Market Overview:

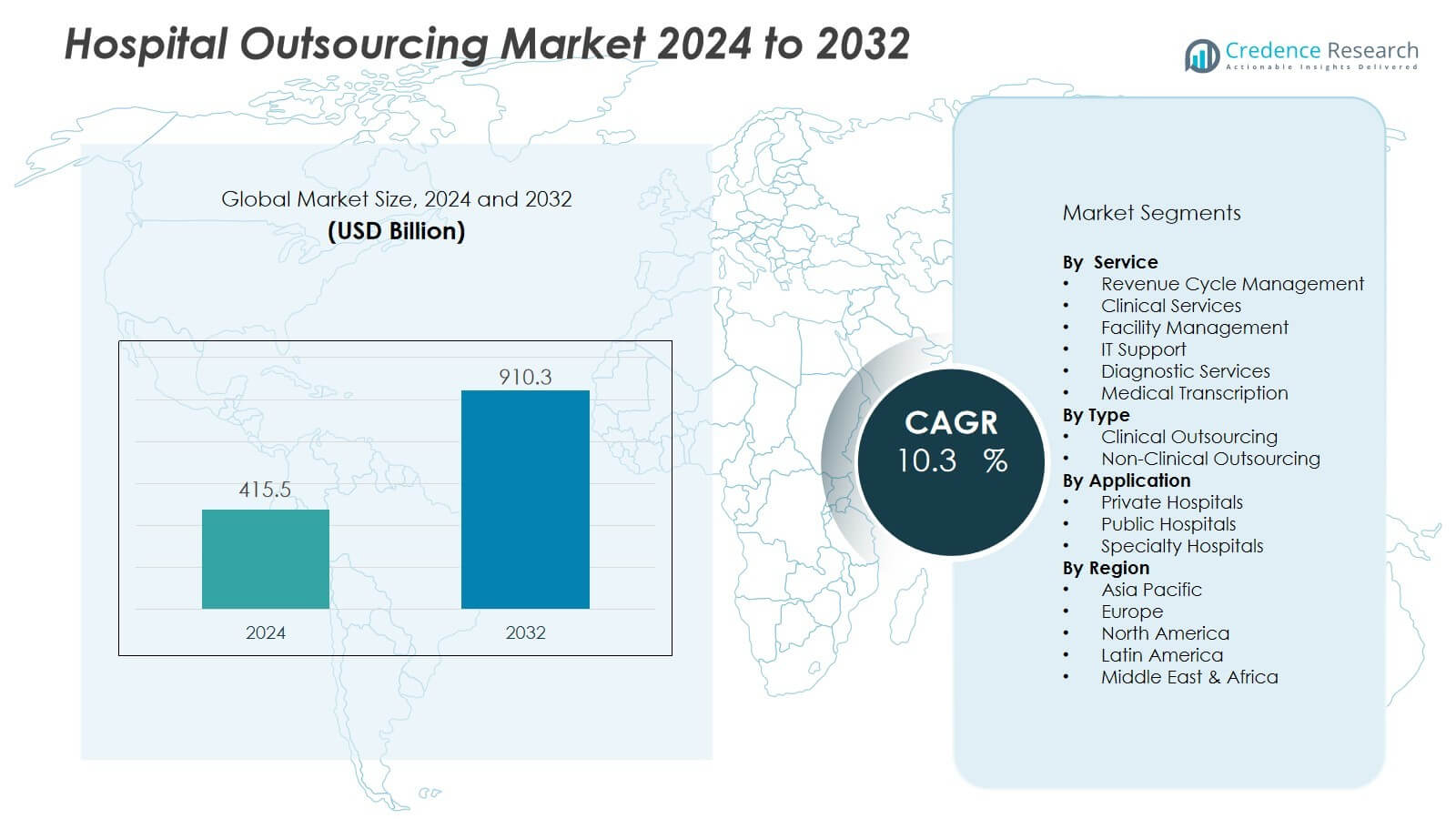

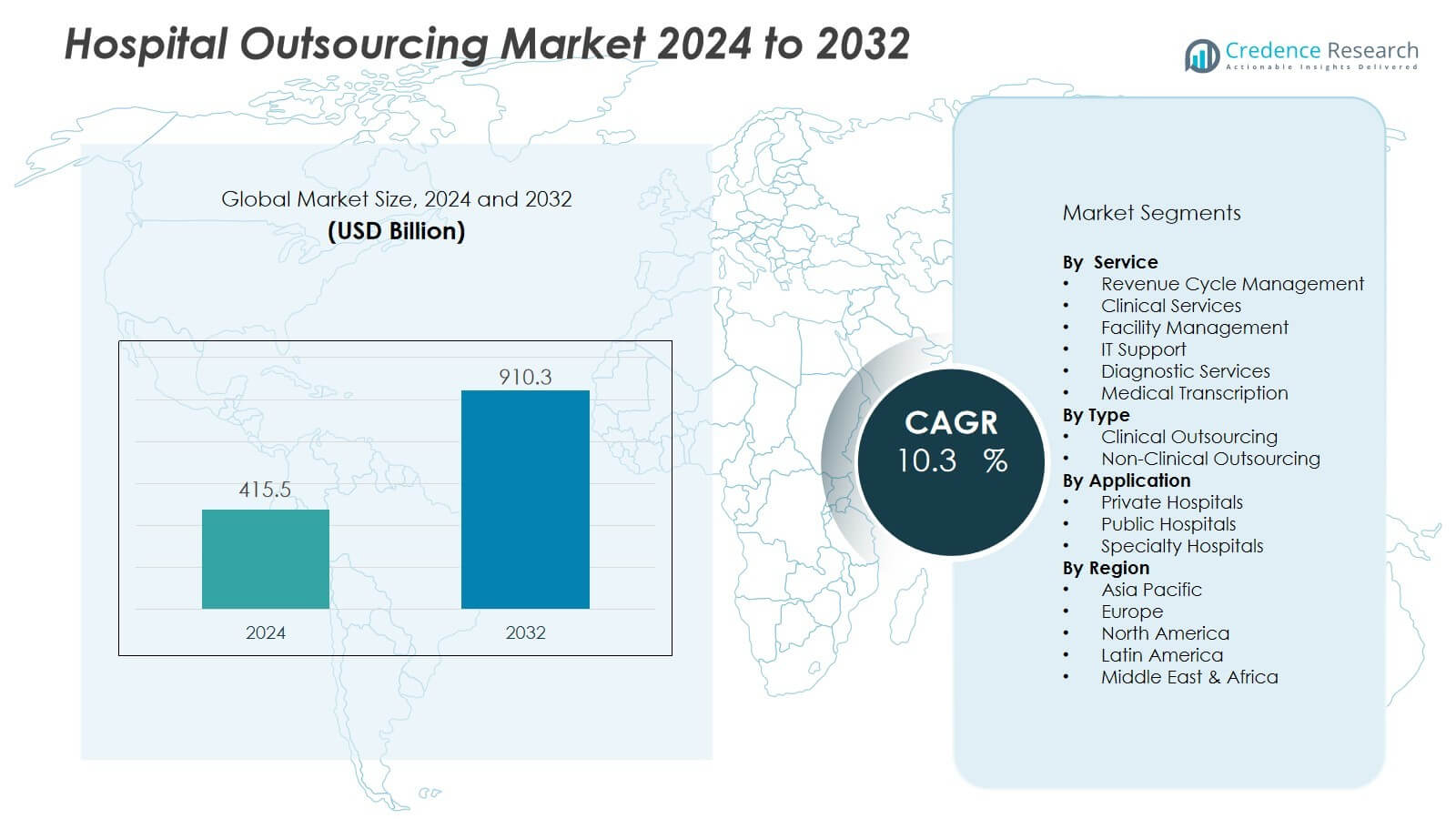

The hospital outsourcing market size was valued at USD 415.5 billion in 2024 and is anticipated to reach USD 910.3 billion by 2032, at a CAGR of 10.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hospital Outsourcing Market Size 2024 |

USD 415.5 Billion |

| Hospital Outsourcing Market, CAGR |

10.3% |

| Hospital Outsourcing Market Size 2032 |

USD 910.3 Billion |

Key drivers shaping the hospital outsourcing market include the need for specialized expertise, reduced labor costs, and the pressure to comply with strict healthcare regulations. Hospitals are outsourcing functions such as medical billing, revenue cycle management, facility management, IT services, and clinical processes to improve efficiency and maintain quality standards. Rising patient volumes, coupled with the integration of advanced technologies in outsourced services, further accelerates market expansion.

Regionally, North America leads the hospital outsourcing market due to the strong presence of advanced healthcare infrastructure and high outsourcing adoption rates. Europe follows closely, driven by government support for cost-effective healthcare solutions and efficiency improvement initiatives. Asia-Pacific is projected to record the fastest growth, fueled by rising healthcare expenditure, increasing private hospital networks, and rapid digital adoption in countries such as India and China. Latin America and the Middle East & Africa also present growth opportunities with expanding hospital infrastructure and increasing demand for specialized outsourcing services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The hospital outsourcing market was valued at USD 415.5 billion in 2024 and is set to reach USD 910.3 billion by 2032.

