| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Feminine Hygiene Products Market Size 2023 |

USD 143.51 Million |

| Indonesia Feminine Hygiene Products Market, CAGR |

6.6% |

| Indonesia Feminine Hygiene Products Market Size 2032 |

USD 255.59 Million |

Market Overview:

Indonesia Feminine Hygiene Products Market size was valued at USD 143.51 million in 2023 and is anticipated to reach USD 255.59 million by 2032, at a CAGR of 6.6% during the forecast period (2023-2032).

The growth of the feminine hygiene market in Indonesia is primarily driven by several key factors. Increased awareness and education around menstrual health, supported by government initiatives and educational programs, have played a significant role in promoting the adoption of hygiene products. Additionally, rising disposable incomes, driven by the country’s economic growth, have empowered more women to afford higher-quality hygiene products. Urbanization and changing lifestyles, particularly in larger cities, have further increased the demand for convenient and effective feminine hygiene solutions. Another important driver is the innovation in products, such as organic and eco-friendly options, which cater to the growing environmental consciousness and diverse consumer preferences. As more women embrace these products, the market continues to expand, especially in response to evolving consumer demands.

The Indonesian feminine hygiene market presents distinct dynamics across different regions. Urban centers like Jakarta and Surabaya show significantly higher consumption rates due to better access to products, greater awareness, and a more developed retail infrastructure. In contrast, rural areas face challenges such as limited access to hygiene products, lower levels of awareness, and cultural barriers, which impact the market penetration in these regions. To address these disparities, there is a need for improved distribution channels and targeted educational outreach to ensure that women across Indonesia, both urban and rural, have equitable access to essential hygiene products. Furthermore, expanding product availability in underserved areas could drive further market growth and help break down remaining social stigmas surrounding menstrual health.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Indonesia feminine hygiene products market was valued at USD 143.51 million in 2023 and is expected to grow to USD 255.59 million by 2032, with a CAGR of 6.6%.

- Increased awareness and education around menstrual health, driven by government and non-governmental initiatives, is empowering women to adopt hygienic practices.

- Rising disposable incomes in Indonesia are enabling women to afford higher-quality, premium products, including organic and eco-friendly options.

- Urbanization is contributing significantly to market growth, as more women in cities gain access to modern retail outlets and diverse hygiene product options.

- Product innovation, especially in sustainable and health-conscious offerings like biodegradable pads and menstrual cups, is driving further market expansion.

- Cultural taboos and stigma surrounding menstruation continue to hinder market growth, especially in rural areas, where traditional alternatives are still widely used.

- Limited access to feminine hygiene products in rural areas remains a key challenge, requiring improved distribution channels and educational outreach to expand market reach.

Market Drivers:

Increased Awareness and Education

One of the primary drivers of growth in the Indonesian feminine hygiene market is the increased awareness and education surrounding menstrual health. Over the years, government and non-governmental organizations have implemented various initiatives to educate women about menstrual hygiene and the importance of using proper hygiene products. Educational campaigns have helped break down long-standing cultural taboos surrounding menstruation, empowering women to adopt hygienic practices and purchase feminine hygiene products. As societal attitudes evolve, more women are becoming comfortable with menstruation discussions, leading to higher demand for products that support menstrual health.

Rising Disposable Incomes

The rise in disposable incomes in Indonesia has contributed significantly to the growth of the feminine hygiene market. As the country’s economy continues to develop, more women have access to higher disposable income, enabling them to afford better quality products. Increased purchasing power has allowed consumers to shift towards premium feminine hygiene products, such as organic or eco-friendly options, which are often priced higher than traditional products. As a result, there is an evident shift towards greater product variety, with women increasingly opting for brands that offer superior quality, comfort, and environmental sustainability.

Urbanization and Changing Lifestyles

Urbanization is another key factor driving the growth of the feminine hygiene products market in Indonesia. As more women in urban areas gain access to modern retail outlets, convenience, and a wider selection of products, demand for feminine hygiene products has surged. Urbanization has also led to changes in lifestyle, with more women participating in the workforce and balancing professional and personal responsibilities. This shift has heightened the need for more convenient, efficient, and portable hygiene solutions. For instance, urban women, especially millennials and Gen Z, show a marked preference for slim, ultra-thin, and discreet products, such as pantyliners and thin towels, which cater to active lifestyles and the need for comfort and minimalism. Furthermore, women in urban areas are more likely to be exposed to global trends and advancements in hygiene products, which has sparked a demand for innovative and high-quality alternatives in the market.

