Market Overview

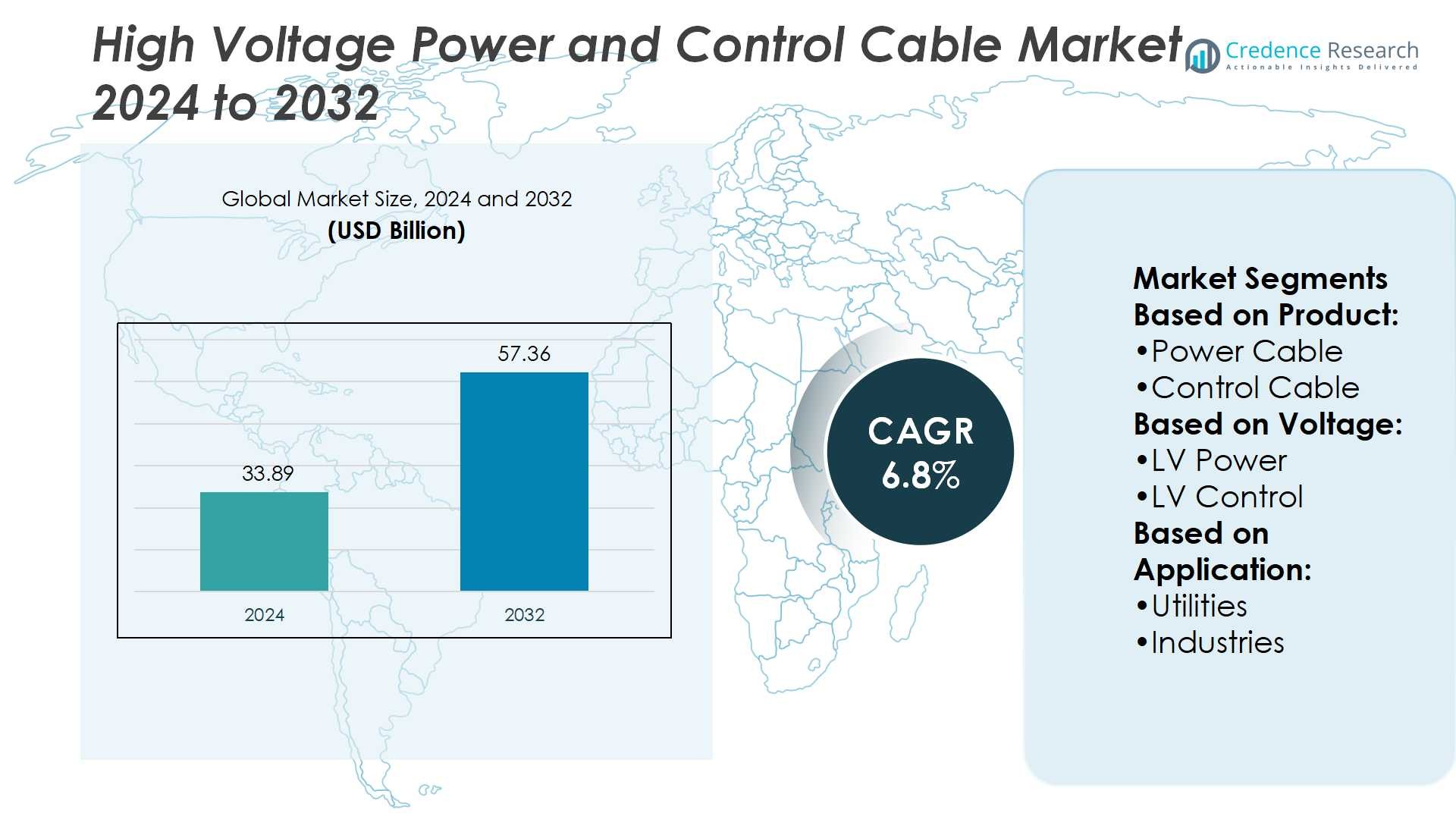

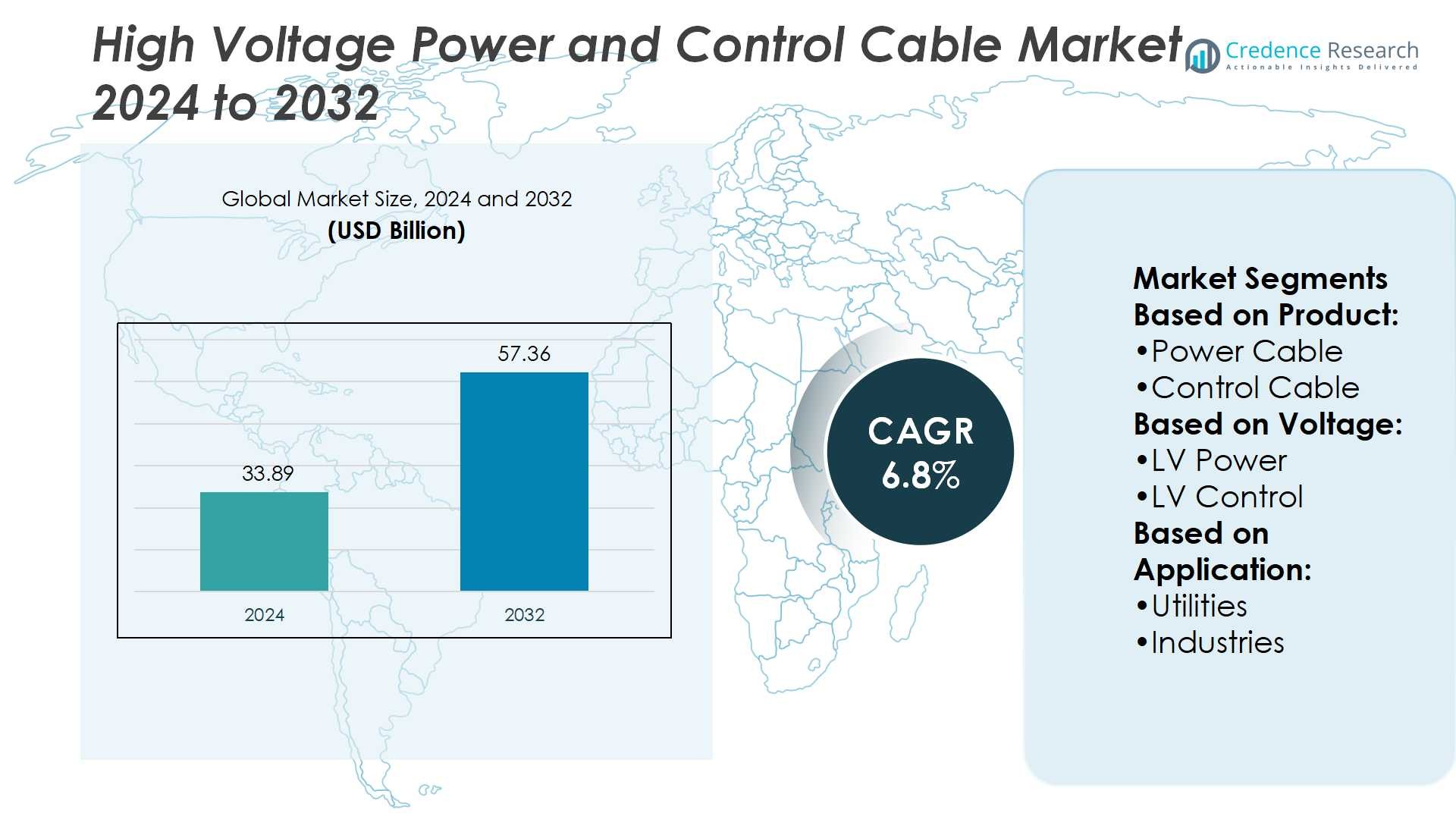

High Voltage Power and Control Cable Market size was valued at USD 33.89 billion in 2024 and is anticipated to reach USD 57.36 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Power and Control Cable Market Size 2024 |

USD 33.89 Billion |

| High Voltage Power and Control Cable Market, CAGR |

6.8% |

| High Voltage Power and Control Cable Market Size 2032 |

USD 57.36 Billion |

The High Voltage Power and Control Cable Market grows through strong demand for reliable transmission networks, renewable energy integration, and infrastructure modernization. Drivers include rising electricity consumption, large-scale grid expansion, and increasing investments in offshore wind and solar projects. Urbanization and industrial automation also strengthen the need for durable power and control cables. Trends highlight the adoption of advanced insulation materials, underground and submarine installations, and digital-ready cables for smart grid applications. Sustainability goals drive innovation in recyclable materials and eco-friendly designs. Together, these factors position the market for consistent growth across utilities, industries, and power generation facilities.

