Market Overview

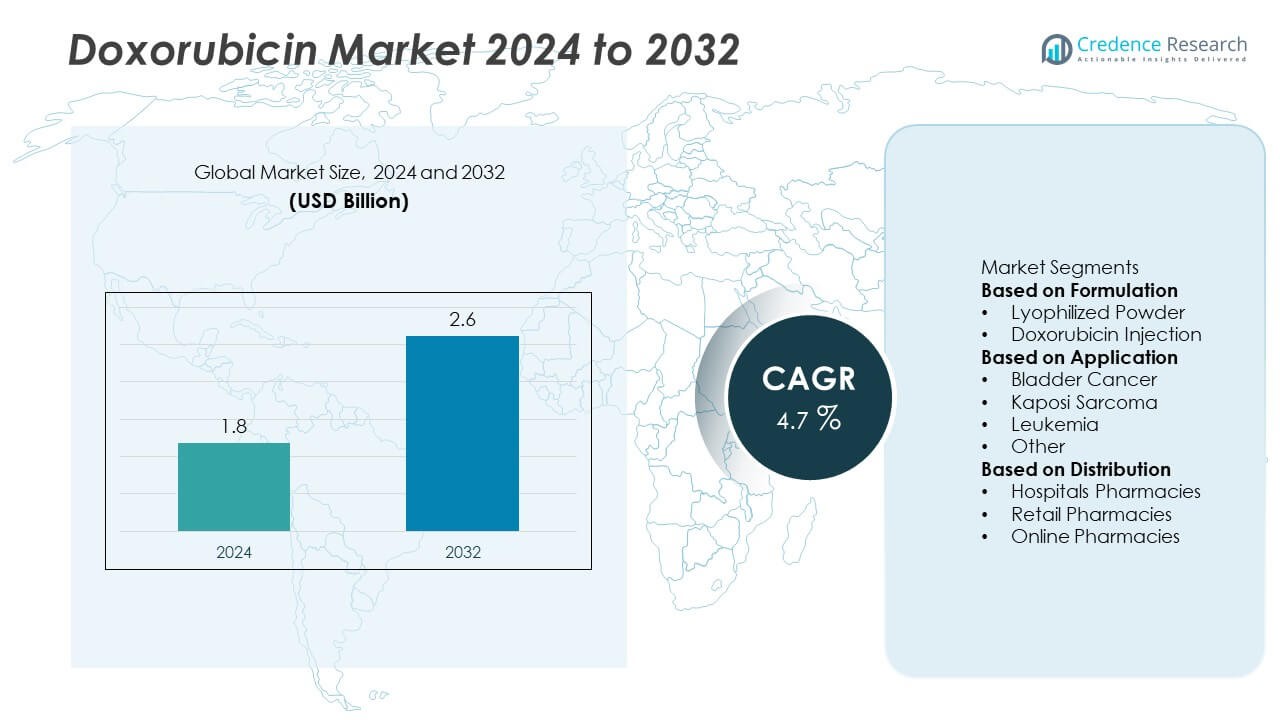

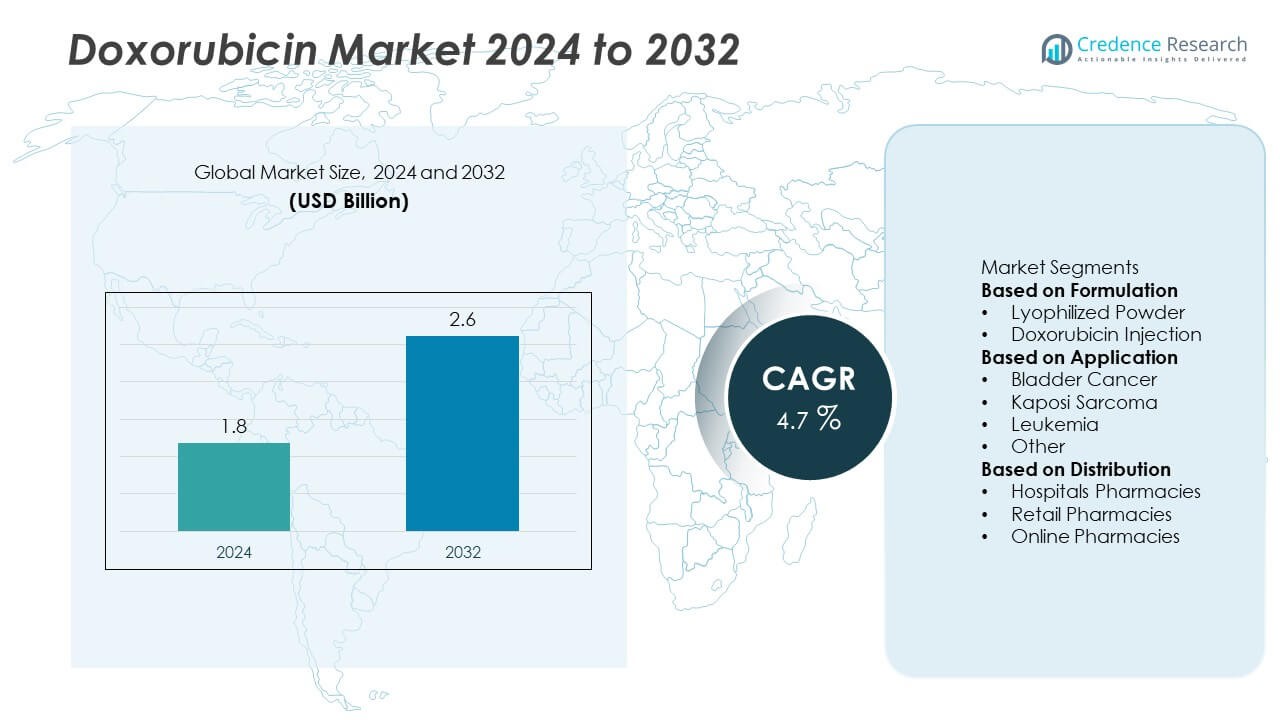

The Doxorubicin market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.6 billion by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Doxorubicin market Size 2024 |

USD 1.8 Billion |

| Doxorubicin market , CAGR |

4.7% |

| Doxorubicin market Size 2032 |

USD 2.6 Billion |

The Doxorubicin market is led by major companies including Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Johnson & Johnson Services, Inc., Baxter, Cipla, Cadila Pharmaceuticals, SRS Life Sciences, and MicroBiopharm Japan Co., Ltd. These players dominate through a strong oncology drug portfolio, advanced manufacturing facilities, and strategic distribution networks. Novartis and Pfizer lead in innovation and global presence, while Sun Pharma and Dr. Reddy’s strengthen generic supply chains. North America leads the market with a 37% share, followed by Europe with 29% and Asia-Pacific with 25%, driven by growing cancer treatment infrastructure and rising chemotherapy adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Doxorubicin market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.6 billion by 2032, growing at a CAGR of 4.7%.

- Rising global cancer incidence and increasing adoption of chemotherapy drugs are driving strong market demand across oncology centers.

- Liposomal and nanoparticle formulations are emerging trends, improving drug safety and expanding applications in advanced cancer treatment.

- Leading companies such as Novartis AG, Pfizer Inc., and Sun Pharmaceutical Industries Ltd. focus on formulation innovation, manufacturing expansion, and global partnerships.

- North America leads with a 37% share, followed by Europe with 29% and Asia-Pacific with 25%, while the doxorubicin injection segment dominates with 67% share due to its extensive use in chemotherapy regimens.

Market Segmentation Analysis:

By Formulation

The doxorubicin injection segment dominated the market with a 67% share in 2024. Its leadership is driven by its widespread use in chemotherapy regimens for various cancers, including leukemia, breast cancer, and sarcoma. Doxorubicin injection provides controlled dosage delivery and better absorption, making it the preferred choice among oncologists. The increasing availability of liposomal formulations and reduced cardiotoxicity risks further enhance its clinical adoption. Hospitals and cancer treatment centers continue to favor injectable forms due to their proven efficacy and ease of administration in combination therapies.