- Rising pressure to cut healthcare costs pushes hospitals to outsource non-core services such as billing and IT.

- Specialized expertise and advanced technologies like AI and cloud systems strengthen efficiency and compliance.

- Hospitals use outsourcing to improve patient satisfaction, reduce waiting times, and enhance service quality.

- Data security and compliance challenges remain critical, with risks tied to HIPAA and GDPR regulations.

- North America leads with 42% share in 2024, followed by Europe at 30% and Asia-Pacific at 20%.

- Asia-Pacific is expected to record the fastest growth, supported by digital adoption and private hospital expansion.

Market Drivers:

Rising Pressure to Reduce Healthcare Costs:

The hospital outsourcing market is driven by the growing pressure on hospitals to reduce operational expenses. Rising treatment costs, limited budgets, and strict reimbursement models push hospitals to seek external expertise. Outsourcing non-core services such as billing, facility management, and IT allows healthcare providers to allocate resources toward patient care. It creates measurable savings while ensuring efficiency across departments.

- For instance, Cognizant deployed 23 robotic process automation bots to fully automate its benefits eligibility verification process, handling 5,000 transactions per day at 100% accuracy and saving 17,000 staff hours annually.

Need for Specialized Expertise and Technology:

Hospitals face increasing complexity in managing functions like revenue cycle management, diagnostics, and clinical data handling. The hospital outsourcing market benefits from access to specialized expertise and advanced technologies through third-party providers. It enables hospitals to maintain accuracy and compliance in highly regulated environments. Outsourcing partners also offer digital solutions such as AI-enabled billing systems and cloud-based data management, which strengthen efficiency.

- For Instance, Oracle Cerner’s cloud-based CommunityWorks platform is deployed at more than 300 community, critical access, and specialty hospitals in 46 U.S. states, integrating EMR data sources for improved patient health insights while maintaining regulatory compliance.

Focus on Patient-Centered Care and Service Quality:

Healthcare providers are under constant pressure to improve patient satisfaction and outcomes. The hospital outsourcing market supports this shift by allowing hospitals to focus on core medical services. It frees medical staff from administrative burdens while enhancing service quality through reliable outsourced functions. This approach improves patient experiences, reduces waiting times, and strengthens the hospital’s reputation.

Growing Demand Across Emerging Economies:

Rapid growth in healthcare infrastructure across Asia-Pacific, Latin America, and the Middle East fuels demand for outsourcing. The hospital outsourcing market in these regions is expanding as hospitals adopt cost-efficient models. It addresses workforce shortages, rising patient volumes, and the need for modern healthcare delivery. Strong private investments and digital adoption also encourage hospitals to outsource specialized functions to ensure scalability.

Market Trends:

Integration of Digital Solutions and Automation:

The hospital outsourcing market is witnessing strong adoption of digital platforms and automation tools to streamline operations. Hospitals increasingly rely on outsourced partners that provide AI-driven billing, robotic process automation, and cloud-based data systems. It helps minimize errors, improve speed, and ensure regulatory compliance in critical functions such as revenue cycle management and clinical documentation. Outsourcing providers also invest in cybersecurity and data protection to secure sensitive patient information. Hospitals benefit from reduced administrative workloads and greater transparency in service delivery. The trend highlights a shift from labor-intensive models to technology-driven outsourcing partnerships that strengthen efficiency and accountability.

- For instance, Anthem, a leading health insurance company, implemented AI-driven solutions that reduced claim denials by detecting billing discrepancies and verifying patient eligibility, leading to a significant improvement in billing accuracy and faster claim processing

Shift Toward Value-Based Care and Strategic Partnerships:

The hospital outsourcing market is influenced by the global transition toward value-based healthcare. Hospitals aim to enhance patient outcomes while controlling costs, which drives demand for outsourcing partners with specialized expertise. It supports hospitals in delivering consistent quality by handling tasks like diagnostic services, facility management, and supply chain optimization. Outsourcing providers are increasingly entering long-term partnerships to ensure sustainable cost savings and service improvements. Hospitals also prefer partners offering integrated solutions that align with their strategic goals. This trend reflects a move from transactional outsourcing toward strategic collaborations that focus on long-term value creation and patient satisfaction.

