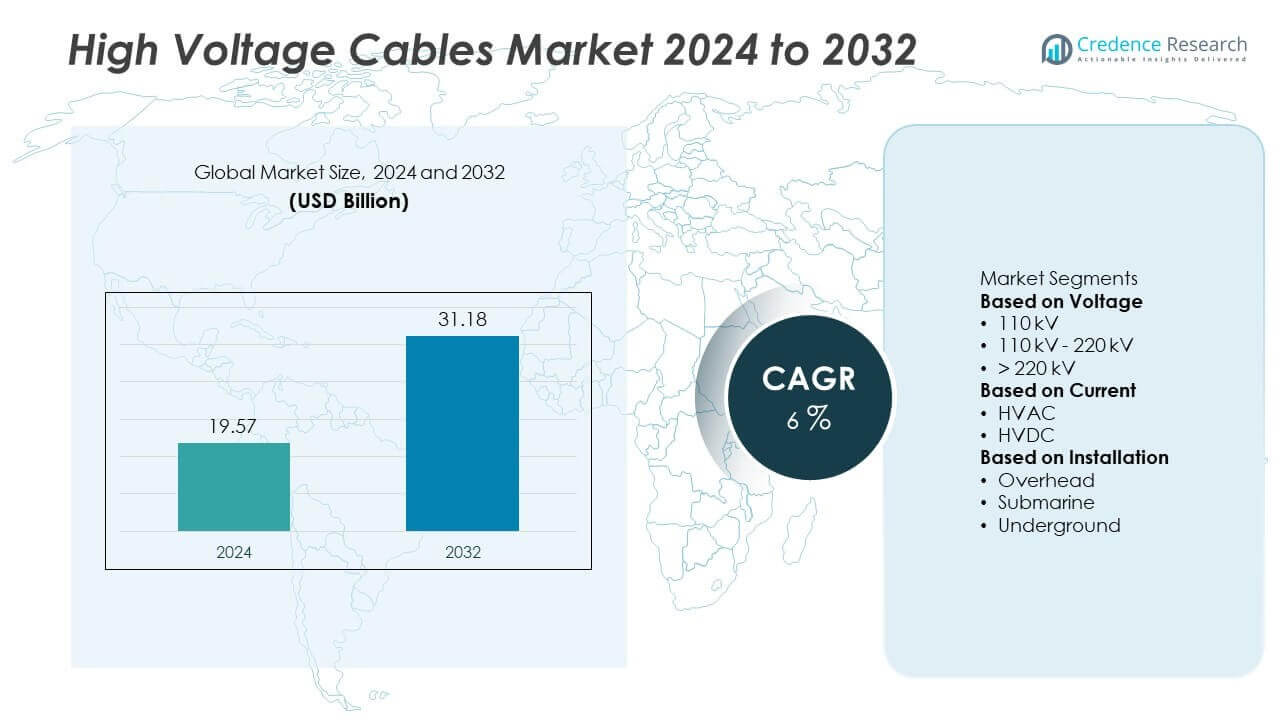

The High Voltage Cables Market was valued at USD 19.57 billion in 2024 and is projected to reach USD 31.18 billion by 2032, expanding at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Cables Market Size 2024 |

USD 19.57 Billion |

| High Voltage Cables Market, CAGR |

6% |

| High Voltage Cables Market Size 2032 |

USD 31.18 Billion |

The High Voltage Cables Market grows with rising electricity demand, renewable energy integration, and large-scale infrastructure expansion. Governments invest in advanced transmission networks to ensure reliable power delivery and reduce grid losses.

The High Voltage Cables Market demonstrates strong geographical diversity, shaped by infrastructure maturity, energy transition policies, and regional demand for reliable power transmission. North America advances with large-scale grid modernization and offshore wind projects in the United States and Canada, while Europe leads in submarine installations and cross-border interconnections to support its renewable energy transition. Asia-Pacific shows rapid growth driven by China’s ultra-high-voltage projects, India’s rural electrification, and Japan’s offshore wind expansion. Latin America steadily adopts high-voltage cables through hydropower and industrial development in Brazil, Mexico, and Chile. The Middle East and Africa emphasize new installations for smart city projects, energy parks, and rural electrification, supported by international collaborations. Key players such as Nexans, Furukawa Electric, LS Cable & System, and Mitsubishi Electric strengthen their presence with advanced cable technologies, global supply networks, and partnerships that address regional power needs while aligning with long-term sustainability goals.

