| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Biomaterials Market Size 2024 |

USD 1,115.89 Million |

| Indonesia Biomaterials Market, CAGR |

14.41% |

| Indonesia Biomaterials Market Size 2032 |

USD 3,276.34 Million |

Market Overview

Indonesia Biomaterials Market size was valued at USD 1,115.89 million in 2024 and is anticipated to reach USD 3,276.34 million by 2032, at a CAGR of 14.41% during the forecast period (2024-2032).

The Indonesia biomaterials market is witnessing significant growth, driven by increasing demand for advanced medical treatments, rising healthcare expenditure, and a growing aging population prone to chronic conditions. Government initiatives to improve healthcare infrastructure and support for biomedical research further bolster market expansion. The rapid adoption of biocompatible materials in orthopedics, cardiovascular devices, and wound healing applications reflects a broader trend toward personalized and regenerative medicine. Technological advancements in bioengineering and the development of novel biomaterials with enhanced properties, such as biodegradability and improved mechanical strength, are shaping product innovation. Additionally, the increasing prevalence of lifestyle-related diseases is prompting higher demand for implants and prosthetics, further accelerating market growth. As domestic manufacturing capabilities expand and collaborations between local players and international companies increase, Indonesia is poised to become a key regional hub in the biomaterials sector. These factors collectively underscore the market’s dynamic evolution and strong growth trajectory.

Geographically, the Indonesia biomaterials market is concentrated in key regions such as Java, Sumatra, Kalimantan, and Sulawesi, with Java being the dominant region due to its well-developed healthcare infrastructure and high population density. Sumatra and Sulawesi are experiencing steady growth as healthcare services expand, while Kalimantan remains a smaller but growing market. The key players in the Indonesia biomaterials market include prominent companies such as Asia Dental, Tricor Group, Panasonic Healthcare Indonesia, Medco Medical, and Indo Medical. These companies are actively involved in the development and distribution of biomaterials across various medical applications, including orthopedics, dental implants, and cardiovascular devices. Their strategies often focus on expanding product portfolios, advancing research and development, and strengthening local partnerships to meet the growing demand for high-quality biomaterials in the region. These efforts are contributing to the dynamic growth and competitive landscape of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indonesia biomaterials market was valued at USD 1,115.89 million in 2024 and is projected to reach USD 3,276.34 million by 2032, growing at a CAGR of 14.41% during the forecast period.

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Growing healthcare expenditure and the rising demand for advanced medical treatments are major drivers of market growth.

- Technological advancements, including innovations in smart biomaterials and biodegradable materials, are shaping the market’s future.

- Increasing prevalence of chronic diseases and an aging population are driving the need for biomaterials in medical implants and prosthetics.

- Market players are focusing on expanding product portfolios, enhancing biocompatibility, and advancing research in regenerative medicine.

- The Indonesian biomaterials market faces challenges such as high production costs and regulatory hurdles, which may slow down market growth.

- Java dominates the market with 55% share, followed by Sumatra at 20%, Kalimantan at 10%, and Sulawesi at 15%.

Report Scope

This report segments the Indonesia Biomaterials Market as follows:

Market Drivers

Growing Healthcare Expenditure and Demand for Advanced Medical Treatments

Indonesia’s increasing healthcare expenditure plays a pivotal role in driving the demand for biomaterials. As the country’s healthcare system continues to evolve, there is a noticeable shift toward advanced medical treatments, including surgeries and implantations that require specialized biomaterials. Rising disposable incomes and greater access to healthcare services contribute to this trend, leading to higher demand for innovative biomaterials. For instance, materials such as biocompatible polymers and composites are increasingly used in orthopedics, dental implants, and cardiovascular applications. As the population becomes more health-conscious, the need for treatments involving biomaterials is projected to rise, supporting market growth in the long term. Furthermore, government policies aimed at improving healthcare access and the promotion of medical technologies further stimulate demand.

