Market Overview

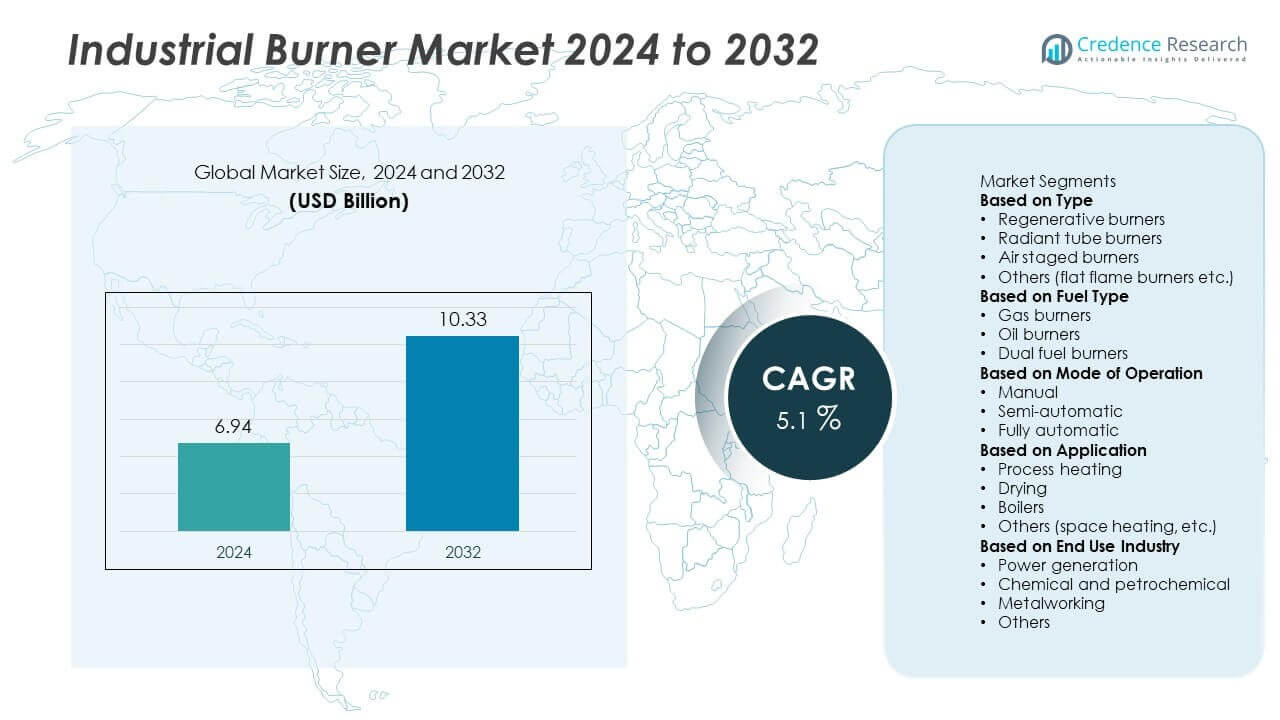

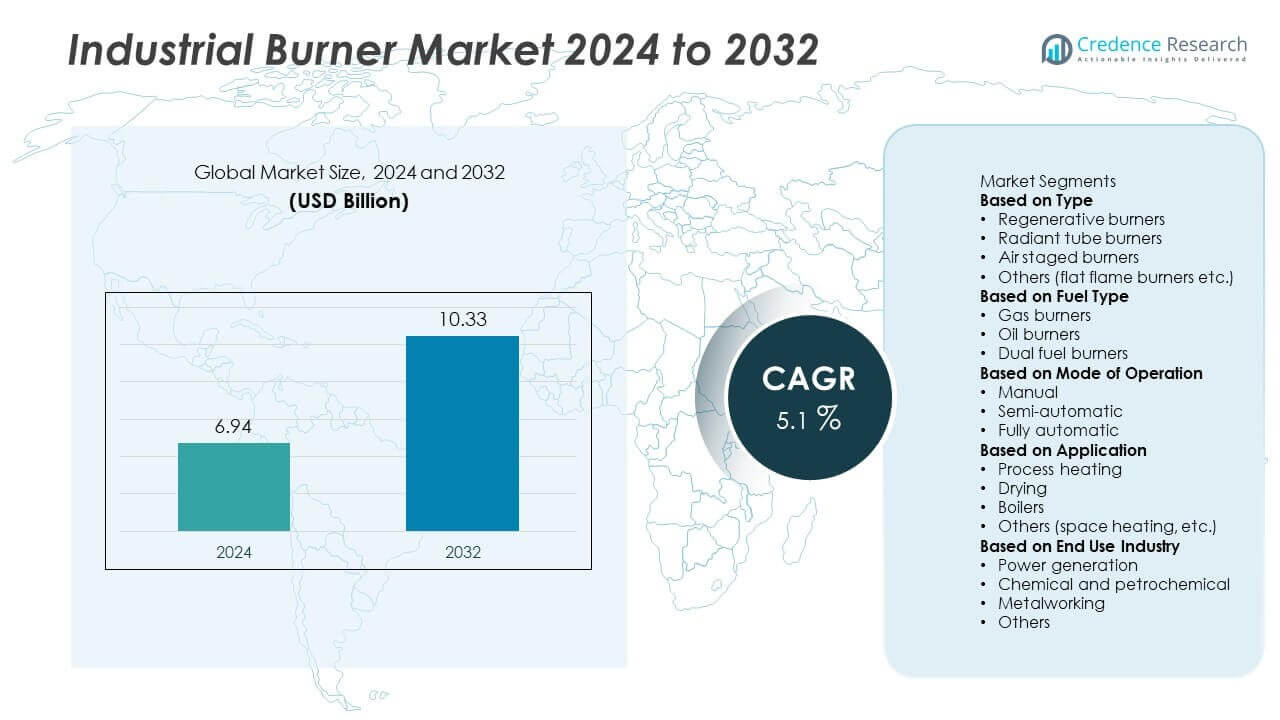

The global Industrial Burner Market was valued at USD 6.94 billion in 2024 and is projected to reach USD 10.33 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Burner Market Size 2024 |

USD 6.94 Billion |

| Industrial Burner Market, CAGR |

5.1% |

| Industrial Burner Market Size 2032 |

USD 10.33 Billion |

Industrial Burner Market grows with rising demand for energy-efficient and low-emission combustion systems across manufacturing, chemicals, and power generation sectors. Strict global emission standards push industries to adopt low-NOx and fuel-flexible burners that optimize efficiency and reduce environmental impact.

Geographically, the Industrial Burner Market shows robust growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with strong demand from chemical processing, metal production, and food industries supported by strict emission regulations and adoption of energy-efficient burners. Europe focuses on low-NOx technologies and retrofitting projects to meet EU decarbonization goals. Asia-Pacific is the fastest-growing region, driven by rapid industrialization, large-scale infrastructure projects, and rising adoption of natural gas and biofuel-compatible burners in China and India. Latin America and Middle East & Africa experience growth from oil & gas expansion, power generation projects, and industrial park developments. Key players shaping this market include Honeywell Thermal Solutions, Alfa Laval, Miura America, Oilon, and Fives Group, who invest in advanced combustion technologies, fuel-flexible solutions, and automation to meet evolving industry demands and regulatory compliance while improving operational efficiency.

Market Insights

- Industrial Burner Market was valued at USD 6.94 billion in 2024 and is projected to reach USD 10.33 billion by 2032, growing at a CAGR of 5.1%.

- Rising demand for energy-efficient and low-emission combustion systems drives strong adoption across manufacturing, chemicals, and power generation sectors.

- Market trends highlight integration of IoT-enabled burners, digital control systems, and fuel-flexible designs supporting hydrogen and biofuel applications.

- Competitive landscape features Honeywell Thermal Solutions, Alfa Laval, Miura America, Oilon, and Fives Group focusing on innovation, automation, and sustainability-focused burner solutions.

- High initial investment and installation costs restrain adoption for small and mid-sized enterprises and delay replacement of legacy systems.

- Asia-Pacific leads growth with rapid industrialization, large-scale manufacturing expansion, and government-led energy efficiency initiatives, while Europe and North America show strong demand for low-NOx burners.

