Market Overview

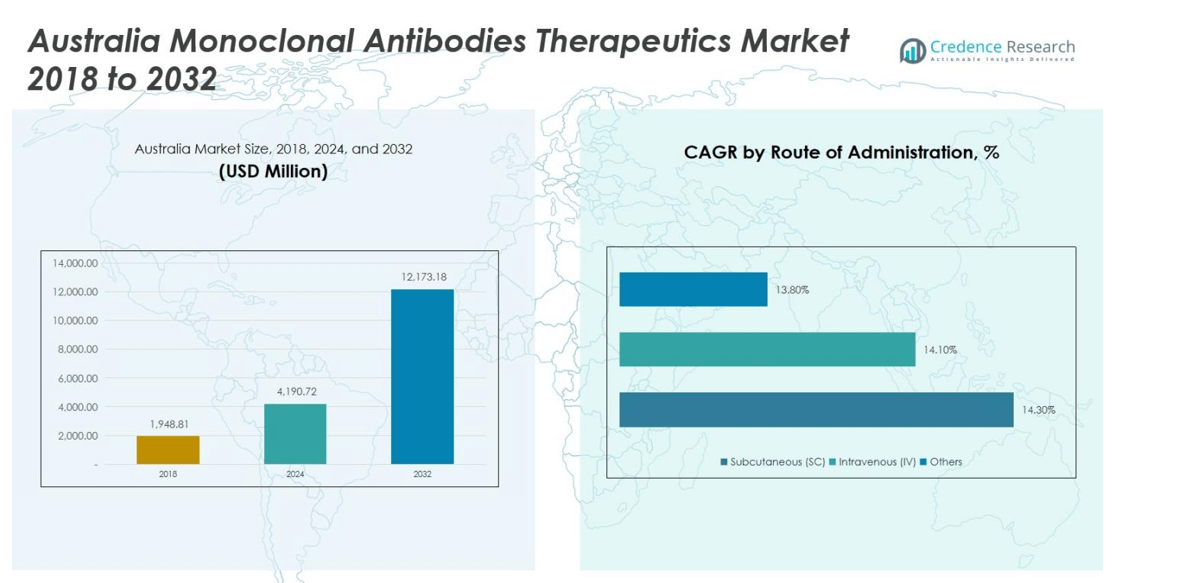

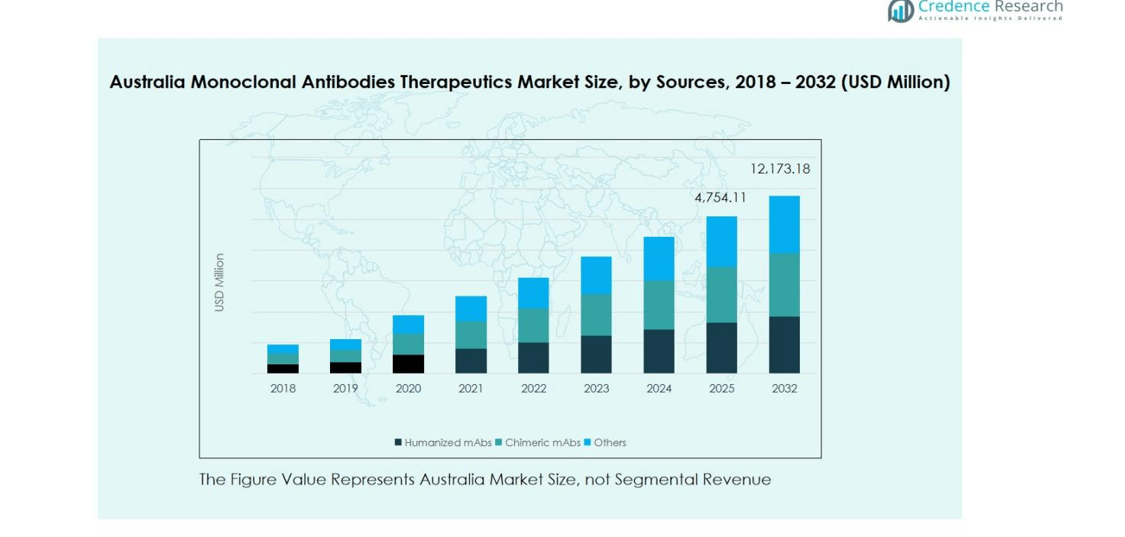

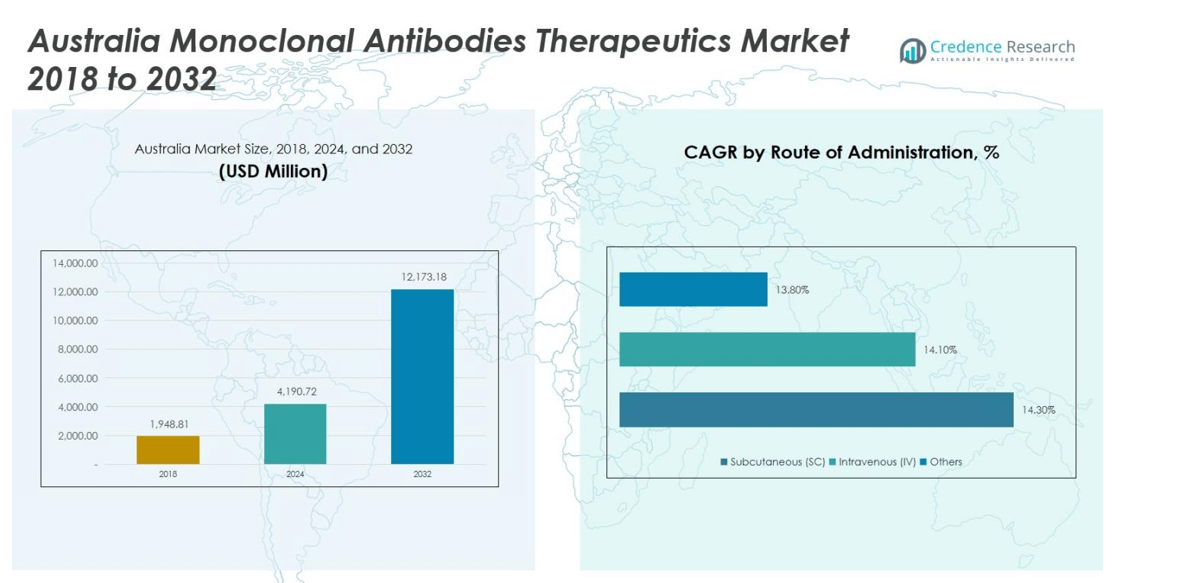

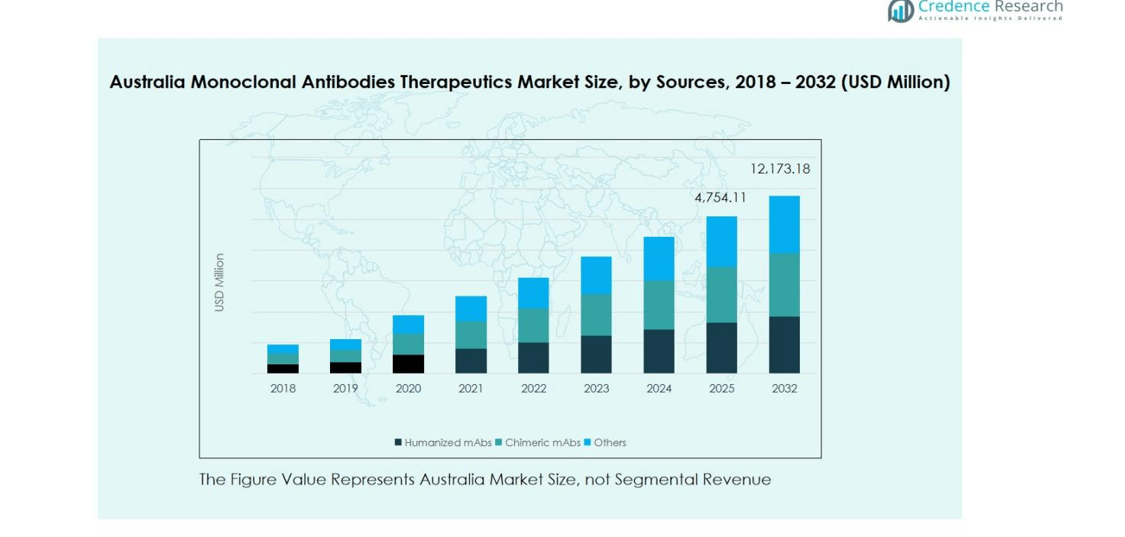

Australia Monoclonal Antibodies Therapeutics Market size was valued at USD 1,948.81 million in 2018, is expected to reach USD 4,190.72 million in 2024, and is anticipated to reach USD 12,173.18 million by 2032, growing at a CAGR of 14.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 4,190.72 million |

| Australia Monoclonal Antibodies Therapeutics Market, CAGR |

14.1% |

| Australia Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 12,173.18 million |