Technological Advancements in Biomaterials

The continuous evolution of biomaterials, driven by technological advancements, is another key factor propelling the market in Indonesia. For instance, research institutions and medical device manufacturers are actively developing biomaterials with enhanced properties, such as biodegradability and bioactivity. These advancements improve the performance and longevity of medical devices, such as prosthetics, dental implants, and tissue engineering products. For example, the emergence of smart biomaterials that can respond to changes in the body or release drugs in a controlled manner is reshaping the future of healthcare. These cutting-edge technologies not only provide better treatment options but also enhance the recovery process, making biomaterials more attractive in a broad range of medical applications. As these materials become more sophisticated, they are expected to drive demand across multiple therapeutic sectors.

Increasing Aging Population and Chronic Diseases

Indonesia is experiencing a demographic shift, with an aging population that is increasingly susceptible to chronic diseases. For instance, the Indonesia Longitudinal Aging Survey 2023 highlights the growing elderly population and its impact on healthcare demand. This shift is driving demand for biomaterials used in the treatment of age-related conditions, including joint replacements, cardiovascular devices, and dental implants. As the elderly population grows, the need for prosthetics, implants, and other medical devices that utilize biomaterials will continue to rise. Additionally, the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and osteoarthritis is contributing to the higher adoption of biomaterials. These conditions often require long-term medical interventions, including the use of implants, pacemakers, and orthopedic devices, all of which rely on advanced biomaterials. This increasing demand for medical solutions targeted at managing chronic conditions ensures a steady market growth trajectory.

Supportive Government Initiatives and Investments

The Indonesian government is playing a critical role in fostering the growth of the biomaterials market through supportive policies and investments. The government has increasingly recognized the potential of the healthcare and biomedical sectors to contribute to the country’s economic growth. Various initiatives aimed at improving healthcare infrastructure, promoting local manufacturing of medical devices, and encouraging research and development in the biomaterials field are positively impacting market dynamics. Additionally, foreign investment in Indonesia’s biomedical sector is on the rise, bringing advanced technologies and expertise into the country. This has resulted in collaborations between local companies and international players, further strengthening Indonesia’s position as a hub for biomaterials production. These government-backed efforts help in creating a conducive environment for the biomaterials industry to flourish, which will continue to drive market expansion over the forecast period.

Market Trends

Surge in Demand for Advanced Medical Treatments

Indonesia’s expanding healthcare sector is driving the increased use of biomaterials in advanced medical treatments. As the economy grows, disposable incomes rise, and healthcare access improves, there is a noticeable shift towards sophisticated medical procedures that require specialized biomaterials. This trend is particularly evident in the rising demand for medical implants, such as artificial joints, dental implants, and cardiovascular devices, which rely heavily on advanced biomaterials. The growing emphasis on patient safety and the need for durable, biocompatible materials further contribute to this surge in demand. Consequently, the biomaterials market in Indonesia is experiencing significant growth, with projections indicating a substantial increase in market size over the coming years.

Technological Innovations in Biomaterials

Advancements in material science are leading to the development of novel biomaterials with enhanced properties, such as biodegradability, bioactivity, and superior mechanical strength. For instance, research institutions and medical device manufacturers are actively developing biomaterials with enhanced properties. These innovations are expanding the range of applications for biomaterials, including tissue engineering, wound healing, and drug delivery systems. The integration of nanotechnology and biotechnology is also facilitating the creation of smart biomaterials that can respond to biological signals or environmental changes, offering targeted therapy and improved medical outcomes. These technological advancements are not only improving the performance of medical devices but also enabling the development of more personalized and effective treatment options, thereby driving the growth of the biomaterials market in Indonesia.

Supportive Government Initiatives and Investments

The Indonesian government is actively supporting the growth of the biomaterials sector through policies that encourage research and development, as well as investments in healthcare infrastructure. For instance, government-backed programs are promoting local manufacturing of medical devices and encouraging research and development in biomaterials. Collaborations between academic institutions and industry are fostering innovation in biomaterials, leading to the development of new products and applications. These government-backed efforts help in creating a conducive environment for the biomaterials industry to flourish, which will continue to drive market expansion over the forecast period.

