Market Overview

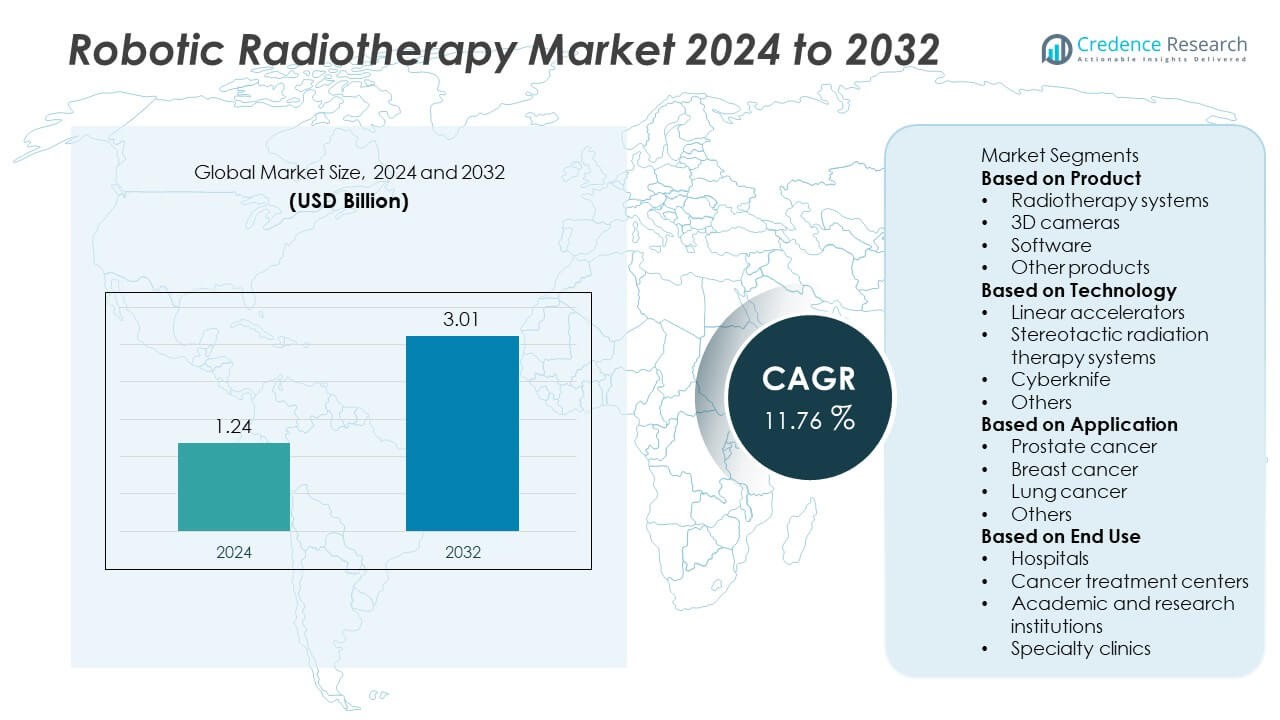

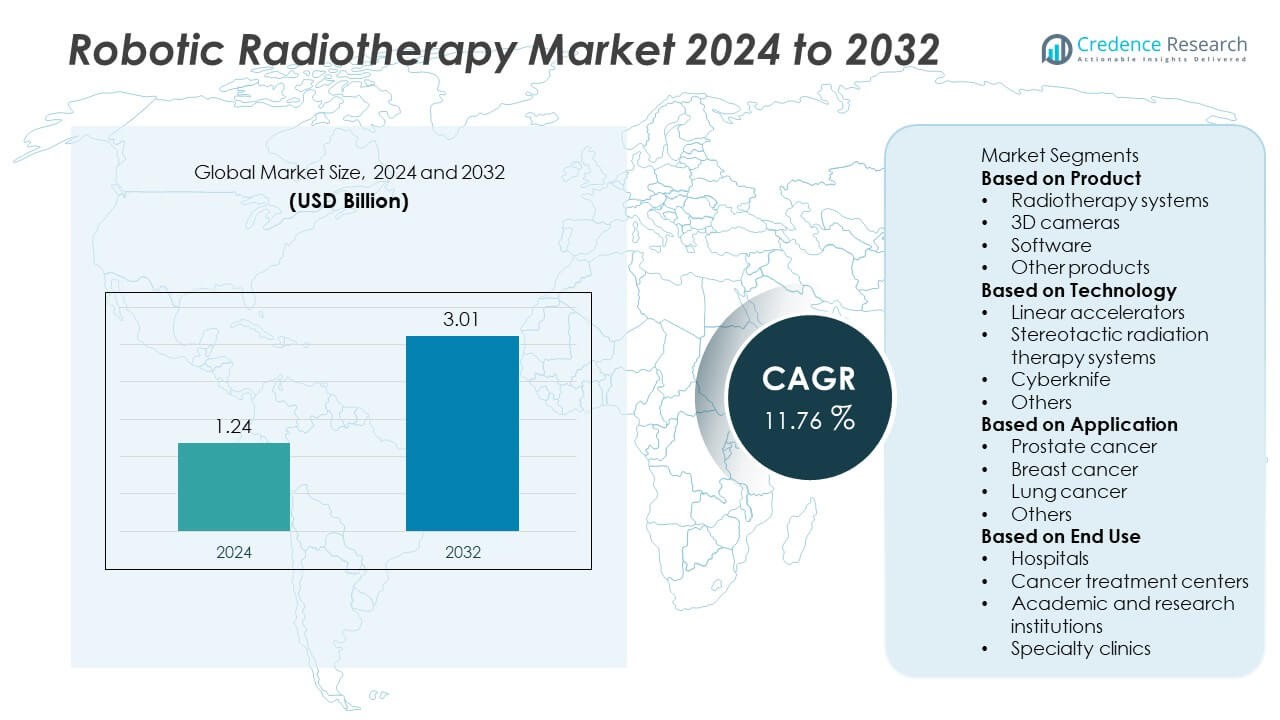

The Robotic Radiotherapy market was valued at USD 1.24 billion in 2024 and is projected to reach USD 3.01 billion by 2032, growing at a CAGR of 11.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Radiotherapy Market Size 2024 |

USD 1.24 Billion |

| Robotic Radiotherapy Market, CAGR |

11.76% |

| Robotic Radiotherapy Market Size 2032 |

USD 3.01 Billion |

The robotic radiotherapy market is led by major players such as Mevion, Brainlab, RefleXion, Mitsubishi Electric, Accuray, GE Healthcare, Ion Beam Applications, Hitachi, Elekta, and Shinva. These companies dominate through innovations in image-guided systems, adaptive treatment planning, and real-time tumor tracking technologies. North America led the market with a 41% share in 2024, driven by strong healthcare infrastructure, high cancer incidence, and widespread adoption of precision radiotherapy systems. Europe followed with a 30% share, supported by advanced oncology centers and government-funded healthcare programs, while Asia-Pacific held 22%, driven by rapid healthcare expansion and growing investments in modern cancer treatment technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The robotic radiotherapy market was valued at USD 1.24 billion in 2024 and is projected to reach USD 3.01 billion by 2032, expanding at a CAGR of 11.76%.

- Market growth is driven by rising global cancer prevalence, increasing demand for precision oncology, and expanding adoption of robotic-assisted treatment systems in hospitals and cancer centers.

- Key trends include the integration of AI and real-time imaging for adaptive treatment planning, along with growing preference for non-invasive, outpatient radiation therapies.

- The market is moderately consolidated, with leading players such as Accuray, Elekta, GE Healthcare, and RefleXion focusing on R&D, product innovation, and partnerships to enhance global market presence.

- North America led the market with a 41% share in 2024, followed by Europe with 30% and Asia-Pacific with 22%; among technologies, Cyberknife held a 47% share due to its high accuracy and versatility in targeting complex tumors.