- For instance, GE Healthcare’s Edison AI-enabled Critical Care Suite embedded on its Optima XR240amx mobile X-ray system accelerated pneumothorax detection from 3.092 seconds to 0.913 seconds, achieving a 338% performance speedup in prioritizing critical cases.

Market Challenges Analysis:

Concerns Over Data Security and Compliance:

The hospital outsourcing market faces challenges due to growing concerns over data security and regulatory compliance. Hospitals transfer sensitive patient information to third-party providers, which creates risks of breaches and unauthorized access. It raises concerns for healthcare administrators and regulators, especially under strict laws such as HIPAA and GDPR. Outsourcing partners must invest heavily in cybersecurity and compliance frameworks to maintain trust. Failure to ensure robust safeguards can lead to legal penalties, reputational damage, and loss of patient confidence. Hospitals remain cautious when choosing outsourcing partners, focusing on those with proven security capabilities.

Dependency Risks and Quality Control Issues:

The hospital outsourcing market is also challenged by dependency on external providers for critical operations. Hospitals risk service disruptions if vendors fail to deliver on performance standards. It creates potential issues in areas such as billing accuracy, supply chain management, and diagnostic support. Maintaining consistent service quality across diverse outsourcing partners remains a major concern. Contract management and monitoring require significant resources to ensure accountability. Hospitals must balance cost savings with strict quality benchmarks to avoid compromising patient care and organizational reputation.

Market Opportunities:

Expansion Through Advanced Technology Integration:

The hospital outsourcing market presents strong opportunities through the integration of advanced technologies. Outsourcing providers are investing in AI, automation, and analytics to deliver faster and more accurate services. It enhances efficiency in billing, clinical data management, and patient support systems. Hospitals that adopt these solutions gain improved transparency and streamlined workflows. The rising demand for digital transformation in healthcare creates space for outsourcing partners to differentiate their offerings. This shift allows hospitals to achieve better patient outcomes while optimizing costs.

Growth Potential in Emerging Economies:

The hospital outsourcing market is expanding in emerging regions where healthcare systems face rising patient volumes and limited resources. Hospitals in Asia-Pacific, Latin America, and the Middle East are increasingly adopting outsourcing to improve efficiency and service quality. It supports the growth of private healthcare networks while addressing staff shortages and cost pressures. Outsourcing providers offering scalable and affordable solutions are well positioned to capture demand. Growing investments in healthcare infrastructure further strengthen opportunities for long-term partnerships. The trend reflects a strong pathway for global players to expand their footprint across high-growth markets.

Market Segmentation Analysis:

By Service:

The hospital outsourcing market is segmented by services such as revenue cycle management, clinical services, facility management, and IT support. Revenue cycle management dominates due to the rising complexity of billing and insurance processes. It helps hospitals reduce administrative costs and ensure compliance with regulatory frameworks. Clinical outsourcing, including diagnostics and medical transcription, is growing with the need for accuracy and specialized expertise. Facility management and IT support remain vital to maintain smooth operations and strengthen digital adoption.

- For Instance, In 2024, Quest Diagnostics expanded into the Canadian market by acquiring LifeLabs, Canada’s leading provider of laboratory diagnostic information. This acquisition enhances access to diagnostic innovation, with LifeLabs retaining its over 6,500 employees, brand, and headquarters. Combining the companies’ expertise is expected to improve processing speed and service quality through investments in new resources and technologies.

By Type:

The market is categorized into clinical and non-clinical outsourcing. Clinical outsourcing covers diagnostic imaging, laboratory services, and pharmacy services, which are expanding with increased demand for accuracy and efficiency. Non-clinical outsourcing includes housekeeping, catering, procurement, and administrative functions. It helps hospitals streamline non-medical operations, reduce expenses, and allocate resources toward patient care. Both categories contribute to improved service delivery and long-term hospital sustainability.

- For Instance, Roche’s Cobas 8800 laboratory platform is a high-throughput molecular diagnostics system that can process up to 1,056 tests in an 8-hour shift, or up to 4,128 tests over 24 hours.

By Application:

Applications include private hospitals, public hospitals, and specialty hospitals. Private hospitals hold a major share due to high adoption of outsourcing to improve competitiveness and efficiency. It enables them to focus on patient-centered care while outsourcing complex administrative and clinical tasks. Public hospitals are also adopting outsourcing to address staff shortages and rising patient volumes. Specialty hospitals rely on outsourcing to strengthen niche services such as diagnostics, rehabilitation, and emergency care. This segmentation highlights broad opportunities across diverse healthcare institutions.

