CHAPTER NO. 1 : INTRODUCTION 22

1.1. Report Description 22

Purpose of the Report 22

USP & Key Offerings 22

1.2. Key Benefits for Stakeholders 23

1.3. Target Audience 23

CHAPTER NO. 2 : EXECUTIVE SUMMARY 24

CHAPTER NO. 3 : INDIA ROBOTIC PROCESS AUTOMATION MARKET FORCES & INDUSTRY PULSE 26

3.1. Foundations of Change – Market Overview 26

3.2. Catalysts of Expansion – Key Market Drivers 28

3.3. Momentum Boosters – Growth Triggers 29

3.4. Innovation Fuel – Disruptive Technologies 29

3.5. Headwinds & Crosswinds – Market Restraints 30

3.6. Regulatory Tides – Compliance Challenges 31

3.7. Economic Frictions – Inflationary Pressures 31

3.8. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 32

3.9. Market Equilibrium – Porter’s Five Forces 33

3.10. Ecosystem Dynamics – Value Chain Analysis 35

3.11. Macro Forces – PESTEL Breakdown 37

3.12. Price Trend Analysis 39

3.12.1. Price Trend by Component 40

3.13. Platform-Level Comparisons and Enterprise Pricing Intelligence 40

3.14. Implications for GTM and Product Positioning 41

3.15. Interest in Adjacent Technologies and Impact on Adoption 42

3.15.1. Observations / Strategic Implications 42

CHAPTER NO. 4 : COMPETITION ANALYSIS 43

4.1. Company Market Share Analysis 43

4.1.1. India Robotic Process Automation Market Company Revenue Market Share 43

4.2. Strategic Developments 45

4.2.1. Acquisitions & Mergers 45

4.2.2. New Component Launch 46

4.2.3. Agreements & Collaborations 47

4.3. Competitive Dashboard 48

4.4. Company Assessment Metrics, 2024 49

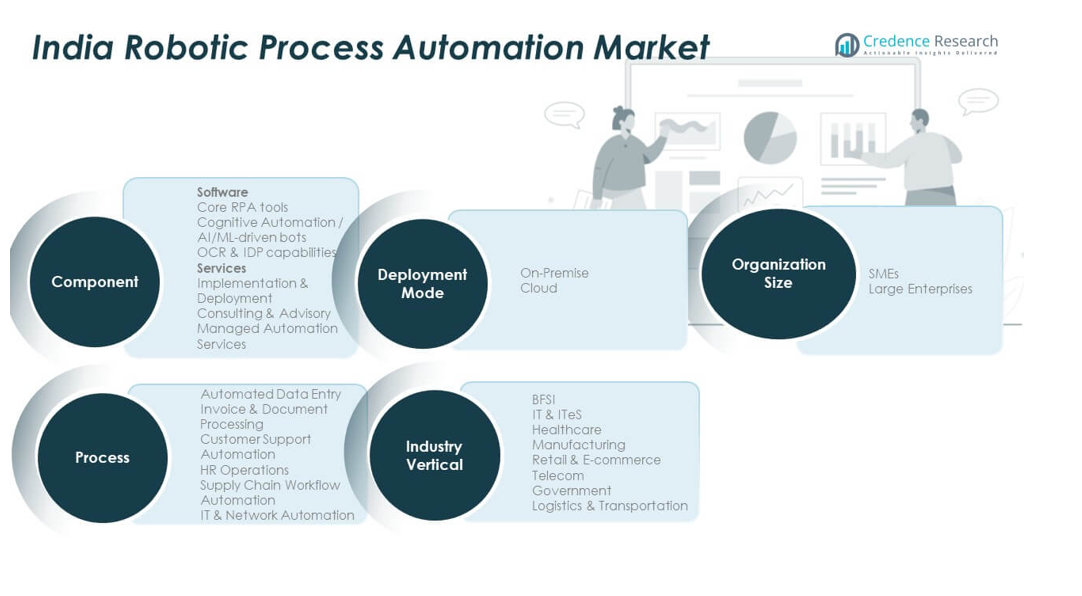

CHAPTER NO. 5 : INDIA MARKET ANALYSIS, INSIGHTS & FORECAST, BY COMPONENT 50

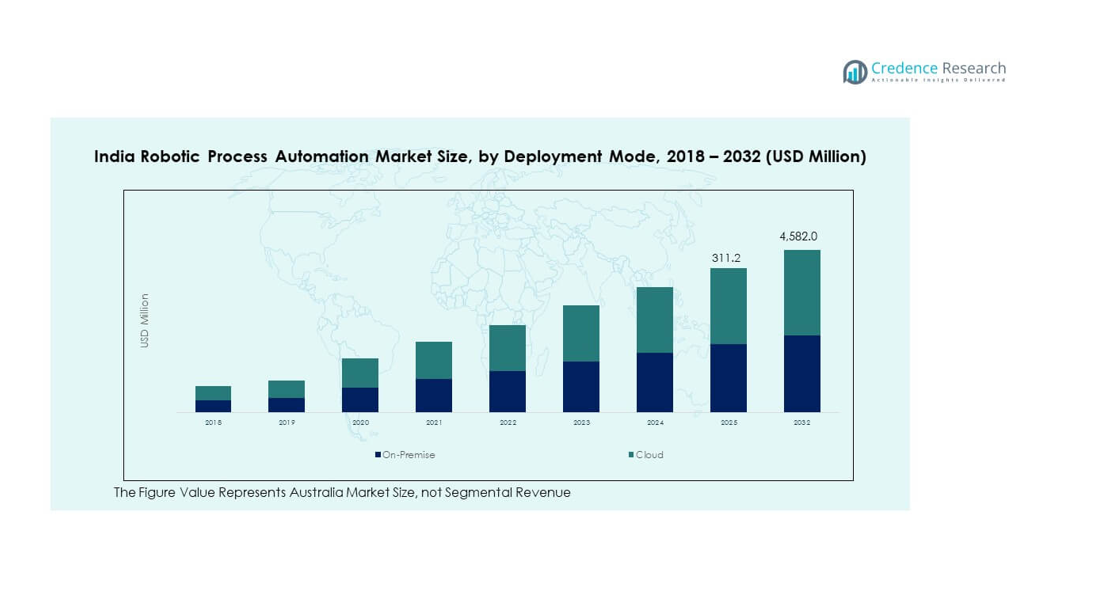

CHAPTER NO. 6 : INDIA MARKET ANALYSIS, INSIGHTS & FORECAST, BY DEPLOYMENT 56