- Latin America and Middle East & Africa witness rising opportunities from oil & gas projects, power generation capacity additions, and industrial infrastructure development supporting steady burner demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Energy-Efficient Combustion Solutions

Industrial Burner Market grows with rising demand for energy-efficient combustion systems across industries. Manufacturers seek burners that minimize fuel consumption and reduce emissions to meet stringent regulations. Energy-intensive sectors such as chemicals, food processing, and metal production adopt high-efficiency burners to cut operating costs. Governments encourage use of low-NOx and eco-friendly burners to limit air pollution. It supports adoption of modern combustion technologies that offer precise temperature control. This shift helps industries achieve sustainability targets and optimize resource utilization.

- For instance, Fives Group launched its ITAS Invistableflame flameless burner, a hydrogen-proven technology capable of operating with 100% hydrogen or natural gas blends. The burner uses flameless combustion to achieve ultra-low NOx emissions by reducing thermal NOx formation.

Expansion of Industrial Infrastructure and Process Heating Applications

Industrial Burner Market benefits from infrastructure expansion and rising demand for process heating in manufacturing, oil & gas, and power generation. New industrial facilities require reliable burners to ensure stable and safe operations. Growth in petrochemical and refining activities fuels need for large-capacity burners with consistent performance. It creates opportunities for suppliers offering tailored solutions for diverse applications. Increasing demand for thermal efficiency drives innovation in burner design. Industries prioritize equipment that ensures long service life and low maintenance requirements.

- For instance, Alfa Laval secured an order to supply marine boiler systems with integrated burners capable of incinerating up to 100 kg/h of ammonia waste gas for four 45,000 m³ multi-gas carriers, marking the first commercial deployment of ammonia-ready combustion technology at sea.

Stricter Emission Standards and Environmental Compliance

Industrial Burner Market experiences growth due to enforcement of strict emission norms worldwide. Regulatory bodies promote adoption of low-emission burners to reduce NOx, SOx, and CO2 levels. Companies upgrade legacy systems with advanced burners to maintain compliance and avoid penalties. It encourages development of clean combustion technologies and use of alternative fuels. Industrial operators focus on reducing carbon footprints and improving workplace air quality. This regulatory pressure fuels steady demand for modern, environmentally friendly burner systems.

Adoption of Automation and Digital Control Technologies

Industrial Burner Market expands with integration of automation, IoT, and digital monitoring systems. Smart burners enable remote operation, real-time performance tracking, and predictive maintenance. These features improve efficiency and reduce unplanned downtime. It allows operators to optimize combustion settings and achieve better fuel-to-air ratios. Demand rises for burners that integrate seamlessly with plant control systems. Rapid adoption of Industry 4.0 practices supports the shift toward intelligent, connected combustion solutions.

Market Trends

Market Trends

Shift Toward Low-Emission and Sustainable Combustion Technologies

Industrial Burner Market shows a strong trend toward low-NOx, low-CO, and eco-friendly combustion solutions. Manufacturers design burners that meet stringent global emission standards while maintaining thermal efficiency. Industries adopt burners capable of using alternative and bio-based fuels to reduce environmental impact. It supports decarbonization efforts and helps meet corporate sustainability targets. Demand for burners with improved combustion stability and reduced greenhouse gas emissions continues to grow. This trend encourages innovation in burner design and fuel-flexible technologies.

- For instance, Fives Group introduced its Hy-Ductflam™ burner, which is designed to operate on 100% hydrogen and offers fuel flexibility, capable of burning a blend of natural gas and hydrogen or switching between 100% natural gas and 100% hydrogen without equipment modifications.

Integration of Automation and Digital Monitoring Systems

Industrial Burner Market embraces digitalization through integration of automation, IoT, and AI-driven control systems. Smart burners enable real-time monitoring, performance optimization, and predictive maintenance. It allows plant operators to improve fuel efficiency and minimize unplanned downtime. Adoption of remote control capabilities increases safety and operational reliability. Demand for burners compatible with SCADA and distributed control systems rises rapidly. This trend supports Industry 4.0 initiatives and promotes fully connected, data-driven industrial operations.