Product Innovation and Sustainability Trends

Innovation in product offerings plays a crucial role in driving market growth. The Indonesian market has witnessed a rise in the availability of new and innovative feminine hygiene products. These innovations include eco-friendly options such as biodegradable pads, organic cotton tampons, and menstrual cups. As consumer preferences shift toward more sustainable and health-conscious products, manufacturers are increasingly focusing on offering eco-friendly alternatives to cater to this demand. For example, PT Uni-Charm Indonesia Tbk launched Charm Daun Sirih + Herbal Bio sanitary napkins, incorporating bio-materials such as pressed sugarcane, limestone, botanical oil, and natural resins to reduce reliance on petroleum-based materials. These products were made available through e-commerce and selected stores, aligning with World Environment Day initiatives. Additionally, brands are incorporating technological advancements in the design and functionality of their products to enhance comfort and usability, which further accelerates consumer adoption. These innovations have helped position feminine hygiene products as not just a necessity but also a choice for better health and environmental sustainability.

Market Trends:

Shift Towards Eco-friendly and Sustainable Products

A significant trend in the Indonesian feminine hygiene market is the growing preference for eco-friendly and sustainable products. For example, Perfect Fit, an Indonesian brand, offers reusable pads, period underwear, and biodegradable bamboo pads, directly addressing both health and environmental concerns. As environmental concerns become more prominent among consumers, women in Indonesia are increasingly opting for products that align with their environmental values. This shift is evident in the rising demand for biodegradable sanitary pads, menstrual cups, and organic cotton tampons. These products not only offer a healthier alternative but also contribute to reducing the environmental impact associated with traditional hygiene products. Manufacturers are responding to this demand by innovating and introducing more sustainable options, which is helping to drive the market’s growth, especially among environmentally conscious consumers.

Growth of E-commerce and Online Retail

The expansion of e-commerce in Indonesia is another key trend shaping the feminine hygiene market. With the increasing internet penetration and smartphone usage, online shopping platforms have become a popular channel for purchasing feminine hygiene products. E-commerce enables consumers to access a wide variety of products that may not be readily available in local retail stores, offering convenience and often better prices. Online platforms also provide women with the ability to purchase products discreetly, which is an essential factor in a market where menstruation is still a sensitive topic. The growth of online retail channels has resulted in increased market accessibility, especially in remote or rural regions where traditional retail infrastructure may be limited.

Adoption of High-Tech Feminine Hygiene Solutions

Another emerging trend is the adoption of high-tech feminine hygiene solutions, particularly those incorporating wearable technologies. Smart menstrual cups, for example, are gaining popularity as they offer features such as tracking menstrual flow and predicting cycles. This trend towards high-tech solutions reflects the growing interest in health monitoring and personalized wellness among Indonesian women. As more women seek products that offer enhanced functionality and health benefits, manufacturers are incorporating innovations such as better absorbency, odor control, and skin-friendly materials to meet these needs. For instance, globally, brands such as Intimina and MeLuna have introduced innovations like smaller, more portable menstrual cups and multiple firmness levels for comfort, and these trends are gradually entering the Indonesian market. This trend is particularly prevalent among younger, tech-savvy consumers who are keen to embrace the latest advancements in personal care.

Rising Focus on Menstrual Health Education

In line with increasing awareness, there is a noticeable trend towards more focused menstrual health education, particularly through digital platforms and social media. As more women in Indonesia gain access to information via online channels, they are becoming more informed about the importance of using hygienic products during menstruation. Social media influencers and health advocates are also playing a significant role in driving this trend by promoting the benefits of various feminine hygiene products and debunking myths surrounding menstruation. This growing knowledge base is contributing to the wider acceptance of feminine hygiene products, leading to higher demand and improved market penetration, especially in regions where awareness was previously low.

