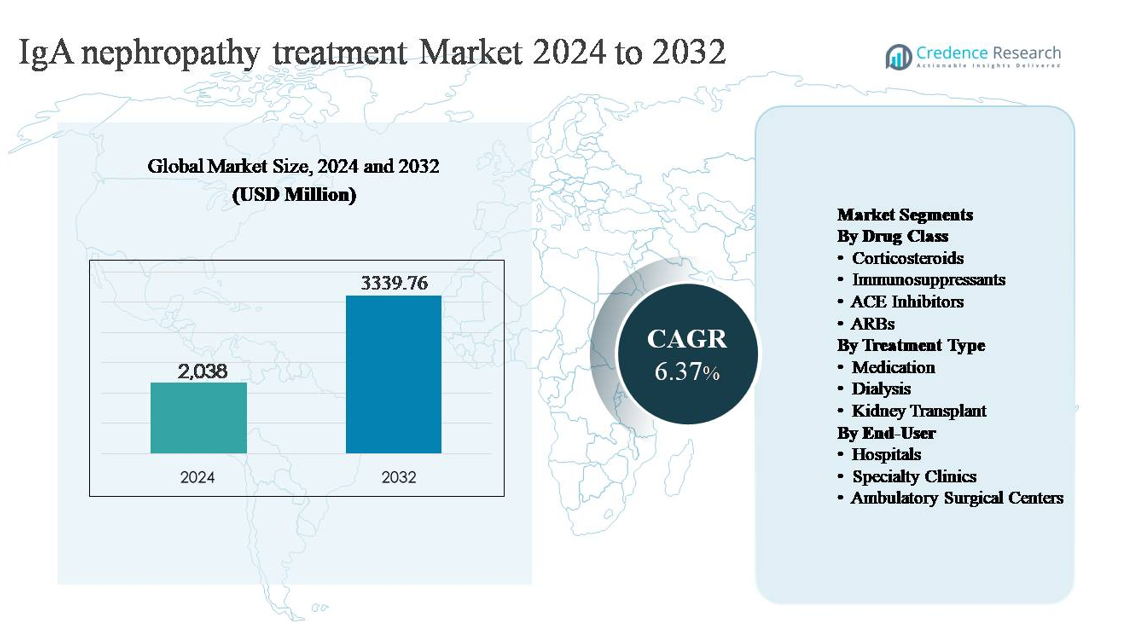

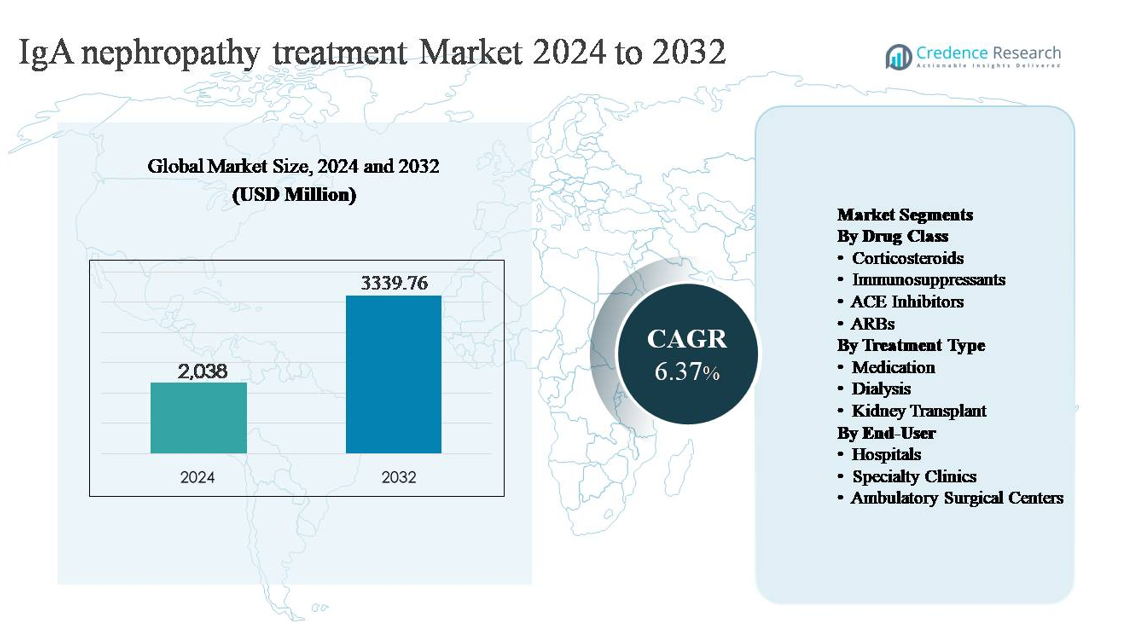

Market Overview

The IgA nephropathy treatment market was valued at USD 2,038 million in 2024 and is projected to reach USD 3,339.76 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IgA Nephropathy Treatment Market Size 2024 |

