| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Writing Instruments Market Size 2023 |

USD 633.31 Million |

| India Writing Instruments Market, CAGR |

13.36% |

| India Writing Instruments Market Size 2032 |

USD 1,959.67 Million |

Market Overview

India Writing Instruments Market size was valued at USD 633.31 million in 2023 and is anticipated to reach USD 1,959.67 million by 2032, at a CAGR of 13.36% during the forecast period (2023-2032).

The India Writing Instruments market is witnessing significant growth, driven by rising literacy rates, expanding educational initiatives, and increased enrollment in schools and colleges across the country. Government investments in education infrastructure and schemes promoting digital and traditional learning are further fueling demand. Additionally, the growing popularity of premium and ergonomic writing tools among students and professionals supports market expansion. Urbanization and the influence of Western lifestyle trends have led to increased demand for aesthetically designed and branded writing instruments. Furthermore, the rise of e-commerce platforms has improved accessibility and product visibility, encouraging consumer purchases. A notable trend is the shift toward sustainable and eco-friendly products, such as biodegradable pens and refillable pencils, aligning with evolving environmental consciousness. Personalized and limited-edition products are also gaining traction, particularly among younger consumers. These combined factors are propelling the market forward, positioning India as a rapidly evolving hub for both mass-market and premium writing instruments.

The geographical landscape of the India Writing Instruments market is shaped by diverse consumer preferences and educational infrastructure across different regions, including Northern, Western, Southern, and Eastern India. Urban centers such as Delhi, Mumbai, Bengaluru, and Kolkata drive significant demand due to high student populations, a strong corporate presence, and growing interest in premium stationery. Meanwhile, rural and semi-urban areas contribute to volume-based consumption driven by affordability and increasing literacy initiatives. Key players operating in the market include domestic and international brands that cater to a wide spectrum of users. Notable companies include Lamy, Montblanc, Waterman, Faber-Castell, Montegrappa, Pelikan, Kaweco, Diplomat, Aurora, Sheaffer, Cello Pens, and Reynolds. These players focus on product innovation, affordability, and sustainability to strengthen their foothold in India. With the rise of e-commerce and organized retail, these brands are expanding their distribution networks and leveraging digital platforms to connect with a broader consumer base across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Writing Instruments market was valued at USD 633.31 million in 2023 and is expected to reach USD 1,959.67 million by 2032, growing at a CAGR of 13.36% during the forecast period.

- The Global Writing Instruments market was valued at USD 22,000.00 million in 2023 and is expected to reach USD 57,196.01 million by 2032, growing at a CAGR of 11.20% during the forecast period.

- Increasing demand for premium, eco-friendly, and personalized writing instruments is driving market growth.

- Rising disposable incomes and urbanization are contributing to the demand for branded and high-quality writing tools.

- The growing trend of online education and corporate gifting is fueling the demand for specialized writing products.

- Intense competition and price sensitivity, especially in rural markets, are posing challenges for premium brands.

- Northern India holds the largest market share, with significant demand in educational hubs and government institutions.

- Major market players include Lamy, Montblanc, Waterman, Faber-Castell, and Cello Pens, with an increasing focus on product innovation and e-commerce channels.