Market Challenges Analysis:

Cultural Taboos and Stigma

Despite growing awareness, cultural taboos and stigma surrounding menstruation remain a significant restraint in the Indonesian feminine hygiene market. In many regions, menstruation is still considered a sensitive and often shameful subject, which can lead to reluctance in adopting hygiene products. This cultural barrier, especially in rural areas, results in lower usage of feminine hygiene products and limits market growth potential. Women in these regions may resort to traditional, less hygienic alternatives, which can impact their health and contribute to the slow adoption of modern products.

Limited Access in Rural Areas

Access to feminine hygiene products remains a challenge in Indonesia’s rural and remote areas. For instance, a United Nations survey found that 1 in 5 adolescent girls encounter obstacles in accessing sanitary products due to high costs or limited mobility, and 22% of women and girls lack the resources to manage their periods well due to insufficient products, education, and facilities. While urban centers experience growing demand and product availability, rural regions face infrastructure limitations that hinder distribution. This issue is compounded by the lack of retail outlets, making it difficult for consumers to find and purchase feminine hygiene products. In many cases, women in these areas either have to travel long distances to purchase products or rely on informal markets, which may not offer a full range of hygienic options. Overcoming these distribution barriers is essential for expanding the market reach.

High Product Costs

The cost of premium feminine hygiene products, such as organic and eco-friendly options, may limit their adoption among price-sensitive consumers. While rising disposable incomes have allowed some women to access higher-quality products, many still find them unaffordable. In particular, low-income households in both urban and rural areas struggle to afford these products, which may deter broader market penetration. Manufacturers must balance the need for product innovation with the necessity to keep prices competitive in order to cater to a wider consumer base.

Lack of Regulation and Standardization

The absence of comprehensive regulations and product standardization in Indonesia’s feminine hygiene sector poses a challenge. The lack of clear guidelines on product quality and safety can lead to substandard products entering the market, potentially damaging consumer trust. As the market grows, the need for stronger regulatory frameworks becomes critical to ensure product quality, safety, and consumer confidence.

Market Opportunities:

The Indonesian feminine hygiene products market presents several opportunities for growth, particularly driven by shifting consumer preferences and increasing awareness. One of the primary opportunities lies in the growing demand for eco-friendly and organic products. As consumers become more environmentally conscious, the preference for sustainable and biodegradable feminine hygiene products, such as menstrual cups and organic cotton pads, is on the rise. This trend offers manufacturers an opportunity to innovate and introduce new products that cater to health-conscious and eco-aware consumers. With Indonesia’s young population becoming more aware of global trends, there is a significant potential for brands to capture market share by offering products that align with these values, ensuring that they remain relevant in a rapidly evolving market.

Furthermore, there is considerable growth potential in rural and underserved areas of Indonesia. While urban centers such as Jakarta and Surabaya are witnessing robust demand for feminine hygiene products, rural regions still present an untapped market. Expanding distribution networks and improving access to products in these areas will not only address existing demand but also open up new growth avenues. Partnering with local retailers, using e-commerce platforms, and launching awareness campaigns focused on menstrual health can significantly increase product adoption. By overcoming infrastructure and awareness challenges, companies can capture a larger portion of the market and drive long-term growth in the Indonesian feminine hygiene sector.