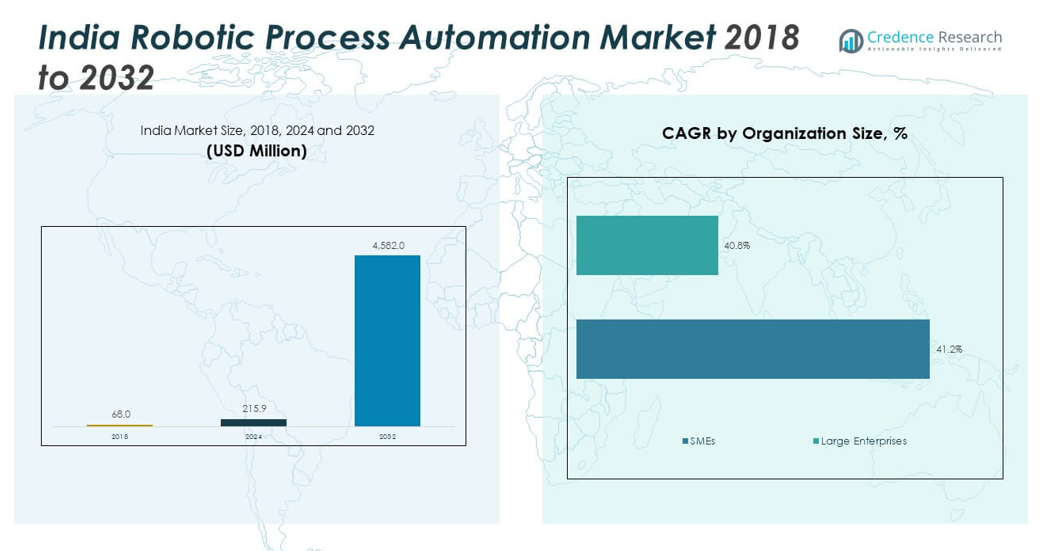

CHAPTER NO. 7 : INDIA MARKET ANALYSIS, INSIGHTS & FORECAST, BY ORGANIZATION SIZE 60

CHAPTER NO. 8 : INDIA MARKET ANALYSIS, INSIGHTS & FORECAST, BY PROCESS 64

CHAPTER NO. 9 : INDIA MARKET ANALYSIS, INSIGHTS & FORECAST, BY INDUSTRY VERTICAL 69

CHAPTER NO. 10 : COMPANY PROFILE 74

10.1. UiPath Inc 74

10.2. Automation Anywhere 77

10.3. Blue Prism (SS&C) 77

10.4. Kofax 77

10.5. EdgeVerve (AssistEdge) 77

10.6. Infosys Ltd 77

10.7. BlackLine Inc 77

10.8. Nippon Telegraph & Telephone Corp 77

10.9. Pegasystems Inc 77

10.10. SAP SE 77

10.11. Company 11 77

10.12. Company 12 77

10.13. Company 13 77

10.14. Company 14 77

List of Figures

FIG NO. 1. India Robotic Process Automation Market Revenue Share, By Component, 2024 & 2032 50

FIG NO. 2. Market Attractiveness Analysis, By Component 51

FIG NO. 3. Incremental Revenue Growth Opportunity by Component, 2024 – 2032 52

FIG NO. 4. India Robotic Process Automation Market Revenue Share, By Deployment, 2024 & 2032 56

FIG NO. 5. Market Attractiveness Analysis, By Deployment 57

FIG NO. 6. Incremental Revenue Growth Opportunity by Deployment, 2024 – 2032 58

FIG NO. 7. India Robotic Process Automation Market Revenue Share, By Organization Size, 2024 & 2032 60

FIG NO. 8. Market Attractiveness Analysis, By Organization Size 61

FIG NO. 9. Incremental Revenue Growth Opportunity by Organization Size, 2024 – 2032 62

FIG NO. 10. India Robotic Process Automation Market Revenue Share, By Process, 2024 & 2032 64

FIG NO. 11. Market Attractiveness Analysis, By Process 65

FIG NO. 12. Incremental Revenue Growth Opportunity by Process, 2024 – 2032 66

FIG NO. 13. India Robotic Process Automation Market Revenue Share, By Industry Vertical, 2024 & 2032 69