USD 2,038 million |

| IgA Nephropathy Treatment Market, CAGR |

6.37% |

| IgA Nephropathy Treatment Market Size 2032 |

USD 3,339.76 million |

The IgA nephropathy treatment market is led by a mix of global pharmaceutical majors and specialty biopharmaceutical companies focused on renal and immune-mediated diseases. Key players include Novartis AG, AstraZeneca plc, Roche Holding AG, Pfizer Inc., Sanofi S.A., Merck & Co., Inc., Bayer AG, GlaxoSmithKline plc, Calliditas Therapeutics AB, and Omeros Corporation, each leveraging strengths in immunology, nephrology, and chronic disease management. These companies compete through established supportive therapies and advancing disease-modifying approaches aimed at slowing renal decline. North America is the leading region, accounting for approximately 38% of the global market, supported by high diagnosis rates, advanced nephrology infrastructure, strong reimbursement frameworks, and early adoption of innovative treatments, positioning it as the primary revenue-generating region globally.

Market Insights

- The IgA nephropathy treatment market was valued at USD 2,038 million in 2024 and is projected to reach USD 3,339.76 million by 2032, expanding at a CAGR of 6.37% during the forecast period, driven by sustained demand for long-term renal disease management therapies.

- Market growth is primarily driven by rising early diagnosis, increasing nephrology referrals, and expanding use of rennin angiotensin system inhibitors and corticosteroids, with the medication segment holding over 70% share due to its role in first-line and maintenance therapy.

- Key trends include a shift toward disease-modifying and targeted therapies, greater risk-based treatment stratification, and growing emphasis on delaying dialysis and kidney transplantation to reduce long-term healthcare costs.

- The competitive landscape features global pharmaceutical leaders and specialty biopharma players competing on clinical efficacy, safety, and renal outcome data, with strong dominance of established therapies supported by broad physician familiarity.

- Regionally, North America leads with ~38% market share, followed by Europe (~27%) and Asia Pacific (~25%), while hospitals dominate end-user demand with the highest share due to advanced diagnostics and specialist-led care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Class:

The drug class segmentation of the IgA nephropathy treatment market is dominated by corticosteroids, which account for the largest market share due to their long-standing role in reducing proteinuria and slowing renal function decline in patients with persistent disease activity. Corticosteroids remain widely prescribed across early and moderate stages, supported by extensive clinical familiarity and established treatment guidelines. ACE inhibitors and ARBs also represent a substantial share, driven by their renal-protective effects and routine use in blood pressure and proteinuria management. Growth is further supported by expanding use of targeted immunosuppressants in high-risk patients.

- For instance, in the multinational TESTING clinical program led by Peking University First Hospital, oral methylprednisolone was administered at an initial dose of 0.6–0.8 mg/kg/day with a capped maximum of 48 mg/day, and the study enrolled more than 500 biopsy-confirmed IgA nephropathy patients with baseline proteinuria exceeding 1 g/day and estimated glomerular filtration rates (eGFR) above 20 mL/min/1.73 m², reinforcing corticosteroids as a cornerstone intervention in active disease management.

By Treatment Type:

By treatment type, medication is the dominant sub-segment, holding the majority market share due to its central role in long-term disease management and its applicability across all stages of IgA nephropathy. Pharmacological therapies are preferred as first-line and maintenance options, delaying disease progression and reducing the need for invasive interventions. The strong dominance of medication is driven by increasing early diagnosis, wider access to nephrology care, and the introduction of disease-modifying therapies. Dialysis and kidney transplant represent smaller shares, primarily associated with advanced-stage patients experiencing end-stage renal disease.

- For instance, Calliditas Therapeutics’ targeted-release budesonide (Tarpeyo®), an oral, delayed-release capsule designed to target the gut mucosal immune system, is administered as a fixed oral dose of 16 mg once daily for a recommended duration of 9 months. It was clinically evaluated in the global NEFIGARD Phase III program, which enrolled approximately 360 adults with biopsy-confirmed IgA nephropathy and baseline estimated glomerular filtration rates above 35 mL/min/1.73 m².

