Market Overview:

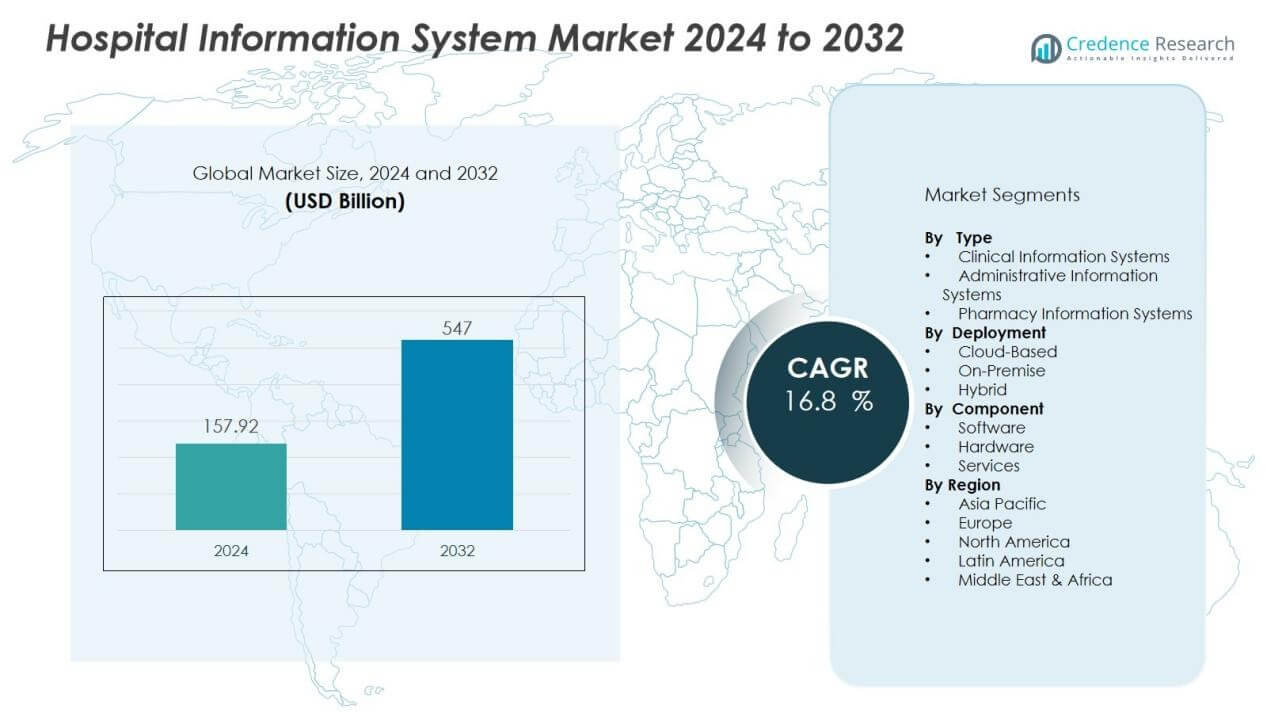

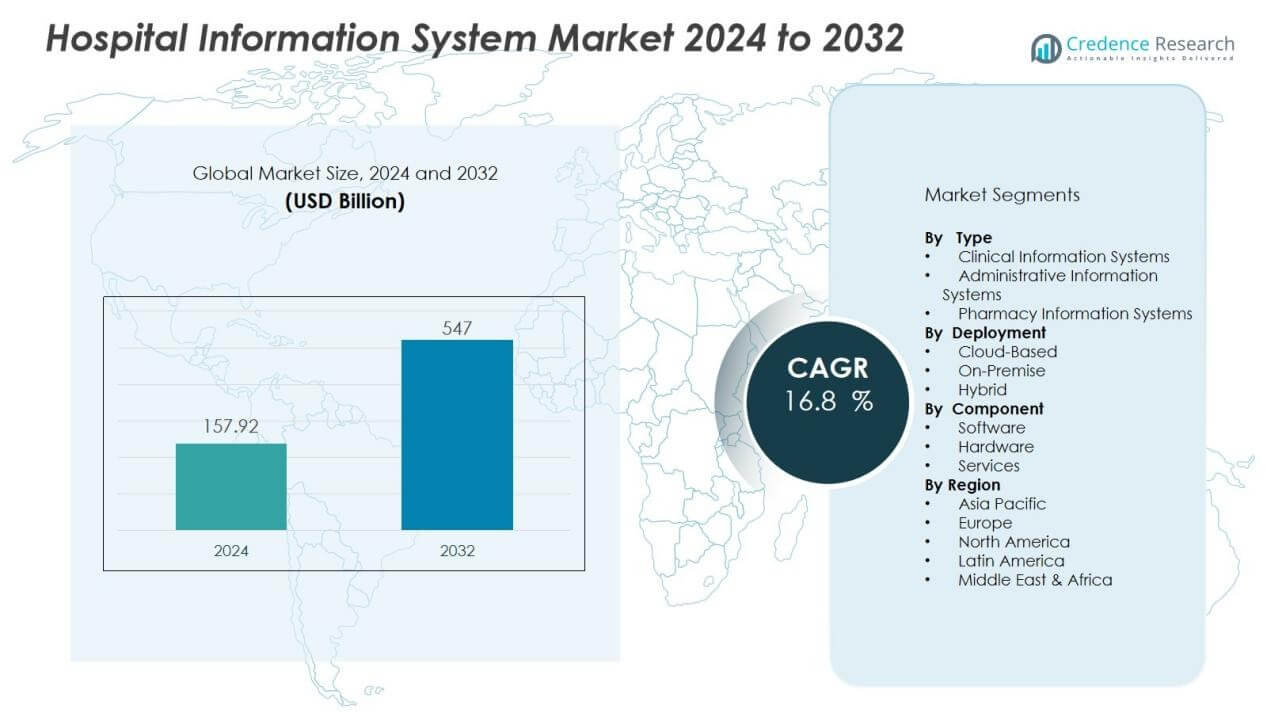

The hospital information system market size was valued at USD 157.92 billion in 2024 and is anticipated to reach USD 547 billion by 2032, at a CAGR of 16.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hospital Information System Market Size 2024 |

USD 157.92 Billion |

| Hospital Information System Market, CAGR |

16.8% |

| Hospital Information System Market Size 2032 |

USD 547 Billion |

Market drivers include the rising need for efficient patient data management, demand for improved hospital workflow, and the push toward paperless healthcare systems. Hospitals are investing in HIS platforms to enhance clinical decision-making, streamline billing processes, and ensure compliance with data protection regulations. The integration of artificial intelligence, cloud-based platforms, and interoperability solutions is further accelerating adoption, enabling healthcare providers to improve accuracy and patient outcomes while reducing operational costs.

Regionally, North America dominates the hospital information system market due to its advanced healthcare infrastructure, strong regulatory frameworks, and early adoption of digital technologies. Europe follows, supported by government initiatives for healthcare digitization and efficiency improvement. Asia-Pacific is projected to record the fastest growth, driven by increasing healthcare expenditure, expanding hospital networks, and rapid adoption of EHRs in countries like India and China. Latin America and the Middle East & Africa present emerging opportunities, fueled by infrastructure modernization and growing demand for technology-driven healthcare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The hospital information system market was valued at USD 157.92 million in 2024 and is projected to reach USD 547 million by 2032, growing at a CAGR of 16.8%.

- Rising demand for efficient patient data management drives adoption, ensuring accuracy and reducing medical errors.

- Hospitals implement HIS platforms to streamline workflows, automate billing, and reduce administrative costs.

- Integration of AI, cloud, and interoperability features enhances scalability, predictive analytics, and real-time data access.

- High implementation costs, legacy systems, and inadequate IT infrastructure remain significant challenges for smaller hospitals.

- North America led with 41% share in 2024, while Asia-Pacific is set to record the fastest growth.