Increasing Prevalence of Chronic Diseases and Aging Population

The rising incidence of chronic diseases such as cardiovascular disorders, diabetes, and osteoarthritis, coupled with an aging population, is escalating the demand for biomaterials in medical devices and implants. Elderly patients often require joint replacements, dental implants, and cardiovascular devices, all of which rely on advanced biomaterials. This demographic shift underscores the need for durable and biocompatible materials that can withstand the physiological demands of aging bodies. Additionally, the increasing prevalence of chronic diseases necessitates long-term medical interventions, including the use of implants, pacemakers, and orthopedic devices, all of which rely on advanced biomaterials. This growing demand is expected to continue driving the expansion of the biomaterials market in Indonesia.

Market Challenges Analysis

High Manufacturing Costs and Limited Local Production

One of the primary challenges facing the biomaterials market in Indonesia is the high cost of manufacturing advanced biomaterials. The production of high-quality biomaterials often requires specialized equipment, skilled labor, and access to advanced technologies, all of which can increase costs. Many biomaterials, particularly those used in medical implants and devices, are imported, which further drives up prices. Local production capabilities for sophisticated biomaterials are still developing, limiting the availability of cost-effective, locally produced alternatives. This dependency on imports not only affects the affordability of biomaterials but also makes the market vulnerable to fluctuations in global supply chains and exchange rates. As a result, the high cost of production remains a significant barrier to market expansion, especially in a price-sensitive market like Indonesia.

Regulatory and Compliance Challenges

The biomaterials industry in Indonesia also faces challenges related to regulatory hurdles and compliance with international standards. While the government has made strides in enhancing healthcare infrastructure, there is still a need for more streamlined and transparent regulatory processes for the approval of new biomaterials. For instance, meeting international quality standards, such as those set by the U.S. FDA or the European Medicines Agency, can be challenging for local manufacturers, particularly small and medium enterprises (SMEs) that lack the resources to conduct rigorous testing and meet global certifications. Delays in regulatory approvals and difficulties in navigating the complex legal landscape can slow down the market entry of innovative biomaterials and limit the competitiveness of local players. Consequently, companies must invest significantly in regulatory compliance and quality assurance processes to ensure market access, which can strain resources and slow product development timelines.

Market Opportunities

Indonesia’s biomaterials market presents several key opportunities, driven by the country’s expanding healthcare sector and evolving medical needs. As the population ages and the prevalence of chronic diseases increases, there is a growing demand for advanced medical treatments such as implants, prosthetics, and dental devices. Biomaterials play a crucial role in these treatments, offering durable and biocompatible solutions for joint replacements, cardiovascular devices, and tissue engineering applications. With the healthcare infrastructure improving and increasing access to medical services, the demand for these products is expected to rise steadily, creating opportunities for both local and international companies. Additionally, as the government continues to support the biomedical sector through research and development funding and initiatives to promote domestic manufacturing, there is a clear opportunity for companies to expand operations and reduce reliance on imported materials.

Technological advancements in biomaterials also present significant growth prospects. Innovations such as biodegradable, bioactive, and smart biomaterials, which can interact with the human body to promote healing or deliver controlled drug release, are gaining traction in Indonesia. These materials are being increasingly integrated into a wide range of medical applications, from orthopedics to wound care and drug delivery. Companies focusing on developing and commercializing cutting-edge biomaterials tailored to the unique needs of the Indonesian market can capitalize on these opportunities. Furthermore, collaborations between local manufacturers and international research institutions could drive the creation of new products and technologies, further enhancing Indonesia’s competitive position in the global biomaterials market. With increasing investments in R&D and a growing consumer market, there is significant potential for innovation and market growth in this dynamic sector.