Report Scope

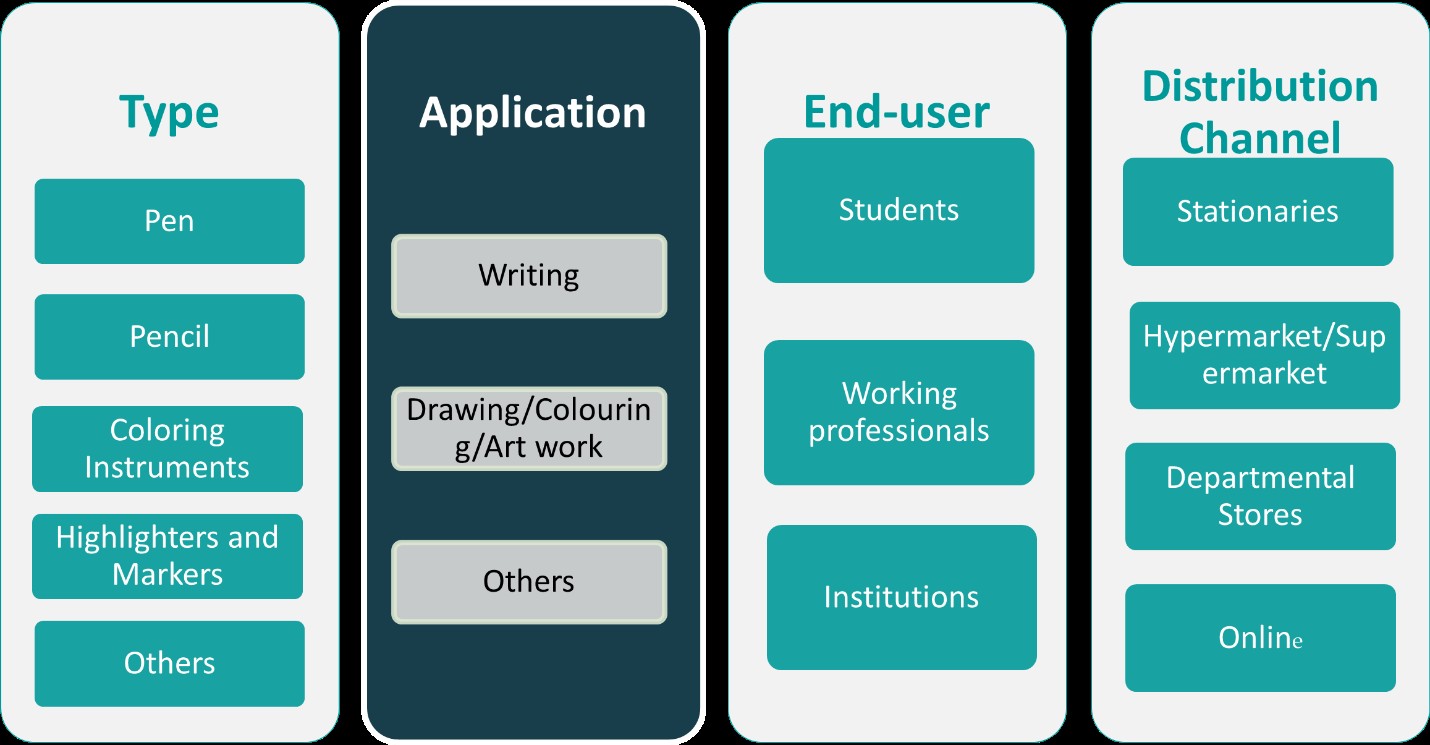

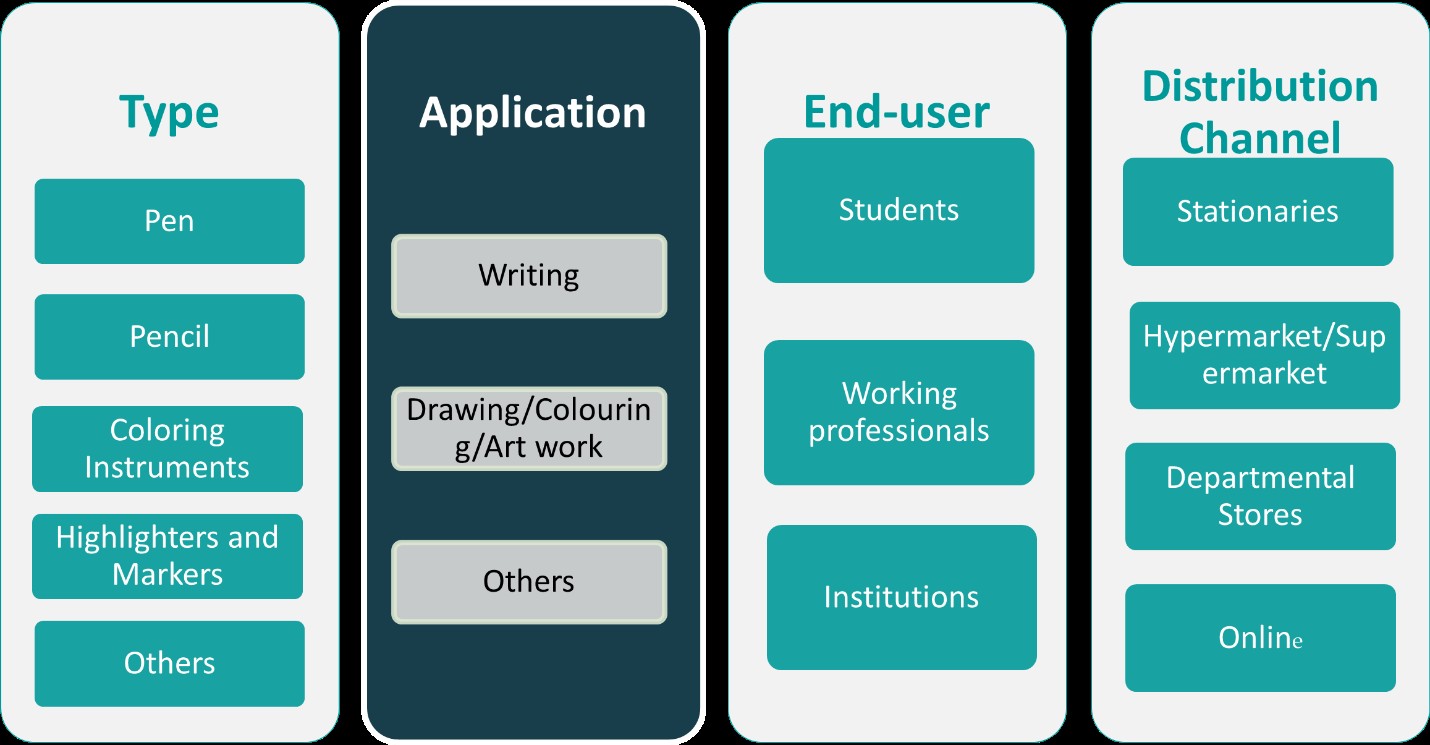

This report segments the India Writing Instruments Market as follows:

Market Drivers

Rising Literacy Rates and Educational Expansion

One of the most significant drivers of the India Writing Instruments market is the consistent rise in literacy rates and the expansion of the education sector. For instance, the Ministry of Statistics and Programme Implementation highlights that India’s literacy rate has steadily increased, reaching 77.7% in 2021. According to national education policies and government data, India continues to make strides in improving access to education across urban and rural regions. As a result, the demand for basic writing tools such as pens, pencils, erasers, and sharpeners is witnessing steady growth. Initiatives like the Right to Education (RTE) Act and the National Education Policy (NEP) have promoted primary and secondary education, further increasing the need for affordable and quality writing instruments. Moreover, the growing number of private schools and educational institutions contributes to consistent product consumption, making the student population a critical consumer base.

Growing Urbanization and Changing Consumer Preferences

Rapid urbanization and evolving consumer lifestyles have led to a surge in demand for more sophisticated and premium writing instruments. For instance, the Indian Brand Equity Foundation (IBEF) reports that urbanization and rising disposable incomes are driving consumer preferences toward high-quality and aesthetically appealing products. With increased exposure to global trends, consumers are now seeking high-quality, ergonomically designed, and aesthetically appealing products. This shift is particularly evident among students, working professionals, and corporate offices. The writing instruments segment is no longer limited to utility; it now reflects status, personality, and brand preference. As a result, domestic and international brands are introducing a wider range of products to meet diverse consumer expectations. Premium pen categories such as rollerball, gel, fountain pens, and stylized mechanical pencils are witnessing increasing traction in urban markets. These products are often used for gifting and professional purposes, which further expands their application scope.