- Data security risks and interoperability barriers require hospitals to prioritize compliance and invest in advanced solutions.

Market Drivers:

Growing Demand for Efficient Patient Data Management:

The hospital information system market benefits from the increasing need to manage large volumes of patient records. Hospitals require accurate and quick access to medical histories, diagnostic reports, and treatment data. HIS platforms provide centralized databases that improve record accuracy and minimize errors. It supports smoother coordination between departments, ensuring better care delivery and patient safety.

- For Instance, The Oracle Health CommunityWorks platform, designed for community and rural hospitals, serves over 300 hospitals across 46 states, based on company announcements from mid-2023

Rising Focus on Workflow Optimization and Cost Reduction:

Hospitals aim to streamline operations while reducing administrative burdens and costs. HIS platforms automate billing, scheduling, and inventory management tasks. It helps reduce paperwork and staff workload, improving overall efficiency. By lowering manual intervention, hospitals can allocate more resources to clinical functions, leading to better financial performance.

- For instance, Epic Systems’ workflow optimization at UCHealth reduced clinical documentation time for nursing staff by 18 minutes per 12-hour shift, saving 64,000 nursing hours annually.

Technological Advancements Driving System Adoption:

Integration of cloud computing, AI, and interoperability features enhances the appeal of HIS platforms. These technologies enable real-time access to data, predictive analytics, and seamless information exchange between systems. The hospital information system market gains momentum through improved functionality and scalability. It empowers hospitals to adopt flexible solutions that adapt to evolving healthcare needs.

Regulatory Compliance and Patient Safety Requirements:

Governments and regulatory bodies enforce strict standards for patient data protection and healthcare quality. HIS platforms help hospitals meet compliance requirements while safeguarding sensitive information. It also reduces risks of misdiagnosis through decision-support tools and automated alerts. Hospitals adopt HIS solutions to align with legal frameworks while prioritizing patient safety and trust.

Market Trends:

Integration of Advanced Digital Technologies:

The hospital information system market is witnessing rapid adoption of advanced digital technologies such as artificial intelligence, cloud computing, and big data analytics. Hospitals use AI-driven tools for clinical decision support, predictive diagnostics, and resource planning. Cloud-based HIS platforms allow real-time data access, scalability, and cost efficiency for both large hospitals and smaller clinics. It also facilitates remote patient monitoring and telehealth integration, strengthening digital healthcare delivery. Big data analytics within HIS enables improved population health management, accurate forecasting, and customized treatment strategies. This trend highlights the industry’s shift toward technology-enabled, patient-centered care models.

- For Instance, As of December 2021, Cerner Real-World Data (CRWD) aggregated de-identified electronic health records from approximately 100 million patients across 117 contributing health systems in the United States, which could be leveraged for large-scale predictive analytics in clinical workflows and medical research. This data includes various care settings and encounter types.

Growing Emphasis on Interoperability and Patient-Centric Care :

Hospitals are prioritizing interoperability to ensure seamless information exchange between different healthcare systems and providers. HIS platforms now integrate with electronic health records, laboratory systems, and pharmacy solutions to create unified care environments. The hospital information system market reflects this trend through platforms designed for cross-departmental collaboration and faster clinical workflows. It enhances transparency and empowers patients with direct access to their medical records, promoting shared decision-making. Rising patient expectations for personalized care are also pushing hospitals to adopt HIS platforms with mobile applications and patient engagement tools. This growing focus ensures improved patient satisfaction and operational efficiency across healthcare ecosystems.

- For Instance, Epic’s MyChart allows over 325 million patients with electronic records to access their health information and communicate with providers through mobile and web apps. MyChart also supports a range of features, including secure messaging, telehealth video visits, and appointment scheduling, at thousands of healthcare organizations.