Market Insights

- The High Voltage Cables Market was valued at USD 19.57 billion in 2024 and is projected to reach USD 31.18 billion by 2032, expanding at a CAGR of 6%.

- Rising electricity demand from industrialization, urbanization, and data center expansion drives the adoption of advanced high-voltage transmission systems.

- Increasing deployment of submarine and underground cables for offshore wind, smart cities, and interconnections reflects a clear trend toward modern and efficient solutions.

- Competitive landscape is shaped by key players such as Nexans, LS Cable & System, Mitsubishi Electric, and Furukawa Electric, focusing on advanced insulation technologies, global expansion, and renewable energy projects.

- High installation costs, raw material price fluctuations, and complex regulatory processes act as restraints that limit rapid adoption in some developing regions.

- North America shows strong growth through grid modernization and renewable integration, Europe emphasizes offshore wind and cross-border links, while Asia-Pacific emerges as the fastest-growing region with ultra-high-voltage projects in China and large-scale electrification in India.

- Latin America expands steadily with hydropower and industrial development, while the Middle East and Africa advance through new installations in smart city projects, renewable parks, and rural electrification programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Electricity Demand and Expanding Transmission Networks

The High Voltage Cables Market is driven by global growth in electricity consumption across industrial, commercial, and residential sectors. Expanding urbanization and industrialization require stronger transmission networks to ensure reliable power delivery. It supports large-scale integration of renewable energy sources into national grids. Governments invest in high-capacity transmission lines to reduce outages and enhance efficiency. Data centers, electric mobility, and urban infrastructure projects further increase demand for high-voltage connections. Growing reliance on uninterrupted energy supply reinforces the need for advanced cable systems worldwide.

- For instance, in July 2025, LS Cable & System completed its fifth submarine cable plant in Donghae City, South Korea, quadrupling its high-voltage direct current (HVDC) cable production capacity to supply projects, including those requiring 525 kV transmission capability.

Government Support for Renewable Energy Integration

The High Voltage Cables Market benefits from policy-driven initiatives that promote renewable energy deployment. Offshore wind, solar farms, and hydropower projects require efficient high-voltage connections to transport electricity to consumption centers. It ensures stable integration of intermittent energy sources with existing grids. Governments in Europe, Asia, and North America provide funding and regulations that accelerate deployment of high-voltage cables in renewable projects. Large interconnection projects across regions also depend on reliable cable systems. This policy support strengthens long-term growth opportunities for the market.

- For instance, Nexans secured a framework agreement with RTE to supply 450 km of HVDC subsea cables and 280 km of HVDC onshore cables to connect the Centre Manche 1, Centre Manche 2, and Oléron offshore wind farms to the French national grid, integrating a combined capacity of several gigawatts.

Technological Advancements Enhancing Performance and Safety

The High Voltage Cables Market experiences strong momentum from innovations in insulation, materials, and monitoring systems. Advanced cross-linked polyethylene (XLPE) cables improve performance, reduce losses, and extend service life. It enables safer and more efficient power transmission across long distances. Real-time monitoring technologies enhance grid resilience by identifying faults before failures occur. Submarine high-voltage cables expand applications in offshore wind and inter-island connections. These advancements position high-voltage cables as critical infrastructure in modern power systems.

Urbanization, Infrastructure Development, and Cross-Border Interconnections

The High Voltage Cables Market grows with large infrastructure projects, industrial expansion, and cross-border energy trade. Expanding metro systems, airports, and industrial hubs require dependable cable networks. It ensures reliable energy supply for construction, operations, and smart city development. Cross-border interconnection projects in Europe, Asia, and Africa further increase the demand for advanced cable systems. Investments in rural electrification also create opportunities in developing regions. These factors highlight the critical role of high-voltage cables in supporting economic growth and energy security.