Increased Government Investment in Education Infrastructure

The Indian government’s increased allocation of funds toward educational infrastructure has directly influenced the writing instruments market. Programs such as Sarva Shiksha Abhiyan and Digital India focus on inclusive and holistic learning, creating opportunities for both traditional and digital learning tools. This increased investment ensures that school-going children are provided with essential learning materials, including stationery products. Furthermore, distribution of free educational kits, which often include writing instruments, in public schools and under CSR (Corporate Social Responsibility) initiatives by private organizations, significantly boosts the market. These government-backed efforts not only raise awareness but also improve accessibility, especially in underprivileged and rural communities, where affordability plays a key role in purchasing decisions.

Rise of E-commerce and Eco-conscious Consumer Trends

The rapid growth of online retailing and e-commerce platforms has transformed the buying behavior of Indian consumers, including how writing instruments are purchased. Digital platforms provide access to a broader range of products, brands, and price points, enabling even small and regional players to reach a national audience. At the same time, rising awareness about environmental sustainability is shifting consumer focus toward eco-friendly and biodegradable writing instruments. Refillable pens, recycled paper notebooks, bamboo pencils, and non-toxic ink are gaining popularity, particularly among younger and environmentally conscious consumers. Companies are responding by integrating sustainability into their product innovation strategies, creating a new segment of green stationery that aligns with global climate goals and local values. This dual impact of digital convenience and green awareness is driving product diversification and market competitiveness.

Market Trends

Surging Demand for Premium and Branded Products

The India Writing Instruments market is experiencing a noticeable shift toward premium and branded products, driven by increasing disposable incomes and heightened consumer awareness. Consumers today seek writing instruments that offer not just functionality but also a sense of personal style and brand value. Premium pens, stylized mechanical pencils, and gel pens with ergonomic designs are increasingly favored by working professionals, students, and gift buyers. Brands are capitalizing on this trend by offering products with sleek aesthetics, advanced ink technologies, and luxury finishes. Corporate gifting culture and academic milestones such as graduations have further amplified the demand for high-end writing tools, helping position these items as both functional and aspirational purchases.

Growing Popularity of Eco-friendly and Sustainable Stationery

Sustainability is emerging as a key trend in the India Writing Instruments market, with both consumers and manufacturers showing increased interest in eco-conscious alternatives. For instance, government-backed initiatives promoting biodegradable products have spurred the adoption of bamboo-based pencils and refillable markers in schools across states like Kerala and Himachal Pradesh. Environmental awareness campaigns, such as those led by NGOs in Delhi, have also encouraged urban consumers to switch to recycled packaging and non-toxic materials. Startups and established players alike are innovating to reduce the environmental footprint of their products, aligning with the values of younger generations and eco-conscious buyers.

Increased Product Personalization and Customization

Another notable trend in the market is the rising interest in customized and personalized writing instruments. Consumers now prefer products that reflect their personality, occasion, or corporate identity. This has led to a surge in demand for pens and pencils that feature names, logos, or tailored designs. Companies, particularly in the corporate sector, are leveraging this trend for promotional and gifting purposes by opting for branded merchandise. In the education sector, personalized stationery is also gaining popularity among students and parents. This trend not only supports customer engagement but also allows manufacturers to command premium pricing, thereby enhancing overall profitability.

E-commerce Growth and Omnichannel Expansion

The rapid expansion of e-commerce platforms has transformed the distribution landscape for writing instruments in India. For instance, online marketplaces like Flipkart and Amazon report a significant increase in sales of subscription-based stationery kits among students in Tier-2 cities. Simultaneously, brick-and-mortar retailers are adopting omnichannel strategies to enhance the shopping experience by combining physical presence with digital touchpoints. Seasonal promotions, influencer marketing, and subscription-based stationery kits are gaining momentum, particularly among students and working professionals. This omnichannel approach is helping brands improve market penetration, streamline logistics, and offer tailored services that meet the evolving needs of diverse consumer groups.

