| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Cheese Market Size 2024 |

USD 2,862.06 Million |

| India Cheese Market, CAGR |

7.24% |

| India Cheese Market Size 2032 |

USD 5,008.17 Million |

Market Overview

India Cheese Market size was valued at USD 2,862.06 million in 2024 and is anticipated to reach USD 5,008.17 million by 2032, at a CAGR of 7.24% during the forecast period (2024-2032).

The India Cheese Market is driven by a rising consumer preference for dairy-based products, supported by growing health consciousness and a shift towards Western food habits. Urbanization and increasing disposable incomes are fueling demand, particularly among millennials and the younger population, who are adopting cheese in everyday meals. The expanding foodservice sector, including fast food chains and restaurants, further boosts market growth, as cheese is widely incorporated into a variety of dishes. Additionally, innovations in cheese varieties, such as low-fat and organic options, cater to the health-conscious segment. The popularity of cheese in processed foods, ready-to-eat meals, and snacks is also contributing to the market’s expansion. As consumers seek convenience and variety, the availability of diverse cheese products in retail outlets is increasing, driving further growth in the market. This combination of changing dietary preferences, increased disposable income, and foodservice expansion is propelling the India Cheese Market forward.

The India Cheese Market is characterized by regional variations in consumption patterns, with northern and western regions leading the demand due to higher urbanization and exposure to Western cuisines. Southern and eastern regions are gradually adopting cheese, driven by changing consumer preferences and increased availability through retail and e-commerce channels. Key players in the Indian cheese market include both domestic and international brands. Prominent companies such as Britannia Industries, Mother Dairy, and Parag Milk Foods play a significant role in catering to the growing demand for cheese. International brands like Meiji Holdings, Fonterra, and Yili Group are also active in the market, expanding their presence through partnerships, product innovation, and distribution networks. As the market continues to grow, these key players are focusing on diversifying their product offerings, including low-fat, flavored, and processed cheese, to meet the evolving tastes of Indian consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Cheese Market was valued at USD 2,862.06 million in 2024 and is projected to reach USD 5,008.17 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Increasing consumer demand for dairy-based products and health-conscious choices is driving the market growth.

- Urbanization and rising disposable incomes are fueling the demand for convenient, ready-to-eat cheese products.

- Product innovations, such as low-fat, organic, and flavored cheese, are becoming popular among Indian consumers.

- The foodservice industry, including fast food chains, plays a significant role in cheese consumption growth.

- Key players in the market include Britannia Industries, Mother Dairy, Parag Milk Foods, and international brands like Fonterra and Yili Group.

- Regional variations in consumption are evident, with the northern and western regions leading the demand, while the southern and eastern regions show increasing adoption.