Market Segmentation Analysis:

By Product

Radiotherapy systems dominated the robotic radiotherapy market with a 61% share in 2024. Their leadership stems from the growing demand for precision radiation delivery and reduced treatment times in oncology. These systems integrate robotic arms, motion tracking, and imaging modules to enhance tumor targeting accuracy while minimizing damage to healthy tissues. Increasing adoption in hospitals and cancer centers, coupled with technological advancements in beam modulation and adaptive therapy, continues to drive this segment. The integration of software-based control systems further improves treatment precision and operational efficiency across healthcare facilities.

- For instance, Accuray’s CyberKnife platform, across its various models, has been used in over 500,000 patient treatments globally. The technology, which includes systems like the CyberKnife S7, utilizes 6D robotic delivery and real-time motion synchronization to achieve sub-millimeter targeting.

By Technology

Cyberknife technology held the largest 47% share of the robotic radiotherapy market in 2024. Its dominance is driven by the system’s ability to deliver highly focused radiation beams with sub-millimeter accuracy. The non-invasive, real-time motion tracking and adaptive targeting features make Cyberknife ideal for treating complex tumors in critical areas such as the spine, brain, and lungs. Growing preference for outpatient cancer care and shorter treatment durations supports adoption. Advancements in AI-driven treatment planning and patient-specific dose optimization are further enhancing its clinical effectiveness and global market penetration.

- For instance, Stanford Health Care operated more than 10 CyberKnife systems that treated over 15,000 cancer patients using Accuray’s Synchrony motion tracking technology. The precision capability enables dose delivery with positional accuracy within 0.5 mm, supporting high control rates for intracranial and spinal tumors.

By Application

Prostate cancer accounted for a 42% share of the robotic radiotherapy market in 2024. The segment’s growth is attributed to rising prostate cancer prevalence and the growing preference for non-invasive, high-precision treatment options. Robotic radiotherapy provides superior accuracy, minimizing side effects on surrounding organs such as the bladder and rectum. Increasing awareness of early cancer detection and the adoption of image-guided and motion-compensated radiotherapy methods are accelerating segment growth. Expanding use of robotic systems in multi-site oncology networks also supports faster treatment delivery and improved patient outcomes.

Key Growth Drivers

Rising Global Cancer Incidence

The increasing prevalence of cancer worldwide is a major driver for the robotic radiotherapy market. With growing cases of prostate, breast, and lung cancers, healthcare systems are adopting advanced radiotherapy solutions for effective, non-invasive treatment. Robotic radiotherapy offers superior precision, minimizing damage to healthy tissues while enhancing patient recovery. The demand for targeted therapies is rising, especially in aging populations. This shift toward precision oncology continues to fuel market growth across hospitals, cancer centers, and research institutions globally.

- For instance, Elekta’s Unity MRI-guided radiotherapy system utilizes integrated 1.5T MRI and linear accelerator technology, and as of mid-2023, the associated MOMENTUM study announced it had surpassed 4,000 patients recruited.

Advancements in Imaging and Motion Tracking Technologies

Innovations in real-time imaging and motion tracking systems are transforming robotic radiotherapy effectiveness. These technologies allow clinicians to accurately track tumor movement and adjust beam delivery with sub-millimeter precision. Integration of AI and 3D imaging enhances treatment accuracy for tumors located in complex or mobile regions. Such technological progress reduces side effects and improves survival outcomes. The adoption of these advancements across major oncology centers supports wider implementation of robotic systems in radiotherapy.

- For instance, RefleXion’s SCINTIX biology-guided radiotherapy system uses 64 PET detectors and real-time emissions to track tumor motion dynamically during treatment. The system achieves continuous beam adjustment with sub-second latency, enhancing outcomes in lung and bone metastasis cases.