- For instance, Honeywell Thermal Solutions deployed its SLATE integrated combustion management platform across industrial burners at food and beverage facilities, enabling digital control of air–fuel ratio and reducing start-up times, with remote monitoring often available through cloud-based dashboards like Thermal IQ.

Rising Popularity of Modular and Compact Burner Designs

Industrial Burner Market witnesses growing demand for compact, modular burners that are easy to install and maintain. Space-saving designs benefit facilities with limited installation areas. Modular burners allow quick upgrades, retrofits, and capacity adjustments based on production needs. It reduces downtime during maintenance and enhances operational flexibility. Manufacturers introduce plug-and-play solutions to simplify integration into existing systems. This trend accelerates adoption in food processing, chemicals, and small-scale manufacturing units.

Increased Focus on Fuel Flexibility and Hybrid Solutions

Industrial Burner Market evolves with demand for burners capable of operating on multiple fuels including natural gas, biogas, and hydrogen blends. Fuel-flexible solutions help industries hedge against price fluctuations and supply disruptions. It ensures continuous operations in regions with variable fuel availability. Growing interest in hydrogen-ready burners supports global energy transition goals. Manufacturers invest in R&D to enhance burner performance across diverse fuel types. This trend strengthens market readiness for future low-carbon energy scenarios.

Market Challenges Analysis

High Initial Costs and Complex Installation Requirements

Industrial Burner Market faces challenges due to high capital costs associated with advanced burner systems. Modern low-NOx and digital burners require significant investment in installation and commissioning. Small and medium enterprises often hesitate to upgrade because of budget limitations. It becomes difficult for cost-sensitive industries to justify replacement of functioning legacy systems. Integration with automation platforms and control systems adds further complexity and expense. Long payback periods slow the adoption of innovative combustion solutions despite their efficiency benefits.

Fluctuating Fuel Prices and Regulatory Pressures

Industrial Burner Market is impacted by volatility in natural gas, oil, and alternative fuel prices. Unstable costs make it challenging for industries to maintain consistent operating budgets. Regulatory requirements for emission reduction demand frequent technology upgrades, adding financial strain. It puts pressure on manufacturers to deliver cost-effective solutions that still meet compliance standards. Availability of skilled technicians for tuning and maintenance remains a concern in several regions. These combined factors create uncertainty and hinder smooth market expansion.

Market Opportunities

Growing Demand for Clean Energy and Sustainable Heating Solutions

Industrial Burner Market holds strong opportunities with rising adoption of clean energy and low-emission systems. Governments promote policies favoring low-NOx, hydrogen-ready, and biofuel-compatible burners to support carbon reduction goals. Industries invest in upgrading older combustion equipment to meet strict emission standards and improve thermal efficiency. It creates strong demand for advanced burners that optimize fuel usage and minimize environmental impact. Expanding focus on sustainability in sectors such as chemicals, food processing, and metals strengthens market prospects. Rapid urbanization and infrastructure growth further drive need for energy-efficient heating solutions.

Advancement of Automation and Smart Combustion Control

Industrial Burner Market gains opportunities from rapid digitalization and Industry 4.0 adoption. Smart burners with IoT connectivity and predictive maintenance features are becoming a key focus for manufacturers. It allows plant operators to monitor performance in real time and reduce unplanned downtime. Integration with advanced control systems enhances combustion efficiency and process reliability. Rising demand for remote operations and energy optimization supports deployment of intelligent burners. Ongoing R&D investments accelerate innovation, creating scope for technologically advanced and adaptive burner solutions.

Market Segmentation Analysis:

By Type

Industrial Burner Market is segmented into regenerative burners, high thermal efficiency burners, direct-fired burners, and self-recuperative burners. Regenerative burners lead adoption in applications demanding high fuel savings and energy recovery. High thermal efficiency burners find demand in sectors such as metals, ceramics, and chemicals where precise heat control is critical. Direct-fired burners remain common due to their simplicity and cost-effectiveness, making them ideal for large-scale operations. It supports continuous and stable heat generation for industrial furnaces and boilers. Self-recuperative burners gain traction due to their ability to recover waste heat and reduce operating costs. Manufacturers focus on designing burners with compact form factors and higher energy efficiency.