Report Scope

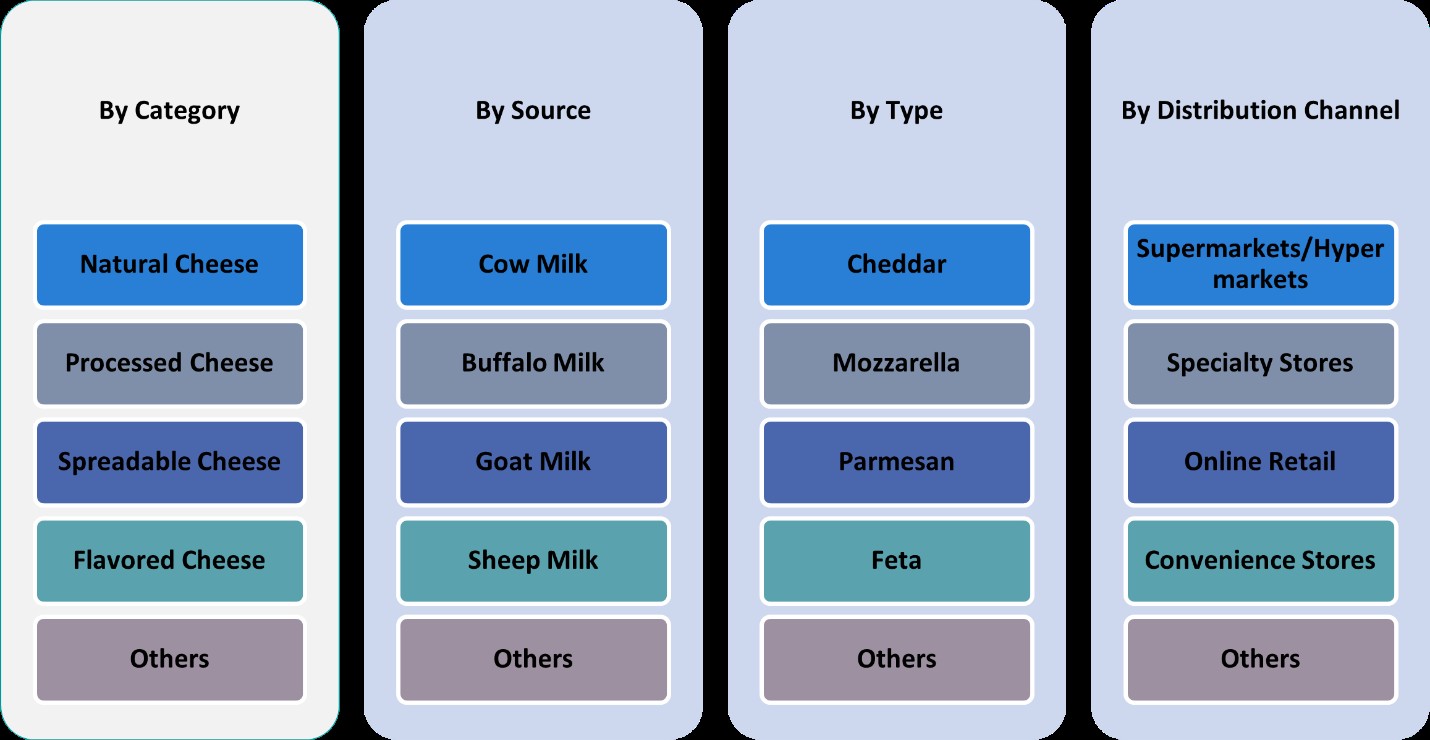

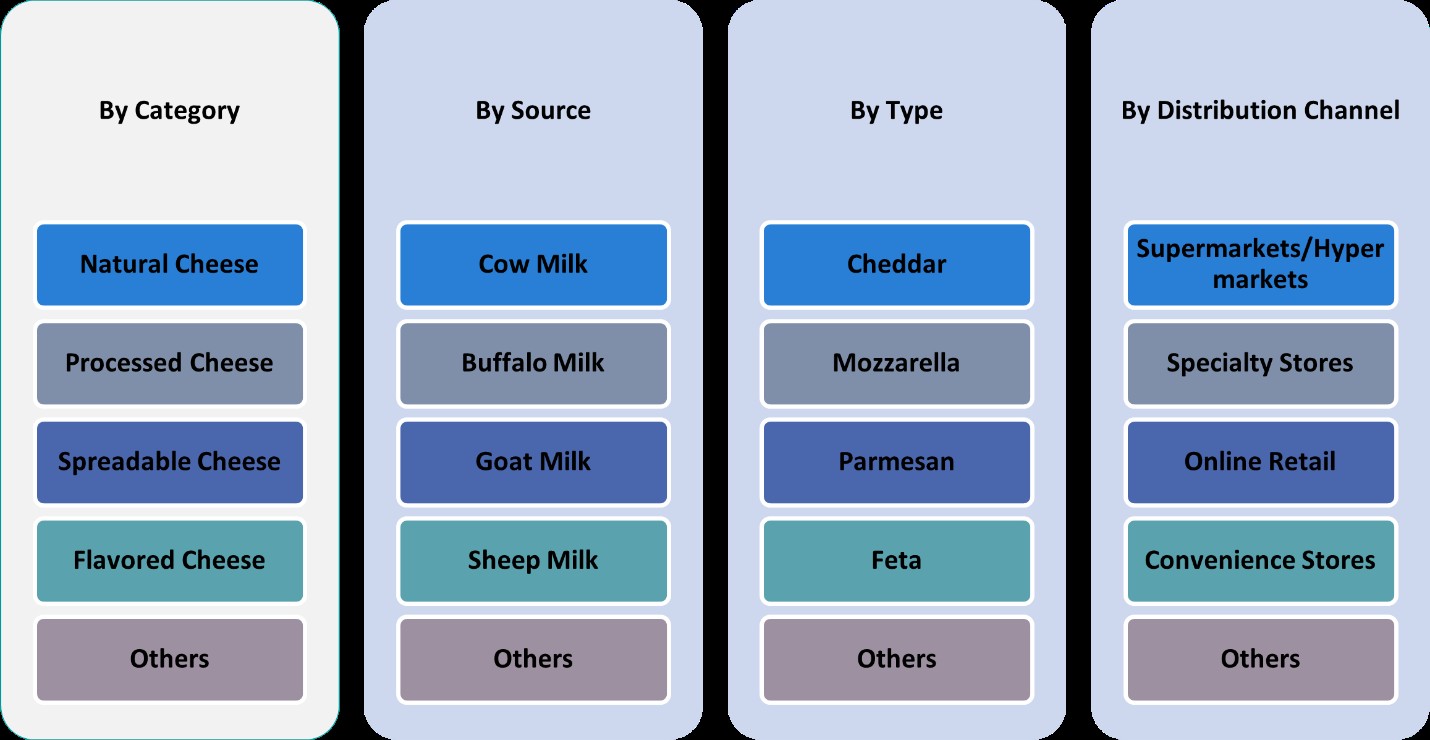

This report segments the India Cheese Market as follows:

Market Drivers

Increasing Consumer Demand for Dairy Products

The growing demand for dairy products is a significant driver for the India Cheese Market. As consumers become more health-conscious, cheese has gained popularity due to its nutritional benefits, including being a good source of calcium, protein, and vitamins. For instance, a report by the National Dairy Development Board highlights that younger consumers in urban areas are increasingly incorporating cheese into their meals, driven by its versatility and nutritional value. The shift in dietary preferences, especially among younger consumers, is propelling the consumption of cheese in daily meals. Cheese’s versatility, being used in everything from sandwiches to curries, snacks, and baked goods, has made it an attractive addition to the Indian diet. As consumer awareness about the nutritional value of dairy products rises, more individuals are incorporating cheese into their meals, which is contributing to market growth.

Urbanization and Changing Lifestyles

Urbanization has had a profound impact on the Indian food market, including the cheese sector. As the country continues to urbanize, there is a shift in lifestyle that favors convenience, variety, and new culinary experiences. For instance, a study by the Indian Council for Research on International Economic Relations found that urban professionals are increasingly opting for ready-to-eat meals, where cheese is a key ingredient, due to their busy schedules. Busy urban professionals and working individuals are increasingly adopting ready-to-eat and processed foods, where cheese is a key ingredient. Additionally, with the increasing number of dual-income households, there is a growing preference for quick meal solutions, driving the demand for cheese-based products. This change in lifestyle is not only leading to higher consumption of cheese but also influencing food choices in urban regions, further expanding the market.