Market Challenges Analysis

Rising Digital Adoption and Decline in Traditional Writing Practices

One of the major challenges facing the India Writing Instruments market is the growing reliance on digital devices for communication, learning, and documentation. For instance, government surveys highlight that over 70% of urban schools in cities like Delhi and Bengaluru have adopted digital classrooms, significantly reducing the use of traditional writing tools. The increasing use of smartphones, tablets, and laptops especially among students and professionals has significantly reduced the frequency of handwriting in daily routines. With the rise of digital classrooms, online examinations, and e-books, the dependency on traditional writing tools is steadily declining. This shift has impacted the demand for basic writing instruments such as pens and pencils, particularly in urban centers where technology adoption is higher. As educational institutions and workplaces continue to embrace digital transformation, writing instrument manufacturers must explore ways to reposition their products to remain relevant in a tech-driven environment.

Price Sensitivity and Intense Market Competition

India’s writing instruments market is highly fragmented and price-sensitive, posing another critical challenge for both established and emerging players. A large segment of the population, especially in rural areas, prioritizes affordability over brand or quality, making it difficult for premium brands to gain widespread traction. The market is flooded with unorganized and local manufacturers offering low-cost alternatives, which intensifies price competition and puts pressure on profit margins. Furthermore, counterfeit and substandard products also undermine consumer trust and brand value. To sustain in such a competitive landscape, companies must balance cost-efficiency with quality, while investing in brand differentiation, innovation, and distribution networks. Navigating this competitive pressure remains essential for long-term growth and customer retention in both urban and rural markets.

Market Opportunities

The India Writing Instruments market presents considerable growth opportunities, particularly due to the country’s expanding youth population and a strong focus on education. With over half of India’s population below the age of 25, the demand for writing instruments from schools, colleges, and coaching institutes remains substantial. Government initiatives to improve literacy, such as the New Education Policy (NEP) and increased budgetary allocation for education infrastructure, are expected to sustain demand for writing tools across both urban and rural areas. Additionally, emerging Tier II and Tier III cities offer untapped potential for market penetration. As educational access improves in these regions, so does the need for basic and quality stationery items. Companies that tailor affordable product lines to these markets, while investing in localized distribution channels, stand to benefit significantly. Moreover, CSR activities and non-governmental educational outreach programs continue to create institutional demand for cost-effective, bulk writing instruments.

Another promising opportunity lies in the premiumization and diversification of product offerings. The growing trend of using writing instruments as lifestyle accessories or gifting items has opened doors for premium brands to expand their presence. Increasing consumer interest in personalized, eco-friendly, and ergonomically designed writing tools creates room for innovation in product development. Brands focusing on sustainability and incorporating recyclable or biodegradable materials into their offerings can attract environmentally conscious consumers, especially in metro cities. Furthermore, the growth of e-commerce and omnichannel retail provides an effective platform to reach a wider customer base with minimal investment in physical infrastructure. Digital marketing, influencer collaborations, and subscription-based stationery services also offer avenues to enhance customer engagement and brand visibility. As a result, companies that align their offerings with evolving consumer values and leverage digital platforms are well-positioned to capture long-term growth opportunities in the Indian writing instruments market.

Market Segmentation Analysis:

By Type:

The writing instruments market in India is segmented by type into pens, pencils, coloring instruments, highlighters and markers, and others. Among these, pens hold the largest market share due to their widespread usage across educational, professional, and personal applications. Ballpoint pens are particularly dominant because of their affordability, reliability, and availability. However, gel pens and premium fountain pens are gaining popularity, especially among students and professionals who prefer smooth writing experiences and elegant design. Pencils, both graphite and mechanical, continue to maintain strong demand in schools and among artists, particularly in the early education segment. Meanwhile, coloring instruments such as crayons, sketch pens, and colored pencils are witnessing steady growth due to rising interest in art education and creative activities among children. Highlighters and markers are also gaining traction in academic and corporate settings, driven by their utility in presentations and study aids. The “others” segment, including correction tools and stylus pens, is gradually expanding with niche demand and product innovation.