- For instance, Limpsfield burners are documented to achieve stack oxygen levels consistently below 3% across the entire firing range for natural gas. In retrofit applications on industrial boilers, documented fuel savings range from 10% to over 30%, depending on the inefficiency of the previous burner system.

By Fuel Type

Industrial Burner Market by fuel type includes natural gas, oil, coal, and alternative fuels such as biogas and hydrogen blends. Natural gas dominates due to its cost-effectiveness, cleaner combustion, and easy availability across key regions. Oil-fired burners hold demand in regions with limited gas infrastructure, serving petrochemical and marine sectors. Coal-fired burners face declining demand due to emission concerns but still serve certain developing regions with coal-based energy systems. It sees rising interest in hydrogen-compatible and biofuel-capable burners that align with decarbonization efforts. Fuel-flexible burners are increasingly preferred to handle supply volatility and price fluctuations. Manufacturers focus on enhancing fuel efficiency and reducing emissions across all fuel types.

- For instance, Oilon offers a range of burners compatible with hydrogen, including the GKP series for dual fuel. While Oilon has extensive experience with hydrogen combustion up to 100%, and can achieve very low NOx emissions (such as below 30 mg/Nm³), these specific performance levels depend on the exact burner model, firing capacity, and the use of supplemental technology like flue gas recirculation.

By Mode of Operation

Industrial Burner Market is segmented by operation mode into automatic, semi-automatic, and manual. Automatic burners dominate due to their ability to deliver consistent performance, precise combustion control, and reduced human intervention. Semi-automatic burners find use in facilities balancing cost and automation needs. Manual burners remain relevant in small-scale applications and low-cost installations where automation is not viable. It benefits from growing demand for fully automated systems integrated with IoT and smart monitoring features. Manufacturers innovate to offer burners with advanced control panels and remote operation capabilities. Rising focus on process safety and energy efficiency strengthens the shift toward automated operation modes.

Segments:

Based on Type

- Regenerative burners

- Radiant tube burners

- Air staged burners

- Others (flat flame burners etc.)

Based on Fuel Type

- Gas burners

- Oil burners

- Dual fuel burners

Based on Mode of Operation

- Manual

- Semi-automatic

- Fully automatic

Based on Application

- Process heating

- Drying

- Boilers

- Others (space heating, etc.)

Based on End Use Industry

- Power generation

- Chemical and petrochemical

- Metalworking

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 30% market share in the Industrial Burner Market, supported by advanced manufacturing facilities and strict environmental regulations. The U.S. dominates with strong demand from chemical, metal, and food processing industries that require efficient combustion systems. Canada follows with investments in energy-efficient equipment and industrial upgrades across its oil & gas sector. The region sees growing adoption of low-NOx and digitally controlled burners to comply with EPA emission standards. It benefits from modernization of industrial boilers and heating systems in large manufacturing hubs. Rising popularity of automation and IoT-enabled burners further strengthens regional growth. Government incentives for clean energy technologies encourage adoption of fuel-flexible and hydrogen-ready burners.

Europe

Europe holds 27% market share and leads in the transition toward sustainable and low-emission combustion solutions. Germany, Italy, and France are major contributors with strong focus on energy efficiency and industrial decarbonization targets. EU regulations favor burners with lower NOx and CO emissions, driving innovation in regenerative and self-recuperative burner technologies. It gains support from widespread retrofitting of existing facilities to meet environmental compliance. Adoption of modular and compact burners grows in industries with space constraints. Investments in green hydrogen projects create opportunities for hydrogen-compatible burners. Rising energy costs encourage industries to install high-efficiency burners to lower operational expenses and carbon footprints.