Growth of the Foodservice and Fast Food Industry

The expansion of the foodservice industry, including fast food chains, restaurants, and cafes, is another important driver for the India Cheese Market. Cheese is an essential component in many popular fast food items such as burgers, pizzas, sandwiches, and pasta, which are increasingly being consumed by Indian consumers. The growth of international and local fast food chains in both metropolitan and tier-II cities has led to higher consumption of cheese-based foods. Additionally, the trend of casual dining and cafes, offering a variety of cheese-based dishes, has made cheese an attractive choice for a wide demographic. The continued expansion of the foodservice sector is expected to further boost cheese demand across India.

Product Innovation and Health-Conscious Offerings

Product innovation plays a crucial role in driving the India Cheese Market, as manufacturers continue to introduce new and healthier options. With increasing awareness of health and wellness, there is a rising demand for low-fat, organic, and fortified cheese products. Consumers are more inclined towards cheese that fits their dietary needs, such as reduced-fat varieties, lactose-free options, and cheese enriched with additional nutrients like probiotics. These innovations cater to the growing health-conscious consumer base while maintaining the taste and texture that cheese lovers enjoy. Furthermore, the introduction of flavored cheeses, such as garlic, herbs, and spicy variants, has expanded the variety of options available, attracting a broader audience. This innovation and variety are crucial in stimulating demand and expanding the market’s reach.