By Application:

Based on application, the India writing instruments market is categorized into writing, drawing/colouring/art work, and others. The writing segment accounts for the largest share, as pens and pencils remain fundamental tools in schools, colleges, workplaces, and households. Despite the rise of digital alternatives, handwriting continues to play a crucial role in examinations, note-taking, and official documentation, sustaining demand in this segment. The drawing/colouring/art work category is experiencing notable growth, driven by increased focus on extracurricular activities and creative learning in educational curricula. This segment is particularly strong in the pre-primary and primary school demographics, supported by art competitions, workshops, and online art tutorials. Additionally, hobbyists and young adults are showing renewed interest in sketching and journaling, further contributing to this trend. The others segment includes specialized uses such as technical drawing and stylus-based digital inputs, which, while smaller in volume, offer future potential as hybrid learning and working models evolve. Together, these applications reflect a diverse and expanding consumer base in the market.

Segments:

Based on Type:

- Pen

- Pencil

- Coloring Instruments

- Highlighters and Markers

- Others

Based on Application:

- Writing

- Drawing/Colouring/Art Work

- Others

Based on End- User:

- Students

- Working Professionals

- Institutions

Based on Distribution Channel:

- Stationaries

- Hypermarket/Supermarket

- Departmental Stores

- Online

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern India

Northern India holds the largest share in the India writing instruments market, accounting for approximately 33% of the total market revenue in 2023. This dominance is driven by the region’s dense population, high literacy rates, and the presence of major educational hubs such as Delhi, Chandigarh, and Lucknow. Additionally, the concentration of government institutions, coaching centers, and universities in the region contributes significantly to the continuous demand for pens, pencils, and related stationery items. The expansion of Tier II and Tier III cities, along with increasing disposable income, has further accelerated the consumption of both economical and premium writing instruments. Moreover, the robust distribution network and retail infrastructure in Northern India enable manufacturers and retailers to ensure wide product availability. Government-backed initiatives and CSR programs that supply free educational materials in rural and underprivileged areas also add to regional growth.

Western India

Western India commands a market share of around 28%, with Maharashtra and Gujarat playing key roles in shaping regional consumption trends. The region benefits from a well-developed industrial base, growing urbanization, and a flourishing education sector. Cities like Mumbai, Pune, Ahmedabad, and Surat are known for their strong emphasis on academics and corporate presence, which drives consistent demand for writing instruments across both educational and professional domains. Additionally, the rising popularity of corporate gifting and customized stationery has encouraged the growth of premium and branded writing instruments. Western India is also home to several manufacturing and distribution facilities, contributing to the availability of a wide range of writing products. The increasing inclination toward creative learning in schools and the rise of art-based extracurricular programs have further supported the demand for coloring and drawing instruments.

Southern India

Southern India accounts for approximately 23% of the writing instruments market and continues to show promising growth potential. The region includes major cities like Bengaluru, Chennai, and Hyderabad, which are known for their high literacy rates, thriving IT sectors, and world-class educational institutions. Southern consumers often exhibit a preference for quality and design, resulting in growing demand for premium writing tools, eco-friendly pens, and personalized stationery. The education system in this region emphasizes holistic development, which fuels the demand for drawing instruments, highlighters, and art-based tools alongside basic writing instruments. Additionally, Southern India is witnessing increased penetration of online retail channels, enabling consumers to access diverse product lines and niche brands. Companies targeting this market are focusing on school partnerships, product innovation, and sustainable materials to align with the progressive consumer mindset.

Eastern India

Eastern India contributes 16% to the overall writing instruments market, representing the smallest share among the four regions. However, the region holds considerable potential due to its growing focus on education and infrastructure development. States like West Bengal, Odisha, Bihar, and Jharkhand are witnessing gradual improvements in literacy rates and educational access, particularly in rural and semi-urban areas. While the demand for basic and affordable writing instruments is currently dominant, there is rising awareness about quality products and branded offerings. Government initiatives aimed at enhancing rural education and increasing school enrollment have started translating into steady demand for stationery items. However, distribution challenges and limited access to premium product categories continue to restrain market expansion in some areas. To tap into the potential of Eastern India, companies are expected to strengthen their rural distribution networks, introduce low-cost innovation, and partner with local educational bodies for wider product reach and awareness.