Shift Toward Non-Invasive and Outpatient Cancer Treatments

The increasing preference for non-invasive treatment options has accelerated the adoption of robotic radiotherapy systems. Patients benefit from shorter recovery times, fewer complications, and minimal hospital stays. Healthcare providers are focusing on outpatient radiation centers equipped with advanced robotic solutions to handle growing patient volumes efficiently. This shift aligns with cost-effective healthcare delivery models, promoting greater access to precision radiotherapy while improving operational efficiency for medical institutions worldwide.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

Artificial intelligence is reshaping robotic radiotherapy by improving tumor localization, treatment planning, and dose optimization. AI algorithms enable adaptive radiation delivery, ensuring continuous realignment with tumor movement during sessions. Automation also enhances workflow efficiency by reducing setup times and improving patient throughput. These advancements present strong opportunities for healthcare providers to deliver faster, more accurate, and personalized treatments while minimizing clinician workload and improving clinical outcomes.

- For instance, Brainlab’s ExacTrac Dynamic system integrates AI-driven surface guidance with thermal imaging, enabling automatic patient position verification in less than 1.5 seconds. The platform processes over 300,000 tracking points per second, enhancing adaptive treatment accuracy for cranial and spine radiotherapy.

Expansion of Robotic Radiotherapy in Emerging Markets

Emerging economies are witnessing increasing investments in oncology infrastructure and robotic radiotherapy installations. Governments and private hospitals are prioritizing advanced cancer care technologies to address growing patient needs. Rising healthcare expenditure, favorable reimbursement frameworks, and growing awareness of precision therapy are expanding opportunities in regions such as Asia-Pacific and the Middle East. This trend supports wider accessibility and adoption of robotic radiotherapy across diverse healthcare systems.

- For instance, Hitachi has numerous proton therapy system installations, including facilities in Japan, China, and Singapore, with some systems having a smaller footprint than conventional solutions. Its compact proton beam technology has been noted to reduce facility size requirements, promoting broader adoption in oncology centers.

Key Challenges

High Equipment and Maintenance Costs

The high cost of robotic radiotherapy systems poses a major barrier to adoption, especially in developing markets. Advanced imaging, software integration, and robotic components significantly increase installation and maintenance expenses. These costs often limit accessibility to large hospitals and specialized oncology centers. Additionally, the requirement for trained personnel and service contracts adds to the financial burden, slowing market penetration among smaller healthcare facilities.

Complex Operational Requirements and Skill Gaps

Operating robotic radiotherapy systems requires specialized technical expertise and continuous staff training. The complexity of treatment planning, calibration, and real-time monitoring creates operational challenges for healthcare institutions. Limited availability of trained oncologists and radiotherapists skilled in robotic systems hinders smooth adoption. Bridging this gap through education, certification programs, and technology partnerships remains essential to ensure optimal performance and consistent treatment outcomes.

Regional Analysis

North America

North America held the largest share of 41% in the robotic radiotherapy market in 2024. The region’s dominance is driven by advanced healthcare infrastructure, high cancer prevalence, and strong adoption of precision oncology technologies. The United States leads regional growth, supported by large-scale hospital investments and research collaborations in AI-based radiation systems. Increasing preference for non-invasive treatment methods and favorable reimbursement policies are accelerating market expansion. Continuous technological innovation by key medical device manufacturers further strengthens North America’s leadership in robotic radiotherapy adoption and clinical implementation.

Europe

Europe accounted for a 30% share of the robotic radiotherapy market in 2024. Growth is supported by expanding cancer care facilities, government funding for radiology infrastructure, and the rising adoption of robotic-assisted treatments. Countries such as Germany, France, and the United Kingdom are investing heavily in next-generation linear accelerators and Cyberknife systems. The region benefits from early regulatory approvals and active collaborations between hospitals and technology developers. Increasing cancer awareness, aging populations, and growing demand for high-precision radiation therapy continue to drive the European market forward.