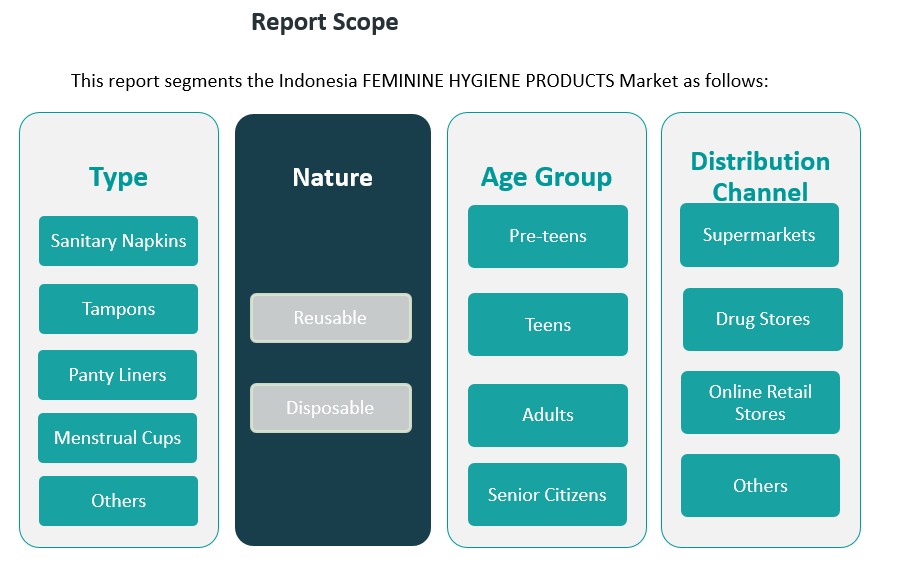

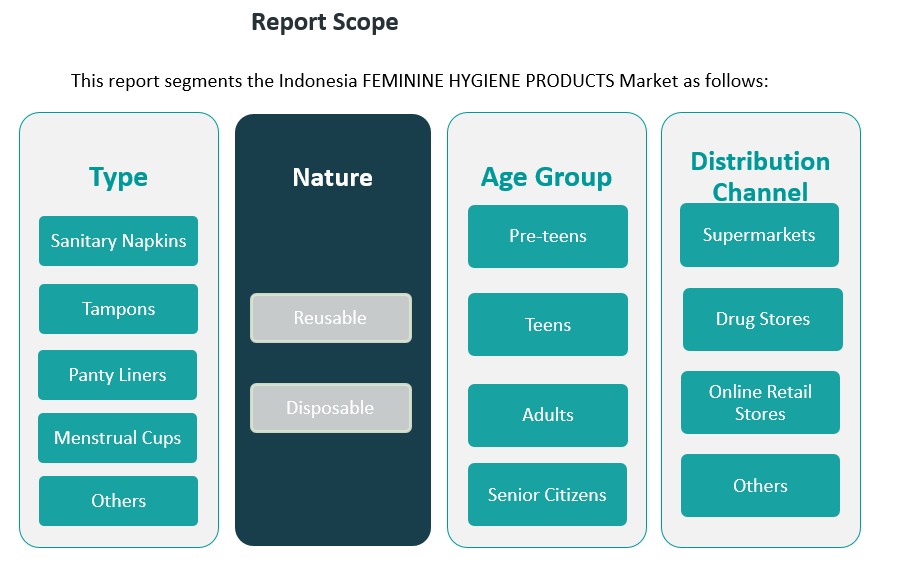

Market Segmentation Analysis:

The Indonesian feminine hygiene products market is segmented across various categories, each contributing to the overall market growth.

By type, the market is dominated by sanitary napkins, which hold the largest share due to their wide accessibility and ease of use. Tampons and panty liners also represent significant segments, with increasing adoption in urban areas. Menstrual cups are gaining popularity, driven by their eco-friendly and cost-effective nature, though they remain a niche segment. Other products, such as period panties and menstrual discs, are emerging as alternatives but have a relatively smaller market share.

By nature, the market is split between reusable and disposable products. Disposable products, such as sanitary napkins and tampons, dominate the market due to their convenience and widespread availability. However, the demand for reusable products, such as menstrual cups and washable cloth pads, is rising as consumers become more environmentally conscious. This shift reflects the growing awareness of sustainability, especially among younger and urban populations.

By age group, the market caters to pre-teens, teens, adults, and senior citizens. Teenagers and adults represent the largest consumer segments, as they are the primary users of feminine hygiene products. However, with the aging population, there is increasing demand for products designed for senior citizens, particularly for those with specific healthcare needs.

By distribution channel, supermarkets and drug stores continue to lead the market, offering convenience for consumers. Online retail stores are gaining momentum, especially with the rise of e-commerce, offering greater accessibility and privacy. Other channels, including small local stores, also contribute to market penetration in rural areas.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

Indonesia’s feminine hygiene market is experiencing dynamic growth, with regional disparities influenced by factors such as urbanization, income levels, and cultural attitudes.

Urban Centers: Jakarta and Surabaya

Urban areas, particularly Jakarta and Surabaya, dominate the market, accounting for a significant share of the total revenue. These regions benefit from higher disposable incomes, greater awareness of menstrual health, and better access to a variety of feminine hygiene products. The prevalence of modern retail channels, including supermarkets and online platforms, facilitates widespread product availability. As a result, urban centers are witnessing an increased adoption of premium products, such as organic and eco-friendly options, aligning with global sustainability trends.