Market Challenges Analysis:

High Implementation Costs and Infrastructure Limitations:

The hospital information system market faces significant challenges due to high implementation and maintenance costs. Smaller hospitals and clinics often struggle to allocate resources for advanced digital solutions. It requires substantial investment in hardware, software, and skilled staff training, which limits adoption in developing regions. Legacy systems within hospitals also create integration issues, delaying the transition to modern HIS platforms. Inadequate IT infrastructure and inconsistent internet connectivity further slow down market penetration. These financial and technical barriers remain critical concerns for healthcare providers seeking digital transformation.

Data Security Risks and Interoperability Barriers:

Growing concerns over data security and patient privacy create hurdles for HIS adoption. Cyberattacks and breaches of sensitive health records threaten hospital credibility and patient trust. It requires robust encryption, compliance frameworks, and continuous monitoring, which increase operational costs. Interoperability remains another pressing challenge, with many systems unable to exchange data smoothly across different platforms. Hospitals face delays and inefficiencies when electronic health records do not integrate seamlessly. The hospital information system market must address these issues to achieve wider acceptance and maximize its potential benefits.

Market Opportunities:

Expansion of Cloud-Based and AI-Enabled Solutions:

The hospital information system market presents strong opportunities through the adoption of cloud-based and AI-enabled platforms. Hospitals increasingly prefer cloud deployment for scalability, cost efficiency, and remote accessibility. AI integration allows predictive analytics, early diagnosis, and better clinical decision-making. It supports automation in administrative tasks, reducing workloads and improving resource utilization. Demand for real-time data access across departments and healthcare networks continues to rise. Vendors offering flexible, secure, and advanced solutions stand to gain significant market share.

Rising Adoption in Emerging Economies:

Emerging markets create growth potential due to expanding healthcare infrastructure and increasing government support for digitalization. Many hospitals in Asia-Pacific, Latin America, and the Middle East are investing in HIS platforms to enhance efficiency and patient outcomes. It creates opportunities for vendors to provide cost-effective and localized solutions tailored to regional needs. The hospital information system market benefits from growing demand for EHR integration, telehealth services, and patient engagement tools. Rising awareness of data-driven healthcare supports faster adoption in these regions. International partnerships and collaborations with local providers further open new revenue streams for industry players.

Market Segmentation Analysis:

By Type:

The hospital information system market is segmented into clinical, administrative, and pharmacy systems. Clinical systems lead due to their role in electronic health records, patient monitoring, and diagnostic support. It helps physicians access real-time data, enhancing care coordination and accuracy. Administrative systems focus on billing, scheduling, and workflow management, reducing hospital overhead. Pharmacy systems support medication management and reduce prescription errors, ensuring patient safety and efficiency.

- Fo Instance, Epic Systems’ EHR platform currently stores over 325 million patient records and enables seamless data sharing among more than 3,600 hospitals and numerous other healthcare organizations in the U.S.

By Deployment:

Deployment is categorized into cloud-based, on-premise, and hybrid models. Cloud-based systems dominate due to scalability, cost-effectiveness, and remote access. It enables hospitals to store and share data securely while reducing infrastructure costs. On-premise solutions maintain relevance among large institutions with strict data control needs. Hybrid models gain attention for balancing security with flexibility, offering customized solutions for diverse hospital environments.

- For instance, Sheba Medical Center in Israel pioneered a hybrid model integrating hospital-based and home hospitalization care, enabling inpatient care transitions after just 48 hours with continuous remote monitoring to ensure patient safety and operational flexibility.

By Component:

The market is divided into software, hardware, and services. Software remains the largest segment due to continuous upgrades and integration of AI and analytics tools. It provides hospitals with advanced features for data handling, clinical decisions, and compliance. Hardware includes servers, storage devices, and networking tools that ensure smooth HIS operation. Services, including implementation, training, and support, play a vital role in enabling hospitals to maximize HIS efficiency and performance.