Market Trends

Rising Popularity of Processed Cheese

Processed cheese is becoming increasingly popular in the Indian market, particularly due to its convenience and affordability. As more consumers seek easy-to-use, ready-to-consume products, processed cheese offers a practical solution. Available in various forms like slices, cubes, and spreads, processed cheese is widely used in sandwiches, burgers, and snacks. This trend is particularly prevalent among urban consumers, who prioritize quick meal solutions due to their fast-paced lifestyles. The growing preference for processed cheese is contributing significantly to the market’s expansion, with both local and international brands catering to this demand.

Increasing Focus on Health-Conscious Products

Health and wellness have become key trends in the Indian food sector, and cheese manufacturers are responding by developing healthier product alternatives. Consumers are increasingly seeking cheese options that align with their health-conscious lifestyles, such as low-fat, organic, and lactose-free varieties. For instance, a survey by Health India revealed that over 40% of urban consumers prefer low-fat and fortified cheese options to meet their dietary goals. The demand for cheese fortified with additional nutrients like calcium, vitamin D, and probiotics is also on the rise. As the awareness of dietary habits and their long-term impact on health increases, cheese producers are focusing on innovation to meet these evolving consumer preferences. This trend is not only expanding the market for healthier cheese options but also attracting a more diverse consumer base.

Growth of Cheese in Traditional Indian Cuisine

Another notable trend in the India Cheese Market is the growing incorporation of cheese into traditional Indian cuisine. While cheese was initially more popular in Western-style dishes, Indian consumers are now using cheese in regional and home-cooked meals. For instance, a study by the Indian Culinary Institute found that dishes like “cheese dosa” and “cheese paratha” have become staples in urban households, blending traditional flavors with modern ingredients. Dishes like “paneer tikka,” “cheese paratha,” and “cheese dosa” are becoming increasingly common, offering a fusion of traditional flavors with modern ingredients. This trend is especially appealing to younger generations who are experimenting with diverse culinary experiences while maintaining ties to traditional Indian flavors. The integration of cheese into local cuisine is helping to broaden its appeal and further boost consumption across the country.

Expanding Retail and E-Commerce Channels

The distribution landscape for cheese in India is rapidly evolving, with significant growth in both traditional retail outlets and e-commerce platforms. The increasing availability of cheese in supermarkets, hypermarkets, and online grocery stores is making it easier for consumers to access a wide range of cheese products. E-commerce platforms, in particular, are playing a crucial role in the growth of the market by offering consumers the convenience of purchasing cheese from home. Additionally, the rise in online food delivery services is also contributing to the growth of cheese consumption, as many foodservice platforms offer cheese-laden meals to consumers. As these retail and online distribution channels expand, cheese availability and accessibility continue to improve, supporting market growth.

Market Challenges Analysis

Limited Consumer Awareness and Perception

One of the key challenges facing the India Cheese Market is the limited consumer awareness regarding the nutritional benefits and diverse uses of cheese. While cheese is a staple in many Western diets, it remains a relatively new concept for a large portion of the Indian population. Many consumers still perceive cheese as a luxury or unfamiliar ingredient, which can inhibit its widespread adoption in everyday meals. Additionally, concerns about the high fat content in cheese and its perceived association with unhealthy diets may deter health-conscious individuals from incorporating it into their regular consumption. Educating consumers about the various types of cheese, their health benefits, and how to incorporate them into Indian cuisine is essential to overcoming this challenge and expanding the market.

High Price and Supply Chain Constraints

The high price of cheese, particularly premium and imported varieties, is another significant challenge in the Indian market. Cheese production in India is still in the nascent stages compared to other dairy products like milk and yogurt, which can lead to higher production costs. For instance, a study by the Indian Council for Research on International Economic Relations found that imported cheese varieties face additional costs due to tariffs and transportation, making them less accessible to price-sensitive consumers. Additionally, the import of cheese from international markets, especially specialized or premium products, increases their cost, making them less affordable for the average consumer. The cost factor is further exacerbated by supply chain constraints, including inadequate cold storage infrastructure and distribution challenges, which can lead to product spoilage and higher transportation costs. These factors contribute to the limited availability and higher pricing of cheese, making it less accessible to price-sensitive consumers. Addressing these issues will be key to increasing cheese adoption across different consumer segments.