Market Trends

Growing Deployment of Submarine and Underground Cable Systems

The High Voltage Cables Market is shaped by rising demand for submarine and underground cable installations. Offshore wind projects, inter-island connections, and undersea interconnectors require high-capacity cables to transmit electricity efficiently. It supports cross-border energy trade and renewable energy integration. Underground systems gain traction in urban areas due to space limitations and the need for safer, aesthetically integrated networks. These trends highlight a shift away from overhead lines toward advanced cable technologies. Investments in offshore and underground projects will continue to strengthen market growth.

- For instance, Nexans was awarded a contract to supply 57 km of extra-high voltage underground cables to replace overhead lines crossing Switzerland’s Saint-Gotthard Pass. The cables will be installed in the new second tube of the Saint-Gotthard Road Tunnel, with work starting in 2028 and finishing by 2030, enabling secure power transmission across the Alps.

Adoption of Advanced Insulation Materials and Smart Monitoring Systems

The High Voltage Cables Market benefits from growing use of advanced insulation materials such as cross-linked polyethylene (XLPE). These cables reduce transmission losses, extend lifespan, and improve reliability under high stress. It also sees rising integration of smart monitoring systems that track performance, detect faults, and ensure preventive maintenance. Digital solutions provide real-time data for utilities to optimize energy transmission. The combination of advanced insulation and intelligent monitoring improves both safety and efficiency. This trend ensures steady adoption of modern cable technologies across regions.

- For instance, LS Cable & System commercialized a 525 kV HVDC XLPE-insulated cable with an operating conductor temperature raised to 90 °C, supporting stable long-distance transmission in Korea’s East Coast–Metropolitan Area network.

Rising Demand from Renewable Energy Projects

The High Voltage Cables Market reflects strong demand from expanding renewable energy capacity worldwide. Wind farms, solar parks, and hydropower projects require high-voltage cables to transmit electricity to urban and industrial load centers. It supports stable grid integration of variable renewable sources. Offshore wind expansion in Europe and Asia particularly drives demand for submarine cable networks. Large-scale renewable targets set by governments ensure long-term opportunities. This alignment with global energy transition strengthens cable market expansion.

Expansion of Cross-Border Interconnection Projects

The High Voltage Cables Market is influenced by increasing investments in cross-border transmission infrastructure. Interconnection projects across Europe, the Middle East, and Asia improve grid stability and enable efficient energy trade. It enhances supply security by connecting regions with surplus power to areas with higher demand. Governments and utilities prioritize long-distance transmission lines to strengthen regional cooperation. Large-scale interconnectors require advanced cable technologies that ensure minimal losses over vast distances. This trend underlines the market’s strategic role in global energy integration.

Market Challenges Analysis

High Installation Costs and Complex Project Execution

The High Voltage Cables Market faces challenges from significant upfront costs and complex deployment processes. Submarine and underground installations require specialized equipment, skilled labor, and lengthy approval procedures. It increases project timelines and creates financial barriers for utilities and governments in cost-sensitive regions. Harsh environmental conditions, including deep-sea and mountainous terrains, add to technical difficulties. Maintenance of such systems also demands advanced monitoring tools and expertise, further elevating operational costs. These financial and logistical challenges limit rapid adoption in some developing markets.

Supply Chain Constraints and Raw Material Price Volatility

The High Voltage Cables Market is also challenged by supply chain disruptions and fluctuating raw material prices. Copper, aluminum, and insulation materials are critical inputs that face global shortages and price instability. It impacts production schedules and reduces profit margins for manufacturers. Limited availability of specialized components, such as XLPE insulation and submarine cable sheathing, creates additional hurdles. Political uncertainties and trade restrictions also affect timely procurement of materials. These risks strain project execution and delay large-scale cable installations worldwide.

Market Opportunities

Rising Investments in Renewable Energy and Offshore Wind Projects

The High Voltage Cables Market presents strong opportunities through expanding renewable energy installations, particularly offshore wind and large-scale solar projects. Governments worldwide set ambitious clean energy targets that require extensive transmission infrastructure. It enables stable grid integration of variable renewable sources by carrying high-capacity electricity over long distances. Offshore wind development in Europe, China, and the United States fuels significant demand for submarine cables. Solar power expansion in Asia and the Middle East also contributes to steady growth. These investments create long-term opportunities for cable manufacturers and utility providers.