- For instance, Pfizer’s largest manufacturing site in Kalamazoo, Michigan produces over 140 million units of sterile injectables and other medicines annually. The facility also manufactures active pharmaceutical ingredients and medical devices, distributing products to over 100 countries globally.

By Application

The leukemia segment held the largest 36% share of the doxorubicin market in 2024. Rising incidence of blood-related cancers and the drug’s inclusion in standard chemotherapy protocols drive this dominance. Doxorubicin remains a cornerstone treatment for acute lymphoblastic and myeloid leukemia due to its strong antitumor activity. Expanding access to advanced oncology care and ongoing clinical trials for targeted formulations support steady growth. Increasing patient survival rates and treatment adherence contribute further to the segment’s sustained market leadership.

- For instance, Dr. Reddy’s Laboratories generic doxorubicin hydrochloride liposome injection is approved for treating specific cancers, including ovarian cancer, multiple myeloma, and AIDS-related Kaposi’s sarcoma.

By Distribution

Hospital pharmacies accounted for a dominant 58% share of the doxorubicin market in 2024. The segment’s strength stems from high inpatient chemotherapy administration and the availability of specialized oncology units. Hospitals serve as primary distribution centers for both branded and generic injectable formulations. The increasing number of cancer care facilities and government-supported oncology programs reinforce this dominance. Retail and online pharmacies are expanding gradually as outpatient chemotherapy and home-based cancer care gain traction, but hospital networks remain the key supply channel for regulated oncology drugs.

Key Growth Drivers

Rising Cancer Incidence Worldwide

The global increase in cancer prevalence is a primary driver for the doxorubicin market. Growing cases of breast, leukemia, and sarcoma cancers have boosted demand for effective chemotherapeutic agents. Doxorubicin’s proven efficacy as a broad-spectrum antitumor drug makes it a key component in combination therapies. Advancements in oncology diagnostics and expanding healthcare access in developing economies further support usage. Increasing cancer awareness programs and rising government investments in cancer treatment infrastructure are expected to sustain steady demand over the coming years.

- For instance, Johnson & Johnson Services, through its Janssen oncology division, is involved in supporting oncology treatment and patient care globally. Their initiatives include research, patient support programs, and collaborations with the medical community.

Advancements in Liposomal Formulations

The development of liposomal doxorubicin formulations has significantly enhanced drug delivery and reduced toxicity risks. Liposomal technology minimizes cardiotoxicity and improves drug targeting to cancerous cells, increasing treatment safety and effectiveness. Leading pharmaceutical companies are investing in long-acting and pegylated variants that extend circulation time and reduce adverse effects. The availability of liposomal forms across multiple cancer types supports clinical acceptance. Growing adoption of targeted chemotherapy solutions is further strengthening this formulation-driven market expansion.

- For instance, the pegylated liposomal doxorubicin formulation DOXIL® achieved a prolonged plasma half-life of approximately 55 hours in humans, a significant increase over conventional doxorubicin. In clinical trials, it demonstrated reduced cardiotoxicity compared to conventional doxorubicin.

Growing Healthcare Expenditure and Oncology Investments

Rising healthcare spending and the establishment of advanced oncology centers globally are accelerating market growth. Governments and private players are increasing funding for cancer care infrastructure and chemotherapy drug availability. Pharmaceutical firms are also investing in oncology R&D pipelines focused on improving doxorubicin efficacy. The expansion of reimbursement coverage and improved drug distribution in emerging economies enhance patient access. Increasing partnerships between research institutions and biopharma companies continue to stimulate innovation and expand therapeutic applications of doxorubicin.