By End-User:

Among end users, hospitals represent the dominant sub-segment, accounting for the highest market share due to their role in diagnosis, initiation of therapy, and management of complex or advanced IgA nephropathy cases. Hospitals benefit from access to multidisciplinary nephrology teams, advanced diagnostic infrastructure, and inpatient dialysis facilities. The dominance of hospitals is driven by rising hospitalization rates for progressive kidney disease and the need for specialized monitoring during immunosuppressive treatment. Specialty clinics are expanding steadily, while ambulatory surgical centers maintain a limited role, mainly linked to procedural interventions.

Key Growth Drivers

Rising Disease Recognition and Earlier Diagnosis

Improved recognition of IgA nephropathy across primary care and nephrology settings is a major growth driver for the treatment market. Wider use of routine urinalysis, earlier referral to nephrologists, and increased availability of kidney biopsy services are enabling diagnosis at earlier stages of disease progression. Earlier identification expands the treatable patient pool and increases the duration of pharmacological management, particularly with renin–angiotensin system inhibitors and corticosteroids. Growing awareness among clinicians about risk stratification based on proteinuria levels, estimated glomerular filtration rate decline, and histopathological scoring supports more proactive intervention. As a result, patients are increasingly managed before irreversible renal damage occurs, driving sustained demand for long-term IgA nephropathy therapies.

- For instance, Roche Diagnostics’ automated urine analyzers, such as the cobas® u 701 microscopy system, are capable of processing up to 116 urine samples per hour with automated detection of erythrocytes and protein-related abnormalities, supporting large-scale screening workflows in hospital laboratories and facilitating earlier identification of persistent hematuria and proteinuria that trigger nephrology referrals.”

Expanding Use of Disease-Modifying Pharmacotherapies

The increasing adoption of disease-modifying drug therapies is significantly accelerating market growth. Beyond supportive care, treatment strategies are shifting toward active modulation of immune-mediated kidney injury. Corticosteroids remain widely used, while immunosuppressants are increasingly prescribed in high-risk patients with progressive disease. In parallel, optimized use of ACE inhibitors and ARBs continues to expand due to their proven role in proteinuria reduction and renal protection. The clinical emphasis on slowing chronic kidney disease progression rather than managing end-stage outcomes is increasing therapy duration and prescription volumes. This evolution in treatment approach strengthens the medication segment and supports sustained growth across both early and moderate IgA nephropathy patient populations.

- For instance, Travere Therapeutics’ dual endothelin angiotensin receptor antagonist sparsentan (brand name: Filspari®) was evaluated at a once-daily oral dose of 400 mg in the PROTECT study, a pivotal Phase 3 clinical trial.

Growing Burden of Chronic Kidney Disease Progression

The rising burden of chronic kidney disease progression associated with IgA nephropathy is a key structural growth driver. A significant proportion of patients experience gradual decline in renal function over time, necessitating continuous monitoring and therapeutic intervention. As healthcare systems focus on delaying end-stage renal disease to reduce dialysis and transplant costs, treatment adherence and optimization have become priorities. This shift increases utilization of long-term pharmacotherapy and specialist care. Additionally, aging populations and higher prevalence of comorbid conditions such as hypertension further accelerate disease progression, reinforcing the need for sustained IgA nephropathy treatment and driving consistent market demand.

Key Trends & Opportunities

Shift Toward Targeted and Precision Therapies

A major trend shaping the IgA nephropathy treatment landscape is the shift toward targeted and precision-based therapies. Treatment strategies are increasingly tailored based on disease severity, proteinuria levels, and patient risk profiles rather than a uniform approach. This creates opportunities for therapies that selectively modulate immune pathways involved in IgA deposition and glomerular inflammation. Precision treatment approaches improve efficacy while reducing systemic side effects, supporting longer-term therapy adherence. As clinical protocols increasingly emphasize individualized treatment plans, pharmaceutical innovation focused on targeted mechanisms represents a significant growth opportunity within the IgA nephropathy market.

- For instance, Novartis’ iptacopan (LNP023), an oral factor B inhibitor targeting the alternative complement pathway, has been evaluated at twice-daily dosing regimens in the APPLAUSE-IgAN Phase III program, which enrolled more than 400 patients with confirmed IgA nephropathy and required documented proteinuria despite optimized supportive care, reflecting targeted modulation of complement activation rather than broad immunosuppression.