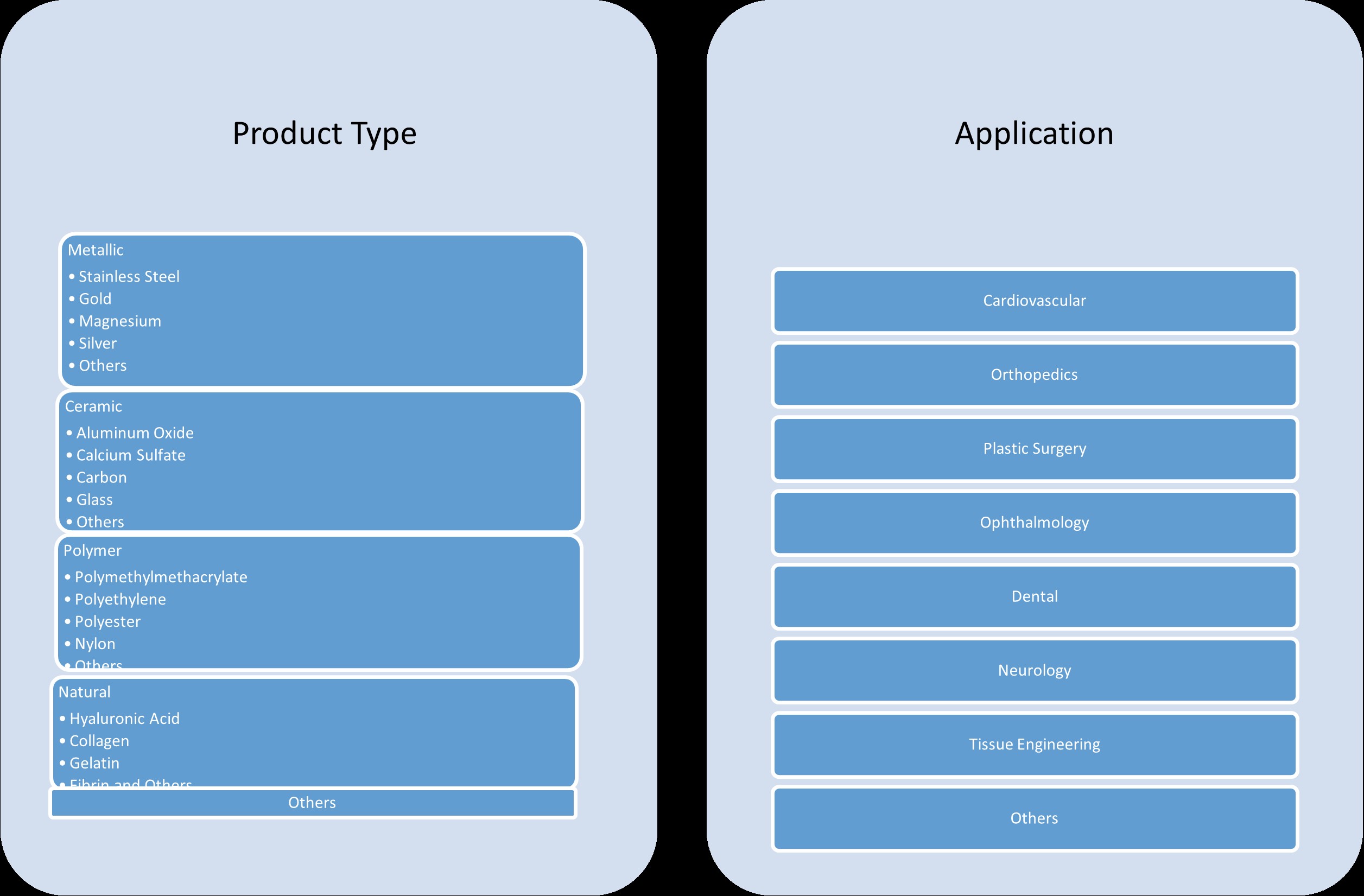

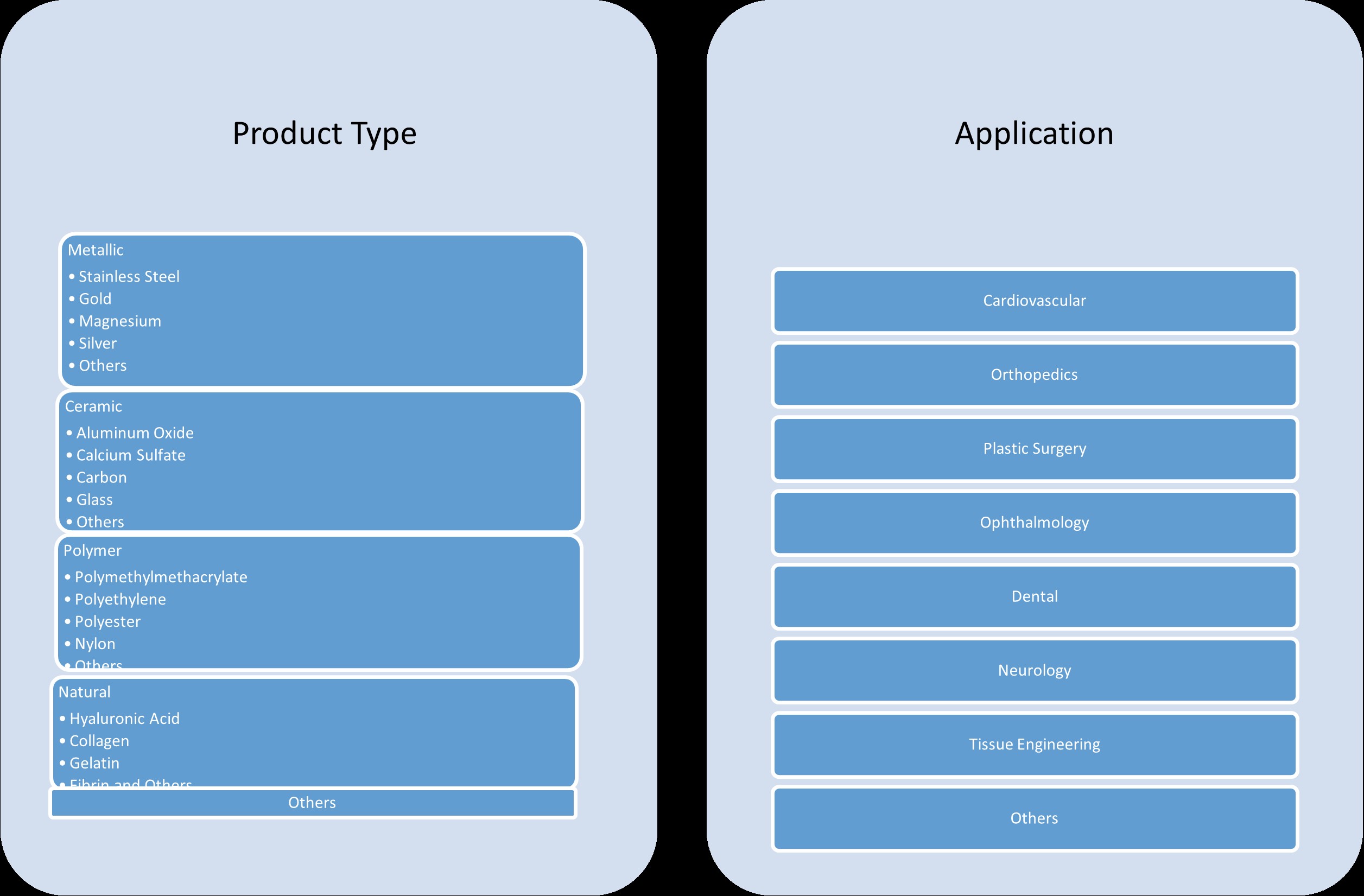

Market Segmentation Analysis:

By Product Type:

The Indonesia biomaterials market is characterized by a diverse range of product types, each catering to specific medical applications. The metallic biomaterials segment includes materials like stainless steel, gold, magnesium, silver, and others, which are primarily used in orthopedics, dental implants, and cardiovascular devices due to their strength and durability. Stainless steel remains the most commonly used metal in medical devices, particularly for joint replacements and fracture fixation devices. Ceramic biomaterials, such as aluminum oxide, calcium sulfate, carbon, and glass, are favored for their biocompatibility and are widely used in applications like dental implants, bone replacements, and tissue regeneration. The polymer segment features materials like polymethylmethacrylate, polyethylene, polyester, and nylon, which are often used in dental and orthopedic applications due to their versatility, ease of processing, and excellent biocompatibility. Natural biomaterials like hyaluronic acid, collagen, gelatin, and fibrin are increasingly used in tissue engineering and regenerative medicine due to their bioactive properties. Together, these product types cater to the growing demand for high-performance materials in the medical field.

By Application:

The biomaterials market in Indonesia is also segmented based on specific medical applications. Cardiovascular applications represent a significant portion of the market, with biomaterials used in stents, heart valves, and pacemaker leads. Orthopedics is another major application area, where biomaterials like metals, ceramics, and polymers are used in joint replacements, bone fixation devices, and implants. Plastic surgery also utilizes biomaterials for reconstructive procedures, with collagen and other natural biomaterials playing a key role in tissue regeneration. In ophthalmology, biomaterials are employed in the development of contact lenses, intraocular lenses, and corneal implants, driving demand for high-quality, biocompatible materials. Dental applications utilize biomaterials for implants, fillings, and crowns, with materials like ceramics and polymers being widely used. Additionally, neurology and tissue engineering are emerging areas in the biomaterials market, with biomaterials being used for nerve regeneration and the development of artificial tissues. These diverse applications highlight the broad scope of the biomaterials market and the growing demand across multiple therapeutic areas in Indonesia.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- Java

- Sumatra

- Kalimantan

- Sulawesi

Regional Analysis

Java

Java holds the largest share of Indonesia’s biomaterials market, accounting for approximately 55% of the total market revenue. The dominance of Java is driven by its role as the economic and healthcare hub of the country. The capital city, Jakarta, along with other major urban centers like Bandung and Surabaya, hosts numerous hospitals, medical research facilities, and healthcare institutions that rely heavily on advanced biomaterials for medical procedures. Additionally, Java’s high population density and its position as the focal point for healthcare policy and infrastructure development further support its substantial share. As the region continues to invest in healthcare technologies and research, Java is expected to maintain its leadership in the biomaterials market, particularly in applications such as orthopedics, cardiovascular devices, and dental implants.

Sumatra

Sumatra, the second-largest island in Indonesia, accounts for approximately 20% of the biomaterials market. The region is home to a growing healthcare sector, particularly in cities like Medan and Palembang. While Sumatra’s market share is smaller than Java’s, the demand for biomaterials is rising due to an increasing focus on healthcare infrastructure development. The region’s hospitals and medical centers are becoming more equipped with advanced medical technologies, leading to a greater need for biomaterials in orthopedic surgeries, cardiovascular treatments, and dental procedures. As the government continues to improve healthcare access and invest in medical services for rural areas, Sumatra’s share of the biomaterials market is expected to grow in the coming years.

Kalimantan

Kalimantan, with a market share of around 10%, represents a smaller portion of Indonesia’s biomaterials market, largely due to its more limited healthcare infrastructure compared to Java and Sumatra. However, Kalimantan is experiencing gradual improvements in healthcare facilities, particularly in urban areas like Banjarmasin and Pontianak. The region’s healthcare demand is driven by the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, which require the use of biomaterials in medical devices like stents, joint replacements, and dental implants. With ongoing healthcare improvements and increased awareness of advanced medical treatments, Kalimantan’s share of the biomaterials market is expected to grow moderately in the future.