Asia-Pacific

Asia-Pacific captured a 22% share of the robotic radiotherapy market in 2024. The region’s growth is fueled by rising healthcare investments, an increasing cancer burden, and government initiatives to modernize oncology infrastructure. Countries like China, Japan, and India are witnessing rapid adoption of robotic treatment systems to improve clinical accuracy and patient recovery rates. Expanding medical tourism and the availability of cost-effective robotic platforms are further boosting demand. Collaborations between global manufacturers and local healthcare providers are helping strengthen the region’s capacity for advanced radiotherapy delivery.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the robotic radiotherapy market in 2024. Growth is supported by increasing investments in oncology care and the establishment of advanced cancer treatment centers. The United Arab Emirates, Saudi Arabia, and Israel are leading adoption, focusing on precision-based radiotherapy and early cancer detection. Strategic collaborations with global technology suppliers are enhancing local expertise. However, limited funding, high equipment costs, and uneven access to specialized care continue to restrain widespread adoption across several parts of Africa.

Latin America

Latin America represented a 3% share of the robotic radiotherapy market in 2024. Regional growth is driven by improvements in healthcare infrastructure, rising cancer cases, and expanding adoption of modern radiation technologies. Brazil and Mexico dominate the market due to government-backed healthcare reforms and partnerships with international equipment providers. Increasing focus on early diagnosis and non-invasive treatment options is enhancing clinical outcomes. However, high installation costs and a shortage of skilled oncology professionals remain key challenges that limit the region’s broader market development.

Market Segmentations:

By Product

- Radiotherapy systems

- 3D cameras

- Software

- Other products

By Technology

- Linear accelerators

- Stereotactic radiation therapy systems

- Cyberknife

- Others

By Application

- Prostate cancer

- Breast cancer

- Lung cancer

- Others

By End Use

- Hospitals

- Cancer treatment centers

- Academic and research institutions

- Specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotic radiotherapy market includes major players such as Mevion, Brainlab, RefleXion, Mitsubishi Electric, Accuray, GE Healthcare, Ion Beam Applications, Hitachi, Elekta, and Shinva. These companies compete through advancements in imaging precision, motion tracking, and real-time adaptive radiation systems. Leading manufacturers focus on integrating artificial intelligence and automation to enhance treatment accuracy and workflow efficiency. Strategic collaborations with oncology centers, research institutions, and healthcare providers are expanding market penetration. Continuous investments in developing compact, cost-effective, and patient-specific robotic radiotherapy systems are further shaping competition. The market remains moderately consolidated, with top players emphasizing innovation in stereotactic radiation and linear accelerator technologies to strengthen clinical outcomes and global presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Elekta reported Unity MRI-guided RT improved urinary symptoms in prostate cancer. Elekta also highlighted adaptive innovations at ASTRO 2025.

- In January 2025, Accuray announced that the company’s Radixact SynC System and CyberKnife S7 System had been approved by the Chinese National Medical Products Administration (NMPA).

- In June 2024, Accuray announced a partnership with Apollo Cancer Centres (ACC) to launch the India Sub-Continent’s first robotic and stereotactic therapy education centre, the Robotic & Stereotactic Radiosurgery Program.

- In July 2023, GE HealthCare, a leading global medical technology, diagnostics, and digital solutions innovator, extended its collaboration with Elekta, a leader in radiation therapy, in the Indian market to expand access to precision radiation therapy solutions.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for robotic radiotherapy systems will continue to grow with rising global cancer cases.

- Integration of AI and machine learning will enhance treatment precision and adaptive planning.

- Compact and cost-efficient robotic systems will gain traction in emerging markets.

- Hospitals will increasingly adopt non-invasive robotic treatments for outpatient care.

- Advancements in imaging and motion tracking will improve real-time tumor targeting.

- Collaboration between technology firms and oncology centers will accelerate clinical adoption.

- Growing preference for personalized radiation therapy will shape product development.

- Asia-Pacific will emerge as a major growth hub with expanding healthcare investments.

- Continuous R&D will drive innovations in dose delivery and patient safety.

- Strategic partnerships and mergers among key players will strengthen market competitiveness.