Expansion of Specialty Nephrology Care Networks

The expansion of specialty nephrology clinics represents an important opportunity for market growth. These centers enable structured disease monitoring, protocol-driven treatment escalation, and long-term follow-up, improving outcomes in IgA nephropathy patients. Specialty clinics also facilitate early intervention, patient education, and adherence management, increasing consistent medication usage. As healthcare systems decentralize chronic kidney disease management away from tertiary hospitals, specialty care settings are expected to play a growing role. This trend supports higher therapy penetration, particularly for maintenance medications, and strengthens the outpatient treatment segment of the market.

- For instance, DaVita Kidney Care operates more than 3,100 outpatient dialysis centers globally and adheres to widely accepted chronic kidney disease monitoring protocols. These standard practices, recommended by expert organizations like KDIGO and the National Kidney Foundation, include the routine measurement of estimated glomerular filtration rate (eGFR) and quantitative urine protein (albumin-creatinine ratio) testing at scheduled follow-up intervals.

Increased Focus on Delaying Dialysis and Transplantation

Healthcare systems are increasingly prioritizing strategies that delay the need for dialysis and kidney transplantation in IgA nephropathy patients. This focus creates opportunities for therapies that effectively slow renal function decline over extended periods. Pharmacological interventions that demonstrate durable proteinuria control and renal preservation are gaining preference. As reimbursement frameworks increasingly favor cost-effective disease management over late-stage interventions, demand for long-term IgA nephropathy treatments is expected to rise. This trend reinforces investment in therapies positioned as renal-protective and disease-modifying rather than purely symptomatic.

Key Challenges

Variable Disease Progression and Treatment Response

One of the key challenges in the IgA nephropathy treatment market is the high variability in disease progression and patient response to therapy. Clinical outcomes differ widely, making it difficult to standardize treatment pathways. Some patients remain stable for years with supportive care, while others progress rapidly despite aggressive intervention. This unpredictability complicates therapy selection and limits consistent clinical outcomes, particularly with immunosuppressive regimens. Variability in response also increases trial complexity for new therapies and may slow broader clinical adoption, posing a challenge to market expansion.

Safety Concerns and Long-Term Therapy Tolerability

Long-term safety and tolerability concerns present another significant challenge. Corticosteroids and immunosuppressants are associated with well-documented adverse effects, limiting their prolonged use in certain patient populations. Physicians must carefully balance efficacy against risks such as infections, metabolic complications, and cardiovascular effects. These concerns can lead to treatment discontinuation or conservative dosing, reducing overall therapy utilization. The need for safer long-term treatment options remains critical, and until such therapies are widely available, safety considerations will continue to constrain broader adoption of aggressive IgA nephropathy treatment strategies.

Regional Analysis

North America:

North America holds the largest share of the IgA nephropathy treatment market at approximately 38%, driven by advanced diagnostic capabilities, high disease awareness, and strong adoption of pharmacological therapies. The region benefits from widespread access to nephrology specialists, early kidney biopsy usage, and structured chronic kidney disease management programs. The United States dominates regional demand due to higher treatment penetration, established reimbursement pathways, and strong uptake of corticosteroids, ACE inhibitors, and ARBs. Ongoing emphasis on delaying progression to end-stage renal disease further supports sustained therapy utilization across hospital and specialty clinic settings.

Europe:

Europe accounts for around 27% of the global IgA nephropathy treatment market, supported by well-established public healthcare systems and standardized clinical guidelines for glomerular diseases. Countries such as Germany, the UK, France, and Italy drive regional demand through early diagnosis, routine proteinuria screening, and consistent use of renoprotective medications. Strong emphasis on evidence-based treatment protocols and long-term disease monitoring supports steady utilization of corticosteroids and supportive therapies. Additionally, increasing collaboration between academic centers and specialty nephrology clinics enhances early intervention, reinforcing Europe’s stable market position.

Asia Pacific:

Asia Pacific represents approximately 25% of the global IgA nephropathy treatment market and is the fastest-growing regional segment. The high prevalence of IgA nephropathy in countries such as China, Japan, and South Korea significantly drives demand. Expanding access to healthcare services, improving diagnostic rates, and growing nephrology infrastructure support increased treatment adoption. Japan remains a key contributor due to long-standing disease recognition and early intervention practices. Rising healthcare expenditure and broader availability of essential medications are further strengthening long-term treatment uptake across both urban hospitals and specialty clinics.