The High Voltage Power and Control Cable Market shows strong regional diversity, with Asia-Pacific holding the largest share due to rapid urbanization and renewable integration, followed by North America and Europe with significant investments in grid modernization and offshore wind projects. Latin America and the Middle East & Africa show emerging growth through electrification and infrastructure programs. Key players include FURUKAWA ELECTRIC, Havells India, LS Cables, NKT A/S, Belden Inc., Klaus Faber, Elsewedy Electric, KEI Industries, Leoni Cables, and Bahra Electric.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Voltage Power and Control Cable Market was valued at USD 33.89 billion in 2024 and is projected to reach USD 57.36 billion by 2032, at a CAGR of 6.8%.

- Market drivers include rising electricity consumption, large-scale grid expansion, and renewable energy integration across major economies.

- Key trends highlight advanced insulation materials, growing underground and submarine cable installations, and digital-ready solutions for smart grids.

- Competitive analysis shows global players investing in R&D, capacity expansions, and sustainable product innovations to strengthen positions.

- Market restraints include high installation costs, complex deployment processes, and raw material price volatility affecting production margins.

- Regional analysis shows Asia-Pacific dominating with rapid urbanization and renewable adoption, while North America and Europe invest in grid modernization and offshore wind.

- Latin America and Middle East & Africa display emerging opportunities through electrification programs and infrastructure development, supported by regional and global partnerships.

Market Drivers

Rising Demand for Reliable Power Transmission in Expanding Infrastructure

The High Voltage Power and Control Cable Market grows due to rapid urbanization and industrial expansion. Power utilities invest in high-voltage networks to support increasing electricity demand. Large infrastructure projects, including smart cities and industrial clusters, drive cable installations. It ensures reliable transmission across long distances without significant losses. Governments prioritize grid modernization programs, creating consistent need for advanced cable systems. The push toward reliable networks sustains steady adoption across developed and emerging economies.

- For instance, FURUKAWA ELECTRIC developed aluminum-sheathed XLPE (cross-linked polyethylene) cables capable of operating at 500 kV class, and has supplied extra-high-voltage cables for numerous grid reinforcement projects in Japan over many years, ensuring stable power transmission.

Integration of Renewable Energy Sources and Grid Expansion Projects

The High Voltage Power and Control Cable Market benefits from rising renewable energy integration. Wind and solar projects require high-capacity cables to connect remote generation sites to national grids. Utilities expand transmission networks to balance variable energy sources with demand. It strengthens cable deployment in offshore wind farms and solar parks. Investments in interconnectors between countries create additional opportunities. This trend secures cables as essential components in advancing clean energy transition.

- For instance, Havells manufactures and offers a range of high-efficiency cables, including XLPE cables, with ratings typically specified up to 33 kV. These cables are essential for various electrical installations, including renewable energy projects.

Increasing Industrialization and Continuous Growth in Heavy-Duty Applications

The High Voltage Power and Control Cable Market gains momentum from expanding industrial operations worldwide. Heavy industries such as mining, steel, and oil and gas rely on robust cable systems. They require durable solutions for continuous high-load applications. It supports stable operations in demanding environments with minimal downtime. Rising demand for automation and process control increases adoption of control cables. Ongoing upgrades in industrial facilities sustain long-term growth.

Strong Emphasis on Safety Standards and Regulatory Compliance

The High Voltage Power and Control Cable Market is influenced by strict safety and regulatory frameworks. Standards mandate efficient insulation and enhanced fire resistance for critical infrastructure. Manufacturers invest in advanced materials to meet these requirements. It reduces risks of outages, accidents, and equipment failure. Regulatory bodies support the adoption of environment-friendly cables with lower emissions during production. The growing focus on safety compliance drives innovation and secures market credibility.

Market Trends

Growing Adoption of Advanced Cable Materials and Insulation Technologies

The High Voltage Power and Control Cable Market shows a strong shift toward advanced materials. Manufacturers use cross-linked polyethylene (XLPE) and ethylene propylene rubber (EPR) to improve efficiency. These materials provide better thermal stability and extended operational life. It ensures reduced energy losses and higher reliability in transmission. The trend supports both underground and subsea installations where durability is critical. Demand for sustainable and recyclable materials further accelerates innovation in this space.