The Australia Monoclonal Antibodies Therapeutics Market is highly competitive, led by key players including F. Hoffmann-La Roche Ltd, AbbVie Inc., Sanofi, Bristol Myers Squibb, Novartis AG, Amgen Inc., AstraZeneca, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies drive market growth through innovation, robust product portfolios, and strategic collaborations, particularly in oncology and autoimmune therapies. Geographically, New South Wales is the leading region, commanding a market share of 32%, supported by advanced healthcare infrastructure, specialized hospitals, and active clinical research. Victoria follows with 25%, benefiting from early adoption of biologics and strong research institutions. Queensland contributes 18% through expanding healthcare access and growing patient awareness, while Western Australia holds 12%, reflecting increasing uptake of targeted therapies. Together, these regions form the core of Australia’s monoclonal antibodies therapeutics market, enabling sustained growth and innovation.

Market Insights

- The Australia Monoclonal Antibodies Therapeutics Market was valued at USD 4,190.72 million in 2024 and is expected to reach USD 12,173.18 million by 2032, growing at a CAGR of 14.1%.

- Growth is driven by rising prevalence of cancer and autoimmune diseases, increasing adoption of humanized and fully human monoclonal antibodies, and supportive government reimbursement policies.

- Key trends include the growing use of personalized medicine, biomarker-driven targeted therapies, and expansion of home-based and subcutaneous administration for patient convenience.

- The market is highly competitive with major players such as F. Hoffmann-La Roche Ltd, AbbVie Inc., Sanofi, Bristol Myers Squibb, Novartis AG, Amgen Inc., and AstraZeneca focusing on R&D, collaborations, and product innovation.

- Regionally, New South Wales leads with 32% share, followed by Victoria at 25% and Queensland at 18%, while humanized mAbs dominate the sources segment with 55% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

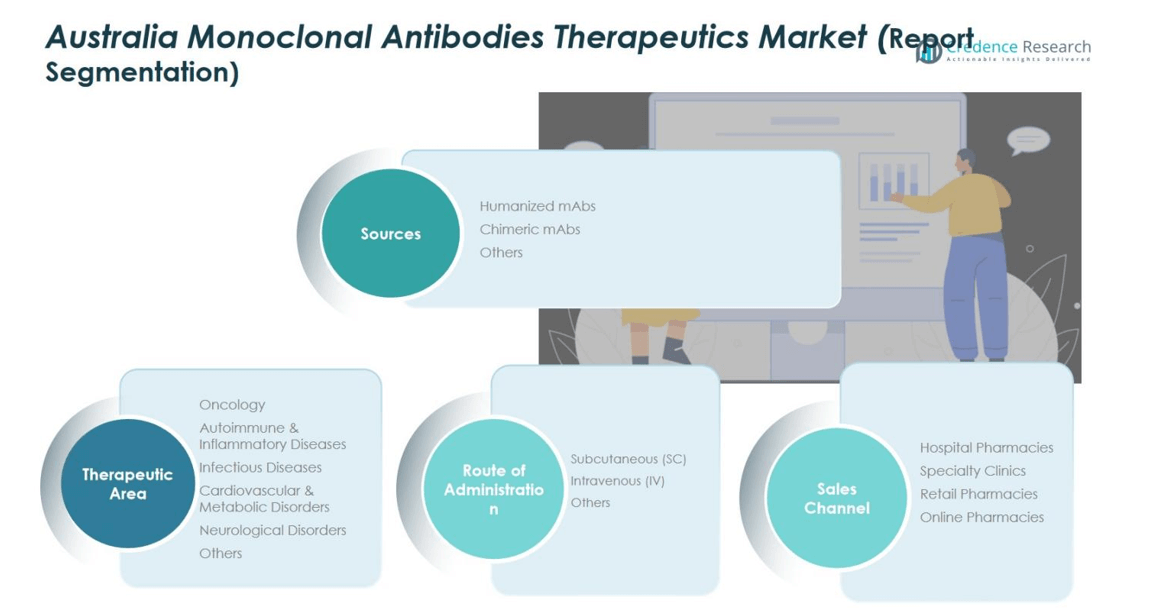

Market Segmentation Analysis:

By Sources:

The Australia Monoclonal Antibodies Therapeutics Market by sources is dominated by Humanized mAbs, accounting for approximately 55% of the market share. Humanized antibodies have gained traction due to their higher efficacy and lower immunogenicity compared to chimeric and other antibodies. The growing prevalence of chronic diseases and cancer, along with increasing R&D investments in advanced biologics, are driving the adoption of humanized mAbs. Chimeric mAbs hold a 30% share, while other mAbs contribute 15%, primarily used in niche therapeutic applications and experimental therapies.

By Therapeutic Area:

Oncology leads the therapeutic area segment, representing around 50% of the market share, driven by the rising incidence of cancer in Australia and the development of targeted therapies. Autoimmune & inflammatory diseases account for 20%, supported by the increasing adoption of biologics for conditions such as rheumatoid arthritis and psoriasis. Infectious diseases, cardiovascular & metabolic disorders, and neurological disorders collectively contribute 30%, with growth propelled by expanding research pipelines, increasing awareness, and government initiatives promoting immunotherapy-based treatments.

- For instance, in autoimmune diseases, Biocon Biologics launched NEPEXTO, a biosimilar to Enbrel (etanercept), in Australia in July 2025 to treat conditions like rheumatoid arthritis, expanding affordable treatment options and enhancing market access for biologic therapies.

By Route of Administration:

In terms of administration, the market is dominated by Intravenous (IV) delivery, capturing 60% of the market share, owing to its rapid systemic delivery and established use in hospitals and specialty clinics. Subcutaneous (SC) administration holds about 30%, gaining popularity due to patient convenience and home-based treatment potential. The remaining 10% is occupied by other routes, which are primarily used in clinical trials and niche therapies. Rising demand for personalized treatment and advancements in formulation technologies continue to drive the segment.

- For instance, Argenx’s VYVGART Hytrulo, approved by the FDA in 2024, allows patients with generalized myasthenia gravis to self-inject a larger-volume formulation comfortably using hyaluronidase-mediated absorption.

Key Growth Drivers

Increasing Prevalence of Chronic and Cancerous Diseases

The rising incidence of chronic conditions and cancers in Australia is a primary growth driver for the monoclonal antibodies therapeutics market. Oncology and autoimmune disorders are contributing significantly to market demand, as targeted biologic therapies offer higher efficacy and improved patient outcomes compared to conventional treatments. Increasing disease burden, combined with early diagnosis and growing patient awareness, fuels the adoption of monoclonal antibody therapies. Hospitals, specialty clinics, and research centers are increasingly incorporating these therapies, expanding their use across both clinical and home-based treatment settings.

- For instance, Monoclonal antibodies such as daratumumab for multiple myeloma and trastuzumab for breast cancer are routinely used in major hospitals, and clinical trials are exploring combination regimens to enhance response rates and lower relapse risk.

Advancements in Biopharmaceutical Research and Development

Continuous innovation in biopharmaceutical research is driving the market, as companies focus on developing next-generation monoclonal antibodies with enhanced specificity and reduced side effects. Investments in R&D have led to humanized and fully human antibodies, boosting efficacy and patient compliance. Collaborations between pharmaceutical firms and research institutions accelerate clinical trials and regulatory approvals, while technology-driven approaches, such as antibody engineering and immunotherapy advancements, expand therapeutic applications. This focus on innovation strengthens the pipeline of novel therapies, sustaining long-term market growth.

- For instance, AstraZeneca’s Tezspire (tezepelumab), a human monoclonal antibody approved in 2022 for severe asthma, demonstrated a 56% reduction in annual asthma exacerbations during clinical trials.

Favorable Government Policies and Reimbursement Initiatives

Supportive regulatory frameworks and reimbursement policies in Australia are stimulating market expansion. Government initiatives promoting biologics, immunotherapy, and personalized medicine facilitate patient access to high-cost therapies, while public healthcare coverage reduces financial barriers. Accelerated approval pathways and funding programs encourage clinical development and commercialization of monoclonal antibodies. These measures not only attract domestic and international investments but also enable faster adoption in hospitals and specialty clinics, driving overall market growth and enhancing the availability of innovative therapies to a broader patient population.