Expansion of Smart Infrastructure and Cross-Border Interconnections

The High Voltage Cables Market benefits from rapid infrastructure modernization and cross-border energy trade. Smart cities, industrial zones, and transport corridors demand reliable high-voltage transmission systems. It supports digital infrastructure growth, electrification of transport, and modernization of aging grids. Cross-border projects in Europe, Asia, and Africa drive demand for advanced cable networks that ensure stable interconnection between nations. Rising collaboration between governments and private players accelerates project execution. These developments highlight the strategic role of high-voltage cables in strengthening energy security and enabling global power exchange.

Market Segmentation Analysis:

By Voltage

The High Voltage Cables Market, by voltage, is divided into 72.5 kV–220 kV, 220 kV–440 kV, and above 440 kV. The 72.5 kV–220 kV segment dominates due to its wide use in urban distribution and regional power transmission. It ensures efficient supply for industrial clusters, residential zones, and infrastructure projects. The 220 kV–440 kV category gains strong demand from long-distance interconnections and renewable energy integration. Above 440 kV cables, though less common, are critical for ultra-high-voltage projects and international interconnectors. Expansion of large-scale power corridors continues to boost demand across all voltage ranges.

- For instance, Furukawa Electric supplied the 275 kV underground XLPE cable system for the Chiba-Katsunan Line in Japan, extending over 30.4 km to reinforce power transmission reliability for the metropolitan Tokyo area. The installation was completed in December 2013, with the system beginning operation in March 2014.

By Current

The High Voltage Cables Market, by current, includes alternating current (AC) and direct current (DC) systems. AC high-voltage cables hold a major share due to their wide deployment in traditional grid networks. It supports cost-effective power transmission across short and medium distances. DC high-voltage cables gain traction for long-distance and submarine applications where efficiency and lower losses are crucial. The shift toward renewable integration and intercontinental connections drives higher demand for HVDC technology. Utilities increasingly invest in hybrid systems to balance reliability and efficiency.

- For instance, Mitsubishi Electric signed an MoU with GE Vernova to supply insulated-gate bipolar transistors (IGBTs) for its voltage source converter (VSC) HVDC systems, supporting the expansion of renewable energy transmission and enhancing overall grid efficiency.

By Installation

The High Voltage Cables Market, by installation, covers overhead, underground, and submarine systems. Overhead cables remain dominant due to their cost-effectiveness and ease of deployment across large distances. It continues to be the preferred option for rural electrification and grid expansion in developing regions. Underground installations are expanding in urban areas where land scarcity and safety concerns require compact solutions. Submarine installations record strong growth from offshore wind projects and cross-border interconnection projects. Rising investments in smart infrastructure and renewable energy strengthen opportunities across all installation categories.

Segments:

Based on Voltage

- 110 kV

- 110 kV – 220 kV

- > 220 kV

Based on Current

Based on Installation

- Overhead

- Submarine

- Underground

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the High Voltage Cables Market, accounting for nearly 32% in 2024. The region benefits from robust investments in renewable energy integration, modernization of existing grid infrastructure, and cross-border interconnection projects. The United States leads demand with offshore wind development, urban grid upgrades, and large-scale transmission projects linking renewable plants to major consumption centers. Canada contributes steadily with rural electrification initiatives, hydroelectric projects, and submarine cable installations for regional connectivity. Mexico supports growth with rising investments in industrial zones and renewable integration under government-backed reforms. It reflects a mature ecosystem with strong regulatory frameworks, advanced technologies, and consistent funding for power infrastructure expansion.

Europe

Europe represents about 29% of the High Voltage Cables Market in 2024, supported by its strong renewable energy transition and interconnection policies. Germany, France, and the United Kingdom drive regional growth with large offshore wind farms requiring advanced submarine cables. The European Union prioritizes cross-border projects that ensure energy security, reduce carbon emissions, and balance regional electricity supply. It also promotes underground installations in urban areas where land scarcity and environmental concerns are high. Scandinavian countries lead in deploying HVDC cables for long-distance renewable integration, while Southern and Eastern Europe expand gradually with modernization of aging grids. Policy support, green funding, and regional cooperation ensure sustained demand for high-voltage cable systems.