Latin America:

Latin America holds an estimated 6% share of the global IgA nephropathy treatment market, supported by gradual improvements in nephrology care and diagnostic access. Brazil and Mexico lead regional demand due to expanding public healthcare coverage and increasing awareness of chronic kidney diseases. However, treatment penetration remains moderate, with reliance primarily on supportive therapies such as ACE inhibitors and ARBs. Limited access to advanced immunosuppressive treatments and late-stage diagnosis constrain market growth. Ongoing investments in hospital infrastructure and specialist training are expected to improve treatment adoption over time.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 4% of the global IgA nephropathy treatment market, reflecting lower diagnosis rates and limited access to specialized renal care in several countries. Gulf Cooperation Council nations contribute the majority of regional demand due to stronger healthcare infrastructure and higher specialist availability. In contrast, many African markets rely primarily on basic supportive therapies, with restricted access to advanced treatments. Gradual healthcare investments, expanding hospital networks, and increasing chronic kidney disease awareness are expected to support modest, long-term market growth across the region.

Market Segmentations:

By Drug Class

- Corticosteroids

- Immunosuppressants

- ACE Inhibitors

- ARBs

By Treatment Type

- Medication

- Dialysis

- Kidney Transplant

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the IgA nephropathy treatment market is characterized by the presence of established pharmaceutical companies, emerging biopharma firms, and specialty-focused players competing across supportive care and disease-modifying therapy segments. Market participants differentiate through clinical efficacy, safety profiles, and long-term renal outcome data. Established companies maintain strong positions through widely prescribed corticosteroids, ACE inhibitors, and ARBs, supported by extensive physician familiarity and global distribution networks. Meanwhile, specialized biopharmaceutical companies are strengthening their competitive standing by advancing targeted therapies designed to address immune-mediated disease mechanisms and reduce systemic side effects. Strategic priorities across the landscape include expanding clinical evidence, securing regulatory approvals for novel therapies, and strengthening market access through reimbursement alignment. Partnerships with nephrology centers, post-approval studies, and lifecycle management strategies further shape competition, as companies focus on sustaining treatment adherence and delaying progression to end-stage renal disease.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis AG

- AstraZeneca plc

- Roche Holding AG

- Pfizer Inc.

- Sanofi S.A.

- Merck & Co., Inc.

- Bayer AG

- GlaxoSmithKline plc

- Calliditas Therapeutics AB

- Omeros Corporation

Recent Developments

- In October 2025, Novartis announced that its oral factor B inhibitor Fabhalta® (iptacopan) met the primary endpoint in the Phase III APPLAUSE-IgAN study, showing slowed decline in kidney function (measured by estimated glomerular filtration rate over two years) in adults with IgA nephropathy. This result is being used to support a planned full FDA approval submission in 2026 following its earlier accelerated approval.

- In April 2025, Novartis AG The US FDA granted accelerated approval to Vanrafia® (atrasentan), an endothelin A receptor antagonist developed by Novartis, for reducing proteinuria in adults with IgA nephropathy at risk of rapid disease progression, based on Phase III evidence of proteinuria reduction.

- In March 6, 2024, Calliditas announced an additional 7-year orphan exclusivity for TARPEYO’s indication in adults with IgA nephropathy who are at risk of progression, reflecting confirmed clinical benefit on kidney function.

Report Coverage

The research report offers an in-depth analysis based on Drug class, Treatment type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Treatment approaches will increasingly focus on slowing disease progression rather than managing late-stage renal failure.

- Wider adoption of targeted and mechanism-driven therapies will improve treatment precision and long-term outcomes.

- Early diagnosis and risk stratification will expand the eligible patient population for long-term therapy.

- Medication-based management will remain the cornerstone of treatment across most disease stages.

- Reduced reliance on broad immunosuppression will improve safety and long-term tolerability.

- Hospitals and specialty nephrology clinics will continue to lead treatment initiation and monitoring.

- Growing emphasis on delaying dialysis and kidney transplantation will strengthen demand for renal-protective therapies.

- Clinical decision-making will increasingly rely on individualized treatment pathways.

- Expansion of nephrology care infrastructure in emerging regions will support steady market growth.

- Long-term disease management strategies will drive sustained therapy adherence and continuity of care.