- For instance, LS Cable & System successfully supplied HVDC submarine cables for Korea’s Jeju–mainland interconnector projects. LS Cable & System provided XLPE cables for the third link, which operates at ±150 kV and enables bidirectional power flow to support renewable energy integration.

Expansion of Underground and Submarine Cable Installations for Grid Reliability

The High Voltage Power and Control Cable Market increasingly focuses on underground and submarine systems. Governments favor underground cables to reduce visual impact and improve safety in urban areas. Offshore wind projects drive rapid demand for submarine cables that can handle large power flows. It strengthens cross-border interconnections and improves energy security. Long-distance submarine projects are gaining traction in Europe and Asia-Pacific. The rising preference for hidden and secure infrastructure positions these systems as key growth areas.

- For instance, NKT supplied the 525 kV HVDC onshore cables in Denmark for the Viking Link project, which is Europe’s longest interconnector between the UK and Denmark. The full interconnector, with a total route length of 765 kilometers, was a collaborative effort involving several suppliers.

Rising Integration of Smart Grids and Digital Monitoring Systems

The High Voltage Power and Control Cable Market is shaped by smart grid integration. Utilities deploy cables compatible with sensors and monitoring units for real-time data. These solutions enhance fault detection and predictive maintenance capabilities. It reduces outages and improves operational efficiency for large power networks. Digital technologies align with broader goals of automation and remote monitoring. This trend ensures utilities maintain resilient and intelligent energy distribution frameworks.

Increasing Focus on Renewable Energy Connectivity and Decarbonization Goals

The High Voltage Power and Control Cable Market trends toward renewable power integration. Expanding solar and wind farms require high-capacity connections to national grids. Offshore wind in particular drives investments in specialized cable systems. It highlights the role of cables in achieving decarbonization targets worldwide. Governments fund interconnection projects to distribute renewable power across borders. The alignment of cables with global energy transition strategies strengthens their strategic importance.

Market Challenges Analysis

High Installation Costs and Complex Deployment Barriers in Large-Scale Projects

The High Voltage Power and Control Cable Market faces challenges due to high installation and deployment costs. Underground and submarine cable systems require advanced engineering, specialized equipment, and skilled labor. It increases project timelines and raises financial risks for utilities and developers. Harsh environments such as deep seas or rocky terrains further complicate installations. Maintenance and repair operations also demand significant investments, creating hurdles for long-term sustainability. Limited access to cost-efficient solutions restricts adoption in emerging economies with budget constraints.

Raw Material Price Volatility and Stringent Regulatory Requirements

The High Voltage Power and Control Cable Market is impacted by fluctuations in raw material prices, particularly copper, aluminum, and polymers. Rising costs affect overall production expenses and pressure profit margins for manufacturers. It creates uncertainty for long-term supply contracts and large infrastructure projects. Compliance with evolving safety and environmental standards increases complexity in design and testing. Strict regulations demand continuous innovation in insulation, fire resistance, and eco-friendly materials. Meeting these requirements raises research and development costs, challenging smaller players to remain competitive.

Market Opportunities

Expanding Renewable Energy Projects and Cross-Border Power Transmission

The High Voltage Power and Control Cable Market holds strong opportunities in renewable energy expansion. Large-scale solar and wind projects require reliable cable networks to connect generation sites with demand centers. It supports offshore wind farms that depend on submarine cables for high-capacity transmission. Cross-border interconnections in Europe, Asia, and the Middle East create new growth prospects. Governments continue to fund clean energy infrastructure, enhancing demand for advanced cable systems. The rising focus on decarbonization strengthens the role of cables in global energy transition strategies.

Growing Investments in Smart Grids and Infrastructure Modernization

The High Voltage Power and Control Cable Market benefits from the modernization of existing transmission and distribution networks. Utilities invest in smart grids that require cables capable of supporting digital monitoring and high-load performance. It enables predictive maintenance, real-time monitoring, and improved grid stability. Urbanization drives underground installations to reduce space usage and enhance safety. Infrastructure upgrades in emerging economies create long-term opportunities for cable manufacturers. Strong alignment with smart city projects further expands market potential in developed regions.