Segmentations:

By Type:

- Clinical Information Systems

- Administrative Information Systems

- Pharmacy Information Systems

By Deployment:

- Cloud-Based

- On-Premise

- Hybrid

By Component:

- Software

- Hardware

- Services

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America accounted for 41% market share in 2024, supported by advanced healthcare infrastructure and early adoption of technology. The region’s hospitals implement HIS platforms to improve efficiency, comply with regulations, and enhance patient care delivery. It benefits from strong government support for EHR adoption and interoperability standards. Large vendors dominate the landscape by offering integrated solutions to hospitals and specialty clinics. Cloud deployment and AI-enabled systems see rising demand across the U.S. and Canada. Strategic partnerships between technology providers and healthcare institutions continue to strengthen market growth in this region.

Europe:

Europe held 28% market share in 2024, driven by strict data protection laws and healthcare digitization initiatives. Governments encourage hospitals to adopt HIS platforms to improve transparency and reduce administrative costs. The hospital information system market in this region benefits from well-established healthcare networks and cross-border data exchange frameworks. It sees steady adoption in countries such as Germany, the U.K., and France, where digital infrastructure is mature. Hospitals focus on sustainability, efficiency, and secure handling of patient records. Regional players also collaborate with international vendors to deliver scalable and compliant solutions.

Asia-Pacific:

Asia-Pacific captured 22% market share in 2024, supported by rising healthcare expenditure and expanding hospital networks. Governments in India, China, and Japan invest heavily in healthcare IT modernization. It creates strong opportunities for vendors offering cloud-based, cost-efficient, and mobile-integrated HIS platforms. Hospitals in this region face growing patient volumes, driving demand for effective digital management systems. Vendors expand through partnerships with local providers to improve accessibility and customization. The hospital information system market in Asia-Pacific is expected to witness the fastest CAGR, reflecting strong digital adoption momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Carestream Health

- Siemens Healthineers

- McKesson Corp.

- Philips Healthcare

- Merge Healthcare Inc. (IBM)

- GE Healthcare

- Cerner Corp. (Oracle)

- Allscripts

- NextGen Healthcare

Competitive Analysis:

The hospital information system market is highly competitive, driven by innovation and strategic collaborations. Key players include Carestream Health, Siemens Healthineers, McKesson Corp., Philips Healthcare, Merge Healthcare Inc. (IBM), GE Healthcare, and Cerner Corp. (Oracle). These companies focus on expanding digital health portfolios, enhancing interoperability, and improving data security. It continues to witness mergers, acquisitions, and partnerships aimed at strengthening global presence and customer base. Cloud-based platforms, AI-driven analytics, and mobile integration remain core areas of investment. Vendors differentiate through customizable solutions, strong service support, and compliance with regulatory frameworks. Growing adoption in emerging economies further intensifies competition, pushing companies to deliver scalable and cost-effective systems.

Recent Developments:

- In August 2024, McKesson Corp signed an agreement to acquire a controlling interest of about 70% in Community Oncology Revitalization Enterprise Ventures (Core Ventures) for $2.49 billion in cash.

- In April 2025, Siemens Healthineers and Tower Health launched a 10-year Value Partnership aimed at equipment enhancement, technology modernization, and clinical improvements.

Report Coverage:

The research report offers an in-depth analysis based on Type, Deployment, Component and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Adoption of AI-driven decision support tools will strengthen diagnostic accuracy and clinical efficiency.

- Cloud-based platforms will dominate deployments, offering scalability and remote accessibility for hospitals of all sizes.

- Integration with telehealth services will expand, enabling better continuity of care beyond hospital settings.

- Interoperability will improve, allowing smoother data exchange across electronic health records and external systems.

- Hospitals will invest in cybersecurity solutions to safeguard patient information against rising digital threats.

- Patient engagement tools, including mobile apps and portals, will become standard features of HIS platforms.

- Vendors will focus on customizable solutions to meet diverse regional and institutional healthcare needs.

- Partnerships between healthcare providers and technology companies will increase, fostering innovation and service expansion.

- Adoption in emerging economies will accelerate, supported by government initiatives and infrastructure upgrades.

- The hospital information system market will continue to evolve as a foundation for data-driven, value-based healthcare delivery.