Market Opportunities

The India Cheese Market presents several promising opportunities driven by shifting consumer preferences and the evolving food landscape. With the growing middle class and increasing disposable incomes, there is a significant opportunity to expand the consumption of cheese beyond urban areas. As more consumers embrace Western dining habits, the demand for cheese-based products is set to rise. The increasing popularity of quick and convenient meal solutions also provides an opportunity for cheese to become a staple in ready-to-eat meals, snacks, and packaged foods. Manufacturers can capitalize on this shift by introducing a variety of cheese products in convenient forms, such as cheese slices, spreads, and snacks, to meet the needs of busy urban professionals and families. Additionally, the rise in health consciousness presents opportunities for cheese brands to innovate and offer healthier alternatives like low-fat, organic, and fortified cheese variants, catering to the health-conscious segment.

Another area of growth lies in the expansion of cheese in traditional Indian cuisine. As Indian consumers experiment with fusion dishes and explore global flavors, there is potential for cheese to become a key ingredient in regional and home-cooked meals. The introduction of cheese in popular Indian dishes, such as “cheese paratha,” “cheese dosa,” and “cheese tikka,” offers new avenues for market penetration. Furthermore, the increasing penetration of e-commerce platforms and online grocery services provides an opportunity for cheese manufacturers to reach a wider audience across India, especially in tier-II and tier-III cities. As these distribution channels expand, cheese products can become more accessible, fostering broader market adoption. These opportunities suggest that the India Cheese Market will continue to experience strong growth as consumer preferences evolve and new product innovations are introduced.

Market Segmentation Analysis:

By Category:

The India Cheese Market is segmented by category into cheddar, processed cheese, spreadable cheese, flavored cheese, and others. Processed cheese holds a significant share of the market due to its convenience and widespread usage in fast food chains and ready-to-eat meals. Its affordability and long shelf life make it an attractive option for both consumers and manufacturers. Cheddar cheese, being one of the most popular varieties, has a large consumer base, particularly in urban regions, and is used in various culinary applications, from sandwiches to baked goods. Spreadable cheese is gaining traction due to its ease of use in sandwiches and snacks, appealing to busy consumers looking for quick meal solutions. Flavored cheese is also growing in popularity, as consumers seek new tastes and combinations, driving innovation in the sector. The “others” segment, which includes niche varieties like blue cheese and cream cheese, continues to grow as consumers explore more exotic flavors and applications.

By Source:

The source of milk used in cheese production also defines key segments within the India Cheese Market, including cow milk, buffalo milk, goat milk, sheep milk, and others. Cow milk-based cheese dominates the market due to its widespread availability and cost-effectiveness. Buffalo milk, particularly popular in India for products like paneer, is also used to produce cheese varieties and is growing in popularity due to its rich texture and high fat content. Goat milk-based cheese is emerging as a niche product, attracting health-conscious consumers looking for alternatives to cow and buffalo milk cheeses. Sheep milk, while not as prevalent, is seeing interest in premium cheese products, particularly in gourmet and international markets. The “others” segment includes cheeses made from camel milk and plant-based alternatives, which are gaining traction among lactose-intolerant consumers and those following plant-based diets. These diverse milk sources offer opportunities for market expansion across various consumer segments.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern region

The northern region holds the largest market share, accounting for approximately 35% of the total market. This is driven by high population density, urbanization, and rising disposable incomes in states like Delhi, Punjab, and Uttar Pradesh. Northern India has seen a growing demand for cheese, particularly in urban centers where Western-style fast food and snacks are gaining popularity. The increasing awareness of cheese’s nutritional benefits and the expansion of international and regional food chains are further fueling market growth in this region.

Western region

The western region, including states like Maharashtra, Gujarat, and Rajasthan, represents the second-largest market share, contributing around 30% to the overall market. Mumbai, being a major metropolitan hub, plays a key role in driving cheese consumption in this region. Western India is home to a diverse population that enjoys both traditional and Western-style cuisines, and the growing adoption of cheese in local recipes has contributed to the segment’s growth. Moreover, the region’s strong foodservice industry, including fast-food chains and restaurants, further boosts the demand for cheese products. The market in this region is expected to grow steadily due to increased urbanization and the introduction of new cheese varieties.