Key Trends and Opportunities

Shift Toward Combination Chemotherapy and Targeted Therapy

Doxorubicin is increasingly used in combination with targeted therapies and immunotherapies to improve cancer treatment outcomes. The trend toward personalized medicine has expanded its role in customized oncology regimens. Research on combining doxorubicin with monoclonal antibodies and kinase inhibitors is yielding promising results in resistant cancer types. Pharmaceutical companies are focusing on optimizing dosage schedules to minimize side effects while enhancing efficacy. This evolution in treatment approaches is creating new clinical and commercial opportunities for doxorubicin-based therapies worldwide.

- For instance, a phase 2 trial (NCT04028063) combining doxorubicin with dual CTLA-4/PD-1 blockade (zalifrelimab + balstilimab) for advanced soft tissue sarcoma enrolled 28 evaluable patients and achieved a median progression-free survival of 25.3 weeks (approximately 5.8 months).

Increasing Use of Nanotechnology in Drug Delivery

Nanotechnology is transforming the administration of chemotherapeutic drugs, including doxorubicin. Nanocarrier systems enhance bioavailability, reduce systemic toxicity, and enable site-specific delivery of the drug. Companies are exploring polymer-based nanoparticles and lipid-based carriers to improve drug stability. Such innovations support safer and more effective cancer management, especially in advanced-stage cases. The growing focus on nanomedicine and precision oncology presents a significant opportunity for expanding doxorubicin applications in both solid and hematologic malignancies.

- For instance, researchers developed polymer-lipid hybrid nanoparticles loaded with doxorubicin where the larger particles had an average size of 255.7 ± 18.45 nm and achieved encapsulation efficiency of 67.2%.

Key Challenges

Cardiotoxicity and Adverse Drug Reactions

Despite its effectiveness, doxorubicin use is limited by serious side effects such as cardiotoxicity and myelosuppression. Long-term use can cause irreversible heart damage, especially in patients receiving cumulative high doses. These risks necessitate careful dose management and frequent cardiac monitoring. The introduction of liposomal and nanoparticle formulations has reduced toxicity but not completely eliminated it. Managing adverse events remains a key clinical challenge, prompting research into less toxic analogs and safer delivery mechanisms to maintain therapeutic efficacy.

High Treatment Cost and Limited Accessibility

The high cost of doxorubicin-based chemotherapy, particularly liposomal formulations, poses a major barrier in low- and middle-income regions. Limited healthcare funding and inadequate reimbursement restrict patient access to advanced cancer treatments. In addition, supply chain inefficiencies and pricing disparities across markets affect drug availability. Generic versions have helped improve affordability but face quality and regulatory constraints in certain countries. Expanding access to affordable, high-quality oncology drugs remains crucial for addressing the unmet demand in emerging markets.

Regional Analysis

North America

North America held a 37% share of the Doxorubicin market in 2024, driven by advanced cancer care infrastructure and widespread availability of oncology drugs. The United States leads regional demand due to a high cancer burden, strong reimbursement systems, and the presence of key pharmaceutical manufacturers. Ongoing R&D in liposomal doxorubicin formulations and growing adoption of precision oncology support steady market growth. The increasing number of chemotherapy centers and rising awareness of early cancer diagnosis continue to strengthen North America’s dominance in the global Doxorubicin market.

Europe

Europe accounted for a 29% share of the Doxorubicin market in 2024, supported by well-established healthcare systems and high adoption of innovative cancer therapies. Countries such as Germany, France, and the United Kingdom are major contributors, driven by strong oncology research and government-backed healthcare programs. The region benefits from regulatory approval of advanced formulations like pegylated liposomal doxorubicin. Increasing prevalence of breast and hematologic cancers further boosts regional demand. Expanding use of combination chemotherapy and rising investment in biopharmaceutical research continue to enhance Europe’s position in the market.