Suburban and Rural Areas

In contrast, suburban and rural regions face challenges that hinder market growth. Limited access to retail outlets, lower levels of awareness regarding menstrual hygiene, and cultural taboos contribute to reduced consumption of feminine hygiene products. These areas often rely on traditional methods, which may not offer the same level of hygiene and comfort as modern products. However, ongoing government initiatives and educational campaigns aim to bridge these gaps, promoting better menstrual health practices and increasing product adoption.

E-commerce and Distribution Channels

The rise of e-commerce has significantly impacted the distribution of feminine hygiene products, especially in regions with limited physical retail presence. Online platforms provide consumers with access to a wide range of products, often accompanied by educational content that enhances awareness. This digital shift is particularly beneficial for reaching underserved populations, offering them convenience and privacy in purchasing hygiene products.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Yoni

Competitive Analysis:

The competitive landscape of Indonesia’s feminine hygiene products market is characterized by the presence of both local and international brands offering a wide range of products. Major international players, such as Procter & Gamble (P&G) with its Always brand and Kimberly-Clark with Kotex, dominate the market. These companies have established strong brand recognition and extensive distribution networks, enabling them to capture significant market share, particularly in urban areas. Local brands also hold a competitive edge by catering to regional preferences and affordability, offering products that are more accessible to price-sensitive consumers. Brands like Sani and Lifree are prominent in this segment. In recent years, the market has seen an increase in demand for eco-friendly and organic products, leading to the rise of niche players offering sustainable alternatives like menstrual cups and organic cotton pads. Overall, the market is highly competitive, with ongoing innovation and pricing strategies driving consumer choice.

Recent Developments:

- In March 2025, Procter & Gamble launched Always Pocket Flexfoam, a new addition to its feminine care line, designed for portability and on-the-go protection. The launch was celebrated with a high-profile partnership at Coachella 2025, where Always and Tampax became the festival’s first-ever period care partners, providing products and on-site activations for attendees. This campaign highlights P&G’s commitment to both product innovation and experiential marketing in the feminine hygiene space.

- In July 2023, Unicharm’s subsidiary in Indonesia launched Charm Daun Sirih + Herbal Bio sanitary napkins, featuring eco-friendly materials. The company continues to innovate with products using bio-materials and is expanding its range of disposable period underwear to meet growing demand, particularly among younger consumers.

Market Concentration & Characteristics:

The Indonesian feminine hygiene products market exhibits moderate concentration, with a few dominant international players holding significant market share. Companies like Procter & Gamble (Always) and Kimberly-Clark (Kotex) lead the market, benefiting from strong brand recognition, extensive distribution networks, and deep consumer trust. These multinational corporations command a large portion of the market, particularly in urban areas, where their products are easily accessible through modern retail channels. However, the market is also characterized by the growing presence of local brands, which cater to more price-sensitive consumers and regional preferences. Local brands such as Sani and Lifree offer competitively priced products, contributing to a fragmented market landscape. The market is also seeing increased diversification with the introduction of eco-friendly and sustainable alternatives, such as menstrual cups and organic cotton pads, catering to environmentally conscious consumers. This dynamic creates a competitive environment where innovation and pricing strategies are crucial for market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue to expand, driven by increasing awareness and higher disposable incomes.

- Urbanization will spur demand in major cities, where access to modern retail channels is growing.

- Rural markets may experience slower growth due to cultural taboos and limited product access, but improvements will be seen through educational initiatives.

- Eco-friendly products, including biodegradable pads and menstrual cups, will become more popular among environmentally conscious consumers.

- E-commerce adoption will make feminine hygiene products more accessible, especially in underserved areas.

- Health-conscious consumers will increasingly demand organic and natural product options, encouraging diversification.

- Government-led menstrual health education campaigns will enhance awareness and boost product adoption, particularly in rural regions.

- Innovation in product design focused on comfort and sustainability will increase competition among brands.

- Distribution networks will strengthen, improving access to hygiene products in remote and rural areas.

- The shift towards sustainability will encourage both local and international brands to focus on eco-friendly manufacturing practices.