Sulawesi

Sulawesi holds around 15% of Indonesia’s biomaterials market, with a steadily growing healthcare sector. Cities like Makassar and Manado are becoming regional centers for medical services, contributing to the rising demand for biomaterials in various medical fields, including orthopedics and ophthalmology. Despite being a smaller market compared to Java and Sumatra, Sulawesi’s growth potential is significant, especially with the government’s initiatives to improve healthcare access in both urban and rural areas. As healthcare infrastructure expands and the local population becomes more aware of advanced medical treatments, Sulawesi is positioned for steady growth in the biomaterials market, with a focus on materials for joint replacements, dental implants, and wound healing.

Key Player Analysis

- Asia Dental

- Tricor Group

- Panasonic Healthcare Indonesia

- Medco Medical

- Indo Medical

Competitive Analysis

The Indonesia biomaterials market is competitive, with several key players actively contributing to its growth through product innovation and strategic expansions. Leading companies such as Asia Dental, Tricor Group, Panasonic Healthcare Indonesia, Medco Medical, and Indo Medical dominate the landscape by offering a wide range of biomaterials used in medical applications such as orthopedics, dental implants, and cardiovascular devices. These companies focus on enhancing product portfolios with advanced biomaterials like biocompatible metals, polymers, and ceramics to meet the increasing demand for medical treatments. These market participants are also making substantial investments in research and development to create materials with enhanced properties like biodegradability, bioactivity, and superior mechanical strength to cater to the growing demand for advanced medical treatments. To stay competitive, firms are strengthening their distribution networks and forming strategic partnerships with local healthcare institutions, which helps in improving market reach and boosting product availability across different regions. Additionally, several companies are focusing on local manufacturing, which not only helps reduce production costs but also ensures a steady supply of high-quality materials to meet the growing demand for medical implants and devices. With an increasing emphasis on technological advancements, companies are integrating new technologies like nanotechnology and biotechnology into their biomaterials, creating smarter, more effective solutions for medical applications. As the market continues to evolve, competition is expected to intensify, and firms that can effectively leverage innovation and build strong partnerships are likely to emerge as market leaders.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Indonesia biomaterials market is moderately concentrated, with a mix of local and international players contributing to its growth. While the market is still evolving, major players hold a significant share, especially in regions with well-established healthcare infrastructure such as Java. The market characteristics include a growing emphasis on high-quality, biocompatible materials for medical applications such as orthopedics, dental implants, and cardiovascular devices. Companies are increasingly focusing on innovation, developing materials with enhanced properties like biodegradability and superior mechanical strength. Additionally, there is a notable trend towards local manufacturing, as companies aim to reduce production costs and ensure consistent supply. With the rising demand for advanced medical treatments, the market is seeing increased competition, and new players are entering the space to cater to the expanding healthcare needs. Overall, the market remains dynamic, with a balance of established players and emerging companies focused on innovation and regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Indonesia biomaterials market is expected to experience steady growth due to rising healthcare demand and advancements in medical technology.

- Increasing awareness of advanced medical treatments will drive the demand for biomaterials, particularly in orthopedics, dental implants, and cardiovascular devices.

- Technological innovations, such as biodegradable and smart biomaterials, will expand the range of applications, particularly in tissue engineering and regenerative medicine.

- The growing aging population in Indonesia will further contribute to the demand for durable and biocompatible materials for medical implants and prosthetics.

- The government’s ongoing initiatives to enhance healthcare infrastructure and promote local manufacturing will strengthen the domestic biomaterials market.

- Collaborations between local and international companies will foster the development of innovative products and increase market competition.

- Regional disparities in healthcare access will continue to shape the biomaterials market, with higher growth rates expected in areas outside Java, like Sumatra and Kalimantan.

- The market will see more focus on sustainable biomaterials as environmental concerns push for greener, eco-friendly alternatives.

- Increased investments in research and development will lead to the introduction of advanced biomaterials with improved performance characteristics.

- As healthcare services expand, especially in rural areas, the overall demand for high-quality biomaterials in Indonesia will continue to rise.