Key Player Analysis

- Lamy

- Montblanc

- Waterman

- Faber-Castell

- Montegrappa

- Pelikan

- Kaweco

- Diplomat

- Aurora

- Sheaffer

- Cello Pens

- Reynolds

Competitive Analysis

The India Writing Instruments market is highly competitive, with several leading players vying for market share through product innovation, branding, and distribution strategies. Key players in the market include Lamy, Montblanc, Waterman, Faber-Castell, Montegrappa, Pelikan, Kaweco, Diplomat, Aurora, Sheaffer, Cello Pens, and Reynolds. These companies cater to diverse consumer segments, from budget-friendly offerings to premium, luxury writing tools. These brands invest heavily in product development and marketing strategies to enhance brand recognition and appeal to the growing number of affluent consumers in urban centers. On the other hand, mass-market brands dominate with affordability, offering a wide range of pens, pencils, and other writing tools at competitive prices. They target the large student and office segment, focusing on high-volume sales. The emphasis on value for money, combined with extensive distribution networks, ensures these brands remain popular in rural and semi-urban markets. With the rise of e-commerce, both premium and budget-friendly brands are adapting their strategies, expanding their online presence, and providing direct-to-consumer sales channels. As sustainability becomes a significant trend, companies are incorporating eco-friendly materials and practices into their production processes to attract environmentally conscious consumers.

Recent Developments

- In February 2023, Zebra Pen Corp., a prominent player in the industry, announced its partnership with Liqui-Mark. This collaboration aims to enhance distribution aspects in the market, bringing about a new era of possibilities.

- In July 2023, Montblanc launched its exclusive “Meisterstück 146 LeGrand” fountain pen, featuring a handcrafted design with intricate detailing, addressing the rising demand for personalized, high-end writing tools in luxury segments.

- In April 2022, Zebra Pen Corp. announced the launch of its official website. This step was taken by the company to enhance user experience, increase e-commerce functionality, and improve brand communication, among other objectives.

Market Concentration & Characteristics

The India Writing Instruments market exhibits a moderate level of concentration, with a mix of both large, well-established global brands and a significant presence of local manufacturers. While premium brands focus on niche segments, offering high-quality, luxury writing instruments, mass-market players dominate the majority of the market by catering to budget-conscious consumers. This dual structure allows the market to address a broad consumer base, from professionals and collectors to students and office workers. Local players often leverage cost-effective production methods and extensive distribution networks, making their products widely accessible, particularly in rural and semi-urban areas. In contrast, international brands emphasize product differentiation through design, quality, and exclusivity. The market is characterized by constant innovation, with trends such as eco-friendly products, personalized stationery, and the increasing popularity of digital writing tools. The competitive landscape is also shaped by e-commerce growth, expanding the reach of both premium and affordable brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing focus on corporate gifting and customization is likely to create new revenue streams for writing instrument manufacturers.

- The increasing number of online platforms and retail channels will further enhance consumer access to a variety of writing instruments, especially in tier II and III cities.

- Rising interest in art, design, and creative hobbies among youth will drive the demand for coloring instruments, sketch pens, and other artistic tools.

- The shift towards premiumization will likely boost the demand for high-end pens and specialized writing tools, particularly among professionals and collectors.

- Companies will increasingly invest in research and development to introduce innovative features such as ergonomic designs and multifunctional writing instruments.

- The demand for high-quality, durable writing tools is expected to rise as schools and offices continue to emphasize quality in stationery products.

- Brands will likely explore partnerships with schools, educational institutions, and corporate entities to expand their reach and enhance brand loyalty.

- Technological integration, such as digital pens and smart writing instruments, could open new avenues for growth in the market.

- A growing preference for multi-use writing instruments will drive the demand for products that combine various features, such as pens with built-in stylus capabilities.

- As global environmental awareness increases, there will be a stronger focus on sustainable production processes, with brands adopting eco-friendly materials and packaging.