Asia-Pacific

Asia-Pacific accounts for nearly 26% of the High Voltage Cables Market in 2024, making it the fastest-growing region. China dominates with massive investments in ultra-high-voltage projects that connect remote renewable generation centers with urban demand hubs. Japan and South Korea deploy submarine cables for offshore wind farms and urban underground systems for safety and reliability. India accelerates demand through rural electrification, smart grid initiatives, and rapid industrialization. Southeast Asian nations including Vietnam, Indonesia, and Thailand expand infrastructure with renewable integration and urban development projects. It reflects a dynamic market driven by rapid economic growth, rising electricity demand, and government-backed digital infrastructure investments.

Latin America

Latin America holds around 8% of the High Voltage Cables Market in 2024, supported by gradual but steady expansion. Brazil leads regional demand with hydropower connections, urban grid modernization, and offshore renewable projects. Mexico shows strong adoption with infrastructure reforms and industrial development requiring efficient transmission systems. Chile, Argentina, and Colombia also contribute with renewable integration and urban power upgrades. It faces challenges of cost constraints and slower regulatory processes, but rising public-private partnerships improve growth prospects. Expanding energy access and renewable initiatives create promising opportunities for high-voltage cable adoption across the region.

Middle East and Africa

The Middle East and Africa together account for about 5% of the High Voltage Cables Market in 2024, reflecting steady yet emerging growth. The Middle East, led by Saudi Arabia, the United Arab Emirates, and Qatar, invests in smart city projects, large-scale industrial zones, and renewable energy parks requiring high-voltage connections. Submarine and underground cables gain traction in urban and coastal developments. Africa demonstrates growing opportunities with South Africa, Nigeria, and Egypt focusing on electrification projects and grid reliability improvements. It benefits from international funding and collaborations to expand transmission networks. Rising adoption of HVDC and modular systems highlights the region’s growing role in global energy connectivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the High Voltage Cables Market is defined by leading players including Nexans, LS Cable & System, Mitsubishi Electric, Furukawa Electric, Ducab, Elsewedy Electric, Brugg Kabel, Iljin Electric, Jeddah Cables, and Gupta Power. These companies compete through strong portfolios of overhead, underground, and submarine cable solutions designed for high efficiency, safety, and long-distance transmission. They focus heavily on innovation in insulation materials such as XLPE, advanced sheathing, and smart monitoring systems to reduce losses and improve reliability. Strategic investments in offshore wind projects, renewable energy integration, and cross-border interconnection initiatives strengthen their market positions globally. Many of these players leverage joint ventures, government partnerships, and regional expansion strategies to capture opportunities in both developed and emerging economies. Cost optimization, quality assurance, and sustainability goals drive continuous product development, ensuring alignment with global energy transition targets. Intense competition among these manufacturers promotes technological advancement, large-scale deployment, and steady growth of the market.

Recent Developments

- In September 2025, LS Cable & System secured a contract from Taiwan worth 160 billion won to supply submarine cable systems.

- In July 2025, LS Cable & System completed its fifth submarine cable plant in Donghae City, Korea. This new facility quadrupled its production capacity for HVDC submarine cables.

- In April 2025, Nexans Won a contract with Interconnect Malta (ICM) to deliver a 220 kV HVAC subsea cable (225 MW) for the second Malta-Sicily interconnector.

- In March 2025, Nexans Secured a frame agreement with RTE to supply 450 km of HVDC subsea cables and 280 km of HVDC onshore cables for three offshore wind farms: Centre Manche 1 & 2 and Oléron.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Current, Installation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for submarine cables will grow with offshore wind and interconnection projects.

- Advanced insulation technologies will improve efficiency and extend cable lifespan.

- Grid modernization will create strong opportunities for underground high-voltage systems.

- Cross-border interconnections will expand to strengthen regional energy trade.

- Renewable energy targets will drive continuous investment in high-voltage cable networks.

- Digital monitoring and IoT-enabled systems will enhance fault detection and maintenance.

- Urbanization will increase demand for compact underground installations.

- HVDC projects will gain prominence for long-distance and intercontinental transmission.

- Emerging economies will adopt new cable networks to support electrification and industrialization.

- Sustainability initiatives will encourage eco-friendly materials and energy-efficient designs in cable production.