FIG NO. 14. Market Attractiveness Analysis, By Industry Vertical 70

FIG NO. 15. Incremental Revenue Growth Opportunity by Industry Vertical, 2024 – 2032 71

List of Tables

TABLE NO. 1. : India Robotic Process Automation Market Revenue, By Component, 2018 – 2024 (USD Million) 53

TABLE NO. 2. : India Robotic Process Automation Market Revenue, By Component, 2025 – 2032 (USD Million) 53

TABLE NO. 3. : India Robotic Process Automation Market Revenue, By Software, 2018 – 2024 (USD Million) 54

TABLE NO. 4. : India Robotic Process Automation Market Revenue, By Software, 2025 – 2032 (USD Million) 54

TABLE NO. 5. : India Robotic Process Automation Market Revenue, By Services, 2018 – 2024 (USD Million) 55

TABLE NO. 6. : India Robotic Process Automation Market Revenue, By Services, 2025 – 2032 (USD Million) 55

TABLE NO. 7. : India Robotic Process Automation Market Revenue, By Deployment, 2018 – 2024 (USD Million) 59

TABLE NO. 8. : India Robotic Process Automation Market Revenue, By Deployment, 2025 – 2032 (USD Million) 59

TABLE NO. 9. : India Robotic Process Automation Market Revenue, By Organization Size, 2018 – 2024 (USD Million) 63

TABLE NO. 10. : India Robotic Process Automation Market Revenue, By Organization Size, 2025 – 2032 (USD Million) 63

TABLE NO. 11. : India Robotic Process Automation Market Revenue, By Process, 2018 – 2024 (USD Million) 67

TABLE NO. 12. : India Robotic Process Automation Market Revenue, By Process, 2025 – 2032 (USD Million) 68

TABLE NO. 13. : India Robotic Process Automation Market Revenue, By Industry Vertical, 2018 – 2024 (USD Million) 72

TABLE NO. 14. : India Robotic Process Automation Market Revenue, By Industry Vertical, 2025 – 2032 (USD Million) 73