Asia-Pacific

Asia-Pacific captured a 25% share of the Doxorubicin market in 2024, propelled by rising cancer incidence and improving healthcare access in China, India, and Japan. Rapid expansion of oncology hospitals and favorable government policies on cancer care contribute to market growth. The growing availability of generic doxorubicin and cost-effective treatment options attract patients across the region. Pharmaceutical companies are investing in local manufacturing and R&D to meet rising demand. Increasing awareness of chemotherapy benefits and expanding insurance coverage are further driving Doxorubicin adoption across Asia-Pacific’s emerging economies.

Latin America

Latin America held a 6% share of the Doxorubicin market in 2024, supported by expanding cancer treatment capacity and rising healthcare investments. Brazil and Mexico lead regional demand due to improving oncology infrastructure and growing access to branded and generic drugs. Government initiatives to strengthen cancer diagnosis and treatment availability are enhancing adoption. However, budget limitations and uneven drug distribution remain key challenges. Collaborations with international pharmaceutical firms and growing participation in clinical trials are expected to accelerate market development across the region over the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the Doxorubicin market in 2024. The United Arab Emirates and Saudi Arabia are key contributors, driven by growing cancer awareness and investments in specialized healthcare facilities. Expanding oncology departments in private hospitals and government support for advanced cancer therapies support gradual market growth. In Africa, increasing cancer screening and aid-driven healthcare initiatives are improving access to essential chemotherapies. Despite limited affordability and infrastructure constraints, rising healthcare modernization is expected to strengthen Doxorubicin adoption across this region in the near future.

Market Segmentations:

By Formulation

- Lyophilized Powder

- Doxorubicin Injection

By Application

- Bladder Cancer

- Kaposi Sarcoma

- Leukemia

- Other

By Distribution

- Hospitals Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Doxorubicin market includes major players such as Novartis AG, Dr. Reddy’s Laboratories Ltd., Baxter, SRS Life Sciences, Sun Pharmaceutical Industries Ltd., Pfizer Inc., Cadila Pharmaceuticals, Johnson & Johnson Services, Inc., Cipla, and MicroBiopharm Japan Co., Ltd. These companies focus on expanding their oncology portfolios through the production of both conventional and liposomal doxorubicin formulations. Leading manufacturers such as Novartis and Pfizer emphasize research on safer and more effective drug delivery systems, while Indian firms like Sun Pharma and Dr. Reddy’s leverage cost-efficient manufacturing to strengthen global reach. Strategic collaborations, product approvals, and regional distribution partnerships are key strategies used to expand market presence. Continuous investment in formulation innovation, coupled with efforts to improve accessibility in emerging markets, enhances the competitiveness of top players in this steadily growing oncology drug landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Baxter International Inc. launched two new National Drug Codes (NDCs) for DOXIL® (doxorubicin hydrochloride liposome injection) in the U.S., changing the 20 mg/10 mL vial to NDC 00338-9667-01 and the 50 mg/25 mL vial to NDC 00338-9665-01.

- In July 2024, Lupin Limited announced that its alliance partner ForDoz Pharma Corporation received U.S. FDA approval for a generic version of Doxorubicin Hydrochloride Liposome Injection 20 mg/10 mL and 50 mg/25 mL vials, referencing Baxter’s RLD DOXIL®.

- In January 2024, Bristol-Myers Squibb announced its acquisition of Mirati Therapeutics, which includes the potential development of new therapies involving Doxorubicin.

Report Coverage

The research report offers an in-depth analysis based on Formulation, Application, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for doxorubicin will continue to rise with increasing global cancer prevalence.

- Liposomal and nanoparticle formulations will gain wider adoption for safer drug delivery.

- Pharmaceutical firms will invest more in reducing cardiotoxicity through advanced formulations.

- Combination therapies will expand as precision oncology becomes more prevalent.

- Emerging markets will see higher accessibility through generic drug production.

- Research in personalized medicine will support tailored doxorubicin-based treatment plans.

- Strategic collaborations between pharma companies will enhance global supply chains.

- Regulatory approvals for new dosage forms will strengthen market penetration.

- Hospitals will remain the leading distribution channel for oncology medications.

- Asia-Pacific and North America will remain the key growth regions for market expansion.