Asia-Pacific

Asia-Pacific leads globally with 33% market share, emerging as the fastest-growing region. China accounts for the largest share due to rapid industrialization, large-scale steel and cement production, and significant investments in petrochemical facilities. India follows with rising demand for process heating equipment driven by infrastructure growth and government-led manufacturing initiatives. Southeast Asia and South Korea contribute with growing adoption of energy-efficient combustion systems in food, textile, and metal processing sectors. It sees rising interest in clean fuel solutions and burners that support natural gas and biogas. Expansion of local manufacturing capacity and government programs promoting energy efficiency further accelerate growth. Increasing focus on industrial automation enhances demand for digitally controlled and smart burners.

Latin America

Latin America represents 6% market share, with Brazil dominating due to its strong petrochemical, food processing, and power generation sectors. Mexico and Argentina show increasing adoption of energy-efficient combustion systems in industrial clusters. It benefits from government initiatives supporting modernization of boilers and reduction of industrial emissions. Demand rises for low-cost, durable burners suited for small and medium industries. Expanding oil refining activities and infrastructure development projects create additional opportunities for suppliers.

Middle East & Africa

Middle East & Africa hold 4% market share, driven by demand from oil & gas, petrochemical, and power generation industries. Saudi Arabia and UAE lead with investments in industrial infrastructure and energy diversification projects. South Africa follows with rising demand for burners in mining and manufacturing sectors. It gains growth momentum from adoption of low-NOx burners and clean combustion technologies to meet emission standards. Ongoing development of industrial parks and manufacturing hubs supports long-term demand. International suppliers expand their presence through partnerships and customized burner solutions for harsh operating environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell Thermal Solutions

- Faber

- Power Flame

- Limpsfield

- Miura America

- Oilon

- Alfa Laval

- Emerson

- Hurst

- Fives Group

Competitive Analysis

Competitive landscape of the Industrial Burner Market features leading players such as Honeywell Thermal Solutions, Alfa Laval, Miura America, Oilon, Fives Group, Emerson, Faber, Limpsfield, Hurst, and Power Flame competing through technology innovation, product efficiency, and global presence. These companies focus on developing low-NOx, fuel-flexible, and hydrogen-ready burners to meet stringent emission regulations and support the transition to cleaner energy. They invest heavily in automation, IoT-enabled controls, and smart combustion systems that enable real-time monitoring and predictive maintenance, helping industries optimize fuel use and reduce downtime. Strategic collaborations, mergers, and capacity expansions strengthen their position in fast-growing markets such as Asia-Pacific and the Middle East. Manufacturers also prioritize modular and compact designs to serve facilities with space constraints and streamline retrofits. Continuous R&D spending drives advancements in burner performance, energy efficiency, and reliability, enabling these players to maintain a competitive edge in a market focused on sustainability and operational efficiency.

Recent Developments

- In September 2025, Fives Group, Unveiled ITAS Invistableflame flameless burner at Gastech 2025. This burner is designed for ultra-low NOₓ emissions, proven for fuel mix flexibility from 100% natural gas to 100% hydrogen.

- In June 2025, Alfa Laval, Secured order for the world’s first marine boiler system for ammonia waste incineration, to be delivered 2027-2028. System to be installed on four 45,000 cubic meter multi-gas carriers.

- In October 2024, Alfa Laval, Announced it will be ready to supply its first fuel systems for ammonia-fuelled vessels by the end of 2025.

- In August 2023, Fives Group, Launched “Hy-Ductflam™”, its first 100% hydrogen duct burner for industrial drying and hot gas generator applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel Type, Mode of Operation, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low-NOx and ultra-low-emission burners will increase to meet global regulations.

- Adoption of hydrogen-ready and biofuel-compatible burners will rise with clean energy initiatives.

- Integration of IoT and smart control systems will become standard in industrial facilities.

- Modular and compact burner designs will gain traction to simplify retrofits and save space.

- Digital monitoring and predictive maintenance will drive higher operational efficiency and lower downtime.

- Fuel-flexible burners will be preferred to manage supply volatility and cost fluctuations.

- Asia-Pacific will remain the fastest-growing region with strong industrial expansion and modernization projects.

- Replacement of aging combustion systems will accelerate in Europe and North America.

- Investments in automation and Industry 4.0 solutions will boost demand for intelligent burners.

- Continuous innovation will enhance energy efficiency and support long-term decarbonization goals worldwide.

Market Trends

Market Trends