Southern region

The southern region, covering states like Tamil Nadu, Karnataka, and Andhra Pradesh, holds a market share of about 20%. Cheese consumption is growing in this region as consumers become more exposed to Western culinary influences. The younger generation, in particular, is adopting cheese in their daily meals, especially in cities like Bengaluru, Hyderabad, and Chennai. Additionally, the southern region’s expanding foodservice sector and the popularity of fast food chains have spurred demand for processed and cheddar cheese varieties. Though cheese consumption is relatively lower compared to northern and western regions, it is expected to grow rapidly due to shifting consumer preferences and increasing urbanization.

Eastern region

The eastern region, including states like West Bengal, Odisha, and Bihar, has the smallest market share, accounting for around 15% of the total market. While cheese consumption in this region has been slower compared to other parts of India, there is a growing trend towards cheese incorporation in traditional and fusion dishes. The expansion of retail and e-commerce platforms is also making cheese more accessible in smaller towns and rural areas. As urbanization continues and consumer awareness of dairy products increases, the market share in the eastern region is expected to grow at a moderate pace in the coming years. However, the region’s overall contribution remains limited due to traditional dietary preferences.

Key Player Analysis

- Meiji Holdings Co., Ltd.

- Yili Group

- Mengniu Dairy

- Fonterra Co-operative Group (APAC Operations)

- Vinamilk

- Mother Dairy

- Parag Milk Foods

- Britannia Industries

- Bega Cheese Limited

Competitive Analysis

The India Cheese Market is highly competitive, with both domestic and international players vying for market share. Leading players such as Britannia Industries, Mother Dairy, Parag Milk Foods, Meiji Holdings Co., Ltd., Yili Group, Mengniu Dairy, Fonterra Co-operative Group (APAC Operations), Vinamilk, and Bega Cheese Limited are shaping the industry through strategic expansions, product innovations, and strong distribution networks. Companies are adopting various strategies to maintain a competitive edge, including product innovation, expanding distribution networks, and improving accessibility. The focus is on offering a wide range of products, from traditional cheddar and processed cheese to niche variants like flavored and low-fat cheese, catering to the diverse tastes and preferences of Indian consumers. The increasing popularity of Western-style fast food and ready-to-eat meals is also driving demand for cheese, particularly in urban regions. The competitive landscape is further shaped by the growing presence of international players who bring global expertise to the market, while local players benefit from a deep understanding of Indian consumer behavior and regional tastes. Many companies are now focusing on enhancing their online and offline retail presence, as well as partnering with foodservice chains, to expand their reach. With the rise in health-conscious consumers, there is a notable shift toward offering healthier cheese alternatives, creating new opportunities for companies to differentiate themselves. Additionally, investments in cold storage and logistics infrastructure are essential to improve product availability and shelf life across various regions.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The India Cheese Market exhibits moderate market concentration, with both domestic and international players competing for market share. While large companies dominate the market, the presence of regional players also contributes to its diversity. Domestic companies have a strong foothold in the market, particularly due to their local expertise, established distribution networks, and consumer trust. International players are expanding their presence by offering premium and specialty products, which cater to the growing demand for higher-quality cheese. The market is characterized by a variety of product offerings, ranging from processed cheese to organic and flavored cheese, catering to the changing preferences of health-conscious and younger consumers. Additionally, with the rise of e-commerce and foodservice channels, accessibility and product availability have improved significantly. The market is evolving, with increasing innovation in cheese varieties and packaging solutions, further enhancing consumer choices and promoting overall market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for cheese in India is expected to grow steadily due to increasing consumption and a shift toward westernized diets.

- Growing awareness about the nutritional benefits of cheese is likely to contribute to its rising popularity in the Indian market.

- The expanding fast-food industry, especially pizza chains and burger outlets, will continue to drive cheese consumption.

- The preference for processed and convenience foods is predicted to boost the demand for various cheese products, including cheese spreads and slices.

- With an expanding middle class and increasing disposable income, cheese consumption is expected to become more mainstream across urban and rural areas.

- The dairy industry in India is witnessing modernization, which will result in improved cheese production techniques and higher quality products.

- Regional variations in cheese consumption are likely to emerge, with different types of cheese becoming more popular in specific regions.

- Increased focus on the export potential of Indian cheese products will open up new markets and revenue streams for producers.

- The rising trend of vegetarianism in India may drive growth in plant-based cheese alternatives, further diversifying the market.

- Government initiatives promoting dairy and agricultural sectors will likely support the growth of the cheese industry by encouraging innovation and sustainability.