Market Segmentation Analysis:

By Product

The High Voltage Power and Control Cable Market divides into power cables and control cables, each serving distinct roles. Power cables dominate due to their extensive use in transmitting electricity across utilities, power plants, and industrial sectors. These cables support high-capacity transfer, ensuring stable distribution networks in both developed and emerging economies. Control cables hold strong demand in automation and monitoring functions across industrial facilities. It provides operational reliability in applications that require real-time data transfer and system management. The combination of both products sustains balanced growth across energy and industrial infrastructures.

- For instance, Belden Inc. launched its 10GX Shielded Cable system capable of delivering 10 gigabits per second performance over distances up to 100 meters, enhancing industrial automation reliability and supporting advanced monitoring in high-voltage environments.

By Voltage

The High Voltage Power and Control Cable Market segments into low voltage, medium voltage, and high voltage systems. Low voltage categories, including LV power and LV control, find use in local distribution networks and residential applications. Medium voltage cables maintain steady growth in industrial plants and regional grid projects. High voltage cables lead in market share due to their critical role in long-distance transmission. It enables utilities to minimize energy losses and improve efficiency in cross-border projects. Each voltage range addresses specific operational needs, ensuring wide coverage across applications.

- For instance, Klaus Faber AG is a major supplier of medium and high-voltage cables in Europe. The company is involved in numerous projects for European grid operators, including supplying 110 kV underground cable systems for Germany’s transmission upgrades, which are crucial for supporting renewable energy integration.

By Application

The High Voltage Power and Control Cable Market applies across utilities, industries, and power plants. Utilities represent the largest segment due to expanding grid infrastructure and renewable integration projects. It strengthens the requirement for both overhead and underground cable networks. Industrial applications include mining, oil and gas, and heavy manufacturing facilities that demand reliable cables for high-load operations. Power plants, including renewable and conventional sources, continue to require durable cables for generation-to-grid connectivity. The broad application base secures continuous growth opportunities across multiple sectors.

Segments:

Based on Product:

- Power Cable

- Control Cable

Based on Voltage:

Based on Application:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America represents 9 % of the High Voltage Power and Control Cable Market in 2024, with the United States holding 78.1 % of the regional share. Growth is driven by modernization of aging transmission networks and integration of renewable energy into national grids. The U.S. continues to lead with large investments in offshore wind, solar projects, and the expansion of electric vehicle charging stations. Canada contributes through hydropower expansion and interprovincial transmission upgrades, while Mexico focuses on industrial electrification and manufacturing growth. The region also benefits from regulatory programs encouraging clean energy adoption and smart grid development. It demonstrates steady demand as utilities replace outdated infrastructure and strengthen resilience against extreme weather events. The market outlook in North America remains positive due to continuous investment in power reliability and energy transition goals.

Europe

Europe holds 7 % of the High Voltage Power and Control Cable Market in 2024, supported by extensive investment in renewable energy integration and cross-border interconnections. France has committed to worth of cable supply agreements to strengthen its grid infrastructure, while Italy’s Prysmian secured to support Terna’s high-voltage transmission projects. Germany, the UK, and Nordic countries drive demand through offshore wind projects, particularly in the North Sea. Eastern Europe is gradually increasing its contribution with grid reinforcement and modernization programs. The European Union’s ambitious carbon neutrality targets push utilities to adopt advanced underground and submarine cable systems for secure and sustainable transmission. The focus on reducing environmental impact and supporting large renewable energy hubs underpins cable demand. Europe’s steady investment landscape ensures the region remains an important growth area despite holding a smaller share compared to Asia-Pacific.

Asia-Pacific

Asia-Pacific dominates with 81 % of the global High Voltage Power and Control Cable Market in 2024, led by China, India, Japan, and South Korea. China continues to expand ultra-high voltage networks to meet growing electricity demand and strengthen renewable energy integration. India invests heavily in smart city projects, urban electrification, and new power plants, driving strong demand for both power and control cables. Japan and South Korea support growth with submarine cable systems for offshore wind and long-distance transmission. Southeast Asia adds momentum with rapid industrialization, rising population, and increased electrification programs in rural regions. The scale of infrastructure investment across Asia-Pacific makes it the global leader by a wide margin. It reflects the region’s strategic focus on energy security, large-scale industrial expansion, and the adoption of advanced underground and submarine cable projects. The dominance of Asia-Pacific is expected to continue due to its unmatched scale and government-backed projects.