Key Trends and Opportunities

Rising Adoption of Personalized and Targeted Therapies

The trend toward personalized medicine is reshaping the monoclonal antibodies therapeutics landscape. Targeted therapies are increasingly preferred for oncology and autoimmune treatments due to their precision and reduced adverse effects. Clinicians leverage biomarker-driven patient profiling to optimize therapy selection, improving treatment outcomes and patient compliance. Pharmaceutical companies are aligning pipelines with these trends, introducing therapies tailored to specific genetic and disease profiles. This approach enhances therapeutic efficiency and opens opportunities for expanding into niche patient segments and rare disease applications.

- For instance, AbbVie has developed Humira (adalimumab), a monoclonal antibody approved for multiple autoimmune conditions, which exemplifies targeted therapy by inhibiting tumor necrosis factor-alpha (TNF-α) to reduce inflammation.

Expansion of Home-Based and Subcutaneous Administration

The increasing acceptance of subcutaneous monoclonal antibody therapies supports market opportunities, particularly for home-based treatments. Patients benefit from convenience, reduced hospital visits, and improved quality of life, while healthcare providers optimize resource utilization. Pharmaceutical companies are innovating self-administration devices and user-friendly formulations, promoting adherence and expanding market reach. This trend aligns with the growing preference for patient-centric care and telemedicine services, creating opportunities to capture untapped market segments and support long-term sustainable growth in the monoclonal antibodies therapeutics market.

- For instance, trastuzumab (Herceptin®) has an approved subcutaneous formulation for HER2-positive breast cancer, simplifying long-term therapy and enabling home administration.

Key Challenges

High Cost of Monoclonal Antibody Therapies

The substantial cost associated with monoclonal antibody therapies remains a key challenge for market expansion. High treatment prices limit patient accessibility and create financial pressure on healthcare systems, especially for chronic and long-term conditions. Although reimbursement policies mitigate some barriers, cost-sensitive patients and smaller clinics may face challenges in adopting these therapies. Pricing pressures also affect market competition, compelling companies to balance innovation and affordability. Addressing these financial hurdles is crucial to ensure broader adoption and equitable access across diverse patient populations in Australia.

Stringent Regulatory and Approval Processes

Complex and rigorous regulatory requirements present challenges in the commercialization of monoclonal antibody therapies. Lengthy clinical trials, safety evaluations, and compliance with manufacturing standards can delay product launches and increase development costs. Navigating these processes requires substantial investment in regulatory expertise and documentation. Additionally, evolving guidelines and approvals for novel therapies may affect time-to-market, impacting competitive positioning. Companies must adopt proactive regulatory strategies and maintain high-quality standards to overcome these challenges while ensuring patient safety and sustaining market growth.

Regional Analysis

New South Wales

New South Wales dominates the Australia monoclonal antibodies therapeutics market, holding a market share of 32%. The region benefits from advanced healthcare infrastructure, a high concentration of hospitals and specialty clinics, and strong research facilities focusing on oncology and autoimmune diseases. Government support and active participation in clinical trials further accelerate adoption. Rising patient awareness and increasing prevalence of chronic diseases contribute to market growth. Investment in healthcare technology and collaborations between biopharmaceutical companies and research institutions also strengthen the region’s market position, making New South Wales a critical hub for monoclonal antibody therapies in Australia.

Victoria

Victoria accounts for 25% of the Australian monoclonal antibodies therapeutics market. The state demonstrates robust healthcare infrastructure with numerous hospitals, specialty clinics, and research institutions engaged in immunotherapy development. A high prevalence of cancer and autoimmune disorders, coupled with early adoption of advanced therapies, drives market growth. Government initiatives promoting biologics and patient-centric care enhance therapy accessibility. Collaboration between pharmaceutical companies and medical research centers accelerates the introduction of innovative monoclonal antibody treatments. Victoria’s focus on clinical trials, patient education, and technologically advanced healthcare delivery positions the state as a key contributor to Australia’s monoclonal antibodies market.