Segmentations:

By Service:

- Revenue Cycle Management

- Clinical Services

- Facility Management

- IT Support

- Diagnostic Services

- Medical Transcription

By Type:

- Clinical Outsourcing

- Non-Clinical Outsourcing

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds 42% market share in the hospital outsourcing market in 2024, supported by advanced healthcare infrastructure and high outsourcing penetration. The United States leads the region with extensive adoption of revenue cycle management, IT support, and clinical data outsourcing. It is driven by rising healthcare costs, strict compliance needs, and demand for specialized expertise. Large outsourcing providers in the region offer integrated services that align with value-based care models. Hospitals focus on enhancing efficiency and meeting regulatory requirements by partnering with specialized vendors. Growth is also supported by strong investments in digital healthcare solutions that strengthen outsourcing demand.

Europe:

Europe accounts for 30% market share in the hospital outsourcing market in 2024, supported by government initiatives promoting cost-efficient healthcare models. Countries such as Germany, the UK, and France are key adopters, driven by aging populations and increased patient loads. It creates demand for outsourcing services in areas such as diagnostics, facility management, and supply chain operations. The region emphasizes compliance and quality assurance, which increases reliance on specialized providers. Hospitals focus on balancing cost efficiency with high standards of care delivery. Strategic partnerships across public and private healthcare systems support outsourcing adoption and long-term service contracts.

Asia-Pacific:

Asia-Pacific holds 20% market share in the hospital outsourcing market in 2024, fueled by expanding private healthcare networks and rising healthcare spending. China and India lead with strong adoption in billing, diagnostic services, and IT outsourcing. It is supported by rapid urbanization, high patient volumes, and increasing investments in healthcare infrastructure. Hospitals in the region seek scalable outsourcing solutions to address workforce shortages and improve operational efficiency. Digital adoption also accelerates outsourcing in both public and private hospitals. The region is expected to record the highest growth rate during the forecast period, creating strong opportunities for global and regional providers.

Key Player Analysis:

- Allscripts

- The Allure Group

- Cerner Corporation

- Integrated Medical Transport

- Aramark Corporation

- LogistiCare Solutions, LLC (ModivCare)

- Sodexo

- Flatworld Solutions Inc.

- ABM INDUSTRIES INCORPORATED

- Abbott

Competitive Analysis:

The hospital outsourcing market is highly competitive, driven by global and regional service providers offering specialized solutions. Key players include Allscripts, The Allure Group, Cerner Corporation, Integrated Medical Transport, Aramark Corporation, LogistiCare Solutions, LLC (ModivCare), Sodexo, and Flatworld Solutions Inc. Companies focus on expanding service portfolios, strengthening digital platforms, and building long-term partnerships with hospitals. It allows them to address rising demand for revenue cycle management, IT services, facility operations, and clinical support. Strategic initiatives such as mergers, technology investments, and partnerships help firms enhance their market presence. Competition is shaped by the ability to deliver cost savings, regulatory compliance, and improved patient service outcomes. Global players target large hospital networks, while regional providers capture niche opportunities by offering tailored solutions. The competitive environment continues to evolve with digital adoption, requiring providers to innovate and align services with the growing shift toward value-based healthcare.

Recent Developments:

- In August 2024, Northrim Horizon acquired Allure Medspa, a multi-location medical spa platform in the Phoenix metro area, appointing Kylie Tan as CEO to lead expansion.

- In July 2025, Aramark Sports + Entertainment formed a strategic partnership with VENU, a live music venue operator, which includes managing food & beverage concessions, retail, and facilities for VENU’s amphitheaters alongside an equity investment.

Report Coverage:

The research report offers an in-depth analysis based on Service, Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Hospitals will continue outsourcing non-core functions to reduce costs and focus on patient care.

- The demand for digital outsourcing solutions will rise with the integration of AI and automation.

- It will benefit from growing adoption of cloud-based platforms for clinical and administrative functions.

- Strategic partnerships between hospitals and outsourcing providers will expand to ensure long-term value.

- The focus on cybersecurity and regulatory compliance will shape vendor selection and service design.

- It will see rising demand for outsourcing in diagnostics, medical transcription, and imaging services.

- Emerging economies will drive strong growth, supported by expanding hospital networks and healthcare spending.

- Outsourcing providers offering integrated and scalable solutions will gain competitive advantage.

- It will be influenced by the global shift toward value-based healthcare and outcome-driven models.

- Hospitals will increasingly adopt outsourcing models to handle staffing shortages and operational complexity.