Latin America

Latin America accounts for 2 % of the High Voltage Power and Control Cable Market in 2024, with Brazil as the largest contributor. Brazil’s reliance on hydroelectric power creates high demand for reliable cable systems to connect remote generation sites with urban centers. Argentina and Chile add to regional demand through the development of wind and solar farms. Industrialization across Mexico, Colombia, and Peru also supports steady consumption of power and control cables. The region faces challenges with limited infrastructure funding, yet international investments are improving the outlook. Grid modernization programs supported by global agencies strengthen opportunities in long-distance transmission projects. It continues to grow at a moderate pace, with demand linked closely to energy diversification and industrial development.

Middle East & Africa

The Middle East & Africa represents 1 % of the High Voltage Power and Control Cable Market in 2024, but the region is gradually expanding due to large-scale electrification and renewable energy projects. Gulf countries such as Saudi Arabia, the UAE, and Qatar invest heavily in solar parks, wind farms, and urban electrification projects to diversify their energy mix. Africa contributes with programs aimed at improving electricity access in Nigeria, Kenya, and South Africa, supported by foreign investment and government-backed initiatives. Submarine and underground cable projects play a role in connecting renewable energy hubs with industrial and urban demand centers. The region faces obstacles such as high installation costs and logistical difficulties, but opportunities are increasing with smart city developments and global partnerships. It is expected to grow steadily as governments pursue clean energy strategies and expand national transmission infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The High Voltage Power and Control Cable Market companies include FURUKAWA ELECTRIC, Havells India, LS Cables, NKT A/S, Belden Inc., Klaus Faber, Elsewedy Electric, KEI Industries, Leoni Cables, and Bahra Electric. The High Voltage Power and Control Cable Market is characterized by strong competition, technological advancement, and continuous capacity expansion. Companies focus on delivering cables with higher efficiency, improved insulation, and durability to meet growing demand from utilities, industries, and power plants. Market participants invest heavily in research and development to support renewable integration, smart grid projects, and large-scale infrastructure upgrades. Competition is also shaped by sustainability goals, with emphasis on recyclable materials and eco-friendly manufacturing practices. Strategic contracts for offshore wind, cross-border interconnections, and underground transmission projects strengthen competitive positions. The landscape highlights a balance between global innovation and regional specialization, ensuring reliable solutions across diverse applications.

Recent Developments

- In May 2025, Red Eléctrica announced the completion of a project that sought to install energy storage batteries in Sant Antoni. The purpose of this project is to improve the operation of the submarine cable that connects Ibiza to Mallorca and the rest of the country, facilitating the full use of the link capacity and improving the dependability of the supply.

- In September 2024, Greece and Cyprus engaged in discussions to finalize the Great Sea Interconnector project. The objective of this new project is to link Greece and Cyprus and ultimately Israel with a high voltage direct current (HVDC) electricity cable system.

- In May 2024, BYD introduced the BYD SHARK, its first pickup truck. The newest model in BYD’s lineup, the DMO Super Hybrid Off-road Platform, is a feature of the BYD SHARK, which is positioned as a new energy-intelligent luxury pickup.

- In January 2023, Nexans partnered with TriMet to co-develop a tooling material made from recycled aluminum for manufacturing rods for cables. The collaboration aims to reduce carbon emissions while maintaining the necessary mechanical properties and conductivity standards for the product.

Report Coverage

The research report offers an in-depth analysis based on Product, Voltage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with rising renewable energy integration into national grids.

- Offshore wind projects will increase submarine cable installations worldwide.

- Smart grid development will drive adoption of digital-ready power and control cables.

- Underground cabling will expand in urban areas to improve safety and reliability.

- Investments in cross-border interconnections will strengthen global energy trade.

- Industrial automation will support steady demand for advanced control cables.

- Governments will push for eco-friendly and recyclable cable materials.

- Infrastructure modernization will sustain growth in developed economies.

- Electrification programs will create new opportunities in emerging markets.

- Continuous R&D will lead to cables with higher efficiency and longer lifespan.