Queensland

Queensland contributes 18% of the market share in Australia’s monoclonal antibodies therapeutics segment. Growth in the region is driven by expanding healthcare infrastructure, rising incidence of oncology and autoimmune disorders, and increasing patient awareness. Specialty clinics and hospitals are adopting biologics, supported by government funding and reimbursement programs. Queensland is witnessing an increase in clinical trials and research collaborations, boosting the availability of targeted therapies. Rising demand for both intravenous and subcutaneous administration methods strengthens market adoption. The state’s investment in healthcare technology and innovative therapies ensures Queensland plays a significant role in the country’s monoclonal antibodies market.

Western Australia

Western Australia holds a 12% share of the monoclonal antibodies therapeutics market in Australia. The region’s growth is supported by advanced hospital networks, specialty care centers, and an increasing focus on oncology and autoimmune disease treatments. Rising patient preference for targeted therapies and subcutaneous administration fuels market adoption. Government-backed healthcare initiatives and reimbursement policies enhance access to biologics, encouraging wider utilization. Collaborative research programs with pharmaceutical companies facilitate the introduction of innovative monoclonal antibodies. With growing awareness of chronic disease management and increasing investments in healthcare infrastructure, Western Australia continues to strengthen its position in the national monoclonal antibodies therapeutics market.

South Australia

South Australia contributes 8% of the market share in the monoclonal antibodies therapeutics segment. The state’s growth is driven by the presence of specialized healthcare facilities and research institutions focused on biologics and immunotherapy. Rising prevalence of cancer and autoimmune disorders supports the adoption of monoclonal antibodies. Government initiatives and reimbursement programs improve patient accessibility to high-cost therapies. Hospitals and specialty clinics are increasingly integrating targeted monoclonal antibody treatments into their service offerings. Clinical research collaborations and technology adoption further strengthen the market. South Australia’s strategic initiatives and healthcare investment ensure steady growth in the monoclonal antibodies therapeutics market.

Tasmania

Tasmania accounts for 3% of Australia’s monoclonal antibodies therapeutics market. The region’s market is gradually expanding due to increasing patient awareness and growing prevalence of chronic diseases. Hospitals and specialty clinics are adopting targeted therapies, supported by government reimbursement initiatives. Limited population size constrains growth, but healthcare infrastructure improvements and regional research programs facilitate access to monoclonal antibody therapies. Subcutaneous administration is gaining traction due to patient convenience and home-based treatment options. Tasmania’s healthcare focus on immunotherapy and collaborations with larger pharmaceutical companies ensures consistent market development, contributing to Australia’s overall monoclonal antibodies therapeutics growth.

Australian Capital Territory

The Australian Capital Territory holds a 2% market share in the monoclonal antibodies therapeutics segment. The region benefits from advanced healthcare facilities and research centers specializing in immunotherapy and oncology treatments. Government support for biologics and early adoption of innovative therapies drive market growth. Hospitals and specialty clinics integrate monoclonal antibodies into treatment protocols, particularly for cancer and autoimmune disorders. Limited population size moderates the overall market size, but high per-capita adoption and patient awareness ensure steady growth. Research collaborations and healthcare investments continue to strengthen the region’s role in supporting monoclonal antibody therapy expansion across Australia.

Northern Territory

The Northern Territory contributes 2% of the Australian monoclonal antibodies therapeutics market. Market growth is supported by improving healthcare infrastructure, rising patient awareness, and government reimbursement initiatives. Specialty clinics and hospitals are gradually adopting monoclonal antibodies for oncology and autoimmune diseases. Population constraints and limited healthcare access in remote areas pose challenges, but targeted government programs and regional healthcare projects are increasing therapy availability. Subcutaneous administration and home-based treatment solutions are helping improve adoption. Strategic collaborations with pharmaceutical companies and investment in healthcare technology further support the Northern Territory’s gradual growth within the national monoclonal antibodies therapeutics market.

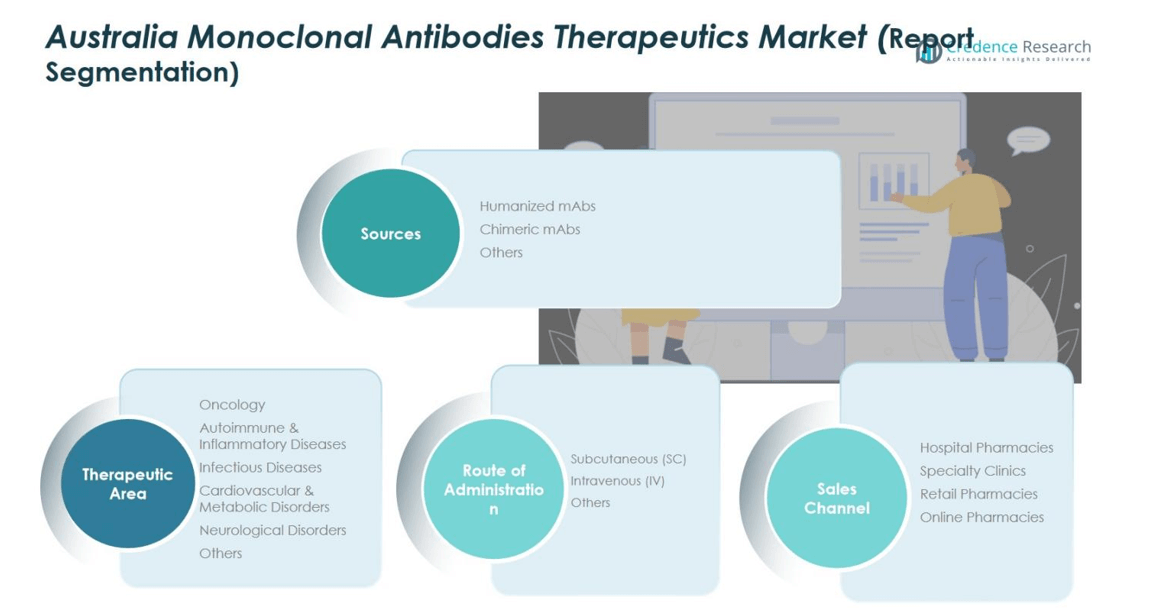

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- New Southwales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Australian Capital Territory

- Northern Teritory

Competitive Landscape

The competitive landscape of the Australia Monoclonal Antibodies Therapeutics Market features key players including F. Hoffmann-La Roche Ltd, AbbVie Inc., Sanofi, Bristol Myers Squibb, Novartis AG, Amgen Inc., AstraZeneca, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies lead the market through continuous innovation, robust product portfolios, and strategic collaborations. Intense competition is driven by the introduction of novel humanized and fully human monoclonal antibodies targeting oncology, autoimmune, and infectious diseases. Companies are focusing on enhancing manufacturing capabilities, expanding R&D pipelines, and forming partnerships with hospitals and research institutions to accelerate product launches. Regulatory compliance and adoption of patient-centric approaches further strengthen market positioning. The competitive intensity encourages innovation in formulation, administration methods, and targeted therapies, ensuring sustained growth while meeting evolving patient and healthcare provider demands in Australia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- AbbVie Inc.

- Bristol Myers Squibb Company

- Novartis AG

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

- Other Key Players

Recent Developments

- In September 2025, Eisai Co., Ltd. announced that LEQEMBI® (Lecanemab) was approved for the treatment of Alzheimer’s disease in Australia.

- In 2025, Neuraxpharm Australia was established in Sydney to commercialize the prescription brands Nuvigil® (armodafinil) and Modavigil® (modafinil), both indicated for the treatment of excessive daytime sleepiness in adults with narcolepsy, which were acquired by Neuraxpharm in December 2024.

- In November 2024, HaemaLogiX, a biotech company focusing on blood cancer treatments, announced plans for an initial public offering (IPO) on the Australian Securities Exchange (ASX) in the second quarter of 2025.

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness strong growth driven by rising prevalence of cancer and autoimmune disorders.

- Increasing adoption of humanized and fully human monoclonal antibodies will expand therapeutic applications.

- Advancements in biopharmaceutical research will accelerate the development of next-generation targeted therapies.

- Government support and reimbursement initiatives will enhance patient access to high-cost biologics.

- Subcutaneous and home-based administration methods will gain wider acceptance among patients.

- Personalized medicine and biomarker-driven treatments will become more prominent in clinical practice.

- Collaborations between pharmaceutical companies and research institutions will strengthen innovation pipelines.

- Growing patient awareness and early diagnosis will support higher therapy adoption rates.

- Expansion of specialty clinics and hospital networks will improve therapy accessibility across regions.

- Continuous investment in R&D and manufacturing capabilities will